Start date and duration

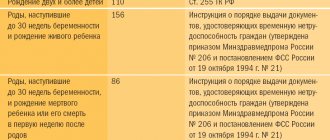

In the case of a multiple pregnancy (two or more children), rest from work begins at 28 weeks. Moreover, the period that remains from this moment until childbirth is approximately equal to the duration stated in the Labor Code of the Russian Federation - 84 days.

The second part, by law, must last 110 days. But if less than 84 days pass from the beginning of the first part of maternity leave to the date of birth, then the second part automatically becomes longer, and vice versa, if childbirth occurs, for example, after 90 days, then the second part will decrease by 6 days and will be equal to 104 days.

Thus, we can conclude that, despite the fact that in the legislation leave due to pregnancy and childbirth is divided into two parts, in practice it is calculated as one period.

One sick leave is also issued for two periods at once.

If a woman is pregnant with twins, maternity leave will be 194 days for normal childbirth, and 210 days for complicated childbirth.

According to general principles, a woman pregnant with twins goes on maternity leave at 28 weeks.

Thus, the pregnant woman herself can approximately calculate the date of departure. But only a gynecologist can determine the exact date and month.

Usually the period before childbirth is approximately 70 days, but this does not mean that if they occur earlier, the duration of the vacation will be reduced.

For officially working women

The following documents will be needed for registration:

- A certificate of incapacity for work, which a woman receives at the consultation where she is registered. It is issued immediately for the entire period, with the exception of an additional 16 days. That is, in the case when a woman is pregnant with twins, sick leave will be issued for 194 days.

- Application for maternity leave. It can be written in free form. The starting date is the number indicated as the beginning of the sick leave. The end date can also be taken from the sick leave, or you can write the duration of the vacation in days.

An approximate text in the application will read as follows: “I ask that you grant me maternity leave from 06/01/2017, lasting 194 days.”

These are the main documents that are provided at the time of registration. In addition to them, there may be additional ones:

- Sick leave for 16 days, issued if complications arise during childbirth, such as a caesarean section. It is issued, as a rule, after newborns are born. And that means it is provided later than the main sick leave.

- Certificate of registration at a medical institution in the early stages of pregnancy. This certificate can be issued before the sick leave begins.

- Certificate of salary for the previous two years in the case where the woman does not have the required length of service in her current job.

In the case of maternity leave, payment can be received at all places of work. This means that if, in addition to her main job, a pregnant woman also works part-time, she must receive as many sick leaves as she has jobs. But there is one nuance here - you can receive payment only if your work experience is more than two years.

Maternity leave can only be granted to those women who are officially employed at the time the sick leave is issued.

The unemployed are not entitled to sick leave due to pregnancy and childbirth. But there are exceptions to this rule, and the following categories of women will be able to apply for maternity leave and its payment:

- if within a year from the date of termination of the employment contract at the last place of work, the woman applied to the Employment Center and received unemployed status;

- if she was dismissed from her previous job as a result of staff reduction or in connection with the liquidation of the enterprise;

- full-time students;

- military personnel.

In all these cases, registration will proceed in the same way as in the previous case.

Based on the above, the following conclusions can be drawn:

- Maternity leave for multiple pregnancies, that is, when a woman is expecting the birth of two or more children, will be 194 days;

- It starts 84 days before your expected due date.

For information on the rules for applying for maternity leave, see the following video:

Still have questions? Find out how to solve exactly your problem - call right now:

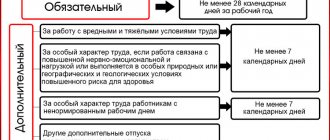

Fringe benefits

A woman pregnant with twins or triplets can count on regional payments , which are set depending on the budget of the region in which she lives. Also, the expectant mother of twins can count on receiving maternity capital, since two babies were born at once.

Some regions, in the event of the birth of triplets, pay the mother an allowance until the last born child turns three years old. Also, in some regions, for the third born child, parents are given a plot of land.

A document on the basis of which a pregnant woman can qualify for cash payments is issued at the hospital. Next, it must be provided to the employer. The documentation accompanying the sick leave certificate is completed in the HR department quite quickly, but the sick leave certificate must be filled out correctly.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Maternity leave for twins is regulated by a number of legal acts. You need to know about your rights and be able to refer to the law in order to get everything that municipal structures and the employer must provide.

