Retirement benefits upon dismissal include:

- severance pay;

- compensation for unused vacation.

Special payments may be provided for in the specific organization where the person worked. But this is optional.

From 2021, Russian citizens become pensioners much later. But the change in the retirement age did not affect the list of payments due to a citizen who has served his time. Let us turn to Federal Law No. 360-FZ of November 30, 2011.

In accordance with Article 2, the following are issued from pension savings:

- lump sum payment;

- urgent payment;

- provision of funded pension;

- transfer of funds to the heirs of a deceased pensioner.

Often the first point is taken as mandatory - something like a holiday gift. But the law talks about something else.

What is a lump sum payment from a funded pension to pensioners?

According to the procedure for issuing pension savings funds dated February 8, 2012, some categories of people have the opportunity to receive them in the form of a whole amount, and not in parts throughout the year. This format for issuing funds is carried out by the Pension Fund of Russia and non-state pension funds in accordance with the Federal Law “On Compulsory Pension Insurance”. In accordance with it, a lump sum payment to pensioners is mandatory insurance coverage, that is, the pension insurance insurer is obliged to transfer it to the citizen on time. In addition, it is possible to receive an urgent payment generated using additional deposits. That is, if you have a question whether there will be lump sum payments to pensioners, then the answer is yes.

You can check the current amount of your pension savings (PS) at the Pension Fund branch located at your place of residence, bringing your passport and SNILS, or check it through the State Services Portal.

- Recommended articles to read:

- Social services for older people

- Diseases of old age

- Valuable tips on how to choose a boarding house

Severance pay

Severance pay is paid by the employer only in certain cases, which include:

- liquidation of the company;

- staff reduction;

- dismissal due to medical reasons;

- refusal to transfer to another location;

- reinstatement of the employee who previously performed this work;

- refusal to transfer to another job required by the employee in accordance with a medical report;

- refusal to continue working due to changes in the terms of the employment contract.

In essence, it represents some kind of compensation for the fact that the citizen was left without work and, accordingly, without a basic income. This benefit is intended to provide financial support for a citizen during his period of incapacity.

The size of the payment varies from average earnings for two weeks to average earnings for three months. To receive the third month's payment, you will need to register with the employment center within two weeks.

Since pensioners cannot be classified as unemployed, the maximum amount of severance pay that they can count on when the factors described above occur is the average earnings for two months.

Full list of severance pay depending on the reason for dismissal:

Last modified: November 2021

Payments upon retirement by age, size, calculation procedure and amount in monetary terms, in the absence of regulation at the federal level, are assigned to the employer. The legislator increased the retirement age without making adjustments to the conditions.

Economic instability and insufficient payments to the pension fund to ensure a decent standard of living for pensioners are contributing factors for raising the retirement age. The pension reform, gradually implemented since 2019, will ensure the provision of benefits and guarantees to pensioners and people of pre-retirement age.

Who is entitled to a lump sum payment to pensioners from the funded part of the pension?

This procedure can be carried out exclusively from the pension fund after retirement. Now let’s look at which pensioners have the opportunity to receive a lump sum payment:

- Persons born in 1967 and younger.

- Persons whose funded pension does not exceed 5% of the old-age pension. In this case, the fixed payment and the funded part, calculated as of the day of appointment of the latter, are taken into account.

- People who have a disability and survivors' pension, and people who have a state security pension, if they are not entitled to old-age benefits due to insufficient length of service or the number of points at the time of reaching the appropriate age.

- Members of the state co-financing program for the formation of pension savings. You could join the program until December 31, 2014. If from October 1, 2008 to December 31, 2014, you managed to submit an application and made at least one contribution before January 31, 2015, you are considered a participant.

- People who paid insurance contributions to the funded part in 2002-2004. Note that since 2005, such actions have ceased to be carried out due to changes in legislation. These are men born in 1953-1966, and women born in 1957-1966 if they still have pension funds.

In addition, a one-time payment is provided to pensioners of the Ministry of Internal Affairs. Also, persons who have lost their jobs in the Ministry of Internal Affairs are entitled to this benefit while maintaining their pension. A one-time payment to pensioners of the Ministry of Internal Affairs is issued if they are registered for the appointment of such a benefit while still in service.

Typically, a lump sum payment is not given to working pensioners. When dismissal due to staff reduction, the employer must simply assign severance pay.

