And not on regular dates (regular paydays). Hence the peculiarities of personal income tax payment in this case. All useful information on the topic is in our article. The general deadline for final settlement with a dismissed person. The timing of settlement upon dismissal is regulated by Article 140 of the Labor Code of the Russian Federation.

If a person’s dismissal occurred on the 16th, then by the 15th of the next month, along with contributions for other employees, he must make payment. Knowledge of the legislative framework is necessary for all taxpayers, and primarily for legal entities. Since they withhold taxes from individuals and pay them wages.

PFR taxes upon dismissal, when to pay

The deadlines for paying insurance premiums by employers in 2021 remain the same. As in the previous year, transfer insurance premiums by the 15th day of the month following the reporting month.

If the 15th falls on a weekend or non-working holiday, then the deadline for transferring insurance premiums is postponed to the next working day after the weekend.

Upon termination of the employment relationship, employees must pay income tax, even if the source that produces the benefits is extinguished at that time. They pay most of the refunds they collect without even considering that they are essentially compensation rather than income.

Articles on the topic (click to view)

- What to do and where to go if you are not paid upon dismissal

- What to do if you are laid off at work

- What to do if the employer does not want to fire at his own request

- What to do if the date of the dismissal order is later than the date of dismissal

- What to do if the employer does not give the work book after dismissal

- What to do if you didn’t work officially, you were fired, you didn’t get paid

- What is the employer obliged to give the employee on the day of dismissal?

The date of dismissal is the last day of vacation. In this case, all payments must be made before the person goes on vacation.

If he did not show up for payment on the date of dismissal, the tax should not be transferred, because he has not yet received the income. In this case, the money must be sent to the budget on the same or the next day after the money is paid.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The salary issued on the day of dismissal must consist of all amounts due to the employee. That is, the organization must pay the employee in full and have no debts to him. This rule is enshrined in the Labor Code of the Russian Federation (Article 140).

Individuals working for a legal entity do not pay personal income tax on their own; a tax agent does this for them.

The main difference between a payment order for tax transfer is the indication of additional information such as KBK, OKTMO, payment period, etc.

Payment of the SV is made simultaneously with all contributions accrued for the remuneration of the enterprise's employees.

Insurance premiums in 2021: payment deadlines

The main change for employers in 2021 is the transfer of the administration of insurance premiums from the Pension Fund of the Russian Federation and the Social Insurance Fund to the tax authorities.

In the purpose of payment, put “Personal income tax on income upon dismissal of employees. Date of income – day month year.”

When paying personal income tax to the budget, you must be guided by Art. 226 of the Tax Code of the Russian Federation According to it, income tax is transferred on the day of salary payment or the next day.

If the quitter applied for payouts later than the date of termination of the employment contract, the money due is paid no later than the next day.

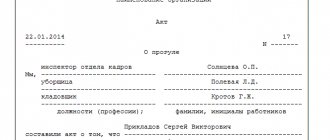

Responsibility of payers for violation of deadlines

Contributions are collected from legal entities-insurers and individuals with individual entrepreneur status in order to financially ensure the implementation of the rights of insured persons to receive compulsory insurance of the appropriate type. Violation of the terms of transfer entails liability under the provisions of Article 122 of the Tax Code of the Russian Federation, if we are talking about pension, health insurance or contributions in connection with loss of temporary disability and in connection with maternity. The Russian Ministry of Finance spoke about the procedure for bringing violators to justice in its letter dated May 24, 2017 No. 03-02-07/1/31912.

Officials indicated that the provisions of this article are fully applicable to late payment of amounts of insurance premiums correctly calculated and reflected in the calculations timely submitted by payers to the tax authorities. In this case, the norms of this article are applied taking into account the position set forth in paragraph 19 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, namely only with the collection of penalties, without imposing a fine.

As for violations with payments to the Social Insurance Fund, the provisions of Article 19 of Federal Law No. 125 of July 24, 1998 provide for the possibility of imposing a fine in the amount of 20% - in case of unintentional and in the amount of 40% - in case of intentional failure to pay the calculated amounts for injuries. But these sanctions are applied only if there is no payment due to:

- understating the base for accrual;

- incorrect calculation or unreasonable application of a reduced tariff;

- other unlawful actions of the policyholder.

