Delay of wages from the legal point of view

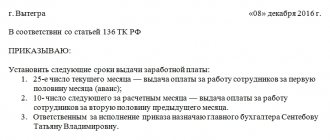

The procedure and timing of settlements with employees are regulated by Art.

136 Labor Code of the Russian Federation. According to parts 5 and 6, the salary must be issued directly to the employee at the location of the enterprise or transferred to a bank account. The frequency of payments is at least once every 15 days. Accordingly, the employee must receive two or more payments each month. The norms of the Labor Code of the Russian Federation do not determine the percentage of payments. Therefore, one of them may be larger in size than the other. For example, the system for paying employees may be as follows: the first payment includes only the salary at the tariff rate, and the second, in addition to the salary, includes bonuses and other additional payments.

Specific dates for payment of wages, in accordance with Part 4 of Art. 136 of the Labor Code of the Russian Federation, are determined in the collective labor agreement for all employees equally or are stipulated directly in the contract with each employee. Moreover, if the payment date falls on a weekend or holiday, then the calculation is made the day before.

For individual payments, special deadlines may be established within which the administration of the organization must make them. So, for example, vacation pay, according to Part 9 of Art. 136 of the Labor Code of the Russian Federation, are transferred to the employee no later than three days before the start of the vacation.

Accordingly, if an enterprise does not comply with these requirements and pays the employee at the wrong time or does not pay the due money at all, then we are talking about delayed wages.

Responsibility for delayed wages lies in the application of financial and other sanctions to the administration of the enterprise in accordance with the norms of the Labor Code, Code of Administrative Offenses and the Criminal Code of the Russian Federation - depending on the timing and amount of accumulated debt.

If necessary, you can go to court to collect wages.

Disciplinary punishment for late payment of wages in 2021

A delay in wage payments that occurred due to the fault of the enterprise management or one of the responsible employees is regarded as a direct failure to fulfill their labor duties. Such an offense entails the imposition on them of one of the types of disciplinary action provided for in Article No. 192 of the labor legislation:

- Comment.

- A reprimand entered into a personal file.

- Dismissal from a position.

Similar measures are applied to persons responsible for the violation if their guilt is proven. For this purpose, a production inspection is carried out by authorized bodies. They can be a trade union commission, an enterprise lawyer, or someone hired by an employee (trade union) from outside, employees of supervisory authorities - the labor inspectorate, the prosecutor's office. Based on the results of the inspection, a statement is drawn up addressed to the head of the enterprise, which describes in detail the violations committed and indicates the relevant articles of labor legislation.

After this, the employer is obliged to consider the submitted application and take the necessary measures to eliminate any violations of the Labor Code of the Russian Federation. At the same time, management must choose the type of disciplinary action against those responsible for late payment of wages.

The head of the enterprise notifies the submitter of the decisions made based on the results of consideration of the submitted application. This obligation is spelled out in Article No. 22 of the Labor Code of the Russian Federation. The expiration date of the imposed penalty is one year from the date of its adoption.

Material and administrative responsibility

The first sanction applied to the administration of an organization is financial liability under Part 1 of Art. 236 Labor Code of the Russian Federation. For each day of delay in payment of money to the employee, interest is charged on the amount owed. Starting from the day following the day on which wages are due and ending with the day the debt is actually repaid.

Important! The amount of interest is determined by Part 1 of Art. 236 of the Labor Code of the Russian Federation and is 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay.

The second sanction that an employer must be subject to for delaying wages and other payments due to an employee is a fine, defined in Art. 5.27 Code of Administrative Offenses of the Russian Federation. When brought to administrative responsibility, the period of delay and the amount of unpaid wages on time do not matter. That is, to qualify the actions of an organization as an administrative offense, a delay in payments of one day is sufficient.

The amount of the fine for non-payment of wages depends on whether the employer committed the violation for the first time or repeatedly within a year. For first-time violators of Art. 136 of the Labor Code of the Russian Federation regarding the timing of settlements with individual entrepreneurs, the amount of the fine under Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation will range from 1 to 5 thousand rubles, for organizations - 30 to 50 thousand.

If an individual entrepreneur or organization has repeatedly accumulated salary debt during the year, the amount of the fine for unpaid wages will be greater and will amount to 10 to 30 thousand rubles for individual entrepreneurs, and from 50 to 100 thousand for organizations (Part 7 of Article 5.27 Code of Administrative Offenses of the Russian Federation).