What do civil servants receive upon retirement?

Payments for civil servants include a long-service pension and some increments. Civil servants receive the right to benefits when they work in federal and municipal organizations for at least 16 years (from 2019 with an increase to 20 years) and reach the age of 60 years for women and 65 for men. If, after achieving the appropriate length of service, a citizen continues to work, then for each year of work over 20 he is entitled to an increase of 3%, but not more than 85%.

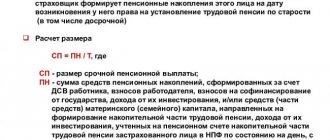

The calculation is carried out according to the following formula:

P = (SZ × 45% - SP) + SZ × 3% + St,

Where:

- P - the amount of pension for length of service;

- SZ - average salary;

- SP - the amount of old-age payments;

- St – more than 16.5 years of experience.

Civil servants are entitled to receive the following amounts and benefits:

- pension part - from 45 to 85% of wages received during the last year of service;

- the right to priority in purchasing free vacation vouchers;

- the right to free travel in city and suburban transport;

- undergoing examination and treatment in departmental medical institutions;

- reimbursement to relatives for funeral expenses.

How much is a lump sum payment to pensioners from the funded part of the pension?

The volume of lump sum payments to pensioners is directly related to the amount accumulated in the pension fund. That is, the larger it is, the larger the payment you will be able to receive. Therefore, if you have just started receiving a pension, you do not need to immediately strive to withdraw the payment. The funded part is still small, which means it will also affect the amount of your lump sum payment to pensioners.

Are you applying for a one-time payment from a funded pension to pensioners? Make sure that the accumulated amount does not exceed 5% of the money given out each month. The amount paid for this period is calculated in accordance with the planned duration of accruals, which is equal to 234 months. Divide the amount by this figure, then calculate what funds will be credited to you along with the savings portion. Divide the funds paid out of savings each month by the number obtained previously, then multiply by one hundred.

Here's an example:

Let's say the insurance benefit is 6,000 rubles. 150,000 accumulated during operation. Then it is necessary to carry out the following operations:

Amount of monthly deduction from the total accumulated amount: 150,000 / 234 = 641 rubles.

As a percentage, this will be: 641 / (6000 + 641) * 100 = 9.7%.

Result: You are not entitled to a lump sum pension payment.

Who is the money given to?

Not all pensioners can receive a one-time subsidy. Federal Law No. 360, Article 4, lists the conditions under which citizens apply to receive one-time payments:

- Citizens who were born before 1966. At the same time, a minimum threshold has been established: for women - starting from 1957, and for men - from 1953.

- The discrepancy between the insurance and funded parts of the pension must be less than or equal to 5%. If the difference is greater, then payments are not assigned.

- Citizens who were officially employed between 2002 and 2004.

- Persons participating in the co-financing program.

- Citizens who took out pension insurance. This must be noted in the individual personal account.

- Citizens who provide themselves with a pension from personal funds.

- Foreigners who meet the above requirements and reside in the Russian Federation on a permanent basis.

At the same time, money can be issued only to those persons who have reached retirement age. The peculiarity of receiving compensation is that citizens who were born before 1966 cannot independently determine the method of forming pension provision.

But those who were born since the beginning of 1967 have this opportunity. Pensioners born before 1966 can receive state assistance, since from 2002 to 2005, employers paid contributions to the funded part of the pension for all their employees.

What is the lump sum payment for pensioners in 2017?

A bill on a one-time payment of 5,000 rubles to pensioners. signed in October 2021.

By the end of 2021, all stages must be completed, and pensioners will receive a lump sum payment in January 2021 along with the pension for this month from the Pension Fund. One-time payments to pensioners should be issued to everyone who applied for a pension before December 31, 2021 and received a pension once or more.

This amount should replace indexation in the second half of the year. The additional funds will be one-time support and will not affect the size of the pension, since the amount is not recognized as part of the pension, but as a means of social assistance from the state.

This change is due to the difficult economic situation - there are no funds for indexation. And pensioners still need help.

Comments: 6

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Elena

06.25.2020 at 12:44 2 months have passed since the electronic assignment of the lump sum benefit and nothing was paid

Reply ↓ - Alexei

03.12.2020 at 10:47It’s not clear - in order to receive a payment, you need to meet all 7 conditions, or any of them?

