Fixed asset retirement ratio

The fixed assets disposal rate is an indicator that describes what part of the fixed assets listed in the organization at the beginning of the reporting period was disposed of during the reporting period due to wear and tear.

It is calculated using the following formula:

Kvyb = OSvyb / OSnp

Where:

- Kvyb – fixed assets retirement rate;

- OSvyb - the cost of fixed assets that were removed from the organization’s records during the reporting period;

- OSNP – the cost of fixed assets listed in the company’s records as of the start date of the reporting period.

The cost of fixed assets means their initial cost, the one at which the object was accepted for accounting.

Also, the coefficient can be calculated using information from accounting records. balance:

Kvyb = page 180, gr. 5 / page 180, gr. 3

The coefficient is calculated for groups of fixed assets and for the organization as a whole. Disposal rates are compared both with industry-wide ones and with those calculated for the company’s own asset groups.

A high or low ratio is neither positive nor negative. The retirement rate is compared with the renewal rate. It represents the ratio of the price of introduced operating systems to the price at the end of the year.

If the value of the retirement coefficient is greater than the value of the renewal coefficient, the price of a group of fixed assets becomes lower. This means that more fixed assets are being retired than are being renewed. If, on the contrary, the renewal coefficient is greater, it means that receipts exceed departures. This indicates an effective policy and expansion of production.

The retirement rate of fixed assets is especially important for organizations involved in industry. Their operating systems have the greatest share and have a great influence on the quality of manufactured goods and production volumes.

Restrictions on donation

The transferred objects can be:

- fixed assets;

- goods;

- in cash;

- finished products;

- intangible assets;

- materials;

- securities;

- property claims (rights), for example, this may be the right to use a land plot disinterestedly transferred by a commercial organization to a non-profit institution or a disinterested assignment by a commercial enterprise of the right to demand payment of the debt of its debtor to a non-profit organization.

For commercial enterprises, an acceptable limit for the value of gratuitously transferred valuables has been established - up to 3 thousand rubles. This restriction does not apply to transactions with individuals and public organizations, charitable and other foundations, budgetary institutions, consumer cooperatives, religious and other non-profit organizations.

In addition, it is possible to transfer property free of charge to commercial organizations-founders, but provided that such operations are stipulated in the charter. Donation of valuables between commercial organizations in the amount of more than 3 thousand rubles. is considered a violation of the requirements of the law, and such a transaction may be declared invalid (clause 1 of Article 168, subclause 4 of clause 1 of Article 575 of the Civil Code of the Russian Federation).

When donating valuables worth over 3 thousand rubles. a citizen or non-profit organization should draw up a written gift agreement (Articles 574 and 575 of the Civil Code of the Russian Federation).

For information about the form used to draw up the consignment note, read the article “Unified form TORG-12 - form and sample.”

Accounting for disposal of fixed assets

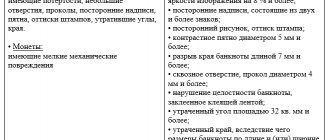

OS may be removed from the organization’s records in the following cases:

- Sale of OS to another individual or legal entity;

- Moral or physical wear and tear of the object;

- Transfer of property as a contribution to the management company of other companies;

- Transfer under a contract of gift or exchange;

- Liquidation during emergencies and accidents;

- Write-off of objects leased with the right to purchase;

- Other cases.

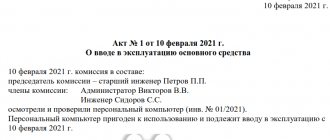

Only a special commission has the right to make a decision on decommissioning an object, which:

- Examines an object;

- Determines the reasons why he drops out;

- Determines the guilty employees in case of premature write-off;

- Determines whether any pieces of equipment can be used;

- Controls the extraction of non-ferrous metals from OS;

- Forms an act.

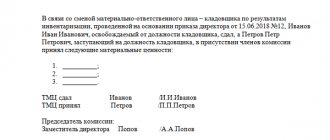

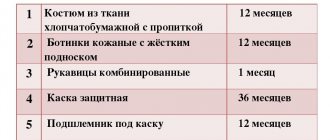

The disposal process is accompanied by the preparation of the following documents:

- Invoice for acceptance and transfer of OS;

- Act on write-off of fixed assets.

