If the employer does not pay wages on time, the employee has the right to suspend work.

Difficulties in the process of activity can arise for almost every company. Sometimes, due to financial difficulties, an employer cannot pay employees wages. In this case, even if the employer is not at fault, the employee has the right to suspend his work and not resume it until the debt is fully repaid. An employee has this opportunity only if the delay in payment exceeds 15 days (142 Labor Code of the Russian Federation). After receiving a notice from the employer indicating that the employer is willing to repay the debt, the employee is required to return to work. In this case, the company is obliged to pay the employee the average salary for all the days while he was at home and did not perform his duties. If the employer refuses to do this, the employee has the right to go to court.

The conditions allowing an employee to suspend his work will be as follows:

- The salary delay exceeded 15 days;

- The employee notified the employer in writing of the suspension;

- The organization in which the employee works does not belong to those bodies where suspension of work is prohibited for employees.

Justification of the grounds for suspension of work

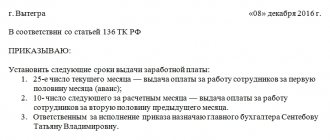

The deadline for paying salaries is defined by law as the 15th day of the month following the month for which this salary was accrued (Article 136 of the Labor Code of the Russian Federation). However, there are also requirements such as:

- the need to pay salaries 2 times a month (at least once every half month);

- fixing specific deadlines applicable to the employer in its internal regulatory document;

- the presence of rules that allow deviations from the deadlines established by law (for example, when the payment day coincides with a day off or when dismissing an employee who was absent from work on the day of dismissal).

All of these requirements affect the date of a specific payment. And they must be taken into account when determining the day on which the salary should be issued. The delay begins on the day following the day of the period calculated according to all the rules.

For example, the deadlines for paying salaries in an organization are set as the 30th (advance payment) and the 15th (final payment). In the month of payment delay, the 15th day happened to fall on a Sunday.

In this case, the payment deadline is postponed to the day before the day off (i.e.

on the 13th). Therefore, the countdown of the delay period will begin on the 14th and end on the 28th.

From the 29th, the employee has the right to submit a notice of suspension of work.

When is absence from work legal?

Article 142 of the Labor Code of the Russian Federation allows an employee, in the event of a delay in wages for a period of more than 15 calendar days, to suspend work, having previously notified the employer in writing. It does not matter whether the employer is to blame for the delay in wages or not. The 15-day period of delay begins to run from the day following the day of payment of wages (part of them), established by the internal labor regulations (Article 14 of the Labor Code of the Russian Federation).

Thus, from the 16th day of salary delay, the employee has the legal right not to go to work. The absence of the employee from the workplace in this case will be legal without the right to apply disciplinary measures against him. You can stay at home indefinitely until the employer is ready to pay the salary debt in full.

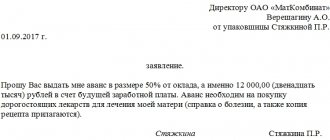

Issuing a notice of suspension of work

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

The notification of work suspension does not have a specific form, so this document does not have an approved form. It can be completed according to the same principles as any application submitted to the employer, indicating in it:

- to whom the document is addressed;

- by whom it was compiled;

- the reason for which the appeal arose;

- decisions made by the employee in connection with the issue described;

- signature of the compiler and date of compilation.

When describing the reason for your request, you should include references to:

- Art. 142 of the Labor Code of the Russian Federation - as giving the right to suspend work;

- provisions of an internal regulatory document establishing specific days for payment of wages;

- legal provisions justifying the postponement.

Among the decisions made by the employee, it is necessary to indicate not only the suspension of work, but also whether the employee will be at the workplace during the period of suspension.

The above sample can be used as a form for notice of suspension of work, but taking into account the fact that in a particular situation additional explanations regarding the determination of dates may be required, the document establishing the timing of payments from the employer will be different, and the decision on attendance at work may be different. employee.

How to correctly formalize a refusal to work in case of delay in salary?

The key to terminating work on this basis is to notify the employer in writing. This may be an official letter left in the employer's office with a note indicating the registration of the incoming document. The law does not establish any time limits for sending notice to the employer. Therefore, the employee, having delivered the notice, has the right to leave the workplace on the same day. Notification of work suspension may be collective.

Important! If an employee leaves the workplace but does not notify the employer in writing of his intention, this will be regarded as absenteeism. And if an employee goes to court with a claim for reinstatement at work, the court clearly recognizes such dismissal as legal.

During the suspension of work, the employee retains his average earnings.

That is, the employer must pay for the entire period of absence of the employee as forced absence.

Let's sum it up

- An employee whose salary payment is delayed by more than 15 calendar days has the right to suspend work. He is obliged to notify the employer of this decision in writing. The suspension period ends on the day the debt is repaid and is paid (based on average earnings). But not everyone can take advantage of this right - the Labor Code of the Russian Federation contains a list of persons who are prohibited from using it.

- When deciding to suspend work, special attention should be paid to the issue of correctly determining the date after which payment can be considered delayed. This date depends not only on the decisions enshrined in the employer’s internal regulatory document, but also on the provisions contained in the Labor Code of the Russian Federation, and, in particular, on the rules for rescheduling.

- A notice of suspension of work is drawn up in any form. It is obligatory for him to provide instructions to whom and from whom this document is being sent, a statement of the essence of the issue, supported by references to regulatory documents and a reflection of the decisions made by the employee.

Wages in Russia, according to labor legislation, must be paid consistently twice a month. The state has developed a whole system of measures to protect the rights of ordinary workers.

Is it necessary to go to work if the employer does not pay wages? What can you do to avoid performing work duties? How to write a statement about suspension of work due to late payment? Let's look at all these questions in more detail.

