Last modified: January 2021

The employer not only accrues and pays income to the employee for the work performed, but also in certain cases withdraws it. Such a procedure is possible both in the interests of the company itself and on the initiative of the employee working in the interests of third parties. In addition, in some cases, the employer is required to deduct wages in accordance with the requirements of current legislation. At the same time, there is a certain set of rules and restrictions that regulate the process of making such deductions.

Withholding of unearned advances issued on account of wages

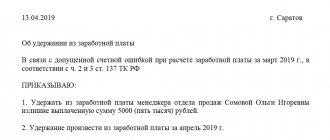

The employer has the right to withhold the unearned advance payment no later than one month from the date of expiration of the period established for its return.

Since withholding is possible only if the employee does not dispute its grounds and amounts, the employer must obtain the employee’s written consent. Such consent to retention is drawn up in free form.

The decision to withhold is formalized by order (instruction). Since there is no unified form for such an order (instruction), it is issued in free form.

Amount and procedure for deductions from earnings

The Labor Code of the Russian Federation (Article 138) determines the maximum values for the amount of deductions, regardless of their type, including for each payment of earnings:

- the total amount of funds earned but not transferred to the citizen cannot exceed 20% of accrued earnings;

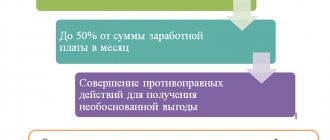

- if several payments are necessary under enforcement documents, the total amount of deductions cannot be more than 50% of earnings;

- the amount of the deduction can reach up to 70% of earnings if deductions are made from the income of a person serving a sentence in a correctional colony, when compensating for damage to the health of another citizen, when compensating for damage in connection with the death of a breadwinner or caused by a crime.

Attention! All deductions made by the employer from the employee’s earnings must be reflected on payslips. The employee must be notified in writing about the size and reasons for reducing the amount paid (Article 136 of the Labor Code of the Russian Federation).

Before making a deduction, the employer must:

- obtain a legal basis for performing the procedure (order, instruction, memo with the resolution of the manager);

- carry out an inspection, establishing the cause, determining the exact amount of damage caused and drawing up an act, if there is a need to compensate the employer for damage (Articles 246, 247 of the Labor Code of the Russian Federation);

- monitor compliance with the established period for preparing a decision on withholding funds from earnings;

- obtain the employee’s written consent to reduce the amount of earnings (if necessary).

Deduction for unworked vacation days upon dismissal

Situations often arise when the dismissed employee has already used vacation for the current working year, which was not fully worked out by him. According to Art. 137 of the Labor Code of the Russian Federation, the employer has the right to withhold from the employee’s salary accrued upon dismissal, his debt for unworked vacation days that were provided in advance.

The working year may not coincide with the calendar year, since for each employee it begins from the day on which the employee began performing his job duties.

For example, the working year of an employee hired on 09/01/2009 expires on 08/31/2010. Example 2 When dismissing an employee, can an employer withhold 100 percent of the cost of uniform from his salary?

This case of deduction does not comply with current legislation, therefore the employer cannot deduct the full cost of uniforms from the employee’s salary upon dismissal. Article 137 of the Labor Code of the Russian Federation contains an exhaustive list of cases of deduction from an employee’s salary. This article does not provide grounds for forced deduction of the cost of uniforms from an employee’s salary. However, by agreement with the employee, it is possible to withhold any amounts, for example, expenses for training the employee. In the situation under consideration, it should be taken into account that deduction is possible only on the basis of the employee’s application, provided that the period for wearing uniforms has not expired. If these conditions are not met, the employee may legally demand the return of illegally withheld amounts.

During the working year, the employee must be provided with annual paid leave, and labor legislation does not contain rules that would allow such leave to be provided in proportion to the time worked by the employee and other periods included in the length of service giving the right to leave in accordance with Part 1 of Art. 121 Labor Code of the Russian Federation.

If an employee is dismissed before the end of the working year, for which he has already used annual paid and (or) additional leave, the employer has the right to withhold part of the payment for the leave provided in advance.

