Obtaining reports on a citizen’s income for a certain period is possible by submitting an application for certificate 2 of personal income tax. The sample document was approved by PR. Federal Tax Service No. MMB-7-11/ [email protected] dated 10/02/2018. But the request for a certificate may differ, depending on the conditions for its receipt (for an employee, a dismissed person, at the Federal Tax Service, etc.). Is the employer obliged to provide a 2nd personal income tax certificate at the employee’s request? What penalties are provided for failure to issue a document?

Why fill out 2 personal income taxes?

Certificate 2 of personal income tax is a reporting form that reflects all taxable types of remuneration of an employed citizen for a certain period, and the deductions provided. The document generated at the end of the year reflects the tax base and the amount of personal income tax paid within the calendar year.

The employer is required by law to generate 2 personal income taxes for all employees at the end of the reporting period, since he acts as a tax agent and is obliged to report to the Federal Tax Service for taxes paid to the state budget.

For an employee or non-working citizen, this form of reporting may be required in different situations:

- The most common reason for providing information about income and taxes paid is to apply for a bank loan, including a mortgage.

- Receiving a tax deduction, regardless of the basis for its provision: treatment, purchase of housing, paid training, etc.

- When applying for a new job. The landlord may request a certificate in Form 2 of personal income tax to summarize the deductions already provided and the total income for the tax period.

- To obtain a visa.

- To calculate vacation pay and temporary disability benefits.

- When applying for benefits, state benefits, subsidies, etc.

- When adopting or registering guardianship.

Obtaining a certificate of the established form is permissible only if the citizen has taxable income.

For example, if a non-working person is registered with the Central Employment Service and receives unemployment benefits, government agencies cannot issue him 2 personal income taxes. In this situation, an individual can request a certificate about the amount of benefits.

Why is it needed?

A 2-NDFL certificate is required in situations where a citizen needs to document the amount of his earnings. It could be:

- When applying for a bank loan. If a citizen applies for a mortgage, the bank must require a document confirming a certain level of official earnings of the client;

- When requesting a visa to visit a foreign country. The receiving party must make sure that the citizen does not have financial problems and does not seek to stay in the country illegally;

- The document will be required when receiving tax deductions;

- When moving to a new job, if the citizen has the right to receive a tax deduction;

Important! When receiving a certificate, a citizen should ensure that it is drawn up in accordance with the provisions of regulations. If the established form is violated, part of the required information is missing from the document, or there are other inaccuracies, the certificate will be invalid.

How to send to an employer

Regardless of whether a citizen currently works in an organization or is a former employee, he has the right to receive a certificate in Form 2 of personal income tax for the period when he performed duties in accordance with the TD.

How can a taxpayer submit an application for personal income tax certificate 2? There are two options:

- Submit the application to the employer in person.

- Send your request by mail.

In the first case, the application is submitted through the secretary for signature by the manager in two copies. In this case, one of them is marked with receipt and returned to the employee, and the second is marked with the number of incoming correspondence. Fixing the date of submission of the application is necessary to comply with the deadlines established by law for the preparation of reports and their issuance to the applicant.

In the second case, the document is sent by registered mail with notification. When the notification spine is returned to the sender, it will be marked with the date the envelope was received by the addressee. This number is the starting point for the time allotted for issuing the certificate.

We recommend additional reading: How can a military personnel order a personal income tax certificate 2 via a report and the Internet

The listed methods are required by the employee if there is no guarantee that the employer will issue a certificate, or he deliberately evades his responsibility or delays deadlines.

In most situations, it is enough for an employee to provide a request form to the accounting department, and a certificate can be received on the same day, depending on the document flow rules provided for by the institution. In any case, the period for issuing the document should not exceed 3 working days.

To a military man

Payments to military personnel are currently made through the Unified Settlement Center of the RF Ministry of Defense, which is located in Moscow. Information flows there from all over the country about the calculation of military allowances. In this case, how to submit an application for a 2nd personal income tax certificate, and how to eventually receive it?

