Application to the labor inspectorate for non-payment of bonus

quoted1 > > Such requests are not considered. How is overtime paid under the labor code? Read how to file a lawsuit against your employer here.

How to draw up an agreement to terminate an employment contract by agreement of the parties, read the link: https://potreb-prava.com/dokumenty/soglasheniya/soglashenie-o-rastorzhenii-trudovogo-dogovora-po-soglasheniyu-storon.html As soon as the stage is completed investigation of the complaint, a separate act is drawn up.

If a violation of the law is confirmed, the employer will have to bear responsibility.

The inspectorate reacts to confirmed violations as follows:

- issues an order - it contains requirements for the immediate elimination of labor violations;

- An employee who violates labor standards is suspended from performing his duties.

- an administrative protocol is drawn up, which records the fact of confirmation during verification of violations (according to the authority of the service);

Attention Complaint to the labor inspectorate about non-payment of bonuses Every employee has the right to complain to the labor inspectorate against his employer if the latter violates labor rights. Such violations include:

- Other violations that are related to the employee’s work activity

- Violation of the work schedule of your employees, as well as their rest schedule;

- Failure to pay compensation benefits;

- Violation of the vacation schedule by the employer;

- Non-payment of wages

Is it possible to complain anonymously?

Any anonymity is contrary to the law; such complaints will not be taken into account, they simply will not be considered!

But what to do if an employee wants to write a complaint, but due to fears of subsequent bias of management towards himself, he does not want his personality to appear during the audit. In this way, you can harm your career.

The solution is to clearly define in the complaint a request to keep personal data unknown to the violator. The applicant has this right of confidentiality, and if he wishes, data on the initiation of his application for verification will not be disclosed without his personal permission.

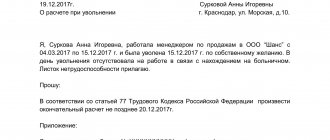

Sample application to the labor inspectorate for non-payment of bonus

Therefore, the complainant is obliged to disclose his personal data.

But, while continuing to work in the organization, he can indicate in the text that he asks, during the process of considering the complaint and checking the facts specified in it, not to advertise his involvement in the preparation of the document. The current legislation protects the interests of workers, so you should not tolerate the arbitrariness of the manager and discrimination of your own rights.

To achieve justice, it is enough to competently draw up a complaint and send it to the supervisory authority. Unfortunately, this cannot be done anonymously. But you can ask the inspectors not to advertise their involvement in the preparation of the document.

Contents: Complaint to the labor inspectorate about non-payment of bonuses Attention Where you can apply If a manager acts contrary to labor regulations, you can file a complaint against him:

- Federal Service for Labor and Employment, known to everyone as the labor inspectorate;

- to the police or prosecutor's office;

- court.

Each of these authorities examines certain violations - from violation of work hours to delays in wages and deprivation of the right to rest. Of course, an ordinary citizen should not understand the intricacies of the functional responsibilities of government agencies.

Therefore, it is better for him to send a complaint to the labor inspectorate. If making a decision on the facts stated in the document is within the competence of Rostrud, it itself will issue an order to the violator of the Labor Code of the Russian Federation with a requirement to correct the situation within a certain time frame. Otherwise, the complaint will be forwarded by the labor inspectorate to the relevant authorities for further consideration.

How can the labor inspectorate help if you have not been paid a bonus?

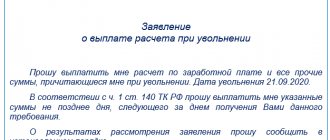

April 21, 2021 According to the norms of labor legislation, on the last day of work of a quitting employee, regardless of the reasons for termination of the employment relationship, the employer is obliged to pay him in full by issuing employment documents and all funds due. It happens that simply in the haste of the calculation, sometimes simply, in the hope of saving material resources, the resigning employee is not awarded the incentive payments (bonuses) due for the actual period worked or compensation for unused days of annual leave.

