Violations of labor discipline

An employee’s misconduct, in essence, is expressed in non-fulfillment or dishonest fulfillment of duties in the position held.

Such violations include:

- Failure to comply with internal labor regulations. It is expressed in being late for work, from lunch or leaving home early.

- Absenteeism, that is, absence from the company premises or another place where a person is sent to perform duties, for more than four hours in a row, without a valid reason.

- Showing up for work under the influence of illegal drugs or alcohol. It does not matter whether the drinking took place at the place of work or outside the organization.

- Disclosure to unauthorized persons of information to which access is restricted.

- Violation of labor protection requirements, if this could lead to an accident, accident or catastrophe, or created a threat of the occurrence of these events.

- Misconduct on the part of a specialist who services funds or inventory items, which caused the loss of trust in the employee.

- Theft of property of workers or companies.

- Immoral misconduct, including mental or physical influence, on the part of a specialist who performs pedagogical duties in relation to students.

For these violations, disciplinary measures may be applied to the employee. They are elected at the personal discretion of the manager, taking into account the nature of the violation and the severity of the consequences.

How to avoid fines at work

https://static.news.ru/photo/f92525cc-c1db-11eb-89a5-96000091f725_660.jpg Photo: unsplash.com

There are many “relatively fair ways” to fine workers. Labor law consultant Ilya Dantsker told NEWS.ru about how you can avoid being punished with rubles at work.

According to the expert, a fine is not a concept applicable to the relationship between an employee and an employer. To impose a fine is the prerogative exclusively of the state represented by its relevant bodies. However, in practice, employers often resort to a financial “whip” system.

As an example, Dantzker cited a flexible and confusing bonus system, in which the payment of bonuses is biased and actually depends on the will of the employer. And just one memo from the manager will be enough for the employee to lose the bonus, which, in terms of its “weight” in the employee’s total income, may even exceed his salary, the expert noted.

But in some cases, a fine can be avoided. However, it all depends on where the person works. If he receives a “gray” salary, the chances of justice being restored are minimal, Dantzker admitted.

There can only be one piece of advice here - read the employment contract carefully before signing. If you were verbally promised mountains of gold, but the minimum wage is specified in the employment contract, weigh the risks and understand that you agree to be paid “in an envelope”, “in cash”. At the same time, you agree to fines for the slightest violations ,” the expert said.

If the company pays a white salary, then you should carefully read the local bonus regulations or compensation and benefits policy (the name of the document may vary).

As a rule, the employee is invited to familiarize himself with this document and sign it at the employment stage. According to the expert, you should study it carefully and understand why your premiums may be reduced or deprived. It is advisable to make a copy of the document without attracting attention.

A certified copy under Art. 62 of the Labor Code of the Russian Federation you can always officially request in case of a conflict. You just need a simple copy for yourself in order to constantly have the bonus criteria in front of your eyes and understand how to work to avoid problems with the bonus ,” Dantzker said.

This understanding will also be useful in the event of an unjustified attempt by an employer to deprive an employee of a bonus. The latter will be able to more confidently defend their rights in dialogue with the employer, the expert emphasized. If you start such a dialogue not with aggression, but with a calm appeal to the internal position of the company, there is a chance to defend your earnings without slipping into conflict, he added.

Add our news to your favorite sources

Add

Is it possible to impose a fine?

The current legislation defines an exhaustive list of measures that can be applied to an employee. In this case, the manager cannot subject the worker to other punishments. In turn, a fine under the Labor Code cannot be applied to an employee. Otherwise, sanctions may be imposed on the manager. That is, the boss cannot determine the maximum or minimum amount of the fine, since the application of such punishment is not within his competence in principle.

What does Russian legislation say about fines at work?

Almost all of the above reasons for imposing fines on personnel are illegal, especially if payment is established in monetary form. According to the law, material deductions from personnel as punishment for disciplinary violations are STRICTLY PROHIBITED (Articles 22, 137 of the Labor Code of the Russian Federation).

REFERENCE! Only certain situations specified in the documents related to the work of the accounting department are allowed for material deductions (for example, an employee may not be paid an advance if he has not worked it out, or an overpayment has been made due to an error).

Relevant studies, due to their relevance, were carried out by various organizations, for example, the National Union of Personnel Officers, the HeadHunter research service, etc.

Based on the summary results of the research, the following features of the application of penalties in Russian companies were revealed:

- about a third of all organizations use a system of monetary influence on employees;

- almost half of the workers have at least once experienced the deprivation of part of their earnings as punishment;

- the most common reasons for fines are disciplinary violations, with tardiness in first place;

- Fines are most common in the areas of trade, tourism, hotel and restaurant business, and security activities;

- about 15% of managers believe that for employees of domestic companies, management is only possible through punitive sanctions, especially monetary ones.

In recent years, there has been a trend toward a decrease in the use of such influences on personnel: the gap over the past 7 years was about 30%. This means that a third fewer managers began to consider negative motivation effective for management, preferring other measures of influence.

The Labor Code of the Russian Federation does not allow the imposition of penalties that are not provided for by federal legislation and regulations on discipline. Penalties are not included in the list of disciplinary penalties.

Deductions from wages (Article 137 of the Labor Code of the Russian Federation) can be made in the following cases:

- refund of advance;

- reimbursement of overpaid amounts;

- refund for used but unfulfilled vacation.

The employer has the right to apply monetary penalties if damage to the organization's property is caused through the fault of an employee. Chapter 39 of the Labor Code of the Russian Federation regulates issues of financial liability of employees.

