The essence of a lump sum payment for vacation in 2021

A lump sum payment for vacation is a popular incentive for employees and a great way to motivate them to work better and more productively.

Every employer knows that the more people are satisfied with their working conditions, pay, management and team, the more enthusiastic and productive they will be at work.

Therefore, the right manager must always remember to reward his employees with additional money.

A vacation lump sum is an incentive payment paid to employees while on vacation.

Basically, it is assigned in a situation of productive and fruitful activity of the employee.

Important! Not every employee can receive a lump sum of payments for vacation, but only those who have distinguished themselves in the process of work.

There are certain conditions for receiving these payments. Every employer should know who is entitled to pay and who is not.

Initial information

A one-time payment for vacation is a popular employee incentive and an excellent way to motivate them to work harder.

Every employer knows that the more satisfied a person is with working conditions, wages, the team and management, the more enthusiasm he will have in the work itself.

Therefore, do not forget to once again please your employees with additional funds.

What it is

A one-time payment for vacation (abbreviated as EVO) is an incentive compensation that is paid for vacation.

It is appointed mainly for good performance and fruitful activity at work.

Please note that not everyone can receive a lump sum payment for their vacation.

There are certain requirements to obtain it. Every employer should know to whom he has the right to pay it and to whom he does not.

Conventionally, all additional payments can be divided into two main categories:

- social;

- incentives.

Social benefits, as a rule, are assigned only when an employee needs to solve any personal life problems.

Such financial assistance is paid at the request of a company employee when something happens to him.

The amount of such assistance is set at the discretion of the director of the enterprise and directly depends on the real financial situation of the company itself.

The incentive payment is assigned only to motivate the employee and set him up for more productive work.

A one-time payment for vacation falls precisely into this category of payments. Every person who is officially employed can apply for a lump sum payment for vacation.

Therefore, if you have never received such help from your company, you should consider starting a serious conversation with your management.

How to correctly fill out form 6-NDFL for employers

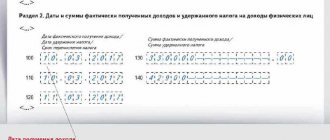

Please note that there is no special procedure for reflecting a lump sum payment for vacation in a special form 6-NDFL. This is not provided for by the tax legislation of our country.

The income that a company employee receives in the form of a lump sum payment for vacation should be classified as incentive payments.

That is, it is reflected in the second section of Calculation 6-NDFL. It looks like this:

| Line 100 entitled “Date of actual receipt of income” | This means that you indicate a specific day when a lump sum payment will be transferred to a company employee |

| Line 110 entitled “Tax Withholding Date” | Implies that you must specify the same date as in line 100 |

| Line 120 entitled “Tax payment deadline” | Implies that it is necessary to indicate the next day after the actual payment of lump sum assistance |

Legal regulation

The main regulatory documents that contain all the necessary information about a lump sum payment for vacation are the Labor Code of the Russian Federation.

In particular, you need to pay attention to articles numbered:

| 136 | Procedure, place and terms of payment of wages |

| 135 | Wage setting |

| 144 | Remuneration systems for employees of state and municipal institutions |

Also, do not lose sight of the Tax Code of the Russian Federation and its articles:

| 226 | Features of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents |

| 270 | Expenses not taken into account for tax purposes |

| 255 | Labor costs |

Basics of the procedure for providing a lump sum payment for vacation in 2021

The amount of lump sum payments to an employee for vacation does not depend on the duration of the vacation itself. Paid annually.

If an employee works on a reduced schedule part-time, then when calculating the lump sum, a coefficient is applied, which is defined as the ratio of the time actually worked by the employee to the normal length of the working week.

To receive the amount, the vacation application must simultaneously indicate a request for the payment of a lump sum benefit, which does not depend on the duration of the vacation itself. Even if the vacation is divided into parts, the benefit amount can be paid immediately upon the first part of the vacation.

This payment is targeted and can only be provided in the current year.