Example of calculating average earnings

On payday November 30, 2021. On December 15, Petrova wrote a statement about suspension of work and did not return to work. On December 24, 2021, Petrova received a notification from her employer that she was ready to pay her salary on December 25, 2017. The next day, Petrova went to work, and Continent LLC calculated the average salary due to her:

Petrova’s salary is 40,000 rubles, the billing period from December 1, 2021 to November 30, 2021, Petrova worked in full.

Average daily earnings will be:

(40,000 x 12) / 12 / 29.3 = 1,365.19 rubles

Now let’s calculate the payment for the period of suspension of work:

1,365.19 x 10 = 13,651.90 rubles.

Thus, Petrova was paid the amount of 33,751.90 rubles, consisting of:

Salaries – 20,000 rubles;

The average salary for suspension of work is 13,751.90 rubles;

In addition, the employer awarded Petrova compensation for each day the money was delayed.

Are you experiencing delays in wages?

There are many authorities where an employee can complain in case of non-receipt of wages. The main ones are the labor inspectorate, the court and the prosecutor's office. Contacting these authorities will help restore justice and punish the unscrupulous employer.

Do you have a question about suspension of work due to non-payment of wages?

Ask an experienced employment lawyer as part of FREE consultation!

Non-payment of income and consequences in this regard

If workers are not paid wages for a long time, they have to go into debt and take out loans in order to simply live on something and go to work. As a result, in addition to the main borrowed funds, you often have to pay interest to banks and microfinance organizations, refuse lucrative offers to purchase something, and save.

This is only a small part of the troubles that people experience when they do not receive their salaries on time.

The law provides for penalties for employers for non-payment of wages; it will depend on the length of the delay, the amount of debt, as well as the reasons why payment was not received on time. Based on this, the employer may face :

- Financial responsibility. That is, management will be obliged to pay not only the debt for work, but also compensation for employees (the procedure for its calculation is presented in Article 236 of the Labor Code);

- Criminal - up to 5 years in prison.

But workers need to take into account the fact that the employer’s liability occurs only if an inspection has been carried out at the enterprise and the guilt of the management has been proven. And to initiate an inspection, a reason is needed - a statement from employees .

Therefore, you should not tolerate management’s negligence; you need to contact the competent authorities and protect your rights.

Employer's liability

Currently, the law is very demanding of enterprises when problems arise with the payment of labor income. In addition to the fact that the employer automatically finds himself in debt to the treasury: most likely, he will be charged penalties and fines for personal income tax and insurance premiums. In addition, he will have additional obligations to his employees.

There is Article 234 of the Labor Code of the Russian Federation, which states: in the event that an employee is deprived of the opportunity to work (illegally), he must compensate him for lost earnings during this time. Judicial practice suggests that suspension of work due to non-payment of wages fully falls under this rule.

The law prohibits an employer from dismissing an employee during a period of suspension of work due to salary arrears .

Also see “Payroll deadlines have changed in 2021.”

Suspension of work activities

According to statistics, every 5 working citizen has encountered a violation of his labor rights. The most common of them is delay or non-payment of wages.

Nobody wants to work “for free,” but few know that there is a law according to which an employee has the right not to attend the workplace if his salary is delayed by more than 15 days (Article 142 of the Labor Code of the Russian Federation).

In order not to officially attend the workplace during the period of delay in payment, the employee must notify management about this. This is best done in writing in the form of a notice or notice.

In this case, you need to make sure that the letter reaches your superiors. To do this, it should be submitted through the reception secretary with the assignment of an incoming number, or by mail with acknowledgment of delivery.

If notification of suspension of work due to non-payment of wages is not received, management may regard the employee’s absence from work as absenteeism and reprimand him or even fire him.

It should be noted that in some situations suspension of work is not possible. Namely :

- If wages are delayed during an emergency or declared martial law;

- If the employee works in the civil service or in a hazardous industry;

- If the worker’s activities are related to medicine or housing and communal services.

In these cases, the employee is obliged to attend his workplace, even despite the delay in payment.

We draw up a letter

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

There is no specific established form for writing a notice of suspension of work; it is written according to the general rules of business correspondence, namely :

- When writing, it is prohibited to use obscene expressions;

- The notification must exclude semantic, spelling and other errors;

- The essence of the notification should be stated briefly and to the point, without the use of complex and emotionally charged speech patterns.

To simplify the process of writing an application, you can use a ready-made template.

Sample

The notice of suspension of work consists of several parts :

- Document header.

- Name.

- Main part.

- Signature and date.

In the header of the document you should indicate the name of the organization, full name of the head, full name and position of the applicant.

As for the name of the document, it can be called: statement, notification or notice.

In the main part , you need to write down the reason for refusing to go to work (due to delays in payment), the deadlines within which wages must be paid under the contract, and the deadlines for late payments. When writing the main part, you can use links to articles of the law, namely Part 2 of Article 142 of the Labor Code of the Russian Federation.

At the end of the notification the date of writing and the signature of the applicant are indicated.

What the law says

Of course, any actions of both the employee and the employer must be within the law. Therefore, suspension of work due to delayed wages under the Labor Code of the Russian Federation is quite realistic, since the Code clearly requires the organization (IP) to comply with the deadlines for issuing wages (Part 1, Article 21).

In turn, the Labor Code of the Russian Federation gives the staff the right, in the event of a delay in the payment of wages for more than 15 days, to suspend the performance of their labor functions. Part 2 of Art. speaks about this. 142. Moreover, the employee has the right to take a break from work until the due salary is paid in full.

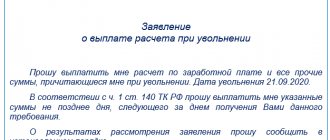

Algorithm for further actions

After writing and delivering the notice, the employee may not attend the workplace. It is in the employer’s interests to repay the debt as quickly as possible. Therefore, after the employer receives the application and finds funds to pay off the wage debt, he is obliged to notify the employee in writing.