It is recommended to independently monitor all accruals in order to be able to defend your interests and return the money due. We will help you figure out how you can appeal the amount received and where to go if you read to the end of our article. To check whether all the money has been credited to you, you need to know what the employer must pay according to the law upon settlement.

Art. 140 of the Labor Code of the Russian Federation regulates the terms when the payment must be made: üdirectly on the day of dismissal; üin the case when the employee was not at work for various reasons, he should receive the money the next day after demands are made for the opportunity to collect the amount due to him. Actual money earned for the period after the last salary received until the day of dismissal.

Cash compensation for the remaining days of unused legally required paid leave. Depending on the reason for dismissal (due to layoffs, in case of liquidation of the enterprise) or cases stipulated by the collective agreement, severance pay;

Complaint to the labor inspectorate about non-payment of bonus upon dismissal

/ / 04/16/2018 129 Views 04/16/2018 04/16/2018 04/16/2018 The employer could deprive the employee of a bonus for a disciplinary sanction.

For example, for being drunk at work, an employee is deprived of a quarterly bonus. Such “punishment” must be formalized by an order from the employer, which the employee must also sign. In addition, the fact of violation of labor discipline by an employee must also be documented. It is these documents that labor inspectors will check.

Inspectors are given 30 days to consider the complaint. During this period they must make a decision on the complaint.

As a rule, this is an unscheduled inspection of the employer. If violations are found during the inspection, the inspector will issue an order to eliminate them. If the refusal to pay the bonus is illegal, the employer will be held administratively liable by the inspector. and get a free consultation within 5 minutes.

Despite the clear requirements of current legislation, Russians often encounter violations of labor rights by their employers. However, discrimination should not be tolerated. It is not difficult to restore justice if you know how to write a complaint (application) to the labor inspectorate in 2021.

When receiving a job, a Russian expects a certain work schedule, salary and the right to rest. Unfortunately, not all of his hopes can be justified. Often employers violate labor laws and respond to workers' indignation with the threat of dismissal.

Faced with such a situation, the employee should not give up.

When can you complain?

Labor legislation states that an employee has every right to file a complaint against his employer if he is not paid the due amount of salary:

- As soon as the day comes following the approved day for issuing money to the employee for payment of his work (you need to check with the salary schedule). For example, an employee can receive payment in two payments (advance payment and salary) - one is issued on the 1st, and the second on the 15th,

- If the dispute concerns issues of dismissal, then a complaint regarding it can be sent within one month from the date when all documents are handed over to the employee against signature,

- For 3 months from the moment when the employee became aware that his rights were violated by the employer (this period is determined by Article 392 of the Labor Code of the Russian Federation).

You can send your complaint regarding a labor offense to the inspectorate even if the employee did not have time to submit the statement of claim to the court (the deadline is restored in some situations).

A complaint may be considered by the inspectorate in parallel with the conduct of a trial regarding the violation. The State Labor Inspectorate is authorized by law to conduct investigations into all violations of labor law.

Statement of claim for recovery of premium

According to Art. 191 of the Labor Code of the Russian Federation, the employer has the right to reward employees by issuing bonuses.

Thus, it turns out that the law delegated to the employer the right to pay a bonus without obliging him. However, a bonus is one of the favorite incentives for employees for work performed. Any organization must have a Regulation on Bonuses or another local act that lists the grounds for calculating bonuses, as well as for non-payment.

In accordance with these grounds, the bonus may be paid to the employee in full, some part of the bonus payments may be withheld, or the bonus may not be paid at all.

If you believe that your employer has violated your right to payment of a bonus, and it is necessary to recover the unpaid bonus, our advice will help you.

- It is worth trying to resolve the issue of paying the attached funds without resorting to court. If the employer does not cooperate, enlist the support of a labor dispute commission or trade union. If an agreement cannot be reached, you will have to file a claim in court - and this will be an arbitration or district court. Which court will resolve your claim depends on the location of the defendant (legal address). Draw up a “correct” statement of claim for the recovery of premiums. In your case, the document will need to indicate the following.

