Home / Labor Law / Payment and Benefits / Bonuses

Back

Published: March 30, 2016

Reading time: 10 min

0

7208

Incentive payments belong to the variable component of employee remuneration and are of a variable nature, unlike salary.

The Labor Code of the Russian Federation (Article 129 Part 1, 135 Part 2, 144) outlines the employer’s right to assign incentive payments, establish their size and frequency. This must be reflected in the local regulations of the enterprise, collective agreements, agreements, a reference to which must necessarily be present in the employment contract with the employee.

This type of payment serves as a material incentive for the employee for his merits and at the same time as stimulation (motivation) to further improve the level of quality and quantity of his work.

- Types of payments Bonuses – regular and one-time

- Rewards

- Allowances

- Additional payments

- How are executive compensation determined?

- Structure of the Protocol (using the example of an educational institution)

Types of payments: incentive or compensation

The use of incentive payments is regulated by the Labor Code of the Russian Federation, the main document containing the norms of labor relations between management and employees.

Explanations of what applies to incentive payments are contained in the following provisions of the Labor Code:

- Art. 57 describes the basic principles for drawing up contracts with employees, including the requirement to indicate payment terms, including incentive payments, in the document.

- Art. 129 contains descriptions of what is included in an employee’s salary.

- Art. 135 establishes the obligation to record the conditions for calculating earnings and incentive payments in documents at the local level (internal regulations, orders, collective agreement).

- Art. 191 determines the rules for processing labor incentives from employers to employees.

Incentive payments are incentives that increase the value of the current employer in the eyes of employees. Labor legislation describes general standards for calculating the income of employees, however, it is impossible to provide for all cases within the framework of the Labor Code - and this is solved by issuing special acts and regulations, for example, stimulating public sector employees through various bonuses.

It is worth learning to distinguish between compensation and incentive payments to public sector employees and other employees, including commercial structures. Incentive bonuses are aimed at rewarding conscientious workers for effective work, therefore they are a type of incentive. Compensation transfers are intended for certain categories of employees, paid in any case, regardless of the results of work and attitude towards it.

At the same time, such payments cannot be considered bonuses and remunerations not related to performance. Many enterprises practice deduction of the 13th salary, while the results and achievements of employees are unimportant.

According to Russian laws, management does not have the right to fine employees or reduce the salary or wage scale, even if the employee made mistakes or was negligent in his work. Disciplinary violations are not a reason for the enterprise to fine citizens.

The procedure for paying for work on holidays (weekends), with a shift work schedule

Weekends are days of continuous rest provided weekly. The procedure for providing such days is established by Article 111 of the Labor Code of the Russian Federation.

The list of holidays and non-working days on the territory of the Russian Federation is established by Article 112 of the Labor Code of the Russian Federation. In accordance with Article 153 of the Labor Code of the Russian Federation, work on holidays (weekends) implies mandatory additional payment.

The minimum surcharge is:

- no less than double piece rate - for piece workers;

- no less than double the daily or hourly tariff rate - for citizens whose wages are paid at the daily or hourly tariff rate;

- no less than a single or hourly rate on top of the salary (if the volume of work does not exceed the monthly working time standard) and no less than a double daily or hourly rate on top of the salary (if the volume of work exceeds the monthly working time standard) - for citizens receiving an official salary.

Specific wage levels are established by a collective (labor) agreement or local regulations. It is possible that instead of an increased salary, the employee (at his request) will be given another day for the intended rest. In this case, the work is subject to payment in a single amount, and the day of supposed rest is not subject to payment at all.

Calling to work on additional days of rest is not considered as working on weekends, and therefore does not imply an increased salary.

Increased payment is subject to the entire period of work on a holiday or weekend, that is, every hour of work performed. The hourly rate is determined by dividing the daily rate by the number of hours of work performed daily.

The procedure for calculating the hourly rate of citizens who receive a monthly salary is not strictly regulated.

We propose to provide for the following procedure in the local regulatory act:

- divide the monthly salary by the usual number of working hours in a particular month;

- divide the monthly salary by the average monthly number of working hours per year (i.e., by the value obtained by dividing the normal number of working hours per year by 12);

- divide the monthly salary by the average monthly number of working hours in the accounting period (i.e., by the value obtained by dividing the normal number of working hours in the accounting period by the number of months in such a period).

If the employment contract specifies a working time schedule according to which work is also expected on holidays (for example, with a shift work schedule), then the hours worked on holidays are subject to double payment.

