The procedure for calculating maternity payments when going on maternity leave is very different from the one that applies when determining the amount of vacation pay and compensation for sick leave in the general case.

Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

Maternity benefits are always paid as 100% of average earnings, and the length of service of the employee does not matter, except in situations where it does not exceed 6 months.

Deadline for maternity leave

The concept of maternity leave is not enshrined in labor legislation. Typically, maternity leave refers to two periods:

- Maternity leave.

- Child care leave up to 1.5 years (paid period).

Maternity leave is necessary for an employee to prepare for the upcoming birth of a child, as well as for postpartum recovery. It is provided only to a pregnant woman; other members of her family cannot take leave. Also, leave can be granted to the adoptive mother, provided that she has taken into the family a child under the age of 3 months.

In the standard case of a singleton pregnancy, maternity leave is issued at the 30th week of pregnancy, when approximately 70 days remain before the upcoming birth. This period can be determined in different ways by agreement with the doctor. Most often, the duration of pregnancy is determined as the obstetric period - it is calculated taking into account the first day of the woman’s last menstrual cycle.

But it is also possible to count the duration of pregnancy by gestational age. It differs from obstetric by an average of two weeks and is determined by ultrasound examination.

Another way to determine the timing of pregnancy is:

- Counting from the date of embryo transfer if pregnancy resulted from IVF.

- Counting from the date of conception (if it is known to the woman).

In some cases, women have the right to early maternity leave until the 30th week of pregnancy . In particular, during multiple pregnancy, when living in environmentally unfavorable conditions, and during premature birth.

If a woman is carrying twins, she is given leave at 28 weeks of pregnancy , or 84 days before giving birth. When a woman learned about a multiple pregnancy only during childbirth, her standard sick leave will be extended to 194 days for the postpartum period.

In case of premature birth (before sick leave was issued), the entire maternity leave will consist only of the postpartum period. After the birth of the child, the woman will be given sick leave for 156 days.

Women who live in environmentally unfavorable regions are issued sick leave for pregnancy and childbirth earlier . We are talking about regions of pollution after the accident at the Chernobyl Nuclear Power Plant, the Mayak Production Association or the dumping of waste into the river. Techa. The specified categories of employees are granted leave for a period of 27 weeks, or 90 days before giving birth.

The adoptive mother's decree is issued upon the adoption of the child with a duration of 70 days . If a woman takes two or more children, her leave will last 110 days.

A woman cannot influence the timing of maternity leave, since they are enshrined in law. But she has the right to go on maternity leave in advance by writing an application for annual paid leave (the employer may refuse to issue annual leave before maternity leave outside the schedule), or to go on sick leave for health reasons.

A pregnant employee also does not have the right to arbitrarily postpone the date of maternity leave. According to the provisions of Order of the Ministry of Health No. 624n, a woman can refuse to issue a sick leave within the allotted time frame, which the antenatal clinic staff will have to document.

But if the pregnant woman then decides to get sick leave, it will be issued to her retroactively. The start date of sick leave will still be indicated as of the 30th or 28th week of pregnancy.

When on maternity leave

If a woman is expecting one child, then she is entitled to maternity leave from the 30th week of pregnancy (about 7 months), and the period of maternity leave will be 140 days (70 days prenatal and 70 days postpartum).

Date of birth and maternity leave calculator

In weeks, the gestational age is 40 weeks from the first day of the last menstrual period. The calculation principle of this calculator is the same as that used by an obstetrician in a clinic, but this calculation only shows the approximate date of birth. According to statistics, only 1 out of 20 women gives birth on the calculated day, the rest give birth 1-2 weeks earlier or later than the expected pregnancy.

You can calculate the timing yourself - from the PDP of November 20, 2019, you need to subtract 70 days of the prenatal period according to the calendar, the result will be September 11, 2019. Next, 140 days of maternity leave are added to the date of sick leave, resulting in the end date of the leave - 01/28/2019.

