Sick leave 2017 calculate Sick leave is a document certifying a valid reason for an employee’s absence from the workplace.

It is issued during pregnancy, during illness, in case of need to care for a child or for other reasons prescribed in regulations. This document serves as the basis for the employer to pay a certain amount of money. However, the procedure for calculating sick leave changes every year.

How is sick leave calculated in 2017?

The amount of money intended to pay for sick leave does not have a fixed rate. The amount of payment is calculated based on the average salary of the employee and his insurance record. In this case, the calculation scheme will look like this:

- The addition of the amounts received by the employee every month during the last 2 working years.

- Finding average daily earnings. In this case, the amount received in the first point is divided by the number of days in 2 years.

- Multiplying the result obtained in point 2 by the number of working days that the employee spent on sick leave.

When calculating sick leave, the length of service coefficient is taken into account.

Average salary in Russia. And also in Moscow, St. Petersburg and in the regions!

How long to wait for funds to arrive

In order for the benefit to be accrued and paid, you will need to confirm the fact of illness, injury, etc. An official document - a certificate of incapacity for work, or sick leave, is issued at the medical institution where the employee went. It opens on the day of application, and is closed and handed over to the employee on the last day of treatment, stay in a hospital, sanatorium, etc. The document is stamped by the medical organization that issued it.

The sick leave certificate is submitted to the employer’s personnel service to confirm a valid reason for the employee’s absence from the workplace and to calculate benefits. It is important for the employee to meet the deadlines; the document must be received by the HR officer no later than six months after its closure. Otherwise, receiving payments on it will become impossible.

The rules regarding the period of payment of sick leave also apply to the employer. After receiving the document, you must complete all calculations within 10 days and issue the money to the employee. As a rule, transfers are made on the day of salary payment to the employee’s card. Or money is issued in cash, if the organization has adopted this form of settlements with employees. The accrued benefit must be reflected on the payslip.

Calculation of sick leave according to the minimum wage

The length of service factor is taken into account on sick leave in accordance with the minimum wage (minimum wage). In this case, its calculation corresponds to the following scheme:

- If the employee’s length of service does not exceed six months, then each month of sick leave will cost no more than 1 minimum wage.

- An employee whose work experience is from 3 to 5 years receives a coefficient of 0.6.

- An employee with 6 to 8 years of experience deserves a 0.8 share.

- A person who has worked for more than 8 years is awarded a coefficient of 1.

The calculation scheme becomes clearer if you look at its example.

Can a salary be less than the minimum wage?

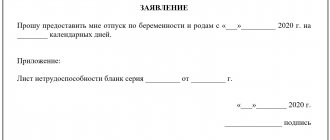

Calculation of sick leave and maternity benefits

To find out the amount of the benefit, the accountant needs to perform a series of steps in sequence. Let's talk about each of them.

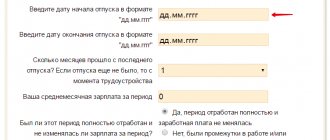

Determining the billing period

The calculation period in the general case is two calendar years preceding the year in which illness, maternity leave or parental leave began. So, if the first day of sick leave or vacation falls in 2021, the calculation period will be the period of time from January 1, 2021 to December 31, 2021 inclusive.

There is an exception to this rule for women who were on maternity leave or maternity leave during the billing period, and because of this they lost wages. It is permissible for them to move one year (or both years) to an earlier time. This transfer is made on the basis of an application that the employee submits to the accounting department.

Let's explain with an example. Let's say an employee took sick leave in 2021. The calculation period for it is 2021 and 2021. But in 2019 she was on maternity leave, and in 2018 she was on maternity leave. The employee wrote a statement asking to exclude 2021 from the payroll period and replace it with 2017. As a result, the calculation period becomes 2021 and 2017.

Calculation of average earnings

The algorithm for calculating average earnings is the same for benefits for temporary disability, for BIR and for child care up to 1.5 years. In all of the above cases, the average earnings include the amounts that the employee received in the billing period and from which contributions to the Social Insurance Fund were paid.

It is possible that the billing period or part of it will fall in 2009 and previous years. At that time, employers did not pay contributions to the Social Insurance Fund, but a single social tax. Then the average earnings include amounts that would be subject to contributions to the Social Insurance Fund if contributions had already been introduced.

Let's illustrate with an example. Let's assume that the employee wrote a request for a transfer, as a result of which 2009 entered the billing period. During 2009, the company paid her financial assistance in the amount of 10,000 rubles. Financial assistance not exceeding 4,000 rubles is exempt from contributions to the Social Insurance Fund. This means that the average salary needs to include 6,000 rubles (10,000 - 4,000).