Basic leave for civil servants: how many days are due and what is the procedure for providing

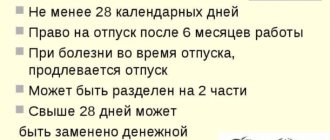

The procedure for granting leaves to civil servants is regulated by the Law “On State Civil...” dated July 27, 2004 No. 79-FZ.

On August 2, 2016, the provisions of the law “On amendments to Articles 45 and 46 of the Federal Law “On the State Civil Service of the Russian Federation in terms of streamlining the duration of vacations in the state civil service”” dated June 2, 2016 No. 176-FZ came into force. The procedure for calculating the duration of leave for all persons holding civilian positions has been unified. Unlike the previous gradation of the duration of rest time depending on the category of the employee’s position, Part 3 of Art. 46 of Law No. 79-FZ establishes a different rule for determining how many vacation days civil servants have.

The duration of the annual basic paid leave in the civil service is currently 30 days, calculated calendar.

The leave of civil servants is based on the following rules established by Art. 46 of Law No. 79-FZ:

- must be provided annually;

- its period is determined on the basis of the vacation schedule, which is approved no later than 2 weeks before the start of the year in which the vacation should be provided;

- leave can be granted in parts, but at least one of them cannot be shorter than 2 calendar weeks;

- the employee must use at least 28 days in one year;

- In case of urgent need, part of the vacation exceeding 28 days can be transferred to the next year, in which it must be used without fail.

At the request of the employee and with the consent of the employer, vacation days over 28 can not be taken, but can receive monetary compensation for them.

Who is entitled to a lump sum payment for vacation in 2021

To receive payment in the form of a lump sum of vacation incentives, you should take into account the rule: the employee must work for at least 6 months in this company.

The assignment of payment amounts can be made in any company, regardless of the form of ownership and organizational and legal form.

The rules for paying a lump sum must be prescribed in the regulations of the organization itself, but they must not contradict the current legislation, signed employment contracts and collective agreements.

Important! There are factors that limit the receipt of this amount:

- the employee has worked for the company for less than six months;

- the employee goes on vacation and immediately resigns;

- the employee plans to go on maternity leave (other payments are planned).

Is financial assistance included in the calculation of vacation pay?

First of all, it is necessary to understand what the payments due to the employee before going on vacation should consist of. According to Art. 115 of the Labor Code of the Russian Federation, each employee, regardless of length of service and other circumstances, is granted leave for a period of at least 28 calendar days per year worked, and in cases established by law, leave may be longer. According to Art. 136 of the Labor Code of the Russian Federation, vacation is paid at least 3 days before its actual start.

At the same time, according to Art. 114 of the Labor Code of the Russian Federation, during the vacation the employee must retain his average earnings. Accordingly, when paying vacation pay, you need to determine what exactly is included in the concept of “average” and what is not. And all the questions are precisely related to whether financial assistance is included in the calculation of vacation pay or not?

How is a lump sum payment paid for vacation in 2021?

Important conditions for assigning and paying a lump sum for vacation:

- calculated by the chief accountant and appointed by the director;

- the amount is set taking into account the financial position of the company;

- paid once a year;

- cannot exceed two employee salaries;

- paid only to an employee who has worked for more than 6 months in the company;

- regulated by current legislation, employment contracts and collective agreements.

Who is the recipient and what is the amount of assistance?

The amount of these payments is established by the accountant (in accordance with the director’s decision), based on the employee’s salary and depending on the financial situation of the organization. Additional payment is made once a year in an amount not exceeding 2 monthly salaries, after the relevant order is issued for the enterprise. To receive it, the employee must work in the organization for at least 6 months.

These payments can be made to employees of various organizations, including: budgetary, municipal and commercial . At the same time, the procedure for calculating them must be regulated by law and the provisions of the labor or collective agreement src=»https://posobie-help.ru/wp-content/uploads/2017/06/edinovremennaja_viplata_otpusk_komu.jpg» class=»aligncenter» width=»700 ″ height=”448″[/img]

Example of a lump sum payment for vacation in 2021

Example 1: Let's take an HR employee as an example.

