Home / Labor Law / Vacation / Educational

Back

Published: 05/03/2016

Reading time: 7 min

0

11674

The modern edition of the Labor Code contains a large list of conditions and requirements for part-time students to take paid leave to take exams. Such leave includes the number of days necessary and sufficient to prepare for the session and pass it. Article 287 of the Labor Code of the Russian Federation states that part-time workers have the right to guaranteed paid leave only at their main place of work. In 2021, the procedure for paying vacations to absentees has not changed.

If a student combines several jobs, then he can take leave at his own expense from other, non-main jobs . But only if this is stipulated in the employment contract and there are necessary conditions for this in the workplace. Otherwise, the employer can always refuse study leave, and absence from work during the session will be classified as absenteeism.

- List of conditions

- Collection of necessary documents

- Amount of payments for study leave

- Vacation dates

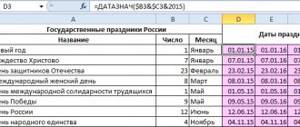

- Display in accounting

- Possibility of extending vacation

Who can receive

Not all employees have the right to apply for study leave. Only key employees of organizations who are simultaneously full-time or part-time students of educational institutions and are receiving education for the first time can count on the privilege (Articles 177, 287 of the Labor Code of the Russian Federation). In addition to these conditions, legislators have provided restrictions on duration:

| Form of study | Payment for study leave 2020 | Duration restrictions |

| Full-time and part-time education | Paid (Article 173 of the Labor Code of the Russian Federation) | In the 1st and 2nd courses - 40 calendar days per academic year. Subsequent periods are 50 calendar days per academic year. During the period of state examinations - up to four months. |

| Full-time education | Not paid (Article 173 of the Labor Code of the Russian Federation) | To pass the session - 15 days per academic year. It takes four months to pass state exams and defend a thesis. One month to pass state exams. |

IMPORTANT!

The total duration is confirmed by a summons certificate.

This is a special form of documentation that an employee provides to the employer to confirm his absence.

What is included in the calculation of vacation pay

The question arises: is downtime due to the fault of the employer or other reasons independent of him and the employee, but paid in any case? You can answer that it is not included, since this time cannot be considered worked, but only paid.

We recommend reading: Tax on the Sale of a Room Less than 1 Million in 2021 Changes in Russia

Workers in hazardous or hazardous industries and persons under 18 years of age must receive compulsory annual leave without exception. Leave at the request of the employee on a personal request, for family and other reasons does not imply any payments. In other cases, the employee must be paid the amount of average earnings for the entire period.

Design principles

Please follow the following order:

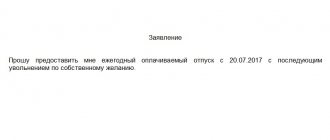

- Receive a free-form application from your subordinate regarding the provision of OU.

- Ask to confirm the application with the appropriate document - a summons certificate. The summons certificate form was approved by Order of the Ministry of Education and Science of the Russian Federation dated December 19, 2013 No. 1368 (as amended on May 26, 2015).

- Based on the application, issue an order. It is recommended to use the unified order form No. T-6 or prepare an order in any form. In section B of the T-6 order form, indicate:

- type of vacation pay;

- number of paid days;

- total duration of training (days);

- start and end dates.

- The employee's absence days are reflected in the time sheet. Moreover, use the codes provided for designating study leaves - “OU”.

- Along with the report card, submit a completed order for study leave to the accounting department; payment and processing are carried out by accountants.

- Don’t forget to make the appropriate note on the employee’s personal card.

Sample application

Sample order

Peculiarities of calculating vacation pay taking into account vacation payments

- Their average earnings were retained.

- Receiving disability benefits (for women - payment of the average salary upon pregnancy).

- A fact of downtime was recorded or the enterprise did not work at all for reasons beyond the control of the employee (industrial accident, fire, natural disaster, etc.).

- There was a strike that did not allow the employee to perform his job duties (if the employee did NOT participate in it).

- The employee took extra days to pay for caring for a disabled person.

- In other cases not described above, the employee was released by management from work while maintaining wages.

According to the legislation of the Labor Code of the Russian Federation, for each year of work an employee is entitled to a vacation of 28 calendar days. The vacation schedule is drawn up taking into account the employee’s length of service and no later than the onset of the new calendar year, taking into account all the features and opinion of the trade union organization (if there is one).

Payment order

Let's determine the key principles of how study leave is paid for part-time students in 2021. General standards are enshrined in Art. 173, 173.1, 174, 176 of the Labor Code of the Russian Federation, as well as in paragraph 14 of Government Decree No. 922 “Regulations on average earnings”.

In accordance with the standards, payment is calculated based on average earnings for each calendar day of the training period. The calculation includes all weekends and non-working holidays that fall during the educational period. The principle of calculating average earnings is similar to the rules for calculating the average salary for paid leave.

IMPORTANT!

The accrued amount must be paid three calendar days before the start of training (Article 136 of the Labor Code of the Russian Federation and Letter of Rostrud dated July 30, 2014 No. 1693-6-1).

How to calculate study leave in 2021:

- We determine the billing period. It corresponds to 12 calendar months preceding the month of the start of the period. For example, an employee goes for training in May 2021. The calculation includes the period 05/01/2018-04/30/2019.

- If maternity leave or maternity leave falls during the billing period, then the periods must be replaced with earlier dates.

- The calculation base includes the amount of accrued earnings and other remuneration for labor due for the time actually worked. Exclude benefits, travel payments, and vacation pay from the calculation.

- Determine the hours worked using time sheets. Take into account all days worked, including holidays and weekends worked. But exclude days of illness, vacations and business trips from the calculation.

