What transactions are reflected in account 62 in accounting?

According to the recommended Chart of Accounts, a business entity must use account 62 to record transactions with buyers and customers.

The law establishes that two types of debts must be kept in the account:

- To the company for goods sold, or work and services performed;

- To buyers for advances received from them.

When selling products or performing work, it must be immediately shown in the debit of the account. At the same time, the same amount is indicated on the sales accounts (90, 91) or the gradual execution of work. After receiving payment from the counterparty, it should be reflected on the credit of the account, simultaneously with the debit of the cash settlement accounts.

If the buyer makes payment before actually receiving goods or work, then this receipt is reflected in account 62 as an advance received. Since this amount is accounts payable, it must be recorded in separate accounts. It is not possible to show both debts collapsed.

Also, the buyer may not repay the debt, but issue his own bill. This paper will act as a deferment of payment and a guarantee of further repayment of the debt.

Attention! This kind of payment must be taken into account in account 62, but separately from simple debt. However, if the buyer issues a third party’s bill of exchange as payment, then such a step is already recognized as a financial investment and is subject to accounting on account 58.

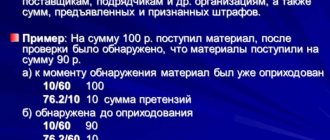

Wiring Dt 62 Kt 90 and Dt 62 Kt 91

Debit 62 Credit 90 and Debit 62 Credit 91 appear in accounting in connection with the receipt of income by the organization.

Dt 62 Kt 90 means reflecting revenue from main activities.

Dt 62 Kt 91 will be needed to reflect other operations. This may include income from:

- from the sale of fixed assets;

- from external sales of materials;

- from writing off expired accounts payable.

For an example of accounting entries for mutual settlements with buyers and customers, see here.

Read more about this in the article “Writing off accounts payable with an expired statute of limitations.”

Characteristics of account 62 “Settlements with buyers and customers”

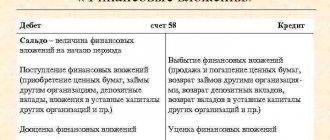

The adopted chart of accounts establishes that account 62 “Settlements with buyers and customers” is active-passive. This means that he can have two balances at the same time - both debit and credit.

This means that this account can immediately show both the company’s receivables and payables:

- A balance in the debit of the account means that buyers have an unpaid debt to the company for work performed or goods shipped.

- The loan balance shows that the organization has received an advance payment for future deliveries of goods or performance of work, but has not yet fulfilled its obligations to buyers or customers.

What does the debit and credit of the account reflect:

- The debit of account 62 shows the amounts of work performed or goods shipped, for which documents for payment were issued to counterparties. In addition, debit can also take into account the amounts of payments that were returned to customers due to failure to fulfill obligations to them.

- Credit 62 of the account takes into account the amounts of money that were transferred by buyers of goods or customers of work for received goods and materials. The amounts that were received as an advance payment for future work or shipment of goods are also indicated here.

The process of determining the balance at the end of the period under review depends on what exactly the balance was at the beginning. If it was debit, then you need to add the debit turnover to it and subtract the credit turnover. If the result is positive, then this balance is entered as a debit at the end of the period. If it turns out to be negative, then it is transferred to credit, but without the minus sign.

You might be interested in:

08 accounting account - “Investments in non-current assets”

If at the beginning of the period under consideration the balance was in credit, then you must first add the credit turnover to it, and then subtract the debit turnover. When determining which part of the balance sheet to record the final balance in, a similar rule applies - if it turns out to be positive, then in credit, otherwise - in debit.

Attention! The balances of account 62 must be shown when preparing the balance sheet, but in different sections. The debit balance is accounted for in accounts receivable and recorded as an asset. At the same time, it is shown minus the reserve for doubtful debts (if it was created). The credit balance constitutes accounts payable and is reflected in liabilities.

Accounting for accounts receivable on account 62

The rules that need to be kept in mind when working with account 62 “Settlements with buyers and customers” are indicated in the chart of accounts and instructions for it, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Count 62 is used to reflect:

- accounts receivable (hereinafter referred to as receivables) of buyers and customers for goods, works, services sold (hereinafter referred to as GWS);

- accounts payable in the form of advances received.