Source data for example.

| Parameter | Meaning |

| Salary | 50,000 rubles |

| Percentage of payout amount | 35% |

The table shows the calculation of amounts

| Calculation stages | Amounts, rubles |

| Payment amount excluding taxes | 50000 * 0,35 = 17500 |

| Not taxed | 4000 |

| The tax base | 17500 – 4000 = 13500 |

| Income tax | 13500*0,13 = 1755 |

| Insurance premiums | 13500*0,3 = 4050 |

| Payment amounts including taxes and insurance contributions | 17500-1755-4050= 11695 |

| Amount of payments including additional payment to vacation pay | 50000+11695 = 61695 |

Taxation issues

A completely logical question arises: is financial assistance for an employee’s vacation subject to taxation? In this case, you should be guided by the provisions of Article 217 of the Tax Code of the Russian Federation. This article stipulates that the following payments are not subject to taxation:

- women who registered in the early stages of pregnancy;

- payments due for child care;

- financial assistance, which is accrued under Article 217 of the Tax Code of the Russian Federation, paragraph 28.

- income totaling no more than 4,000 rubles.

If income exceeds the threshold of 4,000 rubles, then tax is levied depending on the amount in the amount of 13% and is displayed in the 2-NDFL certificate, code 2760 (income) and 503 (deduction).

Regarding insurance premiums, the main thing is not to display the phrase “financial assistance” in the order. Otherwise, this payment will be considered as wages, which has a deduction rate of 22% for payments over 4,000 rubles. Otherwise, insurance premiums are required to be collected from each payment to the employee.

It is worth taking into account that when calculating vacation pay, the following are not taken into account:

- financial assistance to government employees;

- social payments;

- premium;

- courses, utilities, other employee expenses, etc.

Calculation of financial assistance for vacation

Application for a one-time payment for vacation in 2021

The collective agreement provides for a fixed amount of payments for vacation, therefore, if an employee is going to go on vacation in accordance with the schedule, an application should be submitted.

But if the leave is not provided according to the previously approved schedule, then it is necessary to submit an application indicating the full name of the company, the name of the boss and the request for payment of the amount. Documents confirming the need for financial support are attached to the application.

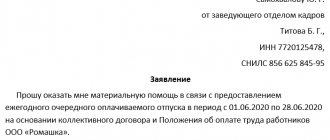

The application must include the following elements:

- full name of the organization in which the person works;

- name of the director of the organization;

- request for a lump sum payment for vacation;

- the amount of money he wants to receive as vacation assistance.

It is also necessary that the application contains additional information confirming that the person really needs additional payment from the company.

How to apply for financial assistance?

There is no generally approved application form for such a payment. Therefore, this document is written either in free form or according to a model already available in the organization. The main points of a written request are:

- name of the institution;

- Full name and position of director and employee;

- request for assistance and temporary boundaries of leave (or other reasons for obtaining financial assistance);

- date of filling out the document, signature and surname of the applicant.

If there is no specific sample of this document at the state employee’s place of duty, then an application for financial assistance for vacation can be written in a similar form:

Sample application for financial assistance

Important! The application must be submitted before the start of the vacation, preferably simultaneously with the application for it, after which the accounting department makes the calculation and the organization pays it (usually along with the required vacation pay).

Taxation of lump sum payment for vacation in 2021

The amount of vacation payments does not constitute financial assistance under the law. In this connection, it is subject to taxation for personal income tax and insurance premiums, as it relates to incentive surcharges.

Therefore, the employer, as a tax agent, is obliged to withhold the tax due from the amounts and pay it to the budget.

Important! The amount of additional payments for vacation is not subject to taxation if its amount is less than 4,000 rubles.

