Personal income tax upon dismissal: when to pay

We will immediately determine the final deadlines for settlements with the budget.

Personal income tax upon dismissal, the period for transfer is regulated in the Tax Code, namely in paragraph 6 of Art. 226. Thus, the employer is obliged to remit the tax no later than the day following the day on which the payments were made. Consequently, the tax from the final payment must be transferred to the Federal Tax Service no later than the day following the day of termination of the employment contract.

If the date of payment of personal income tax upon dismissal falls on a weekend or holiday, then it is permissible to transfer the budget fiscal payment on the first working day. However, tax authorities strongly recommend that settlements with the budget be made simultaneously, that is, on the day payments are made to employees.

Now let’s take a closer look at the taxation procedure for payments accrued upon termination of an employment contract.

When should a fired person be paid?

If an employee has expressed a desire to leave the organization and has written a corresponding statement addressed to the manager, then all due amounts must be paid to him on the day of dismissal. In particular, this applies to:

- remuneration for the number of days worked;

- bonus payments;

- debts to the employee.

The salary issued on the day of dismissal must consist of all amounts due to the employee. That is, the organization must pay the employee in full and have no debts to him. This rule is enshrined in the Labor Code of the Russian Federation (Article 140).

Failure to comply with this procedure for making the final salary payment in the event of an employee's departure may result in liability for the employer. Among other things, delays in wages can even result in criminal punishment for the company’s management.

If the employee did not come to the employer on the day of dismissal to receive the payments due and his work book, then he will have to be paid a salary later. This must be done on the day the employee reports.

The Labor Code also establishes the possibility of making the payment of the last salary not on the day the employee arrives, but on the next day after that. You can push back the deadlines if the accountant needs to recalculate the amounts due (for example, if an employee gets sick, the final payment amount changes, since it is calculated taking into account the number of sick days). An additional day in this case will allow the calculations to be made in a new way, after which the money will be issued to the resigning employee.

Everything is now clear regarding payment of wages in the event of dismissal. But how is personal income tax paid upon dismissal in 2021 on a day that does not coincide with the salary?

For more information about this, see the article: “What are the deadlines for paying salaries upon dismissal.”

What you have to pay

According to labor law, the employer is obliged to pay the resigning specialist the following money:

Now let’s look at which payments should be used to calculate income tax, and which should not be withheld.

The issue of taxation of the final payroll does not arise. The entire salary that is due to a specialist for the time actually worked should be subject to income tax. Please note that if an employee is entitled to tax deductions, then apply them in the general manner.

Calculated vacation compensation upon dismissal is subject to personal income tax in the same way as regular vacation and wages. A rate of 13% is applied to compensation money; if there is a right to a tax deduction, the taxable amount is reduced by the amount of the deduction in the general manner.

Travel expenses should not be subject to income tax if the daily allowance does not exceed the limit established in Article 217 of the Tax Code of the Russian Federation. So, if the daily allowance is more than 700 rubles per day for trips around Russia, and 2,500 rubles for trips abroad, then calculate deductions from the excess amount in the general manner. In this case, payment of personal income tax upon dismissal (terms) does not differ from the generally established ones.

Is compensation for unused vacation subject to personal income tax?

When an employee is dismissed, full payment must be made to him for the entire period of work. This applies not only to wages, but also to unused vacations. For all such periods, the employer must provide compensation to the employee. Its amount is established by law and is usually equal to the standard wages of a particular employee for the vacation period.

Vacation compensation on the day of dismissal is considered the same employee income as wages. This means that income tax must be withheld from it.

Let's sum it up

Salaries, some types of severance pay, as well as compensation upon dismissal are subject to personal income tax in the general manner. Tax deductions are applied in accordance with the Tax Code of the Russian Federation. There are no exceptions for dismissal payments.

The deadline for paying personal income tax upon dismissal is the day following the day of transfer of final settlement payments, that is, the day following the date of termination of the employment agreement. If this date falls on a weekend or holiday, then complete the calculation on the first working day (clauses 6-7 of Article 6.1 of the Tax Code of the Russian Federation).

