Bonuses are one of the most effective methods of rewarding employees. The purpose of the assigned monetary rewards to employees is to stimulate them to achieve higher performance indicators. We are talking about bonuses, which are calculated based on the results of the year. The payment of such a bonus has a beneficial effect on the bottom line of the entire company, increasing the level of productivity and efficiency, and demonstrating the innovative activity of employees. Knowing how to correctly calculate bonuses is very important for an accountant.

Bonus concept

A bonus based on annual performance is the amount of cash payments, which is an incentive bonus for staff in order to achieve better work results and increase the efficiency of the company. The employer can set goals independently at the beginning of the year, and then provide various incentive measures to achieve these goals. The award is one such method.

As a rule, a bonus is understood as the amount of a monetary bonus for achieving a specific threshold of results in work, which is provided for by the plan.

The bonus system is regulated by the company’s internal local documents, the collective agreement, and the regulations on bonuses at the enterprise. The legislation does not have a direct obligation on the employer to provide bonuses to employees. However, if such a point is stipulated in agreements and contracts, then the premium must be calculated.

The establishment of bonus parameters, conditions and methods of incentives rests entirely with the employer. There are no restrictions. However, the terms of the incentive should be agreed upon with a representative of the workforce.

The bonus system assumes:

- systematic payments (for example, every month);

- periodic payments;

- individual payment amounts.

Examples of results for which a bonus is paid:

- for the worker: fulfillment of the production plan;

- for an office worker: fulfilling the sales plan.

Bonuses are classified depending on the assessment of work results:

- for the number of units produced at one cost;

- for each unit in excess of the previously established plan;

- fixed bonus percentage upon exceeding the task.

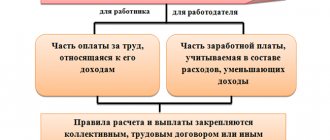

Part of your salary or in addition to it?

Labor Code of the Russian Federation in Part 1 of Art. 135 indicates that remuneration for labor also includes incentive payments, which include bonuses.

If the bonus is not awarded constantly, but depending on the results achieved, then this is no longer part of the mandatory payments, but a form of incentive (Part 1 of Article 129 of the Labor Code of the Russian Federation).

The bonus payment procedure must be documented in the local regulations of the enterprise. These items may contain:

- in the collective agreement (part 2 of article 135);

- in an individual employment contract (part 2 of article 57, 1 paragraph);

- in a specially designated regulatory document, for example, Regulations on bonuses, Regulations on remuneration for labor (part 2 of article 135, part 1 of article 8);

- order for the organization on bonuses for an employee or employees (Part 1, Article 8).

bonus based on the results of work over three years taken into account when calculating average earnings for the payment of vacation ?

Conditions of annual bonus

Year-end bonus (13th salary) is an incentive payment accrued to an employee if he complies with specific conditions established in legal documents during the working year. Such conditions may be the achievement of certain indicators or the absence of negative aspects. In each organization, bonus conditions are developed individually and approved by management.

The document stipulating bonuses at the end of the year must contain the following information:

- when is this type of bonus awarded?

- requirements for those who count on this payment;

- factors influencing the size of the premium (both increasing and decreasing);

- conditions for the employee's bonus payment.

How are bonuses and remunerations at the end of the year taken into account when calculating average earnings ?

When is it more and when is it less?

The amount of the annual bonus is almost never fixed. It would be unfair to reward equally a “veteran” and a young specialist who has barely worked his first year, yesterday’s absentee with a disciplinary sanction lifted, and an impeccable employee who brought profit to the company. The employer usually varies the size of the bonus depending on:

- employee qualifications;

- his work experience;

- working conditions;

- complexity of the labor function;

- time of actual employment;

- quality indicators.

For example, the bonus can be increased if the employee saves the organization’s resources, introduces some useful innovation, achieves particularly high performance, etc. The decrease may be due to comments, reprimands, or errors in work.

REFERENCE! It is most convenient to “link” the size of the bonus to the average salary (monthly or annual) and operate with separately established coefficients.