A one-time payment for vacation must be included in wages and taxation expenses:

- Personal income tax at a rate of 13%;

- insurance contributions to the Social Insurance Fund, Compulsory Medical Insurance Fund, Pension Fund.

Features of taxation

It is noteworthy that a lump sum payment in addition to the annual vacation provided is not financial assistance. It, as already mentioned, is an incentive payment provided along with vacation accruals, and is subject to personal income tax.

This conclusion can be made on the basis of paragraph 1 of Article 226 of the Tax Code . In accordance with it, Russian enterprises are recognized as tax agents if they make charges to the taxpayer specified in paragraph 2 of the same article. In this case, they are obliged to accrue, withhold from the individual and pay the calculated personal income tax to the state budget within the time limits established by law.

This is also consistent with the Letter of the Ministry of Finance dated February 29, 2012 No. 03-03-06/4/13 and the provisions of the Labor Code of the Russian Federation . In accordance with them, EVO must be taken into account when calculating labor costs. Taking this into account, these accruals, which are part of remuneration for work activities, cannot be recognized as financial assistance in the context of Art. 270 Tax Code of the Russian Federation. Therefore, guided by paragraph 25 of Art. 255 of the Tax Code, they must be registered as other costs in favor of the employee specified in the provisions of the collective or employment contract.

In this case, even if in the documents listed above EVO is called financial assistance, this will in no way change the very purpose of the payment and therefore will not have any significance. Indeed, in its essence, as already mentioned, it is an incentive remuneration, calculated and paid together with vacation accruals and subject to personal income tax. To avoid problems with regulatory authorities, these payments are reflected not only in the employment contract, but are also written down in the local documents of the enterprise, which gives the additional payment the status of a production incentive.

As a result, it will be included in labor costs , and therefore will be subject to:

- Personal income tax - 13%;

- insurance contributions to the Compulsory Medical Insurance Fund, Pension Fund and Social Insurance Fund - 22%.

It is worth noting that in the regulations on remuneration for economic justification it is necessary to indicate all the properties of the lump sum compensation, for example:

- fixed or % size;

- required work experience in the company;

- no violations of labor discipline.

It is noteworthy that according to paragraph 11 of Part 1 of Art. 9 and part 1 art. 10 Federal Law No. 212-FZ, financial assistance in the amount of up to 4 thousand rubles per employee for one calendar year is not subject Payments are provided during paid leave, established according to the existing schedule.

In a layoff situation

All money due to the employee, including vacation pay, must be paid within three calendar days before the weekend, and the last payment is made on the last working day before the weekend.

Upon leaving, the employee receives:

- vacation pay;

- arrears of wages for previous periods of work;

- calculation for the current month;

- the amount of vacation compensation that the employee did not use.

Important! A lump sum payment for vacation in this situation is not provided.

Rules for payment upon subsequent dismissal

The right to leave for an employee in case of dismissal is secured by Art. 127 Labor Code of the Russian Federation.

It can be implemented in two ways:

- the possibility of going on vacation with subsequent dismissal;

- compensation accruals for unused vacation.

In addition, if the employer refuses to provide vacation, he is obliged to pay compensation for the entire period of unused vacation.

It is worth noting that the employer has the right to provide part of the vacation and compensate the rest with cash payment. leave followed by dismissal in the following cases:

- an employment contract has been concluded with him;

- the employee terminates the employment contract by agreement with the employer or at his own request;

- the term of the employment contract has expired, but the employer does not want to renew it;

- if an employee wants to quit when his turn on the vacation schedule has come;

- the reason for dismissal is the employee’s desire, and not a violation of labor discipline;

- the application is submitted to the HR department within the appropriate time limit.

It is noteworthy that legislative norms leave it to the discretion of the head of the enterprise to satisfy the employee’s right to rest during dismissal. After submitting the appropriate application, the employee can receive permission not only for extraordinary leave, but also for all previously unused leaves.

The following may serve as grounds for dismissal

- mutual consent of the parties;

- the employee’s own desire;

- moving to another job.

