Depreciation of fixed assets is the inclusion of the cost of fixed assets in the cost of the good or service produced. In accounting entries, depreciation of fixed assets is taken into account in accounting account 02. Depreciation allows the manufacturer to include all production costs in the cost of products. In fact, capital turnover occurs due to depreciation.

Depreciation can be stopped only if the equipment is idle for at least three months and if the facilities are modernized for a period of at least 12 months. Amounts are accrued from the month following the month the facility was put into production and are not accrued from the month following the removal of the equipment from production.

Depreciation cannot be charged on the following items:

- livestock;

- roads;

- natural objects;

- Earth;

- housing facilities.

Postings on account 02 for depreciation of fixed assets

Let's look at the main types of standard transactions for different types of operations.

Depreciation calculation

Postings:

| Debit | Credit | Operation description | OS cost |

| 20.01 | 02.01 | Depreciation calculation. | Over 40,000 rub. |

| 20.01 | 60.01 | The decision not to subject an object to depreciation, but to write off its value immediately. | Less than 40,000 rub. |

Write-off of depreciation

Wiring:

| Debit | Credit | Operation description |

| 02.01 | 01. | Write-off of equipment depreciation amount |

Depreciation of leased equipment

Postings:

| Debit | Credit | Operation description |

| 91.01 | 02.01 | Calculation of depreciation of leased equipment. |

| 02.01 | 03.03 | Write-off of depreciation of leased property. |

Full depreciation (disposal)

Wiring:

| Account Debit | Account Credit | Wiring Description |

| 02.01 | 83.01.1 | The full depreciation of the object, which is included in fixed assets, is reflected. |

What is depreciation of fixed assets

The economic significance of depreciation lies in the gradual transfer of the cost of the (initial) object to the price of the final product (service or work). In other words, this is the monetary expression of OS wear and tear. In accordance with clause PBU 6/01 in accounting, repayment of the value of property is carried out in relation to all objects, except those excluded. A complete list of the latter is contained in clause 17, PBU 6/01. For example, this is land, assets mothballed and transferred for restoration, environmental or housing facilities, etc.

Methods for calculating depreciation

There are several types of depreciation and each of them has its pros and cons:

- linear method;

- reducing balance method;

- calculation of the amount depending on the performance of the object;

- calculation of the amount depending on the service life of the object.

Linear

The linear method is the simplest. It does not require complex calculations and is paid in equal shares by month when depreciation is calculated. To calculate the amount of depreciation, the cost of the object is taken and divided by the period of use by month. Next, the simple proportion of the interest to the amount is solved. This method is useful in maintaining the quality of manufactured products, regardless of the degree of wear of the object.

Example: the price of an object is 600,000, its service life is 5 years. This means that the annual payment will be 20% of the cost of the object or 120,000. Accordingly, the monthly amount will be 10,000.

Reducing balance method

The second method on our list depends on the annual acceleration rate set by the company. This method is applicable if the quality of the product depends on the level of equipment wear.

Example: the price of equipment is 600,000, its service life is 5 years. The annual payment is also 20%, but now there is an acceleration factor, say, 2. It means that the annual percentage of the unamortized amount is multiplied by 2. This means that in the first year it is: 600,000 * 0.4 = 240,000, in the second: 600,000 – 240000 = 360000; 360000 * 0.4 = 144000; and so on. In the last year, depreciation is calculated from the remaining amount.

Depending on the performance of the object

The productivity write-off method is very convenient for machines, machines and other objects that can be predicted to last. The calculation is made exclusively from the work performed using this object.

Example: the price of equipment is 100,000, its resource is 1000 products. This month, 100 products were produced, 10% of the object's resource. This means that the amount of depreciation for this month will be 10% of the cost - 10,000.

Depending on the service life of the object

The method of calculating the amount is simple and is quite often used instead of the reducing balance method, because it is convenient to use if the quality of the product directly depends on the object. Its essence is to pay an amount equal to the ratio of the remaining years of operation to the entire sum of years of operation multiplied by the cost of the object.

Example: the price of an object is 100,000, its service life is 6 years. Sum of years of operation – . In the first year, the payment amount will be 6/21*100000. Further calculations are made according to the same scheme. In the last year the balance of the total amount is paid.

Reflection in accounting and tax accounting

An asset purchased by an organization with a price of over 40,000 rubles is accepted for accounting from the moment of transfer of ownership and formation of the initial value of the object. In tax accounting, the operating system is recorded after its commissioning.

