Account 04 “Intangible assets” is used in accounting in accordance with the standards prescribed in PBU 14/2007. It reflects the assets of legal entities that meet several conditions:

- it is impossible to sense the physical presence of assets, they do not have a material form;

- the result of their exploitation is profit;

- the enterprise has legal grounds to consider the object its property;

- the asset can be identified and valued and is not expected to be offered for sale within the next year.

Characteristics of account 04 “Intangible assets”

Intangible assets (IMA), in accordance with clause 4 of PBU 14/2007, include scientific research, literary works, computer software, inventions, brand, know-how. Separately, business reputation is distinguished as part of intangible accounting objects.

The answer to the question whether account 04 is active or passive is clear – active. Acceptance of objects for accounting is reflected in debit, and disposal is recorded in credit. When an intangible asset arrives at an enterprise, intermediate entries are made in accounting with the participation of account 08, from the credit of which, at the time the object is fully ready for operation, the cost of the intangible asset is written off to debit 04.

The characteristics of account 04 assume that intangible assets are reflected in accounting at their actual cost. It is formed from the costs of acquiring or creating an object, the costs of its delivery, customs duties and commissions of intermediaries of the purchase and sale transaction. VAT amounts are not included in the cost of intangible assets.

There are no sub-accounts for systematizing intangible assets; if necessary, you can introduce your own system of analytical accounting of intangible assets and consolidate it in the working chart of accounts. Account 04 accumulates information about objects with a long period of operation. They may be subject to depreciation, with the exception of assets with an indefinite useful life. No more than once a year, additional valuation or depreciation of intangible assets is allowed.

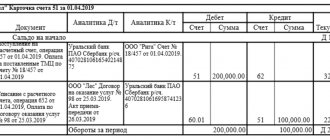

Accounting for account transactions 04.05

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 4 of 7Next ⇒

Account 04 is intended to summarize information about the presence and movement of intangible assets of the organization, as well as about the organization’s expenses for research, development and technological work. Intangible assets are accepted for accounting in account 04 at their original cost. The acceptance of intangible assets for accounting is reflected in the debit of account 04 in correspondence with account 08. When intangible assets are disposed of (sold, written off, transferred free of charge, etc.), their value recorded in account 04 is reduced by the amount of depreciation accrued during use ( from the debit of account 05). The residual value of disposed objects is written off from account 04 to account 91 “Other income and expenses.” The organization’s expenses for research, development and technological work, the results of which are used for the production or management needs of the organization, are taken into account on account 04 apart. Intangible assets include exclusive rights to intellectual property that are used in the production activities of the organization for more than one year and the business reputation of the organization, that is, the difference between the purchase price of the organization and the balance sheet value of all its assets and liabilities on the date of acquisition. An intangible asset does not have a tangible structure, but you must have a document confirming your organization's exclusive right to this asset. If your organization acquired an intangible asset, then you must account for it on the balance sheet at its original cost. The initial cost is the amount of actual costs for the acquisition (creation) of an intangible asset. D08K60.76 – costs associated with the acquisition of a non-material asset are taken into account, D19K60.76 – VAT on the costs of its acquisition is taken into account, D04K08 – a non-material asset is accepted for accounting, D68K19 – tax deduction. Receiving a non-material asset as a contribution to equity capital: D75-1K80, D08K75-1, D04K08. Receipt of nematode stock free of charge D08K98-2. Costs associated with the maintenance and servicing of intangible assets (as well as other production property) include the cost of products, work or services: D 26 (20, 44, ...) K76. Transfer of non-material assets to the authorized capital of another organization: D05K04 - the amount of accrued depreciation is written off, D58-1K04 - transfer of a non-material asset as a deposit in the management company, D19K68, D58-1K19 - restored VAT is reflected in the composition financial investments, D58-1K91-1 - the excess of the value of a non-material asset over its remaining value or D91-2K58-1 - the excess of the remaining value of a non-material asset over the cost, agreed oh establishment. Account 05 is intended to summarize information on depreciation accumulated during the use of the organization's intangible assets. The accrued amount of depreciation of intangible assets is reflected in accounting under the credit of account 05 in correspondence with the accounts of production costs (sales expenses). Upon disposal ( sale, write-off, transfer free of charge, etc.) of intangible assets, the amount of depreciation accrued on them is written off from account 05 to the credit of account 04. Depreciation is the gradual transfer of the value of an intangible asset to the cost of production (work, services). Depreciation is charged for each intangible asset monthly, starting from the month following the month when you accepted the intangible asset for accounting, that is, after you made the posting: D04K08 - the intangible asset was accepted for accounting. Methods for calculating amortization of intangible assets: 1) linear - its even accrual during the useful life of the intangible asset 2) reducing balance method. Formula: amount of monthly depreciation deductions = (initial or remaining cost of a non-material asset – Amount of accrued depreciation) * Coefficient, which cannot be more than 3 / Remaining useful life in months 3) method of writing off the cost based on the volume of production (work). For tax purposes, there are two methods of depreciation of intangible assets - linear and non-line. The method of calculating depreciation must be reviewed annually.

