This or that production can lead to an accident. How to compensate for damage, how to prove an accident? Read this material for step-by-step instructions on how to receive compensation.

ATTENTION : our labor lawyer in Yekaterinburg will not only help you get compensation for an accident, but will also answer other legal questions in the office of the Law Office “Katsailidi and Partners” or by phone

Occupational events leading to compensation

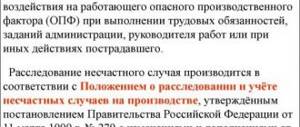

All cases of death or injury while performing the manager’s tasks are subject to a thorough investigation by commissions formed from among the organization’s officials and the labor inspectorate. An accident can happen to a person working under an employment agreement, part-time, or performing a one-time order from a manager under a contract in the interests of the enterprise.

Such employees include:

- persons who carry out practical training or are in training;

- persons performing simple work in occupational therapy – with a mental diagnosis;

- convicts serving a sentence of completing compulsory hours of labor service;

- persons involved in labor in the form of administrative punishment;

- individual entrepreneurs and farmers (members of cooperatives, industries, farms).

All cases of injuries at work are considered by special commissions

Important! If a person performs a labor function and a workplace is assigned to him, but the relationship is not formalized by an agreement, the fact of the relationship is proven in court.

Examples of insurance cases at work

- Case No. 1

At a pipe-rolling plant, a grinder suffered a hand injury while working on a machine. The accident occurred in the workshop during working hours. This is clearly an insured event at work, since the damage was received while performing official duties on the employer’s premises. The employee was officially employed, and contributions were made to the Social Insurance Fund for him.

- Case No. 2

A courier transporting documents from one division of the company to another was attacked and the victim suffered a traumatic brain injury. Despite the fact that the event did not occur within the walls of the organization, the employee was in the performance of his duties - this is also an industrial accident.

- Case No. 3

A minibus en route to the depot became involved in a traffic accident. The driver received bruises and injuries, as a result of which he was unable to go to work and was forced to go on sick leave. This is also the case in production.

- Case No. 4

The organization sent an employee of a pharmaceutical company for training to another city by train. On the way to the destination, a train accident occurred. The worker was seriously injured. This situation also falls under the classification of an industrial accident.

- Case No. 5

An equipment malfunction occurred at a wood processing plant. As a result, three operators were injured. They were taken to the hospital with varying degrees of injuries. Everyone will receive insurance payments in an amount corresponding to the severity of the damage.

Injuries

Injuries can occur as a result of accidents. The gradation varies depending on the severity or occupational disease.

- Damage of varying degrees, resulting in permanent loss of health.

- Death as a result of injuries received.

- Harm to health from overheating or hypothermia.

- Burns of body parts of varying degrees.

- Electrical damage, excess radiation exposure (exposure).

- Drowning.

- Damage caused by destruction or explosions.

- The list is not limited.

Types of injuries sustained at work vary depending on severity

The specified damages are classified as insured if they occurred on the territory of the organization during the performance of a work function, when traveling to the place (from the place) of service on work transport provided by the head of the organization. An incident may occur during a period of rest on the territory of the organization.

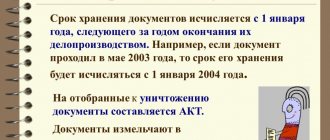

An incident may harm one person or a group. Documents must be filled out according to forms developed by the Ministry of Labor (October 24, 2002), in accordance with Resolution No. 73.

The organization is obliged to insure employees, draw up reports, and inform the Social Insurance Fund.

The employer is obliged to inform the Social Insurance Fund about the incident.

Additional payments

Article 235 of the Labor Code of the Russian Federation established the obligation of the head of the enterprise to compensate the injured employee for material damage received as a result of an accident at work (driving into the internal parking lot of the organization after a lunch break, part of the roof of an unfinished building collapsed on the employee’s car. As a result, the employee was not injured, but the front part The car is subject to restoration).

The amount of compensation is determined according to the market price of damaged or irretrievably lost property. Payment is made upon receipt of an application addressed to the boss. If management refuses to pay, the employee has the right to go to court.

Moral damage is paid by agreement of the parties, and in its absence, in court.