Accounting for the disposal of fixed assets is kept on account 91-3. Write-off of fixed assets due to sale and due to unusability differ in their economic essence. In the first case, the essence is the transfer of ownership, and in the second, the impossibility of using the object.

When registering a deed of gift

If an object is registered as a gift, the following processes are prepared for implementation:

- Fixing the original price

- Depreciation

- Write-off of cost already depreciated

- Financial losses resulting from the transfer

- Adding VAT

| DT | CT | Price | Documentary confirmation | The main task |

| 01.09 | 01.01 | 450 | Acceptance and transfer (drawing up an act) | Initial cost indicator |

| 02.01 | 01.09 | 120 | Depreciation value | |

| 91.01 | 01.09 | 330 | Index after depreciation | |

| 91.01 | 10.01-70.01-69 | 5-20-7 | Costs incurred during transfer | |

| 91 | 68.02 | 59,5 | Inclusion of VAT |

The process of registering transactions for a gift is similar to the sales process. Since the object is transferred to the use of another person free of charge, there is no article on profit. But VAT is taken into account, as well as costs that the company may incur during transportation or other type of transfer.

Disposal of fixed assets: postings

Upon disposal, the following entries are made in accounting:

- D01-2 – K01-1 – write-off of primary cost;

- D02 – K01 – accounting for the amount of depreciation.

After this, the debit of account 91 reflects all the costs of writing off the object, and the credit of the same account reflects the profit from its sale. Write-off costs include the residual price, transportation costs, VAT and dismantling services.

- D91-3 – K01 – accounting for the original price;

- D91-3 – K23, 44 – accounting for expenses for the sale of an object;

- D91-3 – K68 – reflection of debt to the budget for VAT;

- D76, 62 – K91-3 – profits from the sale;

- D10 – K91-3 – accounting of materials received for liquidation at market prices.

At the end of the reporting period (quarter or year), the organization calculates the cost of disposal of fixed assets, as well as the financial result. If the credit balance of account 91-3 is greater than the debit balance, the organization has made a profit. This is reflected by wiring D91-3 - K91-9. When receiving a loss, the posting will be as follows: D99 - K91-9.

If fixed assets are liquidated due to an emergency, accident or wear and tear, the following entries are made in accounting:

- D01-2 – K01-1 – write-off of the primary price of disposed objects;

- D02 – K01 – write-off of depreciation on retired fixed assets;

- D91-3 – K01 – write-off of the residual price;

- D94 - K91-3 - reflection of the loss that was received due to a natural disaster;

- D76, 73 – K94-3 – reflection of a loss that was received through the fault of an employee;

- D82 – K94 – write-off of the resulting loss at the expense of reserve capital;

- D76-1 – K94 – write-off of losses due to insurance compensation;

- D91-9 – K94 – writing off the shortage as company expenses;

- D99 – K91-9 – reflection of the loss from the operation.

If the operating system was transferred to the management company of another company, the following entries are made:

- D01-2 – K01-1 – write-off of the original price;

- D02 – K01 – accounting for the amount of accumulated depreciation;

- D91-3 – K01 – reflection of the residual price;

- D91-3 – K76, 23 – the costs of transferring the object are taken into account;

- D58 – K91-3 – contribution to the management company is taken into account at an agreed price.

The sale of an asset will be formalized in accounting as follows:

- D01-2 – K01 – write-off of the original price;

- D02 – K01-2 – depreciation was written off;

- D91 – K01-2 – write-off of residual value;

- D62 – K91 – presentation to buyers of an invoice for the cost of the sold object, including VAT;

- D91 – K68 – VAT accrual on the sales price;

- D91 – K70, 69, 60 – reflection of dismantling costs;

- D99 – K91 – reflection of loss from sale;

- D91 – K99 – reflection of income from the sale.

The transfer of fixed assets free of charge will be reflected in accounting as follows:

- D01-2 – K01-1 – the original price was written off;

- D02 – K01 – reflects the amount of depreciation;

- D91-3 – K01 – reflection of the residual price;

- D91-3 – K68 – reflects the accrual of VAT on transferred fixed assets;

- D91-3 – K76, 23 – accounting of expenses for the operation;

- D91-9 – K91-3 – write-off of losses from gratuitous transfer;

- D99 – K91-9 – loss accounting was carried out.