If the reason for violating the transfer deadline was simple disorganization, then in this case the violator only faces the accrual of a penalty.

More information about INSURANCE PREMIUMS

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

On the day of dismissal, the employer is obligated to issue the required documents and pay the full amount to the employee.

In the current material, we will understand the features of calculating insurance premiums from calculated amounts, where and when they are paid.

Is it necessary to pay insurance premiums and withhold personal income tax from an employee’s profit upon dismissal? This video explains in detail:

Is compensation for unused vacation upon dismissal subject to personal income tax?

If an employee leaves his job on a day other than payday, then this rule does not work. All funds due to him must be issued on the day of departure. This applies to wages for days worked, bonuses, compensation for unused vacation, sick leave benefits, and all debts.

The organization must pay contributions calculated from the amounts of payments accrued in favor of the resigning employee to extra-budgetary funds no later than the 15th day of the month following the month of dismissal of the employee, simultaneously with insurance premiums calculated from the wages of other employees accrued for that the same month.

Example of a payment order for payment of personal income tax upon dismissal 2018 Penalty for late payment of personal income tax 2021 If you are late with personal income tax in 2021, the tax office may collect an impressive fine from the employer as a tax agent - 20% of the amount of arrears (Article 123 of the Tax Code of the Russian Federation). In addition to the fine, penalties are possible (Article 75 of the Tax Code of the Russian Federation).

This is important to know: Dismissal of a part-time worker by agreement of the parties

A full explanation on the topic: “deadlines for payment of personal income tax and insurance contributions upon dismissal in 2019” from a professional lawyer with answers to all your questions.

Example of a payment order for payment of personal income tax upon dismissal 2018 Penalty for late payment of personal income tax 2021 If you are late with personal income tax in 2021, the tax office may collect an impressive fine from the employer as a tax agent - 20% of the amount of arrears (Article 123 of the Tax Code of the Russian Federation). In addition to the fine, penalties are possible (Article 75 of the Tax Code of the Russian Federation).

The Ministry of Finance wants to introduce a single advance payment for legal entities (money is transferred to a single cash register, and then the tax authorities “distribute” it among taxes). Is it convenient?

The legislator, explaining whether compensation for unused vacation is subject to personal income tax, refers us to the Tax Code. The document states: consider vacation pay the same income as, for example, salary and are subject to personal income tax at the rate of 13%. Since vacation pay is not a salary, personal income tax is calculated and withheld separately.

The calculation of an employee upon his dismissal (payment by the employer of wages and other amounts due to him) is made on the last working day of this employee.

It must be remembered that funds are credited three days before the start of the holiday. The final amount of alimony is not a fixed amount. It is determined based on the number of children who are supported by a single parent.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Employers can give salaries to their subordinates in cash or transfer them to a bank card. Does it depend on the method of receiving money when personal income tax should be transferred upon dismissal of an employee in 2021?

What is personal income tax

What the abbreviation personal income tax stands for is something that employers and the average person who pay tax contributions to the state treasury must know.

The former keep employees on staff and act as a tax agent from the state, the latter receive official wages at the place of employment. Personal income tax means personal income tax. This direct tax brings the lion's share of funds to the country's budget, being in third place in terms of efficiency in attracting them. From the name it is clear that income received by individuals is subject to this tax. They are income tax payers.

Deductions are usually taken from people's wages paid out at the workplace, but according to the law, income can also include:

- rental property fees;

- funds received as a result of the sale of property;

- winning a cash prize in any lottery, etc.

A person must give a portion of the income inflow to the state. Depending on the status of the citizen and the situation in which funds are received, tax rates for withdrawal of fees will differ.

Thus, a tax deduction is usually taken from wages in the amount of 13%, from a cash prize won in the lottery, as much as 35% is deducted, etc.

A person does not make deductions from wages on his own. This is what the company does - the place of work. This deduction is made only if the person is officially employed and receives so-called white wages. There is no tax deducted for black workers and, as a rule, it is higher, while there is no official employment, and the person does not accumulate work experience, which will be useful for employment in another place of work and, upon reaching a certain age, for receiving a pension.

If the employer is responsible for deducting taxes to the state treasury, you are deprived of the annoying and inappropriate need to independently run around credit institutions, filling out certificates and receipts, defend long streams of people in front of the cash registers and submit declaration forms to the tax service of the Russian Federation every 12 months.

