16.09.2019

0

38

4 min.

When applying for employment, the employer and the person applying to occupy a vacant position in the team sign a written agreement, which provides for payment of wages twice a month. If a citizen has unfulfilled court decisions, then all his official income may be subject to foreclosure by order of FSSP employees. The exception is payments from which amounts under writs of execution cannot be withheld under any circumstances and regardless of the size of the citizen’s debts. They are regulated by Article 138 of the Labor Code. The employer (the head of the organization, a specialist in the accounting department) must do everything to implement the decisions of the FSSP employees, without violating the legal rights of employees.

On what grounds can up to 50% of salary be seized?

In accordance with the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ, up to 50% of the salary can be withdrawn on the basis of:

- court writs of execution;

Attention! From June 9, a copy of the writ of execution is a valid basis for deductions from wages.

- court orders;

- resolutions on administrative offenses;

- notarial agreements on the payment of alimony;

- orders of bailiffs.

At the same time, if there are several executive documents, it is not allowed to withdraw more than 50% of earnings for payments (Article 99 of Law No. 229-FZ).

Another comment to Art. 138 Labor Code of the Russian Federation

1. This article establishes the maximum amount of deductions from wages, limiting it to a certain proportion of paid earnings. These restrictions are intended to ensure the protection of wages, which are the main or even the only source of livelihood not only for the employee, but often for his family members, and thereby guarantee that wages fulfill their socio-economic function.

2. As a general rule, for each payment of wages, no more than 20% of the total amount for all types of deductions can be withheld. This withholding limitation applies in all cases unless otherwise provided by federal law.

Employer-mandated withholdings may under no circumstances exceed 20%.

3. The amount of deductions should not exceed 50% of wages in cases where deductions are made on the basis of an executive document. Executive documents mean the documents specified in Art. 12 of the Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings”: writs of execution issued by the courts; court orders; notarized agreements on the payment of alimony or their notarized copies; certificates issued by the CTS; acts of bodies exercising control functions on the collection of funds; judicial acts, acts of other bodies and officials in cases of administrative offenses; orders of the bailiff; acts of other bodies in cases provided for by federal law; writ of execution by a notary if there is an agreement on an extrajudicial procedure for foreclosure of the pledged property, concluded as a separate agreement or included in the pledge agreement.

4. Part 2 of the commented article introduces an additional restriction: if deductions are made on the basis of several executive documents, the total amount of deductions cannot exceed 50% of the employee’s earnings.

5. The amount of deductions should not exceed 70% of wages in cases where deductions are made when:

a) serving correctional labor on the basis of a court verdict;

b) collection of alimony for minor children;

c) compensation for harm caused to the health of another person;

d) compensation for damage to persons who suffered damage in connection with the death of the breadwinner;

e) compensation for damage caused by the crime.

6. In accordance with Art. 50 of the Criminal Code, when imposing a sentence in the form of correctional labor, deductions are made from the earnings of the convicted person in the amount of 5 to 20%. If, along with this, deductions are made for other reasons, then the total amount of deductions cannot exceed 70% of earnings.

7. In accordance with Art. Art. 80 and 81 of the Family Code of the Russian Federation (hereinafter - FC), if parents do not provide maintenance for their minor children, funds for the maintenance of children (alimony) are collected in court, and the amount of alimony is determined either by the share of earnings (1/4 for one child, 1 /3 - for two and 1/2 - for three or more, and this amount can be increased and decreased by the court taking into account the financial situation of the debtor, the children for whose maintenance alimony is being sought, and his other minor children), or in the absence of the debtor regular income in a fixed amount. Furthermore, in accordance with Art. Art. 100 and 103 of the SK, it is possible to conclude a notarized agreement on the payment of alimony, which must establish the amount of alimony for minor children no less than that provided for in Art. 81 SK. Thus, the amount of alimony collected for minor children may be equal to 50% of earnings. If other deductions are also made, their total amount cannot exceed 70% of earnings.

The increased amount of restrictions on deductions from wages applies to the collection of alimony only for minor children. When collecting alimony for the maintenance of other persons (disabled parents, spouses, adult but disabled children, etc.) on the basis of executive documents, the total amount of deductions cannot exceed 50% of earnings.

8. In accordance with Art. 1085 of the Civil Code, if a citizen is injured or his health is damaged, his lost income and additional expenses incurred in connection with this are subject to compensation. Compensation for this damage is made in monthly payments (Article 1092 of the Civil Code), which is possible only through deductions from wages. The total amount of deductions cannot exceed 70% of earnings.

