What compensation is due upon redundancy?

In addition to registering the reduction in accordance with the requirements of the Labor Code of the Russian Federation, the employer is obliged to correctly accrue payments due to employees. The size and composition of compensation will depend on many indicators. For example, on the average monthly salary of the employee, how long he has been on annual leave, as well as the types of activities of the employer himself. In case of layoff, the employee is entitled to the following payments:

- Compensation in the amount of average earnings;

- Compensation for a period of unemployment if a dismissed employee does not find a new job within one month;

- Compensation for “non-vacation” days of vacation;

- Compensation if an employee quits early. Such payments are due if the employee quits before 2 months following the date of notification of the layoff.

Important! In some cases, employees are also entitled to additional payments in connection with layoffs, for example, in accordance with the local documents of a particular company - employer or region.

What does the law say?

The main legal act regulating the reduction procedure is the Labor Code of the Russian Federation. In accordance with it, the employer must make all payments due to employees. This action is carried out after the relevant order is issued.

There is no unified form of the document, but it is the basis for the accounting department to calculate severance pay and compensation to dismissed employees.

Therefore, it is important to fill out the order correctly, i.e. indicate in it the article of dismissal, a list of employees and other necessary information.

Average monthly earnings and compensation for non-employment

The average monthly salary represents the basic payment upon reduction. The amount of other types of compensation primarily depends on it, since they are calculated based on this value. Compensation is paid on the day of dismissal. The payment, which is intended for the period of job search, is compensation for non-employment. However, the employee will have to confirm that he is unemployed. For this:

- In the first month, documents are presented stating that he does not work for another company.

- In the second month, a work book is presented, which does not contain a record of a new place of work.

- In the third month, the employee brings a decision from the employment service.

Important! After dismissal, the employee must register as unemployed. This must be done within 2 weeks at the employment service.

The average monthly salary is paid as compensation towards the first month of work. If an employee immediately finds a new job, he also has the right to receive such compensation. Thus, a payment in the amount of the average salary to an employee upon layoff is due:

- Once, if the employee immediately gets another job;

- Three times maximum – if the employee is not employed.

Elements of an order

The order can be issued either on a standard A4 sheet or on a special form of the organization. The essence of the latter is that at the top of it are the details of the company whose head is signing the document.

The order consists of three sections:

- The standard header for this document. In it, the order is numbered, details and the name of the organization are written down (if this has not been done previously), and the date of signing is indicated. After that, you can get to the point.

- Main part. The body of the order in the vast majority of cases includes a reference to the law (Article 126 of the Labor Code), the word “I order” and an indication to replace the number of days specified in the employee’s application with material resources.

- Final part. It is fundamentally important that the conclusion contains a link to the employee’s statement (indicating the date of his hiring). Also, at the end, the signature of the manager is required, and, if available, the seal of the organization.

Compensation for early dismissal

The employer is required to notify about the upcoming layoff 2 months in advance. After notification, employees continue to work and receive wages. But some of the workers are offered to resign early, that is, before the end of these two months. If the employee agrees, he is awarded additional compensation. It is calculated based on the employee’s average monthly salary, as well as the number of days remaining until the end of two months (180 Labor Code of the Russian Federation).

Thus, in each specific case, the amount of compensation will be calculated separately; maximum payments upon reduction should not exceed 8 employee salaries.

Employer's liability for non-payment violations

If an employer deliberately violates the Legislation and infringes on the rights of an employee by non-payment of compensation either upon dismissal or for additional days of vacation, he faces administrative, financial and even criminal liability.

Financial liability is assigned for delay and non-payment of funds on time, and if an employee goes to court, he may demand compensation for moral damage, which is also measured in monetary terms, according to a court ruling or if it is prescribed in the regulations of the enterprise.

Important! The amount of interest on overdue payments for each day is equal to one three hundredth of the refinancing rate .

Order for payment of compensation in case of layoff

To pay compensation in case of layoffs, the employer issues an appropriate order. There is no special form for such an order; the employer has the right to develop it independently. Such an order is the basis for the calculation of compensation by the accounting department. No special documents are required from the employee to assign him compensation.

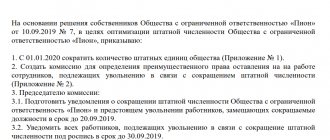

When drawing up an order, it is important to indicate the correct basis for dismissal, indicating the relevant article, and also indicate the following wording: “with payment of severance pay.” The rules for drawing up an order for the payment of compensation are the same as for drawing up other orders. It must be issued on the company’s corporate flank, which should contain the name of the company and its details, as well as the number and date of the order. Here is a sample of such an order.

