Author of the article: Vladimir Danilevsky Last modified: January 2021 5302

A subordinate receives temporary disability benefits on the basis of documents confirming this fact. In most cases, an employee does not need to submit an application for sick leave. The employer pays the benefit independently and then sends an application to the Social Insurance Fund for reimbursement of its expenses. Such a statement is necessary when it comes to the payment of benefits for temporary disability, pregnancy and childbirth, the birth of a baby, and funeral.

Basic provisions

Employers pay insurance premiums, acting as policyholders for compulsory social insurance. They have the right to reduce the accrued amounts of contributions payable to the Social Insurance Fund by the amount of their expenses aimed at paying benefits for temporary disability of subordinates.

If the amount of expenses for transferring benefits for a particular month is greater than the amount of contributions for the same period, then the employer can send an application to the Social Insurance Fund to reimburse the difference or offset the excess amount against future payments. He will need to apply for reimbursement of the benefits paid.

In terms of sick leave payments, the employer is not a tax agent, since he is not the source of the payment of funds. The FSS will independently withhold the required amount of personal income tax from payments. Therefore, there is no need to calculate the company’s tax payments.

Pilot region: rules for filling out an application

Payment for sick leave in pilot regions has a number of differences.

The method of payment for sick leave in pilot regions differs from regular payment. In this case, employees are paid money to a bank card, or they receive it by mail, without taking into account the day of wages. Regarding the submission of the application, there are no changes, since it is also submitted directly to the personnel department, in some cases (described above) to the fund.

The completed application must be ready for scanning; no free form is provided; there is an exact template. You can get an electronic form of the template, or print it out from the HR department; if you have difficulties filling it out, employees should help. If the application is not filled out according to the rules, it will have to be redone and sent back to the HR department.

The good news for workers is that in the coming years the system for receiving payment for sick leave will be improved; you may not even need to fill out an application for payment, but they will be processed automatically. But at this stage it is better to adhere to established standards, and if there is a template, take it as an example.

If a company requires a correctly completed application, but does not provide a template, you can download it from a specialized website and find out all the details of filling it out in the HR department. Otherwise, as always, the application has an arbitrary form. Also on the website you can learn about filling out sick leave, and also download a template, and there are explanations on how to write an application for recalculation of sick pay.

Drawing up an application to the FSS

In order to reimburse from the Social Insurance Fund its expenses for sick leave, the employer draws up a special application, after which it checks the correctness of the information specified in the sick leave certificate provided by the subordinate.

The application form for sick leave is established by order of the Federal Social Insurance Fund of the Russian Federation dated September 17, 2012 No. 355. The document must be filled out in block letters - either through a computer or by hand (ballpoint, fountain, capillary, or gleam pens are acceptable).

Entries must be made in black ink, respecting the boundaries of the columns and fields. Corrections, blots, cross-outs, and blurring of already entered data are prohibited.

If the document contains corrections and blots, then FSS employees may refuse to accept and consider it.

An application for the allocation of funds for payment of insurance coverage must contain the following information:

- name of the insured-employer - full name of the individual entrepreneur or individual, name of the organization;

- employer details – location address, tax identification number, checkpoint, etc.;

- a request, due to these circumstances, to allocate funds for the payment of insurance coverage in a specific amount (indicated in numbers and words);

- current account details – number, full name of the bank, its INN, BIC and other data;

- position of the head of the organization, his signature, full name and current telephone number;

- signature of the chief accountant, his signature, full name and current telephone number;

- seal of the policyholder, if available;

- passport details of the policyholder - series, number, date and place of issue;

- a document that confirms the authority of the employer's representative.

Several documents must be attached to the application:

- a certificate containing a calculation of accrued and paid insurance premiums;

- copies of documentation establishing the correctness of expenses (for example, medical certificates or certificates issued by the registry office).

In doubtful situations, FSS employees have the right to request additional supporting documents.

How to write an application to the HR department?

There is no officially accepted form, so the application is written in a free format. It should be noted that the HR department can give you a ready-made template accepted by the company. The form is filled out by any person, for example, the employee himself or a representative of the policyholder, however, the application must be signed by the employee presenting the sick leave, because he is the insured person.