A request for the issuance of reports in Form 2 of personal income tax must be written by a military personnel in accordance with the established template:

- indication of addressee information;

- reflection of the applicant’s data (full name, personal number, passport details, etc.);

- indication of the need to obtain this type of document;

- a mark in the request for the period for which it is necessary to reflect information on income and the required number of copies of the document.

- It is important to note in what way the certificate should be transferred to the recipient (in person, through a proxy, by mail, etc.).

The application must include the signature of the contractor and the date of application.

The compiled document can be submitted to the ERC or the regional Financial Support Department of the RF Ministry of Defense (Ural Federal District of the RF Ministry of Defense) in person, sent by registered mail with notification or by e-mail.

Another way a serviceman can order a certificate is through the “Personal Account” on the website of the RF Ministry of Defense, which reflects all operations on the calculation of allowances and personal income tax deductions to the budget. This resource allows you to obtain information on the regional Ural Federal District, its opening hours, location, and email address.

How to submit a document to an employer

To submit a completed application, you can go one of three ways:

- the fastest and easiest: give the form personally from hand to hand to a representative of the organization;

- send the application by registered mail via mail (with a list of attachments and acknowledgment of receipt);

- transfer the document through a proxy, having previously provided your representative with a notarized power of attorney.

Source of the article: https://assistentus.ru/forma/zayavlenie-na-predostavlenie-spravki-2-ndfl/

For the bank

Why might an individual need an application for 2 personal income taxes for a bank to provide a certificate? For example, if a citizen receives dividends on shares when a bank acts as the issuer. To do this, it is recommended to check with the financial institution about the request form or use a standard form, which must indicate:

- addressee of the request (full name of the director and name of the institution);

- recipient of the certificate (full name, passport details, contact phone number);

- the basis for providing the document (legal reference);

- the period for which the certificate is required and the number of copies;

- method of obtaining a ready-made reporting form;

- signature and date.

Some banking institutions post application forms on their official websites to provide a certificate in Form 2 of personal income tax.

The issuance of this form of reporting is possible due to the fact that the financial institution, which is the issuer and pays income in the form of dividends to an individual, acts as a tax agent. In accordance with the law, this type of profit is subject to taxation and deductions to the state budget. According to the law, a tax agent is obliged to provide a document on income to an individual upon his request.

We recommend additional reading: Certificate upon dismissal 2nd personal income tax: why is it needed and a sample filling

To the Social Insurance Fund and the tax office

There is no unified application form suitable for all institutions and organizations of various forms of ownership for the provision of a certificate of income. But no matter what format is used, it must reflect a certain list of information.

It is recommended to clarify the form for requesting a certificate for the tax and Social Insurance Fund directly from the government agencies themselves. Because they have their own reporting request form.

For example, for the Social Insurance Fund, a similar sample application would be suitable:

When requesting information from the Federal Tax Service, you can use the free form:

But in most cases, taxpayers prefer the electronic version of requesting personal income tax certificate 2, directly through the official tax website or the Gosuslugi.ru portal.

Upon dismissal

In accordance with labor legislation, the landlord is obliged to provide the employee with documents confirming the fulfillment of duties, including information about the amount of income for the reporting period. To do this, the employee must submit an application for receiving 2 personal income taxes, in the form provided by the employer. They may differ in different institutions, but the following information must be included:

- name of the legal entity;

- Full name and position of the head of the organization;

- applicant’s details (full name, passport details, address, etc.);

- Title of the document;

- description of the essence of the request;

- justification for the obligation of the landlord to issue a certificate (legal norm);

- the period for which reporting is required and the number of original copies;

- date of application and signature.

A taxpayer needs a certificate from his last place of employment first of all when applying for employment.

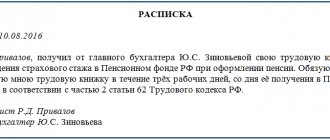

Is a written request for a document always necessary?

