In addition to the usual earnings in rubles, payment of wages in non-monetary form is allowed. This may be necessary for a company when there is a cash shortage. But wages must be paid on time, and the employer offers to receive it in products. Sometimes there may be a good benefit for the employee. For example, partial payment of wages at a dairy plant with products of its own production is very convenient for employees. Products that people go to the store for almost every day can be purchased without trade markups, fresh and of good quality.

Types of non-cash payments

Products that are used to replace payments with money can be manufactured at the enterprise where the citizen works, or can be purchased externally. In any case, it should be suitable for personal use and be useful to a person. In addition to issuing various goods, it is allowed to provide paid services and pay payments for the employee. The following can replace a cash salary:

- products manufactured at the enterprise;

- goods purchased for external sale;

- free food;

- payment for housing;

- insurance.

Important! It is prohibited to issue goods for which restrictions on free circulation have been established as wages. These include alcohol, explosives and toxic substances, drugs, and weapons. It is not permitted to issue promissory notes or receipts in exchange for wages.

Even if a separate agreement is concluded between the manager and the employee, the issuance of such products will be considered illegal.

Accounting for salaries in kind

Depending on what property the organization plans to give to the employee as salary, accounting operations depend.

| Business transaction | Postings | |

| Debit | Credit | |

| Payment in finished products, goods | ||

| Finished products were issued to the employee as payment for his salary | 70 | 90 subaccount “Revenue” |

| Write-off of the cost of finished products issued in the salary invoice | 90 subaccount “Cost of sales” | 43(41) |

| Payment in materials, OS | ||

| Materials (OS) were issued to the employee as payment for his salary | 70 | 91 subaccount “Other income” |

| Write-off of the cost of materials (OS) transferred on account of salary | 91 subaccount “Other expenses” | 01(08, 10, 21) |

| Write-off of depreciation on retired fixed assets | 02 | 01 |

Payment requirements

Issues of payments in kind are regulated by Article 131 of the Labor Code of the Russian Federation. In accordance with it, a number of requirements are established that the employer must fulfill if he decides to use this method of repaying wage debts at his enterprise. These include:

- This method of paying workers must be enshrined in internal regulations.

- Employees must agree with management's proposal.

- The share of wages paid to an employee in non-monetary form cannot exceed 20% of accrued earnings.

- If there are quality complaints about the product, or it turns out to be unnecessary for the employee, he should have the opportunity to replace or refuse it.

The employee determines independently the part of the salary that he will receive in goods. It may be a different percentage in different months. There may be months when he will only agree to give out money. If something in goods or services does not suit an employee, he can refuse to receive them at any time or demand a replacement.

