Organization of accounting under the simplified tax system

Firms using the simplified tax system are required to carry out accounting in full in accordance with current standards and PBUs. Tax accounting is maintained in the tax register KUDiR (Income/Expense Accounting Book). Entrepreneurs using the simplified tax system have the right not to keep accounting, but only to register received income and expenses in KUDiR.

The peculiarity of this regime is that income and expenses are accounted for on a cash basis, i.e. upon payment. Only income received and expenses paid are included in calculations for reporting periods.

Costs are grouped by items and elements, including them in the cost price: depreciation, materials, labor costs and transfers to funds, social services, energy consumption, and others. Expense postings under the simplified tax system are standard - they are accumulated according to cost items, reducing the amount of revenue received. Accounting is used in sales accounting. 90, shipped goods – invoice. 45.

The tax has been calculated according to the simplified tax system - we make the posting

Upon completion of each business transaction, the accountant reflects this fact with an accounting entry. The accounts used depend on the chart of accounts adopted by the company.

To keep records of various taxes, subaccounts are allocated in account 68. Their list must be specified in the accounting policy, guided by clause 4 of PBU 1/2008.

Account 68 can be divided into several sub-accounts, for example:

68.1 - calculations for the simplified tax system;

68.2 - calculations for personal income tax, etc.

A situation is possible when, at the end of the year, the total income tax turns out to be either more than the actual tax amount or less. In the first case, the tax amount must be added, in the second, it must be reduced. The wiring is as follows:

- simplified tax system accrued (posting for advance tax payment) - Dt 99–Kt 68.1;

- tax advance is transferred - Dt 68.1 - Kt 51;

- for the year, additional tax was accrued to the simplified tax system - posting Dt 99 - Kt 68.1;

- reduced tax according to the simplified tax system for the year - Dt 68.1 - Kt 99.

What accounts does the accountant operate when calculating the simplified tax system (postings)

The calculation of the single tax in a company’s accounting is identical to the calculation of income tax and is carried out in stages - the tax base is determined, the amount of the advance payment for the reporting quarter is calculated, and at the end of the year the final amount of tax payable is calculated. The accrual of the simplified tax system is recorded by posting:

D/t account 99 “Profits and losses” C/t account. 68 “Calculations for taxes/fees”.

This entry records the calculation of the advance payment for each reporting period - quarter and the total tax amount at the end of the financial year. In this case, the posting is the same, it does not depend on the taxation scheme chosen by the enterprise - 6% of income or 15% of profit (“income minus expenses”). It is only important to correctly calculate the amount of tax, and here the decisive factor becomes the version of the simplified tax system on which the company operates, since they differ radically in the definition of the tax base and the current tax rates. Let's figure out what the tax calculation should be for each of the simplified regimes.

Postings according to the simplified tax system

The conditions for applying the special regime are established by Chapter 26.2, Part 2 of the Tax Code of the Russian Federation.

If they are violated, the application of the simplified tax system will be considered unlawful, with subsequent additional taxes being assessed based on the general taxation system. Conditions for applying the simplified taxation system:

- the average number of employees does not exceed 100 people;

- the residual value of fixed assets is not more than 150 million rubles;

- annual income does not exceed 150 million rubles.

In addition to these restrictions, there is a ban on the use of a special regime for certain types of activities and if the organization has branches (Clause 3, Article 346.12, Part 2 of the Tax Code of the Russian Federation).

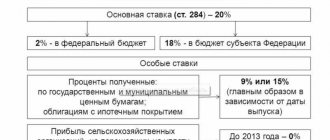

Calculation of simplified tax system 6% of income: postings

The tax base (TB) under the special simplified tax regime of 6% is the total amount of income recorded in the accounting records. To determine the NB for the tax period, income is calculated quarterly with a cumulative total. At the end of the year, the total income result is summed up. The marginal tax rate is 6%, but regional authorities are given the right to set the rate from 1 to 6%. Advance tax is calculated using the formula:

STS = NB x 6%.

