At the birth of a baby, his parents acquire the right to receive a state benefit, which is calculated and issued to them from the funds of the Social Insurance Fund of the Russian Federation, or at the expense of the federal budget. A person who replaces parents has a similar right. This could be, for example, a guardian, trustee, adoptive parent. In all cases, the primary basis for processing and issuing this social benefit is the fact of the birth of a child (first, second, twins, etc.).

Important! This state benefit is paid one-time for each child born, but only to one of the parents (mother or father).

The appointment of a state benefit at the birth of a baby is subject to mandatory registration. The registration procedure itself does not present any difficulties, but largely depends on the actual status of the parent to whom the state benefit will be paid.

| Where to apply for state benefits for a parent (typical situations) | ||

| If everyone in the family is unemployed or studying full-time at a university, educational professional organization or scientific organization | When mother and father work (or serve) | If one parent works (serves) and the other does not have a job |

| At the place of residence (stay, actual residence) of the mother or father in the social protection authorities | At work or in the service of one of the parents | In the organization where the parent works (serves) |

The listed options for obtaining a one-time state allowance for a child fully apply to persons who replace parents.

Legal basis for registration and payment of state benefits for a newborn baby

The procedure for registration and payment of this state benefit is regulated by current legal acts. Their list with current editions and links is presented below in the table.

| Title of the legal act with reference to the latest edition | Scope of application (briefly about the contents) |

| Federal Law of the Russian Federation No. 255 of December 29, 2006 “On compulsory social insurance in case of VNiM” (Actual edition dated December 27, 2018) | Federal Law of the Russian Federation No. 255 comprehensively regulates legal relations related to compulsory social insurance in case of accidents and accidents. Determines the category of citizens subject to this social insurance, its types, as well as the process of providing state benefits (value, conditions, general order) |

| Federal Law of the Russian Federation No. 81 of May 19, 1995 “On state benefits for citizens with children” (actual edition dated July 26, 2021) | This law establishes the types of state benefits and ensures their payment to the uninsured and other persons. He also determines the procedure for recalculation, indexing of state benefits, calculation of average earnings and application of regional coefficients |

| Order of the Ministry of Health and Social Development of the Russian Federation No. 1012n dated December 23, 2009 “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children” (as amended on September 24, 2018) | Details about the registration and payment of state benefits to citizens of the Russian Federation (certain categories of foreigners, stateless persons and persons with refugee status) who have children |

| GOST R 7.0.97-2016. National standard of the Russian Federation, approved. By Order of Rosstandart No. 2004-st dated 12/08/2016 (as amended on 05/14/2018) | This system of standards applies to organizational and administrative documentation and establishes types and sample forms, the composition of details, general rules for the creation and execution of documents |

The amount of state benefit that one of the parents receives for a newborn baby is 8,000 rubles. rub. This figure is determined by law and is subject to annual indexation. In 2021, one of the parents can receive the amount of RUR 17,479. rub. 73 kopecks (indexation was carried out using an increasing multiplier of 1.043) per born baby. This amount of state benefit is established in accordance with RF Regulation No. 32 dated 01/24/2021 and is paid starting from 02/01/2021.

What you need when booking a vacation

A unified sample order for 140 days of maternity leave has been approved by law. To register, the employer must take a number of steps.

1. Check the contents of the employee’s application for maternity leave:

- the document is signed personally;

- the beginning and end are indicated;

- sick note included.

2. Check that the sick leave is filled out correctly.

- the established form has been provided (Order of the Ministry of Health of the Russian Federation dated April 26, 2011 No. 347n);

- the document is filled out properly by the medical professional and the employer.

3. Issue an order for maternity leave.

4. Issue a personal card, including the name of the period, number of days, deadlines, details of the administrative document.

5. Prepare a work time sheet. If the employer uses the forms established by State Statistics Committee Resolution No. 1 of 01/05/2004, the days are indicated by a code (letter P or number 14). When using your own forms, encodings are entered independently.

6. Pay benefits (including part-time workers) for the period in full in the amount of 100% of the average salary, if the insurance period is at least six months.