Occupational diseases

04/30/2003 Resolution No. 76 of the Chief Sanitary Doctor of the Russian Federation recorded in the table the harmfulness and proportion of acceptable chemicals in production.

Categories of occupational diseases are indicated and approved by order No. 417n dated April 27, 2012 by the Ministry of Health and Social Development of Russia in the list:

- chemical poisoning;

- occupational exposure;

- biological component;

- overstrain of the body and overload.

The procedure, conditions and mechanism for conducting an investigation into occupational diseases acquired at work are regulated by the Government of Russia. Resolution No. 967 (December 15, 2000) regulates the application of the established Procedure for recording and investigating diseases (acute and chronic poisoning).

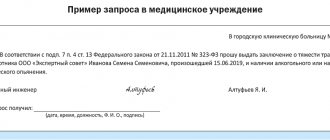

Excerpt from Russian Government Decree No. 967

Acute poisoning is a harmful single exposure to the human body or body of chemical substances that lead to loss of ability to work.

Chronic diseases are harmful effects on the body for a long time of factors that led to the acquisition of one of the disability groups.

Important! The state supervision center, after receiving information about the harmful effects on the employee’s body, begins an investigation within one day, draws up a description of the conditions for performing a work function in production and sends it to a medical institution.

The victim controls the progress of the investigation and, if he disagrees, supplements the description with his own objections. After a diagnosis of an “occupational disease” is made, the employee is sent for a lengthy examination, where a final diagnosis is made. The findings of the medical examination are sent to the employee and the insurance company. An examination is carried out at the pathology center, where the diagnosis is approved or canceled. All interested parties are notified of the conclusions of the examination. The report records the diagnosis, the nature of the disease and the organization where the incident occurred.

The employee is required to undergo a medical examination to make a specific diagnosis.

Compensation amounts are calculated and paid in the interests of the interested person from the funds of the Social Insurance Fund and the organization in accordance with Federal Law No. 125 on compulsory insurance of workers at work against accidents (07/24/1998).

Work injury, payments and compensation in 2021

If you are interested in the question of how an injury at work is paid and what an employer should do in 2019 . The employer makes the following payments and compensations:

- simultaneous (periodic) insurance payments;

- temporary disability benefits;

- payments for an industrial accident as compensation for additional expenses caused by the social, medical, professional rehabilitation of the injured employee.

By the way, if a person was under the influence of alcohol or drugs, he may be deprived of payments.

Examination process

The expert institution begins to investigate the facts and determine the causes and consequences after receiving an incident report. The victim, organization or insurer turns to experts. Disability is established for a period determined by the commission or permanently if the damage was particularly serious. If you disagree with the medical examination, its conclusion can be challenged in court. If the insured person evades the examination without any justification or good reason, or a scheduled examination by experts, the insured person may be deprived of a monthly payment.

Sometimes, due to injuries at work, a citizen may be diagnosed with a disability.

The act indicates the degree of guilt of the victim in percentages, which are taken into account when determining the amount of payment. It cannot be reduced by more than 25%.

Important ! The payment cannot be reduced if the accident resulted in the death of the victim.

If it is established that the insured has direct intent to cause grave consequences, compensation payments are not paid to the victim.

If, during the investigation of the accident, specialists established the employee’s intent, no payments will be made to him.

What should an employee do if injured at work?

When injured at work, an employee must take care not only to restore his health, but also to ensure that during treatment and rehabilitation he receives compensation, that is, compensation for lost wages. According to Article 184 of the Labor Code of the Russian Federation, the employer is obliged to compensate for the earnings that the employee did not receive during treatment. Law No. 125-FZ of July 24, 1998 speaks about this. Moreover, according to this rule, an employee can claim compensation for lost earnings even after returning to work. This is possible in cases where long-term rehabilitation is necessary and the employee cannot work at full capacity. Article 1085 of the Civil Code of the Russian Federation states that an employee can claim compensation in the amount of 100%.

An employee who has been injured at work should remember that in order to receive all the benefits due, it is necessary to provide:

- sick leave;

- documents confirming expenses for treatment and rehabilitation;

- an application requesting reimbursement of the amounts specified in the documents provided (application for a one-time or monthly payment for a work-related injury).