The accounting department of the company where you are employed does this for you.

If, in addition to wages, there was other income, for example, the tenant paid the money or you sold the home and received money, then you are a tax agent for yourself and must declare income by submitting reports to the inspectorate to which you belong according to your place of residence. Then, receive a receipt and use it to independently transfer funds to the country’s budget, using the services of credit institutions.

If reporting documents are not submitted to the tax office on time or are not provided at all, payers are subject to penalties in the form. At the same time, having paid a fine and not submitted a declaration, after a while you will receive another one and pay even more.

Penalty for late submission of a declaration to the tax authorities

Didn't manage to submit your declaration on time? In our article you will learn what consequences result from failure to submit reports on time. Learn more about the statute of limitations for tax offenses and how to reduce the amount of the fine.

If the employer has not transferred personal income tax

The organization transfers the salaries of its employees to bank cards. This means that personal income tax must be paid no later than the next day. Nowadays, the tax office at the location of the organization is responsible for insurance contributions; this is where the transfer should be made for the employee.

According to the tax code, the tax must go to the budget on the day of payment (the next) of wages at the enterprise, regardless of whether the earned funds are issued through the cash register or transferred to the employee’s bank card. The question arises: how to pay personal income tax upon dismissal, since it is necessary to pay the employee on the date of dismissal, until what date is personal income tax paid?

Payment of personal income tax upon dismissal of an employee is carried out no later than the day following the day of payment of settlement payments (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the day is a non-working day, then the deadline for paying personal income tax is shifted to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Compensations related to the termination of employment relations, provided for by a labor or collective agreement, are not subject to taxation if they do not exceed three times the average monthly earnings, for workers in the Far North - six times (Article 217 of the Tax Code of the Russian Federation). Compensations exceeding six times the amount are withheld as usual.

If an organization operates under the general (main) tax regime, then these expenses must be taken into account in tax accounting on the day of accrual.

Therefore, personal income tax must be transferred on the day the funds are transferred to the employee or the next day after payment, but no later.

Parting with an employee requires special actions on the part of the accountant. After all, you need to finally pay the departing employee on his last working day.

The procedure and deadlines for paying insurance premiums upon dismissal of an employee. When to pay deductions for injuries?

Please note that compensation for unused (main and additional) vacation is not accepted in the calculation.

Everything is now clear regarding payment of wages in the event of dismissal. But how is personal income tax paid upon dismissal in 2021 on a day that does not coincide with the salary?

Law No. 212-FZ of July 24, 2009. But in this case we are talking about total compensation, consisting of the following income groups:

- severance pay;

- average monthly earnings for the period of employment;

- payments due to the manager, deputy and chief accountant of the enterprise.

As in the situation with basic salary calculations, monetary compensation for vacation is subject to insurance contributions in the general manner, based on current tariffs. Example 2. Employment contract between Concord JSC and D.L. Korshunov.

Read the article about the deadlines for paying insurance premiums in 2018. We have collected all the deadlines in a convenient table.

If an employee has expressed a desire to leave the organization and has written a corresponding statement addressed to the manager, then all due amounts must be paid to him on the day of dismissal.

How to calculate the amount of personal income tax deductions

In this situation, personal income tax can be calculated using the standard formula, multiplying the financial base in the form of the total income received by the employee by the percentage of the rate that corresponds to the status of a citizen, as with a regular salary payment. Since the situation with foreigners working in Russian companies is quite rare, we are usually talking about 13% of the amount.

How is personal income tax calculated upon dismissal?

The financial basis or basis for calculating the amount of the fee may be:

- money paid as wages;

- funds that play the role of compensation for vacation that the employee did not have time to “take off” while he was on staff;

- severance pay, if its amount is greater than the specified limit.

If dismissal is made early, the employee claims to receive additional compensation. They will not be taken into account when calculating the deduction amount.

Let's give an example of personal income tax payments when an employee leaves work. Svetlana Petrovna Ivanova worked in your organization and submitted her resignation. According to a subsequently issued order, the date of her final dismissal was September 5th. On this day, the accounting department of your company made an accrual in favor of the resigning woman in the amount of 20 thousand rubles (September salary) and five thousand rubles, due for unused vacation by Svetlana Petrovna. The date of disbursement of funds took place on the fifth day of September. At the same time, 13% was withdrawn from both payments, that is, 2 thousand 600 rubles from wages and 650 rubles from money due for vacation.