The letter must indicate that the employer is ready to pay the debt on the day the employee returns to work . After receiving the letter, the employee must go to his workplace and continue his work.

When can you apply for suspension of work for non-payment of wages?

The law allows you to refuse to perform official duties in order to influence a manager who is delaying the payment of wages to his employees. Forcing employees to wait longer than expected for salaries is prohibited by law - the Labor Code obliges business owners to pay staff at least 2 times a month.

Therefore, if the employee continued to come to the workplace when he should have received his salary at least 15 days ago, but never received the payment, he is allowed to:

- stay at home and not show up at work;

- come to the enterprise, but not perform work duties.

In both the first and second cases, the employee is obliged to start work as soon as he receives notification in writing that the manager is ready to transfer his salary, or when he directly receives the money due to him. Moreover, the employer in such a situation must not only pay the arrears of wages, but also transfer compensation for the delay in payments.

However, in order to incentivize the employer to pay money in this way, it is necessary to follow the procedure established by law. Because, if the employee, before going on such a “vacation,” does not inform the manager in writing of his intention to stop working until he receives his salary, the employer has the right to register the missed days of work as absenteeism, which means he can fire the employee.

So, it is necessary to notify your superiors about the suspension of activities by submitting a written notice, which must state that the employee refuses to work due to the fact that he does not receive payment for his work on time, and the delay in payment was 15 days or more. Moreover, the employee must make sure that the manager received the application, otherwise, if necessary, it will be impossible to prove the fact that the notice was sent.

To have proof that the application was accepted, you will have to write 2 copies of the document - give one document to your superiors, and keep the second one (the application must have a note from the employer that he was notified).

The employer knows the laws, and sometimes deliberately refuses to sign the application and put a stamp, and also notifies the secretary and deputy that there is no need to make a mark and there is no need to register the letter in the journal of incoming documents. The law provides for the actions of the employee in such cases - it is necessary to send an application addressed to the manager by letter with acknowledgment of delivery.

Average earnings during work suspension

Having received a notice from the employer indicating readiness to pay wages, the employee is obliged to go to work the next day. If an employee ignores the employer’s message and does not go to work, then he can be fired for absenteeism on legal grounds - paragraphs. “a”, clause 6, part 1 article 81 of the Labor Code of the Russian Federation.

The procedure for calculating average earnings for this period of time is as follows. Initially, the billing period is determined and then the amount of payments for this period that will be included in the calculation.

The billing period in this case is 12 months. Months are taken as calendar months, starting with the month preceding the month for which the calculation is made. For example, if the suspension of work was in December 2021, then the billing period will be from December 2021 to November 2021. The employer has the right to change it to another period. In this case, it is important to consider the following conditions:

- The amount received in the calculation taking into account a different period should not be lower than the amount received in the calculation in the usual way;

- A different billing period must be fixed in one of the following documents: a local regulation or a collective agreement.

Average earnings for the period of suspension will be calculated as follows: average daily earnings multiplied by the days of suspension.

Average daily earnings will be equal to the accrued amounts for the billing period, divided by the number of days actually worked by the employee.

How to write an application for suspension of work for non-payment of wages

The application is drawn up in any form, but there are certain procedures that must be taken into account when writing it.

The notice must be addressed directly to the employee's supervisor. Before stating the essence of the complaint, it is necessary to notify the authorities from whom the application was received - at the top of the form the personal data of the employee is written down (last name, first name, patronymic, position, department, etc.).

The employer's surname and initials are indicated in the upper right corner.

The inscription “APPLICATION” is placed in the center of the form, and below – in the main part of the document – the following information is indicated:

- the day on which wages are usually transferred to the account of the company’s employees (this date is indicated in the company’s internal regulations);

- notification of non-payment of wages on the specified day;

- the total number of days during which the employer is in arrears in paying employees;

- a link to an article from the Labor Code, which states that employees have the legal right not to report to the workplace if wages are delayed by more than 15 days (Article 142 of the Labor Code of the Russian Federation);

- a statement that the employee suspends work until he receives written consent from the employer to transfer funds on a certain day, or until he receives his salary;

- demand to pay wages and compensation for delayed payment;

- personal signature of the employee;

- date of document preparation.

Payment for suspension time

The entire time of suspension of work must be paid by the employer in the amount of average daily earnings for each day of downtime. If the employer refuses to do this, the employee has the right to go to court. However, there are several opinions on this matter. Rostrud, for example, in this matter, takes the employer’s side and says that the employee did not work during this period of time, which means he is not entitled to a salary. In some cases, it is proposed to consider such a suspension of work as downtime due to the fault of the organization. In this case, payment is provided in the amount of 2/3 of the salary. But in this case, the employee loses part of his salary, which worsens his situation. Therefore, idle conditions cannot be used instead of suspension; these are two completely different concepts.

Judicial authorities usually side with the employee, indicating that in addition to average earnings, the employer is also obliged to pay compensation for the entire delay. This is explained by the fact that the employee’s adoption of such a decision is a forced measure, which is permitted by law to encourage the employer to pay wages on time. This right allows you to eliminate the violation committed by the employer in the issue of payment of delayed wages.

Important! The employer is obliged to pay for the period of suspension due to delayed wages during which the employee did not perform his work duties.

What other actions can an employee take to receive the salary withheld by the employer?