- 1 Start date of maternity leave and its duration

- 2 Design features for multiple pregnancies

- 3 List of required documents

- 4 Payment amount

- 5 How are maternity pay paid?

Legislative framework of the issue

The duration of maternity leave in connection with pregnancy and childbirth is established in Article 255 of the Labor Code of the Russian Federation.

The following deadlines are indicated:

- For singleton:

- before the birth of the child, the leave must be 70 days;

- after – 70 days;

- For multiple births:

- prenatal period will be already 84 days;

- postpartum will last 110 days;

- In case of complicated delivery, regardless of the number of newborns, another 16 days are added to the time of release from work duties.

More information about the duration of maternity leave can be found in Federal Law No. 255 “On compulsory health insurance in case of temporary disability and in connection with maternity.” This law also specifies the procedure.

Basic moments

“Maternity leave” is a special leave that the state provides to a woman specifically for the favorable birth of a child. Established at the legislative level, this type of vacation has a limited duration and payment of benefits.

Often, in everyday life, maternity leave is considered to be both maternity leave and parental leave. However, if we consider the issue in a legal context, there are various types of rest for employees in this position. All these concepts can be referred to as disability leave.

Among them are the following types:

- For pregnancy and childbirth - provided in late stages of pregnancy, both before the birth of a child, which allows a woman to devote more time to herself, prepare for such a significant event in life and not think about the work process, and restore the body after.

- For care – both mother and father have the right to apply for this type of leave if he is caring for a newborn child. According to the law, such a benefit for a period of one and a half years can be provided to another relative, which accordingly allows him to receive a monthly benefit.

Thus, the total period of maternity leave, which includes the first two vacation intervals, is at least two years.

Normative base

The legislative framework that regulates the payment of benefits:

- The Labor Code (Article 255 of the Labor Code of the Russian Federation) determines the duration of maternity leave for single and multiple pregnancies, as well as in situations of complicated delivery.

- Federal Law of the Russian Federation dated N 1244-1, as amended in 2021, establishes the terms of maternity leave for persons exposed to radiation in connection with the disaster at the Chernobyl nuclear power plant, including those who permanently reside in a restricted area.

- Federal Law No. 81-FZ - according to it, a woman with a multiple pregnancy has the right to receive increased maternity payments, since there is a direct relationship with the number of children born.

- Federal Law No. 255-FZ reflects the rules and amounts for calculating payments.

- Regional laws in force in a number of regions provide additional payments for mothers or increase the amounts of already established benefits.

When going on maternity leave with twins

Having an official job, any woman has the right to take maternity leave according to the law, which is paid accordingly and has certain terms. The number of days of maternity leave for twins increases due to the fact that carrying several children occurs with a double load. Usually, during a normal pregnancy, they go on maternity leave at the onset of the 30th week. If there is a multiple pregnancy, care is carried out earlier, namely at 28 weeks. Sometimes pregnant employees leave as early as 27 weeks of pregnancy. This issue is resolved after agreeing on its nuances with the employer.

How many days is maternity leave for twins?

The duration of maternity leave with twins is provided for a longer period than for one child in accordance with Article 255 of the Labor Code of the Russian Federation. The standard period of maternity leave lasts 140 days. Its duration for a multiple pregnancy is 194 days, of which 84 are provided for the prenatal period and 110 for the postpartum period. If the presence of twins was discovered only after childbirth, then after 70 days of the prenatal period, 54 days are added to the postpartum time.

It also happens when childbirth occurs with complications. Moreover, after the birth of children, additional sick leave is provided, which is 16 days. Regarding the period of caring for a newborn, it is one and a half years. The law provides for the opportunity to remain on maternity leave for an additional year and a half. Moreover, half of this time will be included in the insurance period.

How to calculate maternity leave with twins?

You can calculate maternity leave when expecting twins in the same way as when you have one child. In order for the calculation to be correct, you should consult a doctor at an early stage. Usually up to two months and be observed with him until the appointed time. At 27-28 weeks, the doctor issues a sick leave certificate. This document indicates the preliminary date of birth. Next, it is transferred to the accounting department, where they are required to calculate the amount of the benefit.

