Responsibility for non-payment of personal income tax

For violation of the procedure for calculating and paying personal income tax, liability is provided for both tax agents (employers) and for individuals themselves who independently received a profit. If personal income tax is not paid on time, a tax liability arises, which must be transferred to the budget. The overdue amount is subject to a penalty, which is a kind of reimbursement of the Treasury's costs for the fact that the taxpayer did not fulfill his obligations on time.

Failure to pay or not pay in full personal income tax, which arose due to an understatement of the tax base, may be punished in the form of a penalty. Collection in this case is possible in the amount of 20% of the debt amount or 40% if the taxpayer committed these actions intentionally. An understatement of the tax base is possible if the taxpayer indicates in the declaration those deductions that he is not entitled to apply.

Postings and accounts

After personal income tax is calculated, postings are made according to Kt account 68, if we are talking about withholding. For debit turnovers there is a different numbering:

- for payment of dividends to shareholders and founders - account 75;

- when withholding tax from wages – 70;

- if we are talking about material assistance - 73;

- for deductions from civil law income – 76;

- for short-term loans from individuals – 66;

- long-term loans – 67;

When transferring the total personal income tax to the budget - Dt 68 and credit turnover on the 51st account.

Payroll postings are typically made on the last day of the month. If we are talking about other income, then postings are made on the same day. This accounting manipulation is mandatory and is reflected in the relevant registers. Account identification numbers are also always used to make documentation and reporting clear.

The implementation of such operations is prescribed by law and is mandatory for various organizations and individual entrepreneurs paying income to individuals

It is important to consider that personal income tax can be withheld not only from the wages that employees receive, but also from other income received and payments made. For example, when purchasing a service or product from an individual

Also see “Reflecting the accrual and payment of dividends in accounting.”

Purchasing works and services from an individual

Another situation that may arise is the purchase of work or services (for example, rental of non-residential premises) by an organization from an individual. By virtue of Art. 226 of the Tax Code of the Russian Federation, in this case, the organization is obliged to withhold personal income tax from the amount of payments, pay it to the budget, and transfer the amount to the seller minus personal income tax at a rate of 13% (with the exception of income listed in Article 217 of the Tax Code of the Russian Federation).

In this case, the following transactions are made:

The main thing to remember is that personal income tax is taken from the income of a specific individual, and no matter what account is used when calculating it, it is necessary to conduct analytics on it for each individual from whose income personal income tax was withheld. It should also be remembered that tax-free income of an individual is established by law - all of them are listed in Art. 217 Tax Code of the Russian Federation.

Examples of personal income tax calculation

An example of calculating personal income tax from employee wages

Every working individual receives monthly income in the form of wages, however, an individual does not independently calculate and pay personal income tax from wages. This is due to the fact that the responsibility for calculating and paying personal income tax on wages falls on employers, who in this case act as tax agents. The employee receives a salary minus tax.

Having calculated the salary, the accountant determines the required amount of deductions for the employee, subtracts the deductions from the salary, and a tax rate of 13% is calculated from the resulting difference.

Toropov received a salary for January 2015 in the amount of 30,000 rubles. He has one child. Let's calculate the personal income tax that the employer must pay on Toropov's salary.

Since Toropov has one child, he is entitled to a standard tax deduction of 1,400 rubles.

Personal income tax = (30000 – 1400) *13% = 3718 rub.

Toropov’s salary in hand = 30,000 – 3,718 = 26,282 rubles.

Postings for accounting for personal income tax from salary:

- D44 K70 in the amount of 30,000 - Toropov’s salary accrual for January 2015 is reflected.

- D70 K68.NDFL in the amount of 3718 - personal income tax is withheld from accrued salaries.

- D70 K50 - in the amount of 26282 - wages were paid to Toropov.

- D68.NDFL K51 – the amount of tax is transferred to the budget.

Please note that to reflect the amount of personal income tax, account 68 is used, in which a separate sub-account is opened. The debit of account 68 reflects the transfer of tax, and the credit reflects its accrual for payment.

An example of calculating personal income tax on dividends:

If an individual has a share in the authorized (share) capital of an organization, then he has the right to receive income in the form of dividends. Dividends are calculated from the organization's net profit.

Personal income tax on dividends must be withheld by the organization paying them. That is, this organization acts as a tax agent. An individual must receive the dividend amount minus tax.

Since 2015, a rate of 13% has been applied to dividends (previously the rate was 9%).

Toropov received dividends in the amount of 30,000 rubles. Let's calculate personal income tax on dividends.

Personal income tax = 30000 *13% = 3900.

Dividends receivable = 30,000 – 3,900 = 26,100.

Postings for accounting for personal income tax on dividends:

- D84 K75 in the amount of 30,000 - dividends were accrued to Toropov for participation in the authorized capital of the company.

- D75 K68.NDFL in the amount of 3900 - the amount of tax on dividends was withheld.

- D75 K50 for 26100 – dividends were paid to Toropov in cash.

- D68.NDFL K51 for 3900 – the amount of tax is transferred to the budget.

An example of calculating personal income tax on a loan

Tax is imposed on income received in the form of interest from the transfer of funds on credit.

Toropov lent the organization a loan in the amount of 30,000 rubles. for a period of 6 months. The income received in the form of interest on this loan is 3,000 rubles. Let's calculate the tax on interest.

A 13% rate is also applicable for this type of income.

