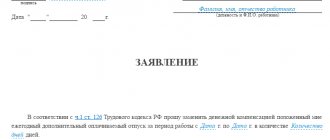

Application for personal income tax deduction for children in 2021: form

There is no single standard application form for 2021, so each employer independently decides what information employees should indicate and develops its own form. From a security point of view, when checking a document, it is advisable to highlight fields for information about:

- surnames and initials of children;

- their age;

- facts of study or disability;

- the date the document was signed by the employee;

- attached papers confirming the right to reduce the personal income tax base.

If an employee has not been working in your organization since the beginning of the year, request a certificate of income and tax amounts from the previous place of work.

Here is a sample application for 2021:

| General Director of Ecostor LLC Mokhov O.L. from manager Kleverova D.L. Application for a standard tax deduction for a child I, Daria Leonidovna Kleverova, based on paragraphs. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, I ask you to provide me with a standard personal income tax deduction for each month of the tax period for my child, Antonina Pavlovna Kleverova, born May 19, 2018. I undertake to promptly report changes in circumstances that served as the basis for providing a standard tax deduction. Attachments: - copy of the birth certificate of A.P. Kleverova; — a copy of the passport of a citizen of the Russian Federation D.L. Kleverova. (pp. 16-17) 01/26/2021 __________________ / Kleverova D.L./ |

The application is usually submitted when the employee becomes entitled to child deductions. Newly hired workers, as a rule, fill out such an application at the time of employment.

IMPORTANT

There is no need to submit an application for deduction annually. If the employee’s right to the deduction has not ceased, the employer continues to provide a child tax deduction in subsequent years.

To reduce the risk of claims about the unjustified provision of a deduction in the case where the employee’s right to a deduction was lost, a phrase can be added to the application form stating that the employee undertakes to inform the employer about the loss of the right to a deduction.

How to determine the amount of the child tax deduction

The amount of the standard tax deduction for children due to parents who regularly pay personal income tax is determined by Article 2021 of the Tax Code of the Russian Federation.

The maximum amount of income that can be reduced by the tax base is 350 thousand rubles ; after it is exceeded, the preference is canceled.

For the first child of two parents, it is equal to 1,400 rubles per month. It will be the same for the second minor. In this case, deductions for each minor or full-time student at a university are added up.

The birth of the third and each subsequent child provides an additional 3,000 rubles in benefits.

For parents, their spouses and adoptive parents, as well as guardians and their spouses, the deduction amounts will be equal. Exception:

- Minor children are disabled;

- Students under the age of 24 with group I or II disabilities.

For parents, adoptive parents and their spouses, the deduction will be equal to 6,000 rubles, and for guardians it will be twice as much – 12,000 rubles.

As a general rule, the deduction is provided to each parent, but for a single parent or guardian, it is provided in double amount.

Interesting information: Social tax deduction for personal income tax. Types and how to get

But the amount also doubles if one of the parents writes a refusal in favor of the other.

When to stop child deductions in 2021: table

Stop giving deductions when one of the following conditions occurs:

| Condition | Month from which no deduction is allowed |

| The employee's income exceeded RUB 350,000. | Month in which the employee's income exceeded the limit |

| The child has turned 18 years old | January next year |

| A full-time student, graduate student, resident, intern, student is 24 years old. The child did not stop studying until the end of the year | January next year |

| A full-time student, graduate student, resident, intern, student is 24 years old. The child stopped studying by the end of the year | Next month after graduation |

| Full-time student, graduate student, resident, intern, student who stopped studying before reaching 24 years of age | Next month after graduation |

Read also

30.08.2016

How to correctly indicate the deadline in an application

The right to deduction arises for employees with the birth of each child. The employer is only obliged to accept the appeal; in his own interests, the employee must submit it.

If in the current year one of the employee’s minor children turns 18 years old, the year for which the deduction is required is indicated. If you are far from the age of majority, then it is not necessary to indicate it.

If a child appears in the family, a new package of documents is submitted, since the right to deduction arises from the moment of birth, adoption or transfer into guardianship.

