How long is a 2-NDFL certificate valid?

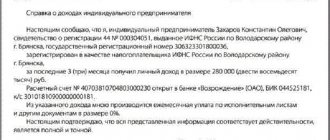

Tax agents (meaning firms, enterprises, individual entrepreneurs paying income to individuals) must, upon receipt of an application from a taxpayer (tax agent employee), issue him a reference calculation of 2-NDFL (clause 3 of Article 230 of the Tax Code of the Russian Federation) for any period, prior to the application date.

The current 2-NDFL form for 2021 can be downloaded here.

A sample application for issuing a 2-NDFL certificate can be downloaded from ConsultantPlus. To do this, sign up for trial demo access to the K+ system. It's free.

And although the validity period of the 2-NDFL certificate is not limited, its contents and date must correspond to the purposes for which it is taken by the employee. So, 2-NDFL is sometimes needed:

- to prepare the 3-NDFL declaration;

- when applying for a loan.

Let's see how long 2-NDFL is valid in these cases.

Validity period of the 2-NDFL certificate

According to the letter of the law, today there are no provisions that would be responsible for regulating specific periods of validity of the paper that interests us. In fact, if you take a certificate at work now, after a long time you will be able to use it as evidence of a specific financial condition or level of income that was relevant at the current time.

The validity period of the certificate will change constantly depending on the situation in which you are interested in its value

This is often what people decide in court regarding:

- non-payment of alimony;

- distribution of property benefits during divorce;

- collection of debts, etc.

At the same time, the tax office or bank may establish other requirements for the validity period of this certificate, which you cannot contradict, even if you wish.

Validity period of 2-NDFL certificate for tax deduction

Receiving a tax deduction is a common practice today. To return some of the money previously spent, you need to submit a declaration to the tax office in form 3-NDFL, which we discussed above, and support it directly with a certificate of your income and tax deductions made for you - 2-NDFL.

In this situation, the validity period of the 2-NDFL certificate will be determined very conditionally, of course, since, we repeat once again, it is not specified by law. However, we can specify a specific period of three years.

The fact is that in 2021, for example, you can receive a tax deduction for the following calendar periods:

- 2018;

- 2017;

- 2016

It will no longer be possible to return funds for 2015, since the law states that tax deductions can be refunded for no more than three previous years. It turns out that if you took out a certificate in 2015, its expiration date will be considered to have already expired.

Validity periods for certificates for tax agents

If you apply to the Federal Tax Service as a tax agent, that is, an employer, you will need a certificate of the form we are interested in to submit for verification the tax deductions made for each employee on the basis of your employee organization.

Providing a certificate is also relevant for organizations that are tax agents, since with its help they report on the implementation of certain tax deductions

The document must be submitted immediately before April 30 of the calendar year following the reporting period. Until this moment, the certificate that you have issued will be considered valid, however, provided that the deadline has been missed, the document will lose its relevance, and you will have to prepare and submit the paper again next year.

Providing information about income for a credit institution

Provided that you need to get a loan from a credit institution, with one hundred percent probability you will have to include in the list of documents required to provide a form of the form that interests us.

Of course, the banking organization will consider not only the data reflected in it, but also pay attention to your credit history and other factors, however, in the case of, for example, a mortgage, you are guaranteed to be required to provide the required document. The only exceptions are those situations in which we are talking about borrowing a small amount, up to 500 thousand rubles

The only exceptions are those situations in which we are talking about borrowing a small amount, up to 500 thousand rubles.

When transferring data to the bank, you need to take into account the different periods for calculating the expiration date of this document

In the situation you are looking for, there may be several current validity periods for the certificate:

- three months;

- year;

- four months;

- six months.

However, it is also necessary to take into account that in this situation the timing will be determined not only by the period for which the bank wants to receive a report, but also by the date of submission of the loan request.

So, if you took a certificate in January, but went to the bank only in March, it is logical that it will not be accepted for consideration, since the organization wants to have information about your solvency at the time of contacting it.

As a consequence, if a document was taken before the appeal, you will have to receive it again if any time has passed between these two events. However, most often, at least 30 days must pass from one moment to the next; in most cases, it is after this period that for the banking system our certificate loses its legal force. However, to avoid getting into trouble, it is best to do the following:

- come to the bank for consultation in advance;

- clarify the question you are looking for and other questions of interest directly from the credit manager.