Personal income tax = 3000 * 13% = 390 rubles.

Postings for accounting for personal income tax on loan interest:

- D50 K66 for 30,000 - reflects the amount of credit money received from Toropov.

- D91/2 K66 for 390 - accrued interest on the loan is written off as other expenses.

- D66 K68.NDFL for 390 – tax is withheld from interest on the loan.

- D66 K50 for (30000+3000-390) – funds were returned to Toropov, taking into account accrued interest minus personal income tax.

- D68.NDFL K51 at 390 – the amount of tax to the budget is transferred.

Tax deductions provided by the state

The legislation provides for deductions from the income of citizens that are not taxed. Such deductions include:

- Standard deductions;

- Social deductions;

- Property;

- Professional.

Standard deductions from income, according to Art. 218 of the Tax Code of the Russian Federation, the following are provided:

- people related to radiation and who have received any illness or injury as a result;

- persons with children. The law provides for a deduction for the first child in the amount of 1,400 rubles, for the second - the same amount, but for the third and subsequent children - already 3,00 rubles. This is stated in paragraph 4 of Art. 218 Tax Code of the Russian Federation;

- military personnel, heroes.

The amount of tax deduction for each category of citizens is different. For example, Chernobyl survivors are provided with a deduction of 3,000 rubles (clause 1, clause 1, Article 218 of the Tax Code of the Russian Federation), and citizens who donated their bone marrow to another person - 500 rubles.

Such a tax deduction can only be presented to residents of our country, and only for types of income that are taxed at the standard rate of 13%.

A person can count on receiving a social tax deduction if:

- he made a donation to social agencies (orphanages, nursing homes). A deduction is provided for the entire amount of donations;

- he pays for education for himself or his children (minors) in accredited educational institutions. In this case, a deduction is also provided for the entire amount, but not more than 50,000 per year (clause 2 of Article 219 of the Tax Code of the Russian Federation) and only if the educational institution has a license;

- he paid for medical services provided to him, his spouse or minor children. You can also deduct the cost of drugs for medical treatment. A deduction is provided if the funds were spent on the purchase of drugs in accordance with the list. The deduction is equal to all actual expenses;

- he contributed sums of money under a non-state pension insurance agreement to his pension, or additional contributions to the funded part of his pension.

After the expiration of the tax period (year), a citizen has the right to submit a tax return for a deduction. Along with the declaration, documents are also submitted that can confirm the expenses that the individual had. Only in this case, a social deduction will be presented.

Property tax deduction is provided from income received by an individual from the sale of his own property (Article 220 of the Tax Code of the Russian Federation). For these purposes, property is recognized as real estate or its share, as well as a share in the authorized capital of a legal entity. But, the deduction can be submitted only if the individual owned the property for less than 3 years, and the transaction amount was less than 1,000,000 rubles.

It also provides a deduction from amounts that were actually spent on the purchase or construction of housing, but from an amount not exceeding 2,000,000 rubles.

According to Art. 221 of the Tax Code of the Russian Federation, professional tax deductions are provided:

- persons officially registered as an individual entrepreneur or a notary or lawyer. Expenses must be documented. If there are no documents for expenses, then the tax deduction will be equal to 20% of the amount of income that the individual entrepreneur received from his activities;

- persons who work not under an employment contract, but under a civil contract (for example, a contract);

- persons who have received remuneration for authorship or invention.

How to calculate severance pay upon dismissal.

The calculation of land tax is described.

Personal income tax penalties in 2021

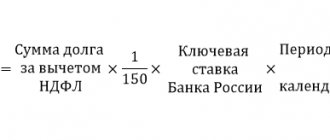

The calculation of penalties in 2021 is made in accordance with Article 75 of the Tax Code of the Russian Federation:

- If the delay is less than 30 days, then organizations are charged a penalty in the amount of 1/300 of the Central Bank refinancing rate currently in effect.

- If the delay is more than 30 days, then penalties are charged in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for the first 30 days and in the amount of 1/150 of the refinancing rate of the Central Bank of the Russian Federation starting from the 31st day of delay.

The accrual of penalties, their payment and write-off occurs on the basis of the Tax Code of the Russian Federation, as well as PBU 10/99. The entire process of generating entries is possible in two versions, depending on the way the accounting or tax accounting requirements are interpreted. From the point of view of accounting standards, these penalties are considered as penalties, and they are written off in the same amount. As for tax accounting, penalties and fines differ both in characteristics and in the method of reflection. Penalties do not have any signs of a fine, since they do not have a fixed amount and are not taken into account when reducing the tax base. In this case, 91 and 99 accounts can be used, and the chosen method must be fixed in the company’s accounting policy.

Let's take a closer look at an example. delayed the payment of personal income tax for 10 days in the amount of 50,000 rubles. The company calculated the penalty and paid it along with the amount of the debt. The refinancing rate on the day of delay is 7.75%. Therefore, the amount of the penalty will be:

50,000 x (1/300 x 7.75) x 10 = 129.17 rubles

The company made the following accounting entries:

| Business transaction | D | TO |

| Personal income tax penalties accrued in the amount of 129.17 rubles | 99 | 68.4 |

| Personal income tax penalties in the amount of 129.17 rubles were paid from the current account | 68.4 | 51 |

Tax reporting

Income tax reporting must be submitted no later than April 30 of the following year. But, during the tax period, only individual entrepreneurs and persons who carry out private practice (notaries and lawyers) are required to make advance payments. They must be paid no later than July 15 (for the first half of the year), no later than October 15 (for the third quarter) and no later than January 15 (for the fourth quarter). Advance payments are paid according to notifications that the tax office itself sends out.

