Salary in accounting: basic operations

Payroll accounting is carried out within the framework of the following main operations:

- payroll;

- personal income tax withholding and salary contributions;

- making other deductions (for example, alimony under writs of execution);

- salary payments (advance, main part);

- payment of taxes and wage contributions to the budget.

These business operations may be supplemented by others, which are determined by the peculiarities of the production process at the enterprise. For example, by depositing salaries.

Each of the noted transactions must be reflected in the accounting registers. They are carried out at different times, which can be determined based on the specifics of tax accounting at the enterprise and the requirements of labor legislation.

Let's study how the timing of the noted transactions for accounting is established, as well as what entries are used when calculating and paying wages.

Features of tax calculation

The main types of income for which personal income tax must be withheld are all kinds of accruals under an employment and civil service agreement. This list includes not only direct wages, but also bonuses, allowances, and some compensation received. Special formulas are used to calculate payments.

However, personal income tax postings are made in the following situations:

- when calculating salaries;

- when deducting tax;

- when issuing wages;

- after transferring the personal income tax amount to the budget.

If an organization has employees who are periodically sent on business trips, they are entitled to appropriate travel allowances, which are also taxed (subject to the legal limit).

So, after deduction of personal income tax, the posting is completed in accordance with the appropriate procedure.

In the situation with travel expenses, several types of postings are provided:

- when issuing an advance to an employee for travel expenses;

- when calculating expenses;

- if personal income tax is assessed on amounts for business trips that exceed the norm;

- After the personal income tax is transferred to the budget, the posting is also done.

If you purchase any services from an individual, you may also need to make tax payments. In this case, the organization must deduct the appropriate amount and provide the seller with funds, taking into account the payment of personal income tax. In such a situation, wiring is also done:

- when the product or service was purchased from an individual;

- posting when withholding personal income tax;

- when transferring personal income tax to the budget;

- when transferring the amount for services or goods to the seller.

When personal income tax has been assessed on the amount, the posting of its deduction and transfer to the treasury is mandatory. After all, entities that transfer income to individuals, as a general rule, simultaneously become tax agents. Accordingly, their responsibilities include withholding and remitting tax payments.

Labor compensation accrued: postings

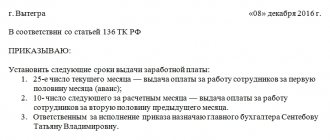

Salaries must be paid at least every half month. For example, until the end of the current month for the first half and until the middle of the next month for the second half. Thus, the generally accepted approach is that the components of salary are:

- An advance paid before the end of the billing month.

Accounting records only reflect the fact of payment of the advance (later in the article we will look at the entries used for such purposes).

- The main part of the salary paid at the end of the payroll month.

If wages are accrued, the posting is as follows: Dt 20 Kt 70 - for the amount of wages for the entire month (regardless of the amount of the advance payment transferred).

In this case, the posting can also be generated by debit of accounts:

- 23 - if the salary is intended for employees of auxiliary production;

- 25 - if salaries are transferred to employees of industrial workshops;

- 26 - if the salary is accrued to management;

- 29 - when calculating wages to employees of service industries;

- 44 - if salaries are paid to employees of trade departments;

- 91 - if the employee is engaged in an activity that is not related to the main one;

- 96 - if the salary is calculated from reserves for future costs;

- 99 - if payments are calculated from net profit.

The salary accrual date is determined based on tax accounting standards, according to which salaries are recognized as income only at the end of the billing month (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Postings for personal income tax

Despite the fact that the payer of personal income tax is an individual, that is, the employee himself, the obligation to pay this type of tax falls on his employer instead of him.

That is, the employer is a tax agent.

In accordance with the above, the company must take into account all expenses of this kind, which must be reflected in the financial statements.

This term in accounting refers to the process of registering business transactions carried out at any enterprise or organization on paper.

That is, a report is generated that displays mainly two operations:

- Loan operations

- Debit transactions

It is thanks to the principle of double entry that accounting has the opportunity to accurately draw up a report, carry out accounting and not miss a single business transaction that can be carried out in a given organization or enterprise.

As for the personal income tax entries themselves, they are also compiled taking into account transactions, both credit and debit.

