09.06.2019

0

1024

5 minutes.

Before a vacation, a person receives a significant amount of money, which includes wages and vacation pay. As a rule, all funds are spent during the rest period, so the obvious desire of the employee is to receive an advance after returning to work. Below we will discuss how possible this is from a legal point of view and how it is implemented in practice, that is, whether it is necessary to pay the employee an advance after the vacation.

How is an advance paid during vacation - payment methods

We figured out whether an advance is due to an employee on vacation or not. You will have to calculate accruals if you worked at least 1 day.

Often accountants have a question: How to pay an advance if an employee is on vacation? For non-cash payments, funds are transferred to the individual’s personal card. There are no problems. The employer fulfilled its duty to the employee.

If earnings are issued “the old fashioned way” from the cash register, the person will have to come to the organization to collect the money. You can notify the pick-up time in advance by telephone. What to do if an employee does not come or does not have such an opportunity? There are three options for resolving the issue.

Paying an advance in cash to an employee on vacation - 3 ways:

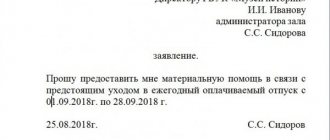

- Pay money in advance before going on vacation - to do this, the employee needs to write an application requesting an advance addressed to the manager. After approval, the cashier will make the calculations.

- Pay the advance on the established settlement day to an authorized person - for example, husband, wife, other relative (or not). The main thing is that the employee delegates the appropriate powers to him.

- Issue funds immediately after returning from vacation - that is, when returning to work.

Note! If the employee does not appear at the organization and does not receive the funds, the employer is obliged to deposit them. This requirement is stated in the Directives of the Central Bank No. 3210-U dated March 11, 2004 (clause 6.5).

Paying an advance in cash to an employee on vacation - 3 ways:

How is an advance paid during vacation - methods of calculation Accountants often have a question: How to pay an advance if an employee is on vacation? For non-cash payments, funds are transferred to the individual’s personal card. There are no problems. The employer fulfilled its duty to the employee.

Employers prefer to combine vacation compensation and advance payment, so as not to make second calculations and transfers later. And, of course, the date from which the employee went on vacation plays a significant role. If it falls at the very beginning of the month, then there is no talk of any advance payment, but if in the second half of the month, then there will be an accrual.

Advance accrued to an employee on vacation - examples

Example 1. There are no actual days worked

Let's assume an employee goes on vacation from August 1st to August 15th. The entire billing period included in the advance payment has not been worked out.

In the time sheet for these days, Fr. is indicated. Is an advance paid during vacation to such a specialist? No, there is nothing to accrue remuneration for, so earnings for the first half of August are not due.

Example 2. There are actually days worked

- 50000 / 22 days x 2 days = 4545 rub.

Since earnings are transferred to the card, there are no problems with payment. For cash payments, you can use the options suggested above.

Advance payment if the employee is on vacation - rules:

- There are days worked in the period from the 1st to the 15th of the month - the advance is calculated.

- There are no days worked in the period from the 1st to the 15th of the month - the advance is not accrued.

- When accruing an advance, funds must be paid according to the general rules - in cash or by bank transfer on the approved settlement date.

Advance payments are made in the same way if the employee is on sick leave. In case of non-cash payments, funds are transferred to his card. When issuing money from the cash register, the employee must come to the organization in person or authorize another person.

Conclusion - in this article we figured out what to do if an employee is on vacation: whether to pay an advance or not. The employee’s right to such payment arises if at least 1 day has actually been worked in the pay period.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Otherwise, there is no need to give out earnings and no punishment is provided for the employer for this. After all, stat.

136 of the Labor Code of the Russian Federation obliges employees to be paid only for the time actually worked.

The question of whether it is necessary to pay an advance to an employee if he is on vacation arises from the inaccuracy of generally accepted formulations. The labor legislation does not say anything about such a concept as “advance payment”.

However, everyone knows that this is money paid for the first half of the current month.

How to pay if an employee is absent during this period due to legal vacation?

- Is it paid if the employee is on vacation at the time of payment?

- Is it allowed if a person had a vacation during the billing period?