Basic information: where the claim is filed (specific court); who is filing the claim (data

Secrets of the payslip

In addition, long-term judicial statistics on the consideration of labor conflicts show that the courts most often take the side of the employee and satisfy his claims. Questions from readers of the RG website about labor relations and disputes are answered by Dmitry Shilov and Oleg Malkin, lawyers of the Independent Analytical Agency "Investkafe". Question: Hello. I am 50 years old. Is there a rule about mothers with many children retiring at 50? I have three children.

The Employer has the right to accrue and pay the Employee a monthly additional bonus, the amount of which should not exceed %.

Complaint to the labor inspectorate for non-payment of bonus

Various nuances in the payment of bonuses In the field of the employment contract “remuneration”, it must be indicated what parameters it consists of.

An employee's income can be created from salary and bonus. In addition, the agreement may contain a reference rule to a provision regarding the procedure for paying bonuses to employees at the enterprise.

The regulations on bonuses reflect general wording. For example, a reference to the fact that if the financial situation at the enterprise is stable, employees may be paid bonuses, but by the decision of the head of the organization. In this situation, it is necessary to understand that paying bonuses to staff is the right of the employer, but not its obligation.

It is important to clarify this in order to write a competent complaint to the Labor Inspectorate about non-payment of bonuses.

If we were talking only about non-payment of wages specified in the employment contract, then writing a complaint, and most importantly, justifying it, pointing to articles of law, would be much easier.

If we are talking about a bonus, then most often judicial practice comes to the aid of the court if a controversial legal relationship regarding non-payment of a bonus causes particular difficulties. If the employment contract clearly states that the components of the employee’s salary are salary and bonus, specific bonus indicators are defined, the bonus is an integral part of the salary.

Thus, the employer assumed the obligation to pay it. If this does not happen, the employee can safely write a complaint to the State Labor Inspectorate. IMPORTANT: If the premium is included

How to properly file a complaint

The law does not define a clear model for this type of complaint, so the format does not have a strict form - the presentation is free. Despite this, some drafting standards should still be followed.

Introductory part

All possible details are indicated in the document being drawn up. This is necessary to initiate a review of the legality of the legal entity’s actions.

What information to provide:

- indicate in full, in accordance with the statutory documents, the name of the structure to which the appeal is addressed (for example, it could be the State Labor Inspectorate of St. Petersburg),

- full name of the party against whom the complaint is being filed. This can be either an organization or a specific individual entrepreneur. The legal address should also be indicated,

- identify yourself as an applicant - indicate your full name, response address, contact phone number and other contact information.

Note! The inspection will not consider messages if they do not contain the applicant’s data. This complies with the rules and is completely legal.

All appeals on behalf of a group of persons must involve their listing. This way you can see on behalf of whom the application was submitted.

Descriptive part

Violations of the rights of its employees committed by the employer are listed here. Provide information accurately and concisely (to the point).

When describing the situation, please include the following information:

- When exactly the employee was employed, the date of official registration for work must be documented. Similarly, when indicating the fact of dismissal, if the complaint is related to the failure to pay the employee in full,

- what position the applicant held,

- when was the official last time payment was made to the employee,

- on what day should wages be paid (this point is set out in the employment or collective agreement, as an option - contact the specialist responsible for salary accruals for information),

- what method is determined by the parties for transferring wages to an employee (crediting to a bank account, issuing through a cash register in cash, etc.),

- total number of days of delay in payment of labor (indicated at the time of document execution),

- the amount of the amount due to the employee as payment for his work (when part of the salary is not given, indicate the exact amount),

- describe exactly what the employer explained about the violation when contacting him in writing.

Final part

In it, the applicant describes the exact requirements put forward upon applying to the inspection:

- demand that the violator immediately eliminate the resulting debt and pay the appropriate amount as compensation for the delay in payment (to determine the amount, 1/300 of the refinancing rate is taken from the amount earned for each day of non-payment). The inspectorate formalizes such a decision in the form of a separate order and transmits it to the employer,

- bring the violator to administrative responsibility in accordance with the Code of Administrative Offenses of the Russian Federation (Article 5.27),

- If the fact of violation is confirmed, bring the culprit to justice if there is a crime under Art. 145.1 of the Criminal Code of the Russian Federation (non-payment of wages and other payments). To do this, the inspectorate sends the materials collected during the inspection to the law enforcement agency, so that the service can resolve the issue of initiating a case on the fact of deliberate actions.