Reply ↓

Anna Popovich

12/03/2020 at 16:43Dear Alexey, in order to qualify for one-time payments under Federal Law No. 360, you must meet all the conditions given.

Reply ↓

01/14/2021 at 18:07

And they sent me... Where did Makar send his calves... To the Pension Fund of the Russian Federation, however!

Reply ↓

02/03/2021 at 16:43

Why only 1953 and 1957? And those who have been women since 1952 are already wealthy?

Reply ↓

02/04/2021 at 19:47

Somehow everything is so complicated!!!

Reply ↓

One-time payment to pensioners in 2021: who is entitled to it and who will not receive it

One-time payment to pensioners of 5,000 rubles. is accrued to everyone who, living in the Russian Federation, has different pension payments from the Pension Fund. It will be issued to everyone who receives an insurance pension and funds under the state pension program.

Let’s take a closer look at the one-time payment of 5,000 rubles to pensioners, namely who is entitled to it. This includes the following categories of pensioners:

- Citizens with an old-age pension;

- Persons who have lost their breadwinner;

- Disabled children and other persons with a disability pension.

It is important that working and military pensioners can receive a lump sum payment.

Let's discuss those who do not receive additional one-time assistance from the state. These include pensioners living outside of Russia. According to the decision of the Constitutional Court, they can receive the pension earned here. However, they are not covered by this payment, which is designed to mitigate the burden of sanctions and other financial difficulties affecting residents of the Russian Federation. In other words, they are under the care of another state, so Russia does not see the need for this step.

One-time payment of 5,000 rubles. was not assigned to military pensioners, since they receive money not through the Pension Fund, but from the Ministry of Defense, the Ministry of Internal Affairs and other law enforcement agencies. There is also another calculation method. But changes have been made, and such pensioners can now also receive this payment.

Read material on the topic: Old age pension

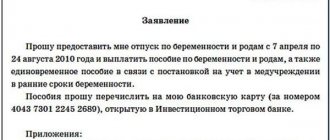

Documents for receiving state aid

One of the main documents for processing a one-time payment to pensioners is an application. Be sure to include the following information in its text:

- FULL NAME;

- the address where you live;

- passport information;

- contact information: phone number, email address;

- personal account insurance number;

- savings account number and method of receiving funds - in cash, to a bank account or card;

- date and place of birth;

- list of documents attached to the application;

- date and signature.

In addition to the application, please provide:

- Citizenship of the Russian Federation or another document that confirms your identity.

- SNILS.

- Work book and pension certificate.

- Certificate about the amount of pension savings.

- Confirmation that assistance from the state for disability has been assigned.

If you cannot personally apply for payments, another citizen may represent your interests. In this case, he must have a notarized power of attorney. You do not need to bring original documents; the law allows for the possibility of providing notarized photocopies.

If erroneous information is accidentally provided, or based on the results of an audit, Pension Fund employees reveal that the applicant cannot receive a one-time benefit, he will be notified of this. Information will be received within 5 days from the moment the decision to refuse was made.

One-time payment of 5,000 rubles to pensioners: advantages and disadvantages compared to indexation

Advantages:

- Allows you to ease the burden on the state budget.

- The Pension Fund of the Russian Federation does not pay interest on the accrual of money from the budget. They are contributed by the budget, bypassing the fund.

- The benefit also applies to pensioners who continue to work - previously they were not affected by indexation.

- The support is intended for all pensioners. This is especially important for those who receive small pensions.

- The pension increases with indexation by a smaller amount than in this case.

There are also disadvantages:

- The amount does not compensate for the current inflation rate.

- It has a fixed amount regardless of the size of the pension.

- A one-time payment to pensioners is not considered for further indexation. The latter is based on amounts for spring 2021.

Supplement to social pension

Pensioners who are not working and whose income is less than the minimum subsistence level established in the region can count on receiving a social supplement to their pension. It is subject to registration along with the pension. To do this, you need to submit a corresponding application.

Additional payments to social pensions can be of two types:

- Federal surcharge – a pensioner’s income is less than the established minimum subsistence level in Russia;

- Regional surcharge – a pensioner’s income is less than the established subsistence level in the region.