The ConsultantPlus system has many ready-made solutions, including information about what happens if wages are delayed. If you don't have access yet, you can get it for free on a temporary basis. For further use of the system, obtain the current K+ price list.

Delay of wages: employer's responsibility

Delay in payment of wages creates different types of liability for different persons. This may include:

- criminal, depending on the nuances of a particular case. Threatens the head of an organization, the employer of an individual or the head of a structural unit of a company. This happens because only sane individuals over 16 years of age (in this case) are criminally responsible;

- administrative. Possible for officials (DL), individual entrepreneurs and legal entities, employers or their representatives if their guilt is proven;

- material. The leader answers;

- disciplinary. Affects the employer himself or his representatives.

Now in more detail about each type.

Employee rights when wages are delayed

Norms Art. 142 of the Labor Code of the Russian Federation gives the employee the right to independently seek payment of the due salary by suspending work. However, this right can only be used if the salary delay is more than 15 days.

Important! To legally begin the suspension of work, the employee must notify the employer about this in writing (Part 2 of Article 142 of the Labor Code of the Russian Federation). The corresponding application (notification) can be submitted to a representative of the administration either in person against a signature or sent by mail, with a list of the contents and a receipt.

If the employee complies with the stipulated requirement of written notification to the enterprise, then disciplinary sanctions cannot be applied to him (for example, dismissal for absenteeism). In addition, the employee retains his average salary for the entire period of suspension of activities. This obligation of the enterprise is another measure of the employer’s liability for non-payment of wages.

At the time of suspension of work, the employee is not required to be present at the workplace (Part 3 of Article 142 of the Labor Code of the Russian Federation). However, he is obliged to go to work the next day after receiving written notification from the enterprise of his readiness to repay the debt on the day he goes to work.

According to Art. 142 of the Labor Code of the Russian Federation, not all employees have the right to suspend work. Thus, if an employee is employed in the sphere of life support for the population (ambulance, heating, water and gas supply enterprises, etc.), he does not have the right to suspend work due to the specifics of his professional activity.

Disciplinary responsibility

Delayed wages due to the fault of the manager or official representatives is an improper performance of their direct duties. This may entail receiving one of the disciplinary sanctions in the form of a reprimand, reprimand or dismissal (Article 192 of the Labor Code of the Russian Federation). If the facts of violation are proven, the employer applies appropriate enforcement measures to the management of the institution (Article 195 of the Labor Code of the Russian Federation).

To carry out an inspection, a representative of the interests of employees (this may be a trade union) submits a corresponding application to the employer, which indicates violations on the part of management. The employer is given 1 week to review this document (Article 370 of the Labor Code of the Russian Federation). Next, he takes measures to eliminate violations, selects the form of disciplinary punishment and notifies the applicant about this (Article 22 of the Labor Code of the Russian Federation).

The period of validity of this punishment is 1 year from the date of its imposition.

Criminal punishment and the peculiarities of its application

The most severe measure of liability for non-payment of wages on time is the application of criminal punishment under Art. 145.1 of the Criminal Code of the Russian Federation. This provision presupposes the presence of two independent elements of a crime. Thus, for Part 1 to apply, two conditions must exist:

- Salaries are paid partially for three or more months in an amount less than half of what the employee is entitled to.

- The reasons for incomplete payment are the selfish interest of the employer. That is, if an enterprise cannot pay its employees in full due to objective reasons, for example, there is simply no money in its accounts and there is no way to replenish them, then it is impossible to bring the management to criminal liability.

The penalty for this act varies from a fine to 120 thousand rubles to a year in prison.

To use Part 2 of Art. 145.1 of the Criminal Code of the Russian Federation it is necessary that:

- the enterprise did not pay wages at all or paid less than one minimum wage per month;

- the debt period exceeded two months;

- the reason for the debt is the employer’s self-interest.

The severity of the sanctions in this situation will be greater: a fine of up to 500 thousand rubles or imprisonment for up to three years.

If, in the presence of any of the specified parts 1 or 2 of Art. 145.1 of the Criminal Code of the Russian Federation, if additionally serious consequences occur, for example the death of a person, then the employer will face a fine of up to 500 thousand or imprisonment for up to five years.