The application is written on standard A4 paper. Typically filled out as follows:

- In the upper right corner the details of the company to which the application is being submitted are indicated - name, position and full name. manager, for example, the general director.

- Under the manager's details, the applicant's details are indicated - full name, registration address, residential address.

- The name of the document is written in the center, that is, “Application”.

- Next comes the body of the application, where a request is written for the appointment and payment of sick leave benefits. It is also indicated how you wish to receive funds - to a personal account or in cash at the accounting department.

Advice - it is worth indicating the law on the basis of which the employer is obliged to pay insurance (No. 255-FZ of December 29, 2006).

- Payment information where the benefit must be credited if you want to receive it into your account. In addition to the account number, you must additionally indicate the following data of the credit institution - full name, BIC, beneficiary's name.

- “Appendix” is written on a new line and the documents that are attached to the application are listed.

- The date of writing the application is written and signed.

If the sick leave is extended and a new sheet is issued, the employee can submit an application for each of them.

Application for sick leave after dismissal of a subordinate

If the employment contract with a subordinate is terminated, and the employer has issued him a work book with the corresponding entry, then the dismissed person has 30 days to, if necessary, provide the former company with a certificate of incapacity for payment.

In this case, the subordinate must draw up a statement that the benefit is transferred to him after he leaves the company, if the employer operates in a region where there is a pilot project for direct transfers of benefits from the Social Insurance Fund. In this case, the completed application is drawn up in the form determined by order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578.

Thus, the dismissed subordinate draws up an application for payment of sick leave, transfers the completed application and sick leave to the former employer, and the employer sends a package of documents to the Social Insurance Fund.

But if the company operates in a region in which the pilot project is not yet operational, then in this situation it is recommended to obtain a sick leave application from a subordinate. Thanks to the application, it is possible to record the date the person applied for help for further tracking of the payment of benefits.

Do I need to write to pay for temporary sick leave?

If an employee receives temporary disability benefits in the traditional way (at the place of work), then there is no need to write an application. The basis for accrual of sick leave, the amount of which will be reflected in a certain column of the pay slip, is a certificate of temporary incapacity for work.

With the launch of the “Direct Payments” pilot project, the number of workers wishing to receive “sick leave”, “maternity” and other amounts directly from social insurance authorities is growing. In this case, the application must be written.

Consideration of an application to the FSS

In order for the Social Insurance Fund to accept an application for sick leave and transfer funds, it is necessary to correctly draw up documents and justify the costs incurred. There are no specific deadlines for submitting an application.

However, the legislation establishes a period of time during which the FSS, in the absence of problems, transfers funds.

The standard period for making payments is 10 days . When checking, funds are transferred based on its results.

The payment period begins to count from the moment the employer provides the requested documents. However, if the amounts indicated in the application raise suspicions among FSS employees that they have been calculated incorrectly, the Fund will organize a verification of the validity of the employer’s expenses and will request other supporting documents and information.

Reimbursement for sick leave in 2021, documents, procedure

The procedure for compensation for sick leave in 2021 will follow a new scheme. The structure of document submission has changed. We will tell you about all the innovations, and step by step we will analyze the mechanism for receiving compensation for sick leave.

Compensation for sick leave, what's new in 2021

Important! If your employee has taken a sick leave, then the first three days of his illness are paid from the organization’s funds. And only for the remaining days of incapacity is it possible to receive compensation from social insurance.

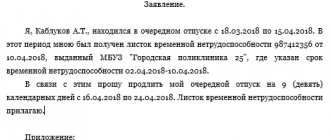

A sample application for payment of sick leave after dismissal contains all of the above requirements. His example can be used to write your statement when applying to an employer for payment.

The law states that if an employee falls ill after leaving work, temporary disability benefits must be paid, regardless of length of service, in the amount of 60% of average earnings. The accounting department of the former employer calculates this amount.

The employer pays for the first three days at his own expense, the subsequent days - at the expense of the Social Insurance Fund.