Remuneration of employees. Part VII

This part of the publication ends the conversation about what Russian legislation and international legal norms guarantee in relation to remuneration. BASIC STATE GUARANTEES FOR PAYMENT OF EMPLOYEES (continued) 7. Limitation of remuneration in kind There are two forms of payment of wages: cash and in kind. According to Part 1 of Art. 131 of the Labor Code of the Russian Federation, wages are paid to employees in cash in the currency of the Russian Federation - in rubles. Obviously, this is the most acceptable and convenient form of payment for a person, especially in modern realities, when the vast majority of workers live “from paycheck to paycheck.” At the same time, the legislation allows the payment of wages in non-monetary, in-kind form, while limiting the size of the non-monetary part. At a certain period in modern Russian history, due to the weakening of the financial system and the lack of funds among employers, the practice of paying wages in non-monetary form became widespread. Products produced by the organization, as well as products of other organizations received through barter exchange, were used as a means of payment. There were often cases when salaries were paid in kind in full. For workers in most cases, this was a big problem: in order to provide for themselves and their families, they had to not only work, but also sell goods received in the form of wages. It would be good if the products were liquid and quickly sold or exchanged for other necessary goods. But in many cases it was not possible to sell the products, and payment of wages in kind became tantamount to non-payment for workers. To protect workers from such situations, Part 2 of Art. 131 of the Labor Code of the Russian Federation establishes that only part of the salary can be paid in non-monetary form, not exceeding 20% of its full amount, and only in cases where this is provided for by a collective agreement or employment contract. In addition, payment of wages in non-monetary form is possible only upon a written application from the employee. The specific content of wages paid in non-monetary form, as a general rule, should not contradict the legislation and international treaties of the Russian Federation. The main international legal norms governing these issues are concentrated in ILO Convention No. 95 regarding wage protection. The Convention provides that the competent public authority may authorize or order the payment of wages by bank checks or postal orders if such form of payment is customary or necessary in view of special circumstances and if the collective agreement or the decision of the arbitration body so provides, or, in the absence of such provisions, the interested party the worker agrees to this. Convention No. 95 also provides that national legislation, collective agreements or arbitration decisions may authorize partial payment of wages in kind in those industries or professions where this form of payment is customary or desirable due to the nature of the industry or profession in question. speech (Articles 3, 4 of the Convention). In Russia, the established Part 3 of Art. 131 of the Labor Code of the Russian Federation a complete ban on the payment of wages in bonds, coupons, in the form of promissory notes, receipts, as well as in the form of alcoholic beverages, narcotic, poisonous, harmful and other toxic substances, weapons, ammunition and other items limited in circulation or seized out of circulation. Other types of non-monetary salary are permitted subject to the restrictions discussed above. In practice, some types of payments made by the employer to the benefit of the employee or in his interests may be recognized as part of the salary in non-monetary form. In particular, according to the tax authorities, the employer’s expenses for paying rent for housing provided to a non-resident employee are wages paid in kind and cannot exceed 20% of the employee’s salary. Failure by the employer to comply with the requirements of Art. 131 of the Labor Code of the Russian Federation in terms of limiting the amount of wages in non-monetary form may entail administrative liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). 8. Ensuring that the employee receives a salary in the event of termination of the employer’s activities and his insolvency. The next guarantee provided for in Art. 130 of the Labor Code of the Russian Federation, is aimed at protecting the employee’s salary in the event of the employer’s insolvency. The Labor Code does not contain rules ensuring the implementation of this guarantee; such norms are established by other federal laws. The provisions of Russian legislation are based on the provisions of ILO Convention No. 173 on the protection of workers' claims in the event of the insolvency of an entrepreneur. Unfortunately, Russian legislation only partially takes into account the mechanisms for protecting wages in the event of employer insolvency, provided for by the Convention. In accordance with sections II and III of ILO Convention No. 173, the right of workers to wage protection in the event of the insolvency of the employer is ensured in the following two ways. The first method is to give a privileged status to the claims of employees for wages in relation to the claims of other creditors of the employer. In the Russian Federation, such a mechanism is implemented in the norms of the Federal Law of October 26, 2002 No. 127 “On insolvency (bankruptcy)”. Article 134 of this law establishes that the claims of employees for wages are satisfied in the second place, immediately after the satisfaction of the claims of persons to whom the debtor-employer is liable for causing harm to life or health, and before the satisfaction of the claims of other creditors. Thus, the priority of workers' demands is established. But other provisions of the same law actually nullify this protection. The wage protection mechanism by establishing a privilege for employee claims is based on the satisfaction of these claims at the expense of the debtor employer’s funds. But there is a limit to everything, and no matter what assets in the form of cash, property, etc. the debtor did not dispose, sooner or later they end. And the situation when funds run out before all the creditors’ claims are satisfied, Russian legislation interprets unambiguously: in accordance with clause 9 of Art. 142 of the Labor Code of the Russian Federation, claims of creditors that are not satisfied due to the insufficiency of the debtor’s property are considered extinguished. Thus, if, after satisfying the claims of first-priority creditors, the employer has no cash or other property left, then the employees will not receive their wage debts, and if the property remains, but it is not enough, then the employees will receive the debts only partially. The rest of the workers' claims are paid off; wage arrears are not returned to them. It turns out like the famous joke: “to whom I owe, I forgive everyone,” but it’s not funny. And all this is absolutely legal. The situation is aggravated by the fact that, due to the imperfection of bankruptcy legislation and the extremely high level of corruption, various deliberate bankruptcy schemes continue to be used: conditions are deliberately created for the insolvency of organizations and measures are taken to conceal funds and the most liquid property in advance. This predetermines subsequent non-payment of wages and the impossibility of satisfying the demands of employees within the framework of bankruptcy proceedings. Such a protection mechanism as giving a privileged status to the demands of workers for wages is not able to fully ensure the implementation of the state guarantee enshrined in Art. 130 Labor Code of the Russian Federation. The second way to protect wages in the event of an employer's insolvency, provided for by ILO Convention No. 173, is the creation of a system of guarantee institutions that ensure that employees receive wages if the debtor is insolvent. Insurance companies, specialized funds, etc. can act as such guarantee institutions. If the debtor enterprise does not have property and cannot satisfy the demands of employees, payment for labor must be made at the expense of the funds of such guarantee institutions. If the salary is delayed beyond the period established by law, the employee can contact the guarantee institution and receive the salary due to him. However, ILO Convention No. 173 establishes the possibility of limiting the claims of workers to be satisfied by the guarantee institution to a certain amount, which should not be lower than a socially acceptable level and is subject to periodic adjustment (indexation) in order to maintain its value. This means that an employee may not receive a full salary, but it is guaranteed and in a much shorter time frame compared to the lengthy bankruptcy procedure and waiting for their turn to satisfy claims. To date, the protection of workers' claims with the help of guarantee institutions is not provided for by Russian legislation. * * * Dear readers! You can read the full text of Solidarity legal adviser Denis ZHURAVLEV in the printed version of Solidarity Illustration by Dmitry PETROV