Comparison of average earnings with the maximum allowable value

Average earnings can be taken into account only in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This rule applies both when calculating benefits for temporary disability, and when calculating benefits under BIR and child care.

The maximum value of the base is approved by the Government of the Russian Federation for each calendar year. If the calculation period included 2009 or earlier periods, then the maximum value of the base is taken to be 415,000 rubles. for every year.

The accountant must compare the average earnings received in the billing period and the maximum base value established for this period. Moreover, it is necessary to compare not the total indicator, but the average earnings for each of the two years of the billing period with the corresponding maximum value of the base for a given year.

Let's give an example. Let's say the billing period is the period from January 1, 2021 to December 31, 2021. The maximum value of the base for 2021 was 865,000 rubles, for 2021 - 912,000 rubles. The average salary of an employee in 2021 was 900,000 rubles, and in 2021 - 850,000 rubles. Thus, the average earnings for 2021 can be taken into account in a part not exceeding 865,000 rubles, and the average earnings for 2021 can be taken into account in full. As a result, when calculating benefits, the accountant has the right to take into account average earnings in the amount of 1,715,000 rubles (865,000 + 850,000).

Comparison of average earnings with the minimum acceptable value

In a situation where during the billing period an employee either earned little or no income at all, it is necessary to compare the actual average monthly earnings with the minimum wage (minimum wage). When making comparisons, you should use the minimum wage value established on the date of onset of illness, maternity leave, or parental leave.

If the actual average monthly earnings are lower than or equal to the minimum wage, then the minimum wage must be used to calculate benefits. Otherwise, the actual average monthly earnings must be used to calculate benefits.

The FSS of Russia, in letter dated 03/01/11 No. 14-03-18/05-2129, recommends the following comparison algorithm: first calculate the average daily earnings based on actual income received, and then based on the minimum wage. Then select the largest value and use it when calculating benefits.

Let's show it with an example. Let's say the disease occurred in 2021, and the calculation period is 2021 and 2021. Average earnings over these years amounted to 76,800 rubles. This means that the actual average daily earnings are 105.2 rubles. (RUB 76,800: 730 days). The minimum wage approved for 2021 is RUB 12,792. This means that the average daily earnings based on the minimum wage is 420.56 rubles (12,792 rubles x 24 months: 730 days). Thus, when calculating benefits, you need to use the value of 420.56 rubles.

Create and submit sick leave registers for free using the “FSS Benefits” service

Calculation of average daily earnings

For temporary disability benefits, in general, the average daily earnings are the average earnings for the billing period (taking into account the maximum value of the base) divided by 730. The resulting value is multiplied by the percentage corresponding to the insurance period. If the experience is 8 or more years - 100%. If the experience is from 5 to 8 years - by 80%. If the experience is less than 5 years - by 60%.

For BIR and child care benefits, in general, average daily earnings are a fraction. The numerator is the average earnings for the billing period (taking into account the maximum value of the base). The denominator is the number of calendar days in the billing period minus the number of calendar days falling within the excluded period. The excluded period includes sick leave, maternity leave, parental leave and days when a woman was released from work according to the laws of the Russian Federation with full or partial retention of her salary (provided that she was not paid contributions in case of temporary disability and in connection with maternity) . Regardless of the experience of a young mother, the average daily earnings are always multiplied by 100%.

Let's give an example. Let’s say that a woman’s average earnings in the billing period are 800,000 rubles, and the maximum value of the base is not exceeded. The number of calendar days in each of the two years of the billing period is 365, for a total of 730 (365 + 365). During the billing period, the employee took sick leave for 15 calendar days. This means that the number of days of the excluded period is 15. The average daily earnings is 1,118.88 rubles (800,000 rubles: (730 days - 15 days) x 100%).

Please note: the average daily earnings for BIR and child care benefits should not exceed the maximum allowable average daily earnings for “regular” sick leave. To learn how to compare these two values, read the material “How to now calculate maternity and child care benefits.”

If the benefit amount is calculated based on the minimum wage, then the average daily earnings are equal to the minimum wage (established on the start date of the bulletin), multiplied by 24 months and divided by 730 days. If an employee works part-time, a coefficient reflecting the duration of working hours should be inserted into the formula.

If the employee’s insurance experience is less than 6 months, then the amount of temporary disability and BIR benefits for a full month cannot exceed the minimum wage multiplied by the regional coefficient (if one has been introduced in the given area). In addition, the law lists situations when temporary disability benefits for a full month, regardless of the amount of earnings, cannot exceed the minimum wage, taking into account the regional coefficient. This is a patient’s violation of discipline, failure to appear at the doctor’s office, etc. (for a detailed calculation algorithm, see the article “Sick leave and benefits: main changes and current issues”).

