Legal regulation

Sick leave benefits are understood as payments made by the employer in favor of a temporarily disabled employee, and such payments are due only to officially employed citizens who have consulted a doctor and issued a sick leave certificate.

The payment of sick leave benefits is regulated:

In Art. 14 of Law No. 255 sets out the general procedure for calculating the amount of sickness benefits, and the specifics of calculating such benefits are given in Resolution No. 375.

Features of calculating benefits

The amount of benefit paid for each day of illness is calculated as the citizen’s average daily earnings for the last 2 years before the illness. To determine the total amount of the benefit, the salary for the two-year period before the start date of sick leave is divided by 730 and multiplied by the number of days spent on sick leave.

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

The amount of sick pay is calculated in proportion to the length of the working day for a part-time shift in the following cases:

- if the average monthly income for 2 years before illness is less than or equal to the minimum wage;

- if the citizen did not work officially for 2 years before illness;

- if the citizen’s total official work experience over his entire life is less than six months.

To qualify for sickness benefits, self-employed people, as well as lawyers, notaries, farmers and members of northern indigenous peoples, must make payments to the Social Insurance Fund themselves.

How to calculate the amount of sick leave for part-time work and what determines the amount of payments

Sick leave benefits are understood as payments made by the employer in favor of a temporarily disabled employee, and such payments are due only to officially employed citizens who have consulted a doctor and issued a sick leave certificate.

Legal regulation

- if the average monthly income for 2 years before illness is less than or equal to the minimum wage;

- if the citizen did not work officially for 2 years before illness;

- if the citizen’s total official work experience over his entire life is less than six months.

in the line “Average earnings for calculating benefits □□□□□□р □□к” the amount of average earnings from which benefits for temporary disability, maternity and childbirth should be calculated, determined in accordance with the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (Collected Legislation of the Russian Federation, 2007, No. 1, Art. 18; 2009, No. 30, Art. 3739; 2010, No. 50, Art. 6601; 2011, No. 9, Art. 1208) and Article 2 of the Federal Law of December 8, 2010 No. 343-FZ “On Amendments to the Federal Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity” ( Collection of Legislation of the Russian Federation, 2010, No. 50, Article 6601, 2011, No. 9, Article 1208);

in the line “Amount of benefit: at the expense of the Social Insurance Fund of the Russian Federation □□□□□□ p □□k at the expense of the employer □□□□□□p □□k” the amount of the benefit to be paid at the expense of the Fund’s budget is indicated accordingly social insurance of the Russian Federation and at the expense of the employer in accordance with the legislation of the Russian Federation;

PROCEDURE FOR COMPLETING Sick Leave BY THE EMPLOYER

- 43 – if the insured person belongs to the category of persons exposed to radiation who, in accordance with the legislation of the Russian Federation, have the right to benefits when assigning and calculating benefits for temporary disability, pregnancy and childbirth;

- 44 – if the insured person started working in the Far North and equivalent areas before 2007 and continues to work in these areas;

- 45 – if the insured person has a disability;

- 46 – if an employment contract (service contract) is concluded with the insured person for a period of less than 6 months. This code is not entered if code “11” is indicated in the line “Cause of disability”;

- 47 – if the illness (injury) occurred within 30 calendar days from the date of termination of work under an employment contract, performance of official or other activities, during which the person is subject to compulsory social insurance in case of temporary disability and in connection with maternity;

- 48 – for a valid reason for violating the regime (if the corresponding code is entered in the line “Notes about violating the regime □□”);

- 49 – if the duration of the illness exceeds 4 consecutive months – for insured persons who were disabled on the day of the insured event. This code is not entered if code “11” is indicated in the line “Cause of disability”;

- 50 - if the duration of the disease exceeds 5 months in a calendar year - for insured persons who have a disability on the day of the insured event. This code is not entered if code “11” is indicated in the line “Cause of disability”;

- 51 – in the case specified in part 1.1. Article 14 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, when the insured person at the time of the insured event works part-time (part-time, part-time working day);

This is interesting: Land tax 2021 Sverdlovsk region for pensioners

As for the sick leave certificate itself, it is in any case drawn up according to the approved form. If for two years the employee’s earnings turned out to be less than the minimum wage or no average earnings at all, then in the bulletin in the column “average earnings for calculating benefits” and “average daily earnings” the amounts are written accordingly based on the minimum wage. In this case, the regional coefficient, if there is one, is not taken into account here.