Work on weekends is always carried out on top of the standard working hours and is subject to double payment, since it cannot be foreseen in advance either by the work schedule or by the working hours. As an exception, the case is considered when an employee who worked on a day off was given another day for supposed rest at his own request, paid in a single amount.

Options for processing incentive payments

- How is overtime paid under the Labor Code?

If you need to legally formalize additional payments to the main part of your earnings, you will need to understand the forms of incentive payments and their correct purpose.

- Surcharge. They are associated with the direct performance of duties according to the job description and additional obligations. Overtime, schedules with night shifts and other work options that require increased pay are not considered additional pay.

- Allowances. For the purpose of incentives, sometimes management, in addition to the salary or tariff rate, adds its own payment system, under which employees have the right to count on an increase in labor income. The nature of the surcharges and the period of their application are determined by the enterprise independently, in accordance with the adopted regulatory act

- Awards. Bonuses are used most often. Management, intending to reward distinguished employees, more often resorts to a bonus system, independently determining the parameters of merit for which bonuses can be awarded. Similar options include bonuses in kind, but according to the law, the amount of such bonuses should not exceed a fifth of the salary.

Different enterprises have their own specific activities, and the administration has the right to develop its own incentive mechanisms for employees, stimulating staff to continue working and achieve high results, since there is no direct ban on the development of individual bonus systems by law.

Procedure for calculation and accrual

The amounts of bonuses can be fixed or expressed as a percentage of the salary. Incentives are given to employees along with their salaries. It is impossible to calculate the exact figure, since it depends on the size of one point. Different organizations set their own for the same successes. Its number is determined in this way: the volume of the total monetary fund for these purposes is divided by the number of points scored by all employees per month or other established unit of time.

You may be interested in : Social benefits for teachers

Thus, every employee strives to perform well in order to get a higher rating. At the same time, his contribution to professional activity is also taken into account.

How is the incentive payment assigned?

The purpose of incentive payments is regulated by law (Labor Code of the Russian Federation). Despite the presence of many deviations and the need for individual regulation, there are general principles for assigning incentives, according to the law.

The sequence of processing an incentive payment is presented in several steps:

- The employer sets out the procedure for providing incentive payments in the documentation - contract and internal regulations. Only entrepreneurs classified as micro-organizations do not have the right to make such orders, reflecting the terms of incentive payments in the contract.

- The hired employee must be familiar with the provisions of the act establishing the procedure for assigning incentive payments.

- If the employee fulfills the conditions for additional payment, the manager orders the person to be rewarded by drawing up a separate order individually or for the entire staff at once.

- Based on the issued order, the accountant calculates and organizes the issuance of funds to everyone mentioned in the list.

When the order is executed, it is transferred to the archive for storage for up to 75 years.

For state employees

If within commercial organizations the issue is resolved quickly - by adopting an internal regulatory document, then in the budgetary sphere management is not vested with the right to dispose of the organization’s funds and income, which means that the formation of conditions for calculating wages is beyond the competence of the administration.

However, incentive payments remain available to public sector employees. They are simply guided by different standards established at the federal level. The basis is the provisions of Order of the Ministry of Health and Social Development No. 818, issued in 2007.

- Remuneration for work on holidays and weekends

It contains standards for the use of incentive surcharges and their types:

- By length of service, continuous experience.

- For quality work results.

- For results and intense work.

- Based on the results of the completed amount of work.

Other local standards are not applicable to public sector employees, and when assigning incentives, it is necessary to be guided by general provisions.

The manager must understand that when issuing an order for a payment of this kind, the enterprise can organize a check on the proper expenditure of funds from the budget.

Educational field

A large share of incentive payments is used for teachers and people working in the field of education. In relation to the personnel of educational institutions, a system of calculating points is used, according to which additional payment is determined. The weight of 1 point in monetary terms is set taking into account the available wage fund.

A separate evaluation sheet is created for each employee, where the results of work are reflected and the amount of the additional payment due is calculated. After determining the total number of points earned by all employees of the organization, the cost of 1 point is calculated. Next, the number of points awarded to a specific person is multiplied by the calculated cost.

In addition to performance indicators in the classroom, extracurricular activities, participation in excursions, organization of events, and hikes are of particular value.

They also take into account work on studying student performance, work with parents, the activity of students at competitions at various levels, and work with families classified as disadvantaged.

The higher the activity of the teacher, the more points and, accordingly, the higher the salary and additional payment as an incentive for the employee.