Turnover in the debit of account 62 occurs when reflecting the debt of buyers when the sale of goods and services takes place. The second side of the posting will be income accounts 90.1, 91.1 or account 46 for the gradual reflection of income from long-term work. Thus, receivables are reflected simultaneously with revenue. In accordance with the accounting rules, revenue is shown in accounting if a number of conditions are met (clause 12 of PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n):

- existence of a legally valid right to receive proceeds;

- availability of total revenue value;

- having confidence in receiving payment;

- a transfer of ownership was carried out, i.e. the buyer accepted the GWS;

- the presence of the total value of the corresponding expenses incurred to obtain this revenue.

If at least one condition is not met, then the payment received by the organization should be reflected as accounts payable, and not repay accounts receivable.

When payment is received from the buyer, account 62 is credited, and a debit entry is made in the cash accounts.

Analytics of 62 accounts should allow checking its balances for the presence of overdue debts, that is, carried out in the context of counterparties, issued invoices, and payment terms. To ensure transparency of reporting, overdue debt must be reserved by posting Dt 91.2 Kt 63 (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In the balance sheet, receivables are shown minus reserves. Debts that cannot be repaid and debts with an expired statute of limitations must be written off (clause 77 of the PBU) at the expense of the reserve by posting Dt 63 Kt 62, and if they were not reserved, then they are written off to the financial results of Dt 91.2 Kt 62. When In this case, for another 5 years, the written off debt is reflected on the balance sheet (account 007) in order to track changes in the financial condition of the debtor and the possibility of repaying the debt.

What subaccounts are used?

On account 62, it is necessary to record both the process of shipping products to customers or providing services to consumers, and the receipt of payment from them.

To do this, the following subaccounts can be opened on the account:

- Account 62.01 - to reflect the payment that was transferred under normal conditions;

- Account 62.02 - to account for advances received from buyers for future supplies of products;

- account 62.03 - for accounting for bills received from buyers.

Additional accounts may also be opened for each of these sub-accounts, depending on the payment currency. In addition, for his convenience, an accountant can organize analytical accounting for each counterparty or concluded agreement.

In addition, it is allowed to keep records in the following context:

- According to the actual payment method (advance payment, payment upon delivery, etc.);

- By the deadline for payment for the supply (whether there was a delay or the repayment period did not occur);

- By the presence of the bill (whether it was presented, whether the maturity date has arrived, etc.).

Attention! The accountant has the right to independently decide how to build accounting for customers in the enterprise. Analytics should allow you to check account balances for overdue debts.

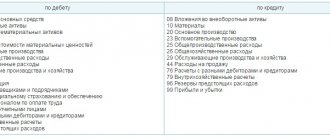

Which accounts does it correspond with?

Accounting account 62 can correspond with the following accounts.

From the debit of account 62 to the credit of the following accounts:

- account 46 - when writing off the cost of the next stage of work;

- account 50 - when returning from the cash register previously deposited funds to the buyer;

- account 51 - when returning funds previously deposited by the buyer from the current account;

- account 52 – when making a return from a foreign currency account of funds previously deposited by the buyer;

- account 55 - when performing a return from a special account of funds previously deposited by the buyer;

- account 57 - when making a refund by postal order or similar method;

- account 62 - when offsetting a previously received advance to repay the buyer’s debt;

- account 76 - when conducting mutual offsets;

- account 79 - when conducting a sale through the head office or branch;

- account 90 - when reflecting the shipment of main products;

- account 91 - when reflecting other sales (fixed assets, materials, etc.).

On the credit of account 62, entries can be made to the debit of the following accounts:

- Account 50 - when reflecting payment for delivered goods to the cash register;

- account 51 - when reflecting payment for delivered goods to the current account;

- account 52 – when reflecting payment for goods delivered to a foreign currency account;

- account 55 – when reflecting payment for goods delivered to a special account;

- account 57 - when reflecting payment by the buyer through a savings account, postal order, etc.