The benefit is paid by the company

- the person must be insured by the Social Insurance Fund: all employees officially employed in organizations that pay taxes;

- the former employee himself was ill and was not caring for relatives;

- the illness must occur no later than 30 calendar days from the date of termination of work at this enterprise;

- the former employee must contact the former employer no later than 6 months after the end date of the sick leave;

- the person at the time of opening the temporary disability certificate was unemployed and was not employed until the time of applying for payment;

- the former employee must provide the company from which he left with a package of documents.

In order to receive the insurance payment required by law, the employee must submit an application for payment of a temporary disability certificate. The content will depend on the reason for drawing up the sheet; the principle of drawing up the document is the same for all cases.

Possible problems

When intending to receive payments from the Social Insurance Fund, employers and subordinates may encounter some problems.

Sick leave length is underestimated

The subordinate must submit an application for additional payment and prepare documents confirming the underpayment. The package of documents is sent to the territorial office of the FSS. Authorized persons will conduct an inspection and, upon receipt of evidence of understatement of length of service, will transfer the remaining amount to the employee.

Sick leave length is too high

The employer is responsible for the overpayment, since documents were submitted to the Social Insurance Fund on his behalf. His duty is to reimburse the costs incurred by the Fund, and the subordinate has the right not to give money to the employer, since he is not to blame for the current situation.

An overpayment can be forcibly recovered from an employee only in two cases:

- the subordinate is to blame for the overpayment - for example, he deliberately provided documents with outdated or inaccurate information, withheld relevant information in an attempt to increase the amount of benefits;

- a counting error occurred - for example, the amount was transferred twice.

If the employer has provided documents in which the information differs, then he will not be able to challenge the actions of the Social Insurance Fund employees in court. But if the Fund requests documents that are not related to dubious payments, then the employer has the right to try to challenge this part of the requirement.

The company ceased operations

It is necessary to apply to the Fund for payments while the employer is operating. If an individual entrepreneur is deregistered or the company has been liquidated, then it will not be possible to obtain cash payments from the Social Insurance Fund.

Artificial creation by a company of a situation in which it has the opportunity to receive funds

If an employer deliberately deceives Social Insurance Fund employees, submits an application for sick leave or compensation for other expenses, then he risks facing criminal liability.

In accordance with the information about unemployed persons, the chief accountant fraudulently prepared a report and an application for reimbursement of insurance funds. The document contained deliberately false data on the costs of transferring maternity benefits. Funds from the Social Insurance Fund to compensate for expenses were transferred to the company’s personal account.

After this, the chief accountant, on his work PC, through an electronic document management system using his and the director’s ES keys, compiled and sent an application, according to which the employees transferred funds to the company’s current account opened in the bank. The third party then withdrew funds from the bank.

It was found that the damage from the illegal conspiracy amounted to more than 1 million rubles. When considering the case, the court qualified this crime under Part 4 of Art. 159 of the Criminal Code of the Russian Federation. The director and chief accountant faced criminal penalties in the form of suspended imprisonment with a probationary period.

Time for calculating benefits under BiR

It is worth keeping in mind that payment of state social insurance benefits and registration of sick leave according to the BiR is considered a right, and not a direct responsibility of the girl.

As a result, if a woman does not take advantage of this opportunity and decides to continue working for a salary, then she is not entitled to such benefits.

Maternity benefits are accrued immediately for all months of leave. According to Article 255 of the Labor Code of Russia, the duration of leave is 70 days before childbirth (84 in the case of expecting 2 or more children) and 70 after (86 in the case of childbirth with severe consequences, 110 in case of multiple births).

Important! Also, girls who live near Chernobyl are entitled to 90 days of prenatal leave.

Article 255 of the Labor Code of the Russian Federation

The time for applying for payments is limited - 6 months are given after leaving maternity leave.

When a woman decides to go on sick leave under the BiR, she will be entitled to benefits. Within 10 days after submitting all the necessary documents, the woman will receive benefits.

Management pays benefits on the next payday. The Social Security Service accrues funds until the 26th day of the month following receipt of documents.