- In the first half

- In the second

- The entire month

- How is it calculated - calculation example

- conclusions

Features of advance payments according to the Labor Code of the Russian Federation

According to the norms of current legislation, the employer is obliged to issue wages to staff at least every half month (Part 6 of Article 136 of the Labor Code). The organization independently approves the exact dates in its LNA. The final part of the salary must be paid no later than 15 days (calendar) from the end of the billing month.

The maximum amount for an advance is not regulated by law. Since a specific amount has not been established, it is accepted that the advance and salary are issued in approximately equal parts, provided that the employee has fully worked the month. If the employee was on vacation, is an advance paid or not? There are clear rules in this regard, which are discussed below.

Is it paid if the employee is on vacation at the time of payment?

Art. 136 of the Labor Code of the Russian Federation regulates the procedure for paying wages. According to the provisions of this article, the employer is obliged to pay wages at least twice a month.

Payment for the first half of the month worked must be paid between the 16th and the last (28th, 29th, 30th or 31st) day of the current month. The commonly used term for this payment is “advance”.

Based on the legal norm of Art. 136 of the Labor Code, the payment made in the current period is part of the salary. The Letter of the Ministry of Labor dated August 10, 2017 No. 14-1/B-725 explains that salaries are issued depending on the time worked.

This means that the so-called advance is calculated and paid for the days actually worked. That is, if during the specified period (from the 1st to the 15th) the employee worked, then he is entitled to an advance.

Whether it is necessary to accrue and pay an advance if the employee is not at work on the payment day due to his vacation depends on whether there were days worked in the first half of the month.

If there were days worked, then the advance must be paid by including this vacationer in the payroll. To receive money, an employee can come to work if he receives cash at the cash desk.

If the salary is transferred to the employee’s card, then everything is simpler, you just need to make a payment by transferring the money to the vacationer’s account.

An advance payment is made in the same way if the employee was on sick leave - details here.

conclusions

So, an advance is a part of the salary that must be paid in accordance with labor laws and other regulations.

The law states that wages are paid in proportion to the time worked. This means that an advance payment is due to a vacationer if during the specified period he had at least one working day.

If an employee was on vacation for half a month, the advance payment should be calculated for the days worked.

This conclusion is justified as follows.

The Labor Code of the Russian Federation does not contain the concept of “advance payment”. However, the employer must pay wages to employees at least every half month. The payment days are determined by the internal labor regulations, collective agreement, and employment contract (Part 6 of Article 136 of the Labor Code of the Russian Federation). The legislation does not establish any restrictions regarding the maximum amount of the advance.

At the same time, regulatory authorities have repeatedly indicated that when paying wages twice a month, the employer must not limit itself to formal compliance with the norms of Article 136 of the Labor Code of the Russian Federation. When paying wages for half a month, the employer should take into account the time actually worked by the employee (the work actually performed by him). A similar opinion was expressed in letters from the Ministry of Labor of Russia dated 02/03/2016 No. 14-1/10/B-660, Rostrud dated 09/08/2006 No. 1557-6.

Thus, if an employee was on vacation, the advance payment to him is calculated based on the number of days actually worked during this period. If an employee has not worked at all for half a month, he is not entitled to an advance.

At the same time, local regulations establish that the advance to the employee is paid as a percentage of the salary (for example, 40 - 50 percent) or in another fixed amount. If the organization uses this method of calculation, then the advance should be paid based on the established percentage, regardless of whether the employee was working or was on vacation. This will not result in excessive payment of wages, since the days that were not worked due to vacation will be taken into account in the final payment for the month. Important! The inspectors did not speak out in favor of this method, so we do not recommend using it in practice.

Is it allowed if a person had a vacation during the billing period?

Let's consider several situations:

- when the first vacation day falls in the first part of the month;

- when vacation starts in the second half;

- when the employee rests for the entire month.

In the first half

To understand this issue, let's look at two cases.

The person is on vacation throughout the entire period for calculation, namely from the 1st to the 15th. On the 15th, the accounting department must pay an advance to the employees.

For the first 15 days, this employee has a no-show note with the OT (vacation) code on his report card.

Obviously, the employee does not have any time worked during this period, which means he is not entitled to an advance.

The employee went on another vacation on the 5th. The employee’s timesheet shows 4 days, from the 1st to the 4th inclusive.