9. In case of death of a citizen in accordance with Art. 1088 of the Civil Code, the right to compensation for property damage arising from this is given to dependent persons and certain other persons. The share of the deceased's income that the dependents received or had the right to receive for their maintenance during his lifetime is subject to compensation (Article 1089 of the Civil Code). The total amount of deductions from the wages of the tortfeasor in this case can also be up to 70% of earnings.

10. If the damage was caused by a crime, which should clearly follow from the content of the writ of execution, up to 70% of earnings are also subject to deductions.

11. In accordance with Art. 99 of the Federal Law “On Enforcement Proceedings”, the amount of deduction from wages is calculated from the amount remaining after taxes are withheld.

12. Part 4 of the commented article contains an additional restriction on deductions from wages, prohibiting them from being made from those payments that are not subject to collection in accordance with federal law. The list of such payments is established in Art. 101 of the Federal Law “On Enforcement Proceedings”. A number of them relate to wages or are paid by the employer. These include:

a) sums of money paid in compensation for harm caused to health or in connection with the death of the breadwinner;

b) compensation payments established by labor legislation (in connection with a business trip, with transfer, hiring or assignment to work in another locality; in connection with the wear and tear of a tool belonging to the employee; sums of money paid by the organization in connection with the birth of a child, with the death relatives, with marriage registration);

c) insurance coverage for compulsory social insurance (temporary disability benefits).

On what grounds is it possible to withhold up to 70% of salary?

Withhold up to 70% of the salary, according to Art. 99 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ, it is possible in the following cases:

- withholding of child support for minor children;

- compensation for personal injury;

- compensation in connection with the loss (death) of a breadwinner;

- compensation for damage resulting from a crime.

According to the norms of the Family Code of the Russian Federation dated December 29, 1995 No. 223-FZ:

- under a notarized agreement on the payment of alimony (Article 110 of the RF IC).

According to the norms of the Labor Code of the Russian Federation:

- when the debtor is serving a sentence (executive work) ( Article 138 of the Labor Code of the Russian Federation).

Commentary on Article 138 of the Labor Code of the Russian Federation

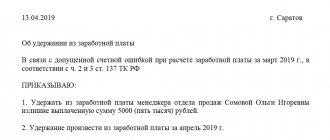

The list of grounds and amounts of deductions from wages is regulated by Articles 137 and 138 of the Labor Code of the Russian Federation.

According to the general rule set out in Article 138 of the Labor Code of the Russian Federation, deductions from wages made by the employer by virtue of the rights granted to him cannot exceed 20 percent of the wages due to the employee (minus personal income tax).

Other rules apply when deductions from wages are made under executive documents. In accordance with Federal Law No. 119-FZ of July 21, 1997 “On Enforcement Proceedings,” when executing a writ of execution, more than 50 percent of wages cannot be withheld from the debtor until the amounts collected are fully repaid. When deducting from wages under several executive documents, the employee must retain 50 percent of his earnings. These restrictions on the amount of deductions do not apply when serving correctional labor, collecting alimony for minor children, compensation for harm caused to health, compensation for harm to persons who suffered damage as a result of the death of the breadwinner, and compensation for damage caused by a crime. In the listed cases, the amount of deductions cannot exceed 70 percent of wages (Article 66 of the Law “On Enforcement Proceedings”).

Collection cannot be applied to sums of money paid:

1) for compensation for harm caused to health, as well as for compensation for harm to persons who suffered damage as a result of the death of the breadwinner;

2) persons injured (wounded, injured, concussed) in the performance of their official duties, and members of their families in the event of death of these persons;

3) in connection with the birth of a child; mothers of many children; single father or mother; for the maintenance of minor children during the search for their parents; pensioners and disabled people of group I to care for them; victims for additional food, sanatorium treatment, prosthetics and expenses for their care in case of harm to health; for alimony obligations;

4) for work in hazardous working conditions or in extreme situations, as well as for citizens exposed to radiation as a result of accidents at nuclear power plants, and in other cases established by the legislation of the Russian Federation;

5) organization in connection with the birth of a child, the death of relatives, and the registration of marriage (Article 69 of the Federal Law of July 21, 1997 N 119-FZ “On Enforcement Proceedings”).

Unreturned amounts due

The organization has the right to issue cash on account (including for travel expenses) in accordance with clause 11 of the Procedure for conducting cash transactions in the Russian Federation, approved by decision of the Board of Directors of the Bank of Russia dated September 22, 1993 N 40.

