Financial assistance in 6 personal income taxes up to 4000

Also, financial assistance can be provided in the form of work, services or goods (food, personal hygiene products, clothing, etc.).

However, the key characteristic of MP is its one-time and one-time nature. How the MP will be reflected in the reporting form for the Federal Tax Service depends on the type and size of the payment. Thus, for materials, the current legislation provides for a number of conditions and tax breaks. In other words, MP is an economic benefit, but since the payment is strictly social in nature, legislators have determined non-taxable limits.

How to show financial assistance up to 4000 in 6 personal income taxes

Material assistance in 6-NDFL: theory of innovation What payments relate to financial assistance Reflection of various types of financial support in 6-NDFL (including up to 4,000 rubles.

and more) How to reflect financial assistance in 6-NDFL (filling example) Financial assistance in 6-NDFL: theory of innovation Since the beginning of 2017, organizations and individual entrepreneurs are required to provide reporting documentation 6-NDFL.

This report contains consolidated data for a specific enterprise on income received by individuals, including (para.

Directive of the Federal Agency for Technical Regulation and Metrology dated December 30, 2005 No. 532-st, contains the definition of material assistance (hereinafter referred to as financial assistance),

Financial assistance in 6-NDFL

per year, employees and former employees who resigned upon retirement due to age or disability (clause 28 of Art.

217 of the Tax Code of the Russian Federation). An employer can pay financial assistance of any size, but 13% tax will have to be withheld from the amount exceeding the limit.

This rule has exceptions when all financial assistance is not subject to personal income tax: payment for treatment of an employee or his spouse, children under 18 years of age, parents, as well as payment for medical services provided to former employees who have retired, provided that financial assistance is provided from the employer’s net profit ( P.

10 tbsp. 217 Tax Code of the Russian Federation); one-time financial assistance related to the death of a family member (spouse, parents, children) of an employee, or a retired former employee, as well as financial assistance to family members of a deceased employee (clause 8 of Article 217 of the Tax Code of the Russian Federation); amounts paid to victims of a natural disaster, other emergency circumstances, or terrorist attacks in Russia (clauses 8.3 and 8.4 of Article 217 of the Tax Code of the Russian Federation)

This payment must be a one-time payment.

An example of reflecting the amount of financial assistance for the birth of a child in the 1C program: ZUP There are several types of material support on which no tax is charged, which means there is no need to reflect these amounts in the calculation.

Both the employee himself and his family members can receive assistance.

There are many reasons for this - from loss of one’s own health to tragedy in the family. But to receive payments, you must confirm your legal rights.

In the calculation, there is no need to show material assistance not subject to personal income tax, which is not named in Appendix No. 2 to Order of the Federal Tax Service of Russia dated September 10, 2016 No.

How to correctly reflect financial assistance in the 6-NDFL report

There are also certain financial limits that set maximum amounts for payment in one year.

They are regulated. 6-NDFL reflects:

- Financial assistance that is subject to taxation in full. It is entered in line 020, where the total amount of accrued income per individual is indicated.

- Payments that are not subject to personal income tax in whole or in part. Financial assistance is indicated in line 020, and its non-taxable part is indicated in line 030.

It is in the latter way that the following payments are reflected:

- Payments to disabled people by public organizations are indicated by deduction code 506, their value is up to 4,000 rubles. for one calendar year.

- Financial support for subordinates who have adopted or given birth to children can reach 50,000 rubles per year.

- The enterprise’s assistance to its employees, as well as to former employees who quit due to retirement, is indicated under code 503, the maximum amount is 4,000 rubles per year.

Financial assistance in the amount of 4,000 rubles in 6 personal income taxes

Financial assistance is a social payment that is not related to wages (clause 3 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Source: https://pskovyurist.ru/materialnaja-pomosch-v-6-ndfl-do-4000-73373/

Financial assistance up to 4000 in 6 personal income taxes

It is impossible to withhold personal income tax from income in kind, so withhold it from the next cash payments to the employee. The day the cash payment is made will be the tax withholding date.

Secondly, if financial assistance is completely reduced by deduction, then in lines 110 “Date of tax withholding” and 120 “Term of transfer” indicate “00.00.0000”.