2012-09-26 12:45:16

News aggregator 24SMI

Comments:

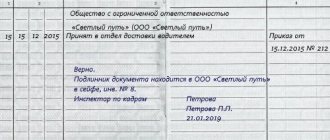

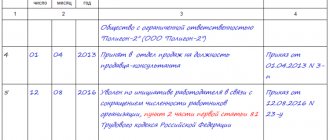

Documenting

First of all, the issue of replacing cash payments with in-kind ones is adopted in the collective agreement and is included in the regulations on wages. The procedure for issuing it should also be specified there. It is mandatory to indicate the form of salary payment in the employment contract, which is drawn up upon hiring an employee. If such a clause is missing in already accepted documents, it can be added by making additions and changes. At the same time, it is necessary to control that the internal documents of the enterprise do not contradict labor legislation. So, for example, if the share of payment in kind is not allowed for more than a fifth of the salary, more percentages cannot be reflected in the collective agreement.

The collective agreement is adopted with mutual consent of the management of the enterprise and the workforce. But, despite this, each employee must have a written statement agreeing to receive part of the salary in kind. It can be issued alone for a long period or only for one month. In the application, the employee can indicate what type of product he would like to receive and what amount of cash payments it can replace. The cost of such products should be recorded in a separate document, which the employee would have the opportunity to review before writing the application. This may be a directive, an order or an annex to a collective agreement. The enterprise administration needs to control that the price of products issued to employees is in an amount not exceeding the market level in the region. Otherwise, the requirement of reasonableness and fairness, which is mandatory for non-monetary payments, will be violated.

What property can be given out

Any property that is beneficial or suitable for the personal consumption of the employee can be issued as salary (clause 2, article 4 of the International Labor Organization Convention No. 95 of July 1, 1949). It could be:

- finished products;

- goods;

- fixed assets;

- materials, etc.

Attention: payment of wages in kind may be considered unjustified if employees are given goods at a cost that obviously exceeds the market price (clause 54 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2). In this case, the market price is the value of the goods that prevailed at the time of payment of wages in the region where the organization is located.

Calculation of wages in kind

The limit on payments in kind is set based on the total amount of accrued wages. In addition to the fixed salary amount, it includes bonuses, allowances, and additional payments. All these payments can be partially replaced in kind. But some accruals do not relate to wages, despite the fact that they are issued along with wages. These include:

- payment of sick leave;

- travel expenses;

- various benefits.

They must be paid only in money; non-monetary forms of remuneration cannot be used.

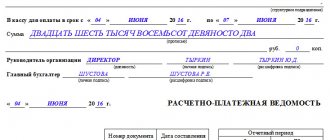

To calculate wages, you can use standard forms, form T-51, form T-49. And for issuance, it is better to draw up a separate statement, since the T-53 form payslip is intended for cash payments. You can develop a form based on the T-49 payroll sheet, adding a separate column in which to indicate the cost of the goods issued. It is allowed to use form No. 415-APK, intended for payment in kind at agricultural enterprises. It is only important that all forms of primary accounting documents that the enterprise decides to use in its activities be consolidated in the accounting policy.

Can wages be paid in kind?

The current Labor Legislation of the Russian Federation does not infringe upon the employer’s right to pay wages in kind to employees of the enterprise. This rule is regulated by Article 131 of the Labor Code of the Russian Federation.

It should be noted that non-monetary forms may only account for a certain portion of wages.

The size of this share should be no more than 20% of the total amount calculated for payment.

From this we can conclude that at least 80% of the salary must be paid in cash (through a cash register or to a bank card), the rest can be paid in kind.

Violation of this rule is considered a violation of the Law.

If necessary, the employer may be held liable for unlawful acts.

Making adjustments to the established rules for paying wages is unacceptable even with the consent of all parties.

If an enterprise pays part of its wages in non-monetary form, the procedure and technology for its payment must be reflected in the collective agreement or other internal documentation.

The papers must describe the exact rules by which remuneration is carried out in the previously specified manner.

No less important is the fact that a non-monetary form of remuneration can only be used if an employed citizen has submitted a corresponding application. It can be issued for 1 month or for a certain period of time.

Pay in kind can be expressed as follows:

- products manufactured at the enterprise where the employee works;

- goods that were purchased for the purpose of sale;

- free food, groceries;

- payment for housing;

- insurance.

In addition, there are some restrictions. Salaries cannot be paid in:

- bonach;

- coupons;

- weapons;

- ammunition;

- debt obligations;

- alcoholic products;

- poisonous, narcotic and explosive substances;

- receipts.