In this case, the amount of the advance payment can be reduced by the amount of insurance premiums paid in the reporting period (for contributions of individual entrepreneurs without employees “for themselves”, the tax can be reduced in full, insurance premiums of companies and individual entrepreneurs with employees can reduce the amount of calculated tax by 50%), as well as trade tax. When calculating the tax for the year by intra-annual periods, the amounts of previously transferred advances are also deducted from the calculated tax amount.

At the end of the year, at the final tax calculation, either an additional payment or an overpayment may arise, which is counted against future payments or returned to the company’s account. The decrease in the final tax amount is recorded by posting: D/t account. 68 – K/t count. 99.

Example:

Individual entrepreneur Ivanov P.T. who has no employees. applies the simplified tax system “income” and maintains accounting. In 2021, he earned 296,000 rubles:

- in the 1st quarter – 60,000 rub.,

- in the 2nd quarter – 120,000 rub.,

- in the 3rd quarter there was no income (production was temporarily suspended),

- in the 4th quarter – 116,000 rub.

In the 1st quarter, the businessman paid part of the insurance premiums “for himself” in the amount of 15,000 rubles.

Advance tax amount for 1 sq. amounted to 3600 rubles. (60,000 x 6%). Since the amount of contributions exceeds the amount of tax, there is no need to pay it and record it in accounting records.

Advance for half a year - 10,800 rubles. (60,000 + 120,000 x 6%). Its size also exceeds the amount of paid insurance contributions and the previous advance payment (15,000 rubles), so tax is also not paid.

In the 3rd quarter, no products were produced and no income was received by the entrepreneur; no advance tax was accrued.

At the end of the year, the tax payable is calculated:

(60,000 + 120,000 + 116,000) x 6% = 17,760 rubles.

Taking into account the paid insurance contributions, the amount of additional tax payment was: 17,760 – 15,000 = 2,760 rubles.

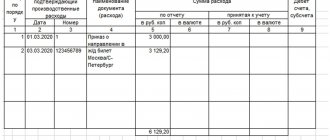

Postings according to the simplified tax system “Income”, reflecting the accrual and payment of tax for the year, will be as follows:

| date | Operations | D/t | K/t | Sum |

| 29.12.2018 | Tax accrued | 99 | 68/USN | 2760 |

| 10.01.2019 | Payment to the budget | 68 | 51 | 2760 |

Single tax calculation

When calculating the amount of a single tax and transferring advances on it, the actual amount of withholding may turn out to be more or less. To align mutual settlements with the budget, you need to make appropriate adjustments. So, when calculating a single tax under the simplified tax system, the posting will look like this:

- Dt 99 Kt 68 - tax is charged on the amount of the advance payment;

- Dt 68 Kt 51 - the advance amount is transferred to the budget.

Further, at the end of the year, depending on the actual tax amount, the following entries are made:

- Dt 68 Kt 99 - reduced simplified tax system;

or

- Dt 99 Kt 68 - additional tax amount has been charged.

For general rules for making accounting entries, see here.

Calculation of tax accrual in 1s

To calculate the simplified tax system in the 1C Accounting program, you will need to fill out a standard report in the program menu. To do this, you need to go to the “Reports” menu and find the “Book for recording income and expenses according to the simplified tax system.” This document must be verifiable, because the book is filled out based on the 1C mechanism, without using standard accounting entries.

The tax return under the simplified tax system is filled out in the section Regulated reports - Tax reporting. The declaration records income or income together with expenses, depending on the type of taxation. There is no operation in the 1C program that would independently calculate the tax. All taxes will have to be calculated manually.

The operation of calculating the simplified tax system is carried out through the posting Debit 99.01.1, which reflects the main taxes, and Credit 68.12, where the single tax is indicated.

Using the simplified tax system will help you get rid of a large number of documents to be prepared and will save your accountant from unnecessary work. However, the simplified tax system will not always help reduce taxes, so before switching to the “simplified” tax system, weigh all the pros and cons, calculate what is more profitable and only then choose the type of tax that suits you best.

Lawyer legal services

Accounting for losses from previous years Special attention should be paid to the situation when your company uses the simplified tax system “Income minus expenses” and receives losses for several years.

Even if the organization operates at a loss, the single tax will still have to be paid, but in a minimal amount. This figure is 1% of the income received. How to calculate tax and take into account losses - see the example below.

