Information on the income of individuals from whom personal income tax is withheld is transmitted to the Federal Tax Service on a quarterly basis by the organizations and individual entrepreneurs paying them. Form 6-NDFL was approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11/450. Let us remind you that a new form has now been approved; you can read how to fill it out for 2021 here.

If a company or individual entrepreneur does not have employees and does not pay income and remuneration, then they do not bear the obligation to submit a zero calculation.

The document contains summary information:

- on the amount of income and deductions provided to taxpayers,

- on withholding tax on personal income.

Line 100 6-NDFL: how to fill out

The dates of actual receipt of income, which are indicated in line 110 by type of payment, are, in particular, the following:

- Salaries, bonuses and additional benefits to employees - the last day of the month for which the accrual was made.

- Vacation pay, financial assistance and sick leave benefits are the day they are paid.

- Payment to a resigned employee - the last day of work for which income was accrued.

- Income in kind – the day of its transfer to an individual.

- The material benefit from saving on interest is the last day of each month during the term of the loan agreement.

- Daily allowance over the established limit is the last day of the month of approval of the advance report.

General requirements for filling out line 120

Line 120 indicates the date no later than which the tax amount must be transferred (clause 4.2 of section IV of the Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11 / [email protected] dated 10/14/2015).

For different types of income that have the same date of actual receipt (if the timing of tax transfer is different), a reservation is made: line 120 is filled out several times - for each transfer deadline separately.

This is where the official information ends and the specifics of filling out different types of payments, controversial issues, ambiguous situations, letters from officials begin...

6-NDFL line 110: what date to put

Line 110 6-NDFL indicates the day on which income tax was withheld. According to paragraph 4 of Article 226 of the Tax Code of the Russian Federation, personal income tax is withheld by the tax agent on the day the income is paid, but taking into account some nuances.

Line 110 indicates dates depending on the form of income:

- Wages, vacation pay, sick leave, financial assistance, final payment upon dismissal - the day they are paid to the employee.

- Income in kind, excess daily allowance and material benefit - the day of actual transfer of cash income from which tax is withheld.

Withholding date in a situation of early payment of income

Income may be issued ahead of schedule, the moment of its occurrence is associated with its accrual. An example would be a salary paid before the end of its accrual month.

Essentially, such an action should be interpreted as payment of an advance. And the issuance of an advance does not require tax to be withheld from it and is not shown in the 6-NDFL report (Letters of the Ministry of Finance of the Russian Federation dated December 15, 2017 No. 03-04-06/84250; dated July 13, 2017 No. 03-04-05/44802, dated 01.02. 2016 No. 03-04-06/4321, Federal Tax Service of Russia dated 04/29/2016 No. BS-4-11/7893, dated 01/15/2016 No. BS-4-11/320).

6-NDFL - reporting of tax agents

To increase control over the payment of personal income tax, form 6-NDFL was introduced in 2016. This form is quarterly for submission to the tax office. The penalties for failure to submit this report will be as follows:

| Violation | Fine amount |

| If you forgot to submit tax calculation 6-NDFL | 1000 rub. for each calendar month starting from the day specified for filing (clause 1.2 of Article 126 of the Tax Code of the Russian Federation) |

| The report was submitted to the inspection late | Likewise |

| Presence of inaccurate information in the report | 500 rub. for each report with false information |

| Violation of the method of submission (submission in paper form instead of electronically) | 200 rub. for each incorrectly submitted report |

In addition, if the report is not received within 10 days from the deadline for submission, the regulatory authorities may block the current account.

As you can see, this report is quite important for inspectors: it is with its help that additional control is carried out on the calculation and payment of personal income tax. Therefore, if after submitting the report you find any errors (if income or tax data has changed, for example), you must submit a corrective report.

Results

Filling out line 110 of tax document 6-NDFL will not cause difficulties for an accountant if you prepare in advance and study the regulatory framework for generating the report.

