Types of deductions

Deductions are conventionally classified into three groups:

- mandatory, provided by law. Their presence and size do not depend on the wishes of the employee and the employer, but are determined by external regulations;

- deductions at the initiative of the employer;

- voluntary, at the initiative of the employee. For example, membership fees to a trade union or under a voluntary health insurance policy.

Deductions of the first group are often regular and occur over a fairly long period of time. The latter are caused by certain events.

Mandatory deductions

By law, the employer must withhold from the employee’s income:

- income tax in accordance with Art. 23 Tax Code of the Russian Federation. Now it is 13%, while the employee has the right to a tax deduction - an amount that will not be taxed.

- deductions according to the writ of execution. This includes alimony, compensation for damage by court decision (for causing harm to health, due to the loss of a breadwinner, etc.), debt to third parties, administrative fines, etc.;

- deductions from the wages of convicts, which go towards their maintenance (Article 107 of the Penal Code of the Russian Federation).

Initially, tax is withheld from each salary payment.

If, in addition, there are financial obligations to third parties, the accountant makes them after deducting personal income tax.

When there are several such obligations, there is also a certain priority between them: first comes alimony and compensation for harm, then administrative fines, payment of debt and interest on it, etc. At the same time, reimbursement of costs for the money transfer also falls on the employee.

Regardless of the frequency of salary payments, transfers according to writs of execution are made once a month after the final income for the past period has been calculated and personal income tax has been withheld. This must be done no later than 3 days after payment of wages.

Article 137 of the Labor Code of the Russian Federation. Limitation of deductions from wages (current version)

1. Deductions from an employee’s salary may be made in cases established by law, i.e. regardless of the will of the employer, and according to his decision. The commented article defines the grounds for deductions made by decision of the employer to repay the employee’s debt, and contains an exhaustive list of such grounds.

It should be emphasized that the employer has the right, but not the obligation, to make deductions. This directly follows from part 2 of the commented article.

2. The grounds and rules for deductions from an employee’s salary are established by the Labor Code in accordance with ILO Convention No. 95 (1949). Article 8 of the Convention provides that deductions from wages are permitted under the conditions and within the limits prescribed by national legislation or determined in collective agreements or decisions of arbitration courts. Workers must be notified of the conditions and limits of such deductions.

3. It is necessary to distinguish from deductions the recovery of the amount of damage caused by the employee (see commentary to Article 248).

4. Along with deductions carried out by order of the employer and aimed at repaying the employee’s debt, there are deductions made on the basis of federal laws. They are aimed at fulfilling the employee’s duties to the state or other persons. Current legislation establishes the possibility of deducting from wages taxes on personal income, administrative fines, fines as a criminal penalty, certain amounts (parts of wages) when serving a sentence in the form of correctional labor, amounts of money by court decision (writ of execution).

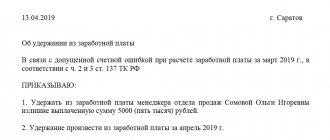

5. The commented article establishes the procedure and conditions of withholdings. Firstly, the employer must comply with the established period - a month from the date of expiration of the period established for the return of the advance, repayment of debt, etc. Secondly, there is no disagreement with the employee regarding the grounds and amount of deduction.

6. A particular difficulty in practice is the question of determining the presence (absence) of a counting error.

A counting error should be understood as an error in arithmetic operations when calculating the amounts to be paid, as well as other technical errors (typos, typos, etc.). Incorrect application of the relevant legal provisions does not constitute a counting error. An erroneous transfer of funds to a bank account is not a counting error. Thus, when considering a case regarding the recovery from an employee of excessively transferred compensation for unused vacation (this compensation was transferred twice due to the employer’s error), the court indicated that a counting error should be considered an error made in arithmetic operations (actions related to counting), while as technical errors, incl. technical errors committed through the fault of the employer are not countable (Definition of the Armed Forces of the Russian Federation dated January 20, 2012 N 59-B11-17).

7. By decision of the employer, amounts overpaid to the employee as guarantee payments in case of failure to comply with labor standards or idle time may be withheld. This is possible in the case when the body for consideration of an individual labor dispute establishes the employee’s guilt in failure to comply with labor standards or in downtime (see also commentary on Articles 155, 157).

8. Amounts paid to an employee as vacation pay may be withheld in the event of his dismissal before the end of the working year for which the vacation was granted. The exception is the grounds for dismissal at the initiative of the employer, not related to the guilty behavior of the employee (clauses 1, 2, 4, part 1, article 81), and dismissal due to the employee’s refusal to transfer to another job, which is necessary for him in accordance with a medical certificate issued in the manner established by federal laws and other regulatory legal acts of the Russian Federation, or the employer’s lack of relevant work (clause 8, part 1, article 77).

At the same time, the employer’s right to a refund for vacation days not worked by the employee, as noted in judicial practice, cannot be made dependent on the presence or absence of accrued but unpaid wages at the time of dismissal from the employee, from which the payment can be made. hold. Otherwise, the principle of equality of workers would be violated: they would be placed in different positions depending on whether any amounts were accrued to them at the time of dismissal (Appeal ruling of the Supreme Court of the Republic of Karelia dated December 27, 2012 in case No. 33-3851/ 2012).