In addition, it is possible to use an online calculator that will help calculate the date when the employee plans to go on maternity leave. To do this, you should indicate the approximate date of conception, and also take into account the characteristics of pregnancy.

B&R manual

Not all expectant mothers know about the benefits they are entitled to receive during multiple pregnancies. For example, not everyone is sure that they will be paid for all additional sick days in the event of a complicated birth. Labor legislation in this case is to protect the rights and interests of the expectant mother.

Additional days of sick leave according to BiR will be paid even if it is extended by 16 days in connection with ECS and if a multiple pregnancy was established at the time of delivery.

How is it paid?

Also, the expectant mother should know that the state pays benefits for each child separately, that is, its amount doubles.

How to calculate benefits?

- SDZ means average daily earnings for the billing period.

- T - means the number of days of maternity leave (this value is taken from the certificate of incapacity for work).

SDZ is obtained according to the following formula:

- SZ - means the total earnings for the entire billing period, that is, the last two years of work, that is, if the calculation is made in 2016, then the salary for 2014 and 2015 (730 days) is taken into account.

- Day - means the number of calendar days in the billing period.

Application for maternity leave with twins

To receive benefits, you must obtain a certificate from a health care institution and issue a certificate from your place of work confirming that the benefit was not assigned.

Nuance! An ultrasound examination of the body does not always show two fetuses. It happens that this fact is discovered after childbirth. The newsletter for the mother in such a situation will be issued as in a standard pregnancy. Therefore, you should get a clarifying certificate from the hospital in order to increase maternity leave.

The application is drawn up in a standard form, it indicates the following points:

- Full name of the company director;

- name of the enterprise;

- Full name and position of the employee;

- duration of rest time;

- request for benefits;

- details of the bulletin issued by the medical institution.

At the end, a date and signature are placed.

It rarely happens that pregnancy and childbirth go without problems. Therefore, women have questions about what the legislation indicates in this regard.

A one-time transfer on the occasion of childbirth and a care allowance for up to one and a half years are provided.

List of required documents

To go on maternity leave if you have twins, you must provide the employer with the following documents:

- passport for receiving a ballot;

- sick leave;

- certificate of early registration;

- information about the actual salary for the last two years (if there was a change of employer);

- statement.

To write an application for maternity leave, you must use a special form, if the organization has one. If you don’t have one, you need to write everything on an A4 sheet. In this case, it is allowed to use typewritten text.

The wording of the text of the application itself should be approximately as follows: “I ask you to grant me maternity leave from “__” _______ 20__. According to "__" _______ 20__." Below are the date and signature with a transcript.

It's fast and free!

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call:

Start date and duration

A total of one hundred and ninety-four days are paid for multiple pregnancies. Of these, 84 days are before birth, and 110 days are after. Childcare is paid for up to one and a half years, when two babies are born at the same time, transfers are made for each child.

Required documents to receive child benefits:

- completed application;

- documents confirming the birth of babies;

- certificates from the registry office;

- a certificate of absence of payments from the organization where the father works.

Child benefits are received by the parent who is caring for the children. Therefore, mom and dad can decide among themselves which of them is more profitable to work and who to take care of the children.

There are some differences from standard payments:

- The amount of the care allowance does not change, but payments are made separately for each child.

- You can apply for additional benefits that are established by local authorities.

- The duration of maternity leave is increasing.

If you return to work early, the duration of your work shift will be reduced by two hours.

The employer is entirely responsible for paying benefits. The exception is when the mother is a private entrepreneur. Transfers are made from the company's budget. Subsequently, the employer receives compensation from the Social Insurance Fund. Also, the Social Insurance Fund can pay the girl directly if the company is liquidated.

Child benefits in 2017-2018:

- Maternity pay. The minimum value is RUB 47,836.52, and the maximum transfer is RUB 368,865.78.

- One-time payment on the occasion of childbirth - 16,350.33 rubles. for each baby;

- Child care transfer. The amount of payments directly depends on the mother’s salary. Earnings for the two years preceding maternity leave are taken:

- for the first baby 3065.69 rubles are due;

- for the second - 6131.37 rubles.