Funds from the Social Insurance Fund will be received by the 26th of the month following the submission of documents

Use the 2021 maternity benefit calculator.

Application form for sick leave 2021

The procedure for filling out the form for receiving direct payment of sick leave benefits for temporary disability: In the header, in the appropriate columns, write the full name of the territorial body of the Social Insurance Fund. The header indicates from whom the application is received. After

Application for sick leave from the Social Insurance Fund (form and sample)

- A sample of filling out an application for reimbursement of expenses for paying four additional days off to one of the parents (guardian, trustee) for caring for disabled children (Appendix No. 7 to the Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017.

Expert opinion

Semenov Alexander Vladimirovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

It is important to remember that each enterprise is obliged to submit an application and sick leave to the territorial body of the Social Insurance Fund no later than five days after receiving the employee’s request.

- members of peasant farms;

- lawyers;

- persons engaged in private practice;

- citizens who become ill or injured within 30 days from the date of termination of their employment contract or service;

- clergy;

- women who were laid off due to company liquidation and became pregnant within a year of registering as unemployed;

- employees who have signed an employment contract;

- entrepreneurs;

- civil servants and municipal employees;

- working members of production cooperatives;

- persons holding state and municipal government positions;

- notaries;

- members of tribal communities of small nationalities, if they pay contributions voluntarily;

Application for sick leave from the Social Insurance Fund (form and sample)

If an employee quits, he can apply for sick pay within 30 days from the date of dismissal. The application is written on standard A4 paper. ST. PETERSBURG AND LENIGRAD REGION: REGIONS, FEDERAL

A sample application for sick leave for pregnancy and childbirth can be found on our website: The application may also be accompanied by sick leave, for the payment of which the employee wishes to use a billing period other than the standard one to determine average earnings. An application will also be required to recalculate sickness benefits if an error was made in the calculation or if information about the employee’s income for previous years has appeared.

Filling out sick leave by an employer in 2021: sample

After completing and entering the data into the application form for sick leave at the Social Insurance Fund, the person who intends to receive payment for the period of illness attaches the original certificate of incapacity to work to the form. Then the entire package of documents is transferred to the employer.

The law does not stipulate a template for filling out an application, so it can be drawn up in free form. Traditionally, HR specialists at each enterprise develop a unified form in which you only need to enter personal information. It doesn’t matter who fills out the form, the main thing is that it is signed personally by the employee.

Types of statements

The application form will differ depending on the type of paper. The appeal may be aimed at reimbursement of expenses for payment of benefits, reimbursement of sick leave or issuance of sick leave.

Application for reimbursement of expenses for payment of benefits for VN

Application for sick leave FFS (form and sample)

Form:

Sample:

Application for compensation for sick leave to the Social Insurance Fund + sample filling

Application form for a certificate of incapacity for work:

Sample:

Application for payment (recalculation) of benefits (vacation pay)

Form:

An application for payment of temporary disability benefits is filled out according to the following sample:

Do I need to write an application for payment of sick leave benefits - download a sample for the Social Insurance Fund, employer

The procedure for applying for sick leave after dismissal is no different from that provided if the employment contract remains in force. The certificate of incapacity for work should be handed over to the employer and accompanied by a statement.

How can an employee register when receiving a payment on the sheet directly through the Social Insurance Fund?

To receive payment through the Social Insurance Fund, you need to fill out a standard application form and submit it to the employer along with a sick leave certificate. Next, the documents are sent to the fund - this function is assigned to the employer, who must transfer the documents to their destination within five days.

Every employee working under the terms of an employment contract has the right to receive benefits for temporary disability. If the employer is unable to pay the costs, then the employee has every right to draw up an application sent directly to the Social Insurance Fund.

Who is entitled to receive benefits under the BiR?

Sick leave for pregnancy and childbirth and the accrual of corresponding payments are due to women who gave birth to a baby or adopted an infant (up to 3 months).