Every working Russian can request and receive a document under the code 2-NDFL, without indicating the reasons why it is needed.

The rules for issuing it are set out in Article 62 of the Labor Code of the Russian Federation and Ch. 23 Tax Code of the Russian Federation.

It is provided upon the first request of the taxpayer, regardless of whether he contacted the employer orally or in writing.

However, the applicant must note that the advantages of a written application are as follows:

- the date of filing the application is indicated, which is the starting point for the three-day period for issuing the certificate;

- allows you to avoid many unpleasant moments, because the employer may deny that the employee contacted him;

- simplifies the employee’s actions when appealing a refusal to issue a certificate through other authorities.

You should always protect yourself with a written request. Although most employers issue a certificate without creating problems for employees at their first request.

And in the event of dismissal of an employee, the management administration is obliged to issue such a document on the day the employee is paid, even without his personal application.

What to do if a new job requires a 2-NDFL certificate? Is this legal? Find out here.

Where to apply if the organization is liquidated

If the enterprise where the citizen worked is liquidated, there are two options for obtaining a 2nd personal income tax certificate:

- personally through the tax office;

- to the landlord through the Federal Tax Service or the Pension Fund.

In accordance with the law, tax agents are required to provide reports in Form 2 of personal income tax for each employee, including those dismissed within the calendar year, no later than March 1 of the following year, for the reporting year. Therefore, individuals cannot request a certificate of income through the Federal Tax Service before the legal entity provides information on this form.

But this rule does not apply to enterprises that are subject to liquidation or reorganization. They must submit all reporting forms before being removed from the register of legal entities. Accordingly, upon employment, information from the previous place of work (if the entire process occurred within one year) will already be available to the Federal Tax Service, and the citizen has the right to request it by submitting an application for certificate 2 of personal income tax to the territorial office of the Federal Tax Service where the liquidated legal entity was registered.

A taxpayer can independently apply to the Federal Tax Service for a certificate if he needs it for personal purposes: to apply for a loan, obtain a visa, etc. But if the document is required at a new place of work, the request can be made to the employer, through the tax office or the Pension Fund. In this case, the application requires a reflection of the reason for providing information about the individual’s income. This could be the calculation of sick leave or vacation pay, or a reflection of the amount of deductions provided.

We prepare a property deduction

To reduce the personal income tax base by the cost of purchased housing and mortgage interest, you must provide the employer with a special notification from the Federal Tax Service.

To receive this document from the tax service, you will have to submit an application for notification of property deduction 2021. You will also need to provide documents confirming your entitlement, according to the list:

- contract of sale;

- mortgage agreement;

- act of acceptance and transfer of the apartment;

- payment documents.

The company will reduce the personal income tax base by an amount not exceeding that specified in the notification.

Current sample application for a property deduction from an employer:

IMPORTANT! You can receive benefits not only through your employer. It is permissible to contact the Federal Tax Service by submitting an application for a property tax deduction

Deadline for submitting personal income tax certificate 2 at the employee’s request

According to the law, the landlord is obliged to issue a certificate in Form 2 of personal income tax within 3 working days from the date of submission of the application. What are the nuances here?

We recommend additional reading: Personal income tax or what kind of personal income tax is it?

When submitting an application in person or requesting through the tax office, the period for issuing the document will be minimal. In some cases, the form is issued on the same day or the next.

If the request is sent by mail, then the countdown begins from the moment the letter is received by the addressee. And if the method of obtaining a certificate of income is also through mail, for example for military personnel, then the period will be increased. That is, the time for sending the application and the certificate itself is not included in the deadline for submitting the reporting form.

When terminating a contract with an employee, the certificate must be generated on the last working day, even if the application was received on the day of dismissal.

In what cases is a certificate needed?

The demand for the document under code 2-NDFL is quite high, because it confirms the receipt of official income by an individual.