The Labor Code of the Russian Federation contains restrictions on withholding for leave granted in advance. Thus, deduction is not made when an employee is dismissed for the following reasons:

- the employee’s refusal to transfer to another job, which is necessary for him in accordance with the medical report, or the employer does not have the appropriate job;

- liquidation of an organization or termination of activities by an individual entrepreneur;

- reduction in the number or staff of employees of an organization or individual entrepreneur;

- change of owner of the organization’s property - in relation to the head of the organization, his deputies and the chief accountant;

- conscription of an employee for military service or sending him to alternative civilian service;

- reinstatement of an employee who previously performed this work by decision of the state labor inspectorate or court;

- recognition of the employee as completely incapable of work in accordance with a medical report;

- death of an employee or employer - an individual, as well as recognition by a court of an employee or employer - an individual as deceased or missing;

- the occurrence of emergency circumstances that prevent the continuation of labor relations (military operations, catastrophe, natural disaster, major accident, epidemic and other emergency circumstances), if this circumstance is recognized by a decision of the Government of the Russian Federation or a government body of a constituent entity of the Russian Federation.

Of the payments due to an employee upon dismissal, the employer has the right to withhold no more than 20 percent of the amount after deducting personal income tax. If the amount of debt exceeds 20 percent of wages, then the excess amount is repaid by the employee voluntarily or the employer recovers it through civil proceedings as unjust enrichment. However, the latter seems difficult, since by virtue of clause 3 of Art. 1109 of the Civil Code of the Russian Federation, wages and other payments provided to a citizen as a means of subsistence, in the absence of dishonesty on his part and an accounting error, are not subject to return as unjust enrichment. Consequently, these funds cannot be recovered from the employee to whose personal account they were transferred.

Thus, if at the time of dismissal the employee still has amounts of unearned vacation pay, the employer can withhold them without his consent in the amount of 20 percent of the payments due to the employee. To repay the remaining amount, the employer can obtain from the employee an application for consent to withhold from the calculation upon dismissal an amount exceeding 20 percent, or agree with the employee on the voluntary return of the overpaid amount of vacation pay to the organization's cash desk. In addition, the employer has the right to “forgive” the employee’s debt for unworked vacation days.

Reflection of deductions in accounting

The amounts accrued on wages are indicated in the accounting records. 70. Deductions must also be reflected in accounting, therefore, accrued on the debit of the account. 70 amounts will be reduced:

- when deducting personal income tax - on an account loan. 68;

- when deducting contributions to the Pension Fund - on an account loan. 69;

- when paying according to writs of execution - on an account loan. 76;

- to compensate for losses from marriage - on an account loan. 28;

- for reimbursement of unreturned accountable amounts - on an account loan. 71;

- when withholding funds in favor of third parties - on an account loan. 76.

After all necessary deductions have been made, wages are paid in cash through the cash register (Debit account 70/Credit account 50) or credited to the employee (Debit account 70/Credit account 51).

Regulatory base of deductions

All types of legal deductions from employee income are enshrined in current legislation. First of all, the specifics of using salary deductions are prescribed in the Labor Code of Russia, namely in articles of the Family Code of the Russian Federation, as well as in some federal laws:

- Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

- Law of July 21, 1997 No. 118-FZ “On Bailiffs”.

- Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

- Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children.”

It is these legal acts that provide the legislative basis for regulating issues related to deductions from the earnings of Russian citizens.

At the employee's request

Deductions from wages can also be made at the request of the employee. In this case, he writes a statement addressed to management. The purposes of deductions can be any:

- payment of contributions to insurance companies - life, health, property insurance, additional medical services, pension savings;

- payment for membership in trade unions and other public (or commercial) organizations;

- payments on loans and borrowings (including mortgages) – principal payments and interest;

- payment for cellular and landline communications, Internet, utility bills;

- repayment of loans or debts to the employer;

- transfer to charitable purposes, etc.

The reason for canceling deductions is also the employee’s statement.