Favorit LLC uses the simplified tax system (the “income minus expenses” scheme). Favorit has the following financial indicators:

- In 2015, Favorit’s income amounted to 143,720 rubles, expenses – 187,330 rubles. A loss of 43,610 rubles was received. (187,330 rubles – 143,720 rubles), in connection with which a tax of 143,720 rubles was assessed. * 1% = 14.372 rub. (minimum value).

- Based on the results of 2021, Favorit’s income amounted to 133,840 rubles, expenses – 127,610 rubles. The tax base is reflected taking into account losses in 2013.

Attention

Accounting for leasing payments under the simplified tax system Leasing means the transfer of any property for temporary use for a certain fee. The leasing agreement may end with the return of the transferred property or its complete redemption.

In this case, the actual owner of the object of the leasing agreement remains the lessor company. The leased asset can be listed on the balance sheet of both parties to the agreement simultaneously. In addition, the company at whose disposal the property comes must reflect in its accounting every payment made for it. Leasing under the simplified tax system “income minus expenses” is shown by the following entry: Dt60 (76) – Kt51 (payment of payment), as well as Dt20 (26, 44, etc.) – Kt60 (76) (charge of payment).

Typical “simplified” accounting entries: debit and credit according to the simplified system

At the end of 2021, a loss of 8,142 rubles was received. (RUB 133,840 – RUB 127,610 – RUB 14,372). 13,384 rubles were transferred to the budget. (1% of 2016 income).

- In 2021, “Favorite” received income of 178,990 rubles, expenses – 112,350 rubles. To determine the tax base for 2015, the Favorit accountant recorded the tax paid for 2021 and made the following calculation:

- RUB 178,990 – 112.350 rub. – 13.384 rub. = 53.256 rub. As of January 1, 2017, Favorit’s balance sheet included an outstanding loss from previous years of RUB 51,752. (RUB 43,610 + RUB 8,142). The Favorit accountant calculated the single tax that must be paid for 2021, thus: (53,256 rubles – 51,752 rubles) * 15% = 226 rubles. The following entries were made in the accounting of “Favorite”: Reporting period Debit Credit Description Amount 2015 99 68 Single tax The accrual of tax is reflected (the minimum indicator in connection with the resulting loss) 14.372 rubles.

Taxes according to the simplified tax system: features, postings, regulations, reporting

Important

Based on the simplified tax system category (6% or 15%), the amount of income or profit is entered. But the application cannot calculate the interest rate in monetary terms, so the tax amount will need to be calculated manually yourself.

The operation in the program takes place using account Dt 99.01.1 (posting for displaying all taxes) and account Kt 68.12 (it indicates the single tax). Submission of the declaration and deadlines All enterprises located on the simplified tax system are required to submit a declaration of their income annually until 31.03, which follows the reporting year. For individual businesses, this date is April 30. The tax return for the simplified tax system is submitted to the official address of the company, at the place of residence of the entrepreneur. Today, the KND form 1152017 is relevant for compiling this form. Such reporting can be provided in three ways:

- In person to the tax office or with a notarized power of attorney.

Accrual of usn (accounting entries)

Organizations that use a simplified taxation system in their work are required to keep accounting records. To properly keep records and eliminate the possibility of errors, an accountant needs to know the basic entries used in “simplified accounting.”

For example, entries reflecting the founders’ contributions to the authorized capital under the simplified tax system and others.

- Buh. postings for contributions to the management company

- Accounting for leasing payments under the simplified tax system

- Accrual of simplified tax system: postings

Buh. entries for contributions to the management company The presence of authorized capital is a necessary condition for the creation of any organization.

The procedure for its formation, the amount, share or percentage of contributions of all participants, the form of payment and other significant nuances are agreed upon in advance and are fixed in the constituent agreement.

Posting on authorized capital is the first posting that is made when opening a new legal entity. faces.

Typical accounting entries according to the usn

Add to favoritesSend by email Calculation of the simplified tax system (postings and applicable accounts) is a seemingly simple question, but sometimes causes difficulties for accountants. Let's consider what transactions are generated in accounting when calculating the simplified tax system.