Within three working days after the end of the period for which the funds were issued (upon return from a business trip), the accountable person is obliged to submit to the organization’s accounting department an advance report on the expenses incurred, with supporting documents attached to it. The amount of accountable funds not returned by the employee within the prescribed period may be withheld from his salary. In this case, the amount of deductions cannot exceed 20% of wages (Article 138 of the Labor Code of the Russian Federation). If the employee’s debt is written off at the expense of the organization, then this amount should be included in the employee’s total income and personal income tax should be withheld from it.

Please note: the issuance of cash on account is carried out only if a specific accountable person fully reports on the advance previously issued to him. In this case, the transfer of cash issued on account by one person to another is prohibited.

For the amounts issued for the report, account 71 “Settlements with accountable persons” is debited in correspondence with the cash accounts. For the amounts spent by accountable persons, account 71 “Settlements with accountable persons” is credited in correspondence with the accounts that record expenses and acquired values, or other accounts depending on the nature of the expenses incurred.

Accountable amounts not returned by employees on time are reflected in the credit of account 71 “Settlements with accountable persons” and the debit of account 94 “Shortages and losses from damage to valuables.” Subsequently, these amounts are written off from account 94 “Shortages and losses from damage to valuables” to the debit of account 70 “Settlements with personnel for wages” (if they can be deducted from the employee’s wages) or 73 “Settlements with personnel for other operations” ( when they cannot be deducted from the employee’s wages).

Example.

The organization issues funds to the employee in the amount of 15,000 rubles. for the purchase of spare parts for routine repairs of equipment listed on the organization’s balance sheet. According to the manager’s order, the money was issued for a period of two days. The employee purchased the required spare parts from an individual entrepreneur for 11,800 rubles, including VAT of 1,800 rubles, and submitted an advance report. He attached a check, the counterfoil of a cash receipt order and an invoice to the report; in all documents, VAT is highlighted as a separate line. The balance of the accountable amount is RUB 3,200. at the employee’s request, it was withheld from his salary, which was issued two weeks later.

The following entries are made in the organization's accounting:

Debit 71 Credit 50

— 15,000 rub. — funds were issued from the cash register for the purchase of spare parts;

Debit 10 subaccount “Spare parts” Credit 71

— 10,000 rub. — spare parts purchased by the accountable person are capitalized;

Debit 19 Credit 71

— 1800 rub. — VAT included;

Debit 68 subaccount “Calculations for value added tax” Credit 19

— 1800 rub. — “input” VAT refunded;

Debit 94 Credit 71

— 3200 rub. - the amount not returned in a timely manner by the accountable person is reflected as a deficiency;

Debit 70 Credit 94

— 3200 rub. — the balance of accountable amounts not returned to the cash desk in a timely manner is deducted from wages.

What payments from an employer cannot be deducted for debts?

It is impossible to make deductions from most funds if the debtor himself receives them as legal compensation (Article 101 of Law No. 299-FZ). Such payments include:

- payments for health damage;

- payments in connection with the death of the breadwinner;

- payments received in connection with injury, as well as in connection with the death of a family member;

- payments from budgets of various levels to victims of man-made disasters, natural disasters and similar emergency situations;

- compensation for travel, expenses in connection with business trips and relocations for official reasons, purchase of labor tools (tools) at your own expense;

For more information about compensable expenses for business trips, see the material “How can I confirm expenses for renting an apartment for employees on a business trip?” .

- alimony received;

- benefits for childbirth, death, marriage;

- payment by the employer of the cost of vouchers to sanatorium-resort and health-improving institutions in Russia for an employee and his family members under 16 years of age;

- payment by the employer of the cost of travel to the place of treatment and back in cases provided for by law.

What is the procedure for deducting debts from wages?

After deducting taxes from the debtor’s salary, the employer makes the remaining deductions, taking into account the maximum limit, in the following order:

- in the 1st place: alimony; compensation for damage to health, for the death of a breadwinner, for damage in connection with a crime;

- in the 2nd place - other deductions (including in your own favor).

If the amount of the amount does not allow satisfying all the claims in the queue at once, then partial repayment for each claim is possible, distributed in proportion to the amounts specified in the executive documents (Article 111 of Law No. 229-FZ).

In this case, the remaining balances of debts for the month are carried over to the following periods and are summed up with payments due for these subsequent periods until all debts are repaid in full.

Article 138 of the Labor Code of the Russian Federation. Limitation on the amount of deductions from wages

To study the process of collection from income, you need to carefully read and study Art. 138 of the Labor Code of the Russian Federation. An employee who works well and does not violate the rules receives a salary, and the manager pays it on time and in full, with the exception of penalties based on court decisions.

It is important to know! The norm regulating the actions of employers to comply with the rules for making deductions from official receipts is Article 138 of the Labor Code of the Russian Federation.