Question 42: accounting for transactions on account 10 “materials” Materials of an organization can be accounted for either at actual cost or at accounting prices. K fact. Costs include: the amount of money paid to the supplier, technical requirements, expenses to bring the mats to a condition in which they are suitable for use. TZR includes: transportation costs, packaging, cat. paid to intermediaries of the organization, expenses for business trips associated with the purchase of mats. These organizational expenses can be taken into account by 3 joint ventures; they must be fixed in the accounting policies. Methods: 1). Includes costs in the actual cost of the material. This method is used by organizations with a small range of materials. With this method, expenses are recorded on the same account as purchased materials. 2).reflection of goods and materials on a separate sub-account to account 10, in this case, the organization needs to determine the amount of goods and materials, which is subject to write-off when transferring materials to the province. 3). TZR are accounted for on account 15. In accordance with PBU No. 5, materials can be written off in the province in 3 ways: 1).FIFO method 2).At the cost of a unit of material 3).At the average cost. The “FIFO” METHOD assumes that materials received earlier than others are transferred to the province first. If the mats are purchased in batches, then the 1st batch is first transferred to the province, then the rest. When writing off values using the average cost method, the accountant needs to determine the average cost of materials. AVERAGE ST-b = (cost of materials at the beginning of the period + number of received materials)/(number of materials at the beginning of the period + number of received materials. By the method -ti of each unit, materials used in a special order are written off. If surplus material assets accumulate in an organization, then the organization can sell them. In this case, it is necessary to reflect in the accounting system => records: 1). Dlhod D62 K91-1, 2). VAT D91-2 K68-3, 3). Seb D91-2 K10, 4). Payment D50.51…K62.5). VAT paid D68-3 K51.6). Determined Finnish result D91-1 K91-9, D91-9 K91-2, D91-9 K99 Pb, D99 K91-9 Ub., if main type , then instead of 91 it is 90.10-41. If the organization transfers the materials free of charge, then it is necessary to reflect => entries: D91-2 K10 - written off the materials; D91-2 K68-VAT; D68 K51-VAT paid; D91-9 K91-2; D99 to 91-9. Losses from the gratuitous transfer of material assets are not taken into account when taxing profits. The receipt of material values is reflected in the receipt order and in the warehouse accounting book. When making an inventory of material assets, an act of goods and materials of assets and an inventory list are drawn up. If there is a discrepancy between the actual availability of property and accounting data, a matching statement is drawn up. D94 K10 - shortage reflected; D20 K10 - the shortage of materials was written off within the limits of the norms of natural loss; D73-2 K94 - the shortage is attributed to the guilty person; D70,50,10 K73-2 - damages are compensated; D73-2 K98 - the excess of the amount of damage over its actual amount was determined; D98 K91-1 - the difference between the amount of damages recovered and its actual amount is taken into account as other income.

43. Accounting for transactions on accounts 15 and 16. Account 15 is auxiliary and is used only when materials are accounted for at accounting prices. The accounting price is set by the organization itself. The fact of self-estimation of values is reflected by the entry: D15 K60. The capitalization of material at the accounting price is reflected by entry D10 K15. The deviation between the actual cost price and the accounting price is reflected using account 16. D15 K16 - written off in excess of the accounting price over the actual cost (savings), or D16 K15 the excess of the actual cost price over the accounting price is written off. Account 16. Write-off of deviations in the cost of inventories is reflected according to the formula (s D debit balance on account 16 at the beginning of the month + about D16/sD 10.41 + about D10, 41) * Cob 10.41. The write-off of deviations in the cost of materials is reflected in the entry D20, 23 K16. The deviation in the cost of mat values is reflected using 91 accounts. D91.2 K16.