Talking about credit

, refers to payments that must be paid, and the debit reflects the amounts already paid to the employee.

The debit also includes accrued taxes.

.

If account 70, called “Settlements with personnel for wages”, is used to record an employee’s salary at enterprises, then the tax, in particular personal income tax, is calculated and accounted for using account 68.

It is called “Calculations for taxes and fees”.

Postings for withholding and paying personal income tax

The withholding and payment of personal income tax tax is shown in the debit of account 68, since the credit of account 80 reflects the accrual of this tax along with the individual’s profit accounts.

Example of personal income tax calculation on dividends

Personal income tax must be withheld and paid not only from wages, but also from income such as dividends.

Dividends are income received by the founders of a particular organization from its profits

.

Naturally, tax must be deducted from them, as from any income. From individuals who are founders - personal income tax.

Before considering an example of posting personal income tax on dividends, it is necessary to understand the rates of this tax for founders of organizations.

Since 2015, the personal income tax rate on dividends has increased from 9% to 13%.

Thus, for example, the founder of a company receives dividends from it in the amount of 100,000 rubles. 13% of 100,000 rubles is 13,000 rubles.

That is, personal income tax for this founder is 13,000 rubles. The accrued income will be equal to dividends minus the amount of tax, namely 87,000 rubles.

Postings for withholding personal income tax from dividends

Now you need to sort out the postings for withholding personal income tax from dividends:

- Dividends accrued

– 100,000. Debit – 84. Credit – 75. - Taxes withheld

– 13000. Debit – 75. Credit – 68 - Dividends paid

– 87000. Debit – 75. Credit – 50 - Tax payable

transferred to the budget - 13000. Debit - 68. Credit - 51

An example of calculating personal income tax on interest received on a loan

When receiving a short-term or long-term loan/credit, each borrower is required to pay certain interest to his lender. Hence the conclusion: income received from providing a loan to a third party must also be taxed.

In particular, such profit is taxed with the help of personal income tax.

Personal income tax on interest received on the loan is charged at the rate of 13%.

It is best to consider the calculation of personal income tax on interest received on a loan using an example.

Let's say an organization took out a loan in the amount of 100,000 rubles. The interest on this loan will be 5,000 rubles.

Taking into account the tax rate and the amount of interest, it is necessary to calculate how much of these five thousand rubles will constitute and be withheld as personal income tax. To do this, multiply 5,000 rubles by 13 percent and divide by one hundred percent.

Thus, it turns out 650 rubles. This is the amount of tax that must be withheld from the lender.

Using accounting entries, this is depicted as follows:

- The transaction name column displays the receipt of a short-term loan

. The amount in our case is 100,000 rubles. Debit – 50. Credit – 66 - The name of the operation is interest accrued

. Amount – 5000. Debit – 91. Credit – 66 - Accrual of personal income tax on interest received on a loan

. Amount – 650. Debit – 66. Credit – 68 - Return of funds received as a loan

. Amount – 105000. Debit – 66. Credit – 50 - Transfer to the personal income tax budget from interest received on the loan.

Amount – 650. Debit – 68. Credit – 51.

This is approximately how accounting reporting is carried out for a company that, in this case, received a loan in the amount of 100,000 rubles.

An example of calculating personal income tax from wages

Under current law, deductions may be made from an employee's wages.

There are 3 types of them:

- Mandatory

- At the request of the employer/enterprise/firm

(for example, for marriage) - At the request

of the workers themselves

The former primarily includes personal income tax. That is, personal income tax in the amount of 13% is withheld and paid to the budget from the employee’s salary on a monthly basis. Moreover, as a result of withholding tax from an employee, his employer forms a debt to the budget. Therefore, in order to avoid confusion, such operations at each enterprise are also accompanied by accounting entries.

It is necessary to look at an example of how personal income tax is withheld.

For example

, the employee was paid a salary of 50,000 rubles.

This includes: wages, all bonuses, additional payments for overtime hours

.

Of these, it can be assumed that he is entitled to a standard deduction in the amount of 3,000 rubles

.

The standard deduction is not taxed, as a result of which the tax base in this case is reduced by 3,000 rubles and amounts to 47,000 rubles.

Calculating 13% of this amount

, we receive personal income tax in the amount of 6110 rubles. Thus, this employee will receive a salary of not 50,000 rubles, but 43,890 rubles.