The sixth of September is the last day when the company’s accounting department can legally send funds collected from the payer’s income to the country’s treasury. The transfer can be processed through a single document, the so-called payment order. The amount indicated in it will be the sum of two deductions at a rate of 13%, that is, a total of 3 thousand 250 rubles will be sent to the tax service.

Video - personal income tax from compensation upon dismissal

Personal income tax upon dismissal, when to pay in 2018

Monitor the presence of arrears in settlements with accountable persons and travel allowances, carry out the transfer of valuables if the former employee was a financially responsible person.

The transfer of personal income tax to the budget is carried out as part of the employer’s fulfillment of the obligations of a tax agent. In fact, the employee is the tax payer, while the employer assumes obligations to calculate personal income tax, withhold tax from the employee’s income and subsequently transfer personal income tax to the budget. If a person quits due to a reduction in staff or numbers, the employer pays him severance pay.

This is important to know: What is the employer obliged to give the employee on the day of dismissal?

Online magazine for accountants

In order not to make a mistake in calculating the deadline and not to mistakenly delay payment, be sure - do not be lazy - once again look at the production calendar 2021. And double-check all holidays and weekends according to the calendar. Relying only on your memory is wrong. Examples of calculating the deadline for transferring personal income tax to the budget in 2021 Example 1. At Kraski LLC, an employee quit on February 15, 2021.

On this day, all final settlements were made with him. The accountant has the right to pay income tax on February 15 or 16.

Example 2. An employee at Salut LLC quit on February 16, 2021. On this day, all final settlements were made with him.

Taking into account the weekend, the accountant has the right to pay income tax on February 16 or 19. Example 3. At Mirage LLC, an employee resigned on February 22, 2021.

On this day, all final settlements were made with him.

Transfer of personal income tax upon dismissal of an employee in 2021

In any organization, certain dates are assigned each month when employees receive salaries. Usually, money is given to employees on the following dates - the 5th or 10th.

The Tax Code of the Russian Federation establishes the deadline for transferring income tax to the budget. Thus, personal income tax from wages, in accordance with current regulations, must be received by the treasury no later than the next day after the payment of remuneration for labor. This period is set quite clearly and does not depend on the method of payment of salaries. The following situations are possible:

- The organization transfers the salaries of its employees to bank cards. This means that personal income tax must be paid no later than the next day. The same procedure is relevant in the case of issuing money in person after first withdrawing it from a bank account.

- Salaries are paid from the cash register (daily earnings). The tax must be transferred to the treasury before the end of the next day.

These rules are enshrined in paragraph 6 of Article 226 of the Tax Code of the Russian Federation. They are valid from 2021.

An enterprise accountant may have a question: when to pay personal income tax when dismissing an employee in 2021? After all, the previous rules do not apply if an employee leaves the company on a day other than the day the remuneration is issued. What to do in this case?

EXAMPLE

All employees receive their salary on the 5th of every month. One of the employees left the company on May 29.

General rule

In 2021, the situation with personal income tax deductions is as follows. Based on Article 226 of the Tax Code of the Russian Federation, the employer is obliged to transfer personal income tax upon dismissal no later than the day following the payment of wages. At the same time, they do not take into account the methods used by the employer to transfer wages to employees. Even in the case of a non-cash transfer to a plastic card, the period is the same.

RULE

In 2021, transfer personal income tax from payments upon dismissal no later than the next day after payment to the employee (clause 6 of article 226 of the Tax Code of the Russian Federation).

KVR and KOSGU for paying bonuses to a former employee.

Features of filling out reports within the framework of compulsory pension insurance. In particular, income from sources in the Russian Federation includes remuneration for the performance of labor duties (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

In order to avoid legal disputes with former employees, we recommend that institutions establish in local regulations the specifics of paying bonuses after the dismissal of employees, namely: the possibility of paying bonuses, conditions for bonuses, terms and methods of making bonus payments.

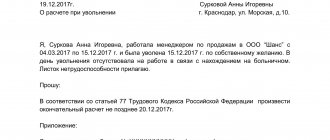

When should a fired person be paid?