Procedure for calculating the payment amount

To determine whether working part-time affects the amount of sickness benefit, you must:

- Calculate the sum of all official incomes of a citizen 2 years before illness.

- Determine the average monthly income for a two-year period before illness ; to do this, you need to multiply the sum of all official income of the employee for a given period by 30.4 and divide by 730.

- Compare the result with the minimum wage.

It is important to take into account that for calculations, the minimum wage established on the date of opening of sick leave is taken, taking into account regional allowances.

If the result obtained is greater than the minimum wage, then the amount of sick leave is calculated using the formula:

where D is the amount of income for the two-year period before the illness (regional allowances are already included in this amount), and B is the number of days spent on sick leave.

If the result obtained is less than the minimum wage, then the amount of sick leave benefits is calculated using the formula:

where M is the minimum wage, RK is the regional coefficient (increment), H is the duration of the shift (in hours), P is the duration of a full shift at a given rate. If an employee works part-time, regardless of the length of the working day, then instead of the multiplier (B/P), the fractional part of the rate is substituted into the formula, for example, when working part-time, the multiplier is 0.5.

Calculation of sick leave: changes in 2021, examples of calculation according to the new rule

For sick leave in 2021, this is 1473.00 (718.00+755.00) thousand rubles. That is, the average daily salary cannot be more than 2020 rubles 81 kopecks. If the estimated earnings are higher, the value determined by the maximum amounts is applied.

This will affect the amount of disability benefits, which are calculated when the employee has a very small salary, or there is no information about the salary for the two previous years. This is due to the fact that instead of paying the employee, in these cases the minimum wage is applied.

We recommend reading: Cannot Be Produced: No Personal Account!

An example of calculating sick leave for part-time work

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Previously unemployed citizen M. got a job at the enterprise on December 1, 2021, then was on sick leave from September 1 to September 18 inclusive. On the date of opening of the sick leave, M.’s working day lasted 5 hours instead of the 8 hours required at this rate by agreement with the employer.

First, the total income for 2 years before the illness is calculated before deducting the 13% tax; it is (9 months of work)*13000/(1-0.13)=134482.76 rubles.

It can be seen that 5600.38 is less than the minimum wage , so the sickness benefit will depend on the length of the working day and will be:

M*RK*B*24 /730*(B/P) = 11163*1.15*18*24/730*(5/8) = 4748.1 rubles, or 263.78 rubles for each day of sick leave .

For part-time work, the size of the sick leave benefit is reduced in proportion to the rate only if the benefit is calculated based on the minimum wage. If the average monthly income for the last 2 years of work is higher than the minimum wage, then hospital payments will not depend on the size of the rate.

How to fill out a sick leave certificate if your average earnings are less than the minimum wage

If an employee is assigned a part-time working schedule, a similar indicator is determined in proportion to the employee’s working hours according to the formula (Part 1.1 of Article 14 of Law No. 255-FZ of December 29, 2006):

What minimum wage should average earnings be compared to in 2020?

The accountant checked the amount received with the current minimum wage. The minimum wage per day is 367 rubles. (RUB 11,163 x 24: 730). This is more than the received value. Therefore, benefits must be calculated based on the minimum wage.