We will give examples of how to reflect financial assistance in 6-NDFL.

Reflection of material assistance in 6-NDFL in the amount of 4,000 rubles: example

First, we will show you how to reflect financial assistance up to 4,000 rubles in 6-personal income tax.

Financial assistance up to 4000 in 6 personal income taxes

In this case, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation), and transfer it no later than the day following the day the income is paid to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation ).

Thus, financial assistance for vacation is reflected in section 2 of Calculation 6-NDFL in the same way as a lump sum payment for vacation:

- line 100 “Date of actual receipt of income” indicates the day of payment (transfer) of financial assistance for vacation in accordance with paragraphs. 1 clause 1 art. 223 Tax Code of the Russian Federation;

- on line 110 “Date of tax withholding” the same date is indicated as in line 100, that is, the date of payment (clause 4 of article 226 of the Tax Code of the Russian Federation);

- line 120 “Tax payment deadline” indicates the day following the date of payment of the income in question (clause 6 of Art.

Mat help 4000 in 6 personal income tax

Important

In addition to transferring salaries and mandatory compensation, some employers provide for the possibility of employees receiving financial assistance. Should I pay taxes on such amounts and how is financial assistance shown in 6 personal income taxes?

Payout value

These are additional funds issued to an employee of an organization in the event of certain life situations that are accompanied by large financial costs. At the legislative level, the concept of “material assistance” is not clearly established.

Moreover, the employer is not obliged to make such payments to individuals. If he still wants to do this, this possibility must be spelled out in the company’s regulations, labor and collective agreements.

Important! The amount of financial assistance and the goals for which it is aimed are determined by each organization for itself.

Financial assistance over 4000 in 6 personal income taxes

MV-7-11/ [email protected] , then fully or partially exempt from taxes. However, it is still taken into account in line 020, and in line 030 it is necessary to show the amount that is not subject to taxation.

The following are exempt from personal income tax:

- Financial assistance for persons with disabilities up to 4,000 rubles per year;

- Money transferred to those who retired or quit due to disability up to 4,000 rubles per year;

- One-time assistance at the birth (adoption) of a child – up to 50 thousand rubles per year. The funds must be paid to the employee within a year.

Important! Any financial assistance over 4,000 rubles per person during the current tax period is not subject to taxes.

To date, there is no consensus on whether to include in reporting financial assistance that does not exceed the established non-taxable limit.

Mat assistance up to 4000 in 6 personal income taxes

How to reflect financial assistance in the calculation? We will dwell on this in more detail in our material.

What kind of material assistance is not reflected in 6-NDFL? The Calculation does not need to show non-taxable personal income tax material assistance, which is not named in Appendix No. 2 to the Order of the Federal Tax Service of Russia dated September 10, 2016 No. MMV-7-11 / The explanation for this is simple.

The amount of calculated tax (line 040) is determined as the difference between lines 020 “Amount of accrued income” and 030 “Amount of tax deductions”, multiplied by the tax rate (line 010).

This is one of the main equalities provided for by the Control Relationships, and which is analyzed during a desk audit of the Calculation.

The Tax Code of the Russian Federation clearly states that the calculation in Form 6-NDFL is filled out only in relation to calculated and withheld tax amounts.

Attention

Tax Code of the Russian Federation).

Note, as mentioned above, the calculation in form 6-NDFL is filled out only in relation to calculated and withheld tax amounts (namely tax, not income).

When calculating personal income tax on amounts of material assistance, personal income tax is calculated only on the difference between the assistance actually paid and 4,000 rubles.

Consequently, Calculation 6-NDFL should include only data on income from which tax is actually calculated (i.e.

Source: https://advokat-demidova.ru/matpomoshh-do-4000-v-6-ndfl

Results

Financial assistance is issued to individuals at their request with the consent of the company’s management. When filling out 6-NDFL, the date of receipt of income and withholding of personal income tax is the day of payment of financial assistance, and the date of transfer of tax is the next working day. The part of financial assistance exempt from personal income tax is reflected as part of tax deductions.

The service generates a report based on the information you filled in. Extensive hint system.

