What must an employer pay a posted employee?

In accordance with labor legislation, the employer must compensate the employee (Article 168 of the Labor Code of the Russian Federation):

The employer sets the procedure and standards for reimbursing employees for travel expenses independently in a collective agreement or internal regulations.

Calculation of travel allowances for renting residential premises

It is done in the same way with travel expenses. Government Decree No. 729 limits the expenses of civil servants for renting residential premises to 550 rubles per day.

However, the Government decided that expenses exceeding the specified amounts, as well as other expenses associated with business trips (provided that they were made by the employee with the permission or knowledge of the employer), can be reimbursed by saving the organization’s funds under the corresponding expense item.

Calculation of travel allowances

In order for an accountant to correctly calculate travel allowances, first of all it is necessary to calculate the days on a business trip. This is necessary to determine the amount of daily allowance.

Here is the calculation of travel allowance (daily allowance) with an example:

The employee is sent on a business trip from February 5 to 12 (the 5th is the date of departure for the business trip, the 12th is the date of return). And so it turns out to be 8 days of business trip. This means that the employee is entitled to daily allowance for 8 days:

If the company sets the daily allowance for business trips within the Russian Federation as 700 rubles, the employee will receive a daily allowance of 5,600.00 rubles. (8 days × 700.00 rub.).

During the business trip, the employee retains his job and average earnings.

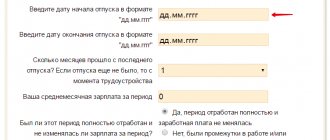

How to calculate travel allowances online

Even if you know the rules by heart for how travel allowances are calculated, it is easy to make mistakes in the calculations, which can lead to long disputes and proceedings. Our free service will help you avoid them.

How to use an online travel allowance calculator in 2021? To do this you will need 4 digits:

- the employee’s total earnings for the last 12 months or for the period actually worked;

- number of days worked (working days, if not sick or on vacation);

- duration of business trip;

- the amount of daily allowance entered by the employer.

All numbers must be entered in the fields provided. And the program itself will calculate the required amounts.

We will show you how to calculate travel allowances in 2021 with examples. Let's say employee Ivanov is sent on a business trip for 10 days. He worked in the organization for 6 months (from January to June 2021). Using the production calendar, we determine that it is 116 days. During this period (according to accounting data) he received 180,000 rubles. Daily allowance in the organization is 100 rubles per day. Enter the initial data.

Click on the “Calculate” button and get the amounts that need to be paid.

The program contains not only an algorithm for calculating travel allowances in 2021, it also calculates average earnings and daily allowances. All this data is accurate and can be used in your work.

Calculation of average earnings

On a business trip, average daily earnings are calculated using the formula:

The procedure for calculating average travel earnings was approved by Decree of the Government of the Russian Federation No. 922 of December 24, 2007. The calculation of average earnings includes all payments, with the exception of vacation pay, temporary disability benefits and some others.

As a general rule, the billing period is 12 calendar months preceding the month of the business trip. When calculating average earnings for business travelers, only working days are taken into account. The total number of days excludes days for which the employee received payments that are not taken into account in calculating average earnings (for example, sick leave).

Here is an example of calculating average travel earnings:

The employee was sent on a business trip from February 5 to February 8, 2021. This means that his pay period is from February 1, 2021 to January 31, 2020.

11 days of sick leave for child care and 28 days of annual leave are excluded from the calculation period.

And so the billing period is equal to 247 working days (from 02/01/2019 to 01/31/2020) minus 11 days and minus 28 days = 208 working days.

During the pay period, the employee received:

- RUB 700,000.00 - wage;

- RUB 50,000.00 – vacation pay;

- RUB 10,000.00 - due to temporary disability.

Average daily earnings:

RUB 3,365.38 (RUB 700,000.00 / 208 working days).

Payment for the trip will be for 4 days:

RUB 13,461.52 (RUB 3,365.38 × 4 days).

The calculation of travel allowances abroad differs from a Russian business trip only in the amount of daily allowances. Average daily earnings are calculated the same way, regardless of the country of travel.

Formula and calculation procedure with examples

The calculation procedure is strictly defined by legislative acts and is carried out as follows:

- To begin with, the amount that was accrued to the employee as salary during the last year before he was sent on a business trip is determined.

- From the amount received, various payments are deducted that are not included in the basic salary, that is, sick leave, vacation pay and others.

- Next, it is necessary to subject the same adjustment to the amounts that were received by the employee as bonuses of various kinds.

- At the next stage, it is necessary to calculate the number of days that were actually worked by the personnel by excluding from the total working time the hours of absence of the person for various reasons: being on vacation, on sick leave, etc.

- Next, the resulting amount of earnings must be divided by the number of days during which the employee was present at the workplace. Based on this figure, the result is obtained, which is accrued to the employee as travel allowances.

As an example, we can cite the following situation: a certain Sidorov, whose average salary is about 15,000 rubles per month, taking into account bonuses and various types of payments, was absent from the workplace for 3 days because he was sent on a business trip. Let's calculate how much he should be credited for these 3 days:

- To determine the average amount of income, it is necessary to subtract from the total number of working days the hours during which he was absent from the workplace for a valid reason (for example, sick leave, vacations, etc.). In this case, Sidorov was at work for 200 days out of a total of 224, since he was on annual leave for 24 days.

- After this, the average amount of income received by the person for the current year preceding the business trip is calculated. The amount of payments for various bonuses, vacation pay and sick pay is excluded from the total earnings received; in this case, this figure will be equal to 150,000 rubles.