Calculation of benefit amount

on temporary disability and on BIR

The amount of temporary disability benefits and BIR benefits is equal to the product of the average daily earnings by the number of calendar days of sick leave or maternity leave indicated on the sick leave.

From April 2021, an additional restriction applies. It applies to a situation where temporary disability benefits, calculated on the basis of average daily earnings and work experience, calculated for a full calendar month do not reach the minimum wage (in 2021 it is equal to 12,130 rubles). Then sick leave should be paid in the amount of the minimum wage for a full calendar month. In this case, the amount of the daily benefit is equal to the minimum wage divided by the number of calendar days of the month in which the illness occurs. The total benefit is the daily benefit multiplied by the number of calendar days of sickness in each calendar month. If a regional coefficient is introduced, then the minimum wage is determined taking into account this coefficient (for more details, see: “Sick leave in 2021: the temporary procedure for calculating benefits was made permanent”).

for child care

Child care benefits are paid every month. The monthly benefit amount is generally equal to the average daily earnings multiplied by 30.4 and multiplied by 40%. When calculating benefits for an incomplete calendar month, the final amount is proportional to the number of calendar days in that month during which the woman was on maternity leave.

If the average monthly earnings do not exceed the minimum wage, the monthly child care benefit must be calculated as follows. You need to take the minimum wage and multiply by 40%. In the case where a woman works part-time, a coefficient reflecting the duration of working hours should be inserted into the formula. If a regional coefficient has been introduced in the area, then it must also be substituted into the formula.

We add that the child care benefit cannot be less than the value that is established for each calendar year. So, in 2021, the monthly amount cannot be less than 6,752 rubles. This rule applies to every child, regardless of the order of his appearance in the family. In areas where district coefficients are applied, the minimum values will be slightly higher because they must be multiplied by the value of the district coefficient.

How is sick leave calculated in 2017?

Calculation of sick leave occurs in accordance with the following example:

- Payment terms . Two working years (2016 and 2017) gave Krotkov an income equal to 308,000 rubles. His work experience is 5 years. His sick leave lasted 12 days.

- Calculation formula . 2021 – 366 days. 2021 – 365 days. From which the amount of payment after sick leave for Krotkov corresponds to this example: 308,000: 731 days * 12 * 0.6. In total, Krotkov will receive 3,033 rubles 65 kopecks.

Are there any restrictions on the amount of benefit?

There are certain limits for the payment. The minimum level is the minimum wage, equal to 7,800 rubles as of July 1, 2017. This indicator is used if the employee has not yet worked for two years and it is not possible to determine his average salary for this period. In such a situation, the benefit amount is significantly less than usual. To protect the rights of workers with short experience, it was decided to equate their earnings for two years to the minimum wage.

The maximum payment amount is also limited. Every year the Government sets the maximum amount for insurance contributions to the Social Insurance Fund. It is indexed annually and in 2021 it is 775,000 rubles, in 2021, respectively, 718,000 rubles, and in 2015 – 670,000 rubles. If wages for past years exceed this limit, then they are not taken into account in the calculation. The Social Insurance Fund cannot pay more in benefits than is established by law.

Procedure for paying sick leave

Payment of sick leave at the expense of the employer is made taking into account 3 days from the moment of illness of the employee. The subsequent period is paid by the Social Insurance Fund. If the purpose of sick leave is to care for a child, the employer does not participate in its payment. This responsibility falls entirely on the FSS.

Features of payment of insurance contributions to the Pension Fund: tariffs, who is exempt, payment terms

The amount of money intended for sick leave is calculated and received by the employee along with wages or advance payment. In this case, the time of their payments is taken into account. If the salary comes before the advance payment, then the sick leave will be paid with it.

What to do if the benefit is greater when calculating

In some cases, workers have a higher average daily income, so it turns out that their sick leave benefits should be higher. The employer, of course, can pay it, but it will not be possible to reimburse the money from the Social Insurance Fund. The fund will be able to return only that part that does not exceed the limit.

If your organization is registered in the region where the pilot project “Direct payments from the Social Insurance Fund” is being conducted, you will not need to calculate benefits at all. Based on data on the average salary, length of service and sick leave itself, the Fund will calculate everything independently. The list of entities that participate in the program is listed in Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. Now sick leave is calculated and paid according to the new rules in more than 30 regions.

