Tweet

The employer can recover the overpaid amount if they made an accounting error. In order to return overpaid amounts to the courts, the employer must prove that the payment was made due to an accounting error.

Overpayment due to an accounting error occurs for both active and laid-off employees. In the first case, the employer can return the overpaid amounts without going to court. The employer must make sure that an error was made in mathematical operations, and that the network performed the math incorrectly (addition, subtraction, division, multiplication). After this, you need to offer the employee to return the money within a certain period or agree to withhold it. Based on the application with consent, it is necessary to issue an order to withhold 20% of earnings monthly. If the employee has already been fired, he will have to go to court. The court will need to submit documents proving the calculation error and describe the calculation algorithm separately. If there is an error in the program, a report from an IT specialist will be needed to document the system failure and indicate how the problems affected computing operations.

Situations when deduction from an employee’s earnings will be legal are listed in Art. 137 Labor Code of the Russian Federation. One of them is that the employee received more than his due due to a counting error. We can talk about overpaid wages, bonuses or benefits (sickness, children). A counting error is an arithmetic error, that is, incorrect execution of mathematical operations (letter of Rostrud dated October 1, 2012 No. 1286-6-1.

In most cases, the issue of returning money is resolved in court, since employees rarely agree to do this voluntarily. However, it should be noted that the employer will not be able to recover the overpayment if the accountant made a technical error or incorrectly applied the rule. The employer will return the money only if he proves a counting error.

What it is?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Arithmetic errors made when an accountant determines the amount of wages for employees of an organization are called calculation errors.

Similar shortcomings arise when performing elementary mathematical operations (addition, subtraction, multiplication) with computational errors.

More about the concept

According to the norms of current legislation, errors in the preparation of documents for payroll can be of two types:

- arithmetic;

- technical.

Determining what kind of mistake was made will influence the need for compensation by the employee. It should also be taken into account that most issues related to deductions from employees’ salaries are considered in court. Therefore, an employer interested in solving the problem in his favor should approach the issues of proving his case as carefully as possible.

What rules of law govern it?

The Labor Code of the Russian Federation in Article 137 provides for the possibility of deducting from an employee’s salary excess amounts previously paid to him due to the presence of an error in the calculations.

However, the Russian Labor Code does not provide a clear definition of the concept of a counting error.

This term is considered:

- In the Letter of Rostrud dated October 1, 2012 No. 1286-6-1

- In the Supreme Court Decision No. 59-B11-17 dated January 20, 2012

Concept of counting error

It was given a clear interpretation by the Supreme Arbitration Court of the Russian Federation in 2012 in Determination No. 59-B11-17. According to the judicial panel, this is an inaccuracy associated with arithmetic operations. Technical failures do not fall into this category.

At the same time, lawyers recommend that organizations protect themselves and equate a technical error with a counting error by introducing a corresponding clause into the collective agreement. Then the return of overpaid wages will be justified, and it will be difficult for the employee to challenge it.

However, there is no clear opinion on this issue yet. Therefore, it is impossible to predict which side a particular court will take in such a situation.

What doesn't apply here?

An accountant's error is not considered an accounting error if:

- he re-transferred any payment to the employee;

- when calculating wages, they did not take into account the employee’s unpaid rest time;

- a larger amount of income tax was deducted from the employee’s salary than required;

- a bonus or allowance was erroneously paid without the appropriate order from management.

Thus, an uncountable error occurs when the employer incorrectly applies legislation or local rules adopted in the organization, as well as when double accrual occurs.

Technical errors associated with incorrect data entry are also highlighted.

An accountant's error, by a court decision, may be recognized as technical, rather than accounting, if it arose due to low qualifications or negligence of an accounting employee.

Bug fix

Select register Salary to be paid

Open the document Transaction entered manually, transaction type Transaction : section Transactions - Accounting - Transactions entered manually. Select the Salary to be paid using the MORE button - Select registers - Accumulation registers tab - Salary to be paid.

Adjustment of the Salary payable register

Go to the Salaries payable and add an entry to the register:

- date - the month of arrears in payment of wages to an employee of the organization according to the register report.

- Movement type - Expense : Expense - is used to adjust the payment of wages to an employee.

- Income - used to adjust accrued wages.

- positive amount for “underpayment”.

Record the document Operation entered manually Record and close button .

Checking the completed adjustment

To check the adjustments made, re-generate the customized report in the Universal report .

As can be seen from the report, the error has gone away: employee Kuznetsova A.V. accrued and paid in August 3,404.04 rubles.

