In addition to moral satisfaction from the work done, employees of any enterprise - be it a large holding company or a modest LLC - must receive payment for their work twice a month. The procedure for paying the required earnings is prescribed by law - in Art. 136 Labor Code of the Russian Federation. The employer needs to develop local regulations, which should indicate:

- specific days of the month on which payments are made;

- place of issue (company cash desk, account with a credit institution).

Question: How to reflect in an organization’s accounting the accrual and payment of monetary compensation to employees for failure to pay wages on time? Wages for the past month were paid to employees in violation of the terms established by the collective agreement for their payment. The amount of compensation for delayed payment of wages, calculated based on the minimum amount established by the Labor Code of the Russian Federation and the number of calendar days of delayed payment, is 12,478 rubles. Compensation due to employees was transferred to the employees' bank accounts. Operations related to the calculation and payment of wages are not considered in this consultation. For the purposes of tax accounting of income and expenses, the organization uses the accrual method. View answer

Before the payment of earnings, the employee must receive written notification of the composition and amount of accruals, types and justification of deductions, and the total amount due to be paid to the employee.

If an employer delays payments to employees, justifying the delay for any reason, he must compensate for his omission with monetary compensation.

Question: Does the labor inspectorate have the authority, when forcibly collecting unpaid wages from an employer, to include compensation for delayed payment of wages in the amount of the collection? View answer

What late payments are eligible for compensation?

In addition to wages, when calculating monetary compensation for money received late, the following payments are accepted:

- vacation pay;

- compensation upon dismissal for unpaid vacation;

- accruals for specific working conditions;

- all types of benefits.

Violation of labor legislation, which clearly stipulates the terms of mandatory payments to employees, is fraught with financial liability for the employer.

Question: What type of income code should I indicate in the payment order when transferring compensation for delayed wages? View answer

How to calculate

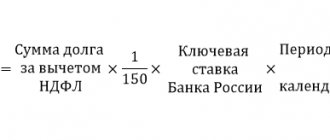

The minimum amount of compensation is calculated based on 1/150 of the Central Bank key rate for each day of delay in transferring wages to an employee. It is calculated on the amount due for transfer to the employee, minus personal income tax and other deductions. To calculate, use the formula:

To simplify calculations, use an online calculator.

Compensation remuneration is calculated starting from the day following the day of the established salary transfer (other accruals under the employment contract) and until the day of actual repayment of the debt. Generate entries for calculating compensation for delayed wages on the date of the order and transfer to employees.

Advance delay

The new edition of the Labor Code of the Russian Federation, unlike the Soviet version of the Labor Code, does not contain the wording “advance payment”. According to the provisions of Art. 136 of the Labor Code, the employer calculates and pays wages to staff at least twice during a calendar month.

Thus, the total amount of monthly earnings can be conditionally divided into the concepts of “salary for the first” and “salary for the second half of the period.” For this reason, it makes no difference which part of the monthly salary is not paid on time.

Are compensation for late payment of wages subject to insurance premiums ?

For each day of delay, the employer is obliged to compensate the employee in an amount no less than that provided by law.

Is liability established in case of non-payment of compensation for delayed wages on time and is interest accrued on it?

Compensation amount

The amount of monetary compensation required for payment in case of delay in salary is set as 1/300 of the Central Bank rate applied for refinancing, multiplied by the number of days of delay.

Need to know: starting from 01/01/2016. The refinancing rate is not set as an independent unit. Its value is now equal to the value of the Central Bank key rate.

The algorithm for calculating compensation is as follows:

DK = ZP X (1: 300) X KST X DP

where DK is compensation for late payment of monetary reward; ZP – the total amount to be paid to the employee; KST – key rate fixed by the Central Bank; DP – number of days of delay in payment of earnings.

Example of compensation calculation

The LLC has drawn up a collective agreement, which stipulates the terms for payment of wages: the first part - on the 21st of the current month; the second part – on the 6th of the next billing period. For the second half of March 2021, the employee was credited 22,000 rubles, taking into account the withheld personal income tax. In fact, the money was transferred to the bank card only on April 25, the delay was 18 calendar days. Cash compensation is calculated using the formula: DC = 22000 x 1/300 x 11 x 18 = 145.20 rubles.