To receive benefits and go on vacation, two main conditions must be met: the woman must be officially registered with the enterprise under an employment contract and management must constantly pay contributions to the Social Insurance Fund. You can also count on benefits:

- full-time students (usually applies to graduate students);

- contract employees (military personnel).

A woman who has given birth and/or adopted a child can count on benefits under the BiR

This opportunity is also provided to unemployed women if, within a year before registering with the employment exchange, they:

- lost their job due to the closure of an enterprise and are officially considered unemployed;

- no longer have the status of a lawyer;

- are no longer individual entrepreneurs.

Important! If a pregnant girl was not officially employed anywhere, did not serve, or did not work at all, then obtaining benefits is impossible.

Also, benefits are not provided if the employee quit of her own free will or is studying part-time.

Even if a girl is unemployed, but she is registered with the Employment Center, she will be able to receive payments

Application form for payment of temporary disability benefits

For the entire period while the employee was unable to perform work duties, compensation will be determined. To receive funds, you will need proof of disability from a doctor. An employee of an enterprise can submit an application to a private or public medical institution.

General provisions

Appealing to the fund to pay for sick leave in the absence of funds in the employer’s account is allowed if a bank card file is created. The FSS issues a refusal to pay when a legal entity has no encumbrances, even if there are insufficient funds to pay off the debt on the certificate of incapacity.

- At the top of the form, in the appropriate field, you must indicate the full name of the FSS body.

- The applicant's full name is written in the header.

- After the phrase “As a result of the occurrence of an insured event, I will ask you to provide”, check the type of insured event.

Medical institutions that have a license to carry out medical activities (examination of temporary disability) have the right to issue the document. The document is drawn up by the responsible medical professional. The citizen provides an identification document.

About sick leave

- You need to fill out the application with a black capillary or gel pen or type it on a computer.

- You cannot make mistakes, corrections, cross out words, or use a proofreader.

- You only need to fill out those items for which the woman has complete information.

If everything is clear with the first group of employees - only female employees - mothers of children - are included in it, then both women and men can be included in the second group. This is due to the fact that, according to the current legislation of the Russian Federation, a small child can be cared for by his mother, father or guardian (but only one).

Application for recalculation and its sample

Recalculation of sick leave is a change by the employer in the amount of cash accruals that the employee received in connection with temporary disability. It can be initiated by both the employee and the employer. A statement is written when an employee needs recalculation. As a rule, this happens in cases where the amount of the benefit does not correspond to the length of service and the average salary.

This is important to know: Is sick leave considered income?

The procedure for drawing up such an application remains unchanged, with the following exceptions:

- The body of the text indicates on what basis recalculation is required. For example, if the length of service is incorrectly calculated or the calculation period needs to be changed when calculating sick leave benefits.

- There is no need to indicate the method of receiving benefits and details, because the employer must initially agree on the recalculation.

- The applications must indicate the availability of a certificate and the amount of wages for a period of no more than 3 years. Without this certificate in the package of submitted documents, recalculation is impossible.

A sample application for recalculation of sick leave benefits can be viewed below:

Application for replacing years when calculating sick leave

By law, all these benefits are calculated taking into account the employee’s average earnings for the two years (according to the calendar) preceding the year in which the event covered by insurance occurred. Thus, if a person did not work for the reasons stated above, his insurance payment is significantly reduced, and recalculation with the replacement of years leads to a reasonable increase in the amount of benefits.

Who is eligible for a replacement?

Russian legislation firmly guards the interests of employees. The transfer of years is one of the measures that follows this principle, since it is needed for the correct calculation of benefits for temporary disability, pregnancy and childbirth, and for caring for a child up to one and a half years of age.

A certificate of incapacity for work is a document issued by a medical institution, containing the necessary information and details and confirming that within the specified period the person could not perform labor duties due to objective reasons.

Since the deadlines for transfers from the Social Insurance Fund, and even more so the deadlines for filing applications, can be quite long, payments to employees must be made regardless of the transfer of compensation, otherwise labor laws will be violated.

Application form for sick leave 2021

There are situations when a special application for sick pay is sent directly to the Social Insurance Fund. Thus, employees of a liquidated enterprise, or independent workers (individual entrepreneurs, notaries) submit an application exclusively to the social insurance authority.

