Types of payments upon dismissal

After the dismissal order has been issued and entered into force, a full payment of the employee’s debts must immediately follow. You can check whether a company is breaking the law using the following categories of cash receipts:

- Salary for time worked;

- Compensation for unused vacation;

- Severance pay in case of liquidation of a company or reduction of staff;

- Other bonuses provided for by regulations within the organization.

Deferment of payments by the employer will aggravate the situation. According to Article 236 he will have to pay compensation for the delay.

Suspension of work due to non-payment of wages as a way to protect the employee

Info Please indicate the legal address of the company, your position and registered address. Describe the problem with non-payment of earnings, indicate the date of the last payment, the total amount of debt. Attach a copy of the agreement between you and the company, a copy of the sheets from the labor report, and a copy of the complaint to the company management (if submitted). Inspectorate employees are obliged to verify the violation of the employee’s rights, impose an administrative fine, and suspend the activities of the enterprise for 3 months.

How to contact the prosecutor's office The petition is written in free form. You can compile it while in the prosecutor’s office building, finding out the position and full name of the employee you want to contact, or send the package by mail.

Features of payment calculation

The amount of all benefits is calculated based on time worked:

- Salary for the current period.

Fact

Salary is calculated using the formula: (salary x number of working days in a month) / number of days actually worked;

- "Thirteenth salary." Possible if such a clause is in the employment contract;

- Severance pay. It is added in the event of liquidation or staff reduction and is paid to employees in the amount of average monthly earnings. In this case, benefits continue to be paid until you start a new job, but no longer than two months after dismissal;

- Premium part. Included in the salary or issued at certain intervals. Quarterly or annual bonuses are recalculated in proportion to the time worked. Holiday bonuses are also added if the employee was on staff for the holiday period.

- Unused vacation. Both the current year and previous years of work are taken into account. The amount of vacation pay depends on the average income in each year. The peculiarity of vacation pay is that the calculation is made by rounding down to whole months.

This is also important to know:

the day of dismissal is considered a working day or not

At a minimum, the employee must be paid wages upon dismissal.

Application for dismissal due to non-payment of wages sample 2021

It is necessary to write a statement, you cannot simply not go to work after 15 days of delay in salary, this will be perceived as a violation of the work schedule (absenteeism), for which the employee can be fired at the initiative of the employer. This cannot be allowed. It is imperative to notify the employer in writing, and a copy of the application with the employer’s signature (stamp of the organization) will serve as proof that the employee notified the organization. If the secretary or office refuses to accept the application or put a stamp on it, then you can notify the organization of your intention by sending the application by mail, using a valuable letter with a description of the attachment and a receipt. The notification will be proof that the letter was received by the employer, which means he has been notified.

Evidence base

To win a dispute, an employee will have to work hard and collect irrefutable facts of violation of labor rights. The minimum that a victim should have is:

- Copies of all orders;

- Employment history;

- Salary certificate;

- Certificate of contributions and income taxes;

- Employment contract.

Employee testimony, audio and video recordings proving the unpaid debt would be useful. General procedure for dealing with salary arrears

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Requirements for payment of money must be based on the law. A person who has not received a settlement must:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- Obtain a certificate from management about the amount of debt;

- Write an application to the labor inspectorate in the prescribed form;

During the inspections, penalties will be imposed on the company, and the case will be sent to court. Debt over 50 thousand rubles will be considered by a federal judge.

If there was a shortfall

The employer can justify the non-payment of funds by the shortage due to the fault of the dismissed person. If this fact is proven to inspectors, the dismissed person will face a fine. It is better to cover the damage immediately if there are no objections to this matter. The deduction will be no more than 20% of the average monthly salary. Otherwise, legal proceedings will begin against the ex-employee.

Do I need to return workwear?

Equipment and workwear issued to employees must be returned in any case. If the uniform is refused to be returned or returned in improper condition, the employer has the right to withhold the cost of the uniform.

How to write a statement about non-payment of wages

- Submit these materials to the labor inspectorate with the involvement of Spetsmetiz LLC to administrative punishment.

- Open a criminal case according to the norm of the Criminal Code of the Russian Federation 145.1.

In addition, you can request an inspection at the enterprise. Ivanova I.I., date, signature. All information will be checked by employees of the prosecutor's office, after which, according to the law, your requirements will be fulfilled (or not).

Attention Calculation of interest on arrears of wages Regardless of the fault of the legal entity, you can demand payment of compensation in connection with arrears of wages. You can calculate the amount of compensation using the formula: K=ZP x D (1/150) x SR.

If you haven't paid your “gray” salary

The law is able to protect citizens only on the basis of documents signed by both parties. The desire to avoid taxes or maintain social benefits pushes employers to hire employees by verbal agreement without formalizing a contract. In this case, in addition to paying wages, you can achieve penalties for the employer and payment of taxes.