Accounting under the simplified tax system Accounts used in transactions for calculating tax under the simplified tax system Tax has been accrued under the simplified tax system - we make the posting Results Accounting under the simplified tax system Accounting in organizations using the simplified tax system is required. Most often, they belong to small businesses (SMB), and have the right to carry out accounting in a simplified form.

In addition, they keep books of income and expenses, which for this taxation system are tax registers.

Insurance premiums

To reflect the amounts of insurance coverage for insured persons, a separate accounting account 69 “Social insurance and security expenses” is used. This account must reflect all types of contributions that the company accrues to the salaries of its employees.

In accounting, provide details of payments for individual subaccounts by type of insurance coverage: compulsory health insurance, compulsory medical insurance, VNIM and contributions for injuries. Record this information in your accounting policies.

Basic accounting entries for salaries and taxes:

| Operation | Debit | Credit |

| Salary accrued | 20, 23, 25, 26, 29, 44 and so on | 70 |

| Personal income tax withheld | 70 | 68 |

| Salary issued | 70 | 50 - from the cash register 51 - from current account |

| Insurance premiums accrued | 20, 23, 25, 26, 29, 44, etc. | 69 |

| Contributions to the budget have been paid | 69 | 51 |

| Insurance fines accrued | 91 | 69 |

| Penalties accrued on insurance premiums | 99 | 69 |

| Penalties and fines paid to the budget | 69 | 51 |

For more information on how to reflect payroll in accounting, see the article “Salary entries.”

If at the end of the tax period the taxpayer has to pay a minimum tax, then in this case it, like the tax calculated in the general manner, can be reduced by the amount of advance payments payable at the end of the reporting periods. There is no need to submit an application to the tax office to offset advance payments against the payment of the minimum tax.

The peculiarity of the simplified tax is that the tax that is larger in size is paid. You will have to pay the minimum tax only if it is greater than the annual amount of the “simplified” tax. If the minimum tax is less than the “simplified” tax, you will have to pay the usual tax according to the simplified tax system (Article 346.18 of the Tax Code of the Russian Federation).

Thus, the tax payment algorithm is as follows:

1. It is necessary to calculate the usual tax of 15% “income reduced by expenses.” 2. You need to calculate the minimum tax. 3. If the minimum tax is less than usual, then the minimum tax must be paid.

GOOD TO KNOW

The taxpayer has the right in the following tax periods to include the amount of the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner into expenses when calculating the tax base, including increasing the amount of losses that can be carried forward to the future.

How is the minimum tax calculated?

The minimum tax is calculated using the following formula:

MN = NB x 1%,

where NB is the tax base, calculated on an accrual basis from the beginning of the year to the end of the tax period. The tax base for the purpose of calculating the minimum tax is income determined in accordance with Art. 346.15 Tax Code of the Russian Federation. Tax calculation is carried out at the place of registration of the taxpayer. Let's give an example of calculating the minimum tax.

Example 1.

Individual entrepreneur “Margelov” received income in 2017: 9,000,000 rubles.

Expenses amounted to: RUB 8,500,000.

Difference between income and expenses: RUB 500,000.

The tax amount calculated in the usual way is:

75,000 rub. (9,000,000 – 8,500,000 = 500,000 x 15%).

The minimum tax will be:

9,000,000 x 1% = 90,000 rub.

Therefore, it is necessary to pay a minimum tax of RUB 90,000.

Previously calculated amounts of advance tax payments under the simplified tax system are counted when calculating the amount of tax for the tax period (clause 5 of article 346.21 of the Tax Code of the Russian Federation).

How to take into account the minimum tax in accounting?

In accounting, advance payments for tax under the simplified tax system, tax paid at the end of the tax period, and the minimum tax are accounted for in account 68, to which a separate sub-account has been opened. Account 68 is credited for amounts due under tax returns (calculations) for contributions to budgets (in correspondence with account 99 - for the amount of income tax, with account 70 - for the amount of income tax, etc.).

