Reflection of data in submitted reports

Information on the amount of income and withheld tax is indicated in the 6-NDFL reporting. When determining the date of taxation of dividends, the requirements of Art. 226 Tax Code of the Russian Federation. The organization acts as a tax agent in relation to the recipient of income, which means the emergence of responsibilities for calculating, withholding tax and transferring it to the budget within the time limits specified by law.

Starting from 2015, the dividend tax rate is set at 13% for residents of the Russian Federation and 15% for non-residents. Previously, the rate was reduced (for residents the value was 9%). Persons receiving benefits for previous periods pay tax at the current rate. When determining status, periods of stay of a person exceeding 183 days during the year are taken into account, excluding the time of treatment and training.

What tax rate are dividends subject to?

At its core, dividends are income that is paid to individuals.

Personal income tax is withheld from him:

- for residents of the Russian Federation the rate is 13%;

- for non-residents – 15%.

Who is responsible for paying personal income tax?

If income is accrued to an employee of an enterprise, then all taxation issues are resolved by the accounting department of this enterprise. It is the chief accountant who is obliged to control the calculations with the budget.

The obligation passes to the recipient of funds if:

- the individual and the company that paid him the income are located in different states;

- the company did not make calculations and did not pay personal income tax.

The legislation regulates the terms of transfer:

- If the funds are paid by the JSC, the transfer must take place within a month after the payment.

- If the funds are paid by an LLC, then the tax must be transferred the next day after payment.

- Until July 15 of the following year after payment, if the tax is paid to the budget independently.

Does the legal form matter for recording dividends?

Art. 43 of the Tax Code of the Russian Federation defines a dividend as income received by its shareholders or founders from the net profit remaining after taxation.

The obligation to reflect dividend payments is provided for in Art. 230 of the Tax Code of the Russian Federation, it states that form 6-NDFL is submitted by tax agents.

All Russian organizations and individual entrepreneurs that pay dividend income are tax agents in accordance with Art. 226 of the Tax Code of the Russian Federation, i.e. Enterprises with any organizational and legal form are required to file 6-NDFL.

Reflection of dividend amounts in reporting

The inclusion of information in the reporting is determined depending on the organizational form of the company performing the payments. The payers of the amounts are LLC or JSC. The following forms of payment are provided:

- Receiving amounts determined depending on the share of participation of persons in the authorized capital of companies registered as LLCs.

- For shares accounted by joint-stock companies on a separate account of a person or by managing shares - participants in the securities market.

When paying remuneration from participation in an LLC, the payment procedure is determined by the charter documents. The taxation of amounts received in a joint-stock company depends on whether the remuneration was received by the distributing company from participation in other authorized capital and whether it was taxed. When making calculations, previously made deductions are taken into account to avoid repeated taxation.

How is the date of actual receipt of income reflected in 6-NDFL when paying dividends?

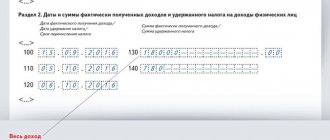

In line 100 of the 6-NDFL declaration, the date of actual receipt of income should be indicated. This indicator is determined depending on the nature of payments, and the rules for its reflection are established by Art. 223 Tax Code of the Russian Federation.

When filling out 6-NDFL, the question of how to reflect dividends in 6-NDFL correctly in time is of particular importance. For dividends, this date will be considered the day on which the relevant payments are made. If dividends issued are taxed at different tax rates, the dividend amounts are reflected in different sheets. If the corresponding funds are issued on more than one day of the reporting period, they are distributed among different groups of lines with the same numbers (100–140).

If there is no basis for division according to tax or temporary criteria, the actual income received in the form of dividends is reflected in line 130. The amount should be indicated together with tax, that is, before it is withheld.

Features of tax calculations

An enterprise in the form of an LLC must transfer the tax no later than the day following the settlement with the recipient. Amounts withheld for remuneration to JSC shareholders have a one-month deferment for transfer. If income is received by a person who is also an individual entrepreneur applying a special regime, tax is withheld in the usual manner.

When payments are made to non-residents and residents in the same period, amounts calculated at different rates are indicated separately in the reporting.

When setting the rate, the following conditions are taken into account:

- Possibility of changing a person’s status during the reporting year. Change can occur in both categories.

- Determination of the rate depending on the category of the recipient confirmed at the time of receipt of the amounts.