- count 60 - when carrying out mutual offsets;

- account 62 – when offsetting a previously received advance to repay the buyer’s debt;

- Account 63 - when writing off a bad debt using a pre-formed reserve;

- account 66 - when offsetting the supply of products against a short-term loan;

- account 67 - when offsetting the supply of products against a long-term loan;

- account 73 - when selling products to company employees;

- account 75 - when conducting mutual offsets according to the requirements of the founders;

- account 76 - when conducting mutual offsets;

- account 79 - when conducting a sale through the head office or branch;

You might be interested in:

Account 19 in accounting: what is it used for, subaccounts, characteristics, postings

Credit shows our debt

Account credit 62 shows the amount of debt to clients, that is, accounts payable. By analogy, let's turn to the subaccounts to account 62. On the loan, subaccounts 62.01 reflect payment for shipments of goods (work, services). Moreover, payment can be made not only in money to a current account or to the cash register, but also by a bill of exchange or by offset.

The credit of subaccount 62.02 shows advances received against future shipments of goods. The credit of subaccount 62.03 records the amounts received from debtors in payment of bills received from them. That is, similar to the situation with the debit of the account, any debt incurred by our organization to clients (payment by the buyer of his bill or purchased goods) is reflected in the credit of account 62.

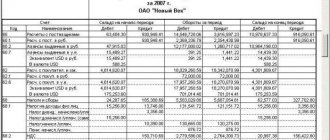

Balance sheet for account 62

By its structure, count 62 is active-passive. This means that it can contain both a debit and a credit balance. In order to calculate them correctly, it is necessary to record transactions for each customer.

Modern computer programs for accounting, for example, 1C, allow you to automatically carry out this kind of accounting, as well as create not only general registers for synthetic and analytical accounts, but also build a balance sheet for each customer.

The balance sheet is a special accounting register. The law does not define strict conditions for how it should look, but it does establish mandatory details for use in it.

These include:

- Name of company and register;

- Start and end days of the register formation, as well as the period;

- In what monetary values is it compiled?

- Indication of responsible persons.

If you are preparing a balance sheet document for account 62, you must adhere to the following rules:

- When compiling debit turnover, it is necessary to reflect all operations of the sale of inventory items to customers. In this case, it is necessary to enter information about the document on the basis of which the sale is made - delivery notes, invoices, UPD, etc. In addition, the debit turnover must reflect the return of funds to the buyer if the delivery of goods or provision of services was not made .

- When registering a credit turnover, it is necessary to include the repayment of the buyer’s debt for the products sold, or the crediting of an advance payment. Here you must also indicate the details of the documents for which the payment was made - PKO, payment orders, etc.

Receipt of payment from the buyer in 1C 8.3

Sometimes situations arise that after posting the document “Receipt of goods” and discrepancies in payment are discovered. You can view these discrepancies in the balance sheet. It is located in the “Reports” menu item, “Standard reports” section. Select “Account balance sheet”.

In the “Period” field, enter from what date to what date you want to generate the report. In the “Account” field, select 62 – “Settlements with buyers and customers”. Press the “Generate” button and look at which counterparty shows what discrepancies:

Let’s say that a discrepancy is identified in the report for some client - his payment is not taken into account in the system according to one of the documents. This discrepancy can be removed using the document “Receipt of funds to the current account.” To do this, find the “Bank and Cash Desk” item in the menu, then the “Bank” section and go to the “Bank Statements” journal.

All receipts of money to the organization’s current account can be done automatically through the connected “Client-Bank”.

For now, let’s consider filling out the document “Receipt to the current account” manually. Click the “Receipt” button.

The following fields are found here:

- “Type of transaction” - select from the list Payment from the buyer.

- “Payer” is a client for whom payment has not been taken into account.

- “Payer” is a client for whom payment has not been taken into account.

- The fields “Agreement”, “VAT rate” and “VAT amount” are filled in automatically after selecting a counterparty, based on the entered data.

