Every citizen who has ever worked or is officially employed is required to pay taxes. Some are paid for by the employer, some have to be paid manually. And the most important thing when paying taxes is to navigate the documents well.

One of the most important documents when working with the tax authorities is the Form 2-NDFL certificate. This is a small document that contains data on both the citizen’s income and taxes paid. Our article will tell you how to obtain a 2-personal income tax certificate.

What is 2-NDFL

2-NDFL is an income statement confirming solvency. A document that indicates the source, amount of earnings and withheld income tax or, in official language, personal income tax. The same 13 percent that is plucked from wages (and other income) in favor of the state. The organization where to obtain a 2-NDFL certificate depends on the place of work, on whether the company currently exists and whether the applicant has an official job.

The certificate form was approved by Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected] BUT! Since 2021, the 2-NDFL certificate has been abolished (Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] ): for reports of legal entities, this data is included in the calculation of 6-NDFL, and for individuals a new certificate format has been introduced about income (required to confirm such for loans and other tasks).

It will be needed in the following cases:

- applying for a loan;

- change of place of work;

- registration of pension;

- filing a tax deduction return (for example, education deduction);

- obtaining a visa;

- labor dispute in court.

This is what it looks like in 2021 – the form is fixed:

Since 2021, its format has changed (simplified and shortened):

What is this document and where can I get it?

The contents of this document are not familiar to people who are just starting their professional activities. The main points of the certificate are devoted to taxes paid and profits received. If we talk about taxes, only personal income tax is taken into account, which has an interest rate of 13%. Amounts are described in rubles and kopecks, making the information especially accurate.

What is a certificate in form 2-NDFL

2-NDFL is one of the most common and most important forms of declarations. Millions of people send requests every day to obtain a document. It is an integral part of various financial transactions, including loans. A certificate is issued automatically when a citizen is fired.

It is better to constantly monitor the information in these certificates, because representatives of tax services constantly update documents.

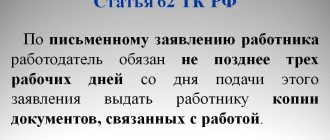

Contacting your employer is a classic way to solve the problem of obtaining a certificate. After the application, no more than 3 days should pass before the document is issued to the visitor.

To obtain a document, you will need to fill out an application; its form can be either simple or written. The manager, director or deputy are the most common recipients for such requests. In what cases is a document required:

- If necessary, accurately calculate your pension.

- When to apply for a visa to travel to other countries.

- When you want to apply for a tax deduction.

- In case of transfer to another place of work.

- When applying for credit loans. Even small amounts will not be approved without providing information about income.

Where to request 2-NDFL

There are two answers to the question of how to get 2NDFL: in the accounting department at your place of work or study. Provided that you are officially employed. It is issued for 1 year or for the period worked in the organization in a calendar year. It contains data:

- details of the organization where you work;

- personal data;

- official income for each month;

- tax deductions;

- The sum of all income, deductions, and taxes withheld.

The employer, as a tax agent, is obliged to prepare an income statement in exactly this form. With the seal and signature of the director. If a person does not have official employment, then a 2-NDFL certificate for unemployed citizens is not issued.

Where can I get a personal income tax certificate 2 if I work?

To answer the question of where to get personal income tax certificate 2, let’s get acquainted with the scope of application of this document. Citizens usually need a certificate of this form for:

- confirmation of work experience during a certain period, as well as the amount of income received during this period;

- filing with the tax authority in order to obtain a deduction for taxes and property;

- a report on the payment of income tax to government authorities in case of belonging (location) in different countries;

- submitting documents for a loan to the bank, which will allow you to get a more convenient interest rate on the loan by minimizing the bank’s risks and confirming the client’s solvency;

- travel abroad - to a visa center to confirm solvency;

- change of place of work - the employer can request this certificate in the package of documents, which is necessary for timely and accurate reflection of data in accounting;

- other cases.

The contents of the certificate reflect information about the employer, employee, controlling tax authority, amounts of employee income received and tax and other deductions from income.

How to get it from your previous job

If you once officially worked, then order the document based on a written application from the accounting department of your previous employer. And no matter in what relationship you part with your boss, he is obliged to provide the paper within three days. In free form, write your last name, first name, patronymic, official and real address of residence, passport details, personal account (TIN) and telephone number. Now it’s clear where to get a 2-NDFL certificate from a previous employer.

It is impossible to obtain data for the unemployed who are registered with the labor and employment bureau and for a private entrepreneur, since they are not considered employees. But if the entrepreneur is also employed, then it will be issued by the employer, and only by the former official boss to the unemployed.

If you changed your job or the organization was liquidated

In some cases, reporting prepared at old workplaces is required. For example, for a pension fund and other similar institutions. One solution is to obtain simple information using the Internet.

If you need a certificate issued officially in accordance with the law, you will have to contact the accounting department at your old place of work. The algorithm of actions remains the same as in the case of a regular place of work, which is still preserved. There should not be any difficulties in obtaining information.

In case of refusal, it is worth recalling that serious penalties are provided for such situations. This leads to the imposition of additional fines.

Receipt of 2-NDFL in case of liquidation of an organization

In some unusual situations, obtaining certificates is impossible. For example, if the old place of work was liquidated for one reason or another. Then you cannot do without contacting representatives of the tax service.

Through the taxpayer’s personal account

Registration on the nalog.ru website requires either a password issued by the Federal Tax Service or an account with government services. Before registering in your personal taxpayer account, make sure you have the data.

Personal account - a quick way? how to get 2NDFL without contacting the employer and the Federal Tax Service directly.

The functionality of the site allows you to request data in electronic form. This will take a couple of minutes. An electronic certificate is equivalent to a paper one; an electronic digital signature is placed on it.

