What are other expenses?

The concept of “other expenses” is spelled out in the same chapter of the PBU, but in section 10/99. Here is an open list of expenses - this means that the accountant can classify as other expenses whatever he deems necessary. However, this can be done if there are no contradictions with current legislation and the accounting policies of the enterprise.

Most often, this type of expense includes:

- losses from the sale of own funds;

- expenses related to the company’s bank account;

- a fund for doubtful debts, the formation of which is the responsibility of each organization, regardless of size;

- various fines imposed on the company.

What is it used for?

All transactions that generate income or expenses that are not related to the main activity of the company are reflected in the accounting department in subaccounts 91. The Accounting Regulations (PBU) 9/99 oblige two types of income and expenses to be attributed to them:

- operational, are directly related to the economic activities of the enterprise, but are not the goal;

- non-operating, formed due to the consequences of the economic activities of the organization.

Additional Information! They are shown separately in the financial statements.

Postings to display profits and losses on account 99

In general, the accounting entry for making a profit or incurring losses in account 99 is as follows:

- Dt99 – Kt84 – retained earnings are taken into account;

- Dt84 – Kt99 – transfer of the amount of net loss;

- Dt99 – Dt90 – write-off of losses for the leading type of activity;

- Dt90 – Kt99 – reflection of profit for the leading type of activity;

- Dt99 – Kt91 – display of losses from other types of activities;

- Dt91 – Kt99 – receipt of income from other types of activities;

- Dt96 – Kt99 – increase in profit due to the balance of unused reserves;

- Dt99 – Kt10 – write-off of the cost of materials damaged as a result of emergency situations;

- Dt73 – Kt99 – recovery of expenses incurred from those responsible in emergency circumstances;

- Dt99 – Kt68 – calculation of income tax.

Profits and losses from emergency circumstances and situations include cash flows due to fire, flood, nationalization of an enterprise, natural disasters, receipt of insurance compensation, etc.

Net operating income

As you can see from these lists, there is a lot of overlap between expenses and income. In this regard, their ratio is used when calculating the amount of profit for other economic factors. activities. Thanks to their separate accounting, it is possible to determine the NER.

The formula for operating income will be:

NOR = the amount of gross income - the amount of operating costs (minus depreciation).

This indicator determines the amount of net profit from the use of property, contributions to the management company and securities, as well as other types of income.

It is very important to calculate it for the current period. This allows you to understand whether the company is operating at the highest level possible. However, a one-time positive result will not serve as a guarantee of profit in the future.

Account 91 “other income and expenses” postings and examples

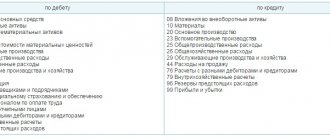

In the debit of account 91 (subaccount 91.2) other expenses are recorded:

- losses associated with the sale of company property;

- interest paid on loans and credits;

- expenses for banking services for servicing accounts with credit institutions;

- fines and penalties paid by the organization;

- recognized losses of previous years;

- accounts receivable that are impossible to collect;

- negative exchange rate differences;

- other expenses listed in the instructions to the Chart of Accounts.

Subaccount 91.9 reflects the final balance for the reporting period for other income and expenses, determined by comparing the turnover in accounts 91.1 and 91.2.

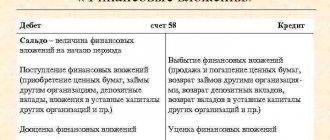

Account characteristics

During the reporting period, account 91 and its subaccounts collect data on transactions related to other types of activities that form its characteristics.

Active or passive

You can easily answer question 91 whether an account is active or passive; just look at how accounting transactions are reflected on it. Receipts are posted as a credit and expenses as a debit. Thus, it is active-passive in accounting. At the end of the reporting month, it must be closed; to do this, all balances must be transferred. At the beginning of a new period, the balance should be zero.

Account 91. accounting for other income and expenses. postings

The following subaccounts can be opened for it:

- 91.1 “Other income”;

- 91.2 “Other expenses”;

- 91.9 “Balance of other income and expenses.”

Income received by the organization (account 91.1) can be classified as other if they represent:

- income from the rental of its property;

- profit under a simple partnership agreement;

- income from the sale of fixed assets and other assets of the company;

- interest received under loan agreements;

- fines, penalties, and forfeit amounts transferred in favor of this organization due to violation of contract terms by counterparties;

- resulting positive exchange rate differences;

- profit of previous periods;

- expired accounts payable;

- other income other than core activities.

Such receipts are reflected in the credit of account 91.

- Dt 91 Kt 60 - attributing the shortage to other expenses after acceptance of goods from the supplier, charging penalties in favor of the supplier.

- Dt 91 Kt 01 - loss from the sale of fixed assets.

- Dt 60 Kt 91 - recognition of accounts payable (including unclaimed or expired) as income of the organization.