If the patient has a small average income or no income at all (if there is no average income), start calculating sickness benefits from this formula (clause 15.3 of the Regulations approved by Government Decree No. 375 of June 15, 2007):

- in March, the possible maximum is 306.1 rubles, the average value is higher than the maximum, so the maximum for this month is taken for payment and the total amount is 9489.1 rubles. (RUB 306.1 x 31 days);

- in April the possible maximum is 316.3 rubles, the average value falls within this maximum, so the amount payable for this month is 9359.1 rubles. (RUB 311.97 x 30 days);

- in May the picture is similar to March, the amount payable for the fifth month of 2020 is 9489.1 rubles;

- in June - as in April, the amount payable for this month is 9359.1 rubles;

- in July the picture is similar to March and May, but the payment is calculated not based on the full number of days in the month (31), but only for the 18 days attributable to vacation. The total amount is 5509.80 rubles. (RUB 306.1 x 18 days).

- in May and July 2021 – 11,163 rubles. : 31 days = 360.10 rub.;

- June 2021 – RUB 11,163. : 30 days = 372.1 rub.

Data for filling out sick leave if average earnings are less than the minimum wage 2020

This formula calculates the cost of one working day. To calculate the BL benefit, you need to multiply the resulting number by the actual number of days of incapacity. In addition, it is necessary to introduce a correction factor depending on the length of total work experience:

- violation by the insured person without good reason during the period of temporary disability of the regime prescribed by the attending physician;

- failure of the insured person to appear without good reason at the appointed time for a medical examination or for a medical and social examination;

- illness or injury resulting from alcohol, drug, toxic intoxication or actions related to such intoxication.

A sample of filling out a sick leave certificate from the minimum wage, taking into account the regional coefficient: Useful video Read about the rules for filling out a sick leave certificate by an employer here: Conclusions Correctly filling out a sick leave certificate is the responsibility of the employee’s employer. In each organization, the role of the employee filling out the sick leave certificate lies either with the accountant or with the head of the human resources department. The employer should carefully consider all recommendations and rules for document execution in order to avoid unpleasant consequences, including when calculating payments from the minimum wage.

Minimum wage for calculating sick leave in 2021

Is it necessary to pay sick leave benefits to an external part-time employee if she is caring for a child under 3 years old at her main place of employment? It is necessary if she also worked in this company for 2 years preceding the illness. The nature of employment at the basic rate does not matter. Question No. 4. An employee has been employed at the company for 2 months in his main position and part-time. How can I pay him for sick leave? If the worker has submitted a certificate f. 182n from the previous place of work, then according to her data, if he did not work anywhere for the previous 2 years - from the minimum wage. Payments to a part-time worker are not taken into account. Question No. 5. How to determine length of service when calculating sick leave benefits for an external part-time worker? You need to ask the employee to provide a copy of the employment record from the main place of employment.

This is interesting: What jobs provide housing in St. Petersburg in 2021

For part-time work, the size of the sick leave benefit is reduced in proportion to the rate only if the benefit is calculated based on the minimum wage. If the average monthly income for the last 2 years of work is higher than the minimum wage, then hospital payments will not depend on the size of the rate.

Subtleties of calculating benefits based on the minimum wage for part-time workers

For employees who are working part-time at the time of the insured event, any benefits are calculated in the same way as for other employees, with one exception, when calculating average earnings based on the minimum wage, the part-time coefficient must be taken into account.

However, some believe that it is not necessary to apply the part-time coefficient to the minimum wage, since this would make the benefit amount less than earnings. Is it possible to follow this approach?

Earnings for calculating benefits are taken equal to 24 minimum wages, if the employee had no earnings at all in the billing period or, in monthly terms, is less than the federal minimum wage at the time of the occurrence of the insured event. To do this, we compare the average monthly earnings of the employee with the minimum wage through the average daily wage

- If the employee’s earnings are more than the minimum wage, then we calculate the benefit based on the employee’s earnings without applying the part-time factor;

- If the employee’s earnings are less than or equal to the minimum wage, then we calculate the benefit based on the minimum wage using the part-time coefficient. If in such a situation the benefit is calculated based on the full minimum wage, then the Social Insurance Fund will refuse to reimburse expenses during the inspection. Most courts adhere to the same position. But there is also an opposite decision, in which the court proceeds from the fact that if an employee is assigned a part-time working schedule (part-time work week, part-time work day), then the average daily earnings are determined in the same way as in the case when the employee has normal working hours and works full time

This is important to know: Is it possible to close sick leave on another day?