According to the above procedure, the minimum amount of compensation fixed in labor law is calculated. The workforce, together with the trade union, may propose to the employer that a different calculation algorithm or an increased amount of compensation be established in the collective agreement.

For the legislator, the absence or presence of the employer’s fault in case of delay in payment of the due remuneration is not significant; in any case, he is obliged to compensate the employee’s monetary losses.

General principle of filling out the 6-NDFL calculation

At the end of May 2021, the tax service issued a letter regarding the reflection of information in 6-NDFL, for a situation where salaries were not paid throughout the entire quarter (letter of the Federal Tax Service dated May 24, 2016 No. BS-4-11/9194).

Since the issues of reflecting information on “carrying forward” salaries were considered by the tax department in earlier letters (letter of the Federal Tax Service dated February 25, 2016 No. BS-4-11 / [email protected] ), where special attention was paid to filling out section 2 of the calculation, in explanation No. BS-4-11/9194, the fiscal authorities focused in more detail on filling out section 1 for the situation of “protracted debt” for salary payments.

So, we can highlight the following features of entering information into the calculation in case of “overdue” salary payment:

- In line 070, which provides for the reflection of the amount of tax withheld in the reporting period, information is entered regarding the total amount of tax for individuals withheld by the tax agent - in the reporting period - in accordance with clause 4 of Art. 226 Tax Code of the Russian Federation.

Additional information on this section can be found in the article “Procedure for filling out line 070 of form 6-NDFL” .

- In line 080, which provides for the reflection of the amount of tax not withheld in the reporting period, information is entered regarding the total amount of tax for individuals not withheld by the tax agent in the reporting period in accordance with paragraph 5 of Art. 226 Tax Code of the Russian Federation.

You can also clarify the principle of filling out individual positions on the website: “Procedure for filling out line 080 of form 6-NDFL” .

- Since tax withholding from individuals is made directly upon the actual payment of income, therefore, if the salary is actually paid outside the reporting period, then 0 is entered in lines 070 and 080.

If you have access to ConsultantPlus, check whether you filled out 6-NDFL correctly. If you don't have access, get a free trial of online legal access.

Accounting and taxation of compensation

Guaranteed compensation for delays in official payments to an employee, like all other types of compensation, are not subject to personal income tax. For the employer, the calculation of compensation involves additional tax and mandatory payments:

- the accrued compensation does not reduce the tax base for income tax;

- From the compensation amounts, contributions must be paid to extra-budgetary funds - Social Insurance Fund, Pension Fund, Compulsory Medical Insurance Fund.

For employers using the “simplified” tax system according to the “income minus expenses” scheme, the annual income tax cannot be adjusted downwards for compensation expenses.

6-NDFL: wages accrued but not paid (example)

Now let's move on to reflecting in the 1st and 2nd sections of form 6-NDFL the situation in which wages are accrued but not paid in the reporting period, and such a delay is of a long protracted nature, for example, several months.

The variety of situations that arise when making salary payments can be found on our website, in particular in the article “6-NDFL - if the salary was paid for several days .

Let's look at an example.

Example

Due to the insolvency of the main buyer, in the second five months of 2021, the company was unable to repay wage arrears to staff. The situation began to improve only in June: the repayment of the debt for the previous months was made in full on June 25, and on the same day the personal income tax was transferred to the budget. Subsequently, the salary payment schedule was not violated: payments were made on the first working day following the reporting month.

Assumptions adopted in the calculation: monthly payroll is 100,000 rubles, deductions are not provided to employees, personal income tax is paid at a rate of 13%.

Filling out form 6-NDFL for the 1st quarter of 2021 and half of 2020 will be as follows:

| Form string | Indicator (date or amount of payment/tax) | ||||

| 1st quarter 2021 | |||||

| 010 | 13 | ||||

| 020 | 300 000 | ||||

| 030 | 0 | ||||

| 040 | 300 000 × 13% = 39 000 | ||||

| 070 | 0 | ||||

| 080 | 0 | ||||

| 100 | 0 | ||||

| 110 | 0 | ||||

| 120 | 0 | ||||

| 130 | 0 | ||||

| 140 | 0 | ||||

| For the first half of 2021 | |||||

| 010 | 13 | ||||

| 020 | 600 000 | ||||

| 030 | 0 | ||||

| 040 | 600 000 × 13% = 78 000 | ||||

| 070 | 500 000 × 13% = 65 000 | ||||

| 100 | 31.01.2020 | 28.02.2020 | 31.03.2020 | 30.04.2020 | 31.05.2020 |

| 110 | 25.06.2020 | 25.06.2020 | 25.06.2020 | 25.06.2020 | 25.06.2020 |

| 120 | 26.06.2020 | 26.06.2020 | 26.06.2020 | 26.06.2020 | 26.06.2020 |

| 130 | 100 000 | 100 000 | 100 000 | 100 000 | 100 000 |

| 140 | 13 000 | 13 000 | 13 000 | 13 000 | 13 000 |

You can see a sample of filling out the second section of the report below.

6-NDFL for the 1st quarter of 2021:

6-NDFL for the first half of 2021:

Thus, a feature of filling out the calculation for long-term non-payment of wages compared to other situations is the entry of information in lines 070 and 080, which is carried out on the principle of actual withholding/non-withholding of tax on personal income by tax agents.

See also “How to submit 2-NDFL and 6-NDFL if there are more than 10 employees, but less than 25”

What to do if there are long delays in wages

If the employer’s delays in payment of wages become a system, and the delays exceed half a month (15 days), then employees are given the right to take measures to normalize the situation:

- payment can be accelerated by a written request from employees to the labor inspectorate with a mandatory indication of the violated right (non-payment of wages), the number of days of delay and the amount due for payment;

- refuse to perform duties and suspend work until the labor remuneration is fully paid. All days of forced downtime at work must be paid according to average earnings;

- resort to the help of the judiciary, the police and the prosecutor's office - illegal actions of the administration for non-payment of wages are punishable by administrative and criminal penalties.

Keep in mind: suspension of work is impossible for workers in areas related to the vital support of the population or with dangerous working conditions - military personnel, police officers, public utility employees, and doctors.

When filing a claim in court, members of the labor collective can add to the amount of debt not only the amount of compensation, but also the inflation rate established in the country. If the employer recognizes the workers' claims, then a writ of execution for the entire amount is issued without a court hearing.

Is compensation for delayed wages subject to insurance contributions or not?

The situation with the calculation of insurance premiums from compensation in the event of a delay in salary payment is quite ambiguous and gives rise to many disagreements between enterprises and regulatory authorities. This type of payment is explicitly absent both from the list of non-taxable payments present in the old law on insurance contributions (Article 9 of Federal Law No. 212-FZ of July 24, 2009, in force until 2017), and in Chapter 34 of the Tax Code. Code of the Russian Federation (Article 422), which regulates the procedure for calculating these contributions from 2021.

Many statements of the Ministry of Labor (for example, Letter No. 17-3 / OOG-692 dated April 28, 2016, Letter No. 03-04-12 / 67082 dated November 16, 2016) contain a provision that employers, delaying When issuing wages to their employees, they are required to charge insurance premiums from compensation. At the same time, the Supreme Court of the Russian Federation voices a different point of view: compensation for delays in payment of wages is directly related to the performance by a citizen of his labor duties, and, therefore, is not subject to contributions (see, for example, Determination of the Supreme Court of the Russian Federation No. 310-KG16-17515 of December 28, 2016 G.).

Tax authorities may be guided by instructions from both the Ministry of Labor and the Supreme Court, and in each specific case this is difficult to predict. Therefore, the best option for employers is to still charge insurance premiums from compensation in case of delays in paying wages to employees, so that there are no problems with the Federal Tax Service.

Read the material on the topic: Accounting

What does an employer face for violating the terms of payment of salary?

Violation of labor legislation, expressed in non-compliance with the salary payment schedule, is an administrative offense recorded in Art. 5.27 Code of Administrative Offences. For such an offense, a fine is imposed on both the manager and the enterprise - up to 5 and 50 thousand rubles, respectively.

If a similar offense is repeated, the head of the company may lose his position for a period of 1 to 3 years.

Criminal prosecution may occur in case of long delays in the payment of required types of remuneration or benefits, if the delays are associated with the manager’s selfish or personal motives. If at least 50% of the due remuneration remains unpaid on time, then the punishment may range from a fine of 120,000 rubles to two years in prison.