- Dt 76 Kt 91 - reflection of unclaimed amounts deposited for wages as income.

- Dt 10 Kt 91 - free receipt of materials.

- Postings Kt 91 Dt 91 also record the results of other income and expenses:

- Dt 91 Kt 99 - profit on other income and expenses is reflected;

- Dt 99 Kt 91 - a loss was received on other income and expenses.

Posting Debit 91 Credit 68 If it is necessary to reflect VAT on transactions not related to the main activities, use the debit of account 91.

I note that income and expenses arising as a result of emergency situations are not taken into account in this account, but are credited directly to the account. 99 "Profits and losses." Video help “Account 91. Accounting for other income and expenses” This video lesson explains how to keep accounting for other income and expenses (account 91), what subaccounts, postings and typical transactions are.

The lesson is taught by the teacher of the site “Accounting and Tax Accounting for Dummies”, chief accountant Gandeva N.V. To watch online, click on the video ⇓ Accounting for other income and expenses The debit of account 91 records expenses, and the credit records income. In its structure, 91 accounting accounts resemble an account. 90 "Sales". At the account

How to close an account

The law obliges organizations to close monthly accounts that collect information about income and expenses from the company’s main and secondary activities. Accounting account 91 allows you to do this in several stages:

- The difference between debit and credit is transferred monthly to subaccount 91.09, and the indicators are also transferred to account 99 “Profits and losses” at a synthetic level.

- At the end of the annual reporting period, analytical levels should be closed and the balance sheet reformed.

In order to correctly close account 91 at the end of the month, you first need to calculate the balance amount for all subaccounts in order to have a complete picture of what will be included in the next reporting period. To identify the interim financial result, you need to compare the results for the debit of subaccount 91.2 and the credit of subaccount 91.1. The resulting debit balance indicates losses, while the credit balance indicates the company’s profit in the reporting period.

What entries will the accountant make to close account 91:

- Dt91.1 - Kt91.9 - the income part is closed.

- Dt91.9 - Kt91.2 - the consumable part is closed.

- Dt91.09 - Kt99 - profit taken into account.

- Dt99 - Kt91.09 - loss taken into account.

After the monthly closure of the synthetic account level 91, analytical information continues to be collected on it throughout the year, reflecting:

- Types of income and expenses.

- Expenditures.

- Divisions.

In order to reset all analytical balances on account 91, at the end of the year the enterprise must undergo a balance sheet reformation. What entries will the accountant make to close 91 accounts at the end of the year:

- write-off of the balance of other expenses is expressed by the following accounting entries Dt91.01 - Kt91.09;

- expenses Dt91.09 - Kt91.2 are closed.

After this, all that remains is to close the resulting total to account 99 “Profits and losses”. Depending on the financial result, one of two postings will be made:

- Dt91.9 - Kt99 - reflects the profit generated at the end of the reporting year.

- Dt99 - K91.9 - a loss was recorded that was not received from the main activity.

All transactions on account 91 must be documented. What documents may regulatory authorities request:

- Invoices.

- Accounting certificates.

- Acceptance and transfer acts.

- Inventory records.

- Depreciation statements.

Important! If you do not close account 91 and transfer analytical and synthetic accounting data from it to account 99, then its balance at the end of the year will be reflected in the balance sheet. As a result, the accountant will not be able to formulate the correct result of the company’s financial activities.

Account 91 in accounting

A complete list of other income and expenses can be studied in the order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

The “Other income and expenses” account is active-passive. The credit of the account reflects the receipt, and the debit records the expense:

The main subaccounts for 91 accounts are presented in the figure:

The purpose of analytical accounting for 91 accounts is to provide the ability to determine the financial result based on each type of income and expense. Consequently, when classifying income and expenses, it is necessary to take into account the homogeneous type of costs to ensure the possibility of determining the financial result for each operation of the same type.

For example, amounts under the article “Fines and penalties for contractual obligations” can be attributed to both expenses and income, therefore, the financial result under this article can be analyzed. Or, by analyzing the expense item for paying for the services of credit institutions, the enterprise will be able to see the effectiveness of working with the bank, whether the bank’s “products” are beneficial to the enterprise.

Existing subaccounts

Account 91 has several mandatory subaccounts in the following groups of income and expenses:

- 91.1 “Other income” - it records assets that are not the result of the main activity.

- 91.2 “Other expenses account” - expenses spent on operations not related to the main activity are reflected here.

- 91.3 “VAT” - serves to reflect value added tax.

- 91.9 “Balance of other income and expenses” - serves to reflect the balance of other income and expenses received in the reporting month.

Information reflected on account 91 1 and account 91 2 is accumulated over an annual period. Each month, a balance is determined from them, which is written off from subaccount 91.9 to account 99 “Profits and losses”. Therefore, account 91 always has a zero balance at the reporting date. At the end of the year, all subaccounts are closed to subaccount 91.9.