The issuance of such goods will be considered a violation of the law even if both parties to the employment relationship have consented to this action.

Taxation of wages in kind

Payments in kind are subject to personal income tax, as are wages paid in cash. An enterprise, being a tax agent, must withhold from the employee and transfer to the budget a tax on the cost of goods and services that replaced the cash part of wages. The tax amount will be:

- 13% – for Russian citizens;

- 30% – for foreigners who are not residents.

The tax base for personal income tax will be the cost of goods and services reflected in the invoices for the issuance of statements.

When paying for housing and other services, tax will be withheld based on the amount indicated in invoices, checks, and receipts. Payments in kind are subject to insurance premiums. Therefore, an employee, receiving part of his salary from the company’s products, can be sure that this will not affect the size of his future pension. When selling goods, the employer is obliged to charge VAT and distribute them to employees taking into account this tax. The amount of VAT depends on the type of products sold and the taxpayer group to which the enterprise belongs. It can be 10% or 18% of the cost. When calculating personal income tax and insurance premiums, this must be taken into account and calculated based on the cost of goods and services, including VAT. The employer is required to remit taxes no later than the day following the day the salary is paid. Therefore, personal income tax is withheld from the amount due for payment.

Payout example

Let's look at a specific example of how the share of salary in kind is calculated. Open Joint Stock Company "North Pole" gave the company's employee D.I. Alekseev a share of the salary for December 2021 in kind. The condition for such payment was previously stated in the employment contract with Dmitry Alekseev.

The employee’s salary for December was accrued in the amount of 35,000 rubles.

Alekseev wrote a statement according to which he was given a bread machine worth 3,000 rubles as part of his salary. The tax in this case was 458 rubles. The price of the household appliance at which the company purchased it was 1,500 rubles. VAT amounted to 229 rubles. Accordingly, the amount of goods does not exceed twenty percent of the salary. The wiring will look like this:

- D44 K70 - the employee was accrued a salary in the amount of 35,000;

- D70 K68 - tax in the amount of 4550 was withheld from it;

- D44 K69 - additional insurance premiums were charged in the amount of 7,700;

- D70 K90 subaccount “Revenue” - Alekseev was given goods as wages in the amount of 3,000 rubles;

- D90 subaccount “VAT” K68 - tax charged in the amount of 458 rubles;

- D90 subaccount “Cost of sales” K41 - the bread machine was written off at cost, the amount of which is 1,271 rubles (1,500 - 229);

- D70 K50 - the citizen received the balance of his salary in the amount of 27,450 rubles (35,000 - 4550 - 3000).

When calculating income tax, income must include the proceeds received from the sale of a bread machine of 2542 rubles (3000 - 458), expenses include the cost of goods 1271 rubles (1500 - 229).

Law Enforcement Measures

Compliance with labor legislation at enterprises is monitored by various supervisory authorities, monitoring the correctness of paperwork and the legality of the employer’s actions. One of the issues being checked is compliance with the deadlines for payment of wages. Even if part of it is issued in kind, this must be done on time. If the money was given out on time, but the employee received the goods instead of wages later, this will be regarded as a violation of the law and will lead to the imposition of administrative penalties. Penalties for late payment are:

- for officials – from 1 thousand rubles. up to 5 thousand rubles;

- for organizations – from 30 thousand rubles. up to 50 thousand rubles.

If an employee does not agree to receive the salary due to him in goods or services, the employer has no right to force him to do so. He is obliged to pay the entire amount in cash within the prescribed period.

Cash payments

Convention No. 95 of the International Labor Organization, ratified by the USSR in 1961, proclaimed the principle of payment of wages in banknotes that have legal circulation in the country of the employer. The same principle is also established by the Constitution of the Russian Federation (Article 75), the Civil Code of the Russian Federation (Article 140) and the Law of the Russian Federation “On the Bank of Russia”. That is, based on the meaning of the provisions of the law, the currency of wages in the Russian Federation is the Russian ruble.

Naturally, the question arises whether the legal requirement in this case is prescriptive. In fact, the above-mentioned regulations, while establishing the Russian ruble as the currency of wages, do not prohibit or restrict the use of the currencies of other countries, provided that this currency has legal circulation on the territory of the Russian Federation.

Adherents of the “ruble salary” usually use Letter No. 1688-6-1 of the Federal Service for Labor and Employment dated October 10 as an argument. 2006, which expresses an opinion regarding the illegality of paying wages in a currency other than Russian rubles. From our point of view, the Federal Service for Labor and Employment is not a body with the right of normative interpretation. And as an administrative interpretation, the said letter should be considered solely as a recommendation.

Thus, due to the literal interpretation, wages to employees can be paid in the currency agreed upon by the parties to the employment contract.