Is compensation for delayed salary payment subject to personal income tax?

If the amount of compensation to employees for delayed payment of wages remains within the minimum value and is calculated in accordance with the Labor Code of the Russian Federation based on the current key rate of the Central Bank, then personal income tax is not collected from the compensation amount. This is recorded in Letter of the Ministry of Finance No. 03-04-05/11096 dated February 28, 2017 and in paragraph 3 of Art. 217 of the Tax Code of the Russian Federation.

For increased compensation established by the employer on his own initiative, this tax is imposed on the difference between the resulting amount and the minimum amount regulated by the Labor Code of the Russian Federation. In such cases, it is necessary to charge personal income tax.

Is income tax withheld?

Clause 3 of Art. 217 of the Tax Code of the Russian Federation states that compensation payments are not subject to taxation within the framework of the norms related to the performance of labor duties.

From this point we can draw conclusions:

- The amount of compensation is 1/150 of the Central Bank refinancing rate, as well as large penalties for non-payment (if they are determined by an employment or collective agreement) are not subject to income tax. There is no need to withhold or pay personal income tax from them.

- If the employer has not established a specific amount of compensation in an employment or collective agreement, but pays it in an amount greater than 1/150 of the Central Bank refinancing rate, personal income tax will have to be withheld from an amount exceeding the norm by law.

The employee was paid compensation in the amount of 1/100 of the Central Bank refinancing rate. There is no clause in employee contracts indicating the amount of the penalty for late wages.

Then, only part of the payment will be subject to taxation, above the established norm: 1/150 - 1/100 = 1/50 of the Central Bank refinancing rate - personal income tax will need to be withheld from the amount of the penalty calculated at the specified rate.

Important! The amount of compensation in excess of the excess norm is subject to income tax in accordance with the general procedure.

Is it subject to insurance premiums?

The procedure for levying insurance premiums from 2021 is determined by Ch. No. 34 Tax Code of the Russian Federation. Art. No. 422 of the specified normative act does not contain in the list of non-taxable amounts the compensation amount for late payment of wages. Therefore, according to the code, such payments must be subject to contributions.

However, in court proceedings, judges take the opposite opinion.

This type of compensation relates to the financial responsibility of the organization, is paid on the basis of the Labor Code of the Russian Federation and ensures the protection of the labor rights of personnel when performing physical labor.

Based on this, representatives of the judicial authority decide that the employer does not have to pay insurance premiums.

In order to avoid litigation, many organizations pay contributions to the budget based on the tax code.

Payment deadlines

In order not to enter into disputes with the tax authority, many organizations pay insurance premiums from compensation payments for delayed salaries.

According to Art. 431 of the Tax Code of the Russian Federation, the transfer of contributions must occur no later than the fifteenth day following the reporting month.

When the amount of the penalty paid for non-payment of wages exceeds the norm and is not stipulated in the contracts, the employer is obligated to pay personal income tax on the excess amount. Payment of income tax under Art. 226 of the Tax Code of the Russian Federation must be made no later than the day of the actual payment of the amount of money to the employee.

Example of taxation

Let's look at specific examples of how the compensation amount is subject to taxes and contributions.

How personal income tax is withheld:

Let's assume that the employer has not established, using regulations, the amount of compensation for non-payment of wages.

In fact, he pays it in the amount of 1/50 of the Central Bank rate.

Income taxation:

- First, let's calculate the amount of compensation payment from which personal income tax is taken:

- 1 / 150 – 1 / 50 = 1 / 100;

- 15000 * 1 / 100 * 7,25% * 3 = 32,63.

- We calculate personal income tax: 32.63 * 13% = 4.24.

- The employee will receive the following amount of compensation:

- 15000 * 1 / 50 * 7,25% * 3 = 65,25.

- 65,25 – 4,24 = 61,01.

How are contributions assessed:

If the employer decides to make insurance contributions in order to avoid litigation, the rates will be identical to the salary: 22% - OPS, 5.1% - Compulsory Medical Insurance, 2.9% - VNiM.

To calculate, let’s take the compensation from the previous example, it is equal to 65.25:

- OPS = 65.25 * 22% = 14.36.