Analytical accounting should be kept separately for each type of income and expense. This should ensure the ability to identify the financial result of the company’s business activities separately for each operation.

Subaccounts

Why are loss standards needed?

Account 94 “Shortages and losses from damage to valuables” influences the formation of expenses. It displays:

- Deficiencies identified during the inventory.

- Damage resulting from damage to company property.

This account is active-passive, so it can have debit and credit balances. The debit collects lost property in total terms. Depending on the amount of losses, there are certain indicators, based on which the company writes off its damage:

- within the limits of natural loss;

- above the norms of natural loss with the appointment of a responsible person;

- above the norms of natural loss without a specific culprit.

Natural loss is the property’s ability to shrink, shrink, rot, break dishes, and other factors beyond the control of the carrier, supplier, or storekeeper.

For each such product in trade there are standards within which shortages and losses are acceptable. For example, when transporting peaches, a certain amount may be crushed in the container, since this is a very delicate product, and there are potholes and potholes on the roads.

To prevent this factor from being used for theft purposes, a specific standard has been established for the product. Loss in excess of the required standard is regarded as theft or intentional damage. Natural loss is calculated using the formula:

Analysis of the effectiveness of operating expenses

In addition to the purposes of recording monetary transactions, accounting for operating expenses helps to solve additional tasks to improve the efficiency of business activities. This type of cost, along with capital costs, makes up a significant part of the financial costs of any organization.

What can you learn from operating expense metrics?

By comparing these costs with revenue from sales of products, we can draw a conclusion about how expensive it is for the enterprise to produce these types of goods. This ratio is called the operating expense ratio.

It allows you to understand how much percent of the income received goes to support the current activities (operations) of the organization, that is, how effective it is.

If you study this coefficient over time, you can track the potential to increase production and/or sales without unnecessary costs. A decreasing ratio indicates a decrease in operating expenses with a constant or even increasing sales volume. This indicates an increase in revenue, and therefore a net increase in the profit of the enterprise.

What factors influence the operating expense ratio?

The reasons that influence the increase or decrease in operating costs can be either external (independent of the organization itself) or internal.

External factors influencing operating costs:

- the level of inflation in the state: the more intense the inflationary processes, the greater will be the operating costs associated with the recalculation of wages, loan payments, costs for contractors’ services, etc.;

- changes in mandatory payments, as well as tax rates - the higher the taxes, the higher the operating costs.

Internal factors (those that can be changed through the efforts of the company itself):

- volume of production of products and their sales - even if, as a result of an increase in volumes, operating expenses increase, the cost per unit of production will significantly decrease, since operating expenses in their constant part will not change;

- duration of the production cycle - the shorter it is, the faster the assets will turn over, as a result of which operating costs will be reduced due to, for example, storage of goods, its natural loss, management costs, etc.;

- labor productivity - the more products each worker produces per unit of time, the lower the operating costs for settlements with personnel will be;

- state of production assets - less worn-out equipment requires less money for maintenance and repairs;

- the number of current assets owned by the organization - a company that owns more property will spend less on rent, leasing and contracts, which will also reduce operating costs.

RESULT. Operating expenses—the day-to-day expenses to keep the business running—are classified as “other expenses.” Reducing these costs leads to increased profits for the organization.

In general terms, operating expenses are the costs of an enterprise that are not directly related to its core activities. The current edition of PBU 10/99 does not contain a precise definition of the terms operating income and expenses due to the change in classification according to Order No. 116n dated September 18, 2006. The legislation now proposes a simplified gradation for other expenses/income, as well as expenses/income for ordinary activities . How to determine what costs belong to what, how to calculate net operating income - we will explain in detail below.

Factors for increasing the efficiency of operating expenses

An important task in enterprise management is to reduce operating costs in order to increase commercial profits. Factors influencing costs are divided into external and internal. Internal ones include:

- Increase in production volume and sales of finished products or services. With their growth comes an increase in costs, but the cost of production decreases, since the constant part of operating expenses does not change.

- Reducing the production cycle time. This entails a reduction in storage costs for products, losses due to natural loss, and costs for accounts receivable.

- Increase in labor productivity per employee. The higher the number, the lower the operating costs.

Reducing enterprise costs - Technical condition of the equipment. The more worn it is, the more often it will need servicing.

- The amount of own current assets also affects operating expenses. The more there are, the less you will have to turn to third parties for borrowed capital.

External factors include:

- Inflation in the country where the company is located.

- Increase in tax rates and other mandatory payments.

Operating expenses are an important indicator for calculating the net profit of an enterprise. Their control and analysis will help reduce current production costs, wisely use enterprise resources and quickly monitor the efficiency of the company.