A tax return is submitted to the tax office. A certificate in form 2-NDFL is also submitted for each employee who worked at this enterprise in the reporting year, even if he quit.

By presenting 2-NDFL certificates, the tax agent fulfills two of his duties to the state at once:

- he reports on the amounts of tax accrued and paid (no later than April 30);

- submits to the tax office information about those citizens from whom it was not possible to withhold tax (until January 31).

In both of these cases, a certificate is submitted to the tax authority. The difference between the certificates will be in what code will appear in the “Sign” column. If the tax was withheld, then the number “1” is put, if not, then “2”. Then the amount of tax that was not withheld for objective reasons will be reflected in line “5.7”.

For individuals, income tax reporting is provided in Form 3-NDFL.

Officials of the enterprise, as well as citizens, should not forget that the state provides for administrative liability for non-payment of income tax. According to Art. 122 of the Tax Code of the Russian Federation, for failure to pay taxes on time, penalties will be charged on the unpaid amount, which are equal to 1/300 of the refinancing rate on the day of delay.

When assigning the right of claim, the old creditor transfers his rights of claim, ownership rights or property to the new one.

Accounting for work in progress is described.

Personal income tax postings

All operations related to payroll calculation are reflected in accounting entries. When personal income tax is accrued or withheld from wages, the posting is reflected in a memorial order filled out for each reporting month. We will look into which subaccounts are used in operations related to the calculation and payment of tax in our article.

Main accounts for reflecting personal income tax

In principle, there are no difficulties with reflecting in accounting entries for the accrual, withholding and payment of personal income tax. Questions often arise with tax refunds.

The Tax Code has approved the rules for keeping records of tax transactions, which indicate that the tax agent is obliged to accrue, deduct and pay personal income tax from the taxpayer’s salary and reflect the transactions accordingly in accounting entries.

Income tax accounting is carried out in subaccount 68, if personal income tax is accrued, the posting is reflected on the loan. Corresponding accounts will be based on the accrual situation. Below we present frequently encountered situations that arise with the reflection of personal income tax in accounting.

Personal income tax postings for material benefits

Income associated with material benefits is the provision of a low-interest or zero-rate loan to an employee, where the lender is an enterprise. The amount of the difference between the percentages constitutes the tax base. The amount of the benefit depends on the interest rate provided by the organization that issued the loan and on the established interest rate of the Central Bank on the date of receipt of the loan.

The accrual and deduction of personal income tax transactions are reflected as follows:

| Debit | Credit | Operation |

| 73 | 51 | Transfer of borrowed funds to the employee’s bank account |

| 73 | 91 | calculated amount of interest on the loan (reflected for each reporting month) |

| 73 | 68 | Tax calculated on the amount of material benefit (for the reporting month) |

| 68 | 51 | Payment of tax to the State budget (for the reporting month) |

Personal income tax calculator

Personal income tax postings under an employment contract

Labor relations between an employer and an individual under a contract are the main type of income of the latter, where the enterprise acts as a tax agent. Payroll, as well as personal income tax accrual and withholding, is reflected in the memorial order as follows:

| Debit | Credit | Operation |

| 44 | 70 | Employee payroll |

| 70 | 68 | Tax is calculated on income from wages and other types of taxable income |

| 70 | 51 | Crediting salary to employee's bank account |

| 68 | 51 | Transfer of tax to the budget |

How to calculate personal income tax

Personal income tax postings for travel expenses

In accordance with the Tax Code, travel expenses are taxed only if the established daily expense limit is exceeded, which is 700 rubles within the territory of the Russian Federation, 2500 rubles abroad.

When paying an employee funds for a business trip above the established daily allowance (by order of the manager), the income received is subject to personal income tax at a rate of 13%.

The accrual of travel allowances and personal income tax deductions will be reflected in the memorial order as follows:

| Debit | Credit | Operation |

| 71 | 50 (51) | An advance was issued to the employee for future expenses |

| 44 (20, 26) | 71 | Travel allowance amount accrued |

| 70 | 68 | Income tax is calculated on the difference between the established daily rate and the amount given to the employee |

| 68 | 51 | Tax transferred to the State budget |

Fine for non-payment of personal income tax

Personal income tax postings for dividends

Reflection of accounting entries for the payment of dividends and the accrual of personal income tax entries will depend on whether the founder is an employee of this organization or not. In the case when the founder works at this enterprise, account 70 will be used, if he is not an employee of the company - account 75.

| Debit | Credit | Operation |

| 84 | 70 (75) | Amount of dividends accrued |

| 70 (75) | 68 | Personal income tax accrued |

| 70 (75) | 51 | The amount of dividends paid minus the withheld personal income tax |

| 68 | 51 | Tax transferred to the budget |

It is important to take into account that personal income tax is calculated for each employee separately, using the corresponding corresponding accounts. When compiling a memorial order, the entries for each account are summarized into a total amount

Accrued personal income tax posting

Today, the basis for personal income tax is certain types of income.

These are basic and additional wages, amounts of sales or leasing, rental payments for movable, immovable property and other material assets that are the property of individuals.

persons, work performed and services provided, dividends from participation in capital, income from deposits and other income. The main points of personal income tax accounting should be considered separately.