How to calculate the amount of personal income tax deductions

In this situation, personal income tax can be calculated using the standard formula, multiplying the financial base in the form of the total income received by the employee by the percentage of the rate that corresponds to the status of a citizen, as with a regular salary payment. Since the situation with foreigners working in Russian companies is quite rare, we are usually talking about 13% of the amount.

How is personal income tax calculated upon dismissal?

The financial basis or basis for calculating the amount of the fee may be:

- money paid as wages;

- funds that play the role of compensation for vacation that the employee did not have time to “take off” while he was on staff;

- severance pay, if its amount is greater than the specified limit.

If dismissal is made early, the employee claims to receive additional compensation. They will not be taken into account when calculating the deduction amount.

Let's give an example of personal income tax payments when an employee leaves work. Svetlana Petrovna Ivanova worked in your organization and submitted her resignation. According to a subsequently issued order, the date of her final dismissal was September 5th. On this day, the accounting department of your company made an accrual in favor of the resigning woman in the amount of 20 thousand rubles (September salary) and five thousand rubles, due for unused vacation by Svetlana Petrovna. The date of disbursement of funds took place on the fifth day of September. At the same time, 13% was withdrawn from both payments, that is, 2 thousand 600 rubles from wages and 650 rubles from money due for vacation.

The sixth of September is the last day when the company’s accounting department can legally send funds collected from the payer’s income to the country’s treasury. The transfer can be processed through a single document, the so-called payment order. The amount indicated in it will be the sum of two deductions at a rate of 13%, that is, a total of 3 thousand 250 rubles will be sent to the tax service.

Video - personal income tax from compensation upon dismissal

Sample payment form for personal income tax

You will find detailed instructions in the article on how to correctly fill out a personal income tax payment form. There you can have 2021.

If an employee is dismissed on the last working day, the employer is obliged to make a final settlement and pay all funds due. At the same time, the employer should not forget about his duties as a tax agent in relation to the income of his employees. When paying personal income tax upon dismissal of an employee, certain specifics must be taken into account in terms of the timing of the tax transfer and its calculation.

Transfer deadlines

In order not to violate the law and transfer personal income tax to the budget on time, you need to be guided by the deadlines shown in the table:

| The procedure for issuing salaries | On what day should personal income tax be transferred? |

| To an employee’s bank plastic card (according to the salary project) | At the same time when the salary is transferred to the card or the next day |

| In hand cash, previously withdrawn from the organization’s bank account | At the same time when funds are withdrawn from the account or on the next day |

| In hand from the cash register or from the proceeds received during the day | At the time of payment or the next day |

The letter from the Ministry of Finance explains that the established deadlines for transferring taxes to the treasury apply not only to the wages themselves, but also to all other money due to the employee.

It turns out that along with the salary tax, personal income tax must be deducted from benefits and compensation for unspent vacation. If such payments are made simultaneously, the tax from them must also be transferred to the budget together.

If you find an error, please select a piece of text and press Ctrl+Enter.

If an employee is dismissed on the last working day, the employer is obliged to make a final settlement and pay all funds due. At the same time, the employer should not forget about his duties as a tax agent in relation to the income of his employees. When paying personal income tax upon dismissal of an employee, certain specifics must be taken into account in terms of the timing of the tax transfer and its calculation.

Concept

Personal income tax - income tax. It is taxed on all income received in Russia. For citizens with tax resident status, the personal income tax rate is 13% (for those staying on Russian territory for more than 183 days during the year), for non-residents - 35%.

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call:

When receiving income related to work activities, the employee’s employer acts as his tax agent. He is obliged to calculate, withhold and transfer personal income tax for his employee. In accordance with Article 226 According to the Tax Code, the following categories of payers must withhold personal income tax:

- organizations (legal entities) registered in the Russian Federation;

- entrepreneurs;

- notaries;

- lawyers;

- separate divisions of companies.

Responsibility for calculating, withholding and paying personal income tax rests not with the employee as a taxpayer, but with the employer.

If an employee is dismissed on the last working day, it is necessary to make a final settlement with him and pay all due amounts (in accordance with Articles 84.1 and 140 of the Labor Code of the Russian Federation):

- salary for actual time worked;

- compensation for unused vacation upon dismissal;

- severance pay (if required by the Labor Code or provided for by a collective agreement);

- other compensation as agreed with the employee.