When presenting the circumstances, refer to legal norms. It can be indicated that the employer intentionally, contrary to the obligations established by Art. 236 of the Labor Code of the Russian Federation, did not pay compensation, although there was a fact of delay in payment.

How to file a complaint with the Labor Inspectorate against an employer?

Applications

When drawing up an application to the inspectorate regarding non-payment of wages, the following attachments will be required:

- an employment contract drawn up between the parties (its copy),

- order confirming the fact of dismissal of the employee, if any (copy),

- employee’s work book (its copy),

- civil passport for identification of the applicant (copy).

All names of documents contained in the application are listed at the end. Opposite each document is written how many pages it contains.

If the document is drawn up by one person, then his personal signature must be present; if we are talking about a collective appeal, each applicant must sign with a decoding of his personal data. Be sure to include the date the document was drawn up.

Watch the video. When to contact the labor inspectorate:

What should an employee do if he has not been paid a bonus?

The bonus is perhaps the most pleasant part of the income.

Any money that is paid for conscientious work or special merit serves as excellent evidence that the employee is valuable and important to the organization.

At the same time, it’s no secret that in many organizations the bonus can be significantly higher than the salary, which allows, not entirely honestly, but still saving on taxes.

However, what if the bonus is not paid? Does this mean that your work is not appreciated, or is it an indicator that the employer simply wants to deprive you of the earnings you deserve? We will tell you in our article about when you need to pay a bonus to an employee and what he should do if he has not received the money.

A bonus can be considered any income that an employee receives for his work in excess of his salary. Bonuses (also sometimes called incentive payments) can be very different, but they all have one goal - to reward an employee for high-quality and conscientious work, compliance with labor standards, or simply long service. In this case, awards should be divided into several groups:

- Bonuses awarded for achieving certain goals.

- Bonuses accrued on certain dates or terms: 13th salary, annual or semi-annual bonus, monthly bonus for the best employee, etc.

- Bonuses for certain employees for the performance of their work;

In fact, practically none.

Although bonus payments are equated to the employee’s earnings, the employer himself has the right to decide whether to pay a bonus or not.

Complaint to the labor inspectorate about non-payment of bonus

Every employee has the right to complain about his employer to the labor inspectorate if the latter violates labor rights. Such violations include:

- Failure to pay compensation benefits;

- Other violations that are related to the employee’s work activity

- Violation of the vacation schedule by the employer;

- Non-payment of wages

- Violation of the work schedule of your employees, as well as their rest schedule;

Failure to pay a bonus is considered a violation only if the obligation to pay it is specified in the employment contract. In other cases, the bonus is paid to one or another employee at the discretion of the employer.

However, if an employee believes that he was undeservedly not paid a bonus, he has the right to write a complaint to the labor inspectorate at the place of registration of the employer.

A written application to the labor inspectorate must contain the following information:

- Full name of the territorial body of the federal labor inspectorate. A complaint against employers registered in Moscow and the region is filed with the State Labor Inspectorate of Moscow

- "Body" of the complaint.

- Information about the applicant - his full name, address of residence, place of work, as well as the position he holds;

Methods for filing a complaint

The standard option is to send a registered letter with notification. In this case, delivery of the application takes at least a week. It is best to take the complaint to the labor inspectorate reception desk yourself so that the secretary can mark the incoming document.

Currently, the most convenient way is to file a complaint electronically through the official website of the Ministry of Labor - Onlineinspektsiya.rf . Citizens can use the following services:

- Submit an electronic complaint, the response to which should come after a month.

- Get advice from the labor inspectorate officer on duty. In this case, the employee will receive a detailed response within three days.

- Check for existing violations online yourself.

- Make an appointment with a labor inspectorate specialist.