- The final determination of status is made at the end of the annual period. At the same time, the tax is recalculated from the beginning of the year based on the actual status data.

Information on dividends received must be reflected separately from information on other income. An important condition for income taxation is the inability to obtain a tax deduction if a person does not have other income.

How is it reflected in the calculation?

Many people are interested in how to reflect dividends in 6-NDFL. First of all, we advise you to focus on Article 226 of the Tax Code.

All accrued dividends in 6-NDFL are reflected in line 020. Including dividends. Although they are also registered separately - in line 025. And only this type of income is shown there.

There are two columns for the tax calculated on dividends in the final form. This is line 040, which indicates exactly the amount of calculated tax. True, not only regarding dividends. Here enter the total amount of calculated tax from line 020.

If we talk about the specifically calculated tax for dividends in 6-NDFL, an example can be seen in line 045. The numbers that are written here must correlate with those given in position 025.

Also in the calculation it is necessary to indicate at what rate dividends were taxed in 6-NDFL (for six months, a year, etc.). As we wrote above, 13 percent of the tax is withheld from Russian residents and 15% from those who are not.

An example of how to reflect dividends in 6-NDFL:

And here’s what you need to know about reflecting dividends to the founder: even if he is an ordinary employee, the tax base is always calculated separately when issuing such bonuses. In 6-NDFL, accrued dividends are reflected according to the general rules.

If you find an error, please select a piece of text and press Ctrl+Enter.

Formation of information in section 1 of form 6-NDFL

The amount of information in Section 1 of Form 6-NDFL depends on the rates applied when assessing amounts at the time of their payment. If an organization has transactions for non-residents and residents, the amounts must be reflected separately. For each bet, a separate block is filled in on lines 010 to 050.

| Line number | Information reflected in the line |

| 010 | The amount of the applied rate |

| 025 | The amount of dividends paid since the beginning of the reporting year, including personal income tax |

| 020 | The amount of income received by an individual, including the amount of amounts received reflected in line 025 |

| 030 | The amount of tax benefits - deductions provided to a person by an organization |

| 045 | Amount of tax withheld |

| 040 | The amount of personal income tax calculated from the income reflected in line 020 |

| 060 | List of recipients of amounts. Employees dismissed within a year and re-employed are indicated once |

| 070 | Total personal income tax amount |

| 080 | The amount of tax calculated but not withheld. The amount is recorded on an accrual basis. |

In case the data of section 1 takes up more than a page, lines 060, 070, 080 point to 1 page. If an unwithheld tax arises and there is no way to withhold it, the organization must notify the person and the Federal Tax Service within a month.

The relationship between dividends and 6-NDFL

Tax calculation form 6-NDFL is intended to reflect the income received by individuals and the tax calculated on them. The rules for preparing the calculation were approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] They are the same for all types of income reflected in the calculation.

Among the most common types of income included in 6-NDFL are wages, vacation pay, and disability benefits. Note! Starting with reporting for the 1st quarter of 2021, a new reporting form will be used, approved by Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] It will combine the calculation of 6-NDFL and 2-NDFL certificates. In this article we talk about filling out the 6-NDFL calculation using the 2021 form.

Dividends are also one type of income for individuals. But not all tax agents reflect them in 6-NDFL. If there are no individuals among the founders or shareholders of the company, then the dividends paid are not reflected in 6-NDFL.

This type of income, such as dividends, has its own specifics. Compared to salary or vacation pay, it does not arise regularly and, accordingly, in 6-NDFL it can also appear only from time to time. But in any case, each payment of dividends to individuals obliges tax agents to enter dividend information into 6-NDFL.

We will discuss in the next section what difficulties a tax agent may encounter when recording dividends in the calculation.

Filling out section 2 of the form

The information in section 2 is formed based on the indicators of the reporting 3 months. When presenting information, it is not necessary to generate data from the beginning of the reporting year. Information for a particular reporting period is reflected in section 2.

| Line number | Information reflected line by line |

| 100 | Date of payment or issuance in property form |

| 110 | The personal income tax withholding day coinciding with the calculation. When issuing a tax deduction, a date with zero data is entered |

| 120 | The date of transfer of the withheld tax, set as the day following the calculation or indicating a zero format similar to line 110. If the date falls on a weekend, the first working day is indicated |

| 130 | Dividend amount |

| 140 | Tax amount |

The company is allowed to issue required dividends in non-monetary form in the event that there are no funds in the company’s account. In reporting, the issue date is the day the assets are actually transferred. The possibility of making settlements with property must be determined by the constituent documents.