This means that on the 15th the employee must be given an advance in proportion to the days worked, that is, based on 4 days worked.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Thus, we can conclude that if an employee’s vacation begins in the first half, then he will be entitled to an advance if there are days worked in the first 15 days.

If this period falls entirely on vacation, then no payment is due. If there are working days, then funds must be paid for them.

In the second

Let's look at another example.

The employee went on another vacation on the 16th. He will be on another vacation until the end of the month.

The employee's workdays are marked on the working time sheet from the 1st to the 15th. Obviously, the advance must be paid to the employee in accordance with the time worked, that is, in full as usual.

Vacation pay will be issued to the employee separately, no later than three days before the start of the vacation (13th). The amount of vacation pay will be included in the calculation at the end of the month, minus the amounts issued (vacation pay + advance payment).

Thus, if the start of the vacation falls on any day of the second half of the month, then the money for the current month must be paid in full.

As for the advance for the next month, you need to look at what day the employee goes to work and accrue funds in accordance with the days worked.

The entire month

Since the employee does not have any time worked during vacation, he is not accrued or paid wages.

Accordingly, in this situation the employee does not receive any money.

Moreover, he will not receive a salary for either the first or the second part of the month, since there will be no days worked.

But he will be paid vacation pay for the entire period.

How is it calculated - calculation example

Employee T.V. Makarov returned from his next paid leave on February 5th.

The standard working time in February is 19 days. According to the production calendar, the hours worked, including weekends and holidays, includes 9 days.

The employee is on vacation, how to issue an advance for the first half of the month

Let us remind you that the advance must be paid based on the actual time worked in the first half of the month. Therefore, to calculate the advance if the employee was on vacation, you need to take into account the period of payment of average earnings. It turns out that if the employee does not have any days worked in the first half of the month, then he need not be paid an advance.

This is a forced measure aimed at stimulating the employer to fulfill its obligations.

Helps to build a competent litigation strategy based on the study and analysis of decisions already available in the database on similar cases. Annual paid leave is based on actual time worked. But labor legislation does not prohibit granting leave in advance, that is, until the employee has the corresponding right. The employee will have to work “advance” vacation days.

Payment of an advance to an employee during vacation

The advance is issued in the second half of the month. Since wages are calculated for the time actually worked (according to the letter from the Ministry of Labor), in order to receive it, you must be at the workplace from the 1st to the 15th.

If at the time of payment of the advance part of the salary the employee was on vacation, but at the beginning of the month he was working, funds are transferred to him or he receives them at the cash desk. The date of issue and size are set by management, recorded in regulatory documents and the rental agreement.

ATTENTION! Personal income tax can be deducted both immediately at the time of issuance of the advance, and after, upon full settlement with the subordinate.

Calculation of advance payment on vacation

The requirement to pay wages at least twice a month is not violated: the Labor Code of the Russian Federation does not require an advance payment to be paid to the employee for time not actually worked. If he worked at least a day before or after his vacation, the size of his advance will depend on what payroll method is adopted in the company:

- calculated - the amount of the advance depends on the actual time worked;

- advance - the amount of the advance does not depend on the actual time worked.

Calculation method of calculating wages If payment for the first half of the month is accrued to employees for the time actually worked, it will be a salary, and not an advance.

An example of calculating an advance for 2021 if the employee was on vacation

The timing of the advance payment is determined by the internal documents of the organization, including a collective agreement, regulations on the payment of wages or bonuses to employees, an employment contract or other agreements.

The date of the scheduled advance payment is any day of the month. But the rule is that the rules enshrined in internal documents cannot conflict with current legislation.

In such cases, the existing norms are recognized as invalid, and the documents themselves are considered to be drawn up in violation of the law.

The employer will be held liable in accordance with legal requirements. Current Russian legislation only establishes periods between payments of 15 calendar days.

To reduce discrepancies, most organizations set the 15th as the advance payment date.

Is it necessary to pay an advance if there was a vacation during the billing period?

The need for payment depends on the time frame of the vacation. Example situations:

- The employee's annual vacation fell in the first two weeks of the month. This means that he was absent from work and did not earn anything. Vacation pay is paid before the vacation, i.e. last month.

- The vacation began, for example, on the 6th, and from the 1st to the 5th the person was at work. During this period, the due amount will be transferred to him.