45. accounting of goods. Goods in the organization's accounting system can be accounted for at actual cost (account 41), at accounting prices (account 15), at sales prices with use. invoices (42 trade margins) and purchase prices. At purchasing prices, goods are recorded by wholesale trade organizations and production organizations. Organizations selling goods at retail can take into account the goods as in fact. cost and at sales prices. Actual The cost of goods consists of the sum of all costs associated with their acquisition. The organization's inventory can be accounted for both on account 41 and on account 44; the chosen method must be fixed in the accounting policy. The receipt of goods is reflected by the following records: purchase D41 K60 D19 K60 - VAT accounting, D68 K19 D60 K 50.51 - contribution to accounting , D41 K75.1 D41 K98 SALE D62 K90.1 - revenue D90.2 K41 - cost D90.3 K68- VAT accrual D50.51 K62 payment Special procedure for transfer of ownership D45 K 41 - cost price D50, 51 K62D90.2 K45 - write-off from the balance sheet D90 K68 - VAT Financial investment in UKD58 K41-shortage D94 K41D73.2 K94D50, 70 K 73.2 Goods can also be written off for own needs D44, 22 K41Organizations can also account for goods at accounting prices using account 42. The trade margin includes the amount of VAT and the income of the trading organization. The amount of the trade margin is reflected in the entry D41 K42. The amount of the trade margin on disposed goods must be written off. Write-off upon sale, the amount of the trade margin on goods sold is reversed in correspondence with account 90.1) D90.2 K42 - using the red reversal method. Write-off of sales. 2) Markdown of goods. The amount by which it is necessary to mark down the goods must be reflected in the entry D41 K42 – reversal. The excess of the markdown of the goods, over the amount over the amount of the trade markdown incl. Includes other expenses D90.2 K41 Increase in markdown of goods by the amount of markup.

46 questions Accounting for equity capital . To successfully conduct business, each organization must have material assets, cash and other assets, the totality of which is usually called the capital of the organization. Sources of formation of economic assets are: Own and borrowed sources. Own sources of the formation of household assets comprise the organization's own capital, which takes into account: authorized capital, additional, reserve, undistributed approx. Accounting for authorized capital.

The management company is a start-up capital, which is invested in stages during the formation of an organization to ensure the initial production activities of the organization, with the aim of making a profit.

Forms of management companies: 1) share capital (in general partnerships and limited partnerships); 2) Mutual fund in production cooperatives; 3) Criminal Code (in OJSC; LLC) 4) Authorized Fund (in state and municipal organizations). There are 80 assets on the account. Accounting for the deposit will be based on their initial cost. Entries on account 80 can be carried out. When forming and changing the Criminal Code, only after making the appropriate changes to the statutory documents. Settlements with the depository for deposits in the management company are studied on account 75-1. After the state register. The organization of its management company will establish the amount of deposits and the fact that the debt will be established will be reflected in the entry D75-1 K80. Upon actual receipt of funds to account D50,51,52K75-1. Accounting for reserve capital.

The Republic of Kazakhstan has created an organization to cover losses, repay bonds, as well as repurchase its own shares, in the absence of other funds.

The formation of the Republic of Kazakhstan is carried out at the expense of net profit. The amount of annual contributions to the Republic of Kazakhstan is provided for by the company’s charter, but not less than 5% of the annual net profit until the size of the capital is reached. Covering the organization's losses at the expense of the Republic of Kazakhstan is reflected in entry D82K84. Use of funds in the Republic of Kazakhstan sent for redemption of bonds D82K66.67. Accounting for additional capital.

The organization's recreation center is part of its own.

Capital, which is allocated as self. The object of accounting and studies on account 83. The sources of formation of the DC are: 1) Increase in the value of non-current assets as a result of revaluation; 2) The difference between the nominal and sales value of the share; 3) positive exchange rate differences associated with the formation of the management company. Revaluation: 1) revaluation D01K83; D83K02. 2) markdown D83K01;D02K83. Accounting for retained earnings (uncovered loss).

Net Profit can be used to pay dividends on account 99. As part of the reformation of the balance sheet with the concluded turnovers of December, the amount of the state of emergency is written off from account 99 in K84. In the balance sheet, the amount of profit for the reporting period is added to the amount of profit from previous years. The state of emergency can be used to pay dividends, to form the Republic of Kazakhstan and to cover losses of previous years. D99K84; D 84 K70; D84-1 K82-2 – coverage of losses from previous years; D84-1K82 - formed at the expense of the net profit of the Republic of Kazakhstan.