Postings for calculating personal income tax from salary

In order to depict the postings for the payment of wages and the withholding of personal income tax from them, accountants use account 70 called “Settlements with personnel for payment of labor”:

- The name of the operation

is payroll. Amount – 50000 - Tax withholding

. Amount – 6110 - Payment of wages.

Amount – 43890 - Transfer of taxes to the budget

. Amount – 6110

Deductions from wages – personal income tax

Deduction from wages is the collection and withholding of mandatory payments, such as personal income tax, as well as deductions at the request and initiative of the employer, at the request of the employee.

Since personal income tax is a mandatory deduction from an individual’s salary

, the current tax legislation

obliges employers to withhold this type of tax

, acting as a tax agent.

When withholding personal income tax, standard deductions are not taken into account, the right to which is granted to persons specified directly in the Tax Code of the Russian Federation.

For example,

A person with one or two children is entitled

to a standard deduction , and more than two children in the amount of 3,000 rubles.

Thus

, for the purpose of uniform, systematized and competent registration of all business transactions at any enterprise, accounting entries are used, with the help of which deductions are made from the salaries of employees of a particular organization.

The main type of mandatory withholding is personal income tax, the rate of which is established in the Tax Code of the Russian Federation and is 13%.

Personal income tax is calculated without taking into account deductions. Postings for personal income tax are made to account 68. When calculating, debit and credit, the name of the transaction, and the amount of the transaction are displayed.

Deductions from wages are divided into three groups: mandatory (prescribed by law), at the initiative of the employer (also regulated by labor law), at the request of the employee. Let's look at the main typical entries for salary deductions.

Mandatory withholdings include taxes on employee income - personal income tax. Different categories of employees have their own tax rate.

Reflected by wiring:

- Debit Credit 68 Personal Income Tax

.

Is issued by the entry:

- Debit Credit 76

.

Payment of withheld obligations in favor of the claimant is made in a writ of execution or within three days and is recorded by recording:

- Debit 76 Credit

.

Transfer costs are borne by the employee (bank commission, etc.).

Example of postings: personal income tax withheld from wages

In the amount of 35,000 rubles. He is a resident, the personal income tax rate is 13%. Alimony in the amount of 7,000 rubles is withheld from him monthly.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 35 000 | ||||

| 68 personal income tax | 4550 | Payroll statement | ||

| 76 | Child support withheld | 7000 | Performance list | |

| 66 | Monthly repayment of loan debt | 112 500 | Payment order ref. |

Calculation of salary taxes and contributions: accounting features

Immediately after payroll is calculated:

1. Personal income tax

The fact of calculation and withholding of personal income tax is reflected in the accounting registers by posting Dt 70 Kt 68.

If a personal income tax deduction is applied to wages, then it does not need to be reflected in accounting.

2. Insurance premiums.

The fact of their accrual is reflected by posting Dt 20 Kt 69.

As in the case of salary postings, correspondence can also be generated by debits of such accounts as 23, 25, 26, 29, 44 and others that we discussed above.

The accrual of personal income tax and contributions is shown, like the accrual of wages, on the last day of the month.

Personal income tax and contributions are calculated on the total amount of salary without any adjustment for the advance payment.

From November 30, 2020, the cashier is not required to require a passport from the recipient of funds to identify him.

When the salary is issued, the postings will be as follows.

Withheld personal income tax posting

No. Contents Dt Kt Primary document 1 Personal income tax under GPC agreements 76 68 GPC agreement 2 Personal income tax on interest on short-term loans from individuals 66 68 Loan agreement 3 Personal income tax on salary 70 68 Tax accounting register 4 Personal income tax when renting premises from an employee firms 76 68 Lease agreement 5 Personal income tax on financial assistance to an employee 73 68 Employee application 6 Personal income tax on dividends 75 68 Protocol 7 Personal income tax on interest on long-term loans from individuals 67 68 Loan agreement We correctly reflect the deduction of personal income tax from wages The main task of an accountant in the accounting department of an enterprise is the correct calculation of earned income, vacation pay, sick leave, night pay, compensation payments, various allowances, financial assistance and the accurate withholding of tax from this income.