These social supplements differ in that the regional ones are paid by social protection authorities, and the federal ones are paid by the Pension Fund of the Russian Federation.

As a rule, this additional payment is accrued in the next month after submitting the application.

Indexation or lump sum payment to pensioners: which is more profitable?

So, we have determined that a one-time payment to pensioners of 5,000 rubles. designed to replace indexing. Let's see how it will affect the budget of no longer working citizens. Let's consider two conditional options (we will take into account the period: January 2016-January 2017):

- The benefit was fully indexed twice in 2021.

- Instead of re-indexation, a payment of 5,000 rubles is made.

Option 1. Carrying out two-time indexation to the inflation level.

Let’s say that at the beginning of 2021, a pensioner is credited with 12,000 rubles. In February 2021, indexation took place and 4% was added to the amount. Then she began to compose:

12,000 rub. + 480 rub. (4% of 12,000 rub.) = 12,480 rub.

These funds are accrued to the pensioner within 7 months (February 2021 – August 2016):

RUB 12,480 × 7 months = 87,360 rub.

After which another indexation takes place in September, increasing the pension by 8.9%. Since inflation in 2015 was 12.9%, and in February pensions rose by 4%, the re-indexation value will be 8.9%:

RUB 12,480 + 1,110.72 rub. (8.9% of 12,480 rubles) = 13,590.72 rubles.

These funds are issued for 5 months, until the next indexation in February 2021 (September 2021 – January 2017):

RUB 13,590.72 × 5 months = 67,953.6 rub.

It turns out that for the current year the citizen was issued:

12,000 rub. + 87,360 rub. + 67,953.6 rub. = 167,313.6 rub.

Option 2. One-time payment to pensioners instead of another indexation.

As in the situation discussed above, during indexation in February 2021, the pension increased by 4%:

12,000 rub. + 480 rub. (4% of 12,000 rub.) = 12,480 rub.

So it is accrued for 12 months, until indexation in February 2021 (February 2021 - January 2017):

RUB 12,480 × 12 months = 149,760 rub.

At the beginning of 2021, 5,000 rubles will be added to it.

For the year, the pensioner will be paid:

12,000 rub. + 149,760 rub. + 5,000 rub. = 166,760 rub.

When analyzing the final amounts, it is clear that the difference is small: in the second option, the pension is lower by 553.6 rubles.

But note that if the pension is larger than in the example, the difference will be more significant. This is due to the fact that indexation, unlike a lump sum payment to pensioners, gives a percentage increase. The advantage of additional indexation in 2021 and the revision of pensions in 2021 is that the calculation would take place based on the size of the already increased benefits.

A survey was conducted on social networks to find out the respondents’ opinions on replacing indexation with a one-time payment to pensioners in January 2021.

The topic was formulated as follows: “5,000 rubles: is this a sufficient replacement before pension indexation in 2021?” The voting results were as follows:

- “No, not worthy. Promises must be kept!” – 50.5%.

- “This is better than a minor increase in pension” – 16.5%.

- “This is the most reasonable measure in the current conditions” – 14.3%.

- “I don’t see much difference” – 9.9%.

- “Yes, worthy for me. I’m a working pensioner!” – 8.8%.

Payments and benefits

Employees of retirement age are workers just like everyone else. The legislation does not provide for them certain working conditions and payments.

Consequently, when such an employee leaves work, he is entitled to the same payments as the rest of the staff, but with certain features. So, upon dismissal, a calculation is provided consisting of the following payments:

- salary for hours worked;

- compensation for missed vacation;

- severance pay;

- other payments provided for in the employment contract or collective agreement at the enterprise.

Thus, we can conclude that the procedure and types of monetary payments are established by labor legislation, as well as local regulatory and legal acts of the law firm. Both are required to be paid.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

The differences between these financial transfers are that the benefits established by the Labor Code apply to all workers, while the latter apply only within one organization.

One-time payment to pensioners in 2021: frequently asked questions from recipients

Question 1 . The funds arrive at the post office, but the pensioner left the region for a short time. Can he get them later?

Answer : if the payment did not take place in January 2017, it will be repeated the next month along with the pension.

Question 2 . I receive two pensions: one from the Pension Fund - an insurance pension without a fixed payment, and the other - for length of service in law enforcement agencies. Where can I expect a one-time payment of 5,000 rubles to pensioners?