When dismissing by mutual consent, the application is written separately, and the entire procedure is regulated by agreement. In other cases, rest can be combined with the dismissal process.

In this case, the employee is entitled to the following payments :

- vacation pay;

- compensation for previously unused vacation days;

- payments for the last month of work;

- arrears of wages for the previous period of work.

The company is obliged to pay vacation pay within 3 calendar days before the start of the vacation. It is noteworthy that final payments are made on the last day of work before rest.

Required documents for registration

The employee himself does not have to provide any additional documents.

If leave is provided to an employee not according to the leave schedule, then he is required to write a separate application indicating a request for payment of a lump sum.

Based on the application, the director of the company creates an order for the assignment of payment, which must indicate the following information:

- amount for incentive;

- date of issue of the amount;

- to whom the amount is intended;

- sources from which payments will be made;

- grounds for assigning the amount.

Features of calculating vacation pay for civil servants

The 2021 bills introduced changes to leave for public service employees. In October of this year, a decree was adopted regarding the reduction of rest periods for workers in certain areas of activity.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

This is important to know: Application for payment and recalculation of benefits, vacation pay

In addition, government officials proposed:

- reduce the duration of leave due for irregular work schedules;

- change the procedure for calculating vacation pay for civil servants based on length of service.

Features when going on maternity leave

Each employer is obliged to pay one-time financial assistance to an expectant mother who will go on maternity leave.

In this case, the woman in the HR department takes special maternity leave. Maternity must be paid in one amount for all days of leave that are provided for by law.

The size of the one-time payment depends on the average woman’s earnings over the last 2 years.

Important! A lump sum payment for vacation in this situation is not provided.

What additional payments can be assigned to company employees?

Without exception, all employees receive a salary, the amount of which depends on their salary, length of service, length of service, additional skills and abilities, internal balance, availability of part-time jobs and the level of bonuses for performance. Incentives are provided only to the best and most effective employees in order to demonstrate their importance in the team and motivate them to continue working.

.

Additional payments can be made as follows:

| Type of joint payment | features |

| incentives | These payments are made selectively. Typically, there are a number of criteria by which employees are evaluated. Bonuses are paid only to employees who achieve specific results in their work. Incentive payments include, in particular, a one-time payment of one-time compensation for unused vacation. |

| Social benefits (material assistance) | These payments are made irregularly only if the employee is in a difficult life situation or upon the occurrence of a significant event (marriage, birth, death of a relative, accident, serious illness, etc.). |

In relation to state and municipal employees

All employees of budgetary and municipal organizations, as well as employees of commercial firms, have the right to annual leave in seven payments. At the same time, the rules of the institution itself must spell out the rules for calculating and paying lump sum benefits for employee vacations.

Important! The main basis for calculating payments is the availability of a sufficient amount of funds in the employer’s accounts to pay one-time incentives to employees for vacation. That is, the enterprise must have a satisfactory financial condition and have profit in its accounts.

Municipal authorities may issue orders for the payment of such incentives to employees for vacation; this must be stated in their Charter. The amount is transferred to employees once a year, which does not depend on the duration of the vacation.

Federal employees have the right to annual leave on a general basis. In this case, the amount of vacation pay is doubled from the salary level. The possibility of receiving additional vacation payments in the form of a lump sum is provided in each region in accordance with local legislation. Funds are paid 10 days before the start of the vacation. In the absence of payments, the civil servant has the right to postpone his vacation until the payments become due.

How to prepare documents for vacation assistance

For vacation, financial assistance to civil servants is issued in 4 stages:

- Drawing up an application from an employee who needs money while on vacation. He is obliged to inform his employer of his intentions. A statement is not written if a person goes on vacation according to a schedule drawn up in advance. In this situation, financial assistance is accrued automatically, but provided that this is provided for by the internal regulations of the enterprise.

The exception is employees of budgetary enterprises. They are given financial assistance once a year. And no statement is written about this.