What about the newbies?

If an employee has worked for the company for less than a year, then whether to pay him remuneration or not depends on the conditions specified in the relevant Regulations.

Some entrepreneurs give year-end bonuses only to employees who have worked the entire year.

Others prefer to encourage “green” employees by recalculating bonuses for the months actually worked.

The same practice applies to resigning employees.

They may not give it

The Regulations on the Prize must stipulate the conditions under which the bonus will not be paid. As we have already established. This is not an obligatory part of the salary, and they have no right to deprive or reduce its size on any grounds.

Specific conditions must be provided for depreciation, for example:

- the presence of an outstanding disciplinary sanction;

- loss caused by the fault of an employee;

- errors in work that led to serious consequences (it must be specified which ones - for example, injuries, accidents).

Annual bonus

This type of bonus is calculated at the end of the year, usually in February of the year following the reporting year. The annual bonus is not a mandatory payment for the employer. Its payments are not required by law. Therefore, there are no specific recommendations on charges and payments. Employers independently develop these points and methods.

Important! The calculation of annual bonuses is necessarily preceded by the inclusion of the main issues of its calculation and payment in local documents. If there is no reference to annual incentive payments in any document, then their accrual is fraught with claims from the tax office. The fact is that such expenses cannot be taken into account in the tax base for income tax.

Local acts should not only mention the bonus, but also specify the size, procedure, conditions and terms of accrual.

Main documents setting out the terms of the bonus:

- employment contract;

- collective agreement;

- wage regulations;

- order on awarding bonuses to special employees.

Payment to a deceased employee

Article 83 of the Labor Code of the Russian Federation states that the death of an employee is grounds for termination of an employment agreement. Consequently, a deceased employee is considered to be dismissed for a reason beyond his control.

Previously, the conditions under which dismissed workers are paid an annual bonus were noted. In the case of deceased employees, the situation is resolved in a similar way.

Relatives of the deceased may be eligible to receive a monetary reward. Ideally, the internal local act should indicate that a dismissed employee can legally qualify for payment of remuneration at the end of the year.

Regulations on bonuses in the company

It is a central document that specifies the basic conditions and information on the organization of the bonus system, including the annual one.

The main sections of the Bonus Regulations regarding the calculation of the annual bonus are presented in the table below.

| Article | Description |

| Indicators according to which the bonus is calculated | Depends on factors: type of company activity, form of remuneration |

| Sources from which the premium is paid | Sources may be: · company expenses; profit after tax |

| Employees who are allowed to issue bonuses | All full-time employees. But within different groups there may be different bonus percentages |

| How many months must you work to receive a bonus? | Full year |

| Bonus payment terms | Depends on the company structure. |

| In the absence of sufficient funds, what are the restrictions on the wage fund? | The refusal can only be justified by the unprofitability of the enterprise. The internal document should indicate the likelihood of a reduction or reasons for refusing to pay the annual bonus |

| In what situations are bonuses deprived? | At the discretion of management |

| Individual cases | These cases relate to termination of the contract or dismissal, depending on the article. |

Important! The enterprise appoints an executive person or commission that deals with the following issues:

fulfillment of bonus conditions;

checking the compliance of persons with bonus requirements;

calculation of bonuses.

The bonus regulations can be downloaded here. Form of bonus regulations

How is the annual bonus paid?

The sequence of payments is as follows:

- The manager receives information from the HR department about the labor performance of the team;

- the manager is presented with information about the time actually worked by employees, about violations of internal regulations, about the fulfillment or overfulfillment of production standards;

- after studying all the data, the manager determines the need for bonuses;

- an order is issued to assign a bonus and its amount in the T-11 form;

- if the order concerns a group of employees at once, then form T-11a is used;

- further, all employees are required to familiarize themselves with the order against signature;

- the order is transferred to the accounting department;

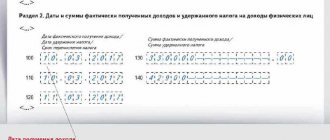

- the accountant draws up an expense order KO-2;

- a payslip is drawn up in form T-49 or a payslip in form T-53;

- When transferring bonuses to employee cards, payroll T-51 is filled out.