Payments

After the occurrence of an insured event, the victim has the right to compensation. Minors and incapacitated family members have the right to maintenance if the employee is seriously injured or dies. The fact that a minor is dependent does not require proof.

Payments in case of death at work are received by:

- minor dependents up to 18 years of age, with full-time education - up to 23 years of age;

- persons who have reached retirement age;

- disabled people for a period, establishing a group;

- an interested person raising a child of the deceased until the ward reaches the age of 14;

- persons recognized as dependents of the deceased by a court decision.

If the deceased employee was dependent on his relatives and (or) interested parties, payments will be made to them

Types of insurance compensation.

- Disability benefits.

- One-time and monthly payments.

- Payment for medical care on the territory of the Russian Federation, compensation for the purchase of additional medicines, if there is a cause-and-effect relationship between the insured event and additional treatment costs.

- Compensation for the costs of providing individual care and care.

- Compensation for transportation costs associated with treatment and routine examinations, for the purchase of prostheses, to the place of examination.

- Providing a vehicle if a disability group is established, the inability to move independently.

The employer is obliged to pay an employee who is injured at work, disability benefits, medical care, and transportation costs.

Important . Moral damage is compensated by the person found guilty of causing harm.

If the employer is at fault, the victim is compensated for moral, material damage and lost earnings.

UtZ = СрЗ/24 (number of months).

UTZ - lost earnings.

Average earnings for two years.

The calculator below will help you calculate your lost earnings.

Go to calculations

If the minimum wage value is larger, then it is used.

If the accident is the fault of the employer, the victim is compensated for moral and material damage

One-time insurance payment in case of an accident at work

In the event of an accident resulting in the loss of a person’s professional ability to work, the victim is subject to a lump sum insurance payment. In the event of the death of the insured person, the payment may be received by eligible persons.

To receive the payment in question, the insured person must have an ITU conclusion that an insured event has occurred due to loss of professional ability to work.

Payments to insured persons must be made no later than 1 month from the date of their appointment.

In the event of the death of the insured person, payment to persons entitled to receive the payment in question is made within 2 days after the insurer receives from the policyholder the documents necessary to assign the payment.

Amount of insurance benefit

In case of temporary disability (during the period until health is restored), the benefit is 100% of the average monthly earnings. The calculation is made in accordance with Federal Law-255 (December 29, 2006) on compulsory insurance for temporary disability.

Important ! The benefit (per calendar month) is paid no more than the maximum established four times the monthly insurance benefit. If the calculated amounts are exceeded, only the established maximum amount of insurance payment is paid.

Dp = Max.S/Kd

DP - daily disability benefit.

Max.S - maximum benefit amount per month.

Kd - period of incapacity for work, calculated in calendar days.

The calculator below will help you calculate your daily disability benefit.

Go to calculations

In case of temporary incapacity for work, a benefit is paid in the amount of 100% of average monthly earnings

One-time and monthly compensations are assigned to the insured persons by decision of the medical commission if there are signs of incapacity during the performance of the manager’s assignment.

Determination of an insured event at work

For each officially employed employee, the employer transfers funds to the Social Insurance Fund. This is a mandatory requirement at the state level. It serves as a guarantor of security for any working citizen, and if an insured event occurs at work (even if a job is lost), the victim will receive a cash payment.

What is an insured event?

This term is given and deciphered in the Federal Law regulating relations in the field of industrial insurance. Thus, according to the law, an insured event at work is a health problem or death, in which two important conditions are met:

- the event took place and is confirmed as a fact;

- it occurred in the workplace while the employee was performing his functional duties.

Simply put, an industrial accident is an event resulting in injury, disability or death that occurs at work.

There are other important nuances that should be taken into account when qualifying an event that happened at work to classify it as an insured event at work:

- if an employee was injured while performing work duties, it does not matter whether he was on the territory of the enterprise or in any other place, if it is proven that at that moment he was on duty (for example, a courier who was delivering a parcel to its destination);

- injury or death is directly related to the employee’s performance of his direct work;

- the victim is an employee officially employed in accordance with the requirements of the Labor Code of the Russian Federation;

- For this employee, the employer made contributions to the Social Insurance Fund.