In addition to sending an application to the employer to suspend work, you can influence the manager in other ways permitted by law.

| Employee action | A comment |

| No other action can be taken until the employer receives notice of the employee's termination. It may happen that the employer immediately makes a concession and pays the debt. | You can familiarize yourself with a sample of writing a notice of termination of work before the payment of wages or approval of a specific date for its payment by clicking on the link ⇒ sample of a statement of termination of work due to delayed wages. |

| If the employer has not taken any action, you can report violations to Rostrud - the labor inspectorate is obliged to respond to the request, conduct an inspection and oblige the employer to pay wages. | You can see how to write an application to the labor inspectorate by clicking on the link ⇒ sample application to the labor inspection about non-payment of wages to employees. |

| The next step will be to notify the prosecutor about offenses occurring in the company. | Read ⇒ a sample application to the prosecutor's office about delayed wages. |

| Finally, the employee has the right to file a claim in court and deal with the employer in court. | You can see how to write a statement to the court here ⇒ a sample statement of claim to the court against an employer. |

Common mistakes

Error: The employee did not show up for work because his salary was delayed. He did not notify his employer of the reasons for his absence.

Comment: If you do not notify the employer before refusing to work due to non-payment of wages, missed workdays may be considered absenteeism.

Error: An employee involved in emergency rescue work did not show up for work due to late wages.

Comment: Employees whose job responsibilities include emergency rescue operations do not have the right to suspend work for the period of non-payment of wages.

In what cases is absence from work prohibited even if wages are delayed?

Meanwhile, the law establishes cases when an employee does not have the right to suspend work, even if he has not been paid for more than 15 days. These cases, in accordance with Art. 142 of the Labor Code of the Russian Federation are:

- filling the position of a civil servant;

- work at enterprises related to the maintenance of hazardous types of production and facilities (metropolitan, airport);

- work in the field of supporting the livelihoods of the population (heat, gas, water supply, heating, energy supply, ambulance, etc.).

Workers in these areas are prohibited from suspending work under any conditions, even if wages are delayed. In case of absenteeism from work, such absence from the workplace will be regarded as a disciplinary offense (absenteeism) with all the ensuing consequences.

Legal regulation

The rules for suspending work due to non-payment of wages, as well as cases when work cannot be left, are described in Art. 142 of the Labor Code, and in Art. 236 of the Labor Code defines a penalty that the employer is obliged to pay to the worker for each day of delay in wages.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

At the moment, the penalty amount is 1/150 of the Central Bank key rate or 5% of the debt amount. Under the terms of a collective or employment agreement, the amount of the penalty may be increased.

The employer's liability for delayed wages is established:

- clause 6 art. 5.27 Code of Administrative Offenses ;

- Art. 145.1 Criminal Code ;

- regional and industry regulations.

Conditions for suspension of work

Work can be suspended by sending written notice to the employer on any day starting from the 16th day of delay in salary or part thereof. The days are counted from the date of receipt of the advance or payment, which is specified in the employment contract or other local acts of the company.

An employee who has suspended work may not appear at the workplace until he receives from the employer a notification of readiness to pay the entire amount of the debt on the day he returns to work.

When suspension of work is prohibited

According to Art. 142 of the Labor Code, suspension of work due to delayed wages is prohibited:

- when a state of emergency or martial law is declared;

- in military organizations, structures of the armed forces , the FSB and the Ministry of Internal Affairs;

- during emergency, search and rescue and fire fighting operations;

- in response to natural disasters;

- for personnel serving particularly hazardous industries;

- for civil servants;

- for workers servicing electrical networks, heating systems , water and gas supply systems;

- for ambulance and emergency workers.

Step-by-step instruction

Registration of suspension of labor activity includes the following steps:

- In the first days of salary delay, the employee sends a complaint to the company management.

- After 15 days, an application for suspension of work is submitted.

- The employee receives a mark of acceptance of the application and stops going to work from the next day.

- On days of forced downtime, a complaint is filed with the labor inspectorate.

- Upon receipt of notification of readiness to pay wages, the employee goes to work the next day.

A claim for unpaid wages is sent to the head of the department. The claim must state the requirement to pay the entire amount of the debt, and also indicate the possible suspension of work in accordance with the Labor Code of the Russian Federation if this requirement is not met.

The purpose of filing a claim is to indicate readiness to resolve the issue amicably and warn the employer about the consequences of further delays in wages. If the reason for the delay was the incorrect work of an accountant or other bureaucratic costs of the company, then usually the salary is paid and a strike can be avoided.

If wages are not paid by the 16th day of delay, an application for suspension of work is drawn up. The application must indicate:

- Full name of the manager and name of the organization;

- Full name and position of the employee;

- salary payment date according to the contract;

- term and amount of debt;

- date of suspension;

- date and signature.

The application is drawn up in two copies and submitted on the last day of work to the immediate supervisor, head of the personnel department or director. One of the copies must bear a mark of acceptance, certified by the signature of the receiving person with a transcript - this copy remains with the employee.

If officials refuse to accept the application or mark it, citing employment or other reasons, it is necessary to hand over a copy, calling two witnesses, and it is advisable to film the process on camera, accompanying the submission of the paper with an oral message about the intention to suspend work starting tomorrow, according to Art. 142 Labor Code of the Russian Federation.

It should be remembered that when conducting an inspection, inspectors do not have the right to disclose the names of those who filed a complaint to the company administration.

Resumption of work

When an employee receives notification from the employer that he is ready to pay wages, he goes to work the next day after receiving such notification.

It is important to note that the document must be drawn up in writing and certified by the signature of the manager and the seal of the company. If the notice was received verbally by phone or in the form of an SMS message, then when leaving for work in the morning you must immediately request a written copy.

If before the end of the first working day after the strike the salary debt has not been repaid in full, the employee has the right to suspend going to work again from the next day without prior notice, since the validity of the previously submitted document remains valid.

Suspension of work in the event of wage arrears is an effective method of influencing the employer, but in order to prevent disciplinary action, it is necessary to follow the procedure for notifying the employer of absence from work, and also seek help from the labor inspectorate.

