What are the employee incentive measures?

To increase labor discipline and production indicators, various organizations often practice comprehensive measures of incentives for work and punishments for shoddy work. If we rely on the Labor Code of the Russian Federation, in particular Article 191, on the part of the employer, incentives for employees can be expressed in the following:

- appointment of a bonus;

- formal thanks;

- donation of a valuable item;

- highlighting the employee as the best in the team;

- issuance of a certificate.

Also see “Types of bonuses and rewards: making a choice.”

Design features

The petition has a number of features. They must be studied before proceeding to drawing up the document. Therefore, it is better for the organization to have a sample application for payment of a bonus so that you can always see how and what needs to be written. The original document itself is filed in a personal file. There are also specific storage periods for such documentation depending on the status of employees (see table):

| Type of application | Period |

| For applications for ordinary workers | The term is 75 years |

| For submissions on bonuses for persons in leadership positions | Indefinitely |

The document is printed on the company’s letterhead, but can also be issued on a regular sheet of paper. Usually one of the required details is a seal (if the company has one).

Also see “Annual bonus for 2021: how to apply.”

Bonus rules

Most often, employers use a bonus system to reward employees. In order to create such conditions in his organization, the manager should:

- calculate the amount of remuneration;

- plan the conditions for issuing bonuses;

- think over the procedure for their calculation;

- highlight the necessary indicators and criteria.

The amount of the bonus is specified in the employee incentive order. It can be expressed:

- as a fixed value;

- as a certain percentage of salary.

Another calculation option is using the entered surcharge factor.

Also see “What are the indicators and criteria for bonuses for an accountant.”

The mentioned reward order can be issued as a reward for increased labor productivity and various achievements.

Such a bonus should be organized on the basis of calculated performance indicators. If this information is correctly defined and provided to staff, employees will see clearly defined goals, rather than a vague concept of hard work that must be achieved in order to receive a raise.

So, for example, for a call center operator this may be a certain number of successful calls.

Such bonuses are most often formed as a percentage of the salary amount. And the frequency of payments can be different - once a year, six months or a month.

In order for bonuses to look like incentives, the employer must approve specific circumstances for issuing them. For example:

- for achievements in the workplace;

- for the employee's birthday;

- if its activities set record labor values;

- the required length of service has been achieved, etc.

The specific motive for incentives must be prescribed in the order. In addition, it must be one-time in nature. Usually, when promoting, they choose a bonus in the form of a percentage of the amount earned or a fixed bonus.

Types of “premium” orders

The types of bonus orders are as follows:

1. By volume of information:

- mass - compiled in the case of bonuses for a group of workers or the majority of members of the workforce;

- single - issued when rewarding an individual employee for certain achievements or merits.

2. According to the regularity of registration:

- planned - issued with the frequency established by internal local acts (orders on monthly, quarterly or annual bonuses);

- unscheduled - issued if necessary by decision of management.

3. Based on the basis for remuneration:

- production - for achieving production indicators, rationalization developments, etc.;

- organizational - for active participation in the public life of the team, sporting achievements, etc.;

- holidays - for a professional holiday, anniversary and in connection with other similar dates.

If you have access to K+, see how to draw up an order for bonuses for an employee’s anniversary, as well as a sample of such an order. If you don't have access, get a free trial.

All of these types of “bonus” orders, despite the different wording of their grounds and different frequency of publication, have a common structure

Drawing up promotion documentation

The grounds for incentives are collective agreements, labor agreements and internal regulations of the enterprise. This form of remuneration may be provided:

- in labor rules;

- wage regulations;

- a separate award document.

The documentation setting out the rules of the incentive system must contain the following information:

- types of awards;

- conditions, procedure and indicators for issuing the additional amount;

- bonus amounts;

- payment procedure;

- the frequency with which additional payments may occur;

- a list of cases of reduction in the amount of the bonus or its deprivation.

Also see “Deprivation of bonuses for employees: approaches and design.”

Let us remind you once again that it is imperative to specify the incentive motive in the order. An example is an increased number of sales or manufactured products over a certain period of time.

When is an order to pay bonuses to employees issued?

An order for bonuses for employees is usually issued based on work results for a certain time period: month, quarter, year. Additionally, other types of bonuses may be paid with varying regularity and one-time payments.

In order for the bonus to have a legal form, the possibility of its payment is provided for in an internal local act - the regulation on bonuses or on remuneration.

Read about how wage regulations are drawn up here.

The algorithm for processing an order for bonus payments to employees includes several stages:

- formation of initial lists for bonuses by department;

- checking compliance with bonus conditions;

- adjustment of the list of employees worthy of material remuneration, due to the presence of grounds for deprivation of bonuses for some of them;

- coordination and clarification of the final amount of bonus payment personally for each employee on the list with the heads of departments;

- Submitting the final version of the order to the manager for approval.