- Based on the employee’s application, according to the rules of the organization, its head issues an order. The document is drawn up in writing. The text of the document reflects the manager’s order to provide financial assistance to a specific citizen. The text specifies the amount of payments. It is usually determined by the amount of a person’s salary, as well as work experience and other parameters.

- The order is sent to the accounting department. Employees provide the employee with the required financial assistance.

- For 3 days preceding the start of the vacation, the due payments are transferred to the citizen’s personal account. They include vacation money + financial assistance that the employee requested in the application.

Conditions of registration

The accounting department handles the accrual. The basis is an order. When is financial assistance paid for vacation? 3 days from the start of the official holiday.

The order is the basis for payments. It is drawn up in writing, with the relevant details. In particular, the document contains:

- name of the company, enterprise;

- the word "order";

- Date of preparation;

- serial number;

- the basis for the purpose of payments;

- text with the appointment of the official responsible for transferring payments;

- information about the application: if the basis for the order issued by the employer is not only the clause of the local NA, but also the application submitted by the employee, the date of preparation of the latter is indicated;

- signatures of the boss, accountant.

Financial assistance for vacation as financial support meets the following criteria:

- Payments can be transferred to the employee regardless of his position, intensity of work, achieved indicators, etc.

- Support is focused on meeting human needs, usually of a material nature.

- Financial assistance for private companies is not the responsibility of the manager. This is his right, which he exercises as a reward for employees who have distinguished themselves at work. For budgetary organizations, this is the responsibility of their leaders, since this type of financial assistance is provided to the character once a year.

- Financial assistance is one-time in nature.

- Financial support may not be provided regularly. It all depends on the state of the company or enterprise.

- The amount of financial support is set by the employer. For ease of calculation, salary is usually used as the calculation base. This applies to both state-owned enterprises and private firms. But the payment depends on the economic situation at the enterprise. If it is on the verge of collapse and collapse, the legal entity cannot pay bonuses to employees.

REFERENCE: these are the main criteria for paying a person financial assistance at work. If the enterprise operates efficiently and makes a profit, then the issue of providing financial support is resolved in a positive way.

Sample application for financial assistance

There is no single strict form. But the submitted application must not contain any blots or corrections. From its contents, the employer must clearly understand that his employee is asking him for financial assistance. Example:

What should you pay attention to?

Every employer must monitor all changes in the country's labor and tax code.

First of all, the employer must pay attention to the following mandatory points:

- who should actually receive a fixed lump sum of holiday payments and who is not eligible for this incentive;

- what is the maximum and minimum lump sum of vacation payments that can be assigned to an employee;

- how many times a year an employee has the right to demand a lump sum of payments for vacation;

- when the amount should be transferred - before, during or after the vacation;

- how to correctly display these amounts in reporting;

- How is this payment taxed?

These issues should be controlled not only by the director of the company, but also by the chief accountant.

The HR employee responsible for vacation planning is also involved in this process.

Nuances of provision

Civil servants

When civil servants receive paid annual leave, a lump sum payment is calculated in the amount of several salaries.

As for financial assistance, it is provided once a year on the basis of a completed application (in accordance with Federal Law No. 79).

Municipal employees

Municipal employees receive a one-time and material payment in accordance with the regulations of local government bodies.

In simple words, the amount of both payments and the procedure for provision are determined exclusively by those regulations that are adopted in each individual municipality.

For example, one may provide a lump sum payment once a year, while the other may provide it if an employee takes a vacation of a maximum of 2 weeks.

In budgetary institutions

One-time assistance to public sector employees can be accrued if information is available in the company’s regulations.

These hired employees include:

- work in the field of education;

- work in the healthcare sector;

- work in social services, science, etc.

If information regarding a one-time payment is reflected in the acts, then workers of budgetary organizations have every right to receive it.

Money can be provided once a year.

If the vacation is divided into several parts, the payment is calculated when submitting the application for the first time.