To avoid claims from inspectors, it is better in such a situation to calculate the benefit in proportion to the employee’s working hours. Let's see how to do this.

Example. Calculation of temporary disability benefits for a part-time employee

/ solution / The algorithm of actions is as follows.

STEP 1. Calculate the average daily earnings of an employee for the billing period of 2014):

STEP 2. We calculate the average daily earnings, calculated based on the minimum wage:

STEP 3. Compare the average employee’s earnings with the minimum wage.

Since the average employee’s earnings are less than the federal minimum wage at the time of the insured event, to calculate the benefit, the employee’s earnings are taken to be equal to 24 minimum wages at the time of the onset of the illness.

STEP 4. Calculate the average daily earnings to calculate benefits.

Since the employee works part-time, we calculate the average daily earnings in proportion to working hours:

STEP 5. Calculate the allowance:

Please note that the part-time coefficient is not applied when calculating benefits based on the minimum wage for employees who, in accordance with the law, have reduced working hours (for example, disabled people of groups I and II - no more than 35 hours per week. After all, the reduced time is for them the maximum daily duration work (shift) and the full standard of work and does not entail a proportional reduction in wages

Do not forget that the amount of the monthly child care benefit cannot be less than the minimum amount in 2015.

- 2718.34 rub. - when caring for the first child;

- RUB 5,436.67 - when caring for a second and subsequent child.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Since the minimum monthly child care benefit this year is greater than the benefit calculated even on the basis of the full minimum wage - 2,386 rubles. (5965 rubles x 24 / 730 x 40% x 30.4 days), the benefit must be paid in the minimum amount.

Birth allowance if you have earnings and experience

If at the time of going on maternity leave the employee had both earnings and length of service, then the shortened working day will not affect the procedure for calculating benefits. This is due to the fact that maternity benefits in this case are calculated from average earnings, and it is not tied to the length of the working day.

If you have length of service and payments under an employment contract (GPC agreement), the benefit is calculated according to the formula:

SDZ x DO

Where:

SDZ - average daily earnings, which is calculated for the 2 years preceding the year of maternity leave;

DO - days of maternity leave (140, 156, 194).

Average daily earnings are calculated using the formula:

(ZP1 + ZP2): 730

Where:

ZP1 - salary for the first year preceding the year of maternity leave;

ZP2 - salary for the second year preceding the year of maternity leave;

730 — number of days in billing years. If one of them is a leap year, 731 days are taken into account. From these, exclude the days when the employee was on maternity leave, maternity leave, sick leave, or was released from work while maintaining her salary.

The calculated SDZ must be compared with the limit established for the year in which the calculation is made. SDZ limit is the maximum value of average daily earnings that can be taken into account when calculating benefits. It is determined based on the maximum base for insurance contributions to the Social Insurance Fund for each year involved in the calculation. In 2021, the SDZ limit is 2,301.37 (815,000 + 865,000): 730. More information about the procedure for calculating SDZ can be found here.

Payment of sick leave for part-time work

Author: Manokhova S.V. , expert of the information and reference system “Ayudar Info”

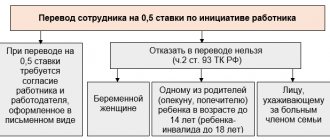

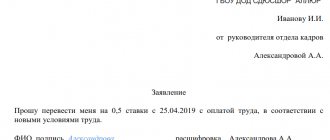

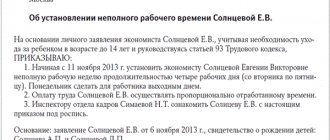

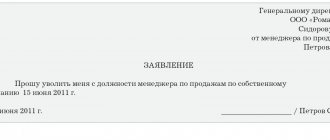

The concept of part-time work is contained in Art. 93 Labor Code of the Russian Federation. In accordance with the norms of this article, by agreement of the parties to the employment contract, an employee, both upon hiring and subsequently, may be assigned part-time working hours:

or part-time (shift);

or part-time work week, including with the division of the working day into parts.