- Therefore, it is necessary to divide 150,000 by 200, and the resulting amount is 750 rubles and will be equal to the average daily earnings of this employee, according to which the business trip will be paid: 750 * 3 = 2250 rubles.

The detailed process of calculating the amount of payments is shown in the video as an example:

Business trip on a day off

If an employee is sent on a business trip on a day off, then this procedure applies.

For example, an employee leaves on a business trip on Sunday in order to attend a meeting on Monday at 10 a.m. Or another example, when an employee worked the whole week on a business trip from Monday to Friday, but bought a return ticket only for late Friday evening and arrived at his destination on Saturday.

are not paid for weekends . For the weekend, the employee will receive only daily allowance .

If an employee worked on a day off that fell on a business trip, then such a day must be paid double . If, according to the employee’s normal schedule, this day off for everyone is a normal working day for the business traveler, he is paid according to the average daily earnings.

If a person gets sick while traveling

Sometimes situations such as illness of an employee on a business trip may arise. In this case, three main directions of development of events are possible, which are previously agreed upon by the employer and employee:

- The employee is forced to interrupt his business trip and return to his place of residence due to the inability to fully continue his official activities.

- The employee continues to travel on a business trip to perform all official duties, regardless of his health condition.

- The sick employee remains at the place of assignment, but does not perform the duties entrusted to him due to lack of opportunity due to illness. Situations of this kind arise when there is no possibility of returning to one’s place of residence due to a rather serious physical condition.

In the first case, the employer interrupts the business trip with a corresponding reduction in payments due for the entire number of days during which the employee was supposed to be on this trip. Instead of this amount, he is paid a salary including sick leave.

As for the other two situations, in this case the employer is obliged to pay travel allowances in the appropriate amount due to the fact that the employee was at the place of official necessity and there was no possibility of returning to his place of residence.

Also, if necessary, if the employee is not able to work at the end of the business trip and does not have the physical capabilities to return to his place of residence, the employer has the right to extend the duration of the business trip while maintaining all due payments.

When an employee presents to the employer a sick leave certificate opened during a period affecting a business trip, the manager is obliged to make all the necessary calculations required when being in hospital.

You can view the rules and a sample of filling out a travel certificate in this article.

If you are interested in how to write an order to change the staffing table, check out this material.

Who cannot be sent on a business trip

Only a full-time employee of the organization with whom an employment contract has been concluded can be sent on a business trip.

The following cannot be sent on a business trip:

- pregnant women;

- workers under 18 years of age (except for creative workers in the media, theaters, etc., as well as professional athletes).

With written consent and if it is not prohibited by medical recommendations (Article 259 of the Labor Code of the Russian Federation), the following may go on a business trip:

- women with children under three years of age;

- workers with disabled children under 18 years of age;

- workers caring for sick family members in accordance with a medical report.

There are no restrictions for a newly hired employee. He can be sent on a business trip on the first day of work.

Indication of travel allowances in the estimate

When arranging a business trip, it is very important to draw up an estimate so that unnecessary questions and disagreements do not arise later. The estimate is prepared in any form. This document indicates all expenses incurred by the employee during the period of his work trip.

“Gray” salary – what is it? Here's the answer. How to open your own business from scratch: a pharmacy? You can find tips on entering the pharmaceutical market in the article.

What is needed to open an individual entrepreneur current account? To find out the answer, follow the link.

Such expenses include:

- Travel to and from your business trip.

- Accommodation in a hotel or renting another type of housing, as well as related expenses associated with accommodation.

- Daily allowance.

- Additional expenses. This may include payment for telephone calls or the Internet, insurance, paperwork necessary to travel to the place of business and much more.

Preparation of estimates is the responsibility of an accountant. An approximate estimate is drawn up before the business trip, and a real estimate is drawn up after the employee returns, who can confirm his expenses with checks and tickets.

Compilation of a report

Within three days after returning from a business trip, the employee is required to submit a report on the expenditure of funds to the accounting department. In the event that he has unused money left from the advance given to him, he must pay it back. Drawing up a report is mandatory even if the employee uses only a bank card for payment and the movement of funds from it can be easily obtained from the bank.

The report must be accompanied by documents such as an order for a business trip, travel documents, hotel receipts, a copy of the passport page with a visa (if this is a business trip abroad) and other checks that relate to reimbursable expenses.

At the end of the article, we recommend watching a video that provides an example of calculating payment for business trips.

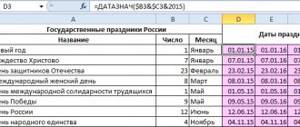

Basic Rules

The accountant must find out for which days the accruals are made. In some cases, travel allowances are paid only on working days. However, most often, funds are paid for all days of a work trip, including days spent on the road, weekends and holidays.

To calculate the payment for one working day of an employee, it is necessary to calculate his average earnings for the last year. When calculating the average daily wage, all allowances and bonuses should be taken into account. However, any financial assistance that the employee received during this year does not need to be taken into account.

After the accountant has calculated the employee's average earnings per day, he needs to calculate the number of days that the employee spent on a business trip. As a rule, a business trip begins on the day the employee departs for the trip and ends on the day of his arrival.

What is a “black” salary, and what is the employer’s responsibility for issuing it?

How to open a bookmaker's office on the Internet? We recommend following the link to find out the answer.

How to open an online clothing store? Details are located here.

The formula for calculating travel allowances involves multiplying the number of days on a business trip by the average daily earnings. This is the amount the employee receives before going on a business trip in the accounting department.

How to correctly calculate travel expenses for an accountant? This is discussed in the video below.

https://youtu.be/JeIT8eqk1ko