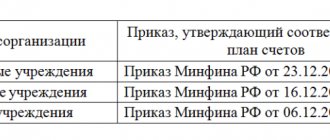

In a commercial organization, according to PBU 6/01, depreciation in accounting and tax accounting begins with the month that follows the month the fixed asset was put into operation. As a basis document, the organization has the right to use the commissioning act in any form:

In accounting and tax accounting, different methods are used to calculate the depreciation of fixed assets and intangible assets. In tax accounting, only linear and nonlinear methods are used.

The following methods of calculating depreciation in accounting are acceptable:

- Linear method.

- Reducing balance method.

- Taking into account the sum of the numbers of years of service life.

- The calculation method is proportional to the volume of products sold.

The methods used in accounting and tax accounting for calculating depreciation of fixed assets and intangible assets must be fixed in the accounting policies of the organization.

Depreciation ceases when the asset's useful life expires or when it is disposed of for other reasons (for example, sale). The accumulated amount is not reflected in the balance sheet items, but is used when forming the residual value of fixed assets or intangible assets. The residual value of an object is equal to the difference between its original cost and the amount of accumulated depreciation.

ConsultantPlus experts discussed how to calculate depreciation on fixed assets. Use these instructions for free.

Postings for writing off depreciation (02 debit account)

The depreciation postings for fixed assets when account 02 is in debit will be as follows:

- D02 - K01 - write-off of depreciation on sold or liquidated fixed assets to reduce its primary cost.

- D02 - K02 - transfer of depreciation on leased property to a separate sub-account.

- D02 - K03 - write-off of depreciation on a retired asset that was intended for rental, to reduce the primary price.

- D02 - K08 - write-off of depreciation of exploration assets that were transferred to intangible assets or fixed assets to reduce the original price.

- D02 – K79-1 – write-off of depreciation on an asset that was transferred to a branch that is on a separate balance sheet (in the accounting of the company’s head office).

- D02 - K79-1 - write-off of depreciation on property that was transferred to the head office (in the accounting of the branch).

- D02 – K79-3 – write-off of depreciation on property that was given to trust management (in the accounting of the management founder).

- D02 – K79-3 – write-off of depreciation on an object accepted for trust management (on a separate balance sheet).

- D02 - K83 - reduction in the amount of depreciation in the event of a decrease in the value of fixed assets as a result of revaluation.

Depreciation of fixed assets

The cost of fixed assets is repaid through depreciation.

Depreciation of fixed assets is calculated in one of the following ways:

- linear method;

- reducing balance method;

- method of writing off value by the sum of the numbers of years of useful life;

- method of writing off cost in proportion to the volume of products (works).

The depreciation rate is calculated based on the useful life, to determine which the NU applies the OS Classification approved by Government Decree No. 1 of 01.01.02. To calculate depreciation in accounting, you can also rely on the above classification.

There are a total of 10 depreciation groups in the Classification.

| Group | Lifespan, years | Composition of the group |

| 1 group | from 1 year to 2 years inclusive | cars and equipment |

| 2nd group | over 2 years up to 3 years inclusive | Machinery and equipment Transport means Industrial and household equipment Perennial plantings |

| 3 group | over 3 years up to 5 years inclusive | Structures and transmission devices Machinery and equipment Transport means Industrial and household equipment |

| 4 group | over 5 years up to 7 years inclusive | Buildings Structures and transmission devices Machinery and equipment Transport means Industrial and household equipment Working livestock Perennial plantings |

| 5 group | over 7 years up to 10 years inclusive | Buildings Structures and transmission devices Machinery and equipment Transport means Industrial and household inventory Fixed assets not included in other groups |

| 6 group | over 10 years up to 15 years inclusive | Structures and transmission devices Housing Machinery and equipment Transport means Industrial and household equipment Perennial plantings |

| 7 group | over 15 years up to 20 years inclusive | Buildings Structures and transmission devices Machinery and equipment Vehicles Perennial plantings Fixed assets not included in other groups |

| 8 group | over 20 years up to 25 years inclusive | Buildings Structures and transmission devices Machinery and equipment Vehicles Industrial and household equipment |

| 9 group | over 25 years up to 30 years inclusive | Buildings Structures and transmission devices Machinery and equipment Vehicles |

| 10 group | over 30 years inclusive | Buildings Structures and transmission devices Dwellings Machinery and equipment Vehicles Perennial plantings |

Let us remind you that changes have recently been made to the Classifier, which apply from January 1, 2021.

Accounting for depreciation of fixed assets on account 02

Why is depreciation charged on fixed assets of companies? There is only one answer: most OS objects are very expensive. If you write off their cost as expenses at a time, this will lead to a significant increase in the cost of production. Therefore, the cost of fixed assets is repaid through depreciation.

However, if the cost of fixed assets in accounting does not exceed 40,000 rubles. per unit, then the company can include them in the materials, having prescribed this in the accounting policy.