If an employee has expressed a desire to leave the organization and has written a corresponding statement addressed to the manager, then all due amounts must be paid to him on the day of dismissal. In particular, this applies to:

- remuneration for the number of days worked;

- bonus payments;

- debts to the employee.

The salary issued on the day of dismissal must consist of all amounts due to the employee. That is, the organization must pay the employee in full and have no debts to him. This rule is enshrined in the Labor Code of the Russian Federation (Article 140).

If the employee did not come to the employer on the day of dismissal to receive the payments due and his work book, then he will have to be paid a salary later. This must be done on the day the employee reports.

The Labor Code also establishes the possibility of making the payment of the last salary not on the day the employee arrives, but on the next day after that. You can push back the deadlines if the accountant needs to recalculate the amounts due (for example, if an employee gets sick, the final payment amount changes, since it is calculated taking into account the number of sick days). An additional day in this case will allow the calculations to be made in a new way, after which the money will be issued to the resigning employee.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Everything is now clear regarding payment of wages in the event of dismissal. But how is personal income tax paid upon dismissal in 2021 on a day that does not coincide with the salary?

When to transfer taxes from a fired person?

In the absence of force majeure circumstances, the employee receives his salary on the day of his dismissal. If he came for the work book later than the established deadline, then the salary is paid no later than the next day. But what should an accountant do with taxes? When does he need to deduct personal income tax when dismissing any of his employees in 2021?

To understand this situation, you need to carefully study the mentioned letter from the Russian Ministry of Finance. It provides key clarifications regarding timing.

Difficulties arise from the fact that employees most often quit without working for a month. In this case, the employer must pay income on the day of dismissal, which is enshrined in paragraph 2 of Article 223 of the Tax Code of the Russian Federation. But personal income tax on dismissal payments by agreement of the parties (and any other reasons) should be transferred maximum the next day after the day the last salary was issued. This is also the last day of work.

Transfer deadlines

In order not to violate the law and transfer personal income tax to the budget on time, you need to be guided by the deadlines shown in the table:

| The procedure for issuing salaries | On what day should personal income tax be transferred? |

| To an employee’s bank plastic card (according to the salary project) | At the same time when the salary is transferred to the card or the next day |

| In hand cash, previously withdrawn from the organization’s bank account | At the same time when funds are withdrawn from the account or on the next day |

| In hand from the cash register or from the proceeds received during the day | At the time of payment or the next day |

This is important to know: When a calculation is made upon dismissal of one's own free will.

The letter from the Ministry of Finance explains that the established deadlines for transferring taxes to the treasury apply not only to the salary itself, but also to all other money due to the employee.

It turns out that along with the salary tax, personal income tax must be deducted from benefits and compensation for unspent vacation. If such payments are made simultaneously, the tax from them must also be transferred to the budget together.

When is income tax withheld and remitted?

Most often, the former employee receives the money due to him directly on the day of actual dismissal or on the last day of work activity according to the contract. Sometimes this event is postponed to the day he appears at the workplace and receives documentation or, at most, to the date following this event.

At the same time, when issuing funds to an employee, the company is obliged, as a tax agent, to withhold from this income funds due to the state treasury, that is:

- 13% for an employee who is a citizen of Russia;

- 30% for a foreigner.

Let's talk about the deadlines for transferring personal income tax when dismissing employees.

According to the established rules, the date of receipt of wages for an employee employed by a company is the last day of the thirty-day reporting period in which the employee earned the funds. If he resigns, the money is received on the actual day of dismissal.

The Tax Code states that the deduction and transfer of income tax to the state treasury must be made by the organization on the day the employee is given the money due

The tax service receives personal income tax from an employee’s salary at the latest on the day following the date the employee receives the funds. In this case, it does not matter at all in what format the money was issued to the employee:

- to a plastic bank card;

- in cash at the cash register.

However, when it comes to dismissal, this scheme does not work, since the day the person leaves work may not be the same day on which the final payment is made.

The time of tax payment does not depend on the format of issuing money to the employee upon dismissal, as is the case with receiving regular monthly wages. Let's consider a table containing information on the timing of the provision of contributions to the state treasury from the income of the payer leaving the company.