This is also important to know:

Loss of trust, dismissal of an employee, article of the Labor Code of the Russian Federation

Those who decide to go to court must attach other documentation:

- Sales receipts, orders;

- Receipts;

- Video materials;

- Correspondence with management regarding fees;

- Envelopes containing money indicating the amount and surname;

- Photo of internal reporting.

It is unlikely that such cases will be taken into account. Therefore, it is first worth reminding management of the consequences of failure to comply with their obligations.

Going to court

If the employer, after checking by the labor inspectorate, does not pay the wages, then the employees can safely write a statement of claim and go to court with this paper.

Decisions on such cases are made within 5 days. In most cases, the court remains on the side of the workers.

Statute of limitations

After the manager stops paying wages, employees must immediately contact the appropriate authorities.

According to Russian law, the statute of limitations for delayed wages and other labor disputes is only 3 months from the moment the employee learned of the violations.

The wording of the statute of limitations is very flexible, which allows employees to file claims even after this time.

The main thing is not to admit in court that the deadline was missed. Otherwise, the court will not consider the case. In addition, if an employee admits missing the claim deadlines, they can be extended. But only if the court recognizes the reasons for absence as valid.

Required documents

In order to go to court, employees must prepare in advance.

First of all, they need to draw up a statement of claim, to which they will need to attach a number of documents:

- employment contract;

- The order of acceptance to work;

- job description;

- income certificate;

- calculation of wages that must be collected from the employer.

In addition to those presented, it is advisable to include in the list of papers several more documents that could confirm the position of the employee who went to court.

Sample statement of claim

A claim filed by an employee to recover wages from an organization does not have a prescribed form.

However, in order for the court to accept it for consideration, it must contain the following information:

- the essence of the problem with precise details;

- information about the addressee and sender;

- list of attached documents.

If it is difficult for an employee to draw up an application on his own, he can contact the above-mentioned authorities or simply use a sample.

A sample statement of claim for delayed wages is here.

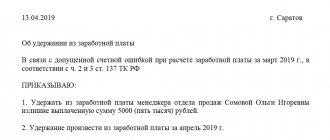

Implications for managers

In addition to imposing fines for expiration of established billing periods, an employer may be charged for a number of illegal actions:

- Forced labor (Article 4 of the Labor Code of the Russian Federation);

- Failure to comply with the procedure and terms for payment of wages provided for in Article 136 of the Labor Code of the Russian Federation);

The company becomes liable under Article 142 of the Labor Code for failure to comply with debt repayment deadlines, and under Article 236 management is obligated to pay a penalty based on the key rate of the Central Bank and the duration of the delay.

Failure to pay wages for more than two months from the date of the established calculation is fined in the amount of 100 to 500 thousand rubles. There are assignments of compulsory work or a ban on holding leadership positions.

Sample application to the prosecutor's office for non-payment of wages in 2021

The application is written to the head of the organization - you need to write at the top the surname and initials of the head, his position in the dative case, and the name of the company. You should also indicate from whom the statement is being written in the genitive case. The main part of the application sets out in free form the essence of the appeal to the manager; the following data should be included in the text:

- clause of the local act establishing the dates for payment of wages;

- number of days of delay in wages;

- the period for which the enterprise owes debt;

- a link to an article of the Labor Code giving the right not to go to work if the delay is more than 15 days;

- notice to stop working until wages are paid.

A sample application form can be downloaded from the link below. The application must be signed and dated.

What is useful to know

Studying labor legislation should be done regardless of whether a person is planning to quit or has just found a job.

If termination of the contract is inevitable and the settlement day is approaching, then:

- Within a month, an employee can seek help from supervisory authorities (labor inspectorate, prosecutor's office, court);

- After 60 days of delay, the management will be liable, entailing a fine, compulsory labor or a ban on taking up a management position;

- A “gray” salary is a good lever of pressure on a careless boss. It is easier for management to pay off debts than to deal with tax and labor inspectors;

- The basis for the protection of rights is the employment contract, which must be carefully studied before signing;

- The management is obliged to control the size and procedure of calculation. Any underpayments are prohibited by law, except for mutually signed documents on the amount of compensation.

How can a fired person defend his rights to wages?

The state provides a citizen with the opportunity to choose where to turn if they have not been paid their salary upon leaving their employer. You can do the following (Article 352 of the Labor Code of the Russian Federation):

- file a complaint with the State Labor Inspectorate (SIT);

- write a statement to the prosecutor's office;

- collect debt through court.

Each of these options is a separate procedure for consideration and obtaining a final decision.

Another way to resolve the problem of non-payment of compensation upon dismissal is to contact the trade union. However, in practice this method is impractical, because such an organ is not available everywhere. And even if he is nominally present, as a rule, he acts in the interests of the employer.