- Compulsory medical insurance = 65.25 * 5.1% = 3.33.

- VNiM = 65.25 * 2.9% = 1.89.

Is compensation due for delayed payment of wages upon dismissal?

Late payment to an employee upon dismissal is a special case of delayed payment of wages, and the employer bears not only financial and administrative liability for this, but also criminal liability.

From the day of dismissal, if the employee has not been paid the full salary, the delay period begins to count. The compensation that the employer must pay him for each overdue day is calculated according to the standard algorithm: as 1/300 of the refinancing rate of the Central Bank of the Russian Federation (see Article 236 of the Labor Code of the Russian Federation). In addition to calculating compensation, if there is a delay in final settlement with a former employee, the employer is required to index the entire payment amount depending on the increase in consumer prices during the period of delay.

The timing of final settlement with a dismissed employee is regulated by the Labor Code in Art. 140. If an employer does not comply with them and delays payment of wages or refuses to pay them at all, he commits an illegal act, for which he may be fined as a legal entity. An employee who has not been paid upon dismissal has the right to file a complaint with the appropriate authority, and the company’s activities may be suspended for a long period – up to 90 calendar days. In the most unfavorable cases, those responsible for delays or non-payment of wages will face criminal liability.

For the employee himself, who has not received his earned money upon termination of an employment contract with an organization or individual entrepreneur, the main authorities to which he can turn to protect his rights are the labor inspectorate, the prosecutor's office and the court. Moreover, when filing a claim in court in such cases, he does not pay the costs of legal proceedings (Article 393 of the Labor Code of the Russian Federation exempts him from this). The victim can file a claim within three months from the date of dismissal. In addition to his salary and compensation for the delay in payment by the employer, the worker can claim compensation for moral damage (see Article 237 of the Labor Code of the Russian Federation).

Obligation to collect insurance premiums

Starting from 2021, control over the calculation and payment of insurance premiums (IC) is exercised by the territorial body of the Federal Tax Service, located at the place of registration of taxpayers. When determining the procedure for calculating contributions, organizations and individual entrepreneurs paying amounts to employees are guided by the provisions of Art. 422 of the Tax Code of the Russian Federation.

For the purpose of calculating CB for compensation amounts:

- Compensation is recognized as a payment to an employee received within the framework of an employment relationship.

- The amount serves as a measure of the employer’s liability for violating the terms of the employment contract.

- The payment is not reimbursement of the employee’s expenses in the performance of duties, which does not allow the amount to be classified as compensation exempt from taxation. According to the Ministry of Finance, the amount compensating for the losses of employees is not full compensation.

Important! The list of amounts paid to employees that are exempt from taxation due to insurance contributions does not contain compensation provided for late payment of wages or their parts. The list given in Art. 422 of the Tax Code of the Russian Federation is closed.

Income tax

Payment of compensation for delayed wages is provided for by labor legislation. It is a sanction for violating the terms of an employment (collective) agreement. This follows from Article 236 of the Labor Code of the Russian Federation. Despite this, the Russian Ministry of Finance prohibits taking such payments into account as expenses.

Situation: is it possible to take into account the amount of compensation for delayed wages as part of non-operating expenses or labor costs? The organization applies a general taxation system.

No you can not.

Expenses for payment of compensation for delayed wages are not considered non-operating expenses in the form of sanctions for violation of contractual obligations (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation). The obligation to pay compensation for delayed wages is provided for by labor legislation, and subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation applies to civil law relations.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38.

Labor costs taken into account when calculating income tax include compensation charges related to work hours or working conditions provided for by Russian legislation and labor (collective) agreements (Article 255 of the Tax Code of the Russian Federation). Compensation for delayed wages is not related to the working hours and working conditions (Article 236 of the Labor Code of the Russian Federation). Therefore, these payments do not reduce taxable profit as labor costs.

Such clarifications are given in letters of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/164 and dated April 17, 2008 No. 03-03-05/38, as well as in the resolution of the Federal Antimonopoly Service of the Central District dated February 21, 2008 No. A09-7868/05-15.

Advice: there are arguments that allow you to take into account the amount of compensation for delayed wages as part of expenses (non-operating or labor costs). They are as follows.