- The employee worked throughout the first half of the month, until the 15th, and went on vacation on the 16th. He has the right to count on the full amount of the advance.

That is, the advance is calculated based on the days worked at the beginning of the month, regardless of their number.

ATTENTION! Vacation pay can be accrued to an employee separately, but no later than three days before the start of the vacation.

Procedure for calculating advance payment after vacation

The law obliges to include the conditions for the payment of wages in the collective agreement, internal regulations, regulations on wages and employment contracts. It is calculated from the salary and the amount of working time.

Working days are entered in the timesheet, which is maintained by the personnel department using forms No. T-12, T-13 or on its own forms. When calculating, use one of the formulas:

- Additional payments (if any) are added to the salary, then the amount is divided by two. The staff receives this half for the first part of the pay period.

- The amount consisting of salary and allowances is multiplied by the advance percentage approved by the enterprise. There are companies where it reaches 70%. In this case, it is better to deduct personal income tax immediately, since later there may not be enough money earned.

At its discretion, the employer has the right to calculate the advance payment individually for each employee or set the same maximum for everyone.

Calculation example

Technologist Ivanova N.M. I worked from November 1 to November 5, and went on vacation on November 6. Her monthly salary is 30 thousand rubles. There are a total of 20 working days in November. The advance will be calculated as follows:

Payment term

The dates for accrual and payment of wages at the enterprise are set by decision of management. The main condition is that the interval between them should be no more than 15 days.

The advance, as a rule, is transferred in the second half of the billing period, and the calculation - in the first half of the next one. Accounting submits reports that fall at the end of the month, so it will be more convenient to make an advance payment before the 25th.

Features of calculating an advance after a vacation

To avoid problems with the law, when paying wages in two payments, an enterprise must adhere to Article 136 of the Labor Code of the Russian Federation. Some employers prefer to issue an advance along with vacation pay in order to avoid debt to the employee, but this is not necessary.

The employee has the right to ask for the advance payment to be transferred to him along with vacation pay or, conversely, to pay him the money after the vacation for the convenience of planning expenses. In any case, you can count on an advance after your vacation if you actually worked at least one day between the 1st and the 15th.

Acting lawyer in Labor Law, head of the HR department. Work experience more than 10 years.

Advance is a part of the employee’s total profit, payments of which are due every month. Based on current legislation, every employer is obliged to comply with this requirement.

The first part of the salary is paid as an advance, and the second part is the main one. There is a practice among management when employees are forced to sign a statement refusing to pay an advance.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

In this case, wages are paid in full once a month. From a legal point of view, such actions are unjustified and the employer has no right to force such a procedure.

Is an advance paid to an employee if the vacation starts from the middle of the month?

How to fulfill this requirement if the employee for some reason did not actually work at that time? Rostrud specialists recommend that employers, in addition to formally complying with the requirements of Article 136 of the Labor Code of the Russian Federation regarding the payment of wages at least twice a month, when determining the amount of the advance, take into account the time actually worked by the employee (actually completed work) (Rostrud letter dated September 8, 2006 No. 1557-6) .

At the same time, leaving the payment of the advance until the last days of the month (after the 20th) is still not recommended, since the meaning of the very concept of “advance on monthly salary” is lost, although there is no direct prohibition in the legislation for such payment periods. Taking into account the above, the employer must independently determine the dates for payment of wages and register them in the documents.

The notice must be in writing, as it is important that the employee signs for it, thereby confirming that he has been warned. Vacation from the middle of the month.

Do I need to pay an advance? If the start of an employee’s vacation begins on days other than the payment of wages and advances, vacation pay is paid to him 3 days before the start of the vacation, and wages and advances must be paid to him on the days established by the employer’s regulatory document.

In addition, the Labor Code of the Russian Federation does not have the concept of “advance”; salaries must be paid every half month. Vacation: controversial issues of registration and calculation 1.

An employee goes on vacation in the middle of the month

Vacation pay does not replace an advance payment. Now whoever wants to do it, I’m talking about employers. For example, at work we have an advance payment strictly on the twentieth, and it doesn’t matter whether a person goes on vacation or not, he still gets the money.

But at my previous job, for example, they didn’t pay me an advance - because I was on sick leave for a week and the boss motivated this by the fact that I supposedly didn’t work - so I wasn’t entitled to it.