- Postings for withholding and paying personal income tax ⇩

- Example of personal income tax calculation on dividends ⇩

- Postings for withholding personal income tax from dividends ⇩

- An example of calculating personal income tax on interest received on a loan ⇩

- Postings for withholding personal income tax from loan interest ⇩

- An example of calculating personal income tax from wages ⇩

- Postings for accrual and deduction of personal income tax from salary ⇩

- Classification of rates and income to which they apply ⇩

- free consultation v

Salary issued (reflected on the employee’s personal account): postings

The fact of salary payment is reflected in accounting by posting Dt 70 Kt 51 (or 50).

A similar posting is used when paying an advance.

The date of formation of the above posting for salary or advance payment is determined based on the date of each payment.

In this case, the actual amount of the “basic” labor payment is calculated minus the advance and personal income tax. It turns out that the tax is “withdrawn” from the corresponding amount, although it is charged on the total salary (the summed amount of the “basic” payment and advance payment). This circumstance reflects the specifics of tax accounting.

In accounting, therefore, in any case, the following should be distinguished:

- advance amount;

- the amount of the “basic” payment.

Postings of payment of wages in terms of the advance and its second half are recorded in the accounting registers on the day the funds are issued to employees.

After all the transfers, the employees’ personal payroll accounts are filled out (on Form T-54). Information is entered into them monthly.

Payment of taxes and contributions: postings

Personal income tax is withheld and transferred from the paid salary (“main” payment) no later than the day following the day the funds are issued.

Contributions are transferred by the 15th day of the month following the month for which the salary was accrued.

Information about this is reflected in the accounting registers when transactions are activated:

- Dt 68 Kt 51 - tax paid;

- Dt 69 Kt 51 - contributions transferred.

In order to reflect in accounting information about other types of labor payments - vacation pay, travel allowances - the same correspondence is used. But you need to keep in mind that in the entries used in payroll and those that characterize the issuance of, for example, vacation pay, the dates of deduction and calculation of personal income tax are determined differently.

The fact is that personal income tax on vacation pay is calculated not at the end of the month, but at the time the vacation is paid. Tax is withheld on the day the funds are issued to the employee. Personal income tax on vacation pay can be transferred on any day before the end of the billing month (clauses 4, 6, article 226 of the Tax Code of the Russian Federation).

Withholding of personal income tax is reflected by posting

The main tax by which the state regulates income received by individuals is the personal income tax, which is calculated and paid in accordance with Chapter. 23 h. Submission of SZV-M for the founding director: the Pension Fund has made a decision. The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder. So, for such persons you need to take both SZV-M and SZV-STAZH!

When paying an employee funds for a business trip above the established daily allowance (by order of the manager), the income received is subject to personal income tax at a rate of 13%. Accrual of travel allowances and deduction of personal income tax, the posting will be reflected in the memorial order as follows: Debit Credit Transaction 71 50 (51) Advance issued to the employee for future expenses 44 (20, 26) 71 Accrued amount of travel allowances 70 68 Accrued income tax on the difference between the established daily rate and issued to the employee in the amount of 68 51 Tax transferred to the State Budget Penalty for non-payment of personal income tax Personal income tax entries on dividends Reflection of entries in accounting for the payment of dividends and the accrual of personal income tax entries will depend on whether the founder is an employee of this organization or not. In the case when the founder works at this enterprise, account 70 will be used, if he is not an employee of the company - account 75.

Salary deductions: postings

Common types of salary deductions include:

- Withholding of alimony (based on writs of execution, based on an agreement with the recipient, at the request of the employee).

In the accounting registers it is reflected by posting Dt 70 Kt 76. Subsequent payment of alimony to the recipient is reflected by posting Dt 76 Kt 51 (50).

- Withholding amounts to compensate the employer for damages.

Here, to reflect deductions in accounting, posting Dt 70 Kt 73.2 is used.

- Retention of unconfirmed expenses issued for reporting.

In such cases, posting Dt 70 Kt 94 is used. Previously unreturned accounts are written off using posting Dt 94 Kt 71.

Deductions are made only after personal income tax is withheld from the employee’s salary (clause 1 of article 210 of the Tax Code of the Russian Federation, clause 1 of article 99 of the law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ).\