- if mommy received a very small salary, then minimum benefits will be accrued. Then it makes sense to choose benefits for caring for two children instead of maternity leave. The law allows such a decision to be made.

- The transfer on the occasion of the birth of the second baby is 453,026 rubles.

These benefits are available to all women. You can learn about additional social support measures through social protection.

Thus, mothers in the capital have the right to additional transfers. On the occasion of the birth of the first baby, 5,500 rubles are paid, and for the second child and subsequent babies - 14,500 rubles. Social security employees determine payments. Documents are submitted to the department at the place of registration

It is important not to miss the deadline for applying, which is six months from the date of birth

Additional financial support is provided to mom and dad who are under thirty years of age.

Documents for receiving benefits:

- passport;

- certificate issued by the registry office;

- birth documents of babies;

- certificate confirming cohabitation.

At the birth of their first child, young parents receive a payment equal to five times the subsistence minimum. For the second child, seven subsistence minimums are already required.

When there is already a child in the family, at the birth of twins the parents become large families.

And this gives access to numerous social support measures:

- land plots for construction are provided free of charge;

- interest-free loans are issued for the purchase of housing;

- travel on city public transport is paid;

- payments are made for the purchase of school uniforms and writing materials;

- utility bills are partially reimbursed;

- full or partial exemption from paying tax on a vehicle.

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

Our experts monitor all changes in legislation to provide you with reliable information.

Subscribe to our updates!

Design features for multiple pregnancies

A maternity leave with twins is issued earlier than a regular maternity leave.

It is necessary to provide the employer with a full package of documents in order to have the right to terminate your employment duties earlier, these are:

- certificate confirming multiple pregnancy;

- sick leave signed by a doctor.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

You can get a newsletter from a private clinic if a woman refuses to be seen at a municipal clinic. But it is required to ensure that such an institution has a license to issue certificates of incapacity for work.

Otherwise, the employer will not be able to provide days off, citing the lack of required documentation. The Labor Code prohibits the dismissal of pregnant women. If the contract is fixed-term and ends during the period when the woman is expecting a child, the employment relationship is automatically extended.

Maternity leave is processed as follows:

- First you need to get a sick leave certificate from the clinic. It must indicate that the pregnancy is multiple. Today it is possible to receive an electronic newsletter if the employer is registered on the website of the Social Insurance Fund (FSS). Then there will be no doubt about the authenticity of the certificate of incapacity for work, and the accountant will not have to comply with the requirements for maintaining paperwork with this type of document. The bulletin is provided to the accountant at the place of work if it is issued on paper;

- Next, you need to write an application for maternity leave.

It is necessary to register separately for maternity leave (BIR) and child care leave.

Parental leave is not provided to those who do not have official employment, but there are a few exceptions:

- if a woman applied to the Employment Center within a year and received unemployed status;

- when being laid off from a previous job;

- Full-time students have the right to academic leave.

Career military personnel are granted maternity leave based on the provisions of the Labor Code of the Russian Federation and the concluded contract.

What payments are due?

The most important issue for every expectant mother is the financial assistance that a woman is entitled to when giving birth to twins. The amount of payments due when applying for maternity leave in connection with the birth of twins has been increased in comparison with standard accruals. In addition, the list of benefits provided is slightly different.

List of payments that a woman is entitled to when taking maternity leave with twins:

Financial compensation provided to a woman in case of registration before the end of the first trimester of pregnancy; One-time payments provided to a girl after the birth of twins. The amount of the benefit, starting from 2015, is 16,350.33 rubles. However, since the woman gave birth to two children, the total amount doubles. Depending on the region of residence of the family, in addition to the designated benefit, additional payments are provided, calculated on the basis of regional coefficients; Financial assistance for caring for twins during maternity leave. After the birth of children, an amount equal to one hundred percent of the average monthly salary for the previous two years of service is paid, if the total work experience is more than eight years. In this case, the minimum value is 38,045.34 rubles, and the maximum amount is 313,512.96 rubles. Payments for two children should not exceed the employee’s monthly salary. Until the children turn one and a half years old, the employee is required to pay an allowance equal to forty percent of the monthly official income for each child; Governor's payments - financial support for working women who received maternity leave for the birth of twins

Financial assistance is provided in all regions of the Russian Federation, but the amount of payments in different regions of Russia differs; Maternity capital - only women who are on maternity leave due to the birth of their second and subsequent children or the birth of twins can count on receiving a certificate in the amount of 453,000 rubles. It is important to note that only families in which newborns were born before 31.12 will be able to use the capital 2021.