Russian legislation provides employed citizens with many additional guarantees. The current rules provide for the possibility of absenteeism due to delayed wages after a subordinate submits a corresponding application.

At the same time, employees must remember that absenteeism due to non-payment of wages has its own nuances and limitations. They must be taken into account not only by workers, but also by employers.

- 1 Actions of an employee under the Labor Code of the Russian Federation in connection with non-payment of wages

- 2 How to write an application?

- 3 Writing sample

- 4 Mistakes you can make

Suspension of work due to delay in payment of wages (Payment based on average earnings)

Calculation in 1C programs: ZKGU 3 and ZUP 3

Continuing the topic of calculating and paying compensation for delayed payment of wages, which was described in my last article, in this article I want to touch on another important topic: “Payment based on average earnings for the period of suspension of work before payment of wages. Calculation in 1C programs: ZKGU 3 and ZUP 3.”

As I wrote in my last article: Delay and late payment is a violation of the law and entails fines and criminal prosecution of the employer, as well as the need to calculate and pay compensation for late payment on time.

But, besides this, in accordance with Part 2 of Art. 142 of the Labor Code of the Russian Federation, if wages are delayed for more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until the delayed amount is paid in full. An exception to this rule is the cases of prohibition of suspension of work specified in the said article. Some categories of workers do not have the right to suspend their work, even if their wages are delayed. (Categories of employees are also described in Article 142 of the Labor Code of the Russian Federation) During the period of suspension of work, an employee has the right to be absent from the workplace during his working hours (Part 3 of Article 142 of the Labor Code of the Russian Federation).

An employee who was absent from the workplace during the period of suspension of work is obliged to begin work no later than the next working day after receiving written notification from the employer of readiness to pay the delayed wages on the day the employee returns to work (Part 4 of Article 142 of the Labor Code of the Russian Federation). If the employee does not return to work after written notice, the employer has the right to dismiss him for absenteeism (clause “a”, clause 6, part 1, article 81 of the Labor Code of the Russian Federation)

For this period (time of forced absence (suspension of work) due to delayed wages for more than 15 days), the average wage must be paid. Average earnings are calculated according to the Rules approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Let's see how to calculate this payment in programs 1C: Salaries and personnel of a government institution 3 and 1C: Salaries and personnel management 3.

The pictures will be presented using the example of the 1C program: Salaries and personnel of a government institution, edition 3. (release 3.1.8.185) Users of the program for self-supporting institutions 1C: Salaries and personnel management 8th edition 3 will also find this material useful, because The interface of programs for “state employees” and “self-supporting employees” is, in principle, very similar.

In order to pay for this period of suspension of work based on average earnings, it is necessary to create a new type of accrual in the program. Create Accruals in the directory (Menu Settings-Accruals

) new directory element.

Enter the name, I called it “Suspension of work due to delay in payment of wages” (Payment based on average earnings).

- In field Purpose of accrual

select

Payment for time of saved average earnings

. - In field Accrual is in progress

established

According to a separate document

. - The default document type is set Absence with payment retained

.

- Calculation and indicators are set by default The result is calculated

. The formula for calculating average earnings was set automatically.

Go to the “Time Tracking” tab.

In the Time type

select the preset directory element “Suspension of work in case of delay in salary payment”

This type of time in the Table is designated as NZ

“Dependencies” tab, select the required values (writs of execution and professional contributions are retained).

The “Priority” tab is filled by default with the required values; it can be edited if necessary.

The “Average Earnings” tab looks like this

Next tab “Taxes and contributions, accounting”

We record the created accrual type.

Payment based on average earnings for the period of suspension of work before payment of wages is made using the document Absence with preservation of pay (Menu Salary-All accruals-Create “Absence with preservation of pay”

)

Create a new Absence document with payment saved.

In our example, we pay employee Yu.V. Kirillova. suspension of work until payment of wages (payment based on average earnings) for the period from November 26, 2018. until November 30, 2018 within 5 calendar days.

Select Type of absence - Suspension of work in case of delay in salary payment

(the type of time that we selected in the settings of the created element of the Accruals directory)

We indicate the start date of November 26, 2018.

and

End date 11/30/2018.

On the Payment automatically

The start date for the earnings retention period

was set The accrual type was automatically set. Suspension of work due to late payment of wages.

(Payment based on average earnings).

If we had several types of accrual created in our database with the time type “Suspension of work in case of delay in salary payment,” then we would need to select the desired type of accrual. We have only one type of accrual with this type of time, so the type of accrual was adjusted automatically. This tab is used to calculate the Average Earnings Payment.

Here we indicate how the payment will occur; in our example, With salary was selected, Payment date 12/05/2018.

tab (details)

as follows.

On the Advanced

You can specify different

funding item, expense item

and

KOSGU

Next, we carry out this document and pay according to the statement in the usual manner, along with the salary for November 2021. I won’t stop at the moment of payment.

That's all I wanted to tell you today. I hope that the material in my article will help you correctly and correctly calculate “Payment based on average earnings for the period of suspension of work until payment of wages” in the 1C programs: Salaries and personnel of a government institution, 8th edition 3 and 1C: Salaries and personnel management, 8th edition. 3. If you still have any questions on this topic, you can ask them in the comments to the article.

Actions of an employee under the Labor Code of the Russian Federation in connection with non-payment of wages

In accordance with Part 6 of Art. 136 of the Labor Code of the Russian Federation, wages must be paid to subordinates at least once every half month. Specific dates for the issuance of advance payments and labor remuneration are determined by the local documentation of the enterprise.

To identify unlawful actions on the part of the employer, the subordinate must take into account the following nuances:

- payment must be made no later than 15 days from the end of the period for which it was accrued;

- if the date falls on a weekend or holiday, workers must receive the due funds the day before;

- in the process of determining the frequency of salary payments, the Labor Code of the Russian Federation does not establish specific deadlines, limiting itself only to the wording “every half month”.