Receiving algorithm:

1. On the main page of your personal account, select the “My taxes” section.

2. Click on the “Income Information” button.

3. You will see information about all employers and income received. To receive a document from the desired organization, click next to it the “Certificate on Form 2-NDFL with signature” button.

4. The download will begin in .zip format. to the computer, after which the document can be opened and printed.

How to correct a certificate

It doesn’t happen often, but it does happen that an error or inaccuracy creeps in during the preparation of a document. If this is discovered during an audit (either internally or externally), the tax agent’s responsibilities include preparing and issuing to the employee and sending to the inspectorate a corrected version of the 2-NDFL certificate. If you do not do this in a timely manner, you may fall under Art. 126.1 of the Tax Code of the Russian Federation, which provides for sanctions for distortion of information submitted to the tax service.

IT SHOULD BE NOTED! If a tax agent discovers an error on his own before the tax authorities find it, he will not be held liable.

In cases where the tax agent has recalculated personal income tax for previous tax periods, as a result of which the amount of income and the amount of tax have changed, a new certificate must be issued and sent to two addresses: to the Federal Tax Service and to the employee.

If personal income tax was paid to the budget, but was not withheld from the employee’s income, it is not indicated in the certificate. Likewise, income that is not taxed is not included in the document. If such data is included in the certificate, the document should be corrected.

But when the first edition of the certificate indicated personal income tax withheld from the employee’s income in an amount larger than required, after which the amount of the overpayment was returned to him, then the correct data must be provided in the new document. Let us remind you that the overpayment of tax must be returned to the individual within 3 months, no more.

***

A certificate in form 2-NDFL is a certificate about the amount of income of an individual and the amount of income tax withheld and paid by the tax agent for the taxpayer. The income indicated in the certificate can be paid either in cash or in kind.

2-NDFL is issued by the employer upon an oral or written request from the employee. The tax agent is given three days to prepare and issue the document. The applicant has the right to apply for any number of copies of the certificate, and he can apply for this document as many times as he needs. There are no provisions in tax legislation that restrict the applicant in this right.

In addition, the 2-NDFL certificate is also sent to the Federal Tax Service. This must be done by law before April 30 of the year that follows the reporting period. Moreover, the tax agent draws up a certificate for each employee of the enterprise or individual who worked under a separate contract.

The certificate form can be found on the Internet, on accounting portals, including ours. If you also need to fill it out, then this opportunity is provided by the official website of the Federal Tax Service, which contains a program that allows you to complete the full execution of the document with the details of the enterprise and the applicant.

It is necessary to issue certificates in form 2-NDFL to enterprises with a significant staff quite often. Therefore, accountants should take care in advance of the availability of the appropriate program and its correct operation.

If an employee intends to receive a certificate as soon as possible, we recommend that he submit a written application. In this case, the enterprise will need to strictly follow the three-day regulations.

Similar articles

- Applications for issuing a 2-NDFL certificate - sample and form

- Help 182-n: what is it for?

- Application for issuance of personal income tax certificate 2. Sample

- Who signs the 2-NDFL certificate?

- How long is a 2-NDFL certificate valid?

Receipt using the State Services portal

If a person does not have registration with the Federal Tax Service, but is registered with State Services, he will also be able to obtain a certificate.

Algorithm:

1. On the login page to your personal account, select the login method “Login through government services (USIA)” and enter the login and password of the registration record on the portal. If you are already authorized in the ESIA, you will log in immediately.

2. Following the algorithm described above, receive the document in the taxpayer’s personal account.

Deadlines for issuing an income certificate by the employer and its validity

The employer’s obligation to issue documents to the employee regarding the person’s employment is established in Art. 62 Labor Code of the Russian Federation. The list of documents specified in the article includes a certificate of income. The issuance period is set within 3 days. The period is calculated in working days. A certificate of income must be issued upon dismissal of an employee simultaneously with the payment on the last working day. Depending on the place of presentation, the validity period of the certificate differs.

| Place and purpose of the performance | Validity period |

| Federal Tax Service for applying for benefits | Has no restrictions |

| Credit institution for drawing up an agreement | Set by the bank itself and may depend on the type of lending, the most common period is within 1-2 months |

| Applying for a visa for a trip abroad | Within 30 days |

| Employment center for applying for benefits | No more than 1 year |

| Social services for help | Within the month following the previous one |

Changes for 2021

Previously, organizations compiled information about employee income for tax authorities and employees on one form. Starting from 2021, employers will issue forms using a new form. It was called “Certificate of income and taxes of an individual.” We have already mentioned this above.

For individuals, the form is familiar. And to tax authorities, information about the income of individuals is now provided by tax agent organizations (that is, those that make payments to individuals within the framework of labor or civil law relations) as part of the 6-NDFL calculation.

About the author of the article

Lidia Ivanova I am the editor-in-chief of the Sashka Bukashki website. More than 15 years of experience working with legal information.

Typical mistakes when filling out 2-NDFL

Error No. 1: Indication in the 2-NDFL certificate of abbreviated forms of surnames, first names, and patronymics of employees.

Comment: This is unacceptable; the full name must be indicated.

Error: The seal impression is placed on the document in a random order.

Comment: The location of the company’s seal on 2-NDFL is the lower left corner.

Mistake #2: The accountant signs with a pen with black ink and puts a stamp on top.

Comment: The accountant's signature must be affixed with a pen with blue ink and must not be hidden under the seal.

Error No. 3: Certificate 2-NDFL containing corrections is sent to the tax authority.

Comment: If mistakes were made when filling out the 2-NDFL certificate, you need to take a new form and fill it out again. Errors and corrections are not allowed.