The main types of deductions from wages are classified into the following categories:

- necessary (fiscal deductions, deductions by court decision);

- related to a person’s work, his job functions;

- produced at the will of the working person.

Which payments are withheld?

Penalties can be imposed on all official income of a citizen with the exception of the categories of transfers specified below. As a rule, social benefits and payments due to dependents (children, disabled people) remain unshakable.

If there are real reasons for reducing the monthly withheld amount, then it is recommended to make a request to alleviate the debtor’s financial situation. What can be attributed to really significant grounds:

- 50% of the debtor’s income is below the subsistence level;

- the debtor has minor or minor children as dependents.

Advice! The request is drawn up to improve the financial situation of the citizen. It is recommended that the document be submitted to the immediate bailiff.

The request requires a detailed description of the debtor's actual financial situation. It is recommended to provide links to regulations that were not taken into account by the FSSP employee and that resulted in infringement of the interests of the individual who applied. Documents confirming the debtor’s position should be attached to the request:

- salary certificate;

- documents on the person’s marital status;

- other documents.

The application is submitted in the following situations:

- when the debtor, after withholding, is left with an amount of money less than the subsistence level for subsistence;

- when the debtor finds it difficult to support himself and his family.

Which ones are not retained?

Penalties are not applied to the following types of income (Part 1, Article 101 of Law No. 229-FZ):

- amounts transferred for the purpose of compensation for harm to health;

- amounts paid in compensation for damage due to the death of the breadwinner;

- payments for transfers to existing vacancies, business trips;

- amounts transferred in connection with the occurrence of certain events;

- insurance coverage;

- child benefits;

- family capital;

- material aid.

What nuances are there regarding alimony?

When establishing alimony in a fixed amount, it must be indexed in accordance with the increase in the cost of living for the corresponding category of citizens in the region or in Russia (if the level of the cost of living has not been established for the region). On such indexation, a decree must be issued by the bailiff and a corresponding order from the one who makes the deductions (Article 102 of Law No. 229-FZ).

IMPORTANT! In terms of child support, deductions can also be made from temporary disability benefits, if there is a court decision or court order (subsection “c” of Article 82 of the RF IC, clause 2 of the RF Government Resolution No. 841 of July 18, 1996).

When transferring alimony, you must also take into account that the costs of the transfer must be paid by the debtor, and not by the organization transferring the alimony (Clause 3, Article 98 of Law No. 229-FZ).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for deducting debts from wages

The responsible FSSP officer receives a court decision. This is the official basis for starting the procedure for initiating enforcement proceedings. After this, he carries out a series of activities aimed at searching for assets and sources of income that should be foreclosed on first, second, and subsequently. As soon as the bailiff receives information about the income of a citizen, he sends the sheets to the location of the tax agent or the company that transfers the salary to the debtor in order to seize them.

The head of the organization or an accounting employee, after receiving the resolution of the FSSP bailiff, is obliged to register it and begin deductions from the person’s money in favor of the claimant by transferring funds to the account specified in the text (bank account). The procedure for executing the order of the FSSP specialist starts in the company from the moment the document is registered with the organization.

It is worth paying special attention that the employer cannot withhold money from benefits transferred through a card account opened in a financial institution into which the employee receives a salary, this is stated in Article 138 of the Labor Code of the Russian Federation “Limiting the amount of deductions from wages.”

Attention! If an employee does not agree with the amount of deductions, he can write a letter of complaint to the bailiff.

In practice, there is no approved format for an application to reduce debt, which is written off monthly from the debtor’s income. In fact, there are unspoken rules for the content of the request, which include the following data:

- in the upper right corner the position of the responsible FSSP employee, the name of the FSSP unit, the surname, name and patronymic of the bailiff to whom the request is addressed are indicated;

- in the upper right corner, below the addressee's data, the surname, first name, patronymic, registration address of the applicant, method of contacting him in the form of a mobile phone number, email are indicated;

- the name of the request is written in the center of the sheet;

- the essence of the appeal is written on the red line or in a new paragraph with reference to the document that is the basis for writing off the money;

- a red line or a new paragraph indicates a link to a regulatory document confirming the real grounds for writing a sample application to bailiffs for debt reduction;

- the wording of the request to reduce the percentage of monthly deduction is written on the red line or in a new paragraph;

- at the end of the request, a list of attached documents is written;

- Below is written the date, month, year of writing the request, signature and full name of the individual who applied.

An application to bailiffs to reduce debt is written on an A4 sheet in compliance with the recommendations stated above. This will help ensure a prompt response from the bailiff to take measures to alleviate the financial situation of the debtor. The request must be submitted to the FSSP office.