You can download the order in form T-11 here. Sample T-11

You can download the order in form T-11a here. Sample T-11a

You can download the KO-2 order here. Form KO-2

You can download the T-49 form here. Blank T-49

You can download the statement in form T-53 here. Sample T-513

You can download the statement in form T-51 here. Blank T-51

How is the annual bonus calculated?

The calculation of bonuses and their payment is carried out at the request and capabilities of the employer.

To calculate the premium you need:

- summarize all employee expenses for the year;

- increasing coefficients are not taken into account when summing;

- multiply income by bonus factor.

The formula looks like this:

GP = (Salary * 12 * P) – (Salary * 12 * P) * 13%,

where GP is the annual bonus amount, t.r.;

Salary – monthly salary of an employee without taking into account increase factors, etc.;

P – percentage of bonus from local acts of the company, unit share;

13% – personal income tax percentage.

How to calculate bonuses based on the results of work for the year?

It was previously stated that information on the payment of bonuses at the end of the year should be reflected in documents - an employment or collective agreement, a special Regulation or order. It should be noted that it is these papers that describe the technology for determining the amount of bonuses for the year. In particular, they must indicate the bonus percentage.

In most cases, the following formula is used to calculate the annual premium:

Year. prem. = (Monthly salary x 12 months x % bonus) – 13% (personal income tax).

The percentage is determined by the employer. The bonus system chosen by the company management must be approved in the documentation.

The specified formula for calculating the annual premium is considered standard and the most common.

Remuneration at the end of the year can be accrued in several ways:

- calculation according to average earnings, proportional to time worked;

- in accordance with a certain established coefficient (%);

- in accordance with a certain amount of money (for example, one or more salaries).

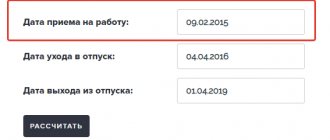

Example of calculation for actual time worked for 2020

In order to understand how to calculate the bonus at the end of the year for the time actually worked, you need to familiarize yourself with the example.

Initial data:

It is assumed that the annual bonus is accrued to the employee in proportion to the time worked. To determine the amount of money to be paid, it is important to calculate how many days he actually worked in the accounting year.

The employer in 2021 calculates the bonus for 2021. He plans to pay it along with the salary for the second half of December on January 14, 2021.

In 2021, there are 247 working days according to the five-day production calendar.

In 2021, the employee spent 5 days on a business trip, 14 days on vacation, and 5 days on sick leave.

Calculation of bonuses for the year:

Number of days actually worked per year = 247 – 5 – 5 – 14 = 223.

Average monthly salary = 30,500 rubles.

Annual bonus = 30,500 x 223 / 247 = 27,536.44 rubles.

Indicators for assigning an annual bonus

To determine these indicators, working conditions at the enterprise are examined.

Approximate bonuses are shown in the table below.

| Form of remuneration | Indicators for the award | Indicators for reducing premiums |

| Piecework | · implementation of the sales (revenue) plan; saving resources | · failure to fulfill the plan; · violation of labor discipline |

| Time-based | · introduction of advanced work methods; · development of new technology; · participation in projects | · violation of the routine; · making mistakes; · decrease in performance in general |

| Piece-bonus | · improvement of quantitative production indicators; · improvement of quality production indicators | · reduction of the variable component of wages; Violation of safety regulations |

Important! The basis for complete deprivation of the bonus is a serious offense: absenteeism, drunkenness at the workplace, intentional damage to property.

Premiums for a period exceeding one month

There are two options for such premiums.

The first is that the duration of the period for which they are accrued does not exceed the billing period. When working hours are fully worked, they are taken into account when calculating average earnings in actual accrued amounts. Example

In December of this year, Ivanov, an employee of Salyut CJSC, was sent on a business trip. The billing period is 12 months. Therefore, it includes the time from December 1 of the previous year to November 30 of the current year. Ivanov worked out the billing period completely.