The legislation distinguishes between two types of property liability. Full financial liability implies recovery of the entire amount of damage. In this case, the employee signs a document in advance confirming full compensation for harm. If an agreement has not been concluded, the amount of deductions is limited to the amount of average monthly earnings (Article 241 of the Labor Code of the Russian Federation).

What measures can be taken against violators?

The manager may apply the following measures to an employee who has committed a disciplinary offense - reprimand, reprimand, dismissal. The Labor Code does not provide for other types of punishment. Although additional measures may be specified in local regulations, for example, deprivation of bonuses.

Disciplinary action

The procedure for applying punishment to an employee is established by law.

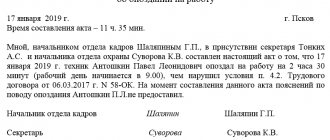

The procedure itself begins with identifying the fact that the employee has violated his duties. After this, the offense must be documented. This responsibility is assigned to the violator’s immediate superior, an authorized person, or a commission if the offense was identified during the inspection. It is necessary to draw up a memorandum, as well as draw up an act in the presence of at least two witnesses.

Next, you need to request a written explanation from the employee regarding the misconduct.

It must indicate:

- Information about the manager or other authorized official who will make subsequent decisions.

- Information about the employee - last name, first name, patronymic, position held.

- Date, place and time of the offense.

- The circumstances that caused this.

- Whether or not the employee admits his guilt.

- Date of execution of the document and personal signature of the worker.

The employee must provide an explanation within two working days from the moment it is requested. Refusal to write must be formalized by deed. Failure to provide an explanatory note is not an obstacle to punishing the violator.

The collected documentary materials are submitted to the head of the company for review. The decision must be made within a month from the moment the offense was discovered. Punishment cannot be applied to a person later than six months. If the situation is related to the conduct of a financial, economic or audit audit, then the person cannot be held accountable after twenty-four months.

The decision made is formalized by an order. The text of the document states:

- Full company name.

- Date and registration number of the order.

- Information about the offender.

- The circumstances of the offense.

- Has the violation been confirmed?

- The requirements of which regulatory legal acts were not met.

- Did the employee admit his guilt?

- The measures of influence that will be applied to the worker.

- Signature of the head of the company.

To place an order, you can use a standard printed form. If you use regular office paper, you must put a corner stamp or company seal on the document.

The employee must be familiarized with the order and signed within three working days from the date of approval of the order. Refusal to read it is formalized by an act and will not interfere with the punishment of the violator.

Deprivation of bonus

Monthly calculation and payment of wages to the employee is the responsibility of the manager. Such payment consists of salary for the position held and bonuses of various nature, for example, for professional qualifications or length of service in the organization.

Quite often, in addition to what is indicated, the employee is awarded bonus funds. They are paid not only as an incentive, but also to stimulate the desire for high quality work. The internal regulations of all companies indicate the conditions for accrual of such funds. In most cases, this means the absence of comments and penalties. Accordingly, if a person has violated his duties, then the manager has every right to deprive him of his bonus. This fact must be reflected in the order. It is necessary to indicate not only that the person is deprived of the bonus, but also the period during which he will not receive such funds.

Types of disciplinary sanctions

Article 192 of the Labor Code of the Russian Federation establishes the measures of influence that are applied when a disciplinary offense is committed.

The list of penalties that can be imposed on an employee includes:

- Comment.

- Rebuke.

- Dismissal.

For certain categories of workers, the legislation provides for additional types of punishment (for example, deprivation of the right to drive special vehicles).

The type of penalty in each specific case is determined by the essence of the violation.

A reprimand is the simplest form of punishment. It is used in cases of minor disciplinary offenses (for example, being a few minutes late) and is expressed verbally.

For violation (or failure to fulfill) official duties, the employee is reprimanded. Unlike a remark, the fact of a violation is recorded in writing (order or instruction).

The most serious punishment is dismissal.

Among the main reasons for dismissal, the Labor Code (Article 81) indicates:

- absenteeism (failure to appear or prolonged absence from work);

- repeated violation of labor duties (with a valid disciplinary sanction);

- showing up at work while intoxicated;

- loss of trust in the employee on the part of the employer.

Important! Dismissal for reasons that are not established by law is considered a gross violation.

Here we must rely on Article 248 of the Labor Code of the Russian Federation. The fundamental principles for both sides are described as follows:

- The amount is recovered in full if financial liability is applied to the employee.

- You cannot recover more than a month's salary. Moreover, when so-called limited liability is used.

The main thing is to find as much evidence as possible in favor of the fact that there is a connection between the employee’s actions and the resulting consequences.

The manager needs to remember the right of subordinates to appeal any decision made in court. When deducting fines from wages, it is necessary to comply with the restrictions established at the legislative level.

The order to collect a fine is issued a maximum of one month after the imposition of the punishment, no later. Otherwise, the legal force of the demand disappears.

What should an employee do if a fine is imposed?

The penalty on the employee must be imposed legally. That is, it is necessary not only to follow the established procedure, but also to apply those measures of influence that are determined by the current rules. The fine is not included in this category. Therefore, if it is used, the employee has every right to apply to authorized authorities and bodies to protect his rights. The resolution of such issues falls within the competence of the labor inspectorate, the prosecutor's office and the court. An employee can also turn to higher management if it has the right to overrule the decisions of the head of the organization.

Employer's liability

In case of exceeding one’s powers, including imposing a punishment on an employee that is not provided for by labor legislation, administrative measures may be applied to the manager. They are expressed in the imposition of a monetary fine and are defined in Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

However, this may not be the end of the matter. It all depends on how often the fines were imposed. If this lasted more than three months, then the question of bringing the manager to criminal liability can be raised, since in this case there is a partial non-payment of funds due. This is stated in Article 145.1 of the Criminal Code of the Russian Federation.