Rules for paying sick leave

The accountant first checks that the sick leave form is filled out correctly. If he notices errors in the execution of the document, sick leave is not paid to the employee until he provides a correctly completed sick leave form. Despite receiving papers certifying a person’s absence from work for a valid reason, not all citizens can receive money for sick leave. Sick leave is paid in the following cases:

- The person officially works for the company. The exception is a contract.

- The employee is officially registered with an individual enterprise. Also, except for the contract.

- The employee works under a contract and at the same time this document contains a clause on providing a social package.

- A citizen voluntarily transfers funds to the Social Insurance Fund.

- The person requiring sick pay is a member of the cooperative.

Working without a work book under an agreement or contract: pros and cons, is there a difference?

If a person does not meet any of these criteria, then sick leave is not paid to him. Sick leave payment is not made under the following circumstances:

- An employee's work is regulated by a contract.

- The treatment regimen was disrupted during the illness.

- The patient's outpatient record does not contain any records of his condition.

- The sick leave was issued by a medical institution operating without a license.

- The sick leave was extended for more than a month, but the medical commission did not give an opinion on this.

- A certificate of incapacity for work was issued, but the patient was not prescribed treatment.

- The date the sick leave was issued is incorrect.

- The employee was suspended from work and his salary was not retained.

- The employee's injury was the result of a criminal violation.

- The enterprise is in a state of idleness.

In order for an employee to receive a payment, documents must be submitted to the Social Insurance Fund to pay for sick leave. Their list includes:

- Certificate of incapacity for work, supplemented by a certificate with calculation of benefits.

- Salary information related to a given pay period.

- Personal income tax-2, containing data for the last 2 years.

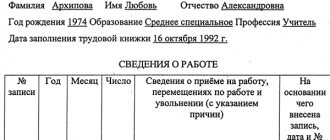

- Employment contract and book.

- Salary certificate taken from other employers.

- An application written by hand, which must indicate the amount of funds required to pay for sick leave.

- Calculation made in accordance with Form 4 of the Social Insurance Fund, taking into account the payment of insurance coverage.

The purpose of these documents is to confirm the status of a person entitled to receive temporary disability benefits. In addition, based on them, the required payment is calculated. Personal income tax is withheld from the results obtained.

Fines for late payment of insurance contributions to the Pension Fund

Another rule for paying sick leave applies to those who have worked at the company for less than 2 months. These employees must present to the employer a certificate from their previous place of employment, which will confirm their income for the last 2 years. The amount indicated therein will be taken into account when calculating the payment.

Where to go and what documents to submit

In all cases, you must still apply for compensation to the Social Insurance Fund. What documents to submit depends on the period for which you want to reimburse the costs of paying benefits.

If benefits were paid before January 1, 2021

If a company applies for reimbursement of expenses that it incurred before January 1, the old scheme applies.

In order to reimburse the excess of expenses for payment of benefits over accrued contributions, you must submit papers to the Social Insurance Fund according to the old list (in accordance with the appendix to the order of the Ministry of Health and Social Development of December 4, 2009 No. 951n in the old version).

This:

- application for reimbursement (there was no official form; each regional branch of the Social Insurance Fund developed its own form);

- calculation of 4-FSS;

- copies of documents that confirm the validity and correctness of expenses for compulsory social insurance. These include certificates of incapacity for work for sick leave and maternity leave and calculations of the amounts of payments for these benefits; certificates from the antenatal clinic, child birth certificate, etc. - for other types of benefits.

The fund must transfer the money to the organization’s current account within 10 calendar days from the date of submission of these documents (Part 3, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ).

Note! The fund will not return money without verification.

In practice, the FSS does not allocate money without an inspection (desk or unscheduled documentary). As part of this verification, the company must submit additional documents that confirm the validity of the assignment and payment of benefits (Part 4, Article 4.6 of Law No. 255-FZ).

The fund makes a decision on the allocation of funds based on the results of the audit.

The period of the desk audit cannot exceed three months from the day the 4-FSS calculation and application were submitted (Part 2 of Article 34 of the Federal Law of July 24, 2009 No. 212-FZ).

Exit - two months from the day the fund made a decision on her appointment (Part 11, Article 35 of Law No. 212-FZ).

The overexpenditure that occurred as of January 1, 2021 must be taken back to the Social Insurance Fund. It cannot be counted towards the payment of contributions to the Federal Tax Service in 2017 (perhaps something will change, but for now it is so).

If benefits were paid after January 1, 2021

Note. To reimburse benefits for 2021, submit a statement of calculation and breakdown of expenses with your application.

The Ministry of Labor, in order No. 585n, added a calculation certificate to the list of papers.