SAMPLE ORDER FOR PAYMENT OF COMPENSATION IN THE EVENT OF REDUCTION

SAMPLE ORDER FOR PAYMENT OF COMPENSATION FOR THE SECOND MONTH

The manager signs the order, after which it is handed over to the employee for review.

Important! To confirm familiarization with the order, the employee must sign.

If he does not do this, then a separate act is drawn up in the presence of at least two people. Such an act will have legal force and will confirm in case of controversial situations that the employer has formalized everything in accordance with the requirements of the law.

How to format it correctly

Registration is carried out on the appropriate form accepted by the organization. When writing an order, you must include the following required details:

- official name of the organization;

- the name of the document, in this case the word “Order”;

- a heading outlining its essence - “about the payment of severance pay”;

- date of publication – no earlier than the date of the employee’s application or dismissal order;

- registration number in the order book;

- place of compilation - the locality in which the organization is located;

- preamble - a statement of the reasons (termination of labor relations) and the legislative basis of the order (the second paragraph of Article 81 and the first part of Article 178 of the Labor Code of Russia);

- the administrative part, following the word “I order”, is drawn up in the form of numbered paragraphs with a clear and unambiguous presentation that does not allow for misunderstanding;

- basis - a reference to the document that is the basis for issuing the order;

- manager's signature;

- study visa for the dismissed person.

IMPORTANT! In the administrative part of the sample order on payments upon reduction, the full name must be indicated. position and personnel number (if any) of the employee, as well as the performer or person in charge.

The document belongs to the group of orders for personnel. On the reverse side there must be visas of the head of the human resources department and the chief accountant.

Visas for the head of the unit in which the employee worked and for a full-time lawyer are desirable, but in practice, organizations set their own visa rules.

The visa is issued in the form of a signature with a transcript and an indication of the position and date of acquaintance.

There is no need to affix the order with the organization’s seal, since it is intended for internal document flow.

An approximate sample of a dismissal order due to staff reduction with severance pay drawn up in accordance with the specified requirements will be as follows (all information contained in it is fictitious):

on payment of severance pay

dated September 06, 2021 No. 52 Minusinsk

In connection with the termination of labor relations caused by staff reduction (clause 2 of article 81 of the Labor Code of Russia), and in accordance with the provisions of part 1 of article 178 of the Labor Code of Russia.

- Pay the driver Niyazov Damir Dusbolovich a severance pay in the amount of the average monthly salary.

- Retain for D. D. Niyazov the average monthly salary for the period of employment from the date of dismissal until the day of placement in a new place of work for no more than two months, with the deduction of the above-mentioned severance pay.

- Chief Accountant R.N. Sivokurov to make payments to D.D. Niyazov in accordance with this order.

Reason – order No. 40 dated 07/07/2017

Director___________/P. D. Mozgov/

I have read the order_________________/D. D. Niyazov/

Chief accountant_______________________/R. N. Sivokurov/

Head of HR Department__________________/G. S. Vinoradov/

The procedure for notifying an employee and the Employment Center

It is important for the employer to comply with the deadline within which to inform the employee about the upcoming layoff. This must be done at least two months in advance, providing the employee with appropriate notice. After this, information on reduced positions is sent to the Employment Center. Only after this is an order issued on dismissal and assignment of compensation payments to employees (Read also the article ⇒ Reduction of internal part-time workers).

Normative base

Correct execution of an order requires an indication of the current provisions of the Labor Code.

Articles you need to pay attention to:

- Art. 180 – the employer’s obligation to offer another vacancy to an employee dismissed due to layoffs;

- Art. 77 – dismissal is allowed by mutual agreement of the parties with the accrual of monetary compensation and severance pay;

- Art. 83 – termination of an employment contract with an employee who has lost his ability to work;

- clause 1 art. 81 – reduction due to refusal to fill a vacant position when the staffing table changes;

- Part 2 Art. 178 – maintaining the average salary while looking for a job after layoffs;

- part 6 art. 81 – restrictions on layoffs of certain categories of workers;

- Part 4 Art. 256, art. 261 – assigning a place to certain categories of employees;

- Part 3 Art. 178 – payment of two-week compensation in case of layoff due to disability;

- clause 8, part 1, art. 77 – dismissal of a disabled person in the absence of a suitable vacancy or refusal of it.

The main article implementing the rights and guarantees of employees is Art. 180.

Labor Code of the Russian Federation

The employer is obliged to warn employees about the upcoming layoff at least two months before dismissal. Employees are familiarized with the order to reduce staff against signature.

An employment contract, with the consent of the employee, can be terminated earlier than the period specified above, and the company pays additional compensation, which is calculated based on the number of days remaining before the expiration of the notice period.