- For a fully worked month, include 29.3 days in the calculation ((365 days a year - 14 holidays) / 12 months). If the month is partially worked, then calculate the time worked using the formula: 29.3 / number of days in the month × days worked.

- Calculate your average earnings by dividing the accrual base by the actual time worked.

- Calculate the amount of vacation pay as follows: multiply the average daily earnings by the number of paid days of the MT.

How is it paid?

If we talk about how such leave is calculated, then in this case the calculation is made, as in the case of annual leave. The basis is the average employee salary. With this calculation, payment must be made every day, including holidays and weekends. This differs from the annual one, in which these days are transferred.

You can analyze payment using an example:

Vacation pay

Pyotr Petrovich was hired as a manager on March 1, while he is receiving a correspondence education in the 4th year of a higher institution. In this case, education comes first for Peter.

The university has a license for students to receive education in a certain type, and there is also state registration with an assigned category. On June 13, Peter submitted an application for leave, which is expected to begin on the 20th of June.

Leave can be granted for 29 days, but if necessary, it can be increased by 11 days - but this is already the maximum duration. The company is obliged to pay the employee for vacation.

The amount of payments is determined by the algorithm:

- determination of the time of work in which the employee works before the grant of leave, in this case this period is from March to June

- taking into account the fact that the company employee worked all working hours without absences due to illness or other reason, and his earnings amounted to 90 thousand rubles. Holidays and weekends are taken into account during the final calculation

- then you need to calculate Peter’s earnings before the vacation using the formula: 90 thousand divided by 3 months (in this case 92 days) = 978.26 rubles per working day

- after which the entire amount received for 29 days of vacation is calculated: 978.26 * 29 = 28,369.54 rubles should be received by the employee for the entire period of study leave

Calculation of study leave, example

Let's determine how study leave is calculated for part-time students in 2021 using a specific example.

Specialist of Vesna LLC Morkovkin A.P. sent for training from 06/19/2019 for 14 days. Correspondence form, 1st year.

For the billing period from 06/01/2018 to 05/31/2019 he was accrued:

- salary - 450,000 rubles;

- vacation pay - 34,000 rubles;

- sickness benefit - 18,257 rubles.

Morkovkin rested for 14 days in the billing period - from 07/04 to 07/17/2018 and was sick for one week (7 days) - from 02/06 to 02/12/2019.

In the billing period, only 10 calendar months—293 days—were fully worked out. (10 months × 29.3).

The number of days for calculating educational leave for July 2021 is 16.07 days. (29.3 / 31 days × (31 days - 14 days)). And also for February 2020 - 21.98 days. (29.3 / 28 days × (28 days - 7 days)).

The total number of days worked is 331.05 days. in the billing period (293 days + 16.07 days + 21.98 days).

The base for calculating vacation pay is RUB 450,000. Vacation and sick pay are not included.

Average daily earnings - 1359.31 rubles. (RUB 450,000 / 331.05 days).

Amount to be paid—RUB 19,030.34. (RUB 1,359.31 × 14 days).

Are vacation pay included in the calculation of average earnings for vacation pay in 2021?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

They are taken into account only to the extent that the employee actually performed the labor function. In March, Ivanov worked 10 days: In August - 20 days: In total, he worked 9 full months. Average earnings per day will be calculated as follows: Finally, we calculate vacation pay:

Tax question

The employer is required to withhold personal income tax from the amount of paid study leave. In addition, insurance premiums must be calculated and paid from the accrued amount. Rates and tariffs are determined in accordance with generally accepted procedures. The provisions are enshrined in paragraph 1 of Art. 420 of the Tax Code of the Russian Federation and in the Letter of the Ministry of Finance dated July 24, 2007 No. 03-04-06-01/260.

Transfer insurance premiums to the Federal Tax Service and the Social Insurance Fund no later than the 15th day of the month following the month of accrual. Transfer personal income tax to the budget no later than the last day of the month in which the amounts were accrued (clause 6 of Article 226 of the Tax Code of the Russian Federation). Reflect the accrued amount in the 2-NDFL certificate under income code 2012.

Sample application

Calculation of vacation pay in 2021

In 2021, a new procedure for calculating the amount of vacation payments will come into force. The change in this provision is due to the fact that in 2021 there will be more holidays, and their number is one of the factors that accountants use when calculating the amount of money “for vacation”.

Bonuses accrued at the end of the quarter must be taken into account in full if the time of their accrual coincides with the framework of the billing period. If not, then it is necessary to take into account one monthly share of such payment per month of the period in which vacation pay is calculated. The bonus paid at the end of the working year must be taken into account in full. There is only one condition here - it must relate to the year that precedes the vacation period.

We recommend reading: If You Don’t Call the Police During a Theft at a Supermarket, You’ll Be Worried

Conditions and restrictions on the provision of rest days

Student leave under the Labor Code is a right that arises for an employee if certain conditions are met. Both the employee and the organization should be aware of the rules for its registration, existing reservations and nuances, so as not to run into problems with the law.

There are three main legislative features related to taking time off for studies:

- It is issued exclusively by the company of primary employment. If a person receiving an education works part-time in a company, then the decision to provide free days rests with the organization. Most often, this nuance is reflected in the employment agreement and is agreed upon on the day the relationship between the employee and the company is sealed.

- Days off for taking university exams should not overlap with rest time received on another basis. If an employee is on maternity leave and wants to take days off to take exams, then the maternity leave will be interrupted for this period. If necessary, annual vacation can be combined with student vacation.

- If a person on study leave falls ill and takes out sick leave, the sick leave benefit is not paid and the period of time off granted is not increased.