Filling out a statement to the cash desk for salary payments

Refill the document Statement to the cashier for the payment of wages for September.

Now, according to the statement, the amount payable for September for employee A.V. Kuznetsova. is 26,100 rubles, i.e. coincides with the credit turnover on the account.

Test yourself! Take a test on this topic using the link >>

See also:

- Accountant Assistant - Universal Report

- Checking salary payments at NU

- How to find out which register moves what?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

If the error in payroll calculation is counting

If, upon detection of a computational error when calculating wages, it was discovered that the employee received less money than he earned, it is necessary to accrue the remaining funds.

When transferring an amount greater than the required amount, it is withheld, with the consent of the employee.

Should the employee return it?

According to the norms of the second part of Article 137 of the Labor Code, the amount overpaid to the employee must be withheld from him.

Procedure

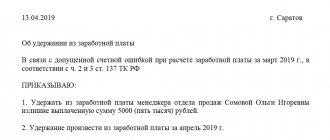

If a counting error is detected and excess funds are transferred to one of the employees, a corresponding report on the discovery of the error is drawn up.

Overpayment of money to an employee as a result of a calculation error when calculating wages must be withheld from him within one calendar month after payment.

But before this, it is necessary to obtain the employee’s consent to withhold, and then issue an appropriate order. If consent is not obtained, the employer, if there is appropriate evidence of excessive payment as a result of a calculation error, may go to court.

Our article will help you write a power of attorney to receive salary. Should alimony be calculated from the 13th salary? Find out here.

Conditions for withholding funds

Withholding from an employee by the employer can be made in the case where the employee agrees with the basis for the deduction of funds and the amount of this amount, as well as with the very possibility of withholding overpaid funds.

The maximum amount of possible deduction from salary cannot be more than 20% of the amount of money received by the employee and is represented by the following formula:

Withholding < 20% (Accrued salary – income tax)

This requirement is also contained in Part 1 of Art. 137 of the Labor Code of the Russian Federation and in the clarification of the Ministry of Health and Social Development of the Russian Federation dated November 16, 2011 N 22-2-4852 On the amount of deductions from wages.

Documenting

Documentation of the operation to return money overpaid to the employee is carried out according to one of the presented options:

| Option 1 | Option 2 |

| The employer obtains written permission from the employee to return the funds. | The employer issues a decree to withhold funds from the employee's salary |

| A corresponding order is issued | The employee signs the issued decree |

| Based on the order, deduction is made | Withholding is carried out on the basis of a decree |

Collection period

The amount of overpayment, with the consent of the employee, must be returned within a month after the accounting error.

If there is no agreement and the employer goes to court, the statute of limitations for debt repayment is three years.

Reflection of returns in accounting

In accounting, the return of overpaid amounts is formalized by the following entries to the credit of the account intended for settlements with personnel for wages (account 70).

| Debit | Credit | Operation |

| 50 (51) | 70 | The amount of overpaid wages was returned to the organization’s cash desk (to its current account) |

| 91-2 | 70 | The unreturned amount of the excess (if the Court refused to collect or the statute of limitations has expired) is written off. |

The unreturned amount of the excess (if the Court refused to collect or the statute of limitations has expired) is written off.

Correction of personal income tax calculations

Funds overpaid as a result of a counting error are not recognized as a material benefit of the employee, and it is unlawful to qualify them as an interest-free loan and tax them at an increased rate of 35%.

If, when a counting error is detected, the employee agrees to withhold the amount of overpayment from him, personal income tax at a rate of 13% is not charged, since this amount of money will be returned to the cash desk or to the organization’s current account.

If the employee has already left the organization, or does not agree to return the excess funds received, and the trial drags on for a long time (more than 12 months), the employer submits information about the impossibility of withholding tax on the income paid to the employee to the Tax Inspectorate.

Should changes be made to the RSV-1 Pension Fund?

Based on Letter of the Ministry of Health and Social Development of the Russian Federation dated May 28, 2010 N 1376-19, changes to the RSV-1 Pension Fund of the Russian Federation (calculation of accrued and paid insurance premiums) do not need to be made if a calculation error is detected by drawing up updated calculations.

This error will be reflected in the corresponding document for the period in which it was discovered.

Thus, if erroneous payments were already included in the tax base for the previous quarter (for example, 1), but this was discovered in the next period (for example, 2), then the error is reflected in the period of its discovery (in the 2nd quarter).

What actions should be taken if a counting error is detected?

If an organization detects a counting error that occurred when paying wages to an employee, the excess money paid is subject to return by deduction (Article 137 of the Labor Code of the Russian Federation).