Financial assistance is provided on the basis of a completed application.

Police officers (Ministry of Internal Affairs) and Ministry of Emergency Situations

According to Order of the Ministry of Emergency Situations of Russia dated March 21, 2013 N 195, employees of the Ministry of Emergency Situations are paid financial assistance once a year in the amount of at least one salary (upon filing a report).

In parallel with this, when submitting a report, the amount of financial assistance may be increased (if there are grounds for this).

As for employees of the Ministry of Internal Affairs, they are entitled to financial assistance in the amount of one salary per 1 calendar year.

According to paragraph 136 of the Procedure for providing monetary allowances to law enforcement officers, which was approved by Order of the Ministry of Internal Affairs of Russia dated January 31, 2013 N 65, payment can be provided on another day (not only before going on vacation) according to the provided report.

Regarding the one-time payment, it can be accrued on the basis of the generated Order of immediate management.

Do they give it to teachers?

The Labor Code of the Russian Federation does not prohibit teachers from receiving one-time assistance. Based on this, they have every reason to formalize it on a general basis.

Part-timers

Part-time workers have the right to receive financial assistance at their main place of work.

If the employment contract in another location provides for the possibility of additional payment, then assistance can be received for any of the jobs based on a completed application.

It is important to note that the legislation does not provide for a ban on receiving additional payments at the same time in several organizations, if this is the decision of the management of the organizations.

Upon dismissal of an employee

When an employee is dismissed, one-time assistance can be provided if it is specified in the company’s local regulations.

The situation with financial assistance is the same.

The only caveat is that if a company has begun bankruptcy proceedings, then there is nothing to count on.

Who pays for Chernobyl vacation? Read our article. When must an employer hand over a work book upon dismissal? Find out here.

When contracting

During the downsizing process, the situation develops in the same way as during dismissal.

To the director

If the collective agreement provides for such a possibility, then the procedure for processing the payment is standard.

The only thing you should remember is that there is a need to form a commission, which decides on the need to accrue additional monetary assistance (material) for the vacation.

Medical workers

Health workers have the right to receive a one-time payment for vacation if such an opportunity is provided in regulations for success.

Financial assistance is provided on the basis of a completed application.

For disabled people

Regardless of whether the employee is disabled or not, the procedure for receiving it is standard, and the frequency of receipt is no more than once a year.

Workers with many children

Often, employees with many children have more privileges under the collective agreement than other workers. Despite the general registration procedure, they have a better chance of receiving a financial payment for their vacation.

Most common mistakes

Mistake #1. Skorov B.A. was hired on April 1, 2021, and on July 1, 2021, he went on vacation. In the application, he indicated a request to provide him with a one-time payment towards his vacation pay.

A comment. Skorov B.A will be denied the amount of payments, since it is an incentive measure applied to employees who have worked in this company for at least 6 months. Duration of employment of Skorov B.A. was only 3 months. This means that he is not entitled to the amount of payment for his vacation.

Error No. 2. Employee Vanov S.S. is a constant violator of labor discipline at Yantar LLC. He did not go on vacation in 2021. For another violation of labor discipline, he was fired. Upon dismissal, he wrote a request to receive a lump sum for vacation in addition to compensation.

A comment. Vanova S.S. the lump sum payment was refused. This part of the payments is an incentive measure for conscientious and high-quality work; it has no relation to those employees who are violators of labor discipline.

Common mistakes

Error: The employee worked at the company for 5 months, after which he took leave. He demands a lump sum payment in addition to vacation pay.

Comment: Employees who have worked for less than six months are not entitled to a lump sum payment for vacation.

Error: The employee regularly violated labor discipline, for which he was fired without having time to take advantage of his annual paid leave. Upon receiving compensation for unused vacation, he demanded an additional lump sum payment for vacation.

Comment: A one-time vacation allowance is an incentive payment for excellent work, therefore violations of labor discipline deprive the employee of the right to receive it.