How to get a child benefit

There are two ways to get child tax credits:

- the first - in the company or entrepreneur where you work;

- the second is at the tax office at your place of residence.

The first method provides that the benefit is issued to you at your place of work. As a result, you are charged income tax (PIT) in a smaller amount. Therefore you get higher earnings.

The second method is used if you did not apply for a benefit at your place of work or if it was provided to you in a smaller amount than needed. There is another case. For example, you received income that is not related to work. For example, from selling your own property or renting out an apartment. The child deduction will also reduce such income. As a result, either you will have an overpayment of tax, which the tax authorities are required to return, or you will have to pay less tax.

Example You have two dependent children. Each of them is entitled to a tax deduction of 1,400 rubles. The total amount of deduction for two children is 2800 rubles.

Situation 1 Your salary is 25,000 rubles. per month. You did not apply to the accounting department at your place of work for child benefits. Your annual income was: 25,000 rubles. x 12 months = 300,000 rub.

A tax in the amount of 300,000 rubles was withheld from him at his place of work. x 13% = 39,000 rub.

You have applied for a deduction to the tax office. After your income was reduced, its amount was: RUB 300,000. — (1400 rub. + 1400 rub.) x 12 months. = 266,400 rub.

The tax due on this income will be: RUB 266,400. x 13% = 34,632 rub.

But at your place of work they withheld 4,368 rubles more from you. (39,000 - 34,632). The budget (tax office) is obliged to return this excessively withheld amount.

Situation 2 You do not have an official job. You sold a car for 300,000 rubles. In this situation, you need to declare the income received and calculate tax on it. When calculating tax, you have the right to reduce this income by 2 deductions at the same time:

— for sellers of property — 250,000 rubles; 2 children - 33,600 rubles. ((1400 rub. + 1400 rub.) x 12 months).

As a result, your taxable income from the sale of the car will be: RUB 300,000. — 250,000 rub. — 33,600 rub. = 16,400 rub.

He owes tax in the amount of: RUB 16,400. x 13% = 2132 rub.

Benefit amount

The amount of income not subject to personal income tax when using the right to a “children’s” benefit depends on the number of children:

- 1 child – 1,400;

- 2nd child – 1,400;

- 3 and subsequent – 3,000.

If the child is disabled, then the parents are provided with a benefit in the amount of 12,000 rubles. For guardians, trustees and adoptive parents of disabled children, the tax base will be reduced by 6,000 rubles.

In this case, the calculation of the amount of reduction in the base for calculating personal income tax in relation to a disabled child is carried out by adding up deductions.

Example

For example, the Kryukov family is raising a disabled son. Both parents have an official salary and pay personal income tax. In this case, both father and mother can receive a deduction in the amount of 13,400 rubles (12,000 + 1,400).

If a parent has the right to a double deduction, then the benefit amount increases 2 times and has the following amounts:

- 1 child – 2,800;

- 2nd child – 2,800;

- 3 and subsequent – 6,000.

When applying a double benefit, the monthly savings from personal income tax for a parent will be 364 rubles for 1 and 2 children and 780 rubles for 3 and subsequent children.

The order of children is calculated even if one of them is no longer supported by their parents.

Example

Sokolova O.V. single mother. She has three children: the eldest son is 26 years old, the middle one is 17, the youngest daughter is 7. She is entitled to a benefit in the amount of 8,800 (2,800 for the middle son and 6,000 for the youngest daughter). Monthly savings on personal income tax will be:

(2800 + 6000) × 13% = 1144 rub.

Registration procedure

The amount of reduction in the tax base directly depends on the income that a single mother officially receives. If it is above 350 thousand per year, the benefit in the form of double tax deductions does not apply. This is stated in paragraph 4 of Art. 218 Tax Code of the Russian Federation.

If the deadline for processing the required deduction was missed, it will not be lost. The required amount of taxes paid can be returned before the end of the year. For this purpose, you will need to submit a special application and documents required by law to the necessary organizations.