In addition, occupational diseases are included in insured events at work. These are disturbances in the functioning of the worker’s body that are directly or indirectly related to the scope of his activity. The disease can be acute or chronic, and the person becomes temporarily or permanently disabled. A mandatory condition for classifying a specific case as an insurance case is the proven fact that the disease was caused by exposure to factors and working conditions.

One-time payments

They are formed and assigned within a month from the date of the insured event. Money is paid to victims or their representatives. In case of death, payments are made no later than 2 days. The amount of the payment depends on the degree of disability and the maximum amount of earnings. In some areas, benefits are increased by a regional increasing factor. The benefit is indexed in accordance with the coefficient. Upon death, the payment is equal to one million rubles.

The amount of lump sum payments depends on the degree of disability and the earnings of the employee with whom the accident occurred

How to prove an accident at work?

When an accident occurs, the first thing the victim should do is seek medical help to determine the severity of the injury. When providing medical care, it is necessary to indicate that the injury was sustained at work.

If possible, you should inform your employer of the accident as soon as possible.

In addition, if possible, it is necessary to record the situation in which the accident occurred by taking photographs or video recording on a phone.

After an accident has occurred, the employer must create a commission to investigate the causes of the accident.

Based on the results of the investigation, a report must be drawn up. If the employee does not agree with the act, he can appeal it.

When proving an accident at work, you should use recordings from CCTV cameras, if any, and witness testimony. In addition, if the cause of the accident was a malfunction of equipment, then this circumstance can be established by examining such equipment and conducting an examination if necessary.

Monthly payments

Payments are made for the entire period until the insured person regains his health. When compensation is calculated, all other benefits and accruals (pensions, scholarships, bonuses) are not reduced.

The payment amount is calculated based on average monthly earnings.

SRZ = ObS/12

Average monthly earnings.

ObS - the total amount of earnings for the year before the incident.

When working for less than a year

СрЗ = ObS/N

ObS - the total amount of earnings for the number of months worked.

N is the number of months worked.

Payments to minors are assigned at least the subsistence level.

The victim is entitled to monthly payments until he can return to work.

The monthly payment amount can be recalculated:

- when the disability group changes;

- in case of death;

- recalculation of average earnings;

- indexing.

Important ! The inflation coefficient is used when calculating average earnings and is taken into account in accordance with the decision of the executive branch of the Russian Federation. The maximum amount in accordance with the legislation as amended is 72,290.4 rubles. If payments were assigned based on the maximum amount in the old version of the law, the amount is recalculated.

The amount of payment may be changed if the disability group of the injured employee changes.

The company's charter may provide for compensation in the event of tragic accidents. On the appointment of payments and other assistance, the head of the organization signs an order, which indicates the basis, amount and timing. Amounts of financial assistance up to 4,000 rubles are not taxed.

Payment calculation

When paying for sick leave, the calculation procedure includes the following steps:

- determining average earnings, with income two years before going on sick leave divided by 730 (the number of days of the specified period);

- the employee’s income is included in the calculation in full, without observing the maximum amount of earnings;

- the resulting value is multiplied by the number of days of sick leave;

- if the average earnings are below the minimum wage, the minimum wage is used in the calculations;

- Personal income tax is withheld from the benefit, this follows from Art. 217 of the Tax Code of the Russian Federation (about the same - in the Letter of the Ministry of Finance of Russia dated February 22, 2008 No. 03-04-05-01/42);

- the benefit is paid on the day of the next advance or salary transfer.

Procedure for assigning payments

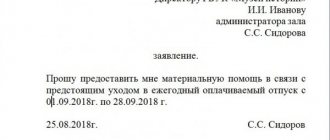

To assign compensation payments in the event of an insured event, the victim or interested person submits an application to the social security authorities. The application with attached documents is submitted by mail, in person or through the State Services portal.

The documents that need to be provided are listed below.

- Passport.

- An act in the approved form (about an accident).

- Conclusions of the labor inspectorate.

- A court decision that established the fact of an insured event.

- A document recording work activity.