Registration of state benefits at work for mother or father

The procedure for assigning and paying state benefits is indicated in Part IV of the Federal Law of the Russian Federation No. 1012n. In order to obtain state benefits for a child born at work, the parent must take the initiative and contact his employer on this issue.

For the purposes of processing this payment, the parent within 6 months. After the birth of the baby, he must submit an application and documents certifying his right to it to the personnel department. An application for the assignment of state benefits addressed to the employer is written in free form. The package of documents submitted for registration purposes must include:

- a standard certificate of birth of a child from the registry office;

- child's birth certificate;

- a certificate from the second parent’s work or service stating that state benefits have not yet been assigned;

- a standard extract from the work book about the last place of work or service (for an unemployed parent) or simply the original (copy) of the work record.

This list of documents is submitted (in person, by mail) in the general case by a person who is a citizen of the Russian Federation. It is not considered exhaustive. Depending on the specific particular situation, the specified checklist may be supplemented with other required documents, which are noted in clause 28, part IV of the Federal Law of the Russian Federation No. 1012n.

For example, if the recipient of the state benefit (applicant) is a person who replaces a parent, then a document certifying his authority must be attached to the application. Thus, the guardian must submit an extract from the decision to establish guardianship of the child, made by the guardianship authorities. In appropriate situations, copies of the refugee certificate, as well as an identity document with a mark on the issue of a residence permit, etc., are attached.

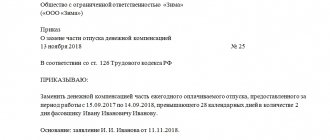

Drawing up an order from the employer on the appointment and payment of state benefits

Issuing an order from the employer on the appointment and payment of state benefits to the parent at the birth of a child is an indispensable stage of registration. After the employee has submitted the required application with documents to the employer, it is subject to consideration. Upon review, the employer makes one of the decisions: pay state benefits to the applicant or deny it. He must indicate his decision in the form of a resolution on the application.

If the decision is positive, then all documents are transferred to the personnel department and the employer’s decision is formalized by order. In other words, a written order from the employer is issued to assign and pay benefits to the applicant. Then for 10 working hours. days money must be paid.

There is no standard form for the order, so its text part is compiled in any form. In this case, the general design principle is applied, which is inherent in standard orders of the employer, i.e. with a similar structure, including the relevant required data, etc. It is based on recommendations and provisions of GOST R 7.0.97-2016. Thus, when compiling this order, it is necessary to indicate the following mandatory details:

- Name and standard details of the organization (author of the order), if the order is not issued on letterhead (TIN, KPP, legal address).

- Name of the document type: “Order”.

- Place of its compilation, publication, as well as date and registration no.

- Grif on restricting access to the order. For example, “for official use” or “secret” (indicated if it contains private, secret information).

- Title (a brief statement of the contents of the order, i.e. what it is about). In relation to the situation under consideration, it can be written as follows: “On the payment of a one-time state benefit at the birth of a child.”

- The main text part of the order. It is recommended to draw up the following scheme: to whom the state benefit is assigned - its size - when, in what time frame this payment must be made - the responsible executor of the order.

- Appendix (list of supporting documents submitted by the applicant).

- Approval stamp (if internal approval of the order is required).

- Position, signature with transcript of the authorized person (employer, director of the organization).

- A corresponding note about the executing employee (full name of the developer of the order, his contacts).

More details about the details that are indicated in documents according to the current standard can be found from the primary source (see Part 4 of GOST R 7.0.97-2016). Typically, the employer's orders are issued on the organization's letterhead.

In what form is it compiled?

To fill out an order, you can use a form developed by the company specifically for filling out documentation of the specified type.

In addition, it is allowed to use a unified form - T-6 . The second design option is considered optional, but recommended.

When using a generally accepted form, the likelihood of making mistakes or providing insufficiently accurate information is reduced.

Expert opinion

Novikov Oleg Tarasovich

Legal consultant with 7 years of experience. Specializes in criminal law. Member of the Bar Association.