Personal income tax is quite rightly called one of the most specific deductions. Its features are that the basis for calculating tax is the entire income of an individual, and payers as tax agents are legal entities.

| № | Dt | CT | Primary document | |

| 1 | Personal income tax under GPC agreements | 76 | 68 | GPC agreement |

| 2 | Personal income tax on interest on short-term loans from individuals | 66 | 68 | Loan agreement |

| 3 | Personal income tax from salary | 70 | 68 | Tax accounting register |

| 4 | Personal income tax when renting premises from a company employee | 76 | 68 | Lease contract |

| 5 | Personal income tax on financial assistance to an employee | 73 | 68 | Employee statement |

| 6 | Personal income tax on dividends | 75 | 68 | Protocol |

| 7 | Personal income tax on interest on long-term loans from individuals | 67 | 68 | Loan agreement |

https://www..com/watch{q}v=9AvsGB67V6E

Standard Relevant for Financial support for your employees is a common practice. An employee can receive a loan on more favorable terms than from a bank. In turn, the employer, with the help of loans, can increase staff loyalty, which will have a positive impact on the activities of the organization as a whole.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, ask your question to an online consultant. It's fast and free!

- Loans for employees: few taxes, many transactions

- Personal income tax accrued (accounting entry)

- Subtleties of deduction and transfer of “salary” personal income tax

- Accounting for personal income tax payments, postings, examples

- Personal income tax: we return, withhold, transfer

- What entries should be made to reflect the accrual of personal income tax on material benefits upon dismissal of an employee{q}

- Interest-free loan to an employee: accounting and taxes

Loans for employees: few taxes, a lot of transactions I. How will this affect the calculation of personal income tax and other taxes{q} Should we reflect the issuance of a loan in some documents, for example, in a certificate of income of an individual{q}

Please explain with an example how to calculate the amount of interest and what transactions need to be made. The determination of the tax base when receiving income in the form of material benefits, expressed as savings on interest when receiving borrowed funds, is carried out by the taxpayer under Art.

That is, the organization does not have the obligation to transfer personal income tax to the budget for material benefit. This is explained by the fact that if an individual is not an employee of an organization, then the organization cannot find funds to transfer taxes to the budget.

Disable advertising Moreover, since the organization is still a tax agent in accordance with Art.

In principle, despite the cancellation of the Methodological Recommendations, any person can appoint his authorized representative in tax legal relations on the basis of Art.

We invite you to read: Penalty under a wiring contract

An authorized representative of a taxpayer - an individual exercises his powers on the basis of a notarized power of attorney, Art.

When determining the amount of material benefit, the refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of borrowed funds is taken into account.

The amount of personal income tax withheld from wages is recorded in the debit of account 70 “Settlements with personnel for wages” and the credit of account 68 “Calculations for taxes and fees”.

Regarding the issue of paying VAT on interest received from employees for using a loan, it can be said that, in accordance with subparagraph.

Reporting periods for such organizations are one month, two months, three months, and so on until the end of the calendar year.

Consequently, non-operating income in the form of interest under a loan agreement is recognized for profit tax purposes on a monthly basis and there are no differences in the recognition of income in the form of interest under a loan agreement in accounting and tax accounting in this case. The loan was issued to an employee of the organization on February 1. The principal is repaid in equal monthly installments along with interest.

We present the calculation of interest and material benefits when repaying a loan in parts, Table 1. Table 1.

Posting personal income tax withholding for GPH In case of a positive decision, a civil law GPH agreement will be concluded with you for the provision of services. Dividends, payments to former employees, other income.

In this article we will talk about changes related to the calculation of personal income tax on amounts of material benefits. Federal law from The economic essence of material benefits is to exempt the taxpayer from any costs that he could have incurred, but did not actually incur.

Let us note that until this year, the types of material benefits not subject to personal income tax were listed only in subparagraph 1 of paragraph 1 of Article of the Code.

From February 15 of the year, material benefits received from the acquisition of securities from a controlled foreign company by a taxpayer who is recognized as a controlling person of such a foreign company, as well as a Russian related party of such a controlling person, are also not subject to taxation.

Moreover, in order to obtain an exemption, it is necessary that the income of such a controlled foreign company from the sale of the specified securities and expenses in the form of the purchase price of the securities are excluded from the profit-loss of this foreign company on the basis of paragraph 10 of the article Disable advertising There are situations when the taxpayer must pay personal income tax on a material benefit independently, for example, if he purchased goods from an interdependent individual in relation to him p.

He will show the salary for each month in separate blocks. The lines will contain the dates of payment of the second part of the salary. The lines will contain the amounts of accrued wages and withheld personal income tax. Situation 3. During the reporting period, additional wages were accrued. Usually, additional wages are associated with the identification of an error. For example, the accountant incorrectly calculated the allowance.

Loans for employees: few taxes, many transactions I.

How will this affect the calculation of personal income tax and other taxes{q} Should we reflect the issuance of a loan in some documents, for example, in a certificate of income of an individual{q} Please explain, with an example, how to calculate the amount of interest and what entries need to be made .

The determination of the tax base when receiving income in the form of material benefits, expressed as savings on interest when receiving borrowed funds, is carried out by the taxpayer under Art. That is, the organization does not have the obligation to transfer personal income tax to the budget for material benefit.