As for HR workers, they have only five days during which they send documents to the social security fund. In this case, the employee must bring a sheet and a completed application. If the application is not completed, you can fill it out using the sample in the HR department, or print it and then simply sign it.

Social Security Fund: Applying Directly

When getting a job, every employee thinks that there will be cases when he will not be able to go to work. At such moments, employees should ask questions to their superiors regarding sick leave. After all, every person gets sick, and no one is immune from this, so a sick leave certificate will be needed.

To receive such benefits, the employee must provide his employer with a sick leave certificate and an application. How is an application for benefits made? When should it be submitted to the employer, and when to the Social Insurance Fund? Where to submit? In the vast majority of cases, the application is submitted to your employer's HR department, accounting department, or manager.

How is sick leave paid in 2021?

Completed sample Download for free The pilot project is that the Fund directly, without the participation of employer companies, pays social benefits to insured persons. These are sick leave, maternity benefits, childbirth benefits, child care benefits up to 1.5 years old, etc.

The Foundation also pays for the costs of preventing injuries and occupational diseases. Currently, 39 regions are already involved in the FSS pilot project.

Consider sick leave in the BukhSoft program. You can easily determine the employee’s insurance length, all the amounts included in the calculation, and find the amount of benefits online.

It is recommended to issue a statement of payment on the company’s letterhead, which already indicates its name, legal form, registration number in the Social Insurance Fund, and code of subordination. You should fill in the number and date of the calculation, as well as the details of the sick leave certificate to which this application is drawn up.

Next, all the necessary information is indicated and the calculation of the amount of benefits during illness is carried out.

How can an employee fill out and submit a form for payment to the Social Insurance Fund?

To directly apply for temporary disability benefits, you must draw up an application in the approved form and attach to it documentary evidence of the existence of grounds for claiming compensation.

To receive funds you need to act in accordance with the algorithm:

- Collect papers.

- Make an appeal.

- Go to the FSS to transfer documents and applications.

- Receive confirmation of registration of the application.

- Choose a method to receive funds.

- Receive money using the chosen method.

Submission of documentation can be carried out without visiting the branch. To do this, you need to go to the State Services portal and select the appropriate service from the proposed list.

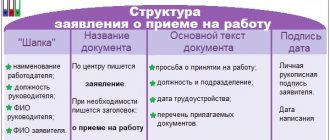

Document structure

The current structure of the document was adopted in 2012. Since then, the application forms for the employee and the employer have been separated. The employer must complete the application, including the following sections:

- To whom is it addressed? Information about the territorial body of the FSS is indicated.

- Who is the sender? Provide information about the employer.

- Main text block. The request for payment of funds is indicated here.

- Recipient details. Information about the period of incapacity for work and the amount required to be paid.

- Information from documents confirming the status of a legal entity.

- Method of transferring funds. Indicate post office or bank details.

- Contact information about the applicant. Phone number and signature verifying the document.

The application from the employee includes the following sections:

- To whom is it addressed? Provide information about the local FSS branch.

- Who is the compiler?

- Main part. The need for payment due to the occurrence of an insured event is indicated.

- The method of receiving funds is indicated.

- Transfer details.

- Details of the documents that were attached to the application to prove the existence of grounds for issuing a temporary residence permit.

- Is it the main job or is the work carried out part-time?

- Confirmation of registration of the application with the Social Insurance Fund.

- Signature and date of application.

The payment procedure does not depend on the person who submitted the application. It also does not affect the basis of the claim for costs.

Attached papers

In addition to the application, some additional documents must be attached:

- Certificate of invoice from the employer.

- Sick leave.

- Employment history.

- Help 2-NDFL.

- Employment contract.

- A copy of the payment order for payment (if the applicant is an individual entrepreneur, lawyer or notary).

- Payment order registration number (if the applicant is an individual entrepreneur, lawyer or notary).

The applicant does not have to provide all the papers on the list. To clarify the required package of documents, you must contact the FSS office.