If you fill out the documentation using your own sample, you should be sure to reflect all the necessary information on the paper, observing the structure and business style of the narrative.

How to fill out T-6 when providing maternity leave?

The unified order form T-6 is used to issue various types of leave.

In general, the document includes 3 blocks , each of which is intended for specific information:

- 1 — filled in when registering the annual paid vacation period;

- 2 — filled out for registration of other leaves, including maternity leave;

- 3 — includes information from previous sections.

When applying for a maternity leave, the first block of the form is not filled out.

The second section must indicate

information of the following nature:

- full name of the company where the pregnant employee is officially employed;

- the serial number assigned to the paper (can consist of not only numbers, but also letters);

- publication date;

- information about the employee - full name, position, name of the structural unit in which she works;

- vacation period and its duration (data in this line is entered based on the information indicated on the sick leave)

- signature of the director of the company or his responsible person;

- employee's signature.

After the order is issued, adjustments are made to the working time sheet. Calculation of benefits for pregnancy and upcoming childbirth is carried out.

The woman’s signature confirms that she has read and agrees with the information specified in the order.

Filling out internal documentation can be done by both the head of the enterprise himself and the person appointed responsible for this action. This role can be played by an employee of the HR or accounting department.

The calculated benefit goes to the pregnant woman’s account along with her next salary.

Below is an example of filing a maternity leave for 140 days using the standard T-6 form.

filling out an order for maternity leave – word.

This is important to know: How to correctly write an application for rescheduling a vacation

Uniform requirements for creating an administrative document

When issuing an order, the general requirements are taken into account, which are defined by Part 3 of GOST R 7.0.97-2016. They relate to design, numbering, use of fonts, indents, spacing, possible highlighting in the text and other nuances. Many of these standards are widely used by organizations. In this regard, it is recommended to pay attention to the following general rules:

- The document can be prepared on paper or electronically.

- Page numbers should be placed at the top, in the middle, but only if the document consists of 2 or more pages.

- It is allowed to use fonts of 12, 13 or 14, and smaller ones in tables.

- Each paragraph should begin with an indentation of 1.25 cm, and there should be a space between words.

- Line spacing can be 1 or 1.5.

- The title is usually written centered or printed in paragraph indentation.

- The text part of the order must be aligned in width.

- Certain details in the text can be highlighted in bold, but only if this norm is spelled out in the regulatory act of the organization ( "addressee", "signature" , etc.).

The listed standards are the generally used minimum of elementary requirements that need to be known and followed when creating administrative documentation.

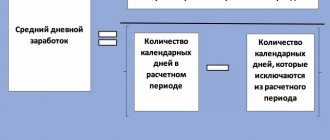

How is the payment amount determined?

The amount of the benefit directly depends on the amount of earnings that the applicant received over the previous two years. A coefficient of 40% is used for calculation.

It is this indicator that is used when calculating the required benefit and is considered one of the constituent elements of the general formula:

Amount of earnings for 2 years/731X40%X30.4. As an example, let’s calculate child benefits for citizen M. Petrova.

- 312,000 rubles – salary amount for 2015;

- 421,000 rubles – the amount of earnings for 2021.

- (312,000 + 421,000)/731 x 30.4 x 40% = 1,002.73 * 30.4 * 40% = 12,193.27 rubles - the amount of the monthly childcare benefit for a child up to one and a half years old.

The benefit is paid every month until the child turns 18 months old. In the future, the money stops being paid, although the woman may be on maternity leave for another 1.5 years. It is important that the employer pays the money from his own funds, and then submits an application to the Social Insurance Fund together with the required calculation and receives reimbursement of expenses for insured events.

Example 1. Sample order for payment of state benefits at the birth of a baby

LLC "Formula Comfort"

Vyborg, Boyaryshnikovy Lane, 2, tel. +7 (81378) 1-11-111

Vyborg September 12, 2021

ORDER No. 222

on payment of a lump sum benefit upon the birth of a child

In accordance with the Federal Law of the Russian Federation No. 81 of May 19, 1995, and also in accordance with the Order of the Ministry of Health and Social Development of the Russian Federation No. 1012n of December 23, 2009

I ORDER:

- Assign and pay a one-time state benefit for the birth of a child to expert Valentina Miroslavovna Zolotareva in the amount of 17,479 rubles. 73 kopecks

- Control over the execution of this order is entrusted to the chief accountant, Chestnaya Evgenia Nikolaevna.

