Who needs to provide a 2-NDFL certificate?

Certificate 2-NDFL will contain information about the income of individuals and the amount of personal income tax for the tax period.

The tax agent provides 2-NDFL certificates to the Federal Tax Service within the following deadlines:

| Help Feature | Sign | Submission deadline |

| Income is reflected regardless of personal income tax withholding | 1 | Until April 1 of the year following the reporting year |

| Income for which personal income tax is not withheld is reflected | 2 | Until March 1 of the year following the reporting year |

In addition to the Federal Tax Service, the tax agent or employer is obliged to provide a 2-NDFL certificate to the employee upon his written request.

Features of issuing a certificate in 2021

The procedure for issuing a 2-NDFL certificate is periodically adjusted. Let us note the main innovations that have appeared in the document in recent years:

- a place has appeared under the document for the signature of the person representing the interests of the tax agent;

- a new line has been introduced where the details of the document with the help of which the representative exercises his powers should be indicated;

- a numeric code has been introduced on the certificate form indicating who signed the document (the head of the organization - the tax agent or his representative).

All help sheets must be numbered in order if the number of pages in the document is more than one. The second and subsequent pages must contain the following inscription at the top: “Certificate of income of an individual for _______ year No. ___ dated ___________.” All pages must be signed by the responsible person of the tax agent.

Why do you need a 2-NDFL certificate?

Certificate 2-NDFL is required by the Federal Tax Service. From this document the tax authorities receive the following information:

- employee's salary;

- tax deductions;

- deductions that were made from the employee.

In addition to the Federal Tax Service, where the 2-NDFL certificate is provided by the employer or tax agent, this document can be requested from the taxpayer in the following cases:

| Situation | Who can request a certificate? |

| Getting a loan | An employee of a credit institution to confirm the income declared in the application form |

Receiving a tax deduction in the case of:

| Inspectorate of the Federal Tax Service |

| Change of place of work | New employer |

| Applying for a visa to travel abroad | Employee of a foreign state mission |

| Getting a mortgage loan | An employee of a credit institution to confirm the income declared in the application form |

In all cases, the form of the 2-NDFL certificate is unchanged; there are no specific features for filling out the certificate depending on the situation.

Why does a dismissed employee need a certificate of income?

Certificate 2-NDFL implies information about taxes withheld from a working citizen. That is, complete data on the amount of income that the employee received and how much money was withheld from him by the enterprise.

Obtaining a salary certificate upon dismissal is necessary in cases where a citizen needs to officially confirm his income:

- when applying for a new job . The accounting department of the new employer needs to see tax deductions from the previous place of employment. New deductions from income depend on this;

- for sick leave . Thanks to the data in the 2-NDFL certificate, the new management makes accruals while the employee is on sick leave;

- to receive unemployment benefits. If an employee contacts the employment service after dismissal, then a certificate is required to calculate benefits, which are based on the citizen’s average earnings;

- to obtain a loan or mortgage . Some banks may require salary documents to provide loans or apply for a mortgage;

- to the tax service . The inspectorate may request a certificate to clarify charges and receive certain deductions;

- to social security . The declaration is needed as proof that the family is low-income and has the right to receive certain benefits;

- to kindergarten or school . If a citizen has a small income, then with the help of a 2-NDFL certificate, he can receive benefits in the form of free meals for his children at school or kindergarten;

- to obtain a visa or new citizenship . People who do not have a formal income have less chance of obtaining a visa or citizenship. Therefore, an income document is necessary to complete these procedures;

- for court . Needed for labor disputes in court;

- for registration of maternity leave . To go on maternity leave and receive payments, the maternity leaver needs this certificate with data for the last two years.

The procedure for issuing a 2-NDFL certificate to an employee

In accordance with Art. 230 of the Tax Code of the Russian Federation, tax agents are required to issue to individuals, upon their applications, certificates about the income received by individuals and the amounts of tax withheld.

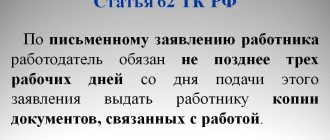

The deadline for submitting a 2-NDFL certificate is regulated by Art. 62 of the Labor Code of the Russian Federation and is no more than 3 days from the date of submission of the employee’s written application.

There are cases when an employee requires a 2-NDFL certificate for previous years - the employer is obliged to provide it. There is no statute of limitations that would limit the issuance of a certificate.