Comment source:

Rep. ed. Yu.P. Orlovsky “COMMENTARY ON THE LABOR CODE OF THE RUSSIAN FEDERATION”, 6th edition ACTUALIZATION

ORLOVSKY Y.P., CHIKANOVA L.A., NURTDINOVA A.F., KORSHUNOVA T.YU., SEREGINA L.V., GAVRILINA A.K., BOCHARNIKOVA M.A., VINOGRADOVA Z.D., 2014

Employer-initiated deductions

Situations when an employer has the right to make deductions from an employee’s salary are specified in Article 137 of the Labor Code of the Russian Federation. It can be done:

- if the employee received, but did not work out, an advance payment, a regular vacation, or did not fully use travel allowances or funds issued for moving to another city;

- if a counting error was made that was not related to an incorrect interpretation of labor legislation;

- if the employee violated labor standards and obligations, committed downtime, etc., and his guilt was proven by a court or a labor dispute commission.

It should be noted that these deductions are the right of the employer, but he can apply them at his own discretion.

However, this must be done no later than a month after the occurrence of the event and only if the employee does not challenge the deduction.

If there is a disagreement between the parties, the issue is resolved by a labor dispute commission or court.

In addition, Article 238 of the Labor Code of the Russian Federation gives the employer the opportunity to recover direct material damage from the employee.

Fines

They also apply to the deductions permitted by Art. 137 Labor Code of the Russian Federation. The Code of Administrative Offenses contains Art. 32.2, according to the provisions of which the fine must be paid by transferring/depositing a specified amount to a banking or other organization.

If payment is not made on time, a copy of the resolution imposing this administrative sanction is sent by the authorized body/employee to the employer for forced deduction of the amount from the earnings of the culprit.

A fine can be imposed on the perpetrator as a criminal punishment. Collection of the established amount is carried out by court verdict.

As established by Article 31 of the Penal Code (Criminal Executive Code), a person must pay the fine imposed on him before the expiration of a month from the date the court decision comes into force.

If the order is not fulfilled voluntarily within the prescribed period, the penalty may be applied to the property of the perpetrator. If the amount of the recovery is less than 2 minimum wages, the person’s material assets are not enough to pay off the debt, the amount may be withheld from the earnings of the culprit. Monitoring the execution of court orders is the responsibility of FSSP employees.

Income from which deductions are not made

An employee's salary consists of more than just salary. In addition, labor legislation provides for a wide variety of payments, including one-time payments. Deductions under a writ of execution take into account other types of income of the debtor: bonuses, food payments, vacation pay and sick leave, etc.

However, some types of payments are exempt from deductions under writs of execution (Article 101 of the Federal Law “On Enforcement Proceedings”). These include:

- compensation for injuries received in the performance of official duties;

- compensation for travel, purchase of medicines, etc.;

- travel allowances and payment for moving to another location in connection with the transfer;

- compensation for the cost of purchasing tools;

- cash payments in connection with a wedding, the birth of a child, or the death of a loved one.

There are also other types of income to which enforcement proceedings do not apply. But they, as a rule, are carried out from the federal or local budget, and have nothing to do with wages.

Collection of various types of income

The law provides for exceptions when amounts calculated by the employer are not subject to collection. The list of prohibitions on deductions includes:

- maternity capital and other payments for minor children;

- monetary compensation for work in difficult conditions;

- compensation for harm to health if injury, mutilation, illness was received at work;

- payments to relatives of those killed at work;

- benefits for a person caring for a disabled person of the 1st group;

- accruals at the time of dismissal of an employee, etc.

A complete list of income not subject to recovery is given in Article 101 of Federal Law No. 229.

7 life situations when a claim procedure is mandatory before trial

Read

Legal grounds and deadlines for canceling a court order

Read

Awards

Bonuses are paid to the employee based on the results of the work performed. This allows the bonus to be added to the salary, which means that deductions on writs of execution should also be calculated from the calculated bonus payments.

Bonuses

Bonus accruals are not included in the list of exceptions. Of all types of bonuses, the employer is required to withhold taxes first and then penalties. When calculating, you cannot take away more than 50%, and in some cases 70%.

13th salary

The 13th salary is essentially a bonus at the end of the year. Part of it will be used to pay off debt obligations in the standard manner.

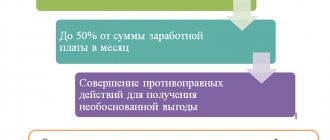

Deduction amount

The amount of deductions is established in the relevant document. This can be a percentage of income (taxes, alimony for a minor child) or a fixed amount.

- Deposited wages - what does it mean?

In some cases, the burden of financial obligations to third parties turns out to be too great and equals the employee’s total income, and sometimes even exceeds it. However, no one has the right to completely leave a person without a livelihood. Therefore, the law provides for a limit on the maximum amount of deductions. After all deductions at the initiative of the employer, the person must receive at least 80% of the salary. For deductions provided for by federal law, the threshold is increased to 50% (Article 138 of the Labor Code of the Russian Federation).

In exceptional cases, it is allowed to increase the total amount of all deductions to 70%. It refers to:

- alimony;

- compensation for harm to health;

- compensation for loss of a breadwinner;

- compensation for the crime committed.

If even this is not enough to pay off obligations, the person accumulates debt.

Moreover, if there are writs of execution in favor of several persons of the same priority, it is not allowed to make payments to only one of them. Transfers must be distributed in proportion to the assigned amount.