Having the correct tax register, where all the necessary information will be reflected, will reduce the time for preparing the report to a minimum. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation of 6-NDFL: instructions for filling out

From the article you will learn:

1. Who and in what order must submit tax calculations in Form 6-NDFL.

2. What is the procedure for filling out 6-NDFL, taking into account the explanations of the regulatory authorities.

3. A practical example of filling out 6-NDFL.

One of the main innovations in tax legislation since 2021 has been the introduction of quarterly personal income tax reporting - the calculation of the amounts of personal income tax calculated and withheld by the tax agent (form 6-NDFL). At the same time, the previously existing annual reporting in the form of 2-NDFL certificates has not been cancelled, that is, from 2021, tax agents are required to submit quarterly personal income tax reporting and annual reporting (clause 2 of Article 230 of the Tax Code of the Russian Federation). If everything is more or less clear with filling out 2-NDFL certificates (only the form changes from year to year, and then only slightly), then the “not yet tested” 6-NDFL form raises many questions. Since the 6-NDFL calculation will have to be submitted for the first time in the 1st quarter of 2021, there is not much time left for a detailed analysis of all the nuances of filling it out. In this regard, in this article I propose to dot the i's in matters of filling out and submitting 6-NDFL, taking into account the official explanations of the regulatory authorities.

Procedure for submitting 6-NDFL

Who should fill out

All persons recognized as tax agents for personal income tax in accordance with the legislation of the Russian Federation (organizations, individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices and other persons engaged in private practice) must submit the calculation of 6-NDFL (Clause 2 of Article 230 Tax Code of the Russian Federation). The calculation must be generated for all individuals to whom income was paid (wages, dividends, remuneration under GPC agreements, etc.), with the exception of those individuals who were paid only income under property purchase and sale agreements, as well as under agreements in of which they act as individual entrepreneurs (clause 1, clause 1, article 227, clause 2, clause 1, article 228).

Due dates

Calculation in form 6-NDFL is submitted by the tax agent for a quarter, half a year and nine months no later than April 30, July 31 and October 31, respectively, and for a year - no later than April 1 of the following year (Information of the Federal Tax Service of Russia dated November 26, 2015). Taking into account weekends and non-working holidays in 2021, the deadlines for submitting 6-NDFL are as follows:

- for the 1st quarter - no later than 05/04/2016 (04/30/2016 - day off, Saturday);

- for six months - no later than 01.08.2016 (31.07.2016 - day off, Sunday);

- for nine months - no later than October 31, 2016;

- for a year - no later than 04/03/2017 (04/01/2017 is a day off, Saturday).

Place of performance

As a general rule, tax agents must submit 6-NDFL to the tax office at their place of registration. At the same time, for certain categories of tax agents, the Tax Code establishes special rules for submitting calculations (clause 2 of Article 230 of the Tax Code of the Russian Federation):

| Categories of tax agents for personal income tax | Place of presentation 6-NDFL |

| Russian organizations and individual entrepreneurs | Tax authority at its place of registration |

| Russian organizations with separate divisions | Tax authorities at the location of separate divisions (in relation to individuals who received income from such separate divisions) |

| Organizations classified as the largest taxpayers | The tax authority at the place of registration as the largest taxpayer or the tax authority at the place of registration of such a taxpayer for the corresponding separate division (separately for each separate division) |

| Individual entrepreneurs using UTII and (or) PSNO | Tax authority at the place of its registration in connection with the conduct of activities subject to UTII (PSNO) |

Presentation method

Calculation of 6-NDFL can be submitted to the tax authority in one of the following ways (Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ):

| Method of presenting 6-NDFL | Submission date |

| Personally or through a representative | Date of actual submission to the tax authority |

| By mail | Date of sending by mail with a description of the attachment |

| In electronic form via telecommunication channels | The date of dispatch, recorded in the confirmation of the date of dispatch in electronic form via telecommunication channels of the electronic document management operator |

! Please note: Calculation of 6-NDFL on paper

- can be submitted only if the number of individuals who received income in the tax period is less than 25 people (clause 2 of Article 230 of the Tax Code of the Russian Federation);

- submitted only in the form of an approved machine-oriented form, filled out by hand or printed on a printer.

Responsibility for failure to submit 6-NDFL

In addition to the obligation to submit 6-NDFL calculations, starting from 2021 liability for non-compliance has also been established. According to clause 1.2 of Art. 126 of the Tax Code of the Russian Federation, for failure to submit 6-NDFL, the tax agent faces a fine of 1,000 rubles. for each full or partial month from the date established for submitting the calculation.

Procedure for filling out 6-NDFL

The 6-NDFL calculation form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] The report includes:

- title page;

- section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

The main difference between 6-NDFL and 2-NDFL certificates is that it is compiled generally for all individuals who received income from a tax agent, without specification for each individual. The basis for filling out the calculation is the data of tax registers for recording income accrued and paid by the tax agent in favor of individuals, tax deductions provided, and calculated and withheld personal income tax.

