What is a monthly performance bonus?

A monthly bonus is a financial reward and encouragement to an employee for productivity and high performance in the financial activities of the organization (read more about why bonus indicators are needed and how they affect the efficiency of the company’s employees, read here, and we talked about the performance evaluation criteria for bonuses for the chief accountant here ).

The equivalent of the incentive payment must be specified in the employment agreement and in the acts directly of the company itself. The bonus may have a fixed amount or be calculated as a percentage of the employee's earnings.

Financial incentives paid monthly are of two types:

- Production is part of the salary. Often, such bonus payments are directly related to the amount of work performed by the employee.

- Non-productive – this is, for example, when an employee has minor children and is given a bonus for this.

For details about when an incentive payment is issued to an employee and how to correctly fill out an order for a bonus at the end of the month, read in a separate material.

Legal basis for bonuses

Promotion is carried out on the basis of legislation and internal rules of the company. And although the norms of the Labor Code of the Russian Federation established some types of remuneration, including the payment of bonuses, this list can be significantly expanded by local regulations.

Despite the fact that the Labor Code of the Russian Federation indicates the types of awards, it does not contain more detailed information. Therefore, when deciding on the type of remuneration, any boss is guided simultaneously by both general and internal norms. Such details are always reflected in the bonus regulations, which are drawn up in the form of a separate local act or may be one of the sections of the collective agreement.

Internal documentation should reflect:

- Types of incentives that will be regularly used in the organization.

- Reasons for their use.

- Frequency of rewards. For example, the bonus will be monthly, quarterly, semi-annual or annual.

- Reasons for reducing incentive payments or canceling them completely.

- The procedure for applying incentive measures.

These conditions are established taking into account the specifics of the organization’s activities and its financial capabilities.

How is the size determined?

The bonus system is controlled and established directly by the organization itself. This is defined in Article No. 114 of the Labor Code of the Russian Federation, that the organization itself determines the periods of bonus payments and the amount.

Calculation of the monthly bonus based on the salary and a certain time interval:

Formula: Bonus = Salary / total number of working days in the period x actual number of days worked in the period .

Example: An employee’s salary is 40,000 rubles.

There are 22 mandatory working days in the period.

4 times the employee did not come to fulfill his work duty due to certain circumstances.

Total: 40.000/22*18= 32.730

Calculation of the monthly bonus based on the percentage of the salary and a certain time period:

Formula: Bonus = Salary x Incentive amount in the form of a set percentage of salary / 100 / total number of working days in the period x actual number of days worked in the period.

Example: An employee’s salary is 40,000 rubles.

There are 22 mandatory working days in the period.

4 times the employee did not come to fulfill his work duty due to certain circumstances.

Percentage – 45%.

Total: 40.000*45%/100/22*18= 14.730

The given formulas are fundamental and may vary depending on the circumstances.

You can find out more about how to calculate the size of the bonus and what its maximum value is here.

The procedure for calculating and processing bonuses for employees

Those involved in calculating the bonus include the following responsible persons:

- department managers who analyze employee performance;

- management assessing the performance of business areas;

- responsible persons of other departments.

Calculation procedure:

- selection of criteria for the payment of bonuses based on the results of the completed working period by the head of the department, the choice is based on the financial situation of the company;

- drawing up a memo, recording the justification for payment of incentives, employees, amounts to be paid;

- amounts are agreed with the finance department;

- the manager makes the final decision on payments;

- an order is formed with the signature of the main persons (you can find out what a sample order for a bonus for a professional holiday looks like here, and in this article we talked about the procedure for calculating incentives for an anniversary);

- The payment is made by the company's accounting department.

What income code applies?

“Income code” is an important column that is available in the 2-NDFL certificate . It must be filled out. Each income must be marked with a four-digit number from 1010 to 4800.

Since the monthly bonus is a component of the monthly salary, the “salary” code 2000 is quite suitable for it.

Reference! There are no fines for an error when an employee issues a certificate, but the correct code is important. Specifying an incorrect code will have a direct impact on how taxes are paid.

Awards and personal income tax

These payments are not always subject to personal income tax, and all types of such remuneration are listed in Art. 217 NK. Personal income tax on material assistance - whether you need to pay or not, whether assistance is taxable, you will find out in the article at the link.

Such rewards include rewards for achievements in the field of technology, education, science, art, culture or other areas of significant importance for the entire state. All these payments are appointed by the Government or state officials.

Also, bonuses issued by companies may not be taxed, and they must be in the form of gifts or financial assistance. In this case, there is no need to pay personal income tax on these funds. But some rules are taken into account:

- per year such payment should not exceed 4 thousand rubles;

- funds are not given out just like that, so they are usually assigned on some significant dates;

- Without fail, a gift agreement is drawn up with the employee who received such remuneration, and it is done in writing and taking into account the requirements in Art. 574 Civil Code.