The following entries must be made in accounting:

| Debit | Credit | Sum | Operation |

| 99 | 68 | 90 000 | Accrued tax due |

| 68 | 51 | 90 000 | The minimum tax has been paid |

When calculating the minimum tax, it is important that it is calculated:

- through advance payments;

- due to payments when paying taxes at the end of the year.

You should also pay attention to the peculiarities of tax accounting, for example, tax under the simplified tax system, as well as the minimum tax, are not taken into account in expenses (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation). If the minimum tax was paid for the year, then the difference between it and the amount of tax calculated in the general manner can be included in expenses when calculating the amount of tax for the next year (letter of the Federal Tax Service dated July 14, 2010 No. ШС-37-3 / [email protected] ).

GOOD TO KNOW

Advance payments of tax paid in connection with the application of the simplified tax system paid during the year are offset against the payment of the minimum tax as a general rule.

Advance payments offset against the minimum tax payment

Advance payments for the single tax by payers using the simplified taxation system are paid no later than the 25th day of the first month following the expired reporting period, which recognizes the first quarter, half-year and nine months of the calendar year (clause 7 of article 346.21, clause 2 Article 346.19 of the Tax Code of the Russian Federation).

Advance payments that an organization pays at the end of the quarter can be offset when calculating the tax amount.

If an organization has overpaid to the budget at the end of the year, then such payments can be offset or an application for a refund of the overpaid tax can be written. But the offset is made only upon application. You cannot make such a calculation on your own in any order. The Tax Code of the Russian Federation does not establish restrictions regarding the offset of overpaid advance payments of tax paid in connection with the application of the simplified taxation system against the payment of advance payments for this tax in the next tax period.

According to paragraph 6 of Art. 78 of the Tax Code of the Russian Federation, the amount of overpaid advance payments for tax paid in connection with the application of the simplified tax system may be subject to refund upon a written application from the organization within one month from the date the tax authority receives such an application.

IMPORTANT IN WORK

When transferring tax and minimum tax, the KBK cannot be confused. When transferring the tax levied on taxpayers who have chosen income reduced by the amount of expenses as an object of taxation, KBK 182 1 0500 110 is indicated, when transferring the minimum tax credited to the budgets of the constituent entities of the Russian Federation - 182 1 0500 110.

On the payment of penalties and their reduction in proportion to the amount of the minimum tax

According to paragraph 3 of Art. 45 of the Tax Code of the Russian Federation, the obligation to pay tax is considered fulfilled by the taxpayer from the moment of presentation to the bank of an order to transfer funds from the taxpayer’s bank account to the budget system of the Russian Federation to the appropriate account of the Federal Treasury if there is a sufficient cash balance on it on the day of payment.

In case of payment of advance payments later than the deadlines established by the Tax Code of the Russian Federation, penalties are accrued for the amount of untimely paid advance payments in accordance with Art. 75 of the Tax Code of the Russian Federation (clause 3 of Article 58 of the Tax Code of the Russian Federation).

In accordance with paragraph 7 of Art. 45 of the Tax Code of the Russian Federation, if a taxpayer has discovered errors in the execution of an order for the transfer of tax, which did not entail the non-transfer of this tax to the budget system of the Russian Federation to the appropriate account of the Federal Treasury, he has the right to submit to the tax authority at the place of his registration a statement of the error, attaching documents confirming payment them of the specified tax and its transfer to the budget system of the Russian Federation to the appropriate account of the Federal Treasury, with a request to clarify the basis, type and affiliation of the payment, tax period or payer status.

- Penalties are charged in the following cases:

- incorrect indication of the BCC;

- late payment of the minimum tax amount.

But it is important that in relation to the minimum tax, penalties can be reduced. If, at the end of the tax period, the amount of calculated tax turned out to be less than the amount of advance payments due during this tax period, it must be assumed that penalties accrued for non-payment of these advance payments are subject to a commensurate reduction. This procedure should also be applied if the amount of advance tax payments calculated at the end of the reporting period is less than the amount of advance payments payable during this reporting period (letter of the Ministry of Finance of Russia dated December 29, 2012 No. 03-02-07/1- 323).

When can penalties be reduced?