An individual entrepreneur or legal entity that attracts employees becomes tax agents for personal income tax and is required to submit quarterly estimates of the amount of personal income tax to the tax authorities (Form 6-NDFL). This reporting form contains generalized information about the income of all employees and the amount of calculated and withheld tax.

An employer can provide financial assistance to an employee in connection with maternity, retirement, vacation and in other cases. How to reflect financial assistance in 6-personal income tax - we will consider below.

Financial assistance in 6-NDFL: how to reflect, example of filling

Any employer can provide financial support to its employees. But if payments are subject to personal income tax, they must be included in the calculation. To understand how to do this correctly, it is useful to consider the most common cases in accounting practice.

Is financial assistance reflected in 6-NDFL?

Information about material remuneration paid is not always entered into 6-NDFL. The need to reflect assistance in the report is related to the purpose and type of payments. In accounting, there is often a mixture of options - a full reflection of the entire amount, partial or no mention of it.

Types of payments that must be shown in the calculation

According to Article 41 of the Tax Code of the Russian Federation, any material incentive, in fact, increases the employee’s income, which means that personal income tax must be deducted from him.

Partial or over-reflection

At the same time, the legislation exempts financial assistance from taxation:

- in an amount not exceeding 4,000 rubles. The reason for issuing the reward does not matter. But if an employee receives an amount exceeding the limit, personal income tax will need to be withheld from it at a rate of 13%;

- in an amount not exceeding 50,000 rubles (for an employee whose family has a child - in the first year after birth or adoption; each parent is entitled to a tax-free payment). This payment must be a one-time payment.

An example of reflecting the amount of financial assistance at the birth of a child in the 1C program: ZUP

What types of financial assistance are not shown in the calculation?

There are several types of material support on which tax is not levied, which means there is no need to reflect these amounts in the calculation. Both the employee himself and his family members can receive assistance. There are many reasons for this - from loss of one’s own health to tragedy in the family. But to receive payments, you must confirm your legal rights.

Table: material payments that are not indicated in 6-NDFL

There are some types of financial assistance that are not taxed, so they do not need to be reflected in the 6-NDFL report

How to enter data on financial assistance in 6-NDFL

All information about financial aid issued, subject to taxation, must be included in the 6-NDFL calculation. The exception is funds accrued but not issued.

In the calculation, there is no need to show non-personal income tax material assistance, which is not named in Appendix No. 2 to Order of the Federal Tax Service of Russia dated September 10, 2016 No. ММВ-7–11/ [email protected]

Indication of the date of actual receipt of funds in the form of financial assistance

To record the correct date of receipt of cash income, you need to look at the Tax Code of the Russian Federation, where the date of its receipt is the day the financial aid is issued. For assistance expressed in kind - the day of direct receipt of income. These dates must be reflected in line 100 of form 6-NDFL.

How to reflect the tax deduction date

The date of tax withholding on material support will be the day the funds are actually issued. If financial assistance is provided in kind, personal income tax is withheld from other income received in cash. In this case, the tax withholding date will be the day the funds are issued. These dates are also reflected in the documents in line 110 of form 6-NDFL.

How to enter information on line 120

Line 120 of form 6-NDFL contains information about the deadline for transferring tax to the budget. Therefore, it indicates the last day on which funds must be transferred from the company’s current accounts. This date is considered to be the working day that follows the day the income was actually issued to the employee.

How to fill out other sections and lines

Reflecting data in other lines of form 6-NDFL has its own characteristics.

What data needs to be entered in section 1

The first section records the entire amount of financial assistance together with personal income tax and separately its non-taxable part. The last lines contain the amount of personal income tax from the financial aid issued.

Information presented in section 2

The second section records all financial assistance issued during the last quarter. If no tax is calculated on it, only the day the assistance was issued and its amount are indicated.

Table: features of filling out when issuing partially non-taxable financial aid

The second section records only the days and data on the amounts of financial assistance received.

Sample of filling out lines for amounts including the amount of calculated personal income tax

In cases requiring personal income tax withholding, the next business day is indicated. Separately, financial assistance is entered along with personal income tax, and in the last line - the amount of tax withheld.