By finding out the exact days of payroll at his enterprise, the employee can accurately determine whether a delay is occurring or not. Delay in itself is a violation of the labor rights of workers and gives them the right to self-defense.

In this case, the subordinate has the right to suspend work activities due to non-payment of wages. To prevent a worker from becoming a violator, he must follow certain rules.

In the event that a subordinate’s salary is not accrued for more than 15 days, he has the right to take the following legal actions:

- provide the employer with a written claim demanding repayment of the debt incurred;

- notify the employer in writing of the termination of your activities and absence from work;

- not perform official duties until written notice is provided by management of the intention to pay wages.

Do I need to pay an employee for time absent from work due to delayed wages?

In the last months of last year, the growth of overdue wages intensified. However, no one repealed the law. In accordance with Article 142 of the Labor Code of the Russian Federation, if payment of wages is delayed for more than 15 days, employees have the right to suspend work, and the employer is obliged to pay them for this time. In what size? This is exactly the topic we will talk about today.

Is payment in question?

Based on generally accepted principles and norms of international law and in accordance with the Constitution of the Russian Federation, an employee has the right to timely and full payment of wages for his work. In accordance with Article 136 of the Labor Code of the Russian Federation, payments must be made at least every half month on the days established by the internal labor regulations, collective agreement, or employment contract. If the employer violates the established deadlines for paying wages, the Labor Code of the Russian Federation (Article 142) gives the employee the right to suspend work (except for the cases listed in part two of Article 142 of the Labor Code of the Russian Federation) for the entire period until the delayed amount is paid. It is important to remember that an employee cannot be subject to disciplinary action for refusing to work if:

- the delay in payment of wages on the day of suspension of work was more than 15 days;

- Before suspending work, the employee notified the employer in writing.

In fact, it turns out that suspension of work (on legal grounds!) due to non-payment of wages is an individual form of employee self-defense, which is stated in Article 379 of the Labor Code of the Russian Federation. This means that during the period of suspension of work (regardless of whether the employee was at the workplace or not*), he must retain all the rights provided for by labor legislation and other acts containing labor law norms (Article 379 of the Labor Code of the Russian Federation), as well as guarantees of the exercise of the right to self-defense. For example, maintaining a job (position), maintaining wages. The employer has no right to prevent employees from exercising self-defense of their labor rights.

Although, to be completely objective, it should be said that the issue of payment for suspension of work within the framework of self-defense is not directly regulated by law. Therefore, different opinions are often expressed on it. Some believe that this time is not subject to payment at all, others that it is subject to payment, but according to the rules of payment for downtime, and others - in the amount of lost earnings. Let's figure this out.

From the Labor Code of the Russian Federation

Suspension of work is not allowed:

- during periods of martial law, a state of emergency or special measures in accordance with the legislation on a state of emergency;

- in the bodies and organizations of the Armed Forces of the Russian Federation, other military, paramilitary and other formations and organizations in charge of ensuring the country's defense and state security, emergency rescue, search and rescue, fire-fighting work, work to prevent or eliminate natural disasters and emergency situations, in law enforcement agencies;

- civil servants;

- in organizations directly servicing particularly hazardous types of production and equipment;

- employees whose job responsibilities include performing work directly related to the livelihoods of the population (energy supply, heating and heat supply, water supply, gas supply, communications, ambulance and emergency medical care stations)

Part two of Article 142 of the Labor Code of the Russian Federation

Payable

So, since no one doubts that refusal to work in case of delay in payment of wages is a form of self-defense of the employee, then in order to exercise this right the employee must be provided with appropriate guarantees. Including wages. Otherwise, can refusal to work be considered self-defense? After all, in this case, the employee loses not only in earnings, but also in the payment of vacation pay and other amounts calculated from average earnings. For example, consider the following situation.

Example

The employee notified the employer in writing of the suspension of work due to the delay in paying him wages (the delay was more than 15 days). The employer informed that no payment would be made to him for the period of suspension. As a result, the employee was forced to continue working, since wages were the only source of income for him and his family.

The above example shows that in the absence of payment, an employee most often continues to work for fear of losing it. He cannot use self-defense as a way to assert his right to gainful employment. Thus, the norms of Articles 21 and 379 of the Labor Code of the Russian Federation are violated. And Article 142 acquires a declarative character.

Thus, despite the fact that the code does not clearly state that the time of suspension of work in the event of a delay in wages must be paid, recognition of such suspension as a form of self-defense of the employee implies a guarantee of payment for this period.

Another argument in favor of payment is that, in accordance with the Labor Code of the Russian Federation (Article 155), payment of the standardized part of wages is not made only if job duties are not fulfilled due to the fault of the employee. Since there is no fault of the employee in the situation under consideration, the period of refusal to work is subject to payment.

Forced labor is prohibited

After amendments were made to the Labor Code (Federal Law of June 30, 2006 No. 90-FZ), the concept of “forced labor” was clarified. Now forced labor refers to work that a worker is forced to perform under the threat of any punishment, while by law he has the right to refuse to perform it. In particular, in case of violation of salary payment deadlines. At the same time, we draw your attention to the fact that in practice it is virtually impossible to prove whether a threat took place or not (assuming that it was expressed orally). If an employee goes to court, it is possible that the decision will be in his favor.

How to pay?

We propose to consider this issue from the perspective of the employer's responsibility. It is no coincidence that an employee’s right to suspend work in the event of a delay in payment of wages is considered in the context of the article (Article 142 of the Labor Code of the Russian Federation), which defines the employer’s liability for failure to pay wages and other amounts due to the employee on time.