The basis for including compensation for delayed wages in non-operating expenses is that subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation does not directly indicate in case of violation of which contractual obligations - civil or labor - it is applied. Therefore, this subclause can also be applied to compensation for delayed wages. In addition, such compensation is not named in Article 270 of the Tax Code of the Russian Federation as expenses not taken into account when taxing profits. Therefore, it can be taken into account as part of non-operating expenses. This position is confirmed by judicial practice (see, for example, decisions of the Federal Antimonopoly Service of the Volga-Vyatka District dated August 11, 2008 No. A29-5775/2007, Ural District dated April 14, 2008 No. F09-2239/08-S3, Volga District dated June 8, 2007 No. A49-6366/2006).

Compensation for delayed wages can also be taken into account as part of labor costs. It is explained this way. Taxable profit is reduced by any payments to employees in cash and (or) in kind, including compensation accruals provided for by labor and (or) collective agreements (paragraph 1, paragraph 3 of Article 255 of the Tax Code of the Russian Federation). The exception is the payments listed in Article 270 of the Tax Code of the Russian Federation. When calculating the tax base for income tax, they cannot be taken into account under any circumstances. In addition, the list of labor costs that are taken into account when taxing profits is open (clause 25 of Article 255 of the Tax Code of the Russian Federation). Therefore, compensation for delayed wages can also be taken into account as part of labor costs. This conclusion is confirmed by the Federal Antimonopoly Service of the Moscow District in its resolution dated March 11, 2009 No. KA-A40/1267-09.

Under such circumstances, the organization can independently decide which group of expenses to include the costs associated with the payment of compensation for delayed wages (clause 4 of Article 252 of the Tax Code of the Russian Federation).

An example of how to take into account compensation for delayed wages. General organization

In August, Alpha LLC delayed payment of salaries to employees. The amount of debt (minus personal income tax) is 300,000 rubles. The amount of calculated compensation was 1650 rubles.

For the amount of compensation, the accountant calculated contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases.

The total amount of insurance premiums was 495 rubles. (RUB 1,650 × 30%), including:

- to the Pension Fund of Russia – 363 rubles. (RUB 1,650 × 22%);

- in the Federal Social Insurance Fund of Russia – 47.85 rubles. (RUB 1,650 × 2.9%);

- in the Federal Compulsory Medical Insurance Fund – 84.15 rubles. (RUB 1,650 × 5.1%).

The contribution rate for insurance against accidents and occupational diseases is 0.2 percent. The amount of accrued contributions was 3.30 rubles. (RUB 1,650 × 0.2%).

On the day of payment of the debt, the following entries were made in the organization’s accounting:

Debit 70 Credit 50 – 300,000 rub. – salaries were paid to employees;

Debit 91-2 Credit 73 – 1650 rub. – compensation was accrued for delayed salaries to employees;

Debit 73 Credit 50 – 1650 rub. – compensation was paid to employees for delayed salaries;

Debit 44 Credit 69 subaccount “Settlements with the Pension Fund” – 363 rubles. – pension contributions have been accrued;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 47.85 rubles. – insurance premiums have been accrued to the Federal Social Insurance Fund of Russia;

Debit 44 Credit 69 subaccount “Settlements with FFOMS” – 84.15 rubles. – insurance premiums to the Federal Compulsory Compulsory Medical Insurance Fund have been calculated;

Debit 44 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” – 3.30 rubles. – premiums for insurance against accidents and occupational diseases are calculated.

In tax accounting, the amount of compensation for delayed wages is not taken into account. Alfa does not withhold personal income tax from the compensation amount.

What you need to know

Due to the unstable economic situation in Russia, many employers may delay wages for their staff.

As a consequence, this leads to a deterioration in financial well-being, and in some situations - non-payment of debt obligations on loans, utilities, and so on.

To be able to defend personal interests, Russian labor legislation has provided for compensation payments for delayed wages.

Thanks to this, many employers try their best to pay employees on time.

Basic moments

As noted earlier, the instability of the economic situation in the country creates many negative trends, including delays or complete disregard for the payment of wages to hired staff by employers.

Such points are clearly described in federal legislation, which also provides for the need to charge payments for any type of activity in accordance with previously reached agreements.