- Agreement on the fulfillment of the employer's assignment in the organization.

- Final diagnosis.

- Commission examination.

- Certificates, receipts, checks for rehabilitation expenses, recommendations for restoring health.

- Document on family composition (in case of death).

- Decision on the fact of dependency.

You need to submit an application to the Social Insurance Fund in the event of an accident and attach certain documents to it

There are 10 days to make a decision, and 2 days in case of death.

All legal facts are proven in court and confirmed only after the judicial act comes into force. In case of delay in compensation payments, the employer pays penalties to the victim in the amount of 0.5% of the amount per day of delay. In this case, the victim can contact the insurer with a claim for payment.

What injury is considered work-related?

According to existing labor legislation, an industrial injury is considered to be any event that causes harm to the health of an employee, occurring during the performance of work duties, as well as during the performance of any actions performed for the benefit of the employer. In particular, these include injuries received independently and inflicted by another person, animal bites, lightning strikes and other events associated with industrial and natural factors. Such injuries will be considered industrial if:

- the employee was at the workplace specified in the employment contract or on a break;

- a company vehicle was used;

- the employee was on a business trip or en route to its destination.

The question of whether a work-related injury occurs when an injury occurs as a result of an accident on personal or public transport is decided depending on the purpose for which the transport was used. An injury is considered work-related if the employee was using such transport to carry out instructions from the manager. It is worth remembering that one of the main criteria for qualifying injuries as work-related is the presence of an order from the manager, as well as his financial interest in the employee performing certain actions.

FAQ

Question : I work officially, an employment agreement has been concluded. He was sent on a business trip to the organization's transport. On the way I got into an accident. The injuries resulted in loss of ability to work, and a disability group was assigned. Am I entitled to benefits due to an accident?

Answer : Yes, they are, since an insured event occurred. The injury occurred on the way to the place of work, therefore it is included in the insurance category. If the trip was for personal reasons, payment will be denied.

If the trip in which the accident occurred, resulting in injuries, was for business purposes, the employee is entitled to payments

Question : The accident happened again. How will compensation be calculated?

Answer : For each incident, benefits are generated separately. The degree of health loss is calculated separately.

Question : My father died while he was doing welding work in a repair organization. The employment agreement was not formalized, but he came to work every day and carried out the manager’s tasks. A criminal case has been opened against the director, who refused me, as the victim’s representative, compensation payments. What are the prospects?

Answer : The fact of performing a labor function must be proven in court. You can file a civil claim during the legal process. Decide on claims for compensation for moral and material damage.

Material costs add up as follows:

- funeral costs;

- lost property;

- lost earnings;

- compensation for legal costs and representative services.

Moral damages depend on the degree of suffering and anxiety associated with the death of a loved one.

You may have to prove in court that you performed your job function

Depending on the internal regulations and charter of the organization, you may qualify for additional payments.

Question : I was using the organization’s transport to pick up flowers for the dacha, got into an accident, and was injured - a broken leg. Am I entitled to compensation and benefits?

Answer : This case is not considered insured, since the trip was carried out for personal purposes.

Question : I worked in a candy production and was injured. Loss of ability to work by 50%. Payments have been processed at the regional Social Insurance Fund. How do payments increase due to inflation?

Answer : From February 1, the amount is recalculated annually taking into account the inflation coefficient for the past period. In 2021, indexation was 4.3%. The next one is expected in 2021.

Payment amounts are indexed annually

Question : The employer is trying in every possible way to hide the fact of the accident and is not conducting an investigation. What are the inspection deadlines and where to apply?

Answer : You must contact your employer in writing with a statement, the labor inspectorate with a complaint, and the police. The fact of loss of health must be recorded in a medical institution. The police will issue a referral for examination. The investigation period for mild damage to health is 3 days, more serious and in connection with death - 15 days. The deadlines may be extended if there are grounds. The employer is required to sign an order to form a commission to investigate the incident.

Question : The father was injured while performing duties at work, what benefits can he claim?

Answer : An accident victim is entitled to compensation based on a sick leave certificate prescribed by a doctor. Benefits are paid for the entire period until he is unable to work. If permanent disability is established - 100% of average earnings.