This is explained by the fact that if an individual is not an employee of an organization, then the organization cannot find funds to transfer taxes to the budget. An organization can deduct money from its employees' wages upon their written request.

The procedure for the relationship between the lender and the borrower is regulated by Chapter 42 of the Civil Code of the Russian Federation. When issuing loans to employees of an organization, it is necessary to conclude a written agreement (Article of the Civil Code of the Russian Federation).

Dt - 51 “Current accounts” Kt - 66 “Settlements on the principal debt” - 500,000 rubles.

- The interest on the loan for the month was calculated: Dt - 91 subaccount “Other expenses” Kt - 66 subaccount “Interest calculations” - 4931.51 rubles.

- Personal income tax is withheld from the amount of interest on the loan: Dt - 66 subaccount “Calculations of interest” Kt - 68-1 641.1 rub.

- Interest was paid on the loan while withholding personal income tax: Dt - 66 subaccount “Calculations of interest” Kt - 51 - 4290.41 rubles.

- The amount of personal income tax payable has been transferred to the budget: Dt - 68-1 Kt - 51 - 641.1 rub.

- Example of calculating personal income tax on wages Unlike other types of income, the amount of personal income tax on earnings is influenced by the following factors:

- the amount of wages, benefits, bonuses, vacation pay, etc.

Calculations for personal income tax." Postings for personal income tax:

- Calculated from personal income tax salary: Dt - 70 “Settlements with personnel for wages” Kt- 68-1

- The tax on the income of shareholders (not employees of the enterprise) from membership in the authorized capital has been calculated (and for employees, the posting is identical to the previous one): Dt - 75 “Settlements with founders” subaccount “Settlements for the payment of income” Kt - 68-1

- Personal income tax was calculated from the amount of monetary awards under civil law contracts: Dt - 76 “Settlements with various debtors and creditors” Kt - 68-1

- Tax amounts transferred to the budget: Dt - 68-1 Kt - 51 “Current accounts”

- Penalties and fines were accrued for personal income tax: Dt-99 “Profit and Loss” Kt-68-1

- The amounts of fines and penalties were transferred to the budget: Dt - 68-1 Kt -51

Example of calculating personal income tax on dividends Condition: Founder P.K. Zakharov

Personal income tax withheld: posting tax withholding from wages

When personal income tax is withheld, the posting is made to the credit of account 68 in correspondence with the debit of one of the accounts for settlements with individuals. The article contains correspondence of accounts and examples, free reference books and useful links.

Transactions with personal income tax in modern accounting and tax accounting are carried out without fail when paying income to individuals. Let us consider in more detail what transactions are generated when accruing, withholding and transferring personal income tax.

Today, the basis for personal income tax is certain types of income.

These are basic and additional wages, amounts of sales or leasing, rental payments for movable, immovable property and other material assets that are the property of individuals.

persons, work performed and services provided, dividends from participation in capital, income from deposits and other income. The main points of personal income tax accounting should be considered separately.

Travel expenses in terms of daily allowance and unconfirmed costs for renting residential premises, in accordance with clause 3 of Art. 217 of the Tax Code of the Russian Federation are standardized for personal income tax purposes. Daily allowances in excess of the norm and expenses for renting residential premises that are not documented are subject to personal income tax at a rate of 13%.

The procedure for calculating and paying personal income tax is regulated. 23 Tax Code of the Russian Federation.

Following the rules set out in this chapter, an organization paying income to an individual is obliged to calculate, withhold and transfer personal income tax to the budget on accrued income, and to pay the individual income minus personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation). Thus, when paying income to an individual, an organization becomes a tax agent for personal income tax (Article 226 of the Tax Code of the Russian Federation).

Personal income tax has been accrued - the posting of this action must be reflected in the accounting records. How to do this correctly, which accounts will participate - you will learn from our article.

Personal income tax in 2021 - general information

Taxation of earnings of individuals

How is material benefit taxed?

Calculation of personal income tax on travel payments

Tax on dividends

Trading operations with individuals

Postings for calculating the withholding and transfer of personal income tax

The calculation and withholding of personal income tax is accompanied by the implementation of the corresponding entries in accounting. The article provides a table with entries for calculating tax payable, as well as examples of calculating personal income tax on dividends, interest on a loan and employee wages.

After considering this topic, we will deal with personal income tax reporting. To account for personal income tax, account 68 “Calculations for taxes and fees” is used, on which the “NDFL” subaccount is opened. When calculating personal income tax for payment to the budget, it is reflected on the credit account.

68 in correspondence with the income accounts of an individual. Tax payment is reflected in the debit of account 68. Postings for withholding and payment of personal income tax Debit Credit Name of transaction 75 68 Withholding personal income tax from dividends of founders and shareholders. 70 68 Personal income tax withheld from employees' wages.

73 68 Tax payable on financial assistance to employees.

Attention

Tax payable on civil income. 66 68 Tax is withheld from income in the form of interest payable from a short-term loan, a loan from an individual. 67 68 Tax is withheld from income in the form of interest payable from a long-term loan, a loan from an individual.

68 51 Total personal income tax payable is transferred to the budget Example of personal income tax accrual from dividends Ivanov I.A., who is the founder, was accrued dividends in the amount of 50,000 rubles. How is personal income tax calculated on Ivanov’s dividends in this example, and what transactions are made{q} Dividends from the founders are subject to a tax rate of 9%.