47. Accounting for debt capital. A bank loan is issued by a bank or other financial institutions in the form of cash.

A commercial loan is a loan provided in commodity form by the seller to the buyer, in the form of deferred payment for goods sold. Provided in bill form or on an open account. By repayment period: 1) The organization usually uses short-term loans to satisfy temporary needs. (average loan term up to one year)

2) long-term loans are used for investment purposes and to service the movement of fixed assets.

To summarize information about the status of short-term loans, account 66 opens next. Sub-accounts 1) short-term loan 66.1 2) short-term loans

An organization can receive borrowed funds in the following forms: *cash; *natural; *in the form of deferment of debt.

Receipt of funds under the loan agreement is reflected by the entry

D50,51,52 K66

D76(60) K66

D10 K 60

D19 K60

D66 K66

Investment asset-costs associated with the acquisition, % are accrued in the amount and period of the agreement. Accrued interest on funds received are his expenses and accounting. The accounting records are reflected in the following entries D91.2 K 66, 67.

% accrued on loans received against investment assets, including them in the initial cost, is reflected in the entry D08, 07 K66.67

Exchange differences on the principal amount of the debt and the accrual of interest arise due to a mismatch in the time of repayment and receipt of the loan, as well as deductions and transfers of interest are reflected in the entry: *positive exchange rate difference D66.67 K91; * negative D91.2 K 66.67.

Long-term loans and borrowings can be accounted for in 2 ways:

1) on account 67 before their maturity date

2) on account 67 there is not a year left until their maturity date

After this, the amount of credits is transferred to account 66.

However, PBU 15 abolished the requirement for transfer from long-term to short-term. Analytical accounting of long-term loans and borrowings, as well as in account 66, is carried out by the vendor.

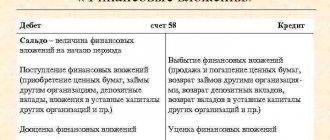

Accounting for financial investments

Financial investments are investments of free funds in securities for the purpose of generating income and other assets, in securities for the purpose of generating income or other benefits. Assets are accepted for accounting as Finnish. Investments subject to the simultaneous observance of the following conditions: 1) Availability of correctly executed documents confirming the right to financial investments and receipt of DS arising from these rights 2) Transition to the release of financial risks associated with them 3) The ability to bring economic benefits to the owner Finn. Investments include the following investments: 1. Management capital of other organizations 2. Securities, on which date the period and cost of repayment are determined. 3. Loans provided to other organizations. 4. Deposits of credit institutions. In accounting practice, there are several ways to evaluate securities: 1) Nominal value of the security 2) Market value. 3) Book value is the estimate in which securities are reflected in the holder’s accounting book 4) Book value is the estimate in which securities are reflected in the balance sheet of the business entity. Financial investments purchased for foreign currency in the Central Bank are reflected in rubles, at the exchange rate of the Central Bank of Russia on the day they were accepted for accounting; to account for Finnish investments in the accounting system, account 58 is used, to which subaccounts are opened. Account By type of finance. Investments. 1. shares and shares 2. debt securities 3. Representative loans 4. Deposits under a simple partnership agreement

49 Form of remuneration Forms of remuneration - time-based and piece-rate. In a time-based system, the employee is paid a salary depending on the time worked. The time worked is indicated by the head of the structural unit in the time sheet. With the piecework form, the employee is paid a salary depending on the amount of work performed, which is indicated in the piecework work order.

50 Accrual and payment of wages Salary accounting is carried out on account 70 in correspondence with cost accounts. When calculating salaries, the accountant makes entries: D20,23,25,26,29,44K70. Simultaneously with salary calculations, contributions to extra-budgetary funds are accrued: D20,23,25,2629,44K69. When calculating contributions in accordance with Federal Law No. 212, the following rates are accepted: 26% is paid to the pension fund for persons born in 1966 and older, for persons born in 1967 and younger, so-called transfers to the insurance part of the pension at a rate of 20% and accumulative at rate 6%. The organization also transfers 2.9% to the social insurance fund, 3.1% to the federal compulsory medical insurance fund, and 2% to the territorial compulsory medical insurance fund. The employee must pay personal income tax at a rate of 13% on the salary amount. When withholding personal income tax, an entry D70K68 is made. The employee is also provided with tax deductions: 1) 400 rubles per employee until the total salary exceeds 20,000. 2) 1000 rubles per child. Profession, social and property deductions are also provided. Employees can receive the following types of leave: 1) annual leave 2) additional leave 3) educational leave 4) maternity leave, child care 5) without pay. When calculating wages, a payroll is prepared and paid according to the payroll. In small organizations, salary calculations and payments are carried out in one document “Payroll”. Vacation must be granted to the employee annually and the employee’s right to it arises after 6 months from the date of continuous work in the organization. The duration of vacation is 28 calendar days. However, the vacation period does not include holidays. Vacation pay must be paid three days before the start of the vacation. The amount of vacation pay is calculated based on average earnings. Vacation pay is accrued in accounting in the same way as salary.