Table 1. Deadline for providing contributions

| Funds issuance form | When are income tax collections transferred to the budget? |

| deadline - the date following the day of settlement with the resigning person |

The time given for the transfer of personal income tax collection is the same for all types of funds issued to a resigning employee. It doesn’t matter whether it’s money left over from the salary, vacation pay compensation or payment of due benefits, the period in any case remains the same.

How much does an employee need to pay?

When dismissing an employee, the employer pays him:

- Wages for hours worked. If, for example, an employee quits on the 16th, then the company must give him a salary for the period from the 1st to the 15th.

- Additional payment to wages, if specified in the employment contract. This could be a bonus, internship, extra pay for night work, etc.

- Compensation for unused vacation. All employees are entitled to claim 28 days of annual leave. That is, for a month of work they are entitled to 2.33 days. If, let’s assume, a person quits on October 16, 2021 and has taken his allotted vacation until the month of August. Then for September and October he should be paid compensation for 4.66 days. Compensation is calculated as the average daily earnings for the previous year multiplied by the number of vacation days.

Some categories of positions are eligible for additional leave. If they do not take time off, the employer also pays compensation for them.

If a person quits due to a reduction in staff or numbers, the employer pays him severance pay.

Such payment is not subject to income tax and insurance premiums, but within the limits of amounts approved by law.

The employer must pay insurance contributions upon dismissal in the general manner, on all amounts paid upon dismissal, except for severance pay within three average earnings.

Deduction rates:

- 22% - pensioners;

- 2.9% - social (VNiM);

- 5.1% - medical;

- 0.2 – 8.5% – for injuries.

Benefits from the social insurance fund are not subject to insurance contributions. This could be, for example, payment for sick leave or child care.

A complete list of income not subject to insurance premiums is approved by Art. 422 of the Tax Code.

Let's look at a specific example of how deductions are made from payments upon dismissal.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Let’s assume that upon dismissal, an employee is accrued: salary 25 thousand rubles, sick leave benefits 5 thousand rubles, compensation for vacation 10 thousand rubles. and severance pay of 24 thousand rubles. the injury rate at the enterprise is 0.2%.

Insurance premiums will be calculated as follows:

All sums upon dismissal are paid at the expense of the employer. No deductions are made from wages.

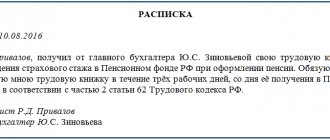

What is considered the date the employee actually received income?

The date of actual receipt of income is the day the salary is paid.

It does not affect the transfer of insurance premiums.

Contributions are paid as a total amount for all employees in one payment document.

The law approves specific frameworks for transferring insurance amounts to the budget.

When to transfer - payment deadline

According to Art. 431 of the Tax Code, every month until the fifteenth day inclusive, the employer is obligated to pay insurance contributions to the budget.

Nowadays, the tax office at the location of the organization is responsible for insurance contributions; this is where the transfer should be made for the employee.

If a person’s dismissal occurred on the 16th, then by the 15th of the next month, along with contributions for other employees, he must make payment.

Separate payments are made for each type of deduction, but with a total amount for all employees.

Deductions for injuries

The amount of contributions for injuries depends on the class of professional risk to which the employer officially belongs. It ranges from 0.2 to 8.5%.

Upon dismissal, it must be paid with all other deductions monthly until the fifteenth day.

Injuries are the only contribution that is now paid to a special account in the Social Insurance Fund.

The rest, starting from 2021, are paid to the Federal Tax Service. However, for organizations and individual entrepreneurs such accounts differ from each other.

conclusions

Let’s highlight a few main points on this topic:

- Amounts not subject to insurance premiums are determined by Art. 422 of the Tax Code of the Russian Federation. Almost all calculated amounts are taxed, and deductions are transferred to the budget.

- Payment is made by the employer by the fifteenth of each month; there is no need to pay them for each resigning employee separately.

- Payment upon dismissal is made to the tax office, excluding contributions for injuries. They still need to be paid directly to the Social Security Fund.

- The amounts are paid at the expense of the company; no deductions are made from the employee’s salary upon dismissal. Only income tax is subject to withholding.

| The article describes typical situations. To solve your problem, write to our consultant or call for free: 8 ext. 217 — Moscow — CALL 8 (812) 309-52-81 ext. 768 — St. Petersburg — CALL ext. 507 - Other regions - CALL It's fast and free! |