KBK for payment of penalties for personal income tax for individual entrepreneurs

| PENALIES, INTEREST, FINES | KBK | |

| Penalties, interest, personal income tax fines on income received by citizens registered as: individual entrepreneur; private lawyers; notaries; other persons engaged in private practice (personal income tax for individual entrepreneurs for themselves) | penalties | 182 1 01 02020 01 2100 110 |

| interest | 182 1 01 02020 01 2200 110 | |

| fines | 182 1 01 02020 01 3000 110 | |

For individuals

Personal income tax on dividends in 2021 - rate, KBK, etc.

We will discuss in our article what rates apply to personal income tax on dividends, as well as at what BCCs the tax is transferred to the budget. March 13, 2021 KBK dividends - in 2021, personal income tax is still withheld from them without fail - is indicated in field 104 of the payment order. Let's consider what budget classification code when paying personal income tax on dividends should be indicated in the payment slip in 2021.

27 Dec 2021 Based on the results of the last reporting year, the management of the company has the right to pay dividends to participants from the amounts of retained earnings. At the same time, individuals receive a corresponding item of income.

Should personal income tax be charged in this case?

NOTE! Tax payment to the budget should not occur

KBC for payment of penalties for personal income tax for individuals

| PENALIES, INTEREST, FINES | KBK | |

| Penalties, interest, personal income tax fines on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation (personal income tax for individuals who must independently pay tax on their income) | penalties | 182 1 01 02030 01 2100 110 |

| interest | 182 1 01 02030 01 2200 110 | |

| fines | 182 1 01 02030 01 3000 110 | |

From dividends and working under a patent

Directing funds to the budget

In 2021, filling out and submitting personal income tax reports on time is not enough if you need funds to pay income taxes to be taken into account in the budget in accordance with their purpose. To do this, you must fill out a payment order to the Federal Tax Service in accordance with all official requirements. Otherwise, the organization and the federal treasury itself may simply not see the transferred funds. Then you will have to:

- clarify all payment details;

- check details;

- look for the mistake made.

Nobody says that the amounts paid will be lost. However, sometimes legal entities and individual entrepreneurs with staff, as a safety net, have to re-transmit the required amount in order to avoid troubles with relations with the Federal Tax Service.

Thus, paying personal income tax in 2021 with a payment order that is generated according to a specific model requires close attention to avoid mistakes. Here is a payment order form that in 2021 legal entities can use to transfer personal income tax.

The form of payment order for personal income tax of the 2021 sample has not changed.

The form of the payment order is given in Appendix 2 to the Regulations of the Bank of Russia dated June 19, 2012 N 383-P. The payment order for the payment of tax should be filled out according to the Rules established in Appendices NN 1, 2, 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n.

KBK for payment of personal income tax for citizens working on the basis of a patent

| NAME | PAYMENT TYPE | KBK |

| Personal income tax on income (in the form of fixed advance payments) received by non-residents working for citizens on the basis of a patent | tax | 182 1 01 02040 01 1000 110 |

| penalties | 182 1 01 02040 01 2100 110 | |

| interest | 182 1 01 02040 01 2200 110 | |

| fines | 182 1 01 02040 01 3000 110 |

FILES

Recipients of dividends and procedure for receiving them

Based on annual results, all shareholders of the company expect to receive additional profit. At the same time, both legal entities and individuals can be the owners of shares. Thus, profit tax is withheld from legal entities, and personal income tax is withheld from individuals.

Depending on how it is reflected in the company's charter, the division of profits between participants occurs in a specific order. The most common variant of “division” is from proportion to share. If it is decided differently, the company will inevitably face a dispute with the tax authorities. Community members who were accepted later than others, according to the share they purchased, receive payments.

How are payments made?

Dividend payments are deducted at the moment when the organization has already covered all necessary expenses. That is, participants receive unallocated money (for example, not needed to pay for something or to maintain the work in an efficient state). The very fact of receiving dividends indicates that the business is performing excellently and is being managed wisely. That is, shareholders must be interested in the company’s income generation and its stable activities.

Payments themselves cannot have a fixed schedule. Shareholders or management of the company decide together at what time (or at what interval) dividends will be transferred. For this purpose, general meetings of shareholders are held, at which the following are decided by a majority vote:

- What part of the profit will be sent as dividends?

- How the profit will be divided among the shareholders.

- When will payments be made?

When a decision is made, a protocol is drawn up confirming that such and such shareholders were present at the meeting, made such and such a decision and contains their personal signatures. You must understand that changing it often or just like that is undesirable, since it affects accounting and interaction with the tax office.

Some clarifications on the BCC for income tax

Personal income tax is calculated by subtracting documented expenses from the amount of income of individuals and taking a certain percentage of this amount (tax rate). Personal income tax is assessed separately for residents and non-residents of the Russian Federation, but this does not apply to employees. Some income specified in the legislative act is not subject to taxation (for example, inheritance, sale of real estate older than 3 years, gifts from close relatives, etc.) The income declaration gives individuals the right to certain tax deductions.

In a situation where the income is wages, the state takes the tax on it not from the employee after accrual, but from the tax agent - the employer, who will issue the employee a salary with taxes already paid to the budget.

Personal income tax on employee income

Paid by the tax agent monthly on payday, maximum the next day. In case of payment of sick leave and vacation benefits, the tax is transferred by the tax agent no later than the end of the month of their payment. It does not matter who the tax agent is - a legal entity or an individual, an LLC or an individual entrepreneur.

Vacation payments are also subject to personal income tax, because it is the same salary, only for the rest period. The tax must be paid before the end of the month in which the employee received his vacation pay.