From 2015, the rate on dividends increases to 13%; read about the taxation of dividends at this link.

https://www..com/watch{q}v=ogdVp1DDb3Y

Personal income tax = 50,000 * 9% / 100% = 4,500 rubles.

Source: https://ortopedgoncharov.ru/provodka-nachislen-ndfl-voznagrazhdenie/

The procedure for calculating personal income tax on material benefits (example)

When receiving a low-interest or interest-free loan from an organization (so-called financial assistance), the employee receives a material benefit in terms of saving on interest. It matters in what currency the loan agreement is drawn up.

If it is issued in rubles, then the threshold rate is 2/3 of the current refinancing rate established by the Central Bank of the Russian Federation on the date of receipt of income (clause 2 of Article 212 of the Tax Code of the Russian Federation).

NOTE! From 2021, the refinancing rate is equal to the key rate (directive of the Central Bank of the Russian Federation dated December 11, 2015 No. 3894-U) and is:

- from 01/01/2016 - 11% (information from the Bank of Russia dated 07/31/2015);

- from 06/14/2016 - 10.5% (information from the Bank of Russia dated 06/10/2016);

- from September 19, 2016 - 10% (information from the Bank of Russia dated September 16, 2016);

- from March 27, 2017 - 9.75% (information from the Bank of Russia dated March 24, 2017);

- from 05/02/2017 - 9.25% (information from the Bank of Russia dated 04/28/2017);

- from 06/19/2017 —– 9% (information from the Bank of Russia dated 06/16/2017).

If the loan is issued in foreign currency, then the established threshold value is 9% per annum (clause 2 of Article 212 of the Tax Code of the Russian Federation).

Moreover, in case of exceeding the threshold values, personal income tax is withheld at 35%.

It is better to consider the postings for calculating personal income tax using a specific example.

The organization issued a loan to employee Ivanov I.I. (resident of the Russian Federation) for a period of 1 year in rubles at a rate of 3% per annum with interest paid at the end of the loan term. Loan size - 500,000 rubles.

Dt 73 “Ivanov I. I.” Kt 50 - 500,000 rub. — the loan amount was issued to Ivanov on December 31, 2016.

Income from the amount of the benefit from 2021, regardless of the date of payment of interest, is determined monthly on the last day of the month. Let's calculate the amount of interest on the loan for January 2021. There was no partial repayment of the loan in January.

500,000 × 0.03 ×31/365 = 1,273.97 rubles.

Dt 73 “Ivanov I. I.” Kt 91 - RUB 1,273.97. — interest accrued for using the loan for January 2021.

We will calculate personal income tax on the amount of material benefit.

2/3 × 10% = 6.67% - threshold, taking into account the current refinancing rate.

6.67 – 3 = 3.67% - interest on material benefits.

500,000 × 0.0367 × 31/365 = 1,558.49 rubles. - material benefit for January 2021. Let's calculate personal income tax (35%) from it: 1,833.74 × 0.35 = 545 rubles.

If Ivanov were a non-resident of the Russian Federation, then the tax would be withheld at a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

Dt 70 (73) “Ivanov I. I.” Kt 68 “NDFL” - 545 rubles. — Personal income tax on material benefits for January 2021 is withheld from the employee’s salary (or other income).

Dt 68 “NDFL” Kt 51 - 545 rubles. — Personal income tax from savings on interest for January 2021 is transferred to the budget.

Personal income tax: main correspondence accounts

Depending on the type of remuneration received by the employee, the entries for calculating personal income tax have the following correspondence:

- Dt 70 Kt 68.01 - personal income tax withheld:

- from salary;

- from sick leave;

- from vacation pay;

- from bonuses;

- from business trips in excess of the norm;

- with material benefits from savings on interest.

- Dt 73 Kt 68.01 - income tax accrued:

- with financial assistance over 4000 rubles,

- from gifts over 4000 rubles.

- Dt 75 Kt 68.01 - personal income tax is charged on dividends to the founders.

- Dt 76 Kt 68.01 - income tax on payments under a GPC agreement to persons who are not members of the state.

When personal income tax is withheld, no additional posting occurs, because income tax is withheld at the time of payment of income to an individual. Since income is paid minus accrued tax, this is an operation to withhold income tax by the tax agent. Until income minus income tax is paid, personal income tax is not considered withheld.

Paying taxes - how to reflect them in accounting entries

In such a situation, the organization itself must determine on which accounting accounts the personal income tax amounts will be taken into account, and consolidate the chosen procedure in the accounting policy order. In accounting, operations related to personal income tax calculations are carried out in accordance with the Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia on October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions on its application" (hereinafter referred to as the Chart of Accounts). To summarize information about settlements with budgets for taxes and fees paid by an organization, account 68 “Calculations for taxes and fees” is intended.

Insurance LawPermalink

Tax obligations of organizations

Payments for taxes and fees can be sent to the federal, regional or local budget. It depends on the type of obligation. Federal taxes include VAT, excise taxes, and income taxes. Local and regional taxes consist mainly of amounts assessed for the use of land and property.

When considering the tax obligations of an enterprise, it would be correct to systematize payments in the context of this economic entity. Let's group the main types of taxes and fees, data on which are entered into account 68 in accounting, according to the method of their payment:

- from the amount of sales proceeds - excise taxes, VAT, customs costs;

- write-off to the cost of products (works, services) - taxes on land, water resources, mining, property and transport of an enterprise, gambling business;

- from net profit - corporate income tax.