How to get back overpaid wages ?

Withholding is permissible if the employee has no objections to the reason and amount of funds to be returned, and no more than 30 days have passed since the discrepancy occurred.

The withheld amount cannot be more than 20% of the payment due to the citizen after personal income tax withholding (Article 138 of the Labor Code of the Russian Federation).

The employee’s consent must be expressed in writing in the form of an application addressed to the management of the enterprise or in the form of a handwritten signature on familiarization with the text of the order to withhold funds, signed by the head of the employer.

If an employee objects to the write-off of a certain amount from his earnings or to the write-off of funds in general, then the employer can resolve the controversial situation by filing an application with the court (Article 248 of the Labor Code of the Russian Federation).

If the error is of a different type

If an error is made in the calculations that is not related to accounting, the employer has the right to notify the employee that such an error has been discovered and ask to return the money accrued by mistake.

In accordance with Article 1109 of the Civil Code of the Russian Federation, if the employee does not agree to the return, even the judicial authorities do not have the right to recover these amounts from the employee of the organization.

However, the unrefunded amount must then be subject to personal income tax.

Non-insurance periods on sick leave - what is it? Find out from our article. Read about marginal profit analysis here.

What do the salary codes on the payslip mean? See here.

Error. Incorrect amount to be paid for salary in the statement

When creating a statement for the payment of wages for September, the accountant discovered that the amount in the To be paid includes the debt for August and does not correspond to the organization’s wage debt to one of the employees of A.V. Kuznetsova.

From the balance sheet for the account it is clear that in front of the employee Kuznetsova A.V. The following salary arrears have arisen:

- for September - 26,100 rubles.

Thus, the discrepancy is obvious - the program shows different amounts of arrears in payment of wages to employee A.V. Kuznetsova. :

- in the payroll statement - 27,904.04 rubles;

- account credit balance – RUB 26,100.00;

- difference (error) – RUB 1,804.04.

But the program will not be able to detect an error based on accounting entries, which is reflected in the salary payment slip. Since 1C has created a special subsystem for accounting for salaries and personnel, which is based on savings registers.

The accumulation register Salary to be paid is responsible for an error in filling out the salary payment slip.

See also How to find out which register moves what?

Examples

In August 2021, Anna Valentinovna Mironova, an employee of the sales department of Orion LLC, was transferred 20 thousand rubles instead of 10 thousand rubles (salary) due to the fault of the accountant. The amount of money was sent twice by mistake. The employee was asked to return the funds, but she refused; it turned out to be impossible to collect the funds. The error was not a counting one.

In February 2021, Anatoly Anatolyevich Ivanov, an employee of a trading enterprise, was credited with 28,000 rubles instead of the required 27,000 rubles. The accountant explained that the extra 1,000 rubles were accrued as a result of an error when adding up payments due to an employee of the organization for providing additional paid services to customers. Ivanov A.A., after familiarizing himself with the error report, wrote a written authorization to return the excessively transferred funds. The incident was settled, as 1,000 rubles were deposited by the employee into the organization’s cash desk.

What entries should the accountant make for this transaction in 2014?

In accounting, these entries according to Instruction No. 162n will look like this:

| Contents of operation | Debit | Credit | Amount, rub. |

| Fixed an error related to the identification of over-accrued wages in November 2013 using the “red reversal” method | 1 401 20 211 | 1 302 11 730 | (30 000) |

| Wages were accrued in accordance with the calculation based on the results of the audit (additional entry) | 1 401 20 211 | 1 302 11 730 | 16 000 |

| At the same time, debt from previous years was accrued, subject to transfer to budget revenue on the basis of a notice (f. 0504805) submitted by the recipient of income to the revenue administrator | 1 304 04 180 | 1 303 05 730 | 14 000 |

| Employees deposited excess wages into the cash register | 1 201 34 510 | 1 302 11 730 | 14 000 |

| Funds have been deposited into the institution's personal account | 1 210 03 560 | 1 201 34 610 | 14 000 |

| Funds have been received into the institution's personal account | 1 304 05 211 | 1 210 03 660 | 14 000 |

| Funds were transferred to the corresponding budget revenue | 1 303 05 830 | 1 304 05 211 | 14 000 |

In addition to adjusting accrued wages, you should recalculate the amount of insurance premiums accrued for these payments and personal income tax. The procedure for correcting errors in the calculation of insurance premiums and personal income tax is similar to the procedure given above. It is necessary to reverse erroneous accruals using the “red reversal” method and reflect in the accounting records the amounts of correctly accrued mandatory payments.