Types of length of service in pension legislation

Legal norms for determining a pension establish requirements for the length of service that gives the right to assign it. How study is considered part of the pension period depends on the period of working activity. The legislator distinguishes the following categories of experience:

- insurance – forms the insurance part;

- general labor – determines the citizen’s labor activity before 01/01/2002;

- preferential – affects the right to retire early.

Does the experience include distance learning?

Often, part-time work is the choice of citizens who work full time. Consequently, throughout this entire time period, management must transfer money for the employee to the Pension Fund.

Naturally, receiving education via correspondence is associated with study and examination sessions.

The management of the enterprise must provide the employee with study leave so that he can take tests and exams in an educational institution for a period of 40 (50) days annually, in an average special institution 30 (40), in graduate school - 30 days, based on what course of study the person is taking .

If a person studies part-time and works at the same time, he has the right to study leave to take the exam

When the deadlines for passing tests and exams last longer than the above-mentioned framework, the employee has the right to take advantage of a share of the next vacation or request several days off without saving earnings.

Important ! Note that the employee retains his average salary, while taxes and various contributions are paid.

In order for a person to be granted study leave, he must ask the educational institution for a certificate calling him to the next session.

However, life is not so smooth. Typically, employees take advantage of their work leave to attend a session, and when they do not have time to meet this deadline, they ask for days off without pay. This does not violate the laws, but if a person is studying at his own expense, then this does not have any weight for the insurance period.

If a person goes on vacation “at his own expense”, during this time contributions to the Pension Fund are paid for him

It is important to remember that management is obliged to provide the employee with leave for the time required to pass final exams or final papers. The average salary in this case remains.

A person also has the right to request paid leave to write and submit a candidate’s or doctoral research paper. The duration of such leave is 3 months or six months, the salary remains with the employee.

Important ! If there are reasons for granting a pension on a preferential basis, academic years are relevant for length of service while simultaneously working at the same time.

For example, this applies to people working in difficult or dangerous conditions. They can take a well-deserved vacation early if they have worked for a certain amount of time in such an environment. So if the employer pays for study holidays, they do not have any significance for the preferential pension.

In some cases, citizens have the right to retire early

What kind of training is included in the insurance period?

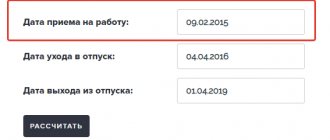

Among the conditions determining the right to receive old-age pension payments, not only the minimum age limit is indicated, but also the citizen’s insurance period. This parameter has been established since 2015 by Law of December 28, 2013 No. 400-FZ. Taking into account transition periods, it will be 15 years, increasing gradually to this value by 2024. In 2021 it will be 10 years.

Since 2002, Law No. 173-FZ “On Labor Pensions” came into force. According to the document, years of study began to be included in work experience when studying before January 1, 2002, and studies before 1992 are taken into account if a person had already started working or completed compulsory military service (for men) before entering the institute.

According to amendments to Law No. 173-FZ, since 2002, training is not taken into account when calculating the parameters determining the assignment of old-age pension payments. From this date, other “non-insurance” periods are taken into account, for example, caring for a disabled person or caring for children.

- Little things from Fix Price that you can use to decorate your home for the New Year

- How to use a credit card from Sberbank

- How to get rid of foot odor. 5 proven recipes

In vocational schools and technical schools

If a Russian studied at a special vocational institution on December 31, 2001, he has the right to count on including periods of study in the insurance period. For a potential pensioner, the status of an educational institution, university or secondary school is important. Studying at a vocational school is considered work experience. There are no additional requirements or reservations.

Studying at a university

If a citizen has received a higher education, periods of study are included in the insurance period with a limitation. That is, when studying at an institute or university before December 31, 1991, it is necessary that before entering a university, a Russian has already worked or served in the army, served in the Ministry of Internal Affairs or other law enforcement units equivalent to the armed forces (for men).

It makes sense to insist on including student time in the insurance period if the minimum required period has not been worked out (for 2019 this is 10 years).

It is important to note: the time of study does not affect the amount of the applicant’s pension.

Secondary specialized education and experience

In this case, the same rule applies as with institutions. What is included in the insurance period:

- If secondary specialized education was received before 2002, and the person chose the previous option for pension calculation, the technical school will be counted towards the work experience;

- If training was completed after 2002 and the previous pension calculation option was chosen, technical training is not counted. In this regard, it is recommended to choose a new procedure, especially if during student life the person paid insurance contributions (for example, if the person studied and worked at the same time), or the study time coincided with the period indicated in Article 12 of Law of the Russian Federation No. 400.

Universities have similar rules.

Do periods of study count towards total work experience?

When calculating pension contributions, the total length of service determined as of January 1, 2002 is taken into account. Then, study affects the amount of the pension, which is determined depending on how long a person worked and the amount of his earnings. There are the following methods for calculating pensions (clauses 3 and 4 of Article 30 of Law No. 173-FZ):

- The value is calculated based on the ratio of a person’s earnings to the average statistical salary, multiplied by the length of service coefficient and the average salary for 07/01/2001 - 09/30/2001. With this method, length of service does not include study: this is beneficial for those who had high earnings in the USSR.

- The amount is calculated using a formula where the average monthly salary is multiplied by the length of service coefficient. This method was preferred for those with low incomes during the Soviet era.

According to the second option, taking into account studies, an increased pension amount may result due to an increase in the valorization percentage.

If for a given period the worker’s salary was at a high level, then the first method is applied. When training at a vocational education institution is not taken into account, it will be more profitable.

- What products should not be stocked in large quantities?