Answer : if a citizen is entitled to two pensions from two organizations and one of them goes through the Pension Fund of the Russian Federation, then the Pension Fund will issue him a lump sum payment. At this point, the reconciliation of the recipients of the two benefits has already been completed.

Question 3 . I will be 55 years old on December 31, 2021. I sent an application for a pension to the Pension Fund office at my place of residence. I have completed my insurance and northern experience. Can I count on a lump sum payment to pensioners in January?

Answer : of course, you are entitled to a lump sum payment, because from December 31, 2021. you are officially considered a pensioner - you will receive old-age insurance benefits.

Question 4 . I am awarded one survivor's pension for 2 children and a second one for caregiving. How much of a lump sum payment awaits me?

Answer : a one-time payment to pensioners of 5,000 rubles. is paid to each beneficiary upon loss of a survivor. An allowance is also provided for a person caring for a citizen under 14 years of age, that is, plus five thousand rubles.

Question 5 . I am disabled group 3, and I must undergo re-examination by the previous ITU commission before December 2021. I am currently in the hospital. If I pass the ITU commission at the beginning of 2021, will I be able to qualify for a one-time payment to pensioners?

Answer : it depends on the date set by the ITU commission. If disability is recognized from 12.2016. and the reason for the delay is considered valid, then a lump sum benefit is issued.

Question 6 . Is the assignment of a lump sum payment to a citizen taken into account when considering the possibility of assigning social support?

Answer : no way.

This payment is 5000 rubles. is not calculated when determining the right to other options for support from the state under the legislation of the Russian Federation and the subject of the Russian Federation.

What do the military get paid?

Payments to military personnel are regulated by Resolution of the Armed Forces of the Russian Federation No. 4202-1 (as amended on November 28, 2015) and Order of the Russian Ministry of Defense No. 2700 dated December 30, 2011. In accordance with these regulations, the lump sum benefit upon retirement depends on length of service. The benefit is:

- 7 cash support salaries if the service period exceeds 20 years;

- 2 salaries for service life less than 20 years;

- additional salary if there are state awards.

Long-service benefits for military personnel are calculated using the following formula:

(DD × 50% + DD × 3% × St) × K,

Where:

- DD - military allowance;

- St - number of years of service over 20;

- K - reduction factor.

Application for a pension in the system of the Ministry of Internal Affairs of Russia (recommended sample, approved by Order of the Ministry of Internal Affairs of Russia dated 01/09/2018 No. 7:

| _____________________________________ (name of the pension authority) From ___________________________________ (special title, full name of the person being dismissed) _____________________________________ residing at ______________ _____________________________________ _____________________________________ APPLICATION FOR PENSION Please assign me _____________________________________________________ (indicate the type of benefit). Currently _____________________________________________________ (indicate whether he receives benefits, from which body, from what time the payment stopped). Family composition ________________________________________________________________ (wife, minor children and other dependents). I request that the pension due to me be paid by (underline as appropriate): transfer to deposit to account N ________________________________________ in branch N ___________________________ of Bank institution N _________________________________________________________________________ transfer through federal postal organizations to the address: __________ _______________________________________________________________ (indicating the postal code) I have read the terms of payment. In the event of circumstances affecting the right to receive a pension or its amount, I undertake to promptly inform the pension authority. I am attaching the following documents to the application: ______________________________ ___________________________________________________________________________ ___________________________________________________________________________ “__” __________ 20__ _________________ (signature) |

Additional payments to military personnel are due in the following cases:

- the pensioner is supported by incapacitated persons;

- military pensioner over 80 years of age;

- the pensioner received group 1 disability;

- is a participant in the Great Patriotic War;

- has lived or worked in the Far North for at least 9 years.

One-time payment to pensioners: what else can pensioners expect in 2021

Increase in pension payments

In 2021, pension indexation will again follow the same pattern. That is, insurance pensions will increase by the level of actual inflation, and state pensions, including social ones, will rise taking into account the increase in the pensioner’s cost of living.

Starting from February, insurance pensions for non-working pensioners will rise to the inflation rate for 2021, or 5.8%. In addition to the insurance pension, up to 4,823.35 rubles. both the size of the fixed payment and the cost of the pension point will increase to 78.58 rubles. In 2016, this figure was 74.27 rubles.