When is it published?

Dismissal due to reduction is possible if there are clear grounds:

- staff reduction - the procedure is carried out in relation to one employee at the main place or part-time;

- reduction of the entire staff - when closing a branch or liquidating a company.

An employee who has received a non-working disability group or who refuses to move to another city along with a branch of the company can also be fired.

An order for the payment of severance pay is issued after the order for staff reduction is issued and the employees are familiarized with it.

What benefits is an employee entitled to?

Employees laid off due to layoffs are paid:

- wages for the last month - in proportion to the hours actually worked;

- severance pay – one average monthly salary for the month following dismissal;

- compensation - for missed vacation, work on holidays, weekends, etc.;

- average earnings for the second and third months - according to the decision of the Employment Service.

Severance pay, together with salary and other compensation, is paid on the day of dismissal.

The additional payment, by decision of the Employment Center, is issued at the end of the second and third months, if work has not been found during this time.

Foundation documents

Documentation support for the reduction procedure is as follows:

- issuing a redundancy order two months before the upcoming dismissal, indicating the grounds (Article 180, Part 2, Article 73);

- drawing up a new staffing table or changing the current one;

- written notification to the Employment Center;

- familiarization of employees with signature of the decision made;

- offering each employee another vacancy or giving written notice that no suitable positions are available;

- written consent of the employee to dismissal;

- issuance of a dismissal order indicating the grounds;

- issuing a payment order;

- making entries in work books, paying employees on the day of dismissal;

- payment of additional compensation based on a certificate from the Employment Center.

How is sick leave paid after dismissal due to staff reduction? Read about this in our article. Is it permissible to lay off a woman on maternity leave when reducing staff? Find out here.

Order of dismissal at one's own request with vacation compensation sample

And in the last working year, she worked only 10 months and 12 days (since 12 days are less than half a month, the period is rounded down. If the employee had worked 10 months and 16 days, they would have been counted as 11 months). For 10 months worked, Dudnikova I.N. Allowed rest: 28 days / 12 days × 10 months. = 23.3 days. During the final settlement, she was entitled to funds only for 23.3 days, but was paid for all 28 days. It turns out that the employee did not have time to work 28 - 23.3 = 4.7 days in the working year, but received payment for them. If vacation pay received for 28 days amounted to 10,000 rubles, then the following amount must be withheld from Dudnikova’s salary: 10,000 rubles.

- Incorrectly calculated date of dismissal (it is necessary to count 14 calendar days, starting from the next day after filing. The fourteenth day corresponds to dismissal. For example, the application was submitted on March 1, 2 weeks are counted from March 2, the day of dismissal is March 15);

- Adding the preposition “from” to the date of dismissal (for example, if “dismiss from March 15” is indicated, this will mean the possibility of dismissal on any day starting from March 15; it is better to write the date without this preposition);

- Lack of signature (the document will not have legal force, since the request stated on paper will not be supported by anything);

- Writing a statement and having it signed by another person (any person can write the text, but the person resigning must sign it).

Is it mandatory when completing the procedure?

Is. Any order is an order of the employer related to the employee’s work activity and dismissal is no exception. It is also the basis for entry into the work book and there is no other basis for this.

Based on Article 78 of the Labor Code of the Russian Federation, by mutual agreement, it is possible to terminate the employment relationship at any stage. As a rule, the beginning of the dismissal procedure is the sending of a corresponding application by the employee to the employer.

If the employer agrees, he can either put a resolution on the application (and this will be enough to issue an order), or offer to record the dismissal agreement in writing (in order to specify the terms of termination of the contract). The issue of recording such an agreement is not clearly regulated and there are no unambiguous requirements for its execution, so the parties can draw up their own form of this document.

It should be noted that the employer may not sign the employee’s resignation letter until full mutual understanding has been reached and the final text of the agreement has been drawn up. However, forcing someone to enter into such an agreement is illegal and can be appealed in court.

This document is drawn up in 2 copies, one for the employee, the other for the employer. The terms of the agreement should not contain provisions that contradict current legislation. It must contain all the basic information about the dismissal:

- reason (by agreement of the parties);

- date of;

- the amount of material compensation that the employee is entitled to upon dismissal;

- special conditions of dismissal (for example, a list of property that was at the employee’s disposal, as well as the procedure for its transfer);

- signatures of the parties to the labor relationship.

We talked in detail about how to legally correctly draw up an agreement to terminate an employment contract by agreement of the parties here, and in this article you will find the features of documenting the termination of an employment contract.

When all the conditions for terminating the contract are agreed upon, the employer proceeds to drawing up an order.