In addition, account 68 is also used to pay personal income tax levied on the income of individuals (employees of the enterprise).

Depending on the tax regime under which the enterprise operates, payment rates and their total number change. For example, organizations using the simplified tax system may be exempt from paying VAT, property and profit tax, and personal income tax.

Personal income tax for individual entrepreneurs in the general mode: how to calculate and pay personal income tax

The tax office may ask for an explanation if it audits you. Then you will explain yourself. In your case, it was not a mistake, but an advance for the order, which was later cancelled. If there are questions, do you have documentary evidence of the operations? When the advance was transferred to you, the client probably wrote on the payment slip: payment for such and such services under such and such an agreement. When you returned the money to him, you had to indicate something like: return of the advance payment under such and such an agreement. This is all reflected in KUDIR as well. This is just an example. There are payments, there is a bank statement - you can explain. If everything is properly formalized, then they won’t ask about it.

The tax office sees what you wrote in the declaration and it transmits the income figure from the declaration to the Pension Fund. She can see something else, the same statement, only during verification, when she requests documents from you and, if necessary, from the bank. In addition, since 2017, contributions are transferred under the administration of the tax office, so now you will only have to deal with it.

Postings for withholding and transferring personal income tax

Transactions with personal income tax in modern accounting and tax accounting are carried out without fail when paying income to individuals. Let us consider in more detail what transactions are generated when accruing, withholding and transferring personal income tax.

We correctly reflect personal income tax withholding from wages

The main task of an accountant in the accounting department of an enterprise is the correct calculation of earned income, vacation pay, sick leave, night pay, compensation payments, various allowances, financial assistance and the accurate withholding of tax from this income. Regulatory acts provide that taxable total income includes dividends, winnings, prizes, gifts, compensation for travel expenses exceeding the daily expense limit established by the state.

Personal income tax is calculated within the framework of clause 3 of Art. 225 of the Tax Code of the Russian Federation, which defines all types of charges subject to taxation. Tax rates are clarified in the Tax Code, Art. 224.

The calculation is made using a standard formula, where the total tax is multiplied by the tax base by the tax rate:

Personal income tax = (salary - SV) * tax rate

where ZP is the amount of income received, rub.; SV - standard deductions, rub.

For example, in October 2021, salesman Anisimov worked for a whole month and his income amounted to 35,000 rubles. At the same time, he has the right to a standard benefit (deduction) for a five-year-old son in the amount of 1,400 rubles. based on the submitted application and a copy of the child’s birth certificate.

An enterprise, in the role of a tax agent, calculates the amount of tax and, no later than the day following the day of payment of income, transfers it to the budget. The tax calculation will be as follows:

Tax amount = (35,000 - 1,400) * 0.13 = 4,368 rubles.

The business journal will contain the main entries:

| № | Dt | CT | Amount, rub. | Primary document | |

| 1 | Accrued for October to Anisimov | 44 | 70 | 35 000 | Payroll or payslip |

| 2 | Personal income tax withheld | 70 | 68 | 4 368 | Payroll or payslip |

We prepare transactions for the transfer of personal income tax

Nowadays, the state clearly sets deadlines and methods for introducing accrued amounts into the budget. It is mandatory to transfer the entire amount of accrued tax to the budget settlement account on the day of payment of wages or no later than the next day after the payment of wages or other income to an individual. The wiring looks like this:

- Dt 68 Kt 51. The documentary basis is the payment order and bank statements.

- Dt 68 Kt 50. Cash order, cash book, bank receipt.

In this case, the tax payment process can be combined. The transfer is made in non-cash form from a current account, or in some situations, money can be deposited into a budget account in cash through the bank's cash desk.

Sample tax payment order:

In 2021, a new form of personal income tax report 6 was introduced, which provides a summary of data on a legal entity. The company reports on this form in terms of the total amount of money paid to employees, the total tax deduction, the rate and personal income tax paid from the income of the company's employees.

Calculation of personal income tax on travel expenses

Travel expenses in terms of daily allowance and unconfirmed costs for renting residential premises, in accordance with clause 3 of Art. 217 of the Tax Code of the Russian Federation are standardized for personal income tax purposes. Daily allowances in excess of the norm and expenses for renting residential premises that are not documented are subject to personal income tax at a rate of 13%.

The norms for daily allowance are set within the following limits: for business trips in Russia - no more than 700 rubles. per day, for business trips abroad - no more than 2,500 rubles. in a day.

Read about similar restrictions introduced for daily allowances from 2021 regarding the calculation of insurance premiums in this article.

When an organization pays daily allowance to an employee by internal order above the established norm, the following entries are made:

Calculation and payment of fixed insurance premiums for individual entrepreneurs in 1C: Enterprise Accounting 8

If you generate payment orders in the program and then upload them to the client bank or send them to the bank directly from the program, you can click on the “Pay from a bank account” button. Payment orders will be created to write off the specified amounts (but these payment orders do not yet generate transactions). If you generate all payments in the client bank, and then load them into the program, then there is no need to press this button. We simply indicate the required amounts in the payments, send and load the statement into the program. The very fact of transferring the amounts of insurance premiums from the account in the program is reflected in the document “Write-off from the current account.” In the case of paying a fixed part to the Pension Fund of the Russian Federation, the type of operation must be selected in the document: “Payment of tax”, the tax - “Fixed contributions to the Pension Fund of the Russian Federation”, the type of obligation - “Contributions, constant part”. In this case, the correct accounting account will be entered automatically.