- 1 — check the box next to the phrase “PDPM”;

- 2 - enter 12/01/2019 in the field on the right or select the corresponding day on the calendar;

- 3 - a singleton pregnancy is indicated (it is not yet known exactly, but in 95% of cases this is exactly the case).

According to PDPM

- Decide on the method of calculations. If the date of birth expected by the doctor is known, then this is enough to make accurate calculations. If you don’t know, then you need to remember when your last period began and select this day on the calculator calendar.

- Select the appropriate method for calculating maternity leave.

- Specify the appropriate date - manually in the format DD.MM.YYYY or select it on the calendar, which will open by clicking on the field.

- Indicate how many children you are expecting - one or more.

- A typical singleton pregnancy lasts 140 days.

- Complication of a pregnant woman’s working conditions due to a polluted and dangerous environment – 160-176 days.

- Singleton pregnancy with complications – 156 days.

- Multiple pregnancy - 194 days.

Calculating maternity leave using our calculator is very simple. To do this, enter the date of the first day of your last menstruation and the number of days of annual leave, if you take it before going on maternity leave.

How to calculate the date of maternity leave

The calculation is carried out according to the formula : 30 weeks of pregnancy are added to the date of the first day of the last menstruation (obstetric weeks). You can go on maternity leave earlier if you take annual leave right before going on maternity leave (if you did not take it earlier in the current year). Then the pregnant woman will go on maternity leave at 26-28 weeks.

We recommend reading: Will the Honorary Donor Benefit Increase in 2021?

When calculating maternity and child benefits, the number of days 731 can be reduced. When calculating, it is necessary to exclude: 1) periods of temporary incapacity for work (regular sick leave), maternity leave (maternity leave), and parental leave; 2) the period of release of the employee from work with full or partial retention of wages in accordance with the law, if insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued for the retained wages for this period (downtime due to the fault of the employer, etc.).

Duration of maternity leave

The duration of maternity leave is not calculated based on length of service, but is provided in a fixed amount.

In case of a normal singleton pregnancy, the period of maternity leave is 140 days (70 days before and after childbirth). This is exactly the period of standard sick leave for pregnancy and childbirth. The doctor or pregnant woman cannot change the indicated duration at their own discretion.

In case of multiple pregnancy, sick leave is issued for 194 days (84 days before birth and 110 days after). If childbirth occurs before the sick leave is issued (between 22 and 30 weeks), then maternity leave is provided for 156 days.

In case of complicated childbirth (for example, by caesarean section), 16 days are added to the standard duration of maternity leave of 140 days. As a result, its duration is 156 days (70 days before birth and 86 after).

Maternity leave when living in environmentally unfavorable conditions is provided 90 days before childbirth, the postpartum period will be 70 days (160 days in total).

Calculation of leave before maternity leave

As mentioned above, an employee can take another annual leave before going on maternity leave.

Registration and calculation of vacation pay is carried out according to a standard scheme with the calculation of amounts for calendar days worked per year, that is, the scheme is the same as for other employees.

Leave before maternity leave lasts 28 days, and immediately after the next leave must be issued to the employee, already related to maternity leave.

The rules apply to all employees and for a pregnant woman going on annual leave immediately before maternity leave, the general provisions from the Labor Code of the Russian Federation apply.

Vacation pay must be accrued 3 calendar days before the employee goes on vacation. The accrual of vacation pay should not affect the amount of benefits paid to an employee going on maternity leave.

Maternity payments: procedure for registration

Art. deals with the issue of registration of maternity leave. 255 of the Labor Code and section 8 of the Procedure for issuing a certificate of incapacity for work of 2011 No. 624-n.

An employee going on maternity leave requires submitting a written application for maternity leave to the employer, accompanied by the original sick leave certificate. A sick leave certificate is issued at the antenatal clinic at the 30th week of pregnancy. Here are the start and end dates of maternity leave and its duration, which the employer must take into account in the calculations.