The right to receive a double deduction is automatically lost if a woman officially gets married. It doesn’t matter here whether her new husband adopts her child. The reason is that spouses bear exclusively equal responsibilities for expenses aimed at raising and maintaining a child.

If during a divorce the spouse does not formalize paternity, the woman can restore her single status.

If a woman is officially employed, the registration process will not be difficult. You will need to write an application using a special form and provide personal documents; the accounting staff will do the rest.

It is necessary to act through the Federal Tax Service if the tax benefit was not provided at the place of official employment or was not transferred in full. In such a situation, a woman should perform the following manipulations:

- The declaration is filled out.

- A certificate in form 2-NDFL is obtained from the head of the enterprise. If a woman is employed in several organizations, this certificate is taken from each of them.

- The required papers are collected.

- The package of collected documents is handed over to the Federal Tax Service specialists.

- Two competent applications are written according to the sample - for a refund of funds and for the transfer of the required amount to a card or account.

Documents attached to the application

Copies of documents submitted along with the application (a sample application for a child deduction is published at the end of our article) must confirm the employee’s right to a “children’s” deduction. Parents (guardians, adoptive parents) attach copies of the following to the application:

- Children's birth certificates, adoption certificates;

- Marriage certificate;

- Certificates: from the child’s place of full-time education, about disability (if the child is disabled).

In addition, the sole parent or adoptive parent must attach to the application for a deduction for the child:

- Document confirming the absence of the second parent: death certificate, court decision declaring missing;

- A copy of the passport pages confirming the absence of a currently valid marriage.

Adoptive parents, guardians and trustees additionally attach:

- An extract from the guardianship authority regarding the right to guardianship of the child;

- An agreement on the right of guardianship or guardianship, or on the transfer of a child to a foster family.

The entire package of documents is transferred to the employer, and if the right to deduction is confirmed, then he will take it into account when withholding income tax from the employee’s earnings.

Where to apply for child tax credit

An application for a standard deduction, as well as documents confirming the taxpayer’s requirements, can be submitted both to the territorial body of the Federal Tax Service and at the place of work.

In the vast majority of cases, it is much easier to contact the employer with a corresponding application.

If we are talking about returning the amount of overpaid tax, then it is more convenient to contact the tax office.

The content of the application will be completely identical. The only difference will be in the “cap”. Instead of information from the management of the employer's organization, you will need to indicate the name of the tax authority and information about its head.

So, all employees who work in compliance with labor laws and pay income tax have the right to submit an application to receive a preference deduction, the main thing is to follow simple rules.

Interesting information: Tax deduction for treatment. Procedure and rules for receiving

Grounds for assigning status

Tax legislation provides for a double deduction for personal income tax for a single mother. In everyday terms, this is any parent who raises children alone. But from a legal point of view this is not entirely correct. A woman receives single mother status:

- Who gave birth to a child outside of marriage (and not within 300 days after its dissolution).

- If the paternity of the baby has not been legally established (voluntarily or in court).

Likewise, a woman who gives birth during marriage or within 300 days after its dissolution can be recognized as single if:

- the spouse is indicated as the father, but such an entry is disputed or there is a court decision that this person is not the father for the child.

- The woman did not marry, but adopted the baby.

A woman whose husband has died, that is, a widow, is not recognized as a single mother. She is not entitled to the benefit in question.

To receive a double deduction for a child, a woman must submit a document that confirms the absence of an official marriage. In accordance with the explanations of specialists from the Ministry of Finance of the Russian Federation, the employee must provide her employer with a certificate in form No. 25 from the registry office. If information about the child’s father is made from the words of the woman herself, then additional evidence will be required that she is not married, for example, a divorce certificate.

Terms of service

The benefit can be obtained in one of two ways:

- directly from the tax agent - an employer under an employment contract or an employer under a civil law contract;

- independently through the inspection, filling out and submitting the 3-NDFL declaration.

The main condition for someone who wants to receive a double standard deduction for a child for a single parent is the presence of minor children or children who are full-time students under the age of 24 years.