The value of the transferred property must correspond to market valuation. When filling out data in the reporting on line 140, there is no total indicator, “0” is indicated. Withholding is carried out for other payments to a person made in cash.

Features of filling out the form when there is a discrepancy between deadlines

Unlike LLCs, in which the payment of dividends and tax withholding must coincide in date, in a JSC personal income tax is transferred within a month. If the JSC's calculations and tax transfers do not coincide across reporting periods, the data is indicated in different quarters.

An example of how amounts are reflected in reporting

The enterprise JSC "Salut" made dividend payments to the company's shareholders in the amount of 325,000 rubles. Payments to shareholders were made on June 15, tax amounts were transferred on July 5. Data are presented in reporting based on the results of the 2nd and 3rd quarters.

The financial statements of JSC Salyut for the 2nd quarter reflect the following lines:

- 020 – dividends in the amount of 325,000 rubles;

- 040 – accrued tax in the amount of 42,250 rubles;

- 070 – the amount of personal income tax on dividends in the total composition of withheld taxes.

In the reporting of JSC Salyut for the 3rd quarter:

- 100 – June 15;

- 110 – June 15;

- 120 – July 5;

- 130 – 325,000 rubles;

- 140 – 42,250 rubles.

In form 6-NDFL for the 2nd quarter, the amount of the transferred tax is not reflected; only 1 section is filled out. Information on repayment of obligations is indicated in the 3rd quarter.

Example of filling out 6-NDFL for dividends

Accountant's Directory

Personal income tax on dividends is transferred no later than the next day after the amount is paid to the founder (clause 6 of Article 226 of the Tax Code). It does not matter whether the money was issued from the cash register or transferred to the card of the participant himself or a third party indicated by him.

For example, if amounts were paid on April 5, 2021, then personal income tax on them must also be paid on April 5 or April 8, taking into account any holidays that fall out. If settlements with the founders in 2021 took place on April 4, then the deadline for payment will be Friday, April 5.

It is precisely according to the deadline established for settlements with the budget that the operation falls into section 2 of form 6-NDFL. This is important to remember when you need to reflect carryover amounts - payments at the junction of quarters. Indeed, the second section contains transactions for the last three months of the reporting period/year. And it is wrong to include unnecessary operations in the section.

When the established deadline for settlements with the budget falls on a weekend or holiday, the deadline is legally postponed to the next working day (Clause 7, Article 6.1 of the Tax Code). This is the date that should appear in section 2. Below, using an example for 2021, you will see how this rule works in practice.

Reflect dividends on lines 100-140 separately from wages, even if this happens - you paid out all the amounts together. The reason is that the date of receipt of income from the salary is different - not the payment day, but the last calendar day of the month for which the calculation is made. In addition, the nature of the payments is completely different.

Take note: in a joint stock company, personal income tax must be transferred no later than 1 month from the date of payment of dividends (clause 9 of Article 226.1 of the Tax Code).

Dividends in 6-NDFL: example of filling in 2021

Based on the results of the second quarter of 2021, Dom LLC received a net profit of 150,000 rubles. On July 9, 2021, the general meeting of founders decided to use this amount to pay dividends.

The authorized capital of the company is divided equally between two participants:

50% belongs to director A.N. Petrov – citizen of the Russian Federation;

50% is in the possession of US citizen I.N. Petrova, who is not listed among the staff of the Dom society.

As of July 9, 2021, the accountant of Dom LLC accrued the following amounts of income in accounting:

Debit 84 Credit 70

– 75,000 rub. (RUB 150,000: 50%) – income accrued to Petrov;

Debit 84 Credit 75-2

– 75,000 rub. (RUB 150,000: 50%) – Petrova’s income is accrued.

On July 12, the amounts were paid by bank transfer. For personal income tax accounting purposes, this date is considered the day the income was received and will be entered by the accountant in the personal income tax register. On the day of payment, entries were made on income tax withholding:

Debit 70 Credit 68

– 9750 rub. (RUB 75,000: 13%) – tax was withheld from payments to Petrov;

Debit 75-2 Credit 68

– 11,250 rub. (RUB 75,000: 15%) – deduction was made according to Petrova.

A total of RUB 21,000 was withheld. (9,750 rub. + 11,250 rub.).

