09.06.2019

0

1179

6 min.

The legislation of the country regulates that an employee receives monthly payment, in accordance with the terms of the employment contract, for the performance of his official duties and at least twice a month. About what the 13th salary is, what documents it is drawn up, how and when it is calculated and paid, more detailed information is presented in the article below.

Legal basis

Labor legislation does not contain information about such payments. Including how the 13th salary is calculated. But Article 191 of the Labor Code of the Russian Federation stipulates the possibility of encouraging labor in any of the following ways:

- declare gratitude;

- issue a diploma or certificate;

- give a valuable gift;

- award a cash prize.

Moreover, the rights of the organization (IP) are not limited to the listed points. It is possible to introduce other forms of incentives. For more information, see “Types of bonuses and rewards: making a choice.” In this regard, we can say that 13 salaries can be paid at the employer’s discretion to anyone: a pensioner, someone resigning of their own free will, or anyone else.

What kind of payment is this

Legislative regulations explain what the 13th salary is and how it is calculated - this is an incentive additional payment paid at the end of the year in order to stimulate the work activity of specialists. This remuneration is paid at the end of the financial period for good work; it is also called the final bonus. This payment is regulated by the Labor Code; Article 191 of the Labor Code of the Russian Federation indicates possible ways to encourage the work of employees:

- announcement of gratitude;

- presentation of a diploma or certificate;

- awarding a cash prize;

- receiving a valuable gift.

In its accounting policies and regulations on bonuses, the organization has the right to independently develop a reward system and include other methods at its discretion. The head of the institution independently decides when the 13th salary is paid in 2021, usually this is done in the last working month of the year (December), issuing an internal decision on the calculation of the thirteenth salary to individual specialists or all employees in the company.

Often the bonus amount is determined based on average earnings. ConsultantPlus experts told us how to calculate it correctly. Use these instructions for free.

to read.

Mandatory bonus at the end of the year

The employer pays 13 salaries on a voluntary basis. Whether there will be progress in its direction or not depends not only on the performance of employees, but also:

- organization capabilities;

- current remuneration system.

If the company suffered losses at the end of 2021, additional remuneration is usually not paid. And this is not a violation.

A different situation arises if there is a clause on annual bonuses in the company’s internal documents. Do they have the right to deprive 13 of their salaries in this case? The answer is clear: no. After all, this rule was established by the enterprise itself. It has undertaken to encourage high-quality work with monetary rewards, for which a special financial reserve must be created. If an employee deserved a bonus but did not receive it, when he goes to court, he will be able to restore justice.

The thirteenth salary is the annual payment to employees of the enterprise at the end of the calendar year. They are paid during the New Year holidays and are an unregulated form of incentives and bonuses.

Who is entitled to the bonus?

Management decides whether or not to pay a bonus at the end of the year. The manager also determines who is entitled to the 13th salary in 2021 based on the results of the financial period. The lists of bonuses include both employees who resign of their own free will and employees who retire. Often it is paid to particularly distinguished employees who are responsible for high results, and to employees who have not violated labor discipline.

The legislative norms do not indicate how much salary 13 the salary should be, and there is no fixed amount of bonuses provided for by law. The amount of payments depends on the profitability of the financial year at the end of which it is paid. If there were losses in the reporting period, then management has the right to refuse bonuses.

IMPORTANT!

The amount of the surcharge is determined either as the average monthly earnings or as a set share of the salary. The amount of the bonus is indicated in the accounting policies of the organization.

Obligations to pay the final bonus and the procedure for calculating the 13th salary are regulated by accounting policies. The possibility of assigning this additional payment depends on the following factors:

- the performance of each employee of the organization;

- financial condition of the institution;

- the incentive system operating at the enterprise.

Therefore, if losses are recorded at the end of the year, then non-payment of the final remuneration is not a violation.

IMPORTANT!

If the accounting policy or other internal organizational document establishes the obligation to pay the thirteenth salary and there are employees who deserve it, it is impossible not to give a bonus. An employee has the right to demand the restoration of his labor rights through the court.

How the 13th salary is calculated in Russia

The concept of “thirteenth salary” is used mainly only by staff in everyday life. Labor legislation does not regulate such a payment, so the accounting department does not have the right to register it as the employee’s next salary based on the results of a month that does not exist.

The enterprise independently determines:

- How are 13 salaries calculated?

- What indicators does it depend on?

All nuances must be spelled out in internal documents: collective agreement, bonus regulations, labor regulations, charter. Some innovations from 2021 in this regard will only affect small businesses. Management sets a budget for such payments, and the accountant distributes the funds.

Features of accrual

Large companies regularly reward employees who achieve high performance levels with bonus payments. In order to introduce the thirteenth salary into the internal structure of his company, the manager needs to systematize the internal document flow and organize the work of the personnel department. Creating all the necessary conditions for such innovations will significantly simplify the calculation of bonus payments . It is important to note that not every worker has the right to the thirteenth salary. As a rule, the employer personally selects those employees who will receive an annual bonus.