Features of bringing to criminal liability for non-payment of wages

In Art. 145.1 of the Criminal Code of the Russian Federation also has a note that allows the management of the enterprise to avoid a fine or imprisonment. If the committed act did not entail serious consequences, was committed for the first time and within two months from the date of initiation of the criminal case the debt to the employees was fully repaid, the guilty person is released from liability under this article.

Administrative punishment for late payment of wages in 2021

Administrative penalties are applicable only if the enterprise management is proven guilty of late payment of workers. In this situation, the employer is liable in accordance with Article No. 5-27 of the administrative legislation of the Russian Federation. In accordance with it, the following fines are provided for enterprise managers for late payment of wages in 2021:

- For the first time - a fine of 10 thousand rubles.

- If you repeatedly violate the provisions of the employment agreement, you will be fined 20 thousand rubles.

- The extreme measure is deprivation of their position with a ban on work in leadership positions for a period of three years.

A legal entity (organization) is subject to the following fines:

- 30-50 thousand rubles for the first violation.

- 70 thousand - in case of a relapse due to the fault of the company.

A company or its manager can be brought to administrative punishment only through the justice authorities. To do this, a citizen or a group of workers whose rights have been violated must file a corresponding application with the courts. It is also possible to contact the labor inspectorate, whose employees, after familiarizing themselves with the essence of the problem, refer the case to the court or prosecutor's office to initiate administrative proceedings.

Results

Thus, in Russia there is a clear system of sanctions for non-payment of wages, the severity of which is determined by the timing and size of the debt to employees.

Sources:

- Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ

- Code of the Russian Federation on Administrative Offenses

- Criminal Code of the Russian Federation dated June 13, 1996 No. 63-FZ.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

If wages are not paid

Alimony withheld from wages - posting

When the manager refuses to pay the salary, Art. 352 of the Labor Code of the Russian Federation establishes opportunities for protecting one’s own interests:

- Self-defense;

- Complaint to the labor inspectorate;

- Protection through a trade union organization;

- Complaint to the prosecutor's office;

- Filing a claim in court.

The last two methods are extreme. Usually they are resorted to only if other methods do not help. They entail both financial punishment for the manager and liability - criminal or administrative.

You can defend your rights from the moment when one day of delay has occurred.

But first, it is better to find out from the accounting department or the general director why the non-payment occurred and when the payment will be made. If the appeal does not produce results, you can take measures that will lead to a fine for not paying wages on time.

When are salaries paid?

The procedure for remuneration of employees is regulated by internal orders and regulatory documents of the organization, as well as the Labor Code. RF. In particular, Article 136 prescribes:

- How should an employer inform its staff about the issuance of a salary;

- Report accrued amounts, including compensation and benefits;

- Indicate whether there were deductions and in what amount;

- Inform employees of the total amount to be paid.

In addition, it states that wages may be paid directly to the employee and his representative, if so provided by law or contract. The money is transferred in person or as a transfer to a bank card, the details of which were provided by the citizen. According to this article, the frequency of contributions must comply with the following rules:

1. Issue is carried out every half month;

2. Employees receive wages no more than 15 days after the end of the period for which the accrual occurred. That is, the monthly income is divided into two parts with a payment interval of two weeks. For example, the first part may be issued on the 5th day of the month following the billing month. But the second one is due no later than the 20th of the same thirty days. If such a day coincides with a holiday or weekend, then the payment is made before it.

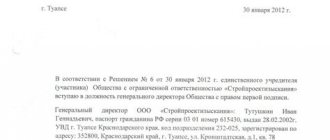

It is worth noting that specific salary days are determined by the employer. It also determines the form and where exactly the funds are issued. Often these nuances are reflected in writing in the content of contracts signed by both parties.

Termination of work

The employee does not have to necessarily seek compensation. In accordance with Articles 142 and 379 of the Labor Code of the Russian Federation, he may stop working for the entire period of delayed wages. To do this, it is important to fulfill the following conditions:

- the delay is more than 15 days;

- The employer must be notified in writing of the suspension of work.

Important! Notification of the employer is possible in two ways - in person or by mail. In the first case, a mark of acceptance is affixed to the second copy. When sending a postal item, a notification of receipt is filled out. As a result, dismissal for absenteeism becomes unacceptable.

It is prohibited to suspend work in case of martial law or a state of emergency, as well as for the following categories of citizens:

- civil servants;

- employees working at particularly hazardous facilities;

- law enforcement officials;

- military personnel;

- specialists from energy supply services for the population.