In general, the employment contract (if there is one) should specify the date of the advance payment and salary, and then everything is paid according to the schedule.

The employee is on vacation, how to issue an advance for the first half of the month

What is the minimum number of vacation days an employee can take? If an employee goes on Monday after a vacation, does he have the right not to include the previous weekend in the vacation period? The purpose of annual paid leave is to restore the employee’s physical and moral strength, and, in general, it must be at least 28 calendar days per year of work. Vacation pay and salary. In conclusion, let us remind you that vacation pay must be paid three days before the start.

Important

But there is no need to rush to pay, along with vacation pay, wages for the time worked before the start of the vacation - wages are paid within the time limits established by the internal regulations of the organization (but, as required by the Labor Code of the Russian Federation, at least every half month). In addition, you can argue this way, as long as the employee is in you, the principle of issuing wages twice a month will be violated.

Advance amounts

The amount of the advance depends on the size of the salary.

The advance payment after vacation must be calculated by the accounting department. However, its size must be less than 50% of the total amount of the payment.

This rule is also enshrined in the relevant regulatory documents. The minimum size should not be lower than the fixed rate.

There are two ways to calculate the advance, which are used by accounting employees:

- calculating the amount of the advance taking into account the amount of time worked. In this case, the main document is the attendance sheet, on the basis of which the advance is calculated.

It is appropriate to use the following formula: salary + additional bonus/total number of hours worked * amount of time worked within 15 days;

- the second option is used less frequently, since the calculation is based on a fixed bet size. As a rule, this method is used in commercial structures, and the formula for calculation will be as follows: salary + additional bonus (if any) * fixed rate.

As for bonuses, this may be overtime.

It is worth noting that medical care, financial payments under certain circumstances, or payments from social packages are not included in the allowances item.

Calculation of payments

The calculation of the amount is carried out by the responsible employee or department in the company. To do this, there are certain rules that must be followed. Thus, advance payments cannot exceed 50% of wages. Such a requirement is enshrined not only in government documents, but also in the company’s internal documentation.

How to calculate how much advance payment is required? As for the minimum level, the advance payment should not be less than wages for a certain number of shifts at the established rate. If such a situation arises, it can be considered a violation for which certain liability is provided.

Let's look at how payments are calculated. There are two options for this:

- by the number of hours worked;

- as a percentage of total earnings.

So, if we are talking about the first method of calculation, then the number of hours and the tariff rate, which is provided in the documents, are taken into account. The employee is entitled to an amount, which can be calculated using the following formula: rate for one hour of working time * period * allowances. Having calculated all the components, we will get the final amount of the advance for the first half of the month.

Vacation and advance payment, possible nuances

Special procedure for paying an advance after a vacation.

Based on current legislation, an advance payment after vacation must be paid if the employee was on his required vacation. In this case, the advance amount is paid 100%.

It is worth noting that there are some nuances that are regulated by a letter from Rostrud in 2006.

Thus, experts created a series of recommendations in which it was proposed to calculate the amount of the advance after vacation in accordance with the amount of time actually worked, regardless of whether he was entitled to vacation.

Based on such requirements, the procedure for calculating the advance payment occurs in the following format:

- An employee has every reason to ask for an advance payment if he worked at least a day in the first half of the month;

- An employee does not receive an advance payment if he has not worked at least one day in the first part of the month.

If the employer decides to use this advance payment scheme, then this will not be a violation of the current legislative framework, since the employee receives an advance for the period of time worked, so there is no infringement of the employee’s rights.

Advance: size and timing of payments, legislative framework

In accordance with Article 136 of the Labor Code of the Russian Federation, payment of an advance is a mandatory step. This rule is also enshrined in the Code of Administrative Offenses and a letter from the Ministry of Finance. The law states that all employers are required to make two payments per month with a difference of no more than fifteen days between them.

The advance itself is a sum of money provided for work not yet done, that is, in advance. And at the end of the month, calculations are made related to the number of hours worked and productivity. The size of the first payment is determined by the company’s internal documents.

As for the size of advance payments, they can be determined monthly and individually, or they can be in the form of a fixed amount. Difficulties with how to accrue funds arise during periods when an employee goes on legally required leave. Whether to give money in this case is discussed below.