From April 1, state pension benefits, including social benefits, will be increased by 2.6%. The procedure will affect both working and non-working pensioners.

From February 1, the monthly payment issued to federal beneficiaries will be indexed by 5.8%.

Citizens who were still working in 2021 will have their insurance pensions increased in August 2021. The largest increase in cash equivalent is three pension points.

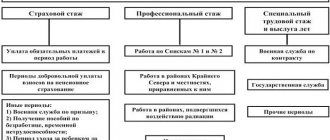

Peculiarities of pension assignment

According to the pension formula used in Russia since 2015, to obtain the right to the insurance part of the pension in 2021, you must have 8 years of experience and 11.4 pension points.

In 2021, the maximum possible number of pension points is 8.26.

The payment period when calculating the funded pension in 2021 is 240 months. This figure is used exclusively to determine the volume of the funded part of the pension. The issuance of the pension itself is for life.

Any person has the opportunity to ask for each type of pension, while remaining at home. This is easy to do by submitting an application on the Pension Fund website in the “Personal Account” column. Here, if necessary, you can change the pension provider.

Extension of the moratorium on the formation of pension savings

The moratorium on the formation of pension savings has been officially extended to 2021. This is in no way a “freeze of pensions” or a “withdrawal of pension savings.” This concept means that 6% of insurance premiums, which could go to the funded part, are redirected to the insurance. That is, insurance premiums paid by the employer are fully included in the formation of the employee’s pension.

The moratorium does not prevent the transfer of savings to management companies or between pension funds if a person wishes. However, it is important to remember that it is not profitable to transfer savings from one insurer to another more often than once every 5 years, since this action reduces the accumulated investment income.

Legal regulation

If a special law does not provide for certain payments upon retirement, then internal local documents approved by the employer and having legal force only if conditions are improved compared to federal ones are fundamental.

Internal documents

How much salary is paid upon retirement by age or a fixed amount of money is important to establish in the collective agreement and in the regulations on remuneration. If this information is missing, then the administration has every right not to make additional payments other than those regulated by the Labor Code.

In general, upon dismissal according to the Labor Code, the following is paid:

- Basic and additional wages for the period worked. This is payment in accordance with the official salary and tariff rates, allowances and bonuses for production performance in proportion to the time worked. Quarterly bonuses and additional payments based on the results of work for the year can be made additionally upon completion of the reporting period and the formation of financial indicators.

- Compensation for unused vacation, regardless of the periods when the employee did not take advantage of the vacation right. Not a single day is lost or burned during dismissal. Alternatively, the pensioner can go on vacation immediately before being released from work.

- Severance pay upon retirement in the event of staff reduction, liquidation of an organization or according to the rules provided for by a collective agreement, legislation or written agreement with the employee.

The final payment to the employee in accordance with Article 140 of the Labor Code is made on the last working day of work according to the schedule, in the event of the employee’s absence from the workplace for valid reasons no later than the next day.

A pensioner’s forced “own desire” to resign is punishable and can be appealed in court with an obligation to compensate for forced downtime and moral damage.

Pension reform

The increase in pensions due to a decrease in the number of pensioners will be carried out gradually from 01/01/2019. Indexation calculations from January 2021 are carried out by the Russian Pension Fund.

According to Law No. 350-FZ of October 3, 2018, when retiring into old age pension, the following conditions must be met simultaneously:

- a gradual increase in the retirement age to 60 years for women, 65 for men, which will reach the threshold in 2023; a gradual increase in the total insurance period to 15 years until 2024; smooth growth of the IPC indicator to 30 units in 2025.

Raising the retirement age by 5 years will affect teachers and medical workers applying for a long-service pension, residents of the Far North and similar regions who have the right to early retirement due to unfavorable climatic conditions. Applicants for a social pension - persons who are not entitled to a pension due to a lack of pension experience or points, will be able to receive a pension taking into account a gradual increase in age.

For government employees

When a civil service employee retires, he will receive a pension, as well as a supplement to it. The supplement represents a certain share of the insurance pension. Having worked in the civil service for at least 15 years, the employee will be rewarded with a bonus of 45% of the average monthly salary.

Expert opinion

Zakharov Nikita Evgenievich

Practicing lawyer with 7 years of experience. Specialization: family law. Member of the Bar Association.