The amount of payments depends on the severity of the damage, the duration of the period during which the person could not work

An examination will be carried out, and if the findings establish the inability to work or carry out professional activities, your father may qualify for such payments.

| Variety | Notes |

| One-time payment | If a multiplying factor is established in your region, the payment will be increased. |

| Monthly payment | It is formed depending on the average monthly earnings, taking into account the regional coefficient. |

| Additional payments | For example, in case of rehabilitation costs as prescribed by a doctor, causing moral damage, etc. |

Question : I work at a factory. The manager informed that in the event of an injury at work, the employee is dealt with by intermediaries - managers. Explain the situation, how this innovation is regulated?

Answer : A pilot project for the rehabilitation of victims has been introduced. This issue is dealt with by the FSS of the Russian Federation - regional branches. Managers deal with issues of restoring the health of victims, representing their interests in medical institutions and centers, in organizations and government structures. An employee of the Social Insurance Fund accompanies the injured employee and assists him in legal matters.

In case of an accident at work, FSS employees accompany the injured worker and provide assistance to him

Question : I work as a tractor driver. Before work, he was repairing a tractor on the instructions of his supervisor and was injured. Is the event insurable? Will I be compensated?

Answer : You are entitled to payments because an accident occurred while performing a job function.

Question : I work in a concern, the salary is high. I was injured and it was considered work-related. Are there any restrictions when making payments?

Answer : The maximum monthly benefit should not be higher than four times the maximum insurance benefit (monthly payment), which is equal to 309,135.44 rubles from 02/01/2020.

There is a maximum amount of insurance benefits that can be assigned to an injured employee

Question : I was injured at work and did not follow the safety rules about which my employer warned me. Will I be paid?

Answer : When investigating the incident, the commission will establish all the circumstances and the degree of guilt of the parties. The conclusions of the report will indicate the fact of careless behavior if there is guilt in your actions. The monthly payment amount may be reduced, but not more than 25%.

Important ! The employer is obliged to assess the working conditions of employees once every five years. The conclusion of the expert assessment indicates all harmful factors at work. When hiring a person, in addition to concluding an employment contract, the employer is obliged to familiarize him with the job description and the conclusion of an independent commission on indicators of conditions in the workplace and on the harmfulness of production. For violation of this condition, the employer may be held liable.

The employer is obliged to familiarize employees with safety rules

What is paid to an employee in the event of a work injury?

All types of payments due to an injured employee are strictly regulated at the legislative level. Their list includes (clauses 1-3, clause 1, article 8 of the Federal Law of July 24, 1998 No. 125-FZ):

- Sick leave during treatment;

- One-time and monthly insurance payments;

- Additional accruals for the period of recovery of the employee’s health (medical, professional, social rehabilitation).

A domestic injury involves payment only of temporary disability benefits.

The sources of financing for most of the above charges are funds from the Federal Social Insurance Fund of the Russian Federation. The exceptions are:

- Disability benefits;

- Payment for vacation for sanatorium treatment;

- Travel to the place of vacation in connection with treatment.

They are paid by the employer, but the amount of sick leave is subsequently compensated to him by the Federal Social Insurance Fund of the Russian Federation as an offset against the transfer of insurance contributions.

How much money you can get from your employer in the event of a work injury, see the video below.

How is sick leave for an injury calculated and paid?

To assign benefits, you must submit a sick leave certificate and an accident report to the accounting department. After receiving them, the employer must:

- Within 10 calendar days from the date of receipt, calculate and accrue temporary disability benefits at the expense of the Social Insurance Fund;

- Pay the employee the due amount of sick leave on the next payday after accrual.

There are cases when the certificate is not ready at the time of receipt of sick leave, in this case it is first paid for as disability on the usual basis, that is, the first 3 days at the expense of the company, the remaining days at the expense of the Social Insurance Fund. After receiving the document, the accrual is reversed and carried out as sick leave due to injury entirely from the Social Insurance Fund budget. If there is a difference in the payment amount, it is paid additionally to the employee within the above-mentioned time frame.

If the sick leave is issued in electronic format, it is enough for the employer to provide its number.