The amount of sick leave that must be paid to an employee depends on his insurance record. If the employee has 8 or more years of experience, then 100% of the average salary is paid. If the employee’s work experience is from 5 to 8 years, then 80% of the average salary is paid. If the length of service is up to 5 years, then 60% of average earnings are paid. Since January 2011, when calculating benefits, average earnings are determined for 2 calendar years preceding the occurrence of the insured event. When calculating average earnings, you must include all payments for which contributions to the Social Insurance Fund were accrued. Since the amount of payments involved in calculating average earnings is limited (the accountant takes into account 385,000 for 2009 and 415,000 for 2010), the average employee’s earnings when calculating benefits will be 800,000 rubles.

Additional payments

For the correct calculation of wages for workers, it is of great importance to take into account deviations from normal working conditions, which require additional labor costs and are paid in addition to the current rates for piece work. Enterprises set the amounts of additional payments and the conditions for their payment independently and are fixed in a collective or labor agreement.

Minimum salary – 4611 rubles

In the Omsk region there is a regional coefficient of 15%

The minimum salary in Omsk is 5303 rubles

In wages, certain amounts are made up of various additional payments:

— for work at night (from 22-00 to 6-00) 40% bonus for each hour of work;

— for work in the evening (from 18-00 to 22-00) 20% bonus for each hour of work;

- overtime work. The first two hours are in time and a half, and the subsequent ones are in double time. Overtime work must not exceed four hours for each employee over two consecutive days and 120 hours per year. At the request of the employee, overtime work, instead of increased pay, can be compensated by providing additional rest time, but not less than the time worked overtime;

— weekends and holidays (double tariff);

— temporary replacement of an absent employee (when combining professions, payments are made by agreement);

— incentive payments (additional payments and bonuses for high qualifications, professional excellence, work with a smaller number, bonuses, rewards, etc.) are determined within the limits of available funds.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest.

Time of forced breaks from work:

- downtime due to the fault of the employer. Paid at 2/3 of the average salary. In accordance with the Labor Code of the Russian Federation, the employer has the right to transfer an employee to another job due to downtime with wages for the work performed, but not lower than the average earnings for the previous job. Additional payment for combinations is made as a percentage of the monthly salary or the hourly wage rate of the replaced employee;

- simple, for reasons beyond the control of the employer and employee. Payment of 2/3 of the tariff or salary;

- downtime due to the fault of the employee. (not paid).

For temporary substitution, the difference between the salaries of the person being replaced and the replacement may be paid, provided that the temporary substitution is not a full-time deputy. Additional payments to employees must have documentary evidence (time sheets, orders, instructions), and their amount is included in taxable income for calculating personal income tax.

52 Calculation of average earnings.

The average salary is calculated from the actual accrued salary for 12 calendar months.

∑ salary ÷ 12 ÷ 29.4 = average daily salary

where, ∑salary is the entire total amount of salary paid during the year

“12” – number of months in a year

“29.4” is a calculated value that shows the number of days in a month. It is equal to 29.4 tk. There are different number of days in months.

For example, to calculate the average salary for 5 days of work in December you need:

∑s/p ÷ 29.4 ÷ 31 × 5

where, ∑s/p – annual salary

“29.4” is the calculated value

"31" is the number of days in December

“5” is the number of days for which you need to calculate your salary.

For example, an employee was absent for a valid reason for 5 days in December, and this calculation formula allows you to see the amount by which the salary should be reduced in December.

⇐ Previous4Next ⇒

Postings to account 04

The receipt of intangible assets can be reflected in two ways, depending on the sources of origin. When purchasing a finished object, the accounting record D04 – K50, 51, 52, 55 is created. The procedure for creating an asset using your own resources is reflected in correspondence:

- D08 – K60, 10, 68, 69, 76, 70 in terms of expenses incurred to create a specific intangible asset;

- D04 - K08 upon completion of operations for the development and creation of intangible assets and the object is completely ready for use.