Help for calculating temporary disability benefits

This document will be the most important when applying for payment. Only the last two years of employment with the employer are taken into account. There is an approved document form, deviation from which is grounds for refusal to accept the paper.

Application form for payment of temporary disability benefits

The form can be filled out manually or printed on a computer. You can download the application for the certificate of incapacity from work using the link:

Is it necessary to file after dismissal?

According to the legislation of the Russian Federation, a citizen can take out sick leave within one month from the date of dismissal. And sick leave can be provided within six months. The entire procedure will take place according to standard algorithms without changes to the package of documents or points of the application. The legal entity is obliged to pay the amount in full.

If the employer refuses to pay, the former employee can file a claim in court.

Regulations

In fact, all information of interest regarding compulsory medical insurance, taking into account the insurance premium, insurance payments, and the occurrence of insured events, is regulated by Federal Law No. 255 “On Compulsory Medical Insurance of the Russian Federation.”

It is obligatory for the employer, according to the legislation of the Russian Federation, to pay the insurance premium for each employee separately to the Social Insurance Fund on a monthly basis.

In the same way, sick leave is calculated and money is paid, accepting compensation from the Social Insurance Fund.

Note ! The availability of insurance payments and compensation for temporary disability is specified in Article 183 of the Labor Code of the Russian Federation.

Article 183 of the Labor Code of the Russian Federation

If the employer refuses to pay sick leave, the employee has the right to appeal this decision in court. The employee also has the right to apply to the labor relations inspectorate to conduct an unscheduled inspection of the relevant employer and its organization as a whole.

If violations occur, then the competent authorities have the authority to issue penalties to the individual entrepreneur or the owner of the organization for violations of Russian labor legislation. Although this situation occurs too rarely. It all comes down to a lack of knowledge of the legislation of the Russian Federation.

The employer is obliged to pay sick leave

In fact, the employer bears virtually no costs. The majority is paid by the state in compliance with all legal regulations.

What is sick leave?

Regardless of the fact that new rules in labor relations have recently become more frequent, the rules established by law regarding the sick leave itself and the rules for filling it out have virtually remained unchanged from 2011 (04/26 – date of installation of the form) to 2021.

Such a document indicates that the employee is temporarily allowed not to work due to temporary disability, and in connection with this situation, his absence from his workplace is due to a valid reason (health reasons).

If there is sick leave, the employee’s absence from the workplace occurs for a good reason

The procedure for issuing sick leave is specified in the Letter of the Social Insurance Fund dated October 28, 2011 N14 03 18/15-12956, paragraph II, clause 17.

In accordance with Federal Law No. 255-FZ dated December 29, 2006, which regulates the procedure for insurance payments and monetary compensation related to temporary disability of an employee, insurance and social payments are made.

In the case of compulsory outpatient treatment, the attending physician is obliged to personally draw up and hand over to the patient a sick leave certificate valid for 15 days.

Important! If it is necessary to extend the validity of a citizen’s certificate of incapacity for work, a special commission of competent persons is created (in accordance with Order of the Ministry of Health of the Russian Federation dated June 29, 2011 N624, paragraph 2, paragraph 11).

A special commission decides whether a person needs to extend sick leave in case of serious illness

Sick leave and disability payments are available to certain groups of people.

| Group of persons | Notes |

| Persons who are citizens of Russia | Subject to regular payments to the Social Insurance Fund from wages. |

| Persons who are not citizens of Russia | They receive disability payments only if they have made contributions to the Social Insurance Fund at least six months before the insured event. This issue is regulated by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N624n, Article 2, paragraph 2, clause 11. |

The time frame for submitting sick leave to the relevant authorities is regulated by a number of legal acts, in particular Federal Law dated December 29, 2006 N 255-FZ. In this case, the policyholder must issue special social security compensation payments within ten days after the provision of sick leave.

Payments are made by the policyholder within 10 days after the provision of sick leave

Payments are subsequently calculated. In cases where such payments are artificially slowed down or delayed, a citizen has the right to complain to the competent authorities about the employer.