Most often, a certificate is asked to provide in the following cases:

- when receiving credit finance from banking institutions;

- for a mortgage (when drawing up an agreement to borrow funds for the purchase of residential premises);

- during employment at a new enterprise;

- when applying for a tax deduction in the following circumstances: payment for studies; acquisition of living space; receiving paid treatment; other expenses.

For all organizations, there are the following grounds for issuing such a certificate for a taxpayer:

Read more: How to change citizenship from Ukrainian to Russian

| Where is it served? | Legal basis | Procedure for providing a certificate |

| To the tax authorities for each citizen who received profit during the past tax period | Reporting standards are set out in clause 2 of Article 230 of the Tax Code of the Russian Federation | The maximum filing deadline is March 31 (inclusive) of the following year following the end of the reporting period. |

| It is provided to the tax service for those persons from whose income personal income tax was not withheld | According to the text set out in paragraph 5 of Article 226 of the Tax Code of the Russian Federation. | Within a month from the date of occurrence of obligations |

| To the taxpayer at his request | Personal written or oral request from an employee (including former employees) | The document must be issued within 3 working days from the date of receipt of the application |

Employer's liability for non-delivery

The landlord does not have the right to refuse to issue an income certificate to an employee or former employee. Violation of legal requirements may subject the employer to penalties.

But the law will be on the employee’s side not from the point of view of violation of tax law, but from the point of view of non-compliance with labor legislation, which obliges the employer to provide the employee with documents confirming his income.

A citizen has the right to file a complaint with the labor inspectorate. Based on the results of consideration of the appeal, the employer may be subject to an administrative penalty in the form of a fine.

Judicial practice on this issue is quite extensive. According to the decision of the Supreme Court, the violator may be imposed penalties in the amount of:

- for officials and individual entrepreneurs – from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 tr.

Tax legislation does not oblige employers to issue certificates in Form 2 of personal income tax, but in accordance with the Labor Code of the Russian Federation, the landlord must provide the citizen with information about income upon request, within the period established by law.

Sample application for personal income tax certificate 2

The taxpayer has the right to request a certificate of income for any period he needs, for example for the last 3 months:

But if a document confirming income is needed for a period longer than a calendar year, then the corresponding number of reports is generated for each tax period separately. This nuance must be indicated in the application for the issuance of personal income tax certificate 2 (sample):

You can request a certificate orally from the accounting department at your place of work if you are sure that there will be no problems with issuing the document and the employer will fulfill its obligations within the time limits required by law.

How to write and sample

Example of an application for issuing a 2-NDFL certificate

There is no legally established form for applying for a 2-NDFL certificate. The document is written by hand or using printing technology. It should reflect the following information:

- Name of the organization, its address;

- The official to whom the application is submitted (company director or chief accountant) indicating the position, surname and initials;

- Position, surname and initials of the employee, structural unit (department, workshop, service, etc.);

- Request for the issuance of a 2-NDFL certificate;

- A legal norm under which the employer is obligated to issue a certificate. This is Article 62 of the Labor Code of the Russian Federation and paragraph 3 of Article 230 of the Tax Code of the Russian Federation;

- The period that must be included in the certificate;

- Number of copies of the document;

- Employee's signature, surname and initials, date of application.

Application for a 2-NDFL certificate to the accounting department

On the application, the head of the company or another authorized person (chief accountant) puts a resolution on issuing a certificate. Such an inscription is an order for accounting employees to begin processing the document.

Note! After receiving the resolution on the application, the citizen is advised to make a copy of the application. So that if the deadline for issuing a document is missed, the employee has evidence of applying for a certificate. Example of an application for a 2-NDFL certificate for a military personnel

A different procedure applies for military personnel. These persons should contact the financial support department of the relevant military district. If a citizen does not have the opportunity to submit an application on his own, this can be done via mail.

Sample application for a 2-NDFL certificate for a military personnel