Account 04 upon disposal of an asset is credited in correspondence with the accounts (debit turnover):

- 91.2 in the case of donation and other methods of gratuitous transfer of rights of use to third parties;

- 58.1 when introducing an intangible asset in the form of a contribution to the authorized capital of another organization.

Business reputation with a positive value as a result of the purchase of an enterprise is reflected in accounting by posting D04 - K76. The revaluation of the asset refers the additional cost of the asset to additional capital D04 - K83, the markdown is shown as D91 - K04. Monthly accrual of depreciation amounts for intangible assets is carried out by entries D26, 20, 23 - K04.

Definition and purpose

Account 04 is used to summarize information about the presence and movement of intangible assets of the company, as well as about its expenditure areas for scientific, research, experimental, design, and technological work.

Acceptance of intangible assets for accounting is carried out within the framework of account 04 based on the original cost. For objects for which depreciation is accounted for, deductions are written off in Kt 04. If they are accepted for accounting purposes, they are reflected in Dt 04.

In the process of disposal of intangible assets during sale, simple write-off, gratuitous transfer, their value, which was previously subject to accounting under account 04, is subject to reduction by the amount of depreciation accrued during the period of use.

The residual value is written off from account 04 to account 91 “Other income and expenses.”

Expenses for research, development, and technological activities are accepted for accounting purposes on the basis of account 04 “Intangible assets” in the amount of actual expenses.

In this case, account 04 is debited in correspondence with account 08. In the process of writing off resources, account 04 is credited with accounts 20, 26 debited.

During the termination of the application of the results of these activities, expenses not included in the costs of classic types of activities are subject to write-off in Dt 91 in correspondence with Kt 04.

Analytical accounting is carried out for individual objects and areas of expenditure. Analytical accounting provides a chance to obtain materials about the presence and movement of assets, as well as the amounts of corresponding expenses.

Account 04 in accounting - a case study

Kleps LLC ordered a video from the Prodvizhenie agency for an advertising campaign for a new product. The cost of the service in full - 45,000 rubles (excluding VAT) was paid in advance. After receiving a record of the advertising appeal, the local documents of Kleps LLC recorded a useful life of 14 months, and the preferred depreciation method was linear. After 2 months the video was lost.

Account 04 in accounting will participate in the following correspondence:

- D60 – K51 – in the amount of 45,000 rubles when making an advance payment for the video recording.

- D08 – K60 – in the amount of 45,000 rubles, the posting reflects the cost of the advertising video as part of the investment in intangible assets.

- D04 – K08 the asset was accepted for accounting at the actual cost of 45,000 rubles.

- D26 - K04 depreciation was calculated for 2 months of airing of the commercial, the total amount of depreciation is 6,428.57 rubles (45,000 / 1 x 2).

- D91 - K04 the asset at its residual value is written off due to loss, the transaction amount is 38,571.43 rubles (45,000 - 6428.57).

The concept and essence of designated property objects

Copyrights, as well as licenses to carry out certain types of activities, new production technologies, and trademarks are recognized as intangible assets.

However, from an accounting point of view, not all of the above are recognized as such. To begin with, it should be noted that accounting for such assets is regulated by the international financial reporting standard IFRS 38, which received the same name. As for the requirements of national Russian legislation, this issue is regulated by the Accounting Regulation No. 14 “Accounting for intangible assets”.

Today, the assessment of the importance of this category of property of organizations has changed somewhat, and in certain sectors of the economy this part of the property becomes more critical than tangible production property. An example of this is the world-famous DELL trademark, where the production process of computer equipment is concentrated in the hands of third-party contractors operating in countries where labor costs are much lower.

The intellectual property, trademark or business model of a company is sometimes one of the most important things, and without proper attention to these elements, a business can fail.

In a situation where a particular enterprise purchases equipment, the question of capitalizing the costs incurred does not arise. Despite the fact that this category of property does not have a physical embodiment, it can also remain a source of income for a long time. And a huge number of companies incur considerable costs to create designated assets, which will subsequently allow them to generate significant income. And in this case, the question arises of what part of these costs should be capitalized as an intangible asset.

If we talk about the international official definition of this category of property, then it means identifying non-monetary property that does not have a physical form. In addition to the epithets indicated in the previous sentence, for a company to recognize this type of property on its balance sheet, the latter must be controlled by the company, bring further economic benefits, their service life must be more than a year, and there is also the possibility of a reliable assessment of their cost.