A sick leave certificate can be issued by an obstetrician-gynecologist from the antenatal clinic, or, in his absence, by a paramedic or general practitioner. The day the sick leave is issued coincides with the day the pregnant woman is registered. For example, if it was Tuesday of the 7th week of pregnancy, then sick leave is issued on Tuesday of the 30th week of pregnancy.

A sick leave certificate is issued at the woman’s next visit to the doctor . Usually, the doctor notifies the woman in advance of the need to bring a set of documents for sick leave to the next appearance.

The employer is obliged to provide his pregnant employee with maternity leave based on her application and does not have the right to refuse her. Vacation is provided outside of the schedule.

After receiving a written application from an employee to grant her maternity leave, the employer must accrue maternity leave to her within 10 days. The payments themselves are made on the next payday. It is worth considering that maternity benefits are paid by the employer, and then he is compensated for expenses based on sick leave from the Social Insurance Fund.

After maternity leave ends, based on the woman’s application, she is granted parental leave for up to 1.5 years (or up to 3 years). A woman cannot receive a salary and maternity, maternity and child benefits at the same time.

If a woman has not taken maternity leave, she has the right to immediately take parental leave.

How to use an online calculator

An online calculator allows you to more conveniently and quickly calculate the desired date. To carry out the calculation, you need to enter the data in the fields:

- date of the PD or PDMP;

- expected number of children;

- Will vacation be taken?

When you enter all the data, the calculator displays:

- day of maternity leave;

- how many days are left until it;

- current gestational age.

When indicating the use of annual leave before maternity leave, the calculator will calculate how many days are left before it.

How to calculate

Here is the procedure for calculating maternity benefits.

Step 1. Determine the billing period.

For employed women, maternity benefits are paid in the amount of their 100% earnings for the 2 years preceding maternity leave. In this case we are talking about calendar years. For example, if a woman goes on maternity leave in 2021, then her income for 2017-2018 will be taken into account. Moreover, it does not matter when exactly she goes on maternity leave: in January or December 2021.

After determining the average daily earnings for two years, the resulting value is multiplied by the number of days for which sick leave was issued. Despite the simplicity of the formula used, the employer should take into account a number of conditions and restrictions.

The billing period may be changed in exceptional cases: if over the previous two years a woman has been on maternity leave or maternity leave for at least one day. In these situations, it has the right to replace the years with previous ones. But a woman is not obligated to replace years if she loses money as a result. Replacement of years is carried out solely at her request on the basis of a written application.

For example, an employee goes on maternity leave in 2021. In 2018, she worked fully, and part of 2021 was on maternity leave (since 2015). In this situation, she has the right to replace 2021 with 2014.

Step 2. Determine the total amount of income for two years.

To determine the amount of earnings, you need to take into account all payments from which contributions to the social insurance fund were paid: salary, bonuses and bonuses.

Sick leave, paid benefits, income under a civil contract and other amounts from which contributions to the Social Insurance Fund were not paid are excluded from the calculation.

The total income obtained as a result of calculations must be compared with the legally established limit of income from which contributions to the Social Insurance Fund are transferred. In 2021 it is 718 thousand rubles, in 2017 – 755 thousand rubles, in 2021 – 815 thousand rubles. If the employee’s annual earnings do not exceed the specified value, then it can be taken into account. If income exceeds the limit, then calculations are carried out according to the maximum value.

Step 3. Determine the number of days that are involved in the calculations.

The formula for calculating maternity leave does not always include the figure of 730 days for two years.

After income has been calculated, the employer should exclude from the calculation period of 365 and 366 days the periods when the employee was on sick leave, parental leave or maternity leave. Administrative leave is not excluded from calculations.

Step 4. Determine the average daily earnings.

As a result, the employer now has two important indicators for calculating average daily earnings: total income for two years and the number of days in the pay period. By dividing one by the other, you can get the average daily earnings.