Validity and expiration date of the 2-NDFL certificate for the tax office

Let's move on to the question “How long is the 2-NDFL certificate valid for the Federal Tax Service?” When the year ends, an individual, based on the rule established by law (Article 229 of the Tax Code of the Russian Federation) or by personal expression of will, sends a 3-NDFL declaration to the tax authorities. Figures relating to income are transferred to it from 2-NDFL.

Although, as we have already figured out, there is no validity period for 2-NDFL certificates, the taxpayer is strongly recommended to check whether he has missed the time to contact the tax authority on an issue for which resolution is necessary, including the information presented in 2-NDFL . Most often, individual taxpayers go to the tax office in order to return previously transferred personal income tax from the budget. At the same time, the deadline for tax refund is 3 years (Clause 7, Article 78 of the Tax Code of the Russian Federation).

ATTENTION! Users of their personal account on the website of the Federal Tax Service of Russia have the opportunity to download Certificates to their computer using this service. It is necessary to take into account that tax agents submit information about an individual’s income for the past calendar year to the tax authority no later than March 1 of the following year. That is, the 2-NDFL certificate for 2021 can be available in your personal account no later than 03/01/2021.

Next, we will consider how long a 2-NDFL certificate is valid for a bank.

Features of the 2-NDFL certificate to various organizations

In practice, the 2-NDFL certificate has a limited validity period.

Validity period of the 2-NDFL certificate for the tax office

The Federal Tax Service uses a certificate in form 2-NDFL as an important reporting document.

- The employer must annually, before the established date, provide information on the accrual and withholding of income tax for each of its employees for the reporting year.

- Often, an individual is required to report for receiving additional income other than wages in the form of a 3-NDFL declaration.

- In this case, a certain part of the reporting is filled out based on the data from the 2-NDFL certificate.

- In this situation, the information from the certificate is valid until the last day of the period provided for reporting to the tax office.

There are no restrictions on the validity period of the 2-NDFL certificate when submitted to the Federal Tax Service for the purpose of reimbursement of previously paid income tax.

The tax inspector will accept the taxpayer's approved income document form issued last month or even the previous year.

Unified forms are submitted on paper, if filled out by hand, or on electronic media: floppy disk, disk or flash card.

You can submit 2-NDFL reports to the Federal Tax Service office:

- Representative of the tax agent.

- By registered mail with a description of the attachment.

- Via the Internet using an electronic signature.

- Tax legislation provides for the provision of tax benefits (deductions) for income tax when making a number of expenses: purchasing real estate, training, treatment.

To receive a refund of overpaid tax amounts or a refund of income tax, it is mandatory to provide a 2-NDFL certificate to the Federal Tax Service.

The validity period of such a certificate is unlimited; the certificate can even be issued in previous years.

Certificate 2-NDFL to credit organizations

Most banks request from a potential borrower a certificate confirming the fact and amount of income received - a 2-NDFL certificate.

The document helps the lender increase guarantees and reduce the risks of non-payment due to the officiality and legality of the information specified in it.

The certificate form allows banks to see the official income of the borrower, from which tax deductions are made, providing the opportunity to verify the authenticity of the document through the Federal Tax Service database.

For credit institutions, the certificate is usually valid for thirty days from the date of issue. The duration of validity of the unified document is directly related to the application for borrowed funds.

If the validity period of the certificate in form 2-NDFL is exceeded, the bank will not be able to see the real picture of the potential borrower’s income level.

More stringent requirements are imposed on the issuance of a certificate for obtaining a mortgage when a certificate issued no earlier than ten days ago is accepted.

Not all types of loans may require a certificate of income in form 2-NDFL; in some situations, banks are ready to accept a certificate in the employer’s form or in their own format.

Types of loans for which a certificate of income is not required at all:

- trade credit through a retail outlet;

- express loan;

- microloan;

- pledge in a pawnshop and some others.

Certificate 2-NDFL for obtaining a visa

Embassies of many countries, in order to obtain a visa to enter their territory, request proof of income in the format of a unified 2-NDFL certificate.

It all depends on the statutory procedures of the visa service chosen to visit the country, since sometimes embassies are limited to a bank account statement.

The 2-NDFL certificate received for the purpose of preparing a visa has the following features:

- limited validity period from ten to thirty calendar days;

- a specified period of recorded amounts, in most cases the previous six months.