Only by taking into account the above requirements can you avoid paying personal income tax on a certain remuneration. Here you will learn how to fill out an application for a personal income tax refund.

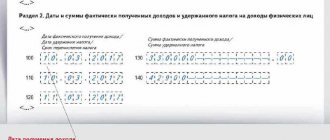

How is the monthly premium reflected in the 6-NDFL certificate?

The funds that are transferred to employees every month are certainly classified by companies as labor costs. Therefore, income for citizens arises on the day the remuneration is calculated, and the date is reflected in the 6-NDFL certificate, namely in line 100 of the second section.

Personal income tax is withheld on the day the premium is paid, and the amount is indicated in the second section of the document on line 110.

Sample of filling out the 6-NDFL declaration.

Important! The deadline for paying the tax is the day following the day the tax was withheld, and information about this is written down in the second section of the document and in line 120.

Recalculation of vacation pay when paying cash incentives

The procedure for recalculating vacation or compensation financial payments differs significantly from the standard procedure for calculating dividends. To do this, it is necessary to perform calculations directly related to the results of work activities .

One-time dividends for high performance or non-production activities are taken towards vacation pay in cases where two conditions are met:

- bonus payments pre-established by the remuneration system for labor activity (clause 2 “Regulations on the system for calculating the average wage.” The Government of the Russian Federation was approved on December 24, 2007 No. 922).

- As for work processes, they are described in paragraph 15 “The position of calculating systems and their features with an average salary.”

When paid for a certain period of time, the calculation of vacation pay is affected by:

- whether or not the premium calculation for the period is exceeded;

- whether the calculated period has been fully worked out.

Example: An employee of an organization has worked out a full payroll period. Bonus time is included in the payslip. This means that accrued incentives are included in vacation pay in full.

Designer Pavlov works for . His salary is 10,000 rubles. He is given leave from September 1 to September 14, 2021. The estimated time from September 1, 2015 to August 31, 2021 has been fully exhausted.

Following the company’s agreement, for the timely completion of the project, which lasted from October 1 to October 31, 2015, on November 1, 2015, Pavlov was given a bonus of 8,000 rubles. Pavlov worked the entire pay period; financial incentives require accrual of vacation pay.

What determines whether a bonus is included in a salary?

The bonus paid to the employee will be his income in any case - regardless of whether it is included in the incentive payments that form the remuneration system. However, for both the employer and the employee, the option of issuing a bonus as part of the salary turns out to be more profitable:

- for the employer - because the amount of bonuses included in the salary can be unconditionally attributed to expenses that reduce the profit base;

- for the employee - because bonuses, which are part of the payment for work, will be taken into account among his income involved in calculating average earnings.

Important! Practical situation from ConsultantPlus Is it possible not to pay an employee a bonus during the probationary period? The answer to this question depends on what kind of remuneration system the employer has adopted. You can find out more details in K+. Trial access to the legal system is free.

Art. allows you to include a bonus in the list of payments that make up the remuneration system. 129 and 135 of the Labor Code of the Russian Federation. In order to give the bonus a legally significant form, the employer must designate it as one of the types of remuneration for work, enshrining this in its internal document (regulations on remuneration or collective agreement).

In addition, you will have to develop bonus rules, which should include:

- lists of types of bonuses accrued;

- an indication of the frequency of accrual of each type;

- determining the circle of employees who will be eligible for bonuses with one payment or another;

- listing of indicators giving the right to accrue bonuses;

- description of the system for assessing indicators that serve as the basis for bonuses;

- formulas for calculating bonus amounts based on an assessment of the indicators that must be achieved to receive a bonus;

- description of the procedure for considering the above indicators;

- a list of grounds for deprivation of a bonus;

- a description of the procedure that allows an employee to challenge the results of the assessment of his right to a bonus.

Read about the main document describing the wage system in this material.

Important! ConsultantPlus recommends that you can pay bonuses to an employee in accordance with your current system of remuneration and bonuses. If you want to issue an award as a one-time incentive, you can follow the procedure... Read more about the procedure for assigning and issuing one-time bonuses in K+. Trial access to the system is free.

Accounting in accounting

All types of bonus payments are reflected differently in accounting. The choice remains with the management of the enterprise or another authorized person. Each method has its own differences (we talked about how to formalize and record the payment of one-time bonuses here).

All bonus payments relate to the income of working personnel and are fully subject to taxation, and require strict accounting (we talked in detail about the peculiarities of taxation of funds allocated for bonuses to employees here).

Examples:

Crediting production allowance

For example, an employee is awarded a bonus for a certain percentage of his salary because the plan was exceeded. And since such incentives are production-related, they are necessarily included in wages.

Crediting non-production allowance

The employee was awarded a one-time bonus. This is taken into account by other expenses, due to the fact that this type of incentive refers to a non-production bonus to wages and is not part of it.