Application:

- Statement by expert V.M. Zolotareva dated 09/12/2021.

- Certificate of birth of a child No. 30 dated 09/02/2021 from the registry office.

- A copy of the birth certificate.

- A certificate from the place of work of the spouse, N. N. Zolotarev, stating that he was not paid state benefits.

General Director Alekseev /A. V. Alekseev/

I have read the order:

09.12.2021 Zolotareva /V. M. Zolotareva/

When a woman goes on maternity leave

Before figuring out how to fill out a sample order for maternity leave 2021, let’s figure out when you need to worry about this.

According to Article 255 of the Labor Code, a woman preparing to become a mother receives a legal break from work. Its duration varies:

- 70 days before the birth of the child and 70 after it - if the employee carried one fetus and gave birth without complications;

- the first part of this period increases to 84 days if there are two or more fruits;

- the second part is extended to 86 days if the woman gave birth with complications;

- the postpartum period will be 110 days if two or more children were born.

To obtain such a break, you must provide a certificate of temporary incapacity for work on the appropriate grounds. You can learn about the procedure for issuing and providing it from Order of the Ministry of Health and Social Development No. 624n dated June 29, 2011.

Therefore, when the employee is approximately seven months old, it is time to start preparing documentation.

Answers to frequently asked questions

Question No. 1: The spouses are divorced. The child remained with his mother. Where can she get state benefits for her newborn baby?

In this situation, the norms of clause 27 of Part IV of the Federal Law of the Russian Federation No. 1012n apply, which clearly states that if the parents are divorced, then the parent with whom the child lives can receive the money. At the same time, the procedure for registering a state permit depends on whether it works or not.

Accordingly, here the state benefit is registered in the name of the mother, since the baby lives with her. If she works (or serves), then she needs to contact her employer (i.e., work or service) regarding registration. If the mother is unemployed at this moment, then she will be able to receive state benefits through the social security authorities.

Question No. 2: Will child support be paid if you write an application after 6 months? since the birth of the baby?

No, they won't pay. In order to receive it, you must comply with the generally established application deadline (the norm is enshrined in Federal Law of the Russian Federation No. 81). What is important is that when submitting an application in person with documents, the day of its acceptance (registration) is usually considered the day of application. If everything is sent to the addressee by mail, then the day of application is the date indicated on the stamp affixed upon sending. This point must be taken into account when submitting documents.

What is needed to apply for maternity leave?

The law establishes that women, upon their application and on the basis of a certificate of incapacity for work, are granted maternity leave, which is issued by order of the employer on the unified form No. T-6, with which the woman must be familiarized with her signature.

In order to issue an order for 140 days of maternity leave, a woman must receive a certificate of incapacity for work, which is issued by a doctor (in the absence of a doctor, a paramedic) at the 30th week of pregnancy (in the case of a multiple pregnancy at the 28th week). Without a certificate of incapacity for work, the employer does not have the right to issue this type of leave.

On the sick leave, the doctor indicates the duration of calendar days of incapacity for work: from 140 calendar days for a singleton pregnancy to 194 days for a multiple pregnancy (for more details, see paragraphs 46-51 of the Procedure for issuing certificates of incapacity for work, approved by Order of the Ministry of Health of Russia dated June 29, 2011 No. 624n).

From the moment of receiving a certificate of incapacity for work, the employee has the right to write an application for maternity leave, the main provisions of which are set out in Article 255 of the Labor Code of the Russian Federation. The order for maternity leave (sample 2021) is presented below.

Sample application for maternity leave

Unified form T-6

This type of document refers to orders for personnel and is subject to storage for 75 years (clause 6 of the List of standard management documents..., approved by Order of the Ministry of Culture of the Russian Federation dated August 28, 2010 No. 558.