Table: filling out section 2 with personal income tax withholding

Financial assistance issued on the last day of the quarter is reflected in the second section in the next quarter.

An example of full inclusion of financial assistance in 6-NDFL

An employee of Parus LLC, O.P. Suvorov, received an allowance in the amount of 80,000 rubles on the occasion of the birth of a child in the family. Most of the amount, namely 50,000 rubles, is not subject to tax by law.

But taxes will need to be charged on amounts exceeding the limit of 30,000 rubles. Accrual - (80,000 - 50,000) x 13% = 3,900 rubles. Assistance was issued to Suvorov on November 18, 2018.

This option for paying financial assistance is entered into Form 6-NDFL under Section 1 as follows:

- line 010 (bet) - 13;

- line 020 (benefits issued to O.P. Suvorov) - 80,000;

- line 030 (non-taxable share) - 50,000;

- line 040 (personal income tax from the financial assistance of O.P. Suvorov) - 3,900;

- line 070 (amount of tax withheld) - 3,900.

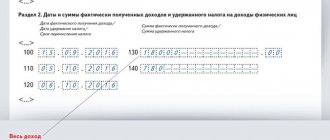

Section 2 of form 6-NDFL will require slightly different filling:

- line 100 (employee O.P. Suvorov’s income was approved) - November 18, 2018;

- line 110 (tax withheld from the benefits of employee O.P. Suvorov) - November 18, 2018;

- line 120 (it is important to transfer the amount no later than this date) - November 19, 2018;

- line 130 (amount of material payments) - 80,000;

- line 140 (tax) - 3,900.

: gratuitous assistance and its reflection in documents

Material payments are the provision of income to an employee, which is in no way affected by the results of his work. It would be wiser to establish the procedure for providing it in a special local act. And if taxes are required to be transferred from payments, it is important to correctly enter the data into the 6-NDFL report.

- Lidiya Ekhontseva

Source: https://ozakone.com/trudovoe-pravo/oplata-truda/materialnaya-pomoshh-v-6-ndfl.html

Line 080 “Tax amount not withheld”

This line reflects the amount of personal income tax that cannot be withheld from the recipient of the income. For example:

- the employee received a gift worth more than 4,000 rubles, but subsequently did not receive income in cash;

- individuals receiving prizes during a promotion or drawing;

- payment to an individual of arrears of wages by court decision.

The amount in this line is indicated as a cumulative total. It is a mistake to write in this line the amount of calculated personal income tax from the salary for June, which employees will receive in July. This amount will appear in your 6-personal income tax within 9 months.

Author of the article: Yulia Khairulina

Create 6-NDFL in the web service for small businesses Kontur.Accounting. The system itself will fill out the help lines based on the accounting data. Easily keep records, pay salaries, send reports via the Internet, get advice from our experts. The first 14 days of work are free.

https://youtube.com/watch?v=27klr1Jw60c%26list%3DPLm5uYVomeohCjKy5g8G0Eok526kqyPcym

Filling out form 6-NDFL: Gifts and financial assistance (dates and amounts)

1. The company gave a gift that is exempt from personal income tax 2. The company gave a gift worth more than 4,000 rubles 3. The company gave a gift to an employee on vacation at its own expense 4.

The company withheld personal income tax from a gift to an employee in the next quarter 5. The company provided financial assistance of less than 4,000 rubles 6. The company provided financial assistance of more than 4,000 rubles 7.

The company provided financial assistance along with vacation pay

The company gave employees gifts worth up to 4,000 rubles. Such gifts are not subject to personal income tax.

In line 020 of section 1 of the calculation, reflect payments that are only partially exempt from personal income tax. In particular, gifts. Such income is exempt from personal income tax in an amount that does not exceed 4,000 rubles for the tax period (clause 28 of article 217 of the Tax Code of the Russian Federation).

There is an exception to the general rule. If an employee receives only income not subject to personal income tax during the year, it does not need to be shown in line 020. For example, a gift of up to 4 thousand rubles.

In relation to such payments, the company is not a tax agent and does not submit income certificates (letter of the Ministry of Finance of Russia dated 05/08/13 No. 03-04-06/16327).