If the employer does not comply with the rules regarding the timing of payment of income to the resigning employee, then he will have to pay him compensation for each day of delay. In case of large-scale violations of labor legislation, the company faces administrative liability in the form of a fine of up to 50 thousand rubles. (under Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation), and for the manager - up to criminal liability.

It is important to understand that responsibility for failure to pay personal income tax to the budget from labor income lies not with the employee, but with the employer.

There is one exception when determining the timing for final settlement. So, if on the last day an employee did not come to work to collect his work book, then the payment can be postponed to another day. For example, when an employee comes for payment or the next day (according to Article 140 of the Labor Code of the Russian Federation).

Payment from compensation

Compensation for unused vacation upon dismissal does not apply to vacation payments. For personal income tax purposes, the moment of receipt of income for all payments, including compensation for unused vacation, is considered the last working day for which the employee was credited with income.

On this date, it is necessary to accrue tax on the employee’s income. The same money must be withheld from the employee’s income when making dismissal payments.

But you must send the tax on these payments, including compensation, to the budget no later than the day following the day the employee’s income was paid.

For example, an employee quits on June 12. Then, as of June 12, 2018, you calculate the amount of the employee’s income, charge personal income tax on it and pay the employee minus tax.

And the next day - 06/13/2018 you transfer the tax to the budget. But you can also send this tax at the time of dismissal, which is the day the income is paid.

Deadlines for transferring personal income tax upon dismissal in 2021

In the case when citizens receive income not related to work activities (for example, selling an apartment), they calculate and transfer the tax once a year. The employer must transfer personal income tax regularly several times a month on payday.

The deadlines for paying personal income tax upon dismissal in 2021 do not depend on the method of salary payment. The tax is paid to the budget no later than the day following the day of payment when income is transferred to a salary card, issued in cash from the cash register or from the employer’s bank account.

Which payments upon dismissal/downsizing are subject to personal income tax and which are not?

Payments to an employee upon dismissal are subject to personal income tax.

The following types of income are subject to taxation:

- salary including bonus based on work results for the last month of work;

- compensation for unused vacation;

- disability benefits.

The legislation provides for a case where personal income tax is not charged on the amount of compensation for unrealized vacation.

This refers to the payment of an amount to the relatives of a deceased employee. Severance pay when an employee is laid off is not subject to personal income tax if it does not exceed the amount of three (for northern areas six) average monthly earnings.

Calculation and transfer procedure

From the amount that is paid to the employee in the form of dismissal, personal income tax is withheld at the standard rate of 13% (as well as from regular salary). The tax base for calculating personal income tax includes:

- Salary.

- Compensation for unused vacation.

- Severance pay exceeding the limit established by law (according to Letter of the Ministry of Finance No. 03-04-06/9881 of 2021).

According to Art. 225 Taxpayer personal income tax is calculated as tax base * 13%.

For example, on the last working day, an employee was paid a salary for the time worked in the amount of 26 thousand rubles. and compensation for unused vacation in the amount of 24 thousand rubles. Personal income tax withheld from wages amounted to 3,380 rubles, from compensation for unused vacation - 3,120 rubles. The employee received 43,500 rubles. (22620+20880) minus personal income tax 6500 rub. (3120+3380). The employer is obliged to transfer 6,500 rubles. the next day, it can be paid in one payment.

Taking into account this example, we can highlight the following procedure for paying personal income tax upon dismissal:

- The employer pays severance payments.

- Withholds tax from the specified income.

- Pays the employee income minus personal income tax.

- Transfers personal income tax to the budget at the employer’s location up to 1 non-working day.

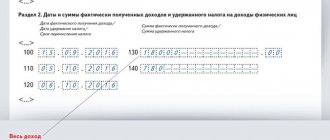

For example, the salary received and compensation for unused vacation must be recorded in the report. Whereas severance pay is indicated only in that part that is subject to personal income tax. For example, an employee was paid severance pay in the amount of 60 thousand rubles, personal income tax was collected from 20 thousand of them. Consequently, only the amount of 40 thousand rubles is included in 6-NDFL, so that there are no discrepancies in accrued and transferred taxes.