If a company applies for compensation for insured events that occurred after January 1, it must submit new documents (FSS letter dated December 7, 2021 No. 02-09-11/04-03-27029):

- an application for the allocation of the necessary funds for insurance payments in the approved form;

- certificate of calculation (Appendix 1 to the application for the allocation of the necessary funds for payment of insurance coverage);

- breakdown of expenses for compulsory social insurance and expenses due to interbudgetary transfers from the federal budget (Appendix 2 to the application).

Companies submit a statement of calculation only when they receive money for periods starting from January 1, 2021. Please indicate the amount:

- the company's debt on contributions at the beginning and end of the reporting (calculation) period;

- accrued contributions for payment, including for the last three months;

- additional accrued contributions;

- expenses not accepted for offset;

- funds received from territorial bodies of the Social Insurance Fund to reimburse expenses incurred;

- returned (credited) overpaid (collected) contributions;

- funds spent for the purposes of compulsory social insurance, including for the last three months;

- paid contributions, including for the last three months;

- written off debt of the policyholder.

What is included in the calculation of sick leave

Based on the information presented, we can conclude that the calculation of sick leave is carried out taking into account the average salary and length of service of the employee. At the same time, years, not months and days, are taken into account as length of service. Also, when applying for payment, attention is paid to where the injury occurred. If its receipt is the result of the production process at the enterprise, then the payment for sick leave will be equal to 270,000 rubles.

When calculating wages, calendar days of the year are taken into account in full. That is, the calculations include weekends, holidays and non-working days.

Documents for receiving compensation

To receive reimbursement for sick leave expenses, the policyholder needs to submit a number of documents to the Social Insurance Fund. Since 2021, the list of these documents has changed slightly (Order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951N).

Order of the Ministry of Health and Social Development of Russia dated December 4, 2009 N 951n (as amended on October 28, 2016)

1 file(s) 398.09 KB

Required documents:

- written statement from the policyholder;

Application to the FSS for reimbursement of benefits

1 file(s) 92.20 KB

- copies of supporting documents (sick leave certificates, certificates from medical institutions, etc.);

- certificate - calculation (must contain the indicators specified in clause 2 (1) of the Order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 No. 951n).

Please note that until 2021 it was also necessary to submit the 4-FSS calculation. Now all information about FSS contributions will be received from the Federal Tax Service. The employer will provide brief information to the fund in the calculation certificate. The certificate is submitted only for periods starting from 01/01/2017.

What else should a temporarily disabled person know?

Even if an employee falls ill during his vacation, he must consult a doctor. Having received a sick leave certificate, he has the right to ask for an extension of leave for the number of days indicated on the certificate of incapacity for work. Sick leave during vacation is paid in the same way as if the person had to work at that time.

They don't let me go on vacation - what should I do? Types of leave and procedure for granting

If a person works in several organizations, he has the right to receive sick pay in each of them. If an employee who terminates the contract with the organization falls ill, he is also entitled to disability benefits. It is paid taking into account a coefficient of 0.6 if the employee falls ill within 30 days after termination of the contract.

In what cases is sick leave required?

Most Russians believe that a certificate of incapacity for work - sick leave - is issued only for periods of illness or maternity leave. However, it is not. According to Article 59 of the Federal Law of November 21, 2011 N 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation,” citizens can receive such a document in the following situations:

- in case of illness;

- when diagnosing an injury;

- in case of poisoning;

- during follow-up treatment in sanatorium-resort organizations;

- when caring for a sick family member;

- due to quarantine;

- for the duration of prosthetics in stationary conditions;

- during pregnancy and childbirth;

- when adopting a child;

- for other conditions associated with temporary disability.

Depending on these situations, the maximum number of days of sick leave may vary. This is due, first of all, to the severity of the citizen’s condition: the worse his state of health, the longer the period of temporary disability.

Interesting facts about sick leave

There are several interesting facts about sick leave abroad that greatly distinguish the foreign benefit system from the Russian one:

- There are no sick days in the USA. The fact of payment for a specific number of days is stated in the contract. Thus, 38% of Americans remain without temporary disability benefits.

- In Israel, only 18 working days spent on sick leave are paid per year. If the employee has not been sick all year, then these days are postponed. But you cannot accumulate more than 90 days. In addition, the first day of illness is not paid, for the 2nd and 3rd days only 50% is paid. Sick leave will be fully compensated starting from the 4th day.

- Germany provides its citizens with the opportunity to get sick for 3 days without taking sick leave. This fact does not affect their income in any way.

The system for calculating sick leave in the Russian Federation is within the strict framework provided for by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.” Thus, in order to be guaranteed to receive paid sick leave, you need to follow the rules.