Penalties cannot be reduced in all cases. For example, if you underpaid tax, then penalties cannot be reduced. This procedure should also be applied if the amount of advance payments of tax paid in connection with the application of the simplified taxation system, calculated for the first quarter, half a year and nine months, is greater than the amount of the minimum tax paid for the tax period in the manner established by clause 6 Art. 346.18 Tax Code of the Russian Federation.

GOOD TO KNOW

Separate deadlines for paying the minimum tax in Sec. 26.2 of the Tax Code of the Russian Federation has not been established. Therefore, it is necessary to pay the minimum tax in the general manner - no later than the deadline specified in clause 7 of Art. 346.21 Tax Code of the Russian Federation.

How to reflect the minimum tax in the declaration under the simplified tax system?

The minimum tax is reflected in a separate line of the tax return according to the simplified tax system.

This is line 280 of your tax return.

Please note that the readings of line 280 of the tax return under the simplified tax system may not coincide with the values of other lines of the declaration, for example, line 100 of section 1.2 of the declaration.

Example 2.

Limited Liability Company "Prospect" received income for 2021 in the amount of 1,300,000 rubles.

Expenses amounted to 1,000,000 rubles.

The difference is 300,000 rubles.

The tax calculated in the usual way will be equal to 45,000 rubles.

The minimum tax is 13,000 rubles.

Therefore, you need to pay a 15% tax in the amount of RUB 45,000.

Example 3.

Limited Liability Company "Prospect" received income for 2021 - 1,300,000 rubles.

Expenses amounted to 2,000,000 rubles.

Consequently, a loss was incurred.

But the minimum tax is 13,000 rubles.

Therefore, a minimum tax must be paid.

In any case, the minimum tax is reflected in the declaration in line 280 of the declaration.

In general, when filling out the declaration it is important:

- calculate tax;

- establish advance payments;

- set the minimum tax.

If you apply the simplified tax system with the object of taxation “income minus expenses”, indicate the amount from line 273 of section. 2.2 tax declarations under the simplified tax system. If at the end of the year you must pay the minimum tax, enter the amount from line 280 of this section.

GOOD TO KNOW:

During the period of validity of the tax rate of 0%, individual entrepreneurs who have chosen the object of taxation in the form of income reduced by the amount of expenses do not pay the minimum tax provided for in paragraph 6 of Art. 346.18 Tax Code of the Russian Federation.

Payment of the minimum tax when switching from the simplified tax system to the general regime during the year

As we said above, from the provisions of paragraph 6 of Art. 346.18 of the Tax Code of the Russian Federation it follows that the obligation to pay the minimum tax under the simplified tax system arises only at the end of the tax period (calendar year).

If the amount of tax (advance tax payments) paid in connection with the application of the simplified tax system, calculated for the reporting periods before the loss of the right to use the simplified tax system, turns out to be less than 1% of the income received during this period, then what amount of tax should be paid - calculated or minimum? There is no answer to this question in the Tax Code of the Russian Federation.

According to the Russian Ministry of Finance and tax authorities, the procedure for calculating and paying the minimum tax applies to all taxpayers, including those who have lost the right to further use the simplified tax system during the tax period. In this case, the tax period for them is the reporting period preceding the quarter, starting from which taxpayers are considered to have switched to the general taxation regime. In other words, the end of the tax period actually coincides with the end of the last reporting period before the loss of the right to use the simplified tax system. Consequently, if the amount of tax calculated based on the results of such a period in the general manner according to the simplified tax system is less than the minimum tax, or losses were incurred at the end of the reporting period (there is no tax base), then the taxpayer becomes obligated to pay the minimum tax (see letters from the Ministry of Finance of Russia dated August 20. 2012 No. 03-11-11/25, dated 10.19.2006 No. 03-11-05/234, dated 06.08.2005 No. 03-03-02-04/1-138, dated 05.24.2005 No. 03-03-02 -04/2/10, Federal Tax Service of Russia dated March 27, 2012 No. ED-4-3/ [email protected] , dated March 10, 2010 No. 3-2-15/12, etc.). Some arbitration courts support the position of the tax authorities, citing similar arguments (see decisions of the FAS North-Western District dated December 28, 2011 No. A26-11119/2010, FAS Ural District dated August 18, 2009 No. F09-5884/09-S2, FAS East Siberian District dated April 8, 2008 No. A33-9924/07-F02-1229/08, etc.).