The same article establishes that when working part-time, the employee’s payment is made in proportion to the time he worked or depending on the amount of work he performed. How is the period of incapacity paid? About this in this material.

A little “normative”

The procedure for calculating temporary disability benefits is established:

Article 14 of Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Federal Law No. 255-FZ);

Features of the procedure for calculating benefits for temporary disability, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375 (hereinafter referred to as Regulation No. 375).

In accordance with clause 16 of this provision, if the insured person is assigned part-time work (part-time work week, part-time work), the average daily earnings are determined according to the rules provided for in clauses 15(1) - 15(3) of the said provision, that is, in in general order.

We will calculate temporary disability benefits

Let us immediately note that the procedure for calculating temporary disability benefits in the event that an employee works part-time is ambiguous. Let us explain why.

According to the general rules, a daily temporary disability benefit is determined by multiplying the average daily earnings of the insured person by the amount of the benefit established as a percentage of the average earnings, depending on the employee’s insurance length (60, 80 or 100%) (Part 4 of Article 14 of the Federal Law No. 255-FZ).

In turn, the average daily earnings for calculating temporary disability benefits are determined by dividing the earnings accrued for the billing period by 730 (clause 15(1) of Regulation No. 375).

For reference: average daily earnings cannot exceed the maximum average daily earnings for calculating benefits (in 2021 - 2,150.68 rubles).

Clause 15(3) of Regulation No. 375 states that in the cases specified in clause 11(1) of the said regulation, for calculating benefits for temporary disability, the average daily earnings are determined by dividing the minimum wage established by federal law on the day of the occurrence of the insured event, increased 24 times, 730.

This is important to know: What date is indicated in the length of service column on the sick leave certificate?

In paragraph 11(1) of Regulation No. 375 we read:

if the insured person had no earnings during the billing period, as well as if the average earnings for this period calculated for a full calendar month are below the minimum wage, the average daily earnings are determined based on the minimum wage (paragraph 1);

if the insured person is working part-time at , the average earnings on the basis of which the benefit is calculated is determined in proportion to the working hours of the insured person (paragraph 2).

Similar rules are contained in Part 1.1 of Art. 14 of Federal Law No. 255-FZ.

The above norms are interpreted differently by different experts.

According to some, the wording of paragraph. 2 clause 11(1) of Regulation No. 375 should be applied exclusively if the employee had no earnings during the billing period or his average earnings for a full month are below the minimum wage. Only in this situation, the average earnings, on the basis of which temporary disability benefits are calculated, are determined in proportion to the length of working hours of this employee (we are adherents of precisely this (more profitable for the employee) option).

Please note: average earnings are determined in proportion to working hours only in the cases specified in Part 1.1 of Art. 14 of Federal Law No. 255-FZ, namely when the insured person had no earnings for the billing period or if the average earnings calculated for this period, calculated for a full calendar month, are lower than the minimum wage and, therefore, when the average earnings are taken to be equal to the minimum wage.

If the benefit is calculated from the actual earnings of the insured person for the billing period, it is unlawful to reduce this earnings depending on the length of working hours established at the time of the insured event.

Other experts believe that para. 2 paragraph 11(1) must be applied literally. If you follow their logic, for all employees working on a part-time basis on the date of the onset of temporary disability, average earnings must be determined in proportion to the length of working time.

For your information: for more information on how to calculate benefits for an employee who works part-time and whose average salary is below the established minimum wage, read the consultation by S. A. Chernov, “Working part-time: the procedure for paying for disability.”