So, an individual entrepreneur must pay insurance premiums in a fixed amount before December 31 of the current year. This can be done at different frequencies: quarterly, half-yearly, one amount at the end of the year, etc. In 1C: Accounting 8, an insurance premium payment assistant has been implemented, which will tell you the required payment amounts for a given period. This assistant is located on the “Operations” tab.

Personal income tax withheld from wages - posting

- tax deduction;

- resident or non-resident status.

- their income is subject to a personal income tax rate of 13%;

- belong to the category of disabled people (disabled people), Chernobyl survivors, veterans, relatives of disabled people and veterans, parents with children under 18 years of age and others;

- their income, cumulatively since the beginning of the year, does not exceed 280,000 rubles.

For residents, the personal income tax rate is 13%, and for non-residents - 30%. A non-resident who resides in the country for more than 183 days becomes a resident.

Important

A tax deduction is an amount by which the taxable amount or tax base can be reduced. There are many types of tax deductions; let's look at the standard type of tax deduction as an example.

We prepare transactions for the transfer of personal income tax

Nowadays, the state clearly sets deadlines and methods for introducing accrued amounts into the budget. It is mandatory to transfer the entire amount of accrued tax to the budget settlement account on the day of payment of wages or no later than the next day after the payment of wages or other income to an individual. The wiring looks like this:

- Dt 68 Kt 51. The documentary basis is the payment order and bank statements.

- Dt 68 Kt 50. Cash order, cash book, bank receipt.

In this case, the tax payment process can be combined. The transfer is made in non-cash form from a current account, or in some situations, money can be deposited into a budget account in cash through the bank's cash desk.

Sample tax payment order:

In 2021, a new form of personal income tax report 6 was introduced, which provides a summary of data on a legal entity. The company reports on this form in terms of the total amount of money paid to employees, the total tax deduction, the rate and personal income tax paid from the income of the company's employees.

To record calculations for personal income tax, account 68 “Calculations for taxes and fees” is used. This is a complex account that has a number of sub-accounts. To account for personal income tax, a “NDFL” subaccount is opened in accounting account 68.

Credit 68 of the account reflects the accrual of tax for payment to the budget, and the debit indicates its payment.

Depending on the type of income received by the employee, credit 68 of account corresponds with the debit of the corresponding accounts for accounting for settlements with personnel.

Calculation of personal income tax from wages:

Petrov received a salary for November of 20,000. The employee has two children, and his salary since the beginning of the year has not exceeded 280,000.

A 13% rate applies to wages. For each child, Petrov is entitled to a standard deduction in the amount of 1400. Read about tax deductions and rates here.

Tax = (20000 – 1400 – 1400) * 13% / 100% = 2236

Postings for accounting for personal income tax from salary:

D44 K70 – wages accrued for November (20000)

D70 K68.NDFL – personal income tax withheld from wages (2236)

D70 K50 – wages paid (20000 – 2236 = 17764)

D68.NDFL K51 – personal income tax transferred to the budget (2236)

Calculation of personal income tax on dividends:

The founder Petrov received income in the form of dividends in the amount of 30,000.

Dividend income is taxed at a rate of 9%, no deductions are applied to this rate.

Tax = 30000 * 9% / 100% = 2700.

Postings for accounting for personal income tax on dividends:

D84 K75 – dividends accrued (30,000)

D75 K68.NDFL – dividend tax withheld (2700)

D75 K50 – dividends paid (27300)

D68.NDFL K51 – NDFL transferred to the budget (2700)

Subaccounts 68 “Calculations for taxes and fees”

Example of a standard deduction. The employee has 2 minor children. His income for the year is 314,536 rubles. According to paragraph 4 of Art. 218 of the Tax Code of the Russian Federation, a deduction of 1,400 rubles is provided for the first two children. That is, an employee’s 2,800 rubles per month are not subject to income tax. Thus, for the year, not 214,536 rubles are subject to taxation, but 314,536 - (2,800 * 12) = 180,936 rubles.

An example of a social deduction. The parent has an annual income of 247,843 rubles. For his child, he paid 37,542 rubles for the year for his college education. Thus, the amount of personal income tax payable, based on their income, would be equal to 247,843 * 13% = 32,200 rubles. But, the tax deduction must be submitted from the amount for training - 37,542 * 13% = 4,880 rubles. That is, the parent will return this amount, and the state will actually be paid 27,320 rubles.

An example of a property deduction. The family bought an apartment for 1,748,532 rubles. Thus, the property deduction will be equal to 1,748,532 * 13% = 227,310 rubles. That is, the family can get back 227,310 rubles.

Example of a professional deduction. The individual entrepreneur incurred expenses in the amount of 69,452 rubles - this is confirmed by documents. His income for this period amounted to 214,589 rubles. Thus, he has the right to receive a tax deduction on confirmed expenses. Consequently, the individual entrepreneur will pay personal income tax on the amount 2 = 145,134 rubles.

Account 68 of accounting is an active-passive account “Calculations for taxes and duties”, which represents general information on settlements with budgets for taxes and duties paid by the enterprise and the taxes of its employees.