So, in order to obtain a 2-NDFL certificate:

| Worker | Employer |

| Must provide a written application for a 2-NDFL certificate | Must provide a 2-NDFL certificate within three days |

Statement

2-NDFL is issued by a tax agent (employer or state) to an individual (employee).

In this case, the employer may not be a legal entity, but is still obliged to issue the employee the required certificate, which will have legal significance equivalent to a certificate issued by a legal entity. A detailed description of tax agents is provided in Art. 230 Tax Code of the Russian Federation. The basis for issuance is the employee’s statement. Its sample is not established, the form can be arbitrary, in some cases an oral statement is sufficient.

In writing, the employee indicates correct information about himself and the period for which the certificate is needed, in years.

Actions of an employee in the event of an employer’s refusal to issue a 2-NDFL certificate

In some cases, the employer refuses to provide the employee with a 2-NDFL certificate upon his written request. Most likely the reason lies in the presence of tax or administrative offenses. In this case, it is recommended to send an application for a 2-NDFL certificate by registered mail with notification to the employer and, in the absence of a certificate, contact the labor inspectorate.

It should be remembered that failure by an employer to provide a 2-NDFL certificate upon a written application from an employee is a violation of labor legislation and entails administrative sanctions (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

| Violator category | Administrative punishment |

| Executive | Warning or fine 1000-5000 rubles. |

| Individual entrepreneur | Fine 1000-5000 rubles |

| Entity | Fine 30,000-50,000 rubles |

| In case of repeated violation | |

| Executive | Fine 10,000-20,000 rubles or disqualification for 1-3 years |

| Individual entrepreneur | Fine 10,000-20,000 rubles |

| Entity | Fine 50,000-70,000 rubles |

If the applying citizen is not a current employee of the enterprise, in relation to this case the effect of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation does not apply, but Art. 5.39 Code of Administrative Offenses of the Russian Federation. According to Art. 5.39 of the Code of Administrative Offenses of the Russian Federation, an unlawful refusal to provide a citizen with information, the provision of which is provided for by federal laws, untimely provision of it, or provision of knowingly false information shall entail the imposition of an administrative fine on officials in the amount of five thousand to ten thousand rubles.

How to obtain a 2-NDFL certificate in case of liquidation of an organization?

In the event of liquidation of the organization, the employee will not be able to obtain a 2-NDFL certificate from the former employer.

In accordance with the legislation of the Russian Federation, it is possible to obtain a 2-NDFL certificate as follows:

| Who requests a 2-NDFL certificate? | Procedure | A comment |

| New employer | Sending a request to the Pension Fund and the Federal Tax Service | The new employer is obliged to explain the need to obtain a 2-NDFL certificate without the participation of the employee (calculation of the amount of temporary disability benefits, tax deductions, vacation pay) |

| Insured person | Sending a request to the Pension Fund | The form was approved by Order of the Ministry of Health and Social Development of the Russian Federation dated January 24, 2011 No. 21n “On approval of the application form of the insured person to send a request to the territorial body of the Pension Fund of the Russian Federation for the provision of information on wages, other payments and remunerations, the form and procedure for sending request, form and procedure for submitting the requested information by the territorial body of the Pension Fund of the Russian Federation" |

| Insured person | Receiving information through the taxpayer’s personal account | On the website of the Federal Tax Service |

The company has been liquidated - where to get a certificate

When an organization or individual entrepreneur has already been removed from the register due to voluntary or forced liquidation, the following should be done.

Firstly, you should explain to the institution that requires the certificate that the former employer has been removed from the register of legal entities (or Unified State Register of Entities) and will not be able to issue the required document. If the new employer really needs the form, he himself can make a request to the tax office and the local branch of the Pension Fund and explain why the certificate is required. Most often, it is needed for the correct calculation of various payments and for processing deductions.

The employee himself has the right to make a request and respond to it. To obtain information, he should send an application to the Pension Fund. The form of the request is determined by order of the Ministry of Social Development of the Russian Federation dated January 24, 2011 No. 21n.

You can do it even simpler and get the necessary information from the “Personal Account” service running on the tax service website. However, before this, you need to make sure that the information in this form will satisfy those who require information about income and personal income tax.

How can an individual entrepreneur provide a 2-NDFL certificate?