To file a complaint through the labor inspectorate, a citizen must be registered on the State Services website and have a confirmed electronic record.

How to write a complaint to the labor inspectorate about non-payment of bonuses, sample

Maria Ivanova, lawyer In accordance with Art.

The law does not establish a fixed form of complaint, but it must meet the requirements for formalizing business correspondence, as well as paragraph 1 of Art. 11 of the Law of May 2, 2006 No. 59-FZ “On the procedure for considering appeals from citizens of the Russian Federation.”

129 of the Labor Code of the Russian Federation, the concept of “wages”, along with additional payments and bonuses of an incentive nature and other incentive payments, also includes bonuses to employees, which are classified as incentive payments. Accordingly, late payment of bonuses entails the same consequences as delay in payment of the main part of wages.

Thus, according to Article 236 of the Labor Code of the Russian Federation, if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation). Right or obligation? The legislation establishes that wages consist of three parts: remuneration for labor, compensation payments and incentive payments (Art.

129 of the Labor Code of the Russian Federation) and in accordance with labor legislation is mandatory for payment.

At the same time, Articles 22, 191 of the Labor Code of the Russian Federation establish that the employer has the right to encourage employees. When is paying bonuses a right, and when is it an obligation? From judicial practice: B. appealed to the Presnensky District Court.

Moscow with a claim to the court for the recovery of bonuses for the 4th quarter of 2011, bonuses based on the results of work for 2011, compensation for the delay in payment of bonuses on the day of actual payment at the rate of 0.04% per day. In the statement of claim she indicated that she was in an employment relationship with the defendant from April 15, 2010 to November 11, 2011, and was dismissed by agreement of the parties.

In January 2012 B.

Bonus after dismissal

The annual bonus is calculated for a full calendar year.

When an accountant calculates remuneration, he must take into account many factors: dismissal at his own request or by agreement of the parties; actual time worked; employee experience. Upon dismissal of one's own free will: if a person worked well and had no reprimands or fines, the annual remuneration is accrued regardless of whether he quit or not. Incentives are calculated based on the company's performance in the new billing period. The employee has the right to apply to the arbitration court after three months after non-payment of the amount due.

When dismissing by agreement of the parties: this dismissal option is a peaceful agreement between the resigning employee and the manager. You need to draw up a document in which all payments will be spelled out: salary, incentive bonuses, bonuses.

If the employee quit before the order for annual compensation was issued, this fact must be stated in the agreement, as well as the procedure for receiving the bonus after dismissal and the amount of the amount.

When calculating remuneration already paid, an error may be discovered that leads to an overestimation or underestimation of its amount. Errors can be counting or they are associated with incorrect application of accrual rules. If an error led to an underestimation of the premium, it can be corrected by adding the required amount of incentives.

If the amount of the bonus paid is too high, the employer who wants to return the overpaid money must go to court. The court's decision will be positive if it can be proven that a counting error was made. If any other error was made when calculating remuneration, the former employee has the right not to return the excess amount paid to him.

Get rid of the rush and routine, check out all the features of the service for free for 30 days. The procedure for terminating an employment relationship is strictly regulated. In general cases, when the initiator was the employer or the employee himself, dismissal is carried out in accordance with a strictly established procedure.

The Labor Code of the Russian Federation provides that, regardless of who initiated the termination of labor cooperation, the employer is obliged to make a full settlement with the employee. Full settlement means not only the accrual of required amounts, but also the withholding of the due money. This procedure is legal, since after termination of the contract the parties cease all legal relations and the fact of non-payments or overpayments can only be proven in court.

The difference between the accrued funds and the withheld funds must be given to the dismissed person or transferred to a bank card no later than the day of his dismissal. Most organizations introduce a regular bonus system, when the bonus is allocated not according to the personal desire of management, but according to the results of work.

Bonus systems are different; they can be calculated individually or collectively, issued monthly, quarterly or once a year. Be that as it may, only those employees who have a bonus clause specified in their employment agreements or such a clause is established by other local regulations of the enterprise can apply for a bonus.