If you fill out the payment in the 6-NDFL calculation, the information for the year will not agree with the 2-NDFL certificates (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

For example

For the first half of the year, the company paid salaries to five employees - 700,000 rubles, provided deductions - 10,000 rubles, withheld personal income tax - 89,700 rubles. ((RUB 700,000 - RUB 10,000) × 13%).

In the second quarter, the company gave employees gifts worth RUB 3,000. for every. A total of 90,000 rubles. A gift to each employee is not subject to personal income tax, so the company did not reflect the gifts in the half-year calculation.

The company filled out Section 1 of the calculation as in sample 54.

If the company gives the employee a gift again, the income may exceed the non-taxable limit. In the period when this happens, reflect in the calculation the cost of all gifts that have been given since the beginning of the year. Write the deduction of 4,000 rubles in line 030 of the calculation.

Sample 54. How to fill out the calculation if the company gave gifts cheaper than 4,000 rubles:

The company gave a gift worth more than 4,000 rubles

The company gave the employee an anniversary gift. The gift cost more than 4,000 rubles. The company withheld personal income tax from the next salary.

Payments that are only partially exempt from personal income tax are reflected in the 6-personal income tax calculation. Including gifts worth more than 4,000 rubles (clause 28, article 217 of the Tax Code of the Russian Federation).

In section 1, reflect the gift in the period when the company gave the gift. In line 020, write down the entire cost of the gift, in line 030 - a deduction of 4,000 rubles. In line 040, fill in the calculated personal income tax. Fill out line 070 if you were able to withhold personal income tax from the gift during the reporting period. Do not fill out line 080 if you can withhold personal income tax until the end of the year.

Withhold personal income tax from the gift from the nearest monetary income. Section 2 should be completed during the period when the company was able to withhold personal income tax. On line 100, write down the date the gift was issued. In line 110 - the day when personal income tax was withheld, and in line 120 - the next working day.

For example

On May 25, the company presented the employee with an anniversary gift worth 15,000 rubles. On this day I calculated personal income tax - 1,430 rubles. ((RUB 15,000 - RUB 4,000) × 13%). The company withheld gift tax from the salary for May, which was issued on June 6. The deadline for transferring personal income tax on gifts is June 7.

In addition to the gift, the company accrued salaries to employees for the six months - 2,340,000 rubles, calculated and withheld personal income tax - 304,200 rubles. (RUB 2,340,000 × 13%). In line 020, the company filled out the gift and salary - 2,355,000 rubles. (2,340,000 + 15,000). In line 030, the company recorded a non-taxable amount - 4,000 rubles. In lines 040 and 070 - calculated and withheld personal income tax - 305,630 rubles. (304 200 + 1430).

The company filled out sections 1 and 2 of the calculation as in sample 55.

Sample 55. How to fill out the calculation if the company gave gifts worth more than 4,000 rubles:

The company gave a gift to an employee on vacation at its own expense

The company gave the employee a gift worth more than 4,000 rubles. The employee is on vacation at his own expense until the end of the year.

The cost of gifts over 4,000 rubles per tax period is subject to personal income tax (clause 28, article 217 of the Tax Code of the Russian Federation). Reflect such income in the calculation of 6-NDFL.

Income arose on the date the company gave the gift. Therefore, reflect the gift in the calculation for the six months. On line 020, write down the entire cost of the gift.

Write down the non-taxable amount - 4,000 rubles - as a deduction in line 030. In line 040, fill in the calculated tax.

Since the employee is on unpaid leave, the company will not be able to withhold personal income tax until the end of the year. Therefore, reflect this tax on line 080.

In section 2, the Federal Tax Service recommends showing the operation like this. In lines 100 and 110 write down the date the gift was issued, in line 120 - the next day, in line 130 - the amount of income, and in line 140 - 0 (letter dated 03/28/16 No. BS-4-11/5278). This order does not follow from the code.

In addition, the tax authorities have finalized the program, so fill out the calculation like this. On line 100, write down the date the gift was issued. And in lines 110 and 120 the zero dates are 00.00.0000 (letter of the Federal Tax Service of Russia dated 04.25.16 No. 11-2-06 / [email protected] ).