Cover page of 6-NDFL calculation

Filling out the title page of 6-NDFL in general is not much different from filling out the title page of any tax return. Therefore, we will dwell in more detail only on the features.

Line “Submission period” - indicates the code of the corresponding reporting period (Appendix 1 to the Filling Procedure approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ):

| Code | Name |

| 21 | 1st quarter |

| 31 | half year |

| 33 | nine month |

| 34 | year |

| 51 | 1st quarter during reorganization (liquidation) of the organization |

| 52 | half a year during reorganization (liquidation) of the organization |

| 53 | 9 months upon reorganization (liquidation) of an organization |

| 90 | year during reorganization (liquidation) of the organization |

Line “Tax period (year)” —indicates the year to which the reporting period relates. For example, when filling out 6-NDFL for the 1st quarter, half-year, 9 months of 2021 and for 2021 as a whole, you must enter “2016” in this line.

Line “At the location (accounting) (code)” - enter the corresponding code (Appendix 2 to the Filling Procedure approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ):

| Code | Name |

| 120 | At the place of residence of the individual entrepreneur |

| 125 | At the lawyer’s place of residence |

| 126 | At the notary's place of residence |

| 212 | At the place of registration of the Russian organization |

| 213 | At the place of registration as the largest taxpayer |

| 220 | At the location of a separate division of the Russian organization |

| 320 | At the place of activity of the individual entrepreneur |

| 335 | At the location of a separate division of a foreign organization in the Russian Federation |

Lines “Gearbox” and “OKTMO Code”:

- the checkpoint and OKTMO code of the organization are indicated - if 6-NDFL is submitted for individuals who received income from the head division of the organization;

- the checkpoint and OKTMO code of a separate division are indicated - if 6-NDFL is submitted for individuals who received income from a separate division of the organization (Letters of the Federal Tax Service of Russia dated December 30, 2015 No. BS-4-11 / [ email protected] , dated December 28, 2015 No. BS- 4-11/ [email protected] ).

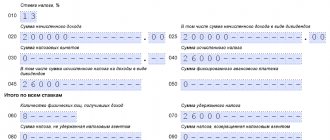

Section 1 of 6-NDFL calculation

The indicators of section 1 of the calculation in form 6-NDFL are filled in with an accrual total for the first quarter, half a year, nine months and a year (Letters of the Federal Tax Service of Russia dated 02/12/2016 No. BS-3-11/ [email protected] , dated 03/15/2016 No. BS-4-11/ [email protected] ).

Line 010 indicates the personal income tax rate (13, 15.30 or 35%), using which the tax amounts are calculated. Each tax rate has its own block of lines 020 – 050. That is, if during the reporting period income was paid to individuals taxed at different personal income tax rates, then for each rate it is necessary to fill out lines 020-050:

- line 020 - the total amount of accrued income for all individuals, taxed at the rate indicated in line 010;

- line 025 - total amount of accrued dividends;

- line 030 - the total amount of tax deductions (including professional, standard, property, social and under Article 217 of the Tax Code of the Russian Federation) provided for income reflected on line 020;

- line 040 - the total amount of calculated personal income tax on income reflected on line 020;

- line 045 - total amount of personal income tax calculated from dividends;

- line 050 - the amount of fixed advance payments of foreign employees, by which the amount of calculated tax is reduced;

The “Total for all rates” block in the 6-NDFL calculation should be only one (summarized for all tax rates), it includes lines 060-090:

- line 060 – the total number of persons who received income from the tax agent. If one person received income taxed with personal income tax at different rates, he is counted as one person. If the same employee is fired and rehired during the same tax period, that employee must also be counted as one person.

- line 070 - total amount of personal income tax withheld (for all rates);

- line 080 - total amount of personal income tax not withheld (for all rates);

- line 090 - the total amount of personal income tax returned by the tax agent to taxpayers in accordance with Art. 231 Tax Code of the Russian Federation.

! Please note: If the indicators of the lines of section 1 do not fit on one page, then the required number of pages is filled in. In this case, the totals for all rates on lines 060-090 are filled out on the first page of the section.

Section 2 of 6-NDFL calculation

The Procedure for filling out 6-NDFL (Appendix No. 2 to the Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ) states that the calculation is completed on an accrual basis from the beginning of the tax period. However, taking into account the clarifications of the Federal Tax Service, this provision is fully applicable only to section 1. Section 2 of the calculation in Form 6-NDFL for the corresponding reporting period reflects those transactions that were completed during the last three months of this reporting period. In addition, if a transaction was carried out in one reporting period and completed in another, the tax agent has the right to reflect it in the completion period. For example, wages for March, paid in April, will be reflected in section 2 of the 6-NDFL calculation for the half-year (Letters of the Federal Tax Service of Russia dated 02/12/2016 No. BS-3-11 / [email protected] , dated 03/15/2016 No. BS- 4-11/ [email protected] ).