Example.

How to issue sick leave to a part-time employee?

- home

- About company

- Articles

- How to issue sick leave to a part-time employee?

May 14, 2020

Customer QUESTION:

How to issue sick leave to a part-time employee in 1C: Enterprise Accounting 3.0?

ANSWER from the consultation line specialist:

If the employee’s average earnings for the previous two years are below the minimum wage, then when calculating temporary disability benefits, the average daily earnings and, therefore, the amount of the benefit will be calculated based on the minimum wage.

However, if the employee works part-time, benefits should be calculated based on actual earnings.

To calculate and accrue benefits for temporary disability, we generate the document Sick Leave (section Salaries and Personnel/All Accruals/Button “Create”/Sick Leave).

For example, a part-time employee was sick for 9 days from 04/01/2020 to 04/09/2020. The employee’s total insurance experience at the time of the insured event is more than 8 years.

To analyze the accrual results, you can generate a printed form for calculating average earnings by clicking the “Calculate average earnings” button.

The average salary of an employee was 240,000 rubles: 120,000 rubles. for 2021 and 120,000 rubles. for 2021. In our example, average earnings did not exceed the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for each year.

Average daily earnings are: 240,000 rubles. / 730 days = 328.77 rub.

On the day of the insured event, the minimum wage is 12,130 rubles. (Federal Law dated December 27, 2019 No. 463-FZ).

The minimum average daily earnings, calculated from the minimum wage, is: 12,130 rubles. * 24 months / 730 days = 398.79 rubles, which is more than the employee’s actual average daily earnings. Therefore, to calculate benefits, we take the average daily earnings calculated from the minimum wage.

The amount of benefits for the first three days of temporary disability (the organization participates in the Social Insurance Fund Pilot Project) is: 398.79 rubles. * 3 days = 1,196.37 rubles.

However, we are not satisfied with this calculation, so we manually change the benefit amount for the first three days of illness to the amount calculated based on the actual average earnings: 328.77 rubles. * 3 days = 986.31 rub.

Personal income tax and the amount payable are automatically calculated from the specified accrued amount.

Then, from the sick leave sheet, go to the Employee Application document and fill it out. On the “Benefit Calculation” tab, in the “Average daily earnings for the billing period” field, the amount of earnings calculated based on the minimum wage was automatically entered. You must manually change it to the amount calculated based on the actual average earnings (in our example - 328.77 rubles).

In the field “Proportion of time when working part-time” instead of “1.000” we write “0.500”, because According to the agreement, the employee works part-time.

Thus, the required amounts of temporary disability benefits will be correctly reflected both in the accounting accounts and in the register of information sent to the Social Insurance Fund for the assignment and payment of benefits for the remaining days of illness.

Part-time work: calculation of sick leave benefits

“Salary”, 2011, N 5

In the last issue of Salary magazine, we talked about the features of calculating average daily earnings when calculating benefits. Not much time has passed since the publication of the material, but we are returning to this topic again to clarify the calculation methodology.

The article “Benefits: features of calculating average earnings” (“Salary”, 2011, No. 4) was devoted to the application of the new provision established by Part 1.1 of Art. 14 Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” (as amended on December 8, 2010, as amended on February 25, 2011) (hereinafter referred to as Law N 255-FZ ). Let's remember the main thing.

The essence of the new provision

In Part 1.1 of Art. 14 of Law N 255-FZ states that if during the billing period the employee did not have earnings or this earnings turned out to be below the minimum wage calculated for a full calendar month, the average earnings for calculating benefits for temporary disability and in connection with maternity are taken equal to the minimum wage.

The minimum wage must be adjusted in proportion to the length of working time if the benefit is calculated for an employee who is assigned part-time work (part-time work, part-time work).

In the above-mentioned article, a certain sequence of actions was proposed when calculating benefits for employees who work part-time. Let's clarify some points.