It is worth noting that the tax base should be reduced by deductions provided by law. For example, for disabled people of the Second World War they are 3000 rubles, for Heroes of the Russian Federation - 500 rubles. per month, for parents 1400 rub. for the first child and the same for the second, etc.

Personal income tax on severance pay

Severance pay upon dismissal does not apply to mandatory payments. According to Art. 178 of the Labor Code, it is paid when the number or staff is reduced, as well as when the company is liquidated. It can also be paid by agreement with the dismissed employee, or its payment can be negotiated under the terms of a collective agreement.

The Labor Code provides for minimum limits for severance pay (if its payment is required by law). Thus, the employee is paid an average monthly salary on the day of dismissal, and another one - for the period of his employment (if he cannot find a job in the second month after dismissal). Severance pay for the third month is paid by decision of the employment service if the dismissed employee managed to register within two weeks after dismissal, and if the applying employee was not employed within 3 months.

Let's give an example of calculating personal income tax on paid severance pay. Engineer Potapov received severance pay in the amount of 105 thousand rubles upon dismissal. His average monthly salary was 25 thousand rubles. Accordingly, the non-taxable amount of severance pay amounted to 75 thousand rubles. From 30 thousand rubles (105000-75000) the employer must withhold and transfer personal income tax in the amount of 3900 rubles. The engineer will teach you 101,100 rubles. (105000-3900).

Responsibility for late payment of personal income tax

Wrongful failure to withhold and transfer personal income tax to the budget is grounds for imposing penalties on the employer. Thus, the tax inspectorate has the right to impose a fine in the amount of 20% of the amount payable (according to Article 123 of the Tax Code of the Russian Federation).

Thus, the employer acts as a tax agent in relation to the employee’s income. He is obliged to withhold tax from income and then transfer personal income tax to the budget. The tax rate is 13%. Upon dismissal, the tax base is formed by the employee’s salary, compensation for unused vacation and severance pay in excess of the limit. The employer is obliged to transfer personal income tax no later than the next day after receiving the final payment, namely the day of dismissal or the employee’s last working day.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

Refund of over-withheld tax

If for any reason an employee is deducted a personal income tax amount that exceeds the required amount, he has the right to demand a refund of the excess amount paid.

To do this, he needs to contact the organization that carried out the tax withholding and fill out the appropriate application addressed to its head. In this application, you must indicate the details of your bank account to which the overpayment amount will be returned.

The Tax Code strictly prohibits the return of overpayments in cash. From the date of receipt of the application from the employee, the company has 3 months to return the amount excessively withheld from the employee; after this period, interest is accrued daily in case of failure to fulfill obligations.

If an organization does not have enough funds to pay this debt, it sends an application to the tax office to return this amount. If the organization itself discovers an overpayment, it is obliged to notify the employee about it within 10 working days.

The taxpayer has the right to independently contact representatives of the tax authority in the absence of a tax agent (the organization on whose staff the employee was), for example, due to its liquidation.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Transfer of personal income tax upon dismissal of an employee in 2021

The employer is required to remit the tax no later than the day following the payment of wages. This requirement is the same for any type of salary payment - in hand from the cash register or by transfer to the employee’s card or account.

When calculating payments, the accountant must take into account a number of features of dismissal. For example, such as providing the remaining days of vacation and subsequent dismissal of the employee, or unexpected sick leave on the day of dismissal. The date of actual receipt of income upon dismissal before the end of the calendar month is considered to be the last day of work (Clause 2 of Article 223 of the Tax Code of the Russian Federation), and Clause 6 of Art. 226 of the Tax Code of the Russian Federation dictates the requirement to transfer tax the next day after receipt. The only exceptions are amounts of vacation pay or sick leave benefits. The company has the right to transfer tax on these payments on the last day of the month in which they were paid, although in practice personal income tax is often transferred immediately after payment of the amounts due.

Personal income tax upon dismissal after using vacation

If there is an order to grant leave followed by dismissal, payments are made:

- vacation pay 3 days before the start of the vacation;

- the rest of the due payments are due on the last day of work before the vacation.

At the same time, it is necessary to transfer personal income tax on the due salary and compensation provided for by the company’s local documents the next day after issuance (i.e., on the first day of vacation of the resigning employee), and the tax on vacation pay can be transferred until the end of the month of their receipt.