Section 2 contains the required number of blocks of lines 100-140:

line 100 - the date of actual receipt of income reflected on line 130. The date of actual receipt of income is determined in accordance with Art. 223 Tax Code of the Russian Federation. For example:

- for income in the form of wages, the date of actual receipt is the last day of the month for which income was accrued for work duties performed in accordance with the employment agreement (contract) (or the last day of work - if dismissed before the end of the calendar month) (clause 2 of Article 223 Tax Code of the Russian Federation);

- for income in cash – the date of payment of such income (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation);

- for income in kind – the date of transfer of income in kind (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation);

- for income in the form of material benefits received from savings on interest when receiving borrowed funds - the last day of each month during the period for which the borrowed funds were provided (clause 7, clause 1, article 223 of the Tax Code of the Russian Federation).

line 110 - the date of tax withholding on the amount of income actually received, reflected on line 130. The date of withholding personal income tax on income in cash coincides with the date of their actual payment. The date of withholding personal income tax on income in kind and received in the form of material benefits coincides with the date of payment of any income in cash from which such personal income tax is withheld (clause 4 of article 226 of the Tax Code of the Russian Federation).

line 120 - the date no later than which the tax amount must be transferred. The deadline for transferring personal income tax is established by clause 6 of Art. 226 of the Tax Code of the Russian Federation: in general, personal income tax must be transferred to the budget no later than the day following the day of payment of income. When paying income in the form of temporary disability benefits and vacation pay, personal income tax must be transferred from them no later than the last day of the month in which such payments were made. For example, if vacation pay was paid to an employee on 03/05/2016, then personal income tax on it must be transferred no later than 03/31/2016.

line 130 - the generalized amount of income actually received (without subtracting the amount of withheld tax) on the date indicated in line 100;

line 140 - the generalized amount of personal income tax withheld on the date indicated in line 110.

! Please note: Each separate block of lines 100-140 contains income data for which:

- the date of their actual receipt coincides;

- the date of personal income tax withholding coincides;

- The deadline for transferring personal income tax established by the Tax Code of the Russian Federation coincides.

For example, on March 10, 2016, vacation pay was paid to one employee, as well as wages for March to another employee who quit on March 10, 2016. The date of actual receipt of income in this case for both vacation pay and wages is 03/10/16. However, the deadlines for transferring personal income tax are different: for vacation pay - 03/31/16, for wages - 03/11/16. Accordingly, when filling out the 6-NDFL calculation for the 1st quarter of 2021, in relation to these two payments, you must fill out different blocks of lines 100-140.

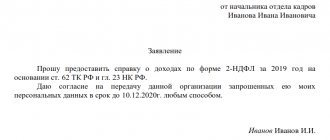

Signing the 6-NDFL calculation

The calculation in form 6-NDFL is signed by the head of the organization or any official authorized to do so by the company’s internal documents (for example, by order of the director) (clause 2.2 of the Procedure for filling out the calculation). In particular, the calculation can be signed by the chief accountant, deputy chief accountant, or accountant responsible for payroll calculations.

Example of filling out the 6-NDFL calculation

The number of employees of Aktiv LLC is 5 people (no payments were made to other individuals in the 1st quarter of 2021). The salary (salary) of each employee is 20,000 rubles per month. Deadlines for payment of wages: the 27th of the current month (for the first half in the amount of 40% of the salary) and the 12th of the next month (final payment). That is, wages for the second half of December 2015 were paid on 01/12/2016, and wages for the second half of March 2021 were paid on 04/12/2016.

To employee Ageeva N.P. A standard tax deduction for a child is provided in the amount of 1,400 rubles per month. No deductions were provided to other employees.

In February 2021, employee Sidorov R.I. annual paid leave was provided: the amount of vacation pay was 18,000 rubles (payment on 02/05/2016), the amount of wages for February was 5,000 rubles.

Data for filling out section 1 of the 6-NDFL calculation

Section 1 of the calculation in form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year. Section 1 of the calculation for the first quarter will include income accrued in January, February, March 2021.