Step 5. Compare the average daily earnings with the minimum and maximum values established by law.

Earnings per day must be compared with the minimum and maximum limits established by law. It should not be less than the amount of earnings determined by the minimum wage, and greater than the value determined on the basis of the maximum income from which contributions to the Social Insurance Fund are transferred.

The minimum minimum maternity leave guaranteed by law is calculated on the basis of earnings, which is determined by the formula: minimum wage * 24 / 730 days. The minimum wage changes regularly, and as a result, the minimum wage for maternity leave also increases.

Thus, based on the minimum wage as of May 2021 (11,163 rubles), the minimum average daily earnings is 367 rubles . If the employee gets less, then the minimum wage value is taken into account.

If the employee was employed on a part-time basis, her average earnings are calculated in proportion to the length of working time. This means that when working part-time, the minimum is considered 50% of the minimum wage.

Also, the average daily earnings received should be compared with the amount of earnings, which is determined on the basis of the marginal base for the purpose of calculating insurance premiums. To do this, two income limits for previous years are summed up and the resulting value is divided by 730.

Thus, for women who go on vacation in 2021, the maximum value of average daily earnings is 2,150.68 rubles. It is defined this way:

755,000 (limit for 2021) + 815,000 (limit for 2021) / 730 days.

Step 6. Compare the resulting maternity leave size with the minimum and maximum values.

As of 2021, the minimum amount of maternity payments that a woman is entitled to with a standard length of leave is 51,380 rubles. This value is calculated based on the minimum wage of 11,163 rubles.

Minimum maternity leave is determined by the following formula:

11163 * 24 months / 730 days * 140 days of sick leave.

If a woman worked full-time, she will not receive less than the specified amount of maternity leave. With an incomplete day, the figure is proportionally reduced. Minimum maternity benefits are provided to women with less than six months of experience and individual entrepreneurs.

The maximum benefit amount in 2021 in the general case (for a vacation lasting 140 days) will be 301,095.20 rubles. = (755000 + 815,000) / 730 * 140.

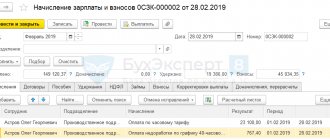

Let's give an example of calculating maternity benefits . Employee Ivanova is going on maternity leave in February 2021. In 2017-2018, she was not on maternity leave or child care leave, therefore, these years will become the calculation period.

The employee was on sick leave for 45 days during the specified time. The employee’s income for 2021 (excluding sick leave payments) amounted to 625 thousand rubles, for 2021 – 956 thousand rubles. Income for 2021 exceeded the limit of 815 thousand rubles, so earnings within the limit will be included in the calculations.

Average daily earnings will be calculated as follows:

(625000+815000) / (730 – 45) = 1440000 / 685 = 2102.19 rubles. The resulting value does not exceed the limit for 2021.

The sick leave was issued to the employee for the standard 140 days . It will be paid in the amount of 100% of the average daily earnings: 2102.19 * 140 = 294306.6 rubles.

When is sick leave issued for pregnancy and childbirth?

A bulletin on pregnancy and subsequent births is issued by an obstetrician-gynecologist. In small settlements, a paramedic has the right to do this. The above form is issued at 30 weeks of gestation. If the expectant mother wishes to postpone her guaranteed period of care for rest to a later time in order to continue working, the doctor is obliged to make a note about this in the outpatient card. The issuance of a ballot at the 28th week may be due to the pregnancy of more than one child.

Basis for calculating maternity benefits

To receive maternity benefits, the following documents are required (clause 5, article 13 of Federal Law No. 255 of December 29, 2006):

- “maternity” sick leave, which contains the corresponding disability code;

- certificate of income received from another employer;

- application for payment of benefits;

- work book and certificate of recognition as unemployed (if benefits are provided to a woman on maternity leave who worked in a liquidated organization or for an individual entrepreneur who has ceased operations).

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!