GOOD TO KNOW:

Since 2013, for taxpayers who have lost the right to use the simplified tax system during the calendar year, a special deadline for submitting a tax return has been introduced: no later than the 25th day of the month following the quarter in which such loss occurred (clause 3 of Article 346.23 of the Tax Code of the Russian Federation) . These changes confirmed the position of the regulatory authorities regarding an earlier deadline for paying the minimum tax.

In our opinion, we cannot unequivocally agree with this opinion for the following reasons:

Firstly, in paragraph 6 of Art. 346.18 of the Tax Code of the Russian Federation expressly states that the minimum tax is calculated for the tax period, which, in accordance with paragraph 1 of Art. 346.19 of the Tax Code of the Russian Federation recognizes the calendar year. The obligation to pay the minimum tax based on the results of part of the tax period (for the reporting period) is not established by law. There are no special provisions defining the last tax period for taxpayers who during the year lose the right to use the simplified tax system, nor Art. 55 of the Tax Code of the Russian Federation, nor Chapter 26.2 of the Tax Code of the Russian Federation do not contain. The specified norms do not provide for the possibility of changing the duration of the tax period, and this is not denied by the Federal Tax Service of Russia in letter No. 3-2-15/12 dated March 10, 2010. Changing the duration of the tax period is allowed only in the event of liquidation or reorganization (Article 55 of the Tax Code of the Russian Federation);

Secondly, paragraph 1 of Art. 57 of the Tax Code of the Russian Federation establishes that changing the established deadline for tax payment is allowed only in the manner prescribed by the Tax Code of the Russian Federation. In accordance with paragraph 3 of Art. 57 of the Tax Code of the Russian Federation, the deadline for paying a tax can be determined by an indication of an event that must occur or occur, however, in Chapter 26.2 of the Tax Code of the Russian Federation, the loss of the right to use the simplified tax system is not designated as an event as a result of which the obligation to pay the minimum tax arises;

Thirdly, the features of calculating the tax base during the transition from the simplified tax system to other taxation regimes are determined by Art. 346.25 of the Tax Code of the Russian Federation, the provisions of which do not provide for the taxpayer’s obligation to calculate the minimum tax before the end of the tax period (based on the results of the reporting period).

The conclusion suggests itself: if a taxpayer loses the right to use the simplified tax system during a calendar year and the amount of tax (advance tax payments) calculated for the reporting periods before losing the right to use the simplified tax system is less than 1% of the income received, then formally he is not required to pay the minimum tax. This position is also reflected in arbitration practice (see decisions of the FAS of the Volga District dated 09/05/2012 No. Ф06-6813/12, Twelfth AAS dated 05/04/2012 No. 12AP-2398/12, FAS of the Central District dated 08/25/2009 No. A64-999 /07-16, Federal Antimonopoly Service of the North-Western District dated December 21, 2009 No. A66-4521/2009, etc.).

There is also no consensus among regulatory authorities regarding the period during which a taxpayer must pay the minimum tax (at the end of the year or at the end of the reporting period). In letters of the Ministry of Finance of Russia dated October 19, 2006 No. 03-11-05/234, dated May 24, 2005 No. 03-03-02-04/2/10, Federal Tax Service of Russia dated February 21, 2005 No. 22-2-14/224, etc. It is noted that taxpayers must transfer the minimum tax within the period established for making the advance payment, that is, before the 25th day of the month following their last reporting period under the simplified tax system. In later letters, the opinion was expressed that it is necessary to calculate and pay the minimum tax in the general manner no later than the deadline specified in paragraph 7 of Art. 346.21 of the Tax Code of the Russian Federation (no later than the deadline established for filing a tax return) (see letters of the Ministry of Finance of Russia dated August 20, 2012 No. 03-11-11/25, Federal Tax Service of Russia dated March 10, 2010 No. 3-2-15/12). At the same time, representatives of the Federal Tax Service clarify that the taxpayer has the right to calculate and pay the minimum tax even before this deadline on a voluntary basis.