- Where to complain about the management company

- 5 drinks for the morning that are as invigorating as coffee

Training and title of labor veteran

Article 7 of the law on veterans specifies the grounds for conferring the title of labor veteran. Thus, a citizen is recognized as a labor veteran if:

- have a “Veteran of Labor” certificate or awards in the labor field (including Soviet-style ones);

- the man has 40 years of insurance experience, and the woman 35.

Again, periods of training are not included in the length of service. However, there is a caveat: the procedure for assigning such a title can be changed by the laws of regional authorities (regional, regional, city halls of Moscow and St. Petersburg).

According to the norms of regional laws, periods of training may well be counted towards length of service.

Features of accounting for assigning a preferential pension

The pension reform provides for maintaining from 2021 some of the grounds for early retirement based on age (old age). An exception is provided for teachers, doctors, creative workers and workers in the northern regions.

After the innovations, the requirements regarding how work experience during the period of study is considered for preferential categories have changed. According to previous requirements, apprenticeship in vocational institutions (technical schools) was taken into account as a benefit under Lists No. 1 and No. 2 if the following conditions were met:

- date of training no later than December 31, 1991;

- upon graduation, the graduate immediately began work in his specialty from Lists No. or No. 2.

Apprenticeships are also counted after 1991 for situations where the list refers to the general work performed rather than a specific position. For example, for a milling machine operator - “working on the machining of a product.” After 2013, the benefit applies to periods when the employer paid insurance contributions. This is also true during training. For educators and teachers, studies are taken into account until 01.10.1993, if before and after studies there was work in the pedagogical profile.

According to the latest legislative changes to increase the retirement age (Law No. 350-FZ), starting from 2021, earlier retirement (by two years) is provided. This is allowed for a working life of 42 years for men and 37 years for women. This duration only provides for crediting the period of temporary incapacity for work, but not the training time.

For work in rural areas over 30 years, an additional “rural” bonus will be awarded from 2021, but this thirty-year period also does not include the student period. In addition to work activity, sick leave and parental leave will be considered with a cumulative limit of up to six years.

What periods of life are considered?

In addition to the periods when pension contributions were made from the employer, the following periods of life may include:

- service in the army, the Ministry of Internal Affairs and other government agencies;

- looking after a disabled person: a child or an adult, if he is assigned to group 1;

- caring for an elderly person over 80 years of age;

- sick leave;

- child care up to 1.5 years (up to 6 years in total);

- receiving unemployment benefits;

- performing public works on a paid basis;

- stay in places of deprivation of liberty subject to further rehabilitation;

- living in a marriage with a military man in settlements where there were no employment opportunities (up to 5 years);

- living abroad with a spouse who is an employee of diplomatic departments (up to 5 years).

All this will be included if the person transferred contributions to the Pension Fund before or immediately after the onset of such periods. Owners of their own businesses must make their own deductions to ensure that their time in business is counted.

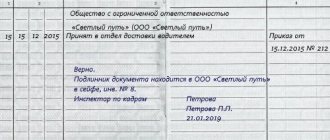

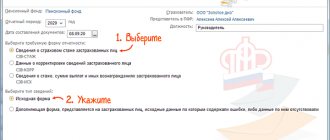

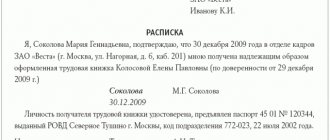

Registration and confirmation

To count student years, a citizen will have to provide the Pension Fund with additional documentation such as:

- employment contract;

- documents confirming employment at the enterprise;

- personal identification card or pass to the enterprise indicating the details of the organization, position and specialty of the employee.

It will be simply ideal when the employee can provide salary statements or copies of accounting documentation. This will be sufficient to prove the relationship between the employee and the employer. When paying piecework, it is important to confirm employment at a specific enterprise.

Video on the topic:

Law

When considering this issue, lawyers, personnel departments and the Pension Fund are based on several legislative acts:

- This is the Labor Code of the Russian Federation.

- Federal Law 166 of December 15, 2001 “On state pension provision in the Russian Federation.”

- Federal Law 400 of December 28, 2013 “On Labor Pensions.”

- Law 4468-1 of 02.12.93 on pensions for employees in the army, the Ministry of Internal Affairs, and other bodies.

It should be taken into account that at this time another pension reform is being implemented, so some provisions in the field of pension experience can also be implemented. It is recommended to keep an eye on important changes.

Working schoolboy

The law allows children over 14 years of age to be hired. At this age, the child already receives a civil passport, he can provide for himself financially and solve other issues in his life.

At the age of 16, a citizen, after the procedure for recognizing early emancipation, can be recognized as legally competent and receive the rights and responsibilities that are usually granted at the age of 18. If a child gets a job at the age of 14, then he can already manage his own funds and make transfers from his salary.

But at this age, contributions are paid not to budgetary organizations, but to private ones.

The employee himself chooses a non-budgetary organization, draws up an application to open an account and receive funds. When hiring an employee, the employer must draw up an employment contract using a special template with such an employee. The employee has the right to vacation and various privileges.

Transfers made for insurance premiums will be included in the insurance period; they are transferred to the account of the state pension provision (disabled population).

An employment contract is an important document when finding employment at school age; only if it is in place will the period of work be counted as work experience. Various agreements for the performance of this or that work are not considered.

Types of educational institutions

On the territory of the Russian Federation, education is provided by various educational institutions. They can be classified into several types at once. They are divided by type of property:

- State.

- Municipal.

- Private.

Regardless of the form for quoting issued diplomas, they must comply with general legislative standards.

If we classify educational institutions by type, they are divided into:

- Initial professional – vocational schools.

- Secondary vocational – colleges and technical schools.

- Higher professional – institutes, academies and universities.

- Postgraduate professional – postgraduate studies and internship.

In addition to those listed, there are institutions where you can improve your qualifications or take a short-term course in a narrow profile.