Let’s say an employee’s wages are not paid on time (the delay is more than 15 days), but the employee continues to work under the threat of punishment (for example, dismissal or other disciplinary action). Please note that in this case we will be talking about forced labor (Article 4 of the Labor Code of the Russian Federation). Since forced labor, according to the Constitution of the Russian Federation (Article 37), is prohibited, in this situation the employer, in fact, violates the employee’s constitutional right to free labor. This means that the employee has every right to leave his job. Are there any guarantees in this regard in the law? We answer, they exist. In all cases of illegal deprivation of the opportunity to work, the employer bears financial liability to the employee in the form of compensation for the earnings he did not receive (Article 234 of the Labor Code of the Russian Federation). For non-payment of wages for more than two months, liability is established under Article 145.1 of the Criminal Code of the Russian Federation.

There is an opinion that, by virtue of the same article 234 of the Labor Code of the Russian Federation, the employer must bear full financial responsibility if the delay in payment of wages is caused by his guilty illegal actions (inaction). If the delay in payment occurred for reasons beyond the control of the employer, then the period of suspension of work must be paid as idle time (at least two-thirds of the tariff rate, salary) (Article 157 of the Labor Code of the Russian Federation). Let's see if this is true. Indeed, at first glance it may seem that the suspension of work in case of delayed wages and downtime have much in common: in both cases there is a temporary suspension of work for economic reasons. Delays in wages and downtime can be caused by both culpable actions (inaction) of the employer and reasons beyond his control. And therefore, payment should be made by analogy.

At the same time, refusal to work in self-defense is not downtime (Article 722 of the Labor Code of the Russian Federation). This means that the application of the rules of payment for downtime to the suspension of work as a form of self-defense is not permissible. In addition, one cannot fail to take into account that the right to suspend work in case of delayed wages is granted regardless of whether the employer is at fault in the actions. In the work time sheet, this time, unlike downtime, is indicated by the letter code “NZ”, regardless of whose fault the suspension occurred. Consequently, the guarantee of payment should also not be made dependent on the employer’s fault. In this case, the most correct option would be to reimburse lost earnings in full. Downtime is a temporary suspension of work for reasons of an economic, technological, technical or organizational nature.

Thus, in order to avoid lawsuits, employers should keep in mind that during the time during which the employee suspended work in self-defense in case of violation of the payment deadlines, the employee should not lose any pay. By the time the actions for self-defense of rights are completed, the employee must receive the delayed salary due to him, taking into account interest (monetary compensation) (Article 236 of the Labor Code of the Russian Federation) plus wages for the period of suspension of work.

From the Labor Code of the Russian Federation

If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time* from unpaid amounts on time for each day of delay starting from the next day after the established payment deadline until the day of actual settlement inclusive. The amount of monetary compensation paid to an employee may be increased by a collective agreement or employment contract. The obligation to pay the specified monetary compensation arises regardless of the employer’s fault.

Article 236

* From December 1, 2008, the refinancing rate is 13% per annum (Instruction of the Bank of Russia dated November 28, 2008 No. 2135-U).

* During the period of suspension of work, the employee has the right to be absent from the workplace during his working hours (part three of Article 142 of the Labor Code of the Russian Federation).

Kirill Mineev, Deputy Head of the Department of Wages, Labor Safety and Social Partnership

Source: kdelo.ru

How to write an application?

This document must be drawn up in two copies. One application is registered at the reception and transferred to the manager. On the second copy, the secretary must put a signature and a stamp confirming its acceptance. The last statement remains with the employee.

Compliance with this procedure is mandatory. Otherwise, the employee may be given absenteeism. An application for absence from work due to delayed wages is drawn up in the name of the head of the company.

The central part of the application must state the essence of the notice:

- indicate the name of the local regulatory act that determines the terms and dates of salary payments (“according to paragraph No.,” wages should have been accrued on such and such a day, month and year);

- indicate the period of delay in wages in days.

In this case, the employee must refer to several articles of the Labor Code. For example, Article 236 of the Labor Code of the Russian Federation obliges management to pay interest to subordinates in case of delayed wages. In accordance with Part 2 of Article 142 of the Labor Code of the Russian Federation, a subordinate may not go to work until the employer pays off the debt based on the notice.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Another article that should also be indicated in the application is Part 1 of Article 157 of the Labor Code of the Russian Federation. It determines the amount of remuneration during the suspension of duties. At the end of the application there is a date, the employee’s signature, as well as a transcript of the signature.

Career

Article 142 of the Labor Code gives employees the right, in the event of a delay in the payment of their wages for a period of more than 15 calendar days, to suspend work (not go to work) for the entire period until the delayed amount is paid. Moreover, the provisions of this article do not contain any indication of the possibility of refusing to work only in the case where the salary is delayed in full for a period of more than 15 calendar days. Even if the delay is partial, the employee has the right to suspend work.

Suspension of work due to non-payment of wages is nothing more than a form of self-defense of one’s labor rights (Article 379 of the Labor Code of the Russian Federation). As the Supreme Court of the Russian Federation explains, an employee has the right to suspend work, regardless of whether the employer is directly at fault (for example, selfish intent) or not (the company’s bank license was taken away, but there are no other accounts) (clause 57 of the Plenum post. RF Armed Forces No. 2 dated March 17, 2004).

| The article is published within the framework of cooperation between HRMaximum and the journal “Actual Accounting” |

According to established judicial practice, for the entire period of delay in payment of wages, including the period of suspension of work, the employee has the right to maintain average earnings. Plus, he is due interest for delayed wages in the amount of not less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at that time on amounts not paid on time for each day of delay, starting from the next day after the due date for payment until the day of actual payment inclusive (Article 236 Labor Code of the Russian Federation; letter of the Ministry of Labor of Russia dated December 25, 2013 No. 14-2-337; rulings of the Supreme Court of the Russian Federation dated April 1, 2011 No. 5-B11-15, dated September 3, 2010 No. 19-B10-10; Review of legislation and judicial practice of the Supreme Court of the Russian Federation for the fourth quarter of 2009, approved by the post of the Presidium of the Armed Forces of the Russian Federation dated March 10, 2010).

