The Labor Code does not contain a clear indication of what certificates are issued upon dismissal of an employee. Other federal regulations contain references to various types of certificates that an employee may need when terminating a contract. In order to avoid disputes between the employer and the employee about the final list of documents that should be received upon termination of the contract, we will tell you in the article what needs to be given upon dismissal, provide a sample dismissal certificate and clarify the requirements.

What certificates are given upon dismissal?

The employer, in addition to issuing a work book on the day of departure, upon dismissal, transfers to the employee, upon his request, documents relating to work activity. These may be the following documents that are usually prepared by the accounting department:

- upon dismissal, a salary certificate is issued in accordance with the form approved by Order of the Ministry of Labor of the Russian Federation No. 182n. It informs about the payments that were made in the previous two years and will be necessary for the next employer or the Social Insurance Fund;

- a certificate of insurance premiums upon dismissal is issued in the form of an extract from the calculation of insurance premiums.

What documents must be provided to a resigning employee?

The mandatory list of documents that the employer is obliged to give to the dismissed person on the last working day includes:

- Employment history.

- A payslip confirming the full calculation of wages and other payments due.

- Medical book.

- Calculation of insurance premiums.

Read about the procedure for documenting the dismissal of an employee here, learn about the rules for writing a letter of recommendation in this material, and we wrote everything about the bypass letter here.

Work record book of a dismissed employee

A work book is the main document of an able-bodied citizen, which allows you to confirm the presence of accumulated work experience. It is needed not only to calculate the pension, but also so that the employer can obtain complete information about the applicant. The labor report reflects information about the date of dismissal and the reasons for termination of the contract.

Entry into the form is carried out in strict accordance with the requirements of regulations. Instructions for filling out work books were approved by the Ministry of Labor (Resolution No. 69 of October 10, 2003).

From January 1, 2021, a test system for digitalizing data on admission and dismissal is being implemented in the Russian Federation.

Work books are planned to be gradually converted into digital format. This innovation is designed to prevent the loss of paper forms or forgery of a document.

Pay slip

In accordance with Article 136 of the Labor Code of the Russian Federation, the employer is obliged to submit a monthly written report on wage accruals and deductions from them. The payslip must be prepared, printed and handed over to the employee upon his dismissal. The pay slip indicates the amount accrued:

- for days of wages worked;

- compensation for missed vacation;

- amounts for sick leave if the employee was sick and closed the sick leave certificate.

Depending on the reason for termination of the employment relationship, other amounts may be indicated on the payslip.

The employee may be issued a receipt upon dismissal in form T-61. It was approved by Decree of the State Statistics Committee of Russia No. 1 of January 5, 2004. The form is not mandatory for employers, but it is often used as a standard one.

Medical book

Not all employees need a medical record , but there are professions where it is impossible to begin work duties without this document. An approximate list of such professions is given in letter of the Ministry of Health of the Russian Federation No. 1100/2196-0-117 dated August 7, 2000.

The medical record form was approved by Rospotrebnadzor (order No. 402 of May 20, 2005). The medical book is handed over to the employer when applying for a job and is kept by him for the entire period of the employee’s work. It can be handed out only in case of outbound trade, for presentation to buyers or inspection authorities.

Upon dismissal, the medical book must be issued to the person leaving on the last working day along with other documents. It does not matter at whose expense the medical examination was completed.

If all expenses were covered by the employer himself, he is still obliged to give the medical book to its owner no later than the day of dismissal.

Some jobs require a health passport. These are works with difficult and harmful conditions, their list is given in the order of the Ministry of Health of the Russian Federation No. 302n dated April 12, 2011. The same order approved the form of the health passport (Appendix No. 7). This document must be kept in the hands of the employee, so the employer is not obliged to issue it upon dismissal.

Calculation of insurance premiums

The employer pays monthly social insurance contributions for each employee:

- pension;

- medical;

- social.

Social payments are subsequently formed from them. The employer is responsible for providing the employee with information about contributions paid to his social insurance. This confirms that the employer has paid the required contributions and makes it easier for the employee to protect his rights to social benefits from the state.

Insurance premiums are calculated by the accounting department. As soon as the department receives a copy of the employee’s dismissal order, the accountant is required to make a final calculation of payments and deductions, as well as prepare information about the contributions paid for the employee.

The calculation form for insurance premiums (DAM) was approved by order of the Federal Tax Service of Russia No. ММВ-7-11 / [email protected] dated October 10, 2021. The employee is given a copy of information about him from section 3 of the DAM.

Which ones still need to be picked up?

Let's figure out what additional documents an employee can take. In some cases, the organization stores personal documents of the employee. The institution is required to issue the following documents:

- certificates and diplomas of advanced training;

- copies of licenses and permits to engage in certain activities;

- award sheets.

Upon dismissal, the employee has the right to take them back; his personal file must contain copies of such documents.

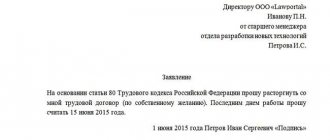

Also, upon dismissal, an employee has the right to receive copies of orders relating to his hiring, transfer within the organization and dismissal, the issuance of bonuses and other incentives. Copies must be certified by the employer accordingly. To receive copies of work-related documents, an employee must submit a written application (Article 62 of the Labor Code of the Russian Federation).