On line 130, reflect the cost of the gift, and on line 140, enter zero.

For example

On May 4, the company presented the employee with a gift worth 10,000 rubles. On this day I calculated personal income tax - 780 rubles. ((RUB 10,000 - RUB 4,000) × 13%). The employee is on vacation at his own expense until the end of the year.

The company will not be able to withhold personal income tax until the end of the year, so it is recorded in line 080. All employees are on vacation at their own expense. There were no cash payments during the year.

The company filled out the calculation as in sample 56.

Sample 56. How to fill out a calculation if the company gave a gift and did not withhold personal income tax:

The company withheld personal income tax from a gift to an employee in the next quarter

The company gave a gift to an employee in the first quarter. I couldn’t withhold personal income tax right away. Tax was withheld only in the second quarter from the employee’s salary.

The tax agent is obliged to withhold personal income tax during the tax period from the cash income that the “physicist” will issue. Last quarter, the company gave a gift to an employee, but was unable to withhold personal income tax. Therefore, in the first quarter the company showed only calculated tax.

The withheld tax must be shown on a half-year basis. In section 1, write down the withheld tax in line 070. Also fill out section 2. In line 100, write down the date the gift was issued, in line 110 - the date when the company was able to withhold personal income tax, in line 120 - the next business day.

For example

On March 16, the company presented a gift worth 7,000 rubles. employee. On this day, the company calculated personal income tax - 390 rubles. ((RUB 7,000 - RUB 4,000) × 13%). In section 1 of the calculation for the first quarter, the company reflected the gift in line 020, in line 030 it recorded a deduction of 4,000 rubles, and in line 040 it entered the calculated personal income tax.

On May 10, the company gave the employee a salary, from which it was able to withhold personal income tax from the gift. The company recorded the gift tax on line 070.

For the six months, the company accrued income (including gifts) to 12 employees at a rate of 13% - 1,890,000 rubles, calculated and withheld personal income tax - 245,180 rubles. ((RUB 1,890,000 - RUB 4,000) × 13%).

The company reflected the gift tax in line 070 of section 1 for the half year. And the gift given and the tax were also shown in section 2 of the calculation. The date of receipt of income is March 16, and the date of personal income tax withholding is May 10. The company filled out the report as in sample 57.

Sample 57. How to fill out the calculation if the company withheld personal income tax from a gift in the next quarter:

The company provided financial assistance of less than 4,000 rubles

The company provided financial assistance to employees during the quarter. Each employee received less than 4,000 rubles for six months.

Payments that are only partially exempt from personal income tax must be reflected in the calculation. Material assistance is exempt from tax in an amount that does not exceed 4,000 rubles for the tax period (clause 28 of article 217 of the Tax Code of the Russian Federation).

At the same time, if an employee received less than 4,000 rubles in a year, the company does not submit 2-NDFL for him (letter of the Ministry of Finance of Russia dated 05/08/13 No. 03-04-06/16327). This means that assistance within the non-taxable amount may not be reflected in the calculation. If you fill out the payment in the 6-NDFL calculation, the information for the year will not agree with the 2-NDFL certificates (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

For example

For the first half of the year, the company paid salaries to 10 employees - 840,000 rubles, and withheld personal income tax - 109,200 rubles. (RUB 840,000 × 13%). In the second quarter, the company provided financial assistance to employees. Total amount of 100,000 rubles. Assistance to each employee amounted to 3,500 rubles. Therefore, the company did not reflect this payment in the calculation. The company filled out Section 1 as in sample 58.

If the company issues assistance to the employee again, the income may exceed the non-taxable limit. In the period when this happens, reflect in the calculation the amount of assistance that has been issued since the beginning of the year. In this case, write down a deduction of 4,000 rubles in line 030 of the calculation.

Sample 58. How to fill out the calculation if the company provided financial assistance of less than 4,000 rubles:

The company provided financial assistance of more than 4,000 rubles

In the second quarter, the company provided an employee with financial assistance in the amount of 15,000 rubles. Only 4,000 rubles are exempt from personal income tax.