The applicant for the benefit will have to confirm the facts that affect its amount: the assignment of a disabled person to a child or the presence of a disability group in an adult who is a full-time student.

Who has the right to reduce the tax base?

Taxpayers on whose income personal income tax is withheld at a rate of 13% are entitled to receive a deduction for each child under the age of 18 or 24 years of age in full-time education. The following citizens have the opportunity to reduce the tax base:

- parents, including divorced and deprived of parental rights;

- trustees;

- guardians;

- adoptive parents;

- adoptive mother/father.

Double tax deduction for a child is provided:

- single parent (guardian, trustee, adoptive parent);

- mother or father, if the second parent has renounced his right.

The only parent is recognized if the second parent is absent, died or is declared missing. A double deduction is provided to single mothers if there is a dash in the “father” column on the child’s birth certificate, or information about the father is entered from the words of the mother.

In the second case, the main condition is that the second parent has the right to receive a “children’s” benefit. That is, he must have official income subject to taxation at a rate of 13%.

Example

The Porokhin couple have a daughter aged 6 years. The wife works in an LLC and receives a salary from which the employer deducts personal income tax. The husband is temporarily unemployed and receives no income. In this situation, the husband cannot transfer his right to deduction to his wife. That is, the spouse has the right to reduce the base when calculating personal income tax only in a one-time amount, in the amount of 1,400 rubles.

If the spouses are officially divorced, then this is not a basis for providing double benefits. Both parents retain the right to reduce the tax base.

Deadlines for receiving a deduction from the Federal Tax Service

To calculate the taxable income base and return overpaid money, the tax office provides deadlines. To acquire the right to withdraw the excess amount, documents are subject to desk verification within 3 months. The control period will be calculated from the next day after the declaration is submitted. Part of the overpaid tax will go to an account belonging to the applicant.

When requesting benefits at the place of work, a refusal is possible. It is expected in the absence of supporting documents or notice in cases where it is necessary to obtain permission from the Federal Tax Service. Payment may not be provided if:

- Declaration 3-NDFL was not filled out on the proper form.

- The deadline for filing it has been missed (3 years after tax withholding and expenses).

- The list of required documents is not complete or there are discrepancies in the applicant’s data.

The decision to refuse to recalculate payments is sent to the person in a written message. He retains the right to appeal the resolution.

Consequently, single mothers, as a particularly vulnerable category of citizens, have the right to special tax deduction conditions. To get the money back, they need to collect a certain list of papers and contact the tax service or their employer.

Double deductions for children: nuances

When applying for double deductions for children, it will be useful for the taxpayer to pay attention to a number of important nuances:

- If the taxpayer has the right to other standard deductions - for example, those established for participants in overcoming the consequences of the accident at the Chernobyl nuclear power plant, then he has the right to fully use them simultaneously with the compensation in question.

In turn, if a person has issued a standard deduction not for children, but on another basis - for example, as a participant in armed conflicts, then he will only have the right to use it. This deduction can be replaced by another standard one - the largest in terms of the amount of personal income tax returned or in terms of reducing the calculated personal income tax from wages.

- If a parent works in several companies, then he can apply for compensation to any of them - of his choice. If necessary, you can take into account income in the form of salaries in each of the relevant companies.

However, when filing a deduction with the Federal Tax Service, you will need to request a 2-NDFL certificate from the accounting departments of each organization confirming the taxpayer’s income. But in any case, the 3-NDFL declaration is prepared alone.

- If a parent worked in one company at the beginning of the year, then quit it, moved to another company and draws up the deduction in question there, for the purpose of calculating the deduction, income received from the previous employer must be used. They are certified by a certificate issued by the accounting department of the employer.

- If necessary, the taxpayer can place 2 schemes for obtaining deductions that we have considered - through the employer and through the Federal Tax Service.

For example, if from January to September 2021 he did not receive appropriate compensation from his employer (alternatively, due to the fact that he did not have time to complete the necessary documents, but received only from October to December), then in 2021 the taxpayer will has the right to apply for a deduction from income from January to September 2021 by contacting the Federal Tax Service.