Requirements for salary certificate

Any certificate from the place of employment upon dismissal is certified in the manner established by the organization, if there is a seal - with the seal of the employer. This is necessary to avoid disputes and litigation in court. There is a form approved by Order of the Ministry of Labor No. 182n containing information on wages for the last two years.

This document must be filled out on a computer or in handwritten form. When filling out the text by hand, you need to use black or blue ink. The letters are written without the possibility of double interpretation of what is written. Corrections are not allowed. All necessary information is taken from accounting documents or official reports. If the information contained in the official document is inaccurate, the institution will be fined.

The document will be needed to establish benefits for a person and guaranteed social support measures (payments for sick leave, pregnancy and childbirth, care for children up to one and a half years old).

How to fill out a salary certificate

The accounting employee fills out the document individually.

The document must be signed by the head and chief accountant of the institution.

The prescribed form consists of four sections which contain:

- Detailed information about the institution.

- Information about the employee who requires the paper.

- Information on the amounts of wages from which the employer made contributions to the Pension Fund of the Russian Federation and the Social Insurance Fund.

- Information about the periods during which no deductions were made.

Filling out the first section begins by indicating the date the paper was provided and its number. The name of the employer (in full form) and the territorial branch of the Social Insurance Fund to which contributions were paid are indicated. It is also necessary to indicate the subordination code of the legal entity, INN, KPP, and location address.

When filling out information about a person, you need to indicate his full name, passport details, address of residence, as well as his pension insurance number (SNILS).

The third section is filled out in ascending order by year (starting with the year of employment), salary amounts are indicated in numbers and in capital text. The amount for which contributions were calculated is taken into account (for 2021, the limit is 876,000 rubles for contributions to the Pension Fund of the Russian Federation, 755,000 rubles for contributions to the Social Insurance Fund).

If a full year has not been worked, the statement includes information only for the period actually worked.

The final section contains information about the periods during which the employee was not able to work, indicating the reason, which is officially confirmed.

Thus, in order to make a correct calculation when dismissing an employee, it is necessary to correctly provide information in the prescribed form.

How to confirm issue: several recommendations

It often happens that an employee loses certificates and copies of papers, and then accuses the employer of not issuing them. To avoid such situations, we recommend drawing up some kind of confirmation certificate, which lists all the papers issued to the employee.

Such an impromptu report must be signed by the employee, indicating the date of review and receipt of the documents.

In addition, do not forget to ask the employee to sign for the receipt of labor and sanitary records in their accounting journals, and in relation to SZV-M, the law obliges the employee to obtain a receipt for receipt of the document.

Legal documents

- Art. 84.1 Labor Code of the Russian Federation

Requirements for a certificate of insurance premiums

A unified form is used in the form KND 1151111. The employee must be given a copy of section 3. Only information about the employee being dismissed must be included.

The filling out requirements do not differ from the previous document, and you will find detailed instructions in the article on how to correctly fill out the new RSV-1 form.

Remember that the new form was introduced on 01/01/2017. If you need to provide information on insurance payments for 2021 and earlier, you will need to prepare a copy of section 6 of the old RSV-1 form.

What penalties does a manager receive for delay or refusal?

For almost every type of document not issued to an employee upon dismissal on time, liability is provided:

- work book - compensation for material damage for all days of delay in the amount of average earnings (Article 234 of the Labor Code). According to labor legislation, this period is recognized as forced absenteeism and is subject to financial compensation;

- certificate 2-NDFL – administrative liability in the form of a fine (Articles 5.27 and 5.39 of the Administrative Code). Its size is 1,000 - 5,000 rubles for officials and individual entrepreneurs; 30,000-50,000 for legal entities;

- certificates and personalized accounting information (SZV-M, SZV-STAZH, DSV-3, calculation of insurance premiums), as well as a certificate for the employment service - similar to the 2-NDFL certificate, responsibility is provided for in Article 5.27 of the Administrative Code.

Remember that the entry about dismissal in the work book must be correctly completed; use this article to check.

What else can an employee request?

In addition to those listed, an employee can make a request to receive other documents:

- order of dismissal or appointment;

- information about existing work experience (represents an extract from the SZV-STAZH form);

- form 2-NDFL;

- information on average earnings (if there is a reduction, if the employee intends to apply to the employment service for benefits);

- information about personalized accounting (includes individual information for the month of dismissal regarding the employee).

Any of these documents may be needed by an employee in connection with dismissal and must be handed over to him by the employer on the last day of his work.

What to do if papers are not issued?

Despite strict legislative norms, quite often documents are not issued to the dismissed person on time. Most often, the reason for refusal is the inability to sign papers due to the absence of the director or other person.

If such a situation arises, the quitter has the right to file a complaint with the labor inspectorate, court or prosecutor's office. Based on the results of the inspection, the employer may be held administratively liable (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Submit a complaint to the labor inspectorate through the website onlineinspektsiya.rf.

The procedure for preparing and issuing papers upon dismissal should be known not only to the employer, but also to the employee. Knowledge of legal norms will allow him to protect his rights, avoid troubles and receive papers in his hands on time.