Another option is that civil servants may receive a pension supplement depending on their salary, which will be calculated over 10 years. What does a pensioner who has worked in such service receive from the state?

- All government guarantees are preserved.

- The right to medical care is given both for the pensioner himself (former civil servant) and for his family members.

- Compensation may be issued for unused vouchers.

- After the death of a civil servant, his family will receive funds for the burial of the deceased.

Social help

In addition to social benefits, older people have the right to receive assistance in kind. For this category of citizens there is a special set of social services, which they can receive completely free of charge. What services are included in the free package, we will consider below:

- Firstly, pensioners have the right to receive medications that are included in the free medical list. As a rule, these drugs include those drugs that are vital. Free drugs can only be dispensed from a state pharmacy. If there is no such pharmacy at the place of residence, the pensioner will not be able to receive this benefit.

- Secondly, pensioners have the right to stand in line to receive referrals to disability sanatoriums. In this case, treatment will be provided free of charge. If a pensioner is a disabled person of the first group, he can receive two vouchers at the same time. One voucher must be used by the disabled person himself, and the second voucher must be used by the person who will accompany him.

- Thirdly, if an elderly person does not want to use services that are provided free of charge, he can receive compensation for this in the form of money. In order to receive additional money for unused services, you need to submit an application. The money will be accrued from a lump sum cash payment and transferred to the person’s personal account.

According to the Federal Law “On State Social Assistance” dated July 17, 1999 N 178-FZ of the Russian Federation, not all pensioners can receive this special set of free services, but only a certain category of pensioners:

- Persons who are veterans or participants of the Great Patriotic War;

- Persons who performed military service and received any state award;

- Persons who performed military service during the Great Patriotic War;

- Citizens who participated in the Great Patriotic War and received the status of “Resident of besieged Leningrad”;

- Citizens who were in the rear during the Second World War;

- Citizens whose WWII veterans and disabled people who were family members died;

- Persons who are disabled.

Elderly people who are in difficult financial situations can turn to the state for help. This category of citizens can be assigned assistance in the form of cash payments or in kind.

People who need help can count on food, hygiene products, and necessary things. If a pensioner is disabled, he can receive a means of mobility and rehabilitation.

In order to exercise the right to receive assistance in a vital situation, you need to do the following:

- visit social protection authorities located at your place of residence;

- apply for assistance;

- provide all the necessary documentation: passport, pension certificate, evidence of being in a difficult situation.

After submitting the application, the citizen will receive a response within ten days. If the answer is yes, then he will receive the help he wanted, that is, either money or in kind.

Pension savings

There are several benefits that a pensioner can receive. Currently, the state provides the following pension savings:

- A lump sum payment is a payment in which you can receive money at one time.

- A term payment is a payment that is accrued monthly for a period of time, but not less than ten years.

- A funded payment is a payment that a pensioner receives every month until the end of his life.

- A payment that can be withdrawn by the heirs of a pensioner.

Important! Legal successors can expect to receive savings only if the investor dies.

Application for benefits

The application must be written first. The required information that must be contained in the application is the following:

- first name, patronymic, last name of the pensioner;

- year and date of birth;

- Place of Birth;

- citizenship;

- gender;

- place of residence;

- passport data;

- SNILS;

- phone number;

- information about pension;

- Bank details;

- date of writing the application;

- personal signature of the citizen.

Important! The application must contain the account number, which is a pension account. This account must be entered by an employee of the Russian Pension Fund.

If the application is not submitted personally by the pensioner, but by his authorized representative, then the application must contain information about the representative: first name, patronymic, last name, data from the passport, telephone number.

Formation of accruals

After the reform, the formation of benefits changed. Currently, all deductions can be made only if a citizen expresses his desire. There are several options for using monetary transfers:

- contributions can be used to transfer payments for unemployed citizens;

- money can be transferred to the accounts of organizations that deliver funds, or to the accounts of Non-State Pension Funds that will invest funds in the financial market.

In 2021, twenty-two percent of contributions are paid, according to which:

- six percent is allocated for fixed transfers;

- the remaining interest must be spent based on whether the citizen retained or abandoned the funded part.

If the benefit is preserved, then all sixteen percent will go to forming an insurance pension. If a citizen refuses to receive this payment, then the funded part will be six percent, and the insurance benefit will be ten percent.