When applying for voluntary contributions, an employee must take into account the following nuances:

- the employer has the right to refuse to make deductions (except for the payment of dues to trade unions);

- in the application it is permissible to indicate a list of payments from which deductions are made;

- the commission for transferring funds to the accounts of individuals or legal entities is paid by the employee (this point is also indicated in the application).

The maximum amount of voluntary payments at the initiative of the employee is not limited.

Mandatory

In accordance with the laws of the Russian Federation, tax and labor codes, there are a number of factors that allow employers to withhold certain amounts from workers’ earnings. These factors fall into three categories: mandatory, employer-initiated, employee-initiated.

Personal income tax

According to the Tax Code of the Russian Federation (Article 226), employers withhold personal income tax (personal income tax) from payments to employees. All income received is subject to taxation: salary, bonuses, additional payments for overtime, vacation pay, benefits, etc. (full list in Article 208 of the Tax Code of the Russian Federation). In addition to cash receipts, tax is levied on funds issued in kind (materials, tools, equipment). Non-taxable amounts include state benefits and pensions, payments for the birth of children, their maintenance (up to 1.5 years) and other income specified in Art. 217 Tax Code of the Russian Federation.

Article 224 of the Tax Code specifies 5 rates at which income tax is calculated:

- 9% – on income and interest on mortgage certificates issued before 01/01/2017;

- 13% - from most types of income of individuals who are residents of the Russian Federation (wages, income from the sale of movable and immovable property, provision of services under labor and civil law contracts, etc.). From dividends received after 01/01/2015;

- 15% - on dividends received by non-resident citizens from Russian enterprises;

- 30% – paid on all income by individuals who are not residents of the Russian Federation;

- 35% – from lottery and other winnings, prize payments and gifts received during promotions and advertising campaigns. From income from bank deposits and savings on loans, in the amount exceeding the rate established by the Central Bank of the Russian Federation.

For residents of the Russian Federation (individuals living in Russia for at least 183 days during the year) with income falling under the 13% rate in Russia, taxable payments are reduced due to the following deductions:

Standard:

- 1400-12000 rub. for relatives or supervised children, depending on their age and health status (presence/absence of disability). The maximum double deduction (24,000 rubles) is provided to one of the parents (or single parent) of a disabled child upon the written refusal of the second to receive it (clause 4 of Article 218 of the Tax Code of the Russian Federation).

- 500-3000 rub. preferential categories of citizens listed in paragraphs 1 and 2 of Art. 218 Tax Code of the Russian Federation.

Social: for training, treatment, pension increase, charity, qualification confirmation (up to 15,600 rubles).

Property: given for the acquisition, construction, sale of expensive movable or immovable property (up to 3 million rubles).

According to executive documents

It is mandatory to withhold from employees the amounts specified in the executive documents received by the enterprise. The following are considered an immutable basis for deductions: writs of execution, orders, agreements on the payment of alimony (after certification by a notary), acts of extra-budgetary funds (FSS, Pension Fund) on debts, judicial acts on offenses, etc. (Article 12 Federal Law 229 dated October 2, 2007).

When determining the procedure for calculating deductions, you need to remember that all amounts are minus the funds remaining after deducting personal income tax. All accrued income is subject to taxation (unless specified in court documents), with the exception of payments specified in Art. 101 Federal Law 229 dated October 2, 2007.

When several writs of execution are received for one employee, payments are made in order of priority:

- first priority – alimony, amounts of payments in connection with the loss of a breadwinner, compensation for moral and physical damage;

- second priority – wages and other payments to persons who worked with the defendant under an employment or other contract;

- third priority – debt to extra-budgetary funds and government organizations;

- fourth priority – other payments (debts to financial, credit and other organizations, interest on debts).

If there are several documents of the same queue with the amount of claims exceeding the maximum possible deduction, then deductions are made in proportion to the amounts specified in them.

The maximum amount of deductions for one or more executive documents is 50%. To pay alimony, cover damages from committing a crime, compensation for health restoration, payments for the loss of a breadwinner - the percentage of withholdings can be increased to 70%.