Taxation

Controversial situation when calculating tax on advance payments.

A controversial situation arises in determining the taxation of an advance payment. Today, even judicial practice is not able to fully determine this issue.

Turning to the Tax Code of the Russian Federation, you can see that the employee is obliged to pay tax on the profit he receives for the work done.

In this case, each employer acting as a tax agent is obliged to calculate the amount of tax along with the amount of salary. With the advance part, the situation turns out to be somewhat more complicated, since there is no clear definition of whether the advance should be considered an income item.

Most experts believe that taxes should be calculated and deducted directly from the second part of the profit received, the payment of which most often occurs in the second half of the month. Since the advance is paid in the first half, it is not taken into account in calculating the tax, which is withheld by the employer for further payment.

It is important to note that personal income tax is also calculated once a month, when it is accrued.

Before this date, the amount of the advance payment received is not included in the execution of this scheme.

As for non-standard situations in which an advance is calculated after a vacation, each case must be calculated individually, also based on the provisions of the established legislative framework.

In this video you will learn how to retain overpaid vacation pay.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The vacation period gives a lot of positive emotions to the vacationer, but sooner or later it ends. The worker goes to his workplace and joins the production process.

The main desire of a vacationer is to receive the next paycheck, because during the vacation all the funds are often spent.

Advance payments

Advance payments are an obligation imposed on each employer by the Labor Code of the Russian Federation. It is enshrined in Article 136 of the Labor Code, which stipulates that wages must be paid twice a month, with an interval of no more than 15 days between payments.

This procedure must be observed by every employer, unless federal legislation provides for other terms for settlements with employees. Certain categories of employees are subject to a different type of payment due to the special nature of their work.

The accrual of an advance is a measure aimed at supporting hired persons. Therefore, if an employer arbitrarily refuses to pay an advance payment, this is a gross violation of the law and entails administrative liability.

Several legislative acts regulate the issue of calculating advance funds:

- Article 136 of the Labor Code of the Russian Federation, which regulates when, where and within what timeframes wages must be paid to employees.

- The Code of the Russian Federation on bringing to administrative liability, which specifies the extent of the employer’s material and other liability for violation of norms.

Ideally, the employer just needs to adhere to the norms of Article 136 of the Labor Code of the Russian Federation and there will be no problems with the law.

Payment of salary to an employee on vacation

Every half month, on the days established by the organization, employees must be paid wages (Article 136 of the Labor Code of the Russian Federation). Therefore, wages consist of two parts:

- advance (salary for the first half of the month);

- final payment for the month (salary for the second half of the month).

Wages are paid on time - on the day determined by the internal labor regulations, collective agreement, employment contract.

Advance payment if the employee is on vacation Annual paid leave is based on the time actually worked.

Vacation. How long do you prepare for it, and how quickly does it fly by? The day inevitably comes when it's time to get back to work. During your vacation, you don’t want to deny yourself anything. A tourist trip, shopping, meeting with friends - everything requires a lot of money. The next paycheck is still quite far away. What to do?

The accrual of an advance is a measure aimed at supporting hired persons. Therefore, if an employer arbitrarily refuses to pay an advance payment, this is a gross violation of the law and entails administrative liability.

Thus, we can conclude that if an employee’s vacation begins in the first half, then he will be entitled to an advance if there are days worked in the first 15 days. If this period falls entirely on vacation, then no payment is due.

Now the size of the wage advance according to the Labor Code of the Russian Federation depends on the time actually worked.

Let us remind you that the advance must be paid based on the actual time worked in the first half of the month.

Payment term

Please note that there are no clear dates specified in any legislative act when advance payments or wages must be paid. Article 136 of the Labor Code of the Russian Federation only states that the period between payments cannot be more than 15 days, and the rest is at the discretion of the employer.

Each organization sets payment dates independently. But usually, before the 15th day of each month, wages are calculated for the calendar period that has already passed and a full payment is made.

And in the second half of the month an advance is given for the current period.

Specific dates for payments, both advance payments and wages, should not only be thought out by the employer based on his own convenience, but also agreed upon with the banking structure.

The final agreed dates are written in:

- Collective agreement.

- Regulations on wages in the organization.

In addition, when hiring a new employee, an employment contract is concluded with each employee, in which specific payment dates are also written down as a separate line.