Calculation of sick leave and benefits when setting part-time work

Unfortunately, the FSS employees are right. As a general rule, the average daily earnings are determined by dividing the total amount of earnings accrued for the billing period by 730 days (part 3 of article 14 of the Law of December 29, 2006 No. 255-FZ and paragraph 15 of the regulation approved by the Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). At the same time, this rule is also applied to calculate the average daily earnings of employees who are assigned part-time work (clause 16 of the regulation approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375). In a situation where, according to the results of the calculation, the average earnings for a full calendar month are lower than the minimum wage established on the day the illness began, such earnings are taken to be equal to the minimum wage. In this case, the value of the minimum wage must be reduced in proportion to the working hours of such an employee. This rule applies only to those employees who, on the day the sick leave was opened, had a part-time working regime established (Part 1.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ). In your case, the employee carries out work and receives wages based on the actual time worked.

We recommend reading: Will a family become poor if they give up property?

Insurance experience 45 years. Salary + RK + SN = 15,300. According to the time sheet, he works 2-3 hours a day. Salary is calculated in proportion to the standard hours/days for a 40-hour work week. Earnings for the accounting years amounted to 92,560.80. That when calculating the daily average - 126.80 rubles, i.e. less than the minimum average salary from the minimum wage - 182.60 rubles. Accordingly, the accruals amounted to RUB 3,725.04. (3067.68 at the expense of the Social Insurance Fund, 657.36 at the expense of the employer). The Social Insurance Fund asks to recalculate sick leave (as a percentage), since the employee works 2-3 hours a day, not 8 hours. The employment contract simply states the salary, the regional coefficient and the Northern bonus. Clarify please. Our employee is registered at full rate, not 1/2 rate; his full rate is indicated in the employment contract. But the working day varies due to professional needs - from 2 to 4 hours, instead of 8 hours (according to standard working hours)

Methodology clarification

In order to find out whether to calculate benefits based on the minimum wage or the employee’s actual earnings, it is necessary to compare two values:

- the amount of the employee’s actual average daily earnings;

- the amount of the minimum average daily earnings, determined based on the minimum wage.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

If an employee is assigned part-time work, then the minimum amount of average daily earnings must be adjusted in proportion to the length of working time. And at what point should this be done - before it is compared with the actual average daily earnings or after?

As of the date of signing for publication of the last issue of the journal, specialists from the Federal Social Insurance Fund of the Russian Federation believed that the minimum wage should not be adjusted when calculating the minimum average daily earnings for an employee who is assigned part-time work. They recommended making adjustments after the two amounts of average daily earnings have been compared, and the value calculated on the basis of the minimum wage has been selected for calculating benefits. The editors brought this position to the attention of readers.

Over time, the point of view of the FSS RF specialists has changed. The minimum wage must be adjusted depending on the length of working hours at the time of calculating the minimum average daily earnings. And this is logical, since now we will compare comparable indicators :

- actual average daily earnings, which was determined taking into account payments calculated in proportion to the time worked;

- the minimum amount of average daily earnings, in which the minimum wage is also adjusted depending on the length of working hours.

Moreover, such a calculation will lead to an increase in the benefit amount. The editors considered this issue again not only with the participation of FSS specialists, but also specialists from the Ministry of Health and Social Development of Russia.

Let's look at the clarified procedure for calculating temporary disability benefits using examples.

Calculation of sick leave in 2021: examples of calculation in a new way

Amount of earnings for previous years: 2021 - 346,000 rubles, 2020 - 511,000 rubles. These values do not exceed the maximum values determined in each year, in 2021 - 755,000 rubles, in 2021 - 815,000 rubles. It follows that the employee’s actual earnings will be used to determine benefits.

Once you have all the specified information in your hands, you can use the online sick leave calculator in 2020. This step will allow you to make calculations with minimal time and without errors.