Financial assistance of more than 4,000 rubles per tax period must be shown in the calculation. On line 020, write down the entire amount of assistance. And in line 030, reflect the deduction in the form of a non-taxable amount - 4,000 rubles (clause 28 of article 217 of the Tax Code of the Russian Federation).

The date of receipt of income in the form of financial assistance is the day of payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). As of the same date, the company withholds personal income tax. Therefore, write down the payment day in lines 100 and 110 of section 2 of the calculation. You can transfer the tax the next day.

For example

On May 17, the company provided the employee with financial assistance - 15,000 rubles. On the same day, I withheld personal income tax - 1,430 rubles. ((RUB 15,000 - RUB 4,000) × 13%). In addition to financial assistance, during the six months the company accrued income to 14 employees - 1,600,000 rubles, calculated and withheld personal income tax - 208,000 rubles. (RUB 1,600,000 × 13%).

Section 1. In line 020, the company recorded accrued income and financial assistance - 1,615,000 rubles. (1,600,000 + 15,000). In line 030 - deduction of 4000 rubles. In line 040 - personal income tax on income and assistance 209,430 rubles. (208,000 + 1430).

Section 2. In lines 100 and 110, the company reflected the date of issue of financial assistance. Line 120 shows the next business day. In line 130, the company recorded the full financial assistance - 15,000 rubles. The company filled out the calculation as in sample 59.

Sample 59. How to fill out the calculation if the company provided financial assistance of more than 4,000 rubles:

The company provided financial assistance along with vacation pay

The company provided the employee with vacation pay and financial assistance for the vacation, which is subject to personal income tax.

Payments can be shown in one block of lines 100–140 if all three dates coincide: receipt of income, personal income tax withholding and the deadline for tax remittance. The date of receipt of income and withholding of personal income tax on vacation pay and financial assistance is the date of payment.

The company reflects this date in lines 100 and 110. In line 120, the company writes the deadline for transferring the tax. Personal income tax on vacation pay can be paid until the end of the month (Clause 6, Article 226 of the Tax Code of the Russian Federation). But the tax on material assistance is due no later than the next day. The dates on lines 120 are different.

This means that in section 2, reflect payments separately.

For example

On April 25, the company gave the employee vacation pay - 16,000 rubles. and financial assistance for vacation - 7,000 rubles. On the same day, the company withheld and transferred personal income tax from these payments - 2,080 rubles. (RUB 16,000 × 13%) and RUB 390. ((RUB 7,000 - RUB 4,000) × 13%).

The date for receiving income and withholding personal income tax is April 25. The deadline for transferring personal income tax from vacation pay is April 30. This is a holiday, so the deadline is moved to May 4th. Tax on material assistance must be paid no later than April 26. The company filled out payments in different blocks of lines 100–140, as in sample 60.

Sample 60. How to reflect vacation pay and financial assistance issued on the same day:

Source: https://nalogypro.ru/help/pay/SwE_Aid.htm

Financial assistance in 6-NDFL

Financial assistance is reflected in 6-NDFL according to special rules. They depend on the type of payment and its size. In the article, we explained what kind of financial assistance is shown in 6-NDFL, and gave examples of filling it out.

The company found an error in 6-NDFL and clarified the report: will inspectors fine

What financial assistance is not reflected in 6-NDFL

In the calculation, companies do not need to show material assistance, which is completely exempt from personal income tax (letter of the Federal Tax Service dated November 1, 2018 No. GD-4-11 / [email protected] ). The list of such payments is in Article 217 of the Tax Code. We have listed the main types in the table.

For example, financial assistance due to the death of a relative and other emergency circumstances is not subject to personal income tax. Therefore, such a payment does not need to be included in either section 1 or section 2 of form 6-NDFL. But there are a number of non-taxable incomes that need to be shown in 6-NDFL.

Types of financial assistance that do not need to be shown in 6-NDFL

No.