But even the presence of an agreed clause nullifies the claims if, for example, the results of the work were unsatisfactory and there was no profit for the specified period. In addition to the profitability of the enterprise, it is also worth paying attention to exactly what wording is written in the documents.

Many employers stipulate the conditions for calculating bonuses so cunningly that in some cases, upon dismissal, the employee automatically loses the right to receive them. Any employee of the organization has the right to a bonus, unless it is a collective and not an individual reward.

Performance bonuses are awarded to main employees, temporary employees, part-time employees, and even those on a probationary period. In exceptional cases, financial incentives are not paid, for example, when employees are laid off due to lack of profitability of production. If bonus payments are specified in one of these documents, then the employee can count on receiving them, but subject to mandatory consideration of the conditions specified in the LLP.

A monthly bonus is usually paid before dismissal, along with other compensation benefits. But even here there may be variations, if bonuses imply a monthly calculation of profit and the establishment of a percentage depending on the value of this indicator, then it is quite possible that the chief accountant upon dismissal will not be able to calculate it without having data.

It should be borne in mind that the calculation of the amount of bonuses will be made based on the period worked, and not on the period of time for which they are provided. Premium payments for a quarter or year are paid after the specified period.

This is due to the need to prepare all documentation for the past period and calculate the possible percentage of incentives for well-coordinated work. Of course, this approach does not make it possible to pay these amounts upon dismissal, so they are paid in the same way as to main employees. However, such a calculation will not be final.

Upon dismissal, the estimated amounts are calculated based on the funds actually earned over 12 months. When calculating quarterly or annual amounts, the previously taken income automatically increases, which makes the previously made calculation of compensation incorrect. For this reason, together with the calculation of the bonus, the employer is obliged to recalculate the amount of estimated compensation, as well as deduct income tax from the difference to the state budget. If we operate with the norms of the Labor Code, then it is impossible to refuse to pay bonuses to a dismissed person.

Labor legislation establishes only one limitation for such accrual - the correspondence of payment to time worked. In practice, obtaining quarterly or annual amounts is not so easy.

The reasons may not be documented. Therefore, each individual case of non-payment requires separate proceedings. The Krasnoglinsky District Court of Samara considered the case on the claim of a dismissed employee, with whom timely payments for quarterly bonuses were not made. The plaintiff made demands for the payment of a quarterly bonus to her, as well as the accrual of penalties for the delay in monetary incentives.

Before the start of the court hearing, the employer paid bonuses in full, but without taking into account compensation amounts. The plaintiff adjusted her demands, declaring her desire to collect a penalty for issuing quarterly bills. The defendant presented local documents that indicated the organization’s procedure for paying quarterly incentives. They indicated that the bonus was calculated on the 1st day of the second month, which follows the already completed quarter.

And the entire period until the end of the current quarter is allotted for the payment of quarterly accruals. This is what was done in relation to the fired person. Therefore, the defendant considered the demands for compensation to be unlawful. The court examined the case and found that a violation of legislative norms regarding the calculation and payment of bonuses had not been established, and therefore the plaintiff did not receive satisfaction for this segment of claims. The remuneration systems operating in modern conditions very often form salaries by composing them from several parts of Art.

One of these parts is incentive payments, which include bonuses. As a rule, a bonus included in the remuneration system is awarded for work results over a period of time and is a fairly regular payment. In order for the bonus to have legal force, all the rules for calculating it must be reflected in one of the internal regulations of the employer, agreed upon with the representatives of the labor collective by the trade union. Among such acts, the Labor Code of the Russian Federation includes Art.

We invite you to familiarize yourself with: Real Estate Donation Agreement

Usually, the document on bonuses also indicates those situations in which an employee is deprived of the right to receive a bonus. It is mandatory that each employee is familiarized with the contents of the regulatory act on bonuses against receipt. As a rule, the premium is accrued after the completion of the period to which it is associated. And in relation to a dismissed employee, such an accrual may occur after his dismissal.