If fixed assets are disposed of due to their theft, the postings will be as follows:

- D01-2 – K01-1 – the primary cost has been written off;

- D02 – K01 – reflects the amount of accumulated depreciation;

- D94 – K01 – reflection of the residual price;

- D99 – K94 – reflection of the price of the object in losses.

If the asset was insured, then after writing off the primary and residual values, the following entries will be made:

- D51 – K76 – capitalization of insurance compensation;

- D76 – K91-3 – reflection of the amount of compensation as profit.

If the OS has been found, it will be necessary to restore its residual value by posting D01 - K94, as well as accrued depreciation (D01 - K02).

If a shortage of OS has been identified, the following entries are reflected in accounting:

- D01-2 – K01 – write-off of the original price;

- D02 – K01 – write-off of depreciation on a retired object;

- D94 – K01 – write-off of the residual value of missing objects.

The amount of damage incurred by the tenant due to damage or loss of property is calculated based on actual losses. Losses are calculated based on market prices prevailing in the area on the day the damage occurred.

The damage caused is recovered from the salary of the guilty employee by order of the employer. The penalty should not exceed the average monthly earnings. The employer may issue an order no later than one month after the final determination of the amount of damage caused.

If a month has passed, or the employee does not voluntarily agree to compensate for the damage caused, and the amount of damage to be compensated is more than the average monthly earnings, recovery can only be carried out by the employer going to court.

- D73 – K94 – writing off the shortage to the guilty employee at book value;

- D73 - K98 - writing off the difference between the book and market price of the shortage to the guilty employee.

If no guilty employees are found, the shortage of OS is written off as a company expense. Wiring D91 - K94 is being done.

BASIS: VAT

The gratuitous transfer of goods (materials) is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Therefore, VAT must be charged on it (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). However, in some cases, the sale of goods (performance of work, provision of services) is not subject to VAT. For example:

provision of free assistance in accordance with the Law of May 4, 1999 No. 95-FZ;

transfer for advertising purposes of goods, the cost of acquisition (creation) of which, taking into account input VAT, does not exceed 100 rubles. for a unit.

For more information about this, see How to calculate VAT for the gratuitous transfer of goods, works, and services.

If the gratuitous transfer of goods (materials) is subject to VAT, make the following entry:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on the free transfer of goods (materials).

The amount of VAT accrued on the value of property transferred free of charge does not reduce the tax base for income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

Input VAT on costs associated with the transfer of goods (materials) should be deducted (clause 1 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). Along with this, other conditions required for deduction must be met. In this case, do the wiring:

Debit 68 subaccount “VAT calculations” Credit 19

– accepted for deduction of input VAT on costs associated with the free transfer of goods (materials).

Tax accounting

Fin. the result of the liquidation of the OS is reflected in non-operating income or expenses. These amounts, together with underaccrued depreciation, are written off as the organization’s costs along with the disposal of fixed assets. This is reflected in the balance sheet in the period in which the transaction was carried out.

Write-off of fixed assets due to wear and tear is taken into account in the financial results of operating activities. The tax office may require reinstatement of input VAT. This can be challenged based on the decisions of the arbitration court.

The Tax Code states that non-operating costs include:

- Expenses for liquidation of OS;

- Amounts of underaccrued depreciation;

- Amounts of capitalized materials received after complete dismantling of special equipment.

When registering transactions for the disposal of fixed assets, you should take into account the residual value according to accounting and tax accounting. If they are the same, no additional calculations will be required. However, in most cases there are permanent, deductible and taxable differences.

Conclusion

Based on all of the above, the following conclusions can be drawn:

- The company's fixed assets are subject to accounting and tax accounting. When the OS is completely used up, broken, or sold, it needs to be written off.

- The decision to write off the operating system is made by a special commission. She also finds the workers responsible for the shortage.

- Income or loss from the transaction is taken into account in the company's activities.

Similar articles

- Account 01 “Fixed assets”

- Fixed assets renewal coefficient - formula

- Fixed asset renewal ratio

- Indicators of movement of fixed assets

- Fixed assets retirement rate