The calculations themselves, taking into account the amounts withheld, are also reflected:

Debit 70 Credit 51

– 65,250 rub. (75,000 rubles – 9,750 rubles) – the amount was paid to Petrov;

Debit 75-2 Credit 51

– 63,750 rub. (75,000 rubles – 11,250 rubles) – settlement with Petrova was made.

Personal income tax must be transferred to the budget, taking into account the weekend, on July 15.

For each income rate, the accountant filled out Section 1. Section 2 was completed without division by rates. And all amounts are shown in one block, since all three dates coincide - dividends to both residents and non-residents were paid on the same day. This means that there will be one date for withholding the tax and the deadline for transferring it to the budget.

The entire operation takes place in July, that is, the third quarter of 2021. The accountant filled out section 2 of form 6-NDFL for 9 months of 2021 for this operation as shown in the sample.

The company paid only part of the dividends

The company held a meeting of participants and distributed dividends. In the second quarter, it paid only part of the dividend.

For dividends, the date of receipt of income is considered the day when the company paid the money (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Therefore, in sections 1 and 2 of the calculation, reflect only that part of the dividends that the participants actually received.

Dividends are taxed at the same rate of 13 percent as wages, so the company adds dividends to income for the reporting period and reflects them in line 020. In addition, dividends must be shown in a separate line - 025. Show calculated personal income tax in lines 040 and 045. B Line 070 reflect the tax that was withheld in the reporting period.

In lines 100 and 110 of section 2, enter the date of payment of dividends (clause 4 of article 226 of the Tax Code of the Russian Federation). Line 120 shows the next business day. In line 130, write down the amount that was given to the founders, in line 140 - the withheld personal income tax. If the company issued dividends on different days, fill out several lines 100–140.

For example

Source: https://1atc.ru/dividendy-v-6-ndfl-2/

Errors that occur when reflecting dividends

When entering data on the taxation of dividends into reporting, errors may occur, the most common of which include:

- Section 2 is completed only during the tax transfer period. Data are not included in later periods during the year.

- Entering information into section 2 when calculating tax on the last day of the quarter.

- Indication in the composition of payments of amounts that are not dividends. Information on payments accrued disproportionately to the shares of participants, in case of incomplete payment of the authorized capital, liquidation of the enterprise within the limits of the contribution share and in other cases established by law is not reflected.

- Inclusion in the list of recipients of persons who do not have the right to receive amounts, for example, those who were not included in the list of shareholders on the date of the decision on payments.

When making calculations, difficulties arise in establishing the date of actual payment. The settlement day determines the period for reflecting the data in the reporting form.

Determining the payment date

Issuing dividends through the company's cash desk or to the recipient's personal bank account allows you to accurately determine the date of payment. Controversial issues of establishing the date of settlements arise in situations:

- Sending amounts to the recipient by postal order. The payment date is considered the day the funds are sent, regardless of the date the person receives the amount. The budget is settled the next day after the transfer is sent. The transfer of amounts is made at the place of registration of the organization making the payments.

- Payments of amounts to the founder excluded from the composition. The day of settlement is considered to be the date of actual disbursement of funds in a manner similar to transactions with existing participants.

- Transfers of dividends to a specially opened bank account under an agency agreement. The date of issue is the day the amounts are transferred to the JSC for subsequent receipt by shareholders. The fact that funds are received or returned to the company’s account due to the expiration of the agreement does not affect the tax collection procedure.

The procedure for settlements and the establishment of payment dates are determined by the meeting of shareholders, founders and statutory documents. Exceeding the amount over the approved amount or changing the order of operations without the consent of all members is not carried out. To transfer amounts to a salary project card, an application from the person is required.

Sanctions for violation of reporting conditions

The Federal Tax Service provides for the imposition of penalties on organizations that perform their duties in bad faith.

| Violation | Amount of fine | Explanations |

| Submitting reports late | 1,000 rubles for each month in full or in part | Failure to comply with reporting requirements may result in the seizure of your current account. |

| Indication of data recognized as unreliable | 500 rubles | Any distortion of data, including details, is considered false information. |

Agents who independently discover inaccuracies in the tax information provided may be exempt from sanctions established by the Tax Code of the Russian Federation. Reliable data must be presented in the updated calculation. The penalty is lifted if the agent corrected the information before the Federal Tax Service Inspectorate discovered the unreliability of the reporting data.