However, since the bonus is part of the remuneration system, the fact of dismissal does not deprive the dismissed person of the right to receive the bonus accrued to him after dismissal, but for the period of his work with the employer, a letter from the Ministry of Finance of the Russian Federation dated Therefore, despite the presence in the Labor Code of the Russian Federation of Art. The bonus, justifiably accrued to the resigned employee, by the employer in the month of accrual will be included in the labor costs taken into account when determining the profit base of the letter from the Ministry of Finance of the Russian Federation from the Condition for including the bonus in the expenses is a mention of it in the employment contract or other local legal acts.

Accordingly, in correspondence with account 76, you must also make an entry for calculating the amount of personal income tax to be withheld from the premium, sub. The amount of the bonus must be subject to insurance premiums in the usual manner, letters from the Ministry of Labor of the Russian Federation from the Accrual of contributions will be displayed by standard entries for attribution to expenses, breaking down the amounts into the corresponding subaccounts of the account Dt 20 23, 25, 26, 44 Kt Since the bonus to the dismissed person is accrued in a period beyond that period of time, which is calculated to determine the average earnings needed to calculate compensation for vacation, it will affect this average earnings only in one case: if the bonus is paid for the year preceding the year of dismissal.

Clause obliges such bonuses to be taken into account in calculating average earnings, regardless of the time of their actual payment. Therefore, in the case of payment of an annual bonus, the dismissed person will have to recalculate the compensation for unused vacation actually paid on the day of dismissal, and not only pay the employee the missing amount, withholding personal income tax from it , but also add additional insurance premiums to the amount of compensation for the vacation, Art.

Disputes regarding non-payment, reduction and late payment of bonuses

From judicial practice: Full name 1 appealed to the Ust-Labinsky District Court of the Krasnodar Territory from (.) with a claim against “(.)” for the recovery of bonuses and compensation for moral damage.

Asked the court to cancel the order (.) -P from (.)

“On amendments to the order dated (.)-P “On material incentives for employees “(.)”

; recover from the defendant in his favor (.) rubles - the amount of the unpaid part of wages, (.) - compensation for the established deadline for payment of wages, (.) - indexation of the amount of delayed wages due to their depreciation due to inflation processes, as well as compensation for moral damage in (.) rubles.

The court decision dated (.) partially satisfied the stated claims. Order (.)-P from (.)

“On amendments to the order dated (.)-P “On material incentives for employees “(.)”

canceled. With MCU

“Centralized accounting of healthcare institutions “(.)”

(.) was recovered in favor of Full Name 1, of which: (.) the amount of the unpaid part of the salary, (.) rub.

- compensation for violation of the established deadline for payment of wages, (.) - indexation of the amount of delayed wages due to their depreciation due to inflationary processes. From “(.)” in favor of Full Name 1, (.) rubles were recovered for compensation for moral damage.

A state duty in the amount of (.) rubles was collected from “(.)” to the state. The defendant filed an appeal with the Krasnodar Regional Court, demanding that the decision of the court of first instance be canceled and the claim denied.

Collection of unpaid premiums through court

October 08, 2021 30408 Payment of bonuses is one of the methods of rewarding employees for performing their job duties. And it is precisely on the topic of determining the frequency of payment of bonuses that labor disputes often arise between the employer and the employee.

How are bonuses assigned to employees and is it possible to recover unpaid bonuses through the court? We will talk about this in our article. Excellent work, as is known, should be rewarded by the employer with bonus payments.

In accordance with the definition noted in the Labor Code of the Russian Federation, bonuses to employees are an increase in wages that is not fixed and has no restrictions on the characteristics of professional activity. The assignment of bonus payments is based on labor and collective contracts and agreements that do not contradict the legislative framework of the Russian Federation.

The number and frequency of bonuses are not limited by any legal aspects, and these incentive payments can be accrued based on the results of the year, quarter or month, depending on the wishes of the employer. Differentiation of the amount of bonus payment can be made taking into account the position and length of service of employees. Based on these nuances, an employee can recover unpaid bonuses from the employer in the manner prescribed by law.