An individual entrepreneur, in the case of payment of income subject to personal income tax, along with organizations, is obliged to provide a 2-NDFL certificate both to the Federal Tax Service and personally to the individual.

The legislation does not provide for a specific form of 2-NDFL certificate intended for individual entrepreneurs in case of confirmation of their own income. An individual entrepreneur has the right to draw up a 2-NDFL certificate, because calculates and pays taxes to the budget. In this case, an individual entrepreneur can confirm his income by providing a copy of a tax return or other documents containing information about receipt of income.

When can an employee receive a certificate?

In accordance with the current fiscal legislation, a 2-NDFL certificate is issued for each employee during the calendar year. All forms collected for employees of the organization must be submitted to the tax office for reporting purposes no later than the end of April of the year following the reporting year.

As for employees, they can request the provision of a certificate an unlimited number of times and at any time.

Such information may be required in accordance with the established form in the following cases:

- in order to obtain a loan or apply for a mortgage;

- when filling out a tax return;

- when applying for a new job;

- when applying for pensions and unemployment benefits;

- to receive financial assistance from the state;

- when applying for a visa and a number of other situations.

In this case, the employer does not have the right to refuse the employee to issue such a document only if it is necessary for the last 4 years, since the fiscal authority stores such information for 4 years. If information is needed for a longer period, then preparing it becomes somewhat problematic.

The execution of the document takes no more than 3 days after the relevant application has been submitted by the employee. In this case, the certificate can be prepared in several copies, each of which has equal legal force.

Also, a certificate in form 2-NDFL is required to be issued to an employee of an enterprise or organization upon dismissal.

How can people who are retired or unemployed get a 2-NDFL certificate?

Unemployed people registered with the Employment Center can obtain a certificate of income by submitting a written application directly to the Employment Center.

If a citizen did not work, was not registered as unemployed at the Employment Center, you should not count on receiving a certificate of income for one simple reason - there was no income and, accordingly, personal income tax was not calculated and paid.

Citizens receiving state pensions cannot apply for a 2-NDFL certificate, because Pension benefits are not subject to personal income tax.

If the employee is no longer working

The procedure for providing a certificate to a former employee is as follows. If the company has not been liquidated and less than four years have passed since the dismissal, then the employee can submit a written application in free form. If the liquidated enterprise no longer exists in the registers, then there are several ways to still draw up and issue the necessary document.

In the first case, the new tax agent (employer) requests information from local branches of the Pension Fund and the Federal Tax Service. The request must indicate the reasons why the certificate is needed. There is also the opportunity for an individual (employee) to view information about personal income tax in the “Personal Account” on the official website of the Federal Tax Service of Russia. This feature has been implemented since 2014; the functionality of the site is constantly being improved and becomes more and more convenient to use. Solving questions online allows you to save time in some cases.

Questions and answers

- We provided the Federal Tax Service and the employee with a 2-NDFL certificate. During the audit, errors were discovered, which we notified the tax authorities by sending an adjustment certificate. Is it necessary to provide a new certificate to the employee?

Answer: Yes, if an error is discovered in the 2-NDFL certificate, the employee must be provided with a new certificate in which the errors have been corrected.

2. I received income, but did not record it anywhere. What should I do to get a 2-NDFL certificate?

Answer: In this case, you need to fill out form 3-NDFL, calculate and pay personal income tax yourself. The tax return will be the document that confirms your income and the tax paid.

general information

Form 2-NDFL is present in almost every list of documents that is attached to applications for a tax deduction, for a loan, to confirm the right to social benefits, etc. For a person who is far from working with papers, it is not immediately clear what officials require of him. Decoding the abbreviation makes it easier to understand:

- Personal income tax (personal income tax) - shows that the document is related to the amount of earnings of employees and the amount of income tax withheld;

- number 2 - indicates the serial number of the form in the fiscal reporting album (for example, as of 2021, reports 3-NDFL, 4-NDFL and 6-NDFL remain relevant).

The procedure for compiling and providing data on cash receipts from citizens is approved by Federal Tax Service Order No. ММВ-7-11 / [email protected] Since 2019, it has divided such concepts as 2-NDFL and income certificate:

- Appendix 1 - describes form 2-NDFL, which is annually generated and submitted by employers to the Federal Tax Service in relation to the earnings of employees and the income tax paid for them;

- Annex 5 - defines the form that is issued at the request of the employee himself (for example, to receive a deduction, unemployment benefits or other payment).