The procedure for calculating sick leave in connection with a work injury:

- The amount of earnings for the billing period from which contributions for injuries were paid in accordance with the established procedure is determined. It should be borne in mind that the maximum amount of earnings taken into account for these purposes is not limited. If there is no income for the billing period, the salary is assumed to be 24 minimum wages;

- The average daily earnings of an employee are determined by the formula: Average daily earnings = Payroll for the billing period / 730.

- The obtained result is compared with the average value calculated based on the minimum wage. For further calculations, the average daily earnings are accepted, which ultimately turns out to be greater.

The amount of disability benefits paid in connection with an injury does not depend on length of service and is always paid in the amount of 100% of average earnings.

- We determine the amount of benefits for the month: Average daily earnings × Number of calendar days in the month of sick leave.

- The monthly amount of benefit received is compared with the maximum benefit amount multiplied by 4. That is, the monthly injury benefit in 2021 cannot be more than 78,283.86 × 4 = 313,135.44 rubles.

- If the amount of the monthly benefit is less, the actual amount of sick leave payable is determined: Average daily earnings × Number of calendar days of sick leave.

If the amount is greater than the maximum, then the calculation is carried out based on the latter.

Sick leave for an injury recognized as an industrial injury, but received as a result of alcohol or drug intoxication, is paid based on the minimum wage.

How are insurance payments from the Social Insurance Fund processed and paid?

One-time, monthly insurance payments are assigned to the insured person on the basis of an application submitted to the FSS and a package of documents attached to it. It is drawn up on an approved form -.

To receive these payments, the employee’s actions must be as follows:

- Submitting an application in the established form in person, by mail, through the MFC or the State Services portal. In case of personal submission, an identification document will be required.

- Along with the application you must provide: Accident Report;

- Conclusion of the medical commission on the level of loss of ability to work following the incident;

- A document confirming the existence of an employment relationship (employment contract; work book);

- Certificate of average earnings (if it is not possible to get it from the employer, you can ask the Social Insurance Fund to request this data from the Pension Fund of the Russian Federation);

If a positive decision is made, a one-time payment is transferred no later than a month from the date of the decision, monthly compensations are paid at the end of the month of their accrual.

In 2021, the maximum monthly insurance payment cannot be more than 79,602.38 rubles, a one-time payment can reach 103,527.66 rubles. These amounts are indexed annually.

Payment is assigned only in the event of the applicant's loss of ability to work, confirmed by the conclusion of a medical commission. Calculation of payments in case of injury is made in the form of a share of average monthly earnings, depending on the degree of loss of ability to work.

Average earnings are determined as follows:

- To calculate average earnings, the formula is used (clause 3 of article 12 of Law N 125-FZ): payroll for 12 months before injury / 12;

If in the selected period there were months that were not fully worked, or periods of income data for which there are no data, they are replaced with amounts for other, fully worked months.

- If an employee worked in the billing period for less than 12 months or 12 months in which information about several months is missing, the formula is applied: Actual payroll for the billing period / Actual number of months worked;

- If an employee has worked for a period of less than a month, average earnings are calculated using the formula: Payroll / Number of days worked × Number of days in a month.

If the commission determines that the insured is at fault for the incident, his payment may be reduced, but not more than by 25%.

How are additional recovery payments determined?

Social rehabilitation payments in case of an industrial injury are awarded only after such a need has been established based on the results of a medical examination. At the same time, it is not allowed to provide the same benefits on several grounds, for example, as a victim of an accident or as a disabled person.

The following payment and compensation procedure applies:

- An application is submitted to the Social Insurance Fund in the same way as is established for one-time and monthly social payments, with the same list of accompanying documents;

- A rehabilitation program approved by medical experts must be attached;

- Within 10 days from the date of receipt, documents are reviewed and a decision is made;

- Within 3 days, an order is issued to assign payments or a reasoned refusal to provide them.

Payment of the relevant amounts occurs within 20 days from the date of the relevant decision. Reimbursable expenses include:

- Medical care, including high-tech care until complete recovery;

- Purchase of medicines and necessary equipment;

- Payment for third-party care;

- Travel for the insured and his accompanying person (if necessary) to undergo sanatorium-resort treatment;

- Cost of spa treatment;

- Manufacturing of prostheses;

- Vocational training and additional vocational education.