For clarity, we will give examples of depreciation calculation and posting to reflect this operation in accounting.

Example 1

Let’s say a company purchased an LG A09IWK split system in September at a cost (including installation) of 98,000 rubles. for installation in the main production workshop. According to the passport of the split system, the service life of the facility is 7 years. The company's accounting policy provides for a straight-line method of calculating depreciation.

Having received the certificate of acceptance and transfer of fixed assets, the company’s accountant determines that the useful life of the split system for accounting purposes. accounting period is 84 months (12 months*7). Consequently, the monthly depreciation amount for the object will be 1,166.67 rubles. (98,000/84)

It is also important to consider that:

- Depreciation on account 02 begins on the first day of the month following the month the split system was accepted for accounting;

- During the reporting year, depreciation of the split system is accrued monthly in the amount of 1/12 of the annual amount.

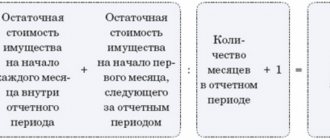

Depreciation calculation for the current year example is shown in the diagram:

The company's accounting records reflect the following entries:

| Dt | CT | Amount, rub. | Wiring Description | Document |

| Monthly during the useful life of the split system | ||||

| 20 | 02 | 1 166,67 | Depreciation accrued on the split system | Accounting certificate-calculation |

Example 2

Let's give an example of determining the useful life of a laptop and posting depreciation and write-off in connection with a donation.

Let’s assume that the company purchased a laptop worth 60,000 rubles for the administration in December 2016. In January 2021, the decision was made to gift it to a retiring employee. The company's accounting policy provides for a straight-line method of calculating depreciation.

We determine the useful life of the laptop. The passport and technical specifications do not indicate the lifespan of the laptop. At the same time, physically it can serve for a long time, but morally it can become obsolete much earlier than physical wear. You can determine the service life of a laptop using the classification approved by the Government of the Russian Federation No. 1 dated January 1, 2002.

Computer equipment with code OKOF 14 3020000 belongs to the second depreciation group with a useful life of two to three years. The company's accountant determined the useful life of the laptop to be 3 years or 36 months.

Please pay attention! Until 01/01/2017 the useful life of a fixed asset could be determined according to the Classification of fixed assets, approved. Government of the Russian Federation No. 1 dated January 1, 2002. This possibility was stated in paragraph 1 of the second paragraph of this classification.

However, everything has changed since 01/01/2017. Resolution No. 640 of 07/07/2016 declared clause 1 of the second paragraph to be invalid. The phrase “the specified classification may be used for accounting purposes” was removed.

In practice, in companies, in order to bring accounting and tax accounting of fixed assets closer together, the useful life was determined taking into account the classification of fixed assets approved by the Government of the Russian Federation. Since 2021, they do not have such an opportunity and must determine the useful life in accounting based on the requirements of clause 20 of PBU 6/01, namely based on:

Thus, according to the example, the following entries were generated in the company’s accounting for account 02:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 26 | 02 | 1 666,67 | Depreciation was calculated on the laptop for January 2021 (60000/36) | Accounting certificate-calculation |

| 02 | 01 | 1 667,67 | The amount of depreciation on the laptop is reflected | Certificate of acceptance and transfer of OS |

| 91.2 | 01 | 58332,33 | The residual value of the laptop is written off as other expenses not taken into account for income tax purposes. | Certificate of acceptance and transfer of OS |

Postings for depreciation (02 credit account)

The depreciation postings for fixed assets when account 02 is on credit will be as follows:

- D08-3 - K02 - depreciation on assets used in construction work.

- D08 - K02 - depreciation on assets that are used to modernize other assets.

- D08 - K02 - depreciation on assets that are used for the production of intangible assets.

- D20 - K02 - depreciation on property used in the main production.

- D23 - K02 - depreciation on assets used in auxiliary production.

- D23 – K02 – depreciation on exploration assets.

- D25 - K02 - depreciation on property that is of general production importance.

- D26 - K02 - depreciation on property that has a general economic purpose.

- D29 - K02 - depreciation on those assets that are used in service production.

- D44 - K02 - depreciation on property that is used for the sale of manufactured goods.

- D44 - K02 - depreciation on assets owned by a trading company.

- D83 – K02 – additional charge of depreciation on property, the value of which was increased as a result of revaluation.

- D97 - K02 - depreciation on assets used to perform work, the costs of which are taken into account as expenses for future periods.

Similar articles

- Accounting for depreciation of fixed assets

- Depreciation in accounting

- Revaluation of fixed assets in 2021

- Accounting for non-current assets

- Accrual of depreciation of fixed assets in 2021