FAQ

Question No. 1. If an employee went on vacation, wrote a statement asking for a lump sum payment for vacation pay, but the director of the company refuses to pay. What should an employee do?

Answer. It is necessary to assemble a special committee, which should consist of three people. At the meeting, an act on the payment of this amount must be developed.

Question No. 2. If an employee is officially unemployed, is it possible to submit a request in the form of an application for payment of a lump sum allowance for vacation?

Answer. This situation does not provide for the obligation of the employer to pay amounts. There is no legal basis for such actions. However, at its discretion, the employer may pay compensation to the employee if he showed excellent performance in the course of his work.

Registration of payments and accrual procedure

In accordance with Article 123 of the Labor Code of the Russian Federation, the worker must be notified of the start time of vacation by the company management two weeks before the start of it, by delivering a written notice drawn up on the basis of the priority schedule. At the same time, the mentioned document does not stipulate the procedure for transferring material assistance; therefore, in order to receive the material, the employee must submit an application requesting its provision.

Considering that this payment is not mandatory, the law does not provide for an approved sample application, therefore the agreed document is drawn up in the manner prescribed for documentation of this type, with the text drawn up arbitrarily. For example: “I would like to ask you to help me in connection with going on vacation.”

on the application and notification, the company’s rate adjuster or HR employee draws up a vacation note indicating the number of days of vacation, the period of its provision, as well as the percentage of assistance, for example, 50% or 100%. At the same time, not one, but two administrative documents are issued. an order drawn up in any form is used to provide assistance

Naturally specified administrative acts are drawn up in duplicate, in connection with their subsequent transfer to the accounting department for accrual of vacation pay and assistance, and are registered in different journals, because orders for vacations relate to documentation for personnel, and orders for the allocation of assistance to documents for core activities .

Additional payment in commercial organizations

Commercial organizations have the right to dispose of the profits received independently.

They, at their own discretion, can establish a similar measure of support and stimulation for workers at the enterprise. Since the Labor Code of the Russian Federation does not contain mandatory norms regulating the provision of financial assistance for vacations, the conditions and amount of support depend on the decisions of the company management itself, enshrined in local regulations.

Management independently determines the amount and period after which the employee becomes entitled to this amount of money. So, it can be stated that it will be issued after the person has worked for a year. The worker will be able to go on vacation after six months, but will receive additional payment only next year.

The company also has the opportunity to assign different amounts of support to each category of employee. Thus, persons occupying management positions can receive compensation in the form of two salaries, and ordinary employees in the amount of one.

In this case, the procedure for obtaining this support will be the same for everyone.

Attention! Despite the freedom granted by the legislator in determining the amount and reasons for providing this type of additional payments, the employer should not worsen working conditions and payment in comparison with the norms of the Labor Code of the Russian Federation.

Regulatory framework governing the calculation of additional payments

The Labor Code does not contain a provision that covers such a concept as financial assistance when going on vacation.

But this type of accrual is used in practice and is enshrined in other regulations. If the additional payment is incentive and is not related to the recipient’s need, it will be part of the employee’s salary. Its calculation is regulated by Part 1 of Article 129 of the Labor Code of the Russian Federation. In such cases, the need to pay funds should be enshrined in local or departmental regulations of the organization. It can be fixed or calculated based on the results of the worker’s activities.

Article 40 of the Labor Code of the Russian Federation provides for the possibility of concluding a collective agreement at a company, which regulates social and labor relations between employees and the employer.

Download for viewing and printing:

Labor Code of the Russian Federation of December 30, 2001 No. 197-FZ (Labor Code of the Russian Federation)

The text of such an agreement may include provisions on the accrual of material support to employees if there are any reasons. In most cases, these grounds are related to the needs of the citizen. In this case, the payment will be a measure of social support.

Note! Payment during the vacation period for public sector employees is mandatory. It is enshrined in Law No. 79-FZ of July 27, 2004 in paragraph 6 of part 5 of article 50.