Whether the 2-NDFL certificate will have a validity period or not directly depends on its intended purpose.

Before submitting a request for a certificate, check in advance the date of provision of the document and the time period of financial data.

Validity period and deadline for submitting the 2-NDFL certificate for the bank

It is extremely common for credit institutions to request the calculation of 2-personal income tax (when citizens contact them to borrow money for various needs).

The validity period of a 2-NDFL certificate for a bank will be determined by its requirements for the period of confirmation of earnings and/or the date of its preparation, which may vary in each individual case depending not only on the credit institution, but also on the characteristics of the loan product claimed by the potential borrower .

As for the deadline for submitting 2-NDFL to the bank, it is determined by the time limits for transferring to the bank all the documents necessary to consider the request to receive borrowed funds.

Read about banks checking the 2-NDFL certificate for a loan here.

Requirements for the validity period of 2-NDFL for mortgages in Sberbank, VTB and Rosselkhozbank

The law does not define a specific validity period for personal income tax certificate 2. It all depends on the requirements of the lender to whom it is submitted for analysis. Banks are especially strict on this issue.

When applying to VTB for a mortgage, you need to prepare a personal income tax certificate 2, which is valid for 45 days. But you need to understand that the institution analyzes information month by month. For example, the form was completed on October 2. The certificate was issued on September 5. In fact, the validity period of 2 personal income tax loans did not exceed 45 days. But the bank may request salary data for September. This option is quite possible. The specific validity period of 2 personal income tax depends on the credit analysts who will review the application.

The applicant also needs to take into account that the banks can provide not 2 personal income taxes, but a certificate filled out on their form.

- VTB requires salary data for the last 12 months to obtain a mortgage. A sample certificate can be downloaded right now.

- Sberbank does not require data on earnings for each month. It is necessary to indicate the average salary and deductions for the last six months. You can see what a certificate similar to 2-NDFL for a Sberbank mortgage looks like in the sample.

- An example of a document for Rosselkhozbank can be downloaded here.

You may be interested in: a complete list of documents for obtaining a mortgage in the main agricultural bank of the country.

Deadline for issuing certificate 2-NDFL

The law does not directly say how quickly this paper is issued by the tax agent. But there is Art. 62 of the Labor Code of the Russian Federation, which limits the time for an enterprise to prepare documents for its employee at the latter’s request to 3 days, including the period for issuing a 2-NDFL certificate. Thus, if an employee has submitted an application for registration of 2-NDFL, it is within this period that it should be done and given to him.

Read more about the procedure for issuing a 2-NDFL certificate to an employee here.

For information about who can endorse the 2-NDFL, see the material “Who has the right to sign a 2-NDFL certificate?” .

What are the consequences of not issuing a 2-NDFL certificate at the employee’s request, read in the article “The employee was not issued a 2-NDFL certificate? Wait for the trial .

Results

The 2-NDFL certificate does not have a validity period, but it does have a deadline for its submission by the employer to the tax authorities and a deadline for issuing it to the employee. The employer is obliged to issue a 2-NDFL certificate to the employee within 3 working days. In addition to the employer, a 2-NDFL certificate for previous tax periods can be requested from the INFS.

Read more about this in the material .

Sources:

- tax code of the Russian Federation

- labor Code

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Certificate validity period in 2021

Currently, the legislation has not changed the requirements for obtaining, filling out and presenting an income certificate. Since both before and now there are no requirements for how long the 2-NDFL certificate is valid, we can say that in each case you need to focus on the specific requirements of the organization requiring the provision of this document.

If a certificate is needed for a bank

In this case, you need to check specifically with the bank itself. However, in practice, a fairly stable position has emerged: the validity period of an income certificate is 30 calendar days from the date of its issuance. When studying a client’s solvency, the bank assumes that there is a small probability that his income may drop sharply in 1 month. Therefore, as a rule, such information is recognized as valid. Accordingly, it is necessary to fulfill the requirements of the credit institution.

If the tax office needs a certificate

In this case, the situation is much simpler - there are no restrictions on the validity period for the tax authorities. The main requirement is to provide a document with reliable information on time. The reason is that the tax office is interested in income for a certain period. And how much time has passed since then does not matter.

Many other organizations that require its provision use the same logic, but it is better to clarify in advance how long the document is valid specifically according to their rules.