Financial assistance not reflected in 6-NDFL

| 1 | A one-time payment to family members of a deceased employee, a former employee who has retired, or an employee, a former employee who has retired, in connection with the death of a member of his family (paragraph 2, paragraph 8, article 217 of the Tax Code of the Russian Federation) |

| 2 | Payments to persons in connection with a natural disaster or other emergency circumstance, as well as family members of persons killed as a result of natural disasters or other emergency circumstances (Clause 8.3 of Article 217 of the Tax Code of the Russian Federation) |

| 2 | Payments to persons affected by terrorist acts on the territory of the Russian Federation, as well as family members of persons killed as a result of terrorist acts on the territory of the Russian Federation (Clause 8.4 of Article 217 of the Tax Code of the Russian Federation) |

What financial assistance is reflected in 6-NDFL

In the report, companies must show financial assistance, which is fully or partially subject to personal income tax. For example, financial assistance at birth 6-NDFL must be shown. After all, it is subject to personal income tax in an amount exceeding 50 thousand rubles. (Clause 8 of Article 217 of the Tax Code). Moreover, non-taxable payments of 50 thousand rubles. are due to every parent.

If you paid financial assistance for other reasons, apply the following rules. Charge personal income tax on payments exceeding 4,000 rubles. (Clause 28, Article 217 of the Tax Code). Moreover, consider the non-taxable limit as a cumulative total from the beginning of the year. When a company may not consider personal income tax

Let's say you paid an employee financial assistance in January in the amount of 3,000 rubles. Then in August they gave out another financial aid - 2000 rubles. The first financial assistance was not subject to personal income tax, since it was less than 4,000 rubles. year to date. When paying the second financial aid, personal income tax must be withheld. After all, the amount of assistance has already exceeded 4,000 rubles. The amount of accrued personal income tax is 130 rubles. [(3000 rub. + 2000 rub. – 4000 rub.) x 13%].

How to record materiel assistance in 6-NDFL

Section 1 . Record the payment in the period in which the employee received the money. Indicate the amount of financial assistance in line 020, the non-taxable part in line 030. In line 040, write down the accrued personal income tax, in line 070 - the withheld personal income tax.

Section 2 . Include the payment in section 2 of form 6-NDFL for the period to which the date on line 120 refers.

In lines 100 and 110, write down the date of payment, in line 120 - the deadline for paying personal income tax. On line 130, enter the entire payment amount, and on line 140, the withheld tax. Below, using the example, see how to reflect financial assistance in 6-NDFL in section 2. Tax officials explained how to process calculations for other payments that can be made in any company.

Example. How to reflect financial assistance in form 6-NDFL

On August 20, the organization paid the employee financial assistance for dental treatment in the amount of 6,000 rubles. When paying, the accountant withheld personal income tax of 260 rubles. [(6000 rub. – 4000 rub.) x 13%]. In Form 6-NDFL, the accountant will show the payment calculated for 9 months of 2021.

Line 020 will show the entire payment of 6,000 rubles, and line 030 will include the non-taxable part of 4,000 rubles. Lines 040 and 070 will reflect personal income tax - 260 rubles. See the completed fragment of section 2 below.

Financial assistance 6-NDFL: example of filling

Important: if you paid financial assistance on the last working day of the reporting period, show the payment in section 2 of form 6-NDFL for the next period (letter of the Federal Tax Service dated November 1, 2018 No. GD-4-11/ [email protected] ).

The fact is that the deadline for paying personal income tax on financial assistance is the next working day (clause 6 of Article 226 of the Tax Code).

And if the deadline falls in the next quarter, the payment should be shown in section 2 of form 6-NDFL for the next reporting period.

Source: https://www.gazeta-unp.ru/articles/52446-kak-otrazit-materialnuyu-pomoshch-v-6-ndfl-v-2021-godu

Responsibility

A tax agent can be fined in three cases:

- Form 6-NDFL has not been submitted to the relevant authorities.

- The reporting was submitted a few days after the deadline.

- The form contains incorrect information.

For each month of delay in delivery, you will have to pay a fine of 1000 rubles in accordance with paragraph 1.2 of Article 126 of the Tax Code of the Russian Federation. 10 days after the delay, the Federal Tax Service may freeze all financial transactions and electronic money transfers. Each form with erroneous information will cost 500 rubles. The last trouble can be avoided if you submit an updated statement with corrections of errors on time.

As additional penalties, administrative fines of up to 500 rubles are applied to the management of the organization. For persistent delays, tax authorities may freeze funds in the taxpayer’s bank account.