In addition, in 2021, amendments to the Labor Code came into force, which secure the employee’s right to receive an average salary during the suspension of work due to non-payment of due income (Article 142 of the Labor Code of the Russian Federation as amended by Federal Law dated December 30, 2015 No. 434- Federal Law).

The reason for the changes, according to the author, lies in the fact that the right of employees to refuse to perform work is a forced measure provided by law for the purpose of stimulating the employer to provide the payment specified in the employment contract within the established time frame. This right requires the employer to eliminate the violation and pay the delayed amount.

Since the lack of payment for labor is an unlawful action (inaction) of the employer, it is he who must bear financial liability to the employee in the amount of the latter’s full average earnings (Article 234 of the Labor Code of the Russian Federation). The risk of organizing production lies with the company, due to which it is obliged to pay the labor of its personnel, regardless of the financial results of its activities. Consequently, if employees suspend work due to illegal deprivation of their opportunity to work, the company is obliged to pay for such suspension as the time of forced absence.

After the publication of the above-mentioned rulings of the Supreme Court of the Russian Federation (rulings of the Supreme Court of the Russian Federation dated April 1, 2011 No. 5-B11-15, dated September 3, 2010 No. 19-B10-10), the lower courts also developed a uniform, stable practice in cases of this type (definitions Chelyabinsk Regional Court dated February 26, 2015 in case No. 11-1996/2015, Krasnoyarsk Regional Court dated January 14, 2015 in case No. 33-48, B-13, Rostov Regional Court dated September 1, 2014 in case No. 33-11822/2014, from 06.06.2013 in case No. 33-6941, the Supreme Court of the Udmurt Republic from 11.18.2013 in case No. 33-4144, the Moscow City Court from 02.12.2013 in case No. 11-4669/2013, the Khabarovsk Regional Court from 10.19.2012 in case No. 33-6468).

Thus, for the entire period of delay in payment of wages, including the period of suspension of work, the company is obliged to pay employees average earnings and compensation in the form of interest due for the delay.

Accounting for payments during the period of suspension of work

Expenses for paying average earnings during the forced suspension of work are taken into account by the company when calculating the income tax base as ordinary labor costs (clauses 6, 14 of Article 255 of the Tax Code of the Russian Federation) in the month of accrual of the indicated amounts (clause 4 of Article 272 of the Tax Code RF).

As for the interest due for delayed wages, according to official explanations of the Ministry of Finance of Russia, such amounts are not taken into account in non-operating expenses (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation) (since this payment arises from labor, and not from civil law relations ), nor in labor costs (Article 255 of the Tax Code of the Russian Federation) (since this payment is not related to the working hours or working conditions, as well as the maintenance of employees) (letter of the Ministry of Finance of Russia dated October 31, 2011 No. 03-03-06/2/ 164, dated 09.12.2009 No. 03-03-06/2/232, dated 17.04.2008 No. 03-03-05/38). However, the judges do not agree with the financial department and recognize the right of companies to take such expenses into account when calculating the income tax base as part of either non-operating expenses or labor costs (regulatory Federal Antimonopoly Service of August 30, 2010 in case No. A55-35672/2009, dated 06/08/2007 No. A49-6366/2006, FAS VVO dated 08/11/2008 No. A29-5775/2007, FAS UO dated 04/14/2008 No. Ф09-2239/08-С3, FAS MO dated 03/11/2009 No. KA-A40/ 1267-09).

In addition, in expenses associated with production and sales (subclause 1, 45 clause 1 of Article 264 of the Tax Code of the Russian Federation), insurance premiums withheld from the amount average wages paid during forced downtime (reg. FAS ZSO dated December 20, 2013 No. F04-8139/13, dated March 5, 2013 in case No. A67-4468/2012).

But insurance premiums are not charged on the amount of interest due for late wages. Thus, the Presidium of the Supreme Arbitration Court of the Russian Federation explained (post. of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 No. 11031/13) that these amounts are subject to Law No. 212-FZ (subclause “and” clause 2, part 1, article 9 of the Federal Law dated July 24, 2009 No. 212-FZ) and on this basis are not subject to inclusion in the base for calculating insurance premiums.

As for personal income tax, the amounts of average earnings we are considering are subject to this tax in general at a rate of 13 percent (clause 1 of article 210, article 217, 224 of the Tax Code of the Russian Federation; letters of the Ministry of Finance of Russia dated April 13, 2012 No. 03-04-05/ 3-502, dated 04/05/2010 No. 03-04-05/10-171). In this case, the tax is accrued on the date of actual receipt of income, which is the day of transfer of funds to the employee’s bank account (clause 3 of Article 226, subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated June 28, 2013 No. 03 -04-05/24633).

Amounts of monetary compensation paid for late payment of wages (Article 236 of the Labor Code of the Russian Federation) are not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated January 23, 2013 No. 03-04-05/4-54, dated 04/18/2012 No. 03-04-05/9-526, Federal Tax Service of Russia dated 06/04/2013 No. ED-4-3/10209).

For accounting purposes, expenses in the form of average earnings and insurance premiums are taken into account on the date of their accrual as part of expenses for ordinary activities by cost elements (“labor costs” and “social contributions”, respectively) (clause 5, paragraph 3, 4 clause 8, clauses 16, 18 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n (hereinafter referred to as PBU 10/99)).

Interest for delayed wages, which is nothing more than the financial responsibility of the employer, is included in other expenses on the date of accrual of compensation (clauses 4, 11, 16, 18 PBU 10/99).