In addition, it is worth remembering the possibility of accruing additional coefficients when applying for maternity leave in connection with the birth of twins. For example, this applies to women who live in the northern regions of Russia.

The authorized government body, which is responsible for the calculation and accrual of payments due when applying for maternity leave, is the Social Protection Fund. To receive financial assistance, you must contact the territorial office of the Social Insurance Fund with the appropriate package of documentation.

List of required documents:

- Birth certificates of both children;

- A document from the second parent’s place of work, which will confirm that funds were not paid in connection with maternity leave for twins;

- Statement;

- Parents' passports;

- A certificate from the place of employment, which contains the average monthly salary for the previous two years of service.

The application is reviewed by FSS employees within ten days from the date of receipt. Six months are allotted to receive the required accruals.

Additional guarantees for the birth of twins

When pregnancy occurs, in accordance with the provisions of Art. 255 every woman is entitled to maternity and pregnancy leave.

At the same time, this article takes into account the increased load on the mother’s body and provides for an additional two weeks of leave before childbirth, as well as 40 days of pregnancy leave after childbirth, in comparison with the usual standards. Thus, a woman pregnant with twins generally receives 194 calendar days of leave versus 140 days during the normal course of pregnancy.

If an additional sick leave is issued during maternity leave, the days of sick leave are added to the days of vacation, but are paid not by the employer, but by the Social Insurance Fund.

During pregnancy, women are also paid in accordance with the established procedure a benefit for early registration at the antenatal clinic. However, in the case of twins, this benefit will not increase in comparison with a singleton pregnancy, since it is paid directly for the fact of starting service in a medical institution. Thus, directly during pregnancy, the expectant mother can rely, first of all, exclusively on her own savings, as well as state social insurance payments while on vacation, since the amount of the benefit for registration is minimal and, taking into account indexation in 2021, is only 628 rubles.

During pregnancy leave, payment of social benefits for the actual time of leave is carried out by the employer or the social insurance fund, if the enterprise where the pregnant employee was employed was liquidated.

How to calculate maternity leave payments?

Since 2013, women have lost the right to choose the procedure for calculating maternity leave payments. This benefit does not depend on length of service, such as simple sick leave. It is calculated based on the average salary. It looks something like this:

- Benefit = earnings 2 years before maternity leave / days (number) * 194 (days of maternity leave)

In this case, it is necessary to take into account the following nuances:

- The total amount of earnings for each previous year should not exceed the maximum established by law. This implies a maximum value, indexed annually, which is the basis for calculating contributions to the Social Insurance Fund. In 2021, this value was 718,000 rubles, in 2015 - 670,000 rubles. When calculating benefits related to maternity, you need to use an amount that is less than the maximum value. The employer will be forced to pay for any amount exceeding the limit from his own pocket.

- There is also a legal limit on average daily earnings (calculated as follows: income for 2 years divided by the number of days in these years). The permissible upper value at the beginning of 2021 is 1898 rubles 77 kopecks per day. This value is found as follows: the maximum bases for accrual for previous years are added together and divided by 731.

- It is customary to exclude from the two-year period: sick leave, periods of maternity leave, parental leave, periods when insurance premiums were not calculated.

- There is such a nuance: the expectant mother of twins and triplets has the right to replace the maternity leave included in the two-year period in the calculations for the previous year (two years) to increase payments.

The maximum and minimum maternity payments are 47,836.52 and 368,865.78 rubles, respectively.

How to calculate maternity benefits using the FSS online calculator

- First, you need to enter the details of the certificate of incapacity into the FSS calculator.

- Next are the calculation conditions:

- experience;

- regional coefficient;

- bet size;

- number of hours per week;

- years of earnings;

- amount of earnings.

If necessary, you can add an employer.

- Press the button - calculate.

- The following values appear in the “calculation” tab:

- number of days missed;

- total benefit amount;

- how much is attributed to the Social Insurance Fund;

- additional payment by the policyholder.

The received data can be printed.