To learn about the grounds on which an employee can be deprived of a bonus, read the article “What are the grounds in the Labor Code of the Russian Federation for depriving an employee of a bonus?”

Incentive procedure

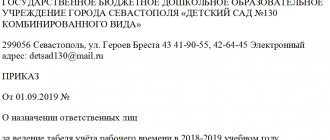

The type of remuneration in question is drawn up in the form of an order to reward the employee on form T-11 (approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

The basis for the publication of this document is:

- title business paper;

- reports on the employee's work done.

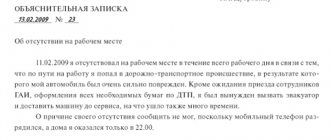

Another criterion may be a memorandum of encouragement for the employee, a sample of which is prepared in free form. Typically, these documents come from the immediate supervisor assigned to the employee.

Thus, an order to reward for good work is most often drawn up in a special form provided for by the legislation of the Russian Federation. If for one employee, then the T-11 form is valid, and for several at once - T-11a.

Persons to whom it is decided to apply incentive measures must be familiarized, against signature, with a sample order to encourage an employee drawn up in their address.

In addition, this document becomes the basis for making a note in the work book, which should be done in a timely manner - no later than 7 calendar days. Moreover, the entry in it must fully correspond to the text in the order. Additionally, information about the incentive is entered into the employee’s personal file.

Further, following the link from our website, you can find a free current sample of an incentive order.

This document should mention:

- full initials of the employee – last name, first name and patronymic;

- his personnel number;

- job title;

- the department in which he works;

- reasons for incentives - success in sales, birthday, etc.;

- the selected type of incentive - gratitude, certificate, gift or bonus amount.

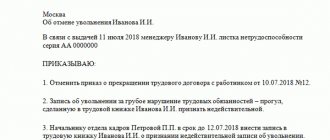

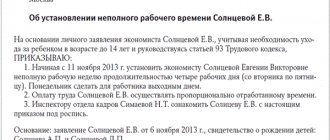

Below is a completed sample order for incentives for an accounting employee for the 1st half of 2021:

Read also

07.01.2019

Grounds for drawing up an order

The grounds for bonuses and subsequent drawing up of orders are determined by the manager. Let's look at the most popular:

- Working beyond normal.

- Performing tasks of particular difficulty.

- Plan overfulfilment.

- Holidays, anniversaries.

- Conscientious work over a period of time.

As a rule, the bonus initiative is first initiated by the head of the department. He sends a memo to the director. It indicates the request for a bonus and the basis for payments.

When do you need a memo about nominating an employee for a bonus?

Regular bonuses provided for by the wage system do not require the execution of any additional documents to consider the issue of bonuses to an employee. The procedure for assigning and paying such bonuses is already provided for by the internal regulations on bonuses.

But for one-time, irregularly issued bonuses, it is necessary to clarify a number of indicators that are essential for bonuses:

- reasons for payment;

- circle of persons awarded;

- the period to which the bonus will relate;

- forms of bonuses;

- premium size.

The right to make the final decision on the payment of bonuses - both regular and irregular - still remains with the head of the organization. Only in the first case does he approve the results of the distribution of the bonus fund, and in the second must he make a decision on payment or non-payment of the bonus.

More details about award calculations can be found here.

Award according to the Labor Code of the Russian Federation

While performing his duties, a company employee must receive a salary to pay for the work he performs. However, this is not the only type of payment he can count on. Sometimes management considers it right not to limit itself to salary, but to make additional payments, which can sometimes be important.

According to Article 129 of the Labor Code of the Russian Federation, bonus payments are the amount given to an employee in order to motivate employees.

Article 191 of the Labor Code of the Russian Federation describes what incentives can be applied to employees. Can be used: bonus, declaration of gratitude, awarding a diploma or gift of honor, payment of a bonus. The list of rewards can be supplemented by other types, for example, by awarding an honorary title.

The reasons for additional payments and their order are based on the company’s documents. Here are examples:

- inner order rules;

- regulatory acts of the enterprise;

- collective agreement;

- other papers.

Types of awards

There are two types of payments:

- incentives;

- stimulating.

Employees receive them for outstanding performance or when they perform their duties conscientiously.

Incentive payments are made to increase employee motivation to be productive.

Incentives are recognition of an employee’s success by management and the workforce. Incentives may count toward career advancement.

According to Article 129 of the Labor Code of the Russian Federation, remuneration for labor consists of three parts:

- Payment for work performed.

- Compensation payments.

- Incentive payments.

Bonus rules are being developed at the enterprise gradually. When talking about labor success, the average values of indicators are taken. Bonuses are usually given based on the numbers received per month.

If an employee is awarded a personal bonus, the payment of incentive amounts is not time-based, but is made in connection with specific successes.