NOTE! Personal income tax is not charged on the advance payment. An employer is prohibited from paying personal income tax from its own funds.

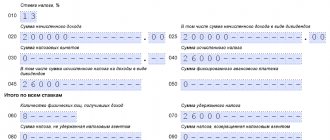

How is personal income tax calculated?

All taxes are calculated using the formula: tax base multiplied by the tax rate. The differences lie in what is taken as the basis and what interest rate is set.

For personal income tax, it matters whether the employee is a resident of the Russian Federation or not. If during the year he stayed in the country for more than 182 days, then personal income tax will be calculated at the resident rate of 13%. Non-residents must pay a rate almost three times higher - they are subject to a rate of 30%.

Current KBK

BCC for tax transferred by a tax agent – 182 1 01 02010 01 1000 110.

If there is a delay, you will have to pay penalties according to KBK 182 1 0100 110.

The imposed fine must be repaid according to KBK 182 1 0100 110.

Interest on this type of personal income tax is paid according to KBK 182 1 01 02010 01 2200 110.

Answers to common questions

What are dividends for?

Russian legislation is structured in such a way that it is very problematic to withdraw cash from an enterprise. The tax authorities and banks are of the same opinion that all business should be transparent and the enterprise should not have cash; they require it to operate on a non-cash basis. However, company participants have every right to receive income from their work in addition to wages; there is one option for receiving retained earnings - dividends. They are paid by decision of the general meeting of shareholders, publication of minutes and distribution in accordance with the share in the authorized capital. Thus, we understand that this is one of the few ways to bring funds into cash circulation.

If I made a mistake in the KBK regarding the payment of personal income tax on dividends, what should I do?

Draw up a free-form application addressed to the head of the Federal Tax Service where the enterprise is registered. Indicating the reason why it is necessary to clarify the payment and attaching a payment order. And also write the correct KBK where you need to transfer the funds. If during the period of the proceedings you were charged a penalty, then you also need to pay it and not make a mistake in the KBK, since this mistake already entails more serious consequences, such as blocking of current accounts.

Personal income tax from dividends in 2021 kbk sample payment form

There are special formulas for calculating tax, as well as special details for payment documents. Payment details include data from the tax office and the payer (tax agent), as well as special payment encodings, including KBK. Budget classification codes change regularly.

Personal income tax on dividends in 2021: rate, calculation, new examples

For non-residents - 15% or at the rate from the double tax treaty. Apply these rates to dividends that you pay both for the year and for intermediate periods - 9 months, half a year, quarter.

Therefore, even one error in the KBK can lead to the fact that the payment does not reach its intended destination, and you will end up in arrears. Below are the new KBK, for which taxes, contributions, penalties and fines must be paid in 2021. Name of contribution KBKSInsurance contributions for compulsory pension insurance (basic tariff) Contribution 182 1 0210 160 Penalties 182 1 0210 160 Fine 182 1 0210 160 Insurance contributions for compulsory social insurance in case of VNiM Contribution182 1 0210 160Peny182 1 0210 160Fine182 1 0210 160Insurance contributions for compulsory medical insuranceContribution 182 1 0213 160Peny182 1 0213 160Fine182

Personal income tax changes in 2020-2020

If there are those who are still wondering about the calculation of personal income tax without changes, then all the detailed information can be easily found on the Internet, without even having difficulty finding what you need. Why are there examples and diagrams? There are even online calculators that should accurately calculate all taxes. So there was no need to worry about the availability of information, and there is no need to worry in the future.

The entire amount of tax payments that the state collects from the population goes primarily to the benefit of the state budget, as the main source of its financing. This is practically the most important instrument of fiscal policy of the Russian Federation. However, now very often there are bad rumors about upcoming changes, which is quite suspicious and frightens people who are not familiar with it.

Kbk for personal income tax from dividends to the founder in 2020

Do not issue another payment with the correct BCC. This is not necessary, the Federal Tax Service itself will redistribute the cash receipts to the desired address. The most important thing is to write the application on time. Please also keep in mind that an error in the KBK for personal income tax may result in the accrual of penalties. But don't rush to pay them. If the Federal Tax Service clarifies your payment, all penalties will be removed.

In this case, the calculation procedure will be as follows: personal income tax = D x 13%, where D is the dividends accrued to the resident. 13% is the tax rate. The calculation will be more complicated if the organization is the founder of another company from which it received any amounts for participation in the current or previous year.

KBK dividends in 2021

- The date and number of the protocol must be indicated;

- everyone present at the meeting is listed;

- the agenda is indicated;

- the location of this meeting is indicated;

- At the end of the document, the chairman and secretary of the meeting put their signatures.

Payment order for payment of dividends in 2021

KBK codes are used by all organizations and individual entrepreneurs transferring budget payments when drawing up payment orders. These codes help tax and government fund officials track what taxes and contributions you pay.

In this case, the basis for the payment will most likely have a code ZD, that is, voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the Federal Tax Service, because we, as a rule, transfer penalties not for the current period, but for past ones.

Changes to the KBK for 2021

- Additional information. In a column such as the priority of payment, in 2021 the number five is entered, and in the column called “code” a zero is entered if the manager pays material resources on his own initiative, and not in response to a written request for repayment of personal income tax debt from tax officials.

- Recipient information. Point four described how to correctly enter the details of the recipient’s bank.

- Personal income tax on income from a tax agent (except for the cases described in Articles 227 and 228 of the Tax Code);

- Personal income tax from citizens whose methods of obtaining income are described in Article 227 of the same code;

- Personal income tax on citizens’ income, which is described in Article 228 of the Code.