The payment is transferred to a bank card or sent by postal order.

Conditions for payment of compensation

To make payments to an employee in the event of an accident at work, the following conditions must be met:

Refusal of compensation

Even an insured employee working under an employment contract may be denied compensation if he was injured while under the influence of alcohol or as a result of committing criminal acts.

- The employee must be insured by the Social Insurance Fund. The employer is obliged to transfer insurance payments for all employees with whom an employment contract has been concluded. If an individual performs work on the basis of a civil law contract or a work contract, then insurance is provided only if this clause is present in the document.

- An investigation into the accident was carried out in accordance with Article 229 of the Labor Code of the Russian Federation. Based on the results of the investigation of the industrial accident under the Labor Code of the Russian Federation, the commission recognized that the injury occurred as a result of the accident. If it turns out that the employee was injured on his own, he will not receive compensation.

The following video examines the question: what social benefits is a worker injured in an industrial accident entitled to receive?

Compensation for treatment costs

Remember! An employee injured as a result of an accident at work will be compensated for the following expenses from the budget of the Social Insurance Fund:

- for medical care, including high-tech, received by the employee from the moment of the accident until the moment of recovery;

- for the purchase of medicines;

- to pay for care services for an injured employee;

- to pay for transportation costs associated with transporting the injured employee and one accompanying person to the place of treatment;

- to pay for sanatorium-resort treatment;

- to pay for the manufacture and repair of prostheses.

To prove the expenses incurred, the injured employee must provide:

- extract from the medical history;

- appointments made by doctors and prescriptions written out;

- financial documentation confirming the fact of incurring and the amount of expenses.

Employees of the Social Insurance Fund are given 10 days to consider the issue of payment of compensation on the merits and make a decision.

Scope of damages

Employees who have a social insurance policy have the right to expect compensation for damages in excess of the insurance coverage. If a citizen was injured or otherwise damaged, or a disease occurred, he will be compensated for the income lost due to this event that he could have had before the situation occurred.

When determining the amount of compensation, the employee’s salary and other income are taken into account, that is, money that the victim could receive at work. The specificity of civil and labor legislation is the fact that lost wages are not reduced by the amount of pensions and other benefits assigned to the employee due to injury. These payments cannot be counted toward your reimbursement benefit.

We can say that currently, working citizens are guaranteed the protection of their property rights.

The amount of payments due to the injured person can be increased due to the concluded agreement, as well as as required by law (Article 1083, clause 3 of the Civil Code of the Russian Federation). How to determine the amount of harm? It is assigned as a percentage of the average monthly earnings, paid until the moment of injury, damage, illness, or until the citizen loses his ability to work in accordance with the degree.

The content of a citizen’s lost earnings includes types of remuneration for work at the place of work (main) and part-time work. We are talking about earnings that are subject to income tax. Profit received as a result of doing business and the author's fee are included in lost earnings based on data from the tax authorities.

Business profits and fees are taken into account in amounts that are calculated before taxes are withheld. The victim's income is calculated by dividing the total amount of wages by the 12 months that preceded the injury.

If at the time of injury a person worked less than this period, then the total amount of income is divided by the time that he actually worked at the enterprise.

If, as a result of a health injury sustained at work, provided that the person took sick leave for a short time, he is entitled to compensation for lost earnings for the entire period of his absence from work. If a different situation occurs, the person has lost the ability to work forever, in this case the loss of ability to work is determined by degree, it is established how much the employee has lost the skills for previously performed work in his qualifications and specialty.

Persons entitled to payments upon death of the victim

If injuries sustained in an accident result in the death of an employee, the following persons are eligible to receive benefits:

- dependents of the deceased person at the time of his death, as well as those who became unable to work within five years after death;

- children of the deceased who were born after his death;

- parents and spouse of the deceased;

- a person engaged in caring for the disabled dependent of a deceased person.

In addition to a one-time payment, relatives have the right to a survivor's pension.

You can ask questions about compensation for work injury in the comments to the article