If Russian citizens have a document that can confirm the presence of official employment with a specific employer, then there is every chance of counting on compensation payments established by the legislation of the Russian Federation.

Expert opinion

Soloviev Ilya Mikhailovich

Lawyer with 10 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

The process of registering this kind of additional financial assistance is directly related to the acquisition of legal force by new Regulations in Russian legislation.

As a consequence, this entailed:

| Fixing a new list in relation to the dates of accrual of official wages | In case of violation of the period established by the norms of the Law, Russian citizens have the right to count on the accrual of compensation |

| Formation of disciplinary sanctions | From the direct employer in case of violation of the employment agreement and the norms of current labor legislation |

| The process of calculating a specific percentage on official wages | Thanks to this, it is possible to significantly minimize the inconvenience that employees were able to experience due to late payment of wages |

These features provide an opportunity to specifically regulate cash flows and thereby force direct employers to approach the procedure for accrual and calculation of this type of payments with full responsibility.

For what reasons are wages not paid on time?

The norms of Russian legislation specifically differentiated the conditions for the purpose of receiving compensation payments for late payment of wages.

Due to the fact that direct employers assume responsibility for calculating the payments in question no later than the 15th day of the next calendar month, identified violations of this condition automatically entail liability in the form of the accrual of penalties for the purpose of calculating compensation payments to the hired staff.

How to remove a seizure from a car imposed by a bailiff for alimony, read here.

The provision under consideration is also supplemented by the fact that direct employers take responsibility for paying funds every 15 days, and this is of a regular nature.

Such moments imply that employers are forced to fully comply with the procedure for calculating wages.

Otherwise, the portion of the unpaid wages must be subject to interest payable in the following calculations.

Monthly delays automatically entail an increase in compensation payments. Speaking about the reasons for the occurrence of salary arrears, among them are:

- lack of funds flowing into the company;

- decline in the company's production capacity;

- lack of sufficient level of product sales, and so on.

In other words, the reasons can be very diverse. Regardless of the reasons for the delay, when calculating the amount of compensation payment, the established refinancing rate of the Central Bank is taken into account.

The formula looks like:

Based on this formula, we can conclude that employees can easily make a preliminary calculation of the payment themselves, which will eliminate the possibility of various misunderstandings with their immediate employer in the future.

What's the catch?

It often happens that until the case reaches the court, clear clarification on certain tax issues is not easy to achieve. Some issues have to be sorted out, as they say, in practice.

The capital's tax authorities accused the local organization of violating paragraph 6 of Article 226 of the Tax Code. The essence of the claim was that the company untimely transferred personal income tax to the budget on certain payments to full-time employees. We were talking about additional payments for temporary substitution and work on days off, which were paid only after two months, and about the tax that was paid on these payments almost a month later.

Let’s leave aside the legality of the timing of income payment for now and focus on paying the required tax. The company, appealing to paragraph 2 of Article 223 of the Tax Code, argued that the date of receipt of wages is recognized as the last day of the month for which income was accrued. That is, personal income tax is transferred at the end of the month on completely legal grounds.

The tax authorities had their own opinion on this matter, supported by Article 123 of the Tax Code, on the basis of which the organization was issued a fine and a penalty.

Please note that the salary and personnel program from Bukhsoft will help eliminate any misunderstandings and possible penalties!

When must an employer pay wages?

Each company sets its own deadlines for paying wages. But it is legally determined that payments cannot occur less than 2 times a month. Moreover, this must be prescribed in one of the following documents:

- Employment contract;

- Collective agreement;

- Internal labor regulations.

Expert opinion

Soloviev Ilya Mikhailovich

Lawyer with 10 years of experience. Specialization: civil law. Extensive experience in developing legal documentation.

It is necessary to indicate a specific date, not a time interval. Many leaders make a similar mistake. The result is the imposition of penalties.

- Vacation pay;

- Benefits;

- Premiums and so on.

- Labor Code of the Russian Federation;

- Code of Administrative Offenses of the Russian Federation;

- Letter of the Ministry of Labor of Russia dated August 18, 2021 No. 14-2/B-761.

Payments for the calendar month worked must be made to the employee no later than the 15th of the following month.

A delay in salary that is not the fault of the company does not relieve the manager of responsibility. He is obliged to calculate and pay compensation for each day of waiting.