- Reduction of wages at the initiative of the employer under the Labor Code of the Russian Federation

When determining incentive payments for preschool institutions, they proceed from the division of personnel into educators and teachers. 60% of the total salary fund is allocated to them. However, besides them, the organization’s staff includes representatives of other professions: watchman, cook, cleaner, etc.

The value when establishing the amount of payment in a preschool institution is determined by the success achieved when working with clubs, additional educational programs and electives.

For management personnel, the level of additional payment is determined differently. The director of an educational institution and the head of a preschool institution expect to increase income due to:

- Active work with parents;

- No complaints;

- Conducting specialized training;

- Involving young people in the teaching field;

- Achieved level of Unified State Examination results.

- Development of talents, discovery of gifted students.

Each educational organization establishes its own Regulations, with mandatory consideration of the requirements of the law and approval of the Regulations, which are adopted after preliminary agreement with the staff.

Health workers

Medical workers are subject to uniform rules set out in a special program after the start of the modernization of this area, launched in 2011.

Thanks to recent changes in the salaries of employees of medical institutions, both specialists and nurses (middle and junior level) can now count on incentives.

Responsibility for making any decisions regarding additional payments to health workers rests with representatives of regional health care structures, and the amount of additional payments is set within the medical institution.

Parameters that influence stimulants:

- Population;

- residential density;

- advantageous age;

- characteristics and predisposition to diseases;

- mortality.

In addition to these characteristics, incentive additional payments are influenced by the range of medical services provided, location, specifics and level of the institution.

In some cases, the incentive payment is not applicable:

- in relation to the heads of the institution, if they are not included in the category of practicing specialists;

- to doctors who have already established payment for a participant in the national health project;

- for persons working on high-tech equipment and receiving additional payments for this.

The management of the organization reserves the right to refuse additional payment if there are complaints about the quality and volume of work performed.

Cultural sphere

Employees in the field of cultural development have their own types of payments - with regular or one-time use.

Among the regular payments fixed at the federal level, there are additional payments for professional skills, inclusion in a “national” or “honored” title, length of service, awarded degree, and other important indicators.

Appointment Criteria

The appointment of incentive payments is possible by employers if either a trade union body or representatives of its interests chosen by the collective participate in this process.

The basic criteria for assigning payments are:

- the focus of the company’s employees on high results of their work;

- efficiency from the introduction of new methods of work of the organization;

- general assessment of the work of a specific employee for a year of work or for a certain time period;

- conscientiousness and completeness of performance by the professional worker of the labor functions assigned to him;

- the level of responsibility of a professional worker in accordance with his position in the enterprise.

In many government agencies, management is guided by additional criteria when assigning additional payments and allowances:

- the employee’s use of his own methods, which increased the efficiency of the entire enterprise;

- the professional worker is highly qualified;

- the presence of significant achievements among employees in the course of their work activities.

Night shift pay

At night, each hour of labor is paid in a larger amount, the amount of which cannot be less than that specified by labor legislation (Article 154 of the Labor Code of the Russian Federation). This rule also applies to those citizens who were hired specifically to perform duties at night.

Government Resolution 554 of July 22, 2008 provides for one minimum amount of additional payment for night work for all workers, in particular, a 20 percent additional payment for each hour of work. The additional payment is calculated taking into account the hourly tariff rate (salary calculated per hour of work). It follows that when establishing additional pay for night work, other allowances or additional payments are not taken into account.

The period from 22.00 to 6 a.m. is considered night time.

Employers are legally required to reduce the duration of work on the night shift by one hour without further work. The exception is the cases indicated by Article 96 of the Labor Code of the Russian Federation.

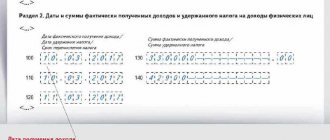

Employee Scorecard

Based on the fulfillment of the performance criteria defined above, incentive payments are distributed among the company's employees. To record the degree of their implementation, a score sheet is used. The form of the document itself is not regulated by any legislative acts, but is necessarily prescribed in local regulatory documentation, for example, in the Regulations on incentive payments.

As practice shows, it is convenient to design a Sheet in a tabular form. Here the serial number and name of the criterion itself, its description are recorded. The following indicates the rating scale that is used by the employee to evaluate his performance according to each of the criteria. The document is personally signed by the employee and his supervisor. After this, the Sheet is transferred to a specially created commission, which makes its mark on the quality and effectiveness of the specialist’s work. Depending on the assigned point, a reward is awarded.