We recommend reading: Subsidies for housing purchases in the city of Orel

If the employee’s insurance experience is more than six months

The examples given below will help us understand when and how to apply the norm of Part 1.1 of Art. 14 of Law N 255-FZ when calculating temporary disability benefits for an employee who is assigned part-time work and whose insurance period is more than six months .

In example 1, when calculating benefits, the norm of Part 1.1 of Art. 14 of Law No. 255-FZ does not apply. The benefit is calculated as usual.

In example 2, the benefit was calculated taking into account the above norm - the benefit was calculated from the minimum amount of average daily earnings.

Example 1 . A.S. Kalistratov works at OJSC “Doblest” at 0.75 times the salary. From March 30 to April 6, 2011 (8 calendar days) he was on sick leave.

Let us determine the amount of temporary disability benefits if the employee has six years of insurance coverage.

Solution. Let's determine the amount of average daily earnings to calculate benefits. It is equal to 114.46 rubles. (RUB 83,552.89: 730).

To understand, you need to apply the norm of Part 1.1 of Art. 14 of Law N 255-FZ or not, let’s compare the amount received with the amount of average daily earnings calculated based on the minimum wage.

The amount of the minimum average daily earnings is 106.77 rubles. (RUB 4,330 x 0.75 x 24 months: 730).

Please note: when determining the amount of average daily earnings based on the minimum wage, we adjusted the minimum wage in proportion to the length of A.S.’s working hours. Kalistratova. This is done so that both amounts of average daily earnings that we compare become comparable - the actual average daily earnings are calculated from earnings for part-time work, and we calculated the minimum average daily earnings in proportion to the time worked by the employee.

Since 114.46 rub. > 106.77 rubles, further calculation of benefits is carried out based on the amount of the employee’s actual average daily earnings. That is, in this situation, the norm of Part 1.1 of Art. 14 of Law N 255-FZ we do not apply.

Let's determine the amount of daily allowance. It is equal to 91.57 rubles. (RUB 114.46 x 80%).

The amount of temporary disability benefits will be 732.56 rubles. (91.57 RUR x 8 calendar days). From her:

- RUR 247.71 (91.57 rubles x 3 calendar days) are paid at the expense of the employer;

- RUR 484.85 (732.56 rubles - 247.71 rubles) - at the expense of the Federal Social Insurance Fund of the Russian Federation.

We will determine the amount of temporary disability benefits.

Now we compare the resulting amount with the amount of average daily earnings calculated based on the minimum wage, and choose a larger value.

The amount of the minimum average daily earnings is 106.77 rubles. (RUB 4,330 x 0.75 x 24 months: 730). It is more than the amount of average daily earnings (106.77 rubles > 106.16 rubles), so we apply the norm of Part 1.1 of Art. 14 of Law N 255-FZ and further calculation of benefits is based on this amount.

The amount of the daily allowance will be 85.42 rubles. (RUB 106.77 x 80%), and the amount of temporary disability benefits is RUB 683.36. (RUB 85.42 x 8 calendar days).

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

256.26 rubles will be paid from the employer’s funds. (85.42 rubles x 3 calendar days), at the expense of the Federal Social Insurance Fund of the Russian Federation - 427.1 rubles. (683.36 rubles - 256.26 rubles).

Please note: if in the area where the employer is located, a regional coefficient was applied to wages, when calculating benefits based on the minimum wage, this coefficient would need to be applied at the final stage of the calculation, multiplying the received benefit amount by it. This is stated in clause 11.1 of the Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity, approved by the Decree of the Government of the Russian Federation of June 15 .2007 N 375 (as amended on 03/01/2011).

For example , if the regional coefficient is 1.5, the benefit amount in example 2 will be 1025.04 rubles. (RUB 683.36 x 1.5).

Of this amount, 384.39 rubles will be paid from the employer’s funds. (256.26 rubles x 1.5), at the expense of the Federal Social Insurance Fund of the Russian Federation - 640.65 rubles. (RUB 1,025.04 - RUB 384.39).