Data for filling out section 2 of the 6-NDFL calculation

Section 2 of the calculation in Form 6-NDFL for the corresponding reporting period reflects those transactions that were carried out over the last three months of this reporting period. Moreover, if an operation was carried out in one reporting period and completed in another, then the tax agent has the right to reflect such an operation in the period of its completion (Letter of the Federal Tax Service of Russia dated February 12, 2016 No. BS-3-11 / [email protected] ).

In the example under consideration, such “borderline” operations include:

- wages for December 2015, paid in January 2016;

- wages for March 2021, paid in April 2021.

According to the explanations of the Federal Tax Service (Letter of the Federal Tax Service of Russia dated February 25, 2016 No. BS-4-11 / [email protected] ), section 2 of calculation 6 of personal income tax reflects wages for December, paid in January 2021. And wages for March, paid in April, will be reflected in section 2 of the 6-NDFL calculation for the first half of 2021.

Based on the available data, the calculation of 6-personal income tax for the 1st quarter of 2016 will look like this:

We examined the main nuances of filling out the calculation on form 6-NDFL. For additional security, I highly recommend that after filling out your 6-NDFL calculation, you check whether it corresponds to the control ratios established by Letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] “On the direction of control ratios.” Failure to comply with these control ratios serves as the basis for the tax authority to send a request to the tax agent for clarification, as well as for drawing up an audit report.

Normative base

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

- Information from the Federal Tax Service dated November 26, 2015 “The Federal Tax Service of Russia has explained the new procedure for calculating personal income tax by a tax agent”

- Letters from the Federal Tax Service of Russia:

- dated 12/30/2015 No. BS-4-11/ [email protected]

- dated 12/28/2015 No. BS-4-11/ [email protected] “On the issue of filling out the calculation in form 6-NDFL”

- dated February 12, 2016 No. BS-3-11/ [email protected] “On the issue of filling out form 6-NDFL”

- dated February 25, 2016 No. BS-4-11/ [email protected] “Regarding the completion and submission of form 6-NDFL”

- dated March 10, 2016 No. BS-4-11/ [email protected] “On the direction of Control ratios”

- dated March 15, 2016 No. BS-4-11/ [email protected]

If you find the article useful and interesting, share it with your colleagues on social networks!

If you have any comments or questions, write to us and we’ll discuss them!

Filling out line 120 depending on the type of income paid

Wage

When filling out line 120 for wages paid, you must indicate the day following the day of its payment (clause 6 of Article 226 of the Tax Code of the Russian Federation). Difficulties arise when the day following the day of payment of income is a holiday or weekend. In this case, the line indicates the first working day after this date (clause 7, article 6.1 of the Tax Code of the Russian Federation).

Example 1

Salaries were paid on June 11. June 12 is an official holiday (Article 112 of the Labor Code of the Russian Federation). In line 120 we indicate June 13.

If you need to recalculate an employee’s salary, for example, due to a technical error, consider the following. If, as a result of such recalculation, an additional payment was accrued to the employee, then the date of personal income tax withholding from it is indicated separately in line 120 as the day following the day of accrual of such additional payment and tax withholding from it.

Ways to check the correctness of filling

In the letter dated 03/10/2016 N BS-4-11/3852, the Tax Service specifically provides detailed explanations by which ratios you can independently check whether Form 6 of personal income tax is filled out correctly. So, first of all, it is worth paying attention to the fact that the date of line 120 must necessarily be later than that indicated in 110. If this rule is violated, then for filing each such document you will need to pay a fine of 500 rubles.

Most often, the dates must coincide or, in extreme cases, differ by a maximum of one day (the hold date is one day later). Otherwise, the Tax Office may require an explanation as to why the tax payment date came later than the personal income tax tax.

If any inaccuracies or errors were identified in filling out the form, the accountant will be given 5 working days to correct them. He will also need to write an explanatory note indicating the reasons for such errors.

Where can I get the 6-NDFL form to fill out?

Form 6-NDFL has a specific form approved by law. It is provided only to the tax service, to which the enterprise itself belongs, regardless of where their divisions are located.

A blank 6-NDFL reporting form can be obtained in various ways, namely:

- Download directly from the official website of the IFTS portal;

- Download from other sources on the Internet.

Important!!! The form must be filled out correctly and comply with the form established by law. If there are any differences, tax authorities may not accept 6-NDFL reporting.

In this case, the reporting deadlines will be violated, clarifications will need to be made and, naturally, a lot of time will be spent on corrections. In order to avoid this, you must immediately ensure that the reporting is filled out correctly and without any comments.