- In this case, there is no need to fill out an “invoice for payment”.

- “Article DDS” is also filled out automatically based on the agreement.

- “Purpose of payment” is required.

- “Account” - for such operations we indicate 51, if foreign exchange receipts - 52.

- “Incoming number” and “Incoming date” are the number and date of the payment order that was generated by the client-bank of the counterparty.

- “Settlement account” - 62.01 (with buyers and customers)

- “Advance account” - 62.02

- “Debt repayment” is a very important point; it determines the method of debt repayment depending on the type chosen. There are three types: automatically, according to a document and not repaid.

Let's look at everything one by one. If you select “Debt repayment” automatically and post the document, then the posting Dt 51 - Kt 62.01 is generated - the system has distributed the amount to one document.

Let's say you need to make a payment from a buyer that is more than what was not included in the report for this counterparty. Then two entries Dt 51 - Kt 62.01 are generated with distribution into two documents:

This distribution can be seen in the balance sheet if you click the “Show settings” button in the report and check the “Documents of settlements with counterparties” checkbox. Click “Generate”.

We see that the distribution of the amount between two documents is also displayed.

Now let’s look at the second type of debt repayment – according to a document. We select from the list the document on which we will attach the debt. For this repayment method, the “Document” item located below becomes active. When clicked, a window appears in the interface of which you can select the desired document.

The third type of debt repayment is not to repay. In this case, the entire amount will be transferred to the advance payment account. The wiring Dt 51 - Kt 62.02 will be generated:

Now let’s look at another option: “Receipt of payment from the buyer” based on the invoice that we issued to the client. We go to the “Customer Accounts” journal.

We find the required account in the list and use the “Create based on” button to select “Receipt to current account” from the list:

An absolutely identical document is generated as discussed earlier, but already completely filled out. We indicate the date of receipt, “Incoming number” and “Incoming date” of the payment order. There is no need to enter or change anything else. All that remains is to do:

>

In the same way, you can create a “Receipt of payment from the buyer” based on the “Realization”. To do this, go to the “Sales (acts, invoices)” journal, find the required document in the list, also click “Create based on” and select “Receipt to current account” from the drop-down list:

It differs from the previous method in that here in the item “Repayment of debt” the type “By document” is entered and the document itself is automatically inserted - “Implementation”:

There is no need to change anything here either. We're just carrying it out.

Typical entries for accounting account 62 for dummies

Let's look at typical transactions for account 62:

| Debit | Credit | Description |

| Selling goods to a buyer | ||

| 62/1 | 90/1 | Goods shipped to buyer |

| 90/2 | 41, 43 | The cost of goods sold is written off |

| 90/3 | 68 | VAT charged on sales |

| 50, 51 | 62/1 | The goods are paid for by the buyer |

| 90/9 | 99 | The financial result from the sale was calculated |

| Purchasing goods with prepayment | ||

| 50, 51 | 62/2 | Received advance payment for goods |

| 76 | 68 | VAT has been charged on the advance payment |

| 62/1 | 90 | The shipment has been made to the buyer |

| 90/3 | 68 | VAT has been charged on the sale |

| 62/2 | 62/1 | The prepayment has been offset |

| 68 | 76 | VAT has been deducted from the advance payment |

| Payment for goods by bill of exchange | ||

| 62/1 | 90/1 | The goods have been shipped to the buyer |

| 90/3 | 68 | VAT charged on the sale amount |

| 62/3 | 62/1 | A promissory note was received as payment |

| 50, 51 | 62/3 | The buyer has made payment |

| Postings for writing off debt on account 62 | ||

| 91 | 62 | Debt was written off for expenses if no reserve was created, or for the amount of debt not covered by the reserve |

| 63 | 62 | The debt was written off within the created reserve |

| 007 | – | The written-off debt was taken into account in the off-balance sheet account |

| Other postings to account 62 | ||

| 62 | 50, 51 | Refund of advance payment for undelivered products |

| 62 | 76 | Settlement has been made |

| 62 | 91 | Sales of non-core products were made |

| 60 | 62 | Settlement has been made |