“The thirteenth salary” is money given to an employee at the end of the year as an incentive

Who should

As mentioned above, 13 salary refers to incentive payments that are used to increase the motivation of employees to improve the results of their work activities. This means that only those employees who have constantly increased their work performance over the course of the year can receive this bonus.

The conditions for receiving a financial award must be enshrined in local regulations. These documents must be presented to each worker for review purposes. As a rule, information about all incentive payments is recorded on the pages of the collective agreement. This document provides the procedure for calculating the annual bonus and the method for determining its size.

There are several significant conditions on which the size of the financial reward and the procedure for receiving it depend. Below we suggest that you familiarize yourself with the most common rules established by large enterprises:

- The collective agreement, which is concluded between the company administration and all employees, specifies a certain amount of financial remuneration and the procedure for receiving it.

- In the case where the employer sets a salary in the amount of a certain percentage of the employee’s average earnings for one year, the company employee must work exactly one year to receive remuneration in the form of the full amount.

- When internal regulations are applied within the company, which is used as the basis for determining the amount of the annual bonus, each employee of the enterprise has legal grounds to receive this payment. The amount of financial remuneration is determined by the amount of time worked.

When considering the question of who is entitled to the 13th salary, special attention should be paid to the situation related to the dismissal of an employee at his own request. Employees who terminate an employment agreement on their own initiative have the right to receive additional payments only if this fact is recorded on the pages of the collective agreement or in the bonus regulations . It is important to note that current regulations state that incentive payments are one of the components of wages. This means that in the event of dismissal due to staff reduction, the company administration must include this payment in the total amount given to the dismissed worker. If there is no payment, the dismissed employee may appeal to the labor inspectorate or court to protect his rights. If, as a result of the investigation, violations on the part of the employer are revealed, the latter will face penalties from control authorities.

Salary goal 13 – to stimulate increased productivity

Payment terms (when given)

As a rule, in most enterprises the thirteenth salary is accrued at the end of the calendar year. Much less frequently, this payment is issued at the beginning of a new reporting period. It should be noted here that it is possible to receive this financial incentive at another period of time. However, the possibility of receiving this bonus depends on the routine established within the company and the main direction of its activities.

In order to find out when the 13th salary is issued to an employee, you should find out whether this payment is used by the enterprise itself. You can obtain the necessary information by studying the collective agreement or bonus regulations. Next, you should find out which calculation method is used specifically by this company. You need to understand that the amount of the bonus depends on the amount of time spent fulfilling work obligations. And it is this factor that is the main reason that the financial reward in question is issued at the end or beginning of the year.

Is it accrued during maternity leave?

The question of whether additional bonus payments are awarded to workers on maternity leave is of paramount importance for expectant mothers. According to experts, in order to receive these funds, the worker must, before actually going on maternity leave, fulfill all her duties established by internal regulations. Strict adherence to the company’s internal rules allows you to count on receiving additional payments. In the event that the company’s internal documents do not contain information about the receipt of the thirteenth salary by employees on maternity leave, the decision to issue funds rests with management.

Who gets the 13th salary?

Year-end bonuses are usually given out on an ongoing basis in large companies or government agencies. To issue them, you need well-organized work of personnel specialists and competent execution of documents. The introduction of such an incentive system should not cause any particular difficulties.

Who exactly the funds will be credited to depends on the manager. Since the 13th salary is a method of encouragement, employees who have shown good results during the year and have not violated labor discipline will be able to count on it.

What to follow regarding how the 13th salary is calculated:

- Labor Code, art. 191 – incentives for work activities;

- Tax Code, art. 255 – funds included in labor costs.

Where did this name come from?

The concept of the 13th salary arose in Soviet times, although even then there was no official term in the laws. In essence, the 13th salary is a bonus that was paid at the end of the year. Unlike other bonuses that had to be earned, almost everyone received an annual payment (with the exception of only those who committed serious offenses during the year). The size of the bonus in the vast majority of cases was equal to the employee’s average monthly earnings (salary). Those who had extensive work experience at the enterprise and were in good standing with management could receive more.

Due to the fact that the “annual” bonus was generally accepted, it began to be considered not as an incentive for employees, but as something obligatory. It was understood that a person, having worked for a year, received 12 salaries and another one in the form of a bonus.

Certificate of average earnings for the last 3 months at the last place of work in 2019-2020

How to apply

In accounting, the “thirteenth salary” is issued under a different name. According to the organization’s documents, it can go like this:

- Year-end bonus for all employees of the enterprise.

- Cash rewards for individual employees for achieving excellent results.

- Bonuses for specialists due to their high level of qualifications.

It is important to make a choice before calculating the 13th salary.

The next step is issuing an order to provide a bonus on form T-11 or T-11a. The text provides reasons for the decision: exceeding the norm, increasing labor productivity, making proposals for savings, etc.

Reasons for reducing payments may be violation of safety regulations, non-compliance with labor discipline, etc.

You can download the forms of these standard orders on our website using the link.

The source of payment of 13 salaries may be a material fund created by management in order to reward good employees.

Some owners issue funds from retained earnings from previous years (JSC and LLC). Information about this should be in the charter. It is needed to process accounting transactions.

How is the 13th salary calculated?

The calculation procedure differs depending on the payment method.

Fixed amount

Used in cases where a bonus is assigned to some employees. The size of the bonus can be set in different ways at the discretion of the employer.

EXAMPLE Management has established in internal regulations how salaries for 2021 are paid to certain categories of employees. At the beginning of 2021, fixed amounts will be issued, which are:

- for management staff - 60,000 rubles each;

- for sales agents – 25,000 rubles each;

- for employees of the financial department - 32,000 rubles each.

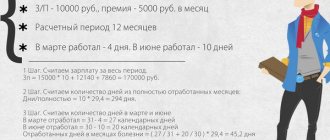

Percentage of salary or calculation coefficient

Bonus payments can be differentiated according to certain criteria. For example, length of service, number of sales made, etc. Then the formula for calculating the 13th salary based on salary will be as follows:

- PREMIUMmax. – the largest amount of money that an employee can receive, according to the internal bonus rules;

- Drab. – number of working days per year;

- Dr. – the number of days actually worked per year.

PREMIUMmax. = SALARY × % Keep in mind: the amount may increase throughout the year, this must be taken into account.

In addition, the employer must not only inform in local documents how the 13th salary is calculated, but also deduct income tax from it to the budget. Example According to the bonus regulations, employees who have worked for a year in full (taking into account the main vacation) are given a bonus in the amount of 40% of the salary. Sales representative Topolev was on annual leave for 20 working days and 7 working days on vacation at his own expense. His salary is 36,700 rubles. How to calculate the 13th salary for an employee for 2021?

Solution

- Let us determine the maximum share of funds paid to Topolev subject to the conditions of the bonus provision: 36,700 × 40% = 14,680 rubles.

- Let's calculate the number of days actually worked by the employee. According to the production calendar, in 2021 the number of working days is 247. To receive the full bonus, you need to work 227 days (minus 20 days of required rest). Topolev worked: 3 – 27 = 220 working days.

- Here's how to calculate the 13th salary for Topolev, taking into account the time he worked:

Also see Bonuses and Income Tax: Taxation Rules.

Average annual earnings

The most labor-intensive process for calculating bonuses at the end of the year. The accountant will need certain information: the amount of the employee’s income for the year, the number of employees in the department, length of service, etc.

Now about how the 13th salary is calculated based on average annual earnings:

Salary.sr.g. + Pstage

- P salary average year – bonus from average annual income;

- Experience is cash payments provided for length of service.

Example

Construction calculates bonuses based on the average annual earnings of employees (indicated in the bonus regulations). How is the 13th salary of installer Larionov calculated if the bonus from the average annual income is 12,000 rubles, and additional payments for length of service are 6,300 rubles?

Solution

12,000 + 6,300 rub. = 18,300 rub. must pay Larionov 18,300 rubles.

Calculation upon termination of the contract at one's own request

The management of the enterprise in which the employee carries out his professional activities must calculate wages in all cases of termination of the employment contract.

The employee’s own desire is no exception; in due time, all amounts must be calculated and paid to the dismissed person.

Salary calculations must be carried out for all resigning employees; as for the issuance of additional payments, the reason for which the dismissal occurred plays an important role. In some situations, this factor affects the likelihood of paying certain types of financial assistance.

During the dismissal process, the employer adheres to the rules established by Article 140 of the Labor Code of the Russian Federation.

It states that funds must be credited to the employee’s account within the time period established by law.

Otherwise, the citizen has the right to complain to higher authorities, after which the company’s management may be held accountable.

The following types of funds are required to be paid upon dismissal:

- salary for the month worked or part thereof;

- compensation for unused vacation (if the employee did not register for a rest period);

- severance benefits.

The employee will receive the listed payments regardless of the reason for which he was fired.

In addition, some organizations expect to accrue additional payments. The technology for calculating and accruing them must be present in internal documentation - in the collective agreement.

Is the 13th salary due on maternity leave?

Monetary remuneration is paid to an employee taking maternity leave, provided that she has fulfilled all points of the internal act entitling her to receive a bonus at the end of the year. When this fact is not stated in detail in the documents, the final decision remains with the employer.

Each employee of the organization must be familiar with the documents informing about the bonus